By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Renewed hawkish sentiments are building up at the Fed for the second half this year. That’s what we saw today. While the Fed kept rates steady today “to assess additional information and its implications for monetary policy,” the median projection in the FOMC’s infamous “dot plot” today calls for two more rate hikes this year, bringing the top of the range to 5.75%.

Of the 18 members, only two projected keeping rates the same, and 16 projected one or more rate hikes, going up all the way to one member projecting 1 full percentage point in hikes, according to the dot plot (my detailed discussion here).

Powell pointed at it right up front at the press conference in the prepared remarks: “Nearly all committee participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year,” he said.

“Perhaps more restraint will be necessary than we had thought at the last meeting,” he said, pointing at the dot plot’s projections for core PCE inflation that moved up, for GDP growth that moved up, and for unemployment that moved down.

Forget rate cuts this year. Powell emphasized at the press conference that no committee member projected a rate cut on the dot plot: “I think as anyone can see, not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate if you think about it.” So he brushed that off the table entirely.

July would be a “live meeting,” Powell said twice at the post-meeting press conference, to make sure everyone got it, meaning the first of those rate hikes could happen at the next FOMC meeting in July.

In terms of pausing and then un-pausing, the Fed isn’t blazing any trails here. The Bank of Canada hiked last week after its pause since March, on resurging inflation fears; and the Reserve Bank of Australia, hiked for the second time since its pause, on inflation fears and surging labor costs without productivity gains. So maybe that’s the new pattern.

Powell said all kinds of worrisome stuff about inflation.

Core inflation “has not really moved down. It has not reacted much to our existing rate hikes. We’re going to have to keep at it,” he said.

“If you look at core PCE inflation over the last six months, you’re not seeing a lot of progress. It’s running at a level over 4.5%, far above our target and not really moving down. We want to see it moving down decisively, that’s all.”

“We don’t think we’re there with inflation yet… If you look at the full range of inflation data, particularly the core data, you just aren’t seeing a lot of progress over the last year,” he said.

“Headline inflation has come down materially, but we look at core as a better indicator of where inflation overall is going.”

“What we’d like to see is credible evidence that inflation is topping out and then getting it to come down.”

“We’re two-and-a-quarter years into this, and forecasters, including Fed forecasters, have consistently thought inflation was about to turn down and typically forecasted that it would, and been wrong.”

“Of course we are going to get inflation down to 2% over time. We want to do that with the minimum damage we can to the economy, of course. But we have to get inflation down to 2% and we will. And we just don’t see that yet.”

“Look at core inflation over the past six months, a year. You’re not seeing the kind of progress we want to see.”

“I still think, and my colleagues agree, that the risks to inflation are to the up side still.”

“Every year for the past three years, it [the median core PCE projection] has gone up over the course of the year. And it’s doing that again. We see that, and we see that inflation forecasts are coming in low again. And we see that it tells us that we need to do more.”

“We’re committed to getting inflation down. And that’s the number one thing. So that’s how I think about it.”

Why slow the pace of rate hikes on the way to the “destination?”

“It seems to us to make obvious sense to moderate our rate hikes as we got closer to our destination. The decision to consider not hiking at every meeting and to hold rates steady at this meeting is a continuation of that process.”

“The main issue that we’re focused on now is determining the extent of additional policy-firming that may be appropriate to return inflation to 2% over time.”

“So the pace of the increases and the ultimate level of increases are separate variables, given how far we have come.”

“It may make sense for rates to move higher, but at a more moderate pace.”

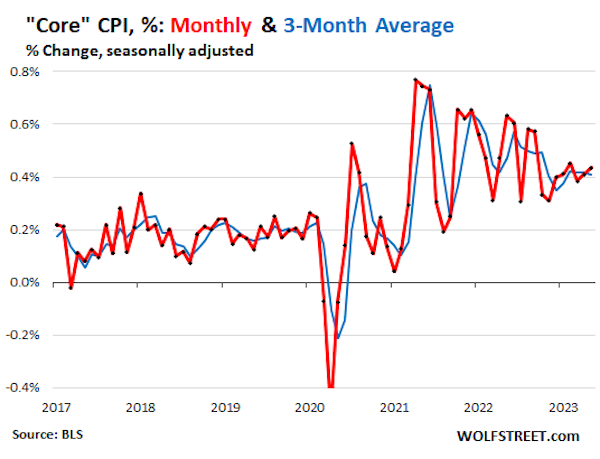

Here is what Powell was talking about in terms of core inflation not having moved down.

What Powell means: core inflation “has not really moved down.”

On a month-to-month basis, core CPI ticked up in April and May. The three-month average hasn’t moved down at all in seven months, running at an annualized rate of over 5%. Month-to-month, three-month-average, and six-month average measures are what Powell is referring to, not the year-over-year rates, which are skewed by the base effect.

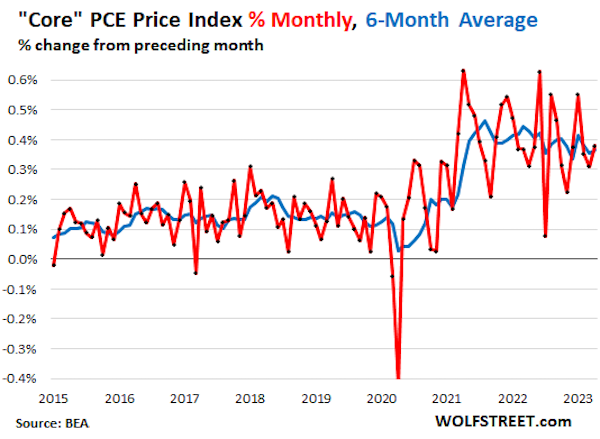

The month-to-month core PCE price index, and its six-month average, which Powell specifically referred to, also ticked up in April and is running at an annualized rate of 4.7%, roughly the same since July 2022:

My highly cynical take is should they move forward with at least 2 more interest rate hikes, equity investors will throw a tantrum as the punch bowl gets emptied just a bit more. But that really be the short term impacts, equities in broad terms seem okay even if the upward momentum really is limited to a small grouping of outperforming equities ( Apple, Tesla, Nvidia, etc…). I’m a bit unsure what the Federal Reserve and their many economists foresee in this strong, or seemingly strong, US economy in the second half and into 2024. Maybe the core measures and PCE are a proving a bit too “sticky” at this 3.5% to 5% annualized range, my two cents.

The banking sector might find a little breathing room, but the seeds of discontent have been sown within their real estate and CRE exposures. Much of the CRE risk may actually reside in the securities markets, as many property types are collected in the securitization process. So, longer term investors might be on the hook when it comes to the investing risk. This also serves as a feedback loop, when you see executives and CEO really pushing hard for return to office. Get off the damn couch you lazy caterwaulers working from home. You can’t do Excel spreadsheets and Accounting entries exclusively from your home ( actually yes you can do this quite well from home ).

I haven’t done an Excel spreadsheet in an office in years. Ditto for accounting entries. I’ve never done those in a public place like an office.

Ahhhh, the joys of working from home, just like my father did.

What’s really been surprising to me about the FIRE sector is the resiliency of the various derivatives contracts to what has been a rapid increase in interest rates. We’ve been told again and again about not learning the lessons from 2008 and how the trillions or is it quadrillions of derivatives contracts are bound to blow up “next time”, but here we are and seems like most people don’t even know how to spell derivatives anymore.

I didn’t pay too much attention to the debacles of SVB, Signature Bank, etc but on seems to me for SVB they basically made a wrong way bet in Treasuries. Now it could be the case they turbocharged their bets by dabbling in interest rate swaps, but I don’t even recall reading anything about that.

Anyway wake me up when Deutsche Bank goes to hell.

Actually, SVB was criticized for NOT hedging their investments in long-term treasuries and MBS, despite the Fed telegraphing the rise.

I think they could’ve muddled through (at much lower profitability) had it not been for the extreme excess of uninsured deposits (> 90%). On paper, losses on their held-to-maturity securities exceeded the equity cushion. As their tech-heavy depositors panicked, triggering the bank run, it turned that paper loss into a real one in a matter of 48 hours.

Need to do MORE? Haven’t ‘they’ done quite enough, already?

The whipping will continue until morale improves.

23 years of negative real fed funds rates (minus a stretch in 2005-08) can’t be undone in 1.5 years.

either the Fed beats inflation with a deflationary crash or the Fed lets 3% CPI be the “new normal” (while real wages don’t keep up for the foreseeable future)

And that’s really the gist of it, isn’t it? The Fed acted as the super duper credit card for the American elites, and they just went on a tear. Now, as I look around me, at where I work, at where I live, America has changed in some profound and not very good ways. Parts of this were seen when covid-19 brought everything to a halt for a couple of years. Parts of this change can be seen in our little proxy war in Ukraine.

What is going to become our new normal?

In my opinion, 3% to 4% CPI = new normal while median real wages don’t grow for 10+ years.

After the first signs of a deflationary crash, the Fed will open the monetary spigots again. The pain will be felt by the bottom 60% via another round of financial repression.

I just heard on the news one needs to make $30/hr to be able to afford a one bedroom apartment in my state, and over $40/hr to afford a one bedroom apartment in our major metropolitan areas. I’m in the PNW. This means newly hired engineers where i work can barely afford to rent here and forget about ever buying a house. The factory floor workers? Honestly, it would be stupid to hire on where I work.

This whole “Shining city on a hill” and “Arsenal of democracy”, forget about it. It’s done, gone. For how long? Who knows, a generation unless American elites wake up and smell reality.

First, the hope of buying a house, any house went away.

Then renting the house.

Followed by nice two, three bedroom apartment.

Later a junior one bed apartment was the dream.

And now a studio apartment.

And this the reason for all the homeless. It is process that has been happening during the past forty years.

If a growing number of people cannot afford to rent a studio apartment, forgetting about buying a house, which has been becoming more true for over forty years, what is going to happen?

Funny how the cost of just living keeps increasing with hardly a complaint by those in charge. Could it have been all that easy money for those with the connections? However, when the masses make just a little bit more, it is tell to panic and kill the growth.

war is peace

poor is rich

dead is better

With a $31.9 trillion national debt, every 1% increase in interest rates will end up costing taxpayers $319 billion per year. I wonder how much that figures into the Fed’s calculations?

If you are trying to lower the amount of money in the system in order to lower prices, injecting $1.6 trillion ($31.9T x 5.25%) a year of interest income into the economy doesn’t seem to be a very smart way of going about it.

Over a decade of easy money. So, as the gains are being sold, they will be able to park the cash into money market funds, treasuries, and other bonds at a higher rate for safety. After all the easy money, the big players weren’t about to sell and park their cash at low interest.

And with the government in another long-term war, more money is made from lending to the government. They will be borrowing more than ever. The banks weren’t about to let that windfall pass with low interest rates.

People keep thinking they need to lower interest rates to help main street. Not a rat’s butt is given to main street. Years of low interest rates that could have been better spent that went to asset bubbles. And the next interest rate cuts are going right back into asset bubbles (if they ever really go away since it’s all the empire has got).

“Powell said all kinds of worrisome stuff about inflation.

Core inflation …has not really moved down. It has not reacted much to our existing rate hikes. We’re going to have to keep at it,” he said.”

This is a supply issue! Prices are high due to the broken supply chain’s inability to supply enough stuff to meet demand! The Fed is striking the wrong anvil!

Seems to me if the experts at the Fed must be aware of this! If after 15 months of beating up the economy and threatening banking with recessionary interest rate hikes (that aren’t working), they have another agenda,,, perhaps using inflation as a tool to bring wages under their control!

This seems to be more a problem for the transportation department than the Fed! I’m not sure how the Fed could even deal with supply side issues… It seems to me we need better transport infrastructure! Perhaps a cross country high speed rail system such as China is building. A National Infrastructure bank could be explored as a source for funding.

Spending taxpayer dollars domestically rather than for war is another subject that could be explored!

Supply issues, prices gouging, war, available land to build on…all things driving inflation that the Fed can’t control.

A fresh perspective would be that they have done everything they can reasonably do monetarily with respect to balancing inflation and full employment, and allowing for the other issues to resolve themselves through the rest of government’s influence, rather than overly crushing wages enough to compensate for the things they can’t control.

Are “rate hikes” the new “tax cuts for the rich” as the cure for everything? Jim Cramer on TV last night said out loud that the goal of the rate hikes was to kill wage growth. That sounds like the next thing once there are no taxes left to cut.

The equity markets seem to be on a serious upward trajectory. It’s amazing given all the shocks and dislocations of the past 3 years that markets are not far off highs. I guess all that printed money has to go somewhere to inflate asset markets.