Yves here. Key data on student debt show how rapidly it has grown, so that it has become the largest type of non-mortgage consumer borrowing. Tom Neuburger explains the dynamics, that the price of higher education is non-negotiable and student debt allows for higher charges.

Neuburger hoists a comment from Naked Capitalism reader lincoln which sets forth the additional, substantial public subsidies to higher education. What was supposed to be a public good instead has become a source of rent extraction by a loyal Democratic party cohort.

lincoln also mentions that student debt levels didn’t take off until 2008. I believe two factors played a significant role. One was the 2005 bankruptcy reform act, which made student debt the only type of consumer borrowing that cannot be discharged in bankruptcy. A second was the way the crisis was a wrecking ball for many new and recent graduates. In the wake of the financial meltdown, unemployment was higher among college grads than those with only high school degrees. Many 2008 graduates had job offers rescinded, leaving them with no income. Employers cut hours and fired staffers, with those with the least tenure most vulnerable. All those factors meant many student borrowers missed payments, which meant they were hit with higher penalty interest rates, turning their debt burdens into millstones.

By Thomas Neuburger. Originally published at God’s Spies

Biden Signs Off on Restarting Student Debt. Why?

For those on the left … too many of us have been interested in defending programs the way they were written in 1938.” —Barack Obama, 2006 “I’m glad we won the race in New York, but I hope the Democrats don’t use it as an excuse to do nothing on Medicare.”

There I made the point that the road to the debt ceiling deal was entirely avoidable; thus it was a road that national Democrats wanted to take. I also speculated on why this was.

But the student debt part of the discussion deserves its own discussion.

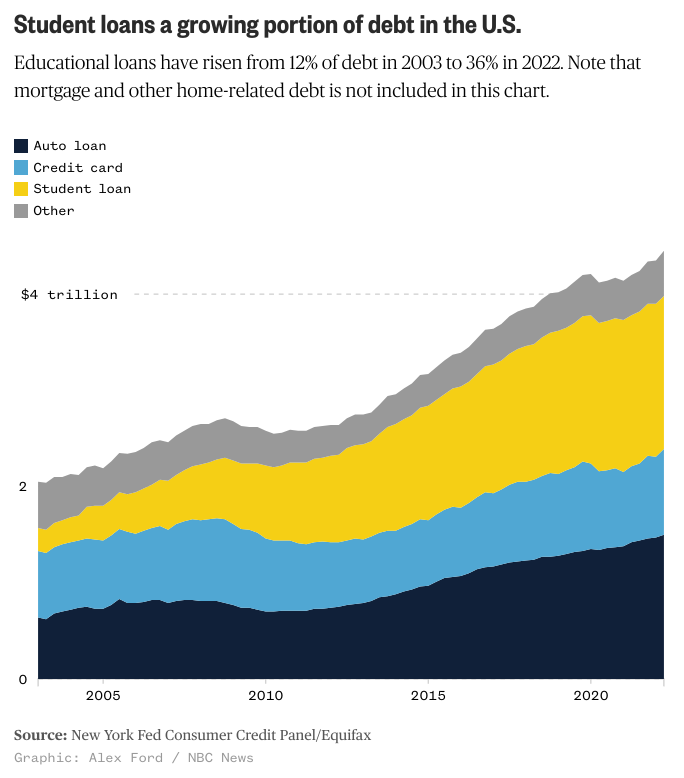

Consider the chart at the top, which shows the rate of student debt growth as a percentage of non-mortgage consumer debt. The rate is astounding.

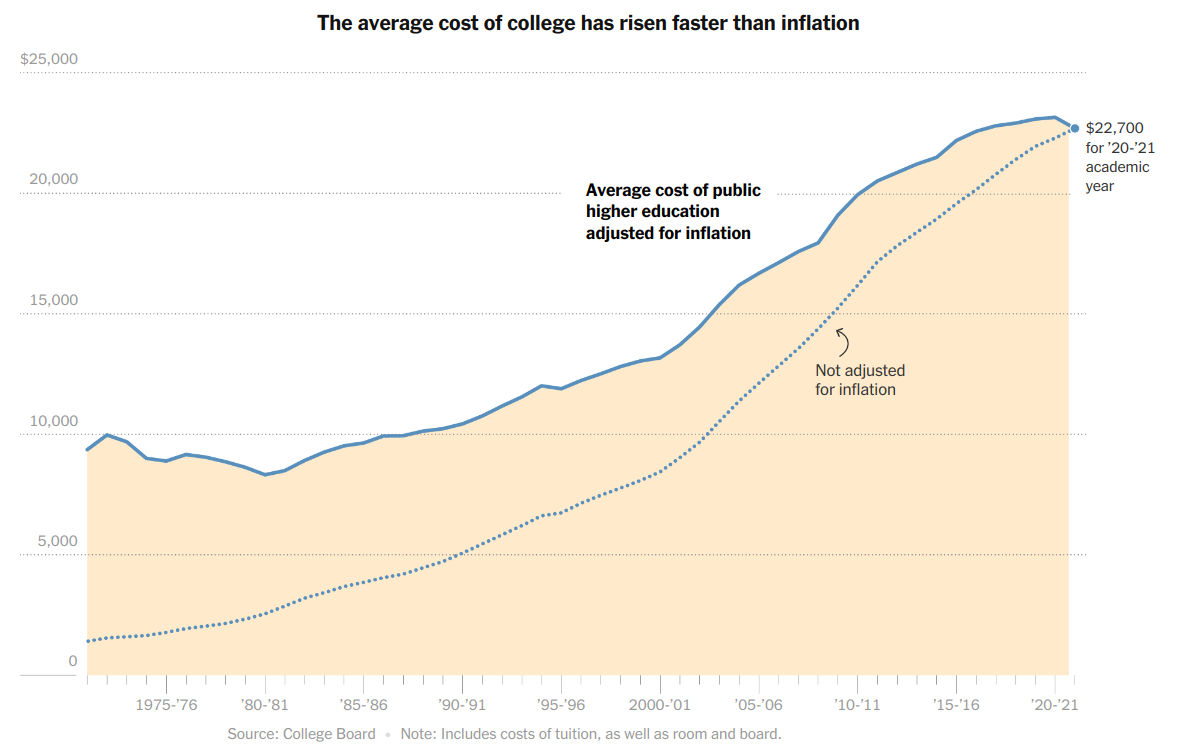

Now consider this, the rate of increase of the cost of public higher education from the New York Times:

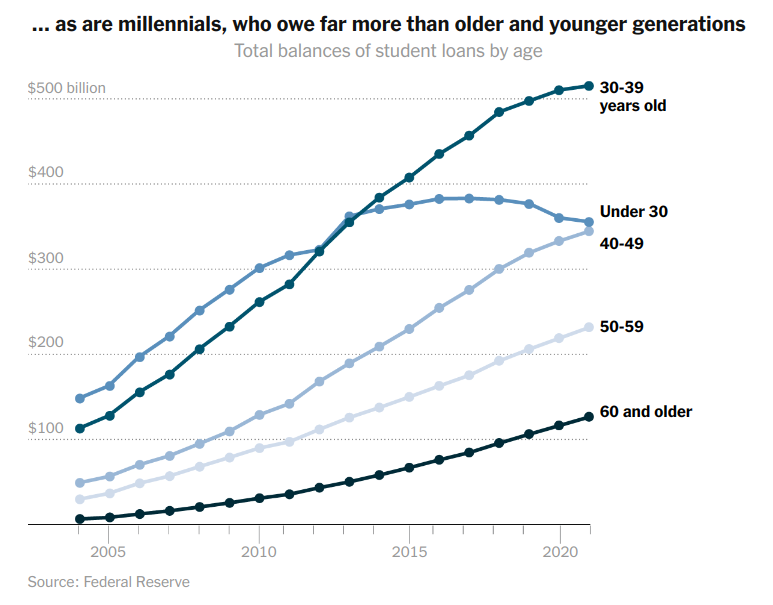

The share of this debt burden is not evenly split. As the Times points out, millennials carry an unequal share. (Note that those under 30 appear to be giving up on college.)

How big is the student debt burden? According to Forbes (paywalled article) as of May, 2023 the student debt picture looks like this (emphasis mine):

- $1.75 trillion in total student loan debt (including federal and private loans)

- $28,950 owed per borrower on average

- About 92% of all student debt are federal student loans; the remaining amount is private student loans

- 55% of students from public four-year institutions had student loans

- 57% of students from private nonprofit four-year institutions took on education debt

Nearly two trillion dollars is the student debt burden today, up from a tenth of that in the mid-2000s.

Neoliberal Government at Work

Why is the national student debt burden so high? In answer, I offer you this, a comment posted by “lincoln” at the excellent economics site Naked Capitalism(emphasis in the original):

If we ever want to properly fix the U.S. student debt crisis, then we need to understand exactly how it was created.

Students borrow money to pay universities, which are the main beneficiary of the $1.7 trillion in outstanding student debt. How much students borrow has ballooned exponentially over the last 15 years. This was during a period of record low borrowing costs (see Fed ZIRP – Zero Interest Rate Policy), and a drop in college enrollment.

Our federal government loans trillions of dollars to a universities students, so these students can pay whatever education related costs the university decides is reasonable. And this cost is non-negotiable. The trillions in federal student loans that universities get is in addition to their exemption from all federal and state income taxes, their exemption from paying property taxes on university land, and their right to issue tax exempt bonds to fund construction, renovation, and operational costs. This does not include the $50 billion per year the U.S. government pays to universities in federal contracts and research grants. These institutions are eligible for almost every government subsidy and tax loophole imaginable.

If nothing is done to reign in and reduce how much universities charge their students, then future student debt is just going to keep ballooning. Forgiving student debt won’t fix this problem, it can only delay a much needed reckoning. …

The ballooning of this debt that started a student loan crisis did not slowly develop over the course of decades. Most of it occurred after the 2008 Great Financial Crisis. Mainstream media has been extremely hesitant to point this out, as well as that universities are the most responsible for creating and perpetuating our student debt crisis.

His bottom line and mine: When government sells education as the answer to government-caused wealth inequality, and makes trillions in student loans available to the industry that supplies it, government is helping that industry fleece its customers.

The student loan program is a transfer of wealth to rich institutions from the working class. How surprising is that in these neoliberal times?

I have what I believe an option to the student loan problem.Instead of loaning student money use the money to give grants to colleges with strings attached.The grants must be used to lower the tuition and make college affordable.In the long term this would be a big money saver because there would be no interest cost. It should also help to make colleges compete for students. Probably the cost would be less than what is spent on interest and money lost because of defaults.

These are good ideas, though those loans that cannot be discharged in bankruptcy are a gold mine for the education industrial complex (e.g. aside from the interest revenue, are they being securitized to ‘clean up’ other forms of more nasty debt, such as auto loans, credit card debt, etc.?). It will take some very serious reform and smashing to bits quite a few rice bowls.

That sounds great, but you then create two other problems.

#1. Colleges will have less control over what they spend money on. Less Ka-ching for the Administration.

#2. How will the financial institutions give up control of the aspirational working class?

The only thing that is going to solve this problem is the new generations of students refusing to play the game. Fortunately that’s happening. The beast is being starved and it’s going to destroy a lot of schools.

not students choices so much as lack of students, the demographic cliff is already causing many college closures… basically millenials are echo-boomers, and after that the number of students is starting to be waaaay less because the cohorts are smaller, I’m sure there’s some element of choice as well (i.e. not even being able to pay even with loans) but I doubt it’s the main factor.

Yes agreed. But I know some admissions folks at higher Ed institutions saying that the kids are way more savvy about paying and what to pay. They also will walk out if they don’t get a deal

The beast is not being starved…the beast (education admin finance exploitation) is being over-fed, stuffed, jam packed because of laws created by our congress men and women … specifically, as mentioned above, the reform act in 2005 ….. Biden pushed for it with Clinton nudging and support (the Repubs are not any less culpable…IMHO.Both parties working together have done far worse, despite the Kabuki narrative of division) . Oh the noble reasons were to make Higher education more accessible but, as history shows, it’s intent was to guarantee profitability to the FIRE sector……. with Guaranteed loans etc, why would an interest rate be charged at all….free market …yea right. So the gates were open with guarantees, warranties, laws, tax breaks, advantages, footsies, bribes, parades, parties, winks and nods. Why would these higher education institutions not charge more when it is all guaranteed? Any “businessman” (Fire sector predator) would be laughed and run-off from the carcass or food trough — your choice.

Take a look at the affordable care act —- how much financial advantage must be given to the Free Market by our congress men and women — why, with all the tax breaks, favoritism, thousands of carve outs and give-aways bestowed upon the FIRE sector by our congress critters enactments…why does the FIRE sector never seam to move anything forward but just burdens the entire society to pay for their glutinous and ruinous Free Market folly ??

Bla Bla Bla…Congress critters, not all mind you….by any measure of recent history, congress critters (1970s on maybe)…this is just my supposition (me being a fool…but a good natured one) by any measure of recent history, congress critters do not do the bidding of the people (constitutional We the People) they do the bidding of the FIRE sector. Shocking, I know.

It seams that Congress critters…the ones that enact law…legislatures work for the FIRE sector. They some times don’t even realize they are Congress men and women but refer to themselves as Politicians, Professional Politicians…. sort of like Professional Wrestlers

Rant over… thank you for your patience with me

“We, the People, are the rightful masters of both the Congress and the Courts. Not to overthrow the Constitution, but to overthrow the men who have perverted it.” – Abraham Lincoln

Rant appreciated ! Lots to riff on here, but I assume @Cocomaan is referring to the slump in the curve for the under-30 cohort on the graph of total debt burden in the article above. I would agree, though, that this curve really would need to take a much sharper dive before we could confidently say the beast is being starved (though perhaps there are other indicators showing greater changes in the number of students attending college).

One other point regarding “Congress critters…the ones that enact law”: I think your choice of the word “enact” here is worth emphasizing, as it’s we can ask how many of those critters are actually involved in writing the laws that they enact. My impression is that much of the text is now crafted by lobbyists and corporate lawyers, and the critters themselves mostly just read and approve it.

Yep you read me right. As long as unemployment stays this low I think it will continue to slump.

The next few years will be a nightmare for many colleges. It won’t restructure the system from the ground up, but if federal regulation of student loans changes, it will be chaos

Student debt is the new indentureship.

I have read anecdotes that some enterprising young people have managed to pay off college loans with credit cards and/or other consumer debt that is dischargeable in bankruptcy. And subsequently declared bankruptcy. Good for them. There is a significant constituency in the US who believe such techniques are immoral, but I see it differently. Some years ago I attended my son’s public university orientation and attended the financial aid seminar for parents. Not only was it a given that all students would take loans, but these were also a prerequisite to many of the grants and support offerings held out as bait. When we met with the financial aid “officer”, I was told that the modest savings account I had established in my son’s name was a regrettable choice because having money reduced his eligibility for financial aid. In any case, I busted my butt to pay his tuition and fees and he graduated without loans hanging over him. Just as I did, back when one could pay for college with a part-time job. And to me, debt-free graduates are the moral choice, regardless of how you get there.

Where’s David Graeber when you need him?

His chapters in “Bullshit Jobs” describe the cost escalation perfectly, and how they are not limited to education or the public sector in general.

There should be more reporting on parent PLUS loans and the effects on senior poverty and intergenerational transfers of wealth. PLUS loans bear higher interest than student loans—try to figure out the logic in that.

A couple of relevant factoids: Tuition (in-state) at my flagship state university was $943.50 my freshman year, in 2023 dollars according the the Bureau of Labor Statistics Inflation Calculator. I remember, to the penny, because I wrote the checks. Today tuition is $9,790.00. According to my calculator that is a 938% increase. Simple arithmetic says this is an annual increase of 19%. Room and board have increased more. According to the University Fact Book, tuition accounted for 10% of the total budget of the university way back then. Now, tuition is about 36% of the budget, but the locals do not see this as the tax increase it is. Yes, that university is better, and certainly bigger, than in the 1970s. But not that much better, although the football team is riding high (so all is good according to the current zeitgeist). I never took out a student loan, but among those who did I never heard of indebtedness after the fact being a particularly difficult problem. But YMMV.

Heh… what percentage do the coaches get?

They are paid by the “Athletic Association” instead of the university, but the head coach is the highest paid “state employee” by a substantial margin (i.e., a factor of 25-30). As are most of his assistants. It should also be noted that the fundraising arm of the Athletic Association is, or was, called the “Student Educational Fund.” Probably makes those donations seem more legitimately tax deductible.

As a public service, here is the current USA Today NCAA Finances spreadsheet (public universities). Note how many athletic programs would be in the red but for the mandatory student fees “allocated.”

Sounds like Alabama, or maybe Georgia.

Thomas

How much of this college price rise is due to various State governments boycotting the tax-funded funding of the State universities in their States during the Great Tax Revolt era?

Maybe my brain isn’t working, but how much of the increased % of student debt as to overall debt is just the demographic bulge of that age cohort? Many more people born in 1986 than 1976, plus immigration.

Put the words “luxury student housing” and the name of a city with a major university in it into a search engine and you will quickly find out what a lot of that student loan money is paying for.

When I attended the University of California in the late seventies, the educational and registration fees amounted to $630 a year — about $3367 adjusted for inflation. My best recollection is that I budgeted around $3800 a year for living expenses — about $20K in 2023 dollars.

Today in-state students are expected to fork-over something like $14,617 in tuition and fees — and more than double that if you include living expenses (the Financial Aid office recommends budgeting $41,000 a year total). To attend an overcrowded public institution whose degrees are increasingly devalued by the job market.

This blatant and shameless rent extraction by the PMC and FIRE is inevitably destroying social cohesion in America. Both the 2020-21 Black Lives Matter and January 6 movements shared a common grievance: unfair treatment by the state.

Social cohesion matters.

When I was an out of state student in the California State University system (Sacramento) in the early 70s tuition was $50 a credit for me and it was free for CA residents. The privatization and monetization of college educations is one of the most insidious things that unregulated capitalism has done to this country. You get a piss poor education and ring up a lifelong debt in the process. I subsequently got my PhD at Georgetown Univ., but interestingly, I found some of the courses at Sac State to be quite superior to those I attended at Georgetown.

Tuition and fees at state universities should be linked to minimum wage. It should be equal or less than 2000 hours worked at minimum wage for the state.

Why not have universities guarantee at least a portion of the loans? As it stands, they have no incentive to help students graduate on time, with useful degrees and every incentive to keep raising their prices.

I’m 63 & never broke out of the bottom 50% of household income until I was 30 in 1990. In my first 15 years of work I was paid hourly, and, like about 1/3 of Americans, I was paid every week. I cooked in Boston in the 80’s, and, relatively speaking, did well. I could get full Social Security at 67 instead of 65 cuz my congress critter Tip O’Neil defined bipartisanshit as kissing right wing butt. I had student loans from Sept. 1978 to May? 2022.

Social policy discussions SHOULD be broken down by quintiles of household income.

What is the current and what is the historical MEDIAN debt load for the bottom 20%, the next 20, … , the way to the top 20%.

What is the probability that someone from the top 20% ends up in the top 20% at age 28 and 38 and 48, versus the lower quintiles?

MY gut and MY experiences in the 70s and 80’s sure lead ME to suspect that bottom feeders like me were more likely to be debt serfs if we had ‘soft’ 4 year degrees instead of STEM kind of degrees.

WHERE is the data from the Policy Peep$ who’ve got their fancy degrees from the hundreds of programs issuing graduate degrees in Social Work, Public Policy, Housing, Labor whatevers, … ??

While I’ve always believed that Reagan & Cheney-Bush & Atewater & Rove & Trump were NEVER on my side, hence I’d NEVER vote for them, the other side couldn’t be more politically pathetic by intent and design.

Theodore White has a critique of Liberal world, written in 1973 and it is in ‘The Making of The President, 1972’.

people were fed up with mattresses of studies – hence, nixon.

What progress have me made in the 50 years since? Trump?!

rmm.

Thanks. And thanks to “lincoln.”

One excuse for high doctor pay is that it costs so very much to go to medical school. And it does. So not only does the academic shakedown affect the poor students but it ripples through other parts of the economy and creates a class of debt slaves that must toe the line or else.

Whereas there once was an America where higher education and success were not regarded as necessary twins. Many of my favorite writers either didn’t go to college or didn’t bother to finish. The real Lincoln was of course almost totally self educated.

Knock the higher education shibboleths off their perch.

I think if we want to reduce the price of a university education, then we must dispel some of the misconceptions that universities use to justify their excessively high prices.

U.S. universities will often try to justify their extortionate prices by suggesting that university degrees are an essential qualification for our most important professions. The credential of a university degree, by itself and without relevant work experience, is in the context of employment a qualification for only an entry level job. This becomes more apparent when you consider the many years of learning after college graduation that are required to become proficient in a particular field.

Many people will enter finance with a similar university degree, which gives them all a similar knowledge of this sector that the university has taught them though subject specific coursework. But after a few years of intensive work experience, these same people will develop a much more specialized understanding of their specific areas that is more important to their professional performance than a university credential. One of the weird results of this is that finance professionals can gain detailed knowledge in a particular area like fixed income, or detailed knowledge in another area like equities, but they will only be professionally competent in one of these areas despite having the same subject specific university education. This is because the complex domain knowledge of their specific areas is acquired on the job and not at the university.

What this means is a superstar fund manager that specializes in equities will be completely incompetent and will cause disaster when asked to perform a fixed income task like rebalancing a multibillion dollar bond portfolio to higher duration. It does not matter that he has the same university degree as a fixed income fund manager, because the ability to properly manage the bond portfolio only comes from work experience. You can see this same dynamic in many other highly specialized professions.

Asking a prosecutor or a criminal defense attorney to draw up an IPO prospectus or a bond indenture document would result in similar levels of incompetence despite the fact that defense and corporate lawyers have the same subject specific university education. Medical doctors graduate from U.S. universities with the same generic doctor of medicine credential, but they require years of on the job training during residency in order to acquire the skills of a particular medical specialty. So asking an ophthalmologist to perform heart bypass surgery, or asking a cardiologist to perform brain surgery, would result in disastrous levels of incompetence despite the fact that ophthalmologists and cardiologists and neurosurgeons all have the same subject specific university education.

The point of all this is universities do not provide the detailed training that allows people to competently perform these highly specialized professions, but in the context of employment training they do provide qualifications for an entry level job.

It is necessary to properly understand that universities do not teach all the skills for this worlds most highly specialized professions, because this is a claim that universities suggest or make as one justification for their extortionate pricing.

“…The point of all this is universities do not provide the detailed training that allows people to competently perform these highly specialized professions, but in the context of employment training they do provide qualifications for an entry level job…”

Notice the varied educational and professional background of many people at large financial institutions. The range of schools the industry chooses job candidates from (somewhat of an automated selection by class or class aspiration) seems more narrow than the eduational/professional backgrounds they are willing to consider for entry level and some other types of jobs.

One of the more colorful background stories: Alan Greenspan used to be an aspiring jazz musician who played with Quincy Jones. Often wonder if that would have made a difference had he not become an Ayn Rand groupie and then went on to join the Fed.

But I assume somebody that wasn’t a Randian would not have been appointed.

It all fits together. Students need to borrow more as tuition increases and schools keep adding features to attract students. These features get added into the cost of education and then the tuition increases. As schools get bigger and more complex they need more administration so more administration is added. This cost gets added into the cost of education and then tuition increases. While all of that is happening, it is harder for students to get a good-paying job to pay down their loans, so the loan amount keeps growing. The whole thing might change if schools were on the hook for their students getting the employment and commensurate salary to pay off their loans. Almost like the mortgage crisis when organizations that made the initial loan could sell it off and wipe their hands of the loan.

It has not been mentioned but there may be another factor in the student loan conundrum. When I was in school at a community college in California many of my classmates were women with children. I did not deal with it but my understanding from them was that the student loans included money for rent and food and child care. Without the student loans they would be living in very precarious circumstances. The loan officers in the college were eager to be helpful. The women needed reliable cars to tote the kids around. Many of these women with kids had no good job prospects and no child support. Coming from California high schools they had no concept of compound interest. They needed the student loans to feed the kids and provide a place for them to live and they wanted to live in nice places. School was secondary to them. Living and raising their kids was the first prority and student loans were a lifeline. I have not seen a breakdown but I wonder what proportion of the national student loan debt is tuition and books and what proportion is living expenses for twenty somethings. The fundamental problem is that we have outsourced most of the jobs that do anything productive to China and we have imported massive amounts of low wage labor for everything else. Michael Hudson has mentioned this. A partial solution to much of the student loan problem might be solved by a federal takeover of child support since men in this age group have low paying jobs and cannot really play a meaningful role in providing what is needed to raise children. In a way, from what I saw, much of the excess in student loans is due to the difficulty for young people to get jobs that pay enough to survive especially women with children. And my impression from my classmates was that very few thought they would ever be able to pay these loans off which is quite realistic since even with a degree from junior college in most areas their earning capacity is going to be low.

The “problem” are several of what I consider fairly distinct issues which need to be addressed separately. Professional students who realistically expect high incomes aren’t, for the most part, suffering from debt burdens. Not to say they shouldn’t be carefully examined, and reformed…but they aren’t part of a crisis. Undergraduate loans to students that who do not graduate…these need to have some sort of bankruptcy like process to resolve…especially smaller loan amounts.

In addition, I would require any institution granting loans to retain an interest in financial performance of loans they grant. Say 20% or 25%.

What is really needed is serious reform of higher education in the US. And I think they will be facing serious competition from online alternatives. Among other things.

And, most importantly, no loan forgiveness without serious reform. I’m ok with the $10,000 proposal…but not without demanding some accountability for the schools granting these loans.

The costs rise and the academic year shrinks. Tenure is disappearing and adjuncts … low paid adjuncts … increase. Tenure was a bulwark of academic freedom. Adjuncts are employees on short term contracts. All this as administrators proliferate.

I entered university 70 years ago. I was able to pay a significant portion of the cost working summer jobs. I was able to pay for graduate courses working a weekend job and later to pay for and complete a graduate degree while teaching school. None of that would be possible today.

For my son, tuition is his senior year was double, IIRC, that of his freshman year. That was in the 1980s.

All this while fund raising is constant and for many colleges endowment has gone through the roof. Methinks it does not compute.

Credit spends the same way as cash.

Supply : Demand, Price Point

What the market will bear

This really could be simplified into a simple pair of statistics, 1. Interest on federal loans issued 2008+/- are ~7%, (not able to refinance unless you want a private servicer), 2. Nominal wage growth 2009-2019 averaging ~2.9.

Don’t get me started on federal plans requiring interest capitalization if you want to switch to a different type of income based repayment…