By Lambert Strether of Corrente

Origin stories are often contested, but the origin of the Trillion Dollar Platinum Coin is undisputed: A blogger going by the handle Beowulf, whose real name is Carlos Mucha, in a comments section. Propagation stories are another matter. In this post, I will give four versions of how Beowulf’s idea propagated: Brian Beutler’s (2017), Carl Beijer’s (2023), Alex Carp’s (2023), and lastly my own (2013, written as a refutation of Brad DeLong’s proposition that the blogosphere was no longer “vital”). Please note that I’m not at all trying to nitpick about who wrote what when influenced by whom; Beowulf deserves full credit for the idea. My real concern is how ideas propagate (“Great oaks from little acorns grow,” as the saying goes).

Before I go on, however, I should explain the Trillion Dollar Platinum Coin (a.ka. “The Coin”). From Rohan Grey’s very useful #MintTheCoin FAQ[1]:

The #MintTheCoin hashtag was first used in 2011 in reference to the current proposal for the Treasury Secretary to unilaterally exercise their authority to mint platinum coins under 31 U.S.C. § 5112(k) in order to avert a debt ceiling crisis. For more historical context, click here.

(This is why you always see the Platinum Coin come up during debt crises[2].) And:

31 U.S.C. § 5112 of the Coinage Act gives the Treasury Secretary the discretionary authority to mint and issue coins containing a wide range of metals, including copper, zinc, silver, gold, palladium, and platinum.

There is no statutory or constitutional limit on the quantity of coins that the Treasury Secretary may issue.

Or as Bloomberg’s Joe Weisenthal puts it:

Idea behind the Platinum Coin is simply that, under current law, the Treasury is allowed to produce, well, platinum coins in any denomination. And if deposited at the Fed, could create debt breathing room. It's basically a hack to circumvent a dumb law that accomplishes nothing

— Joe Weisenthal (@TheStalwart) February 5, 2021

(The “dumb law” being the debt ceiling, which is in fact dumb.)

And now to our four origin stories.

2017. From the Daily Beast, “Where Did This Absurd #MintTheCoin Idea Come From?“:

Talking Points Memo’s Brian Beutler plumbs the origins of the coin:

An American lawyer writing under the pseudonym Beowulf first explained the platinum coin concept in the comments section of a post titled ” Repeat After Me: The USA Does Not Have A ‘Greece Problem’,” written by Marshall Auerback and published on a blog called The Center of the Universe.

His comments caught the attention of other writers, including management consultant Joe Firestone (.pdf), who pressured him to expand on the idea. “He eventually just broke down and wrote something on it,” said Stephanie Kelton, an economics professor at the University of Missouri, Kansas City, and an early evangelist of the platinum coin model, in a telephone interview. Kelton is the creator and editor of a website on economic policy called New Economic Perspectives where Firestone and Auerback are both contributors.

“It’s a variation on a theme that many of us have been writing about for a long time,” Kelton said. “If you boil things down to who issues the currency, you can do it via the bank, or you can have the government do it. This goes way back in the academic literature. … Now it’s being referred to as the magic coin and a gimmick, and certainly it has that aspect to it — but this law basically says the U.S. currency can come from the U.S. government. That’s really all the coin is. It doesn’t do anything terribly scary from my perspective. It doesn’t have any danger economically.”

Beutler’s account accords with my recollection. (Joe Firestone in fact blogged on The Coin here at Naked Capitalism in 2013, 2015, and again in 2015, at least, and also prolifically on the now-defunct blog for which I was the administrator, Corrente.) But we don’t have to rely on my recollection; via Know Your Meme (!!!), we find that the Wayback machine has archived Auerbach’s post and Beowulf’s comment, dated May 24, 2010:

Matt Franko,

Curiously enough Congress has already delegated to Tsy all the seignorage power authority it needs to mint a $1 trillion coin (even numismatic coins are legal tender at their face value and must be accepted by the Federal Reserve)– the catch is, its gotta be made of platinum (ditto the balls of any President who tried this). So for a 1 oz. coin, Tsy would net only $999.998 Billion :o)

(k) The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

http://www.law.cornell.edu/uscode/31/usc_sec_31_00005112—-000-.html

So there is your origin. (Beowulf’s idea was originally expressed in a collegial discussion in a long comment thread involving several MMTers, including Scott Fulwiler.)

We now move to 2023, where — because of yet another stupid debt crisis — the coin has become a topic of conversation once more.

May 10, 2023. From Carl Beijer, “Thank a comments section guy for the trillion-dollar coin“:

The idea for the trillion dollar coin came from a guy named Carlos Mucha, who posted about it under the handle Beowulf more than a decade ago. Mucha does not endorse MMT.

Americans generally became aware of the idea during a surge of media coverage during Dec 2012 / Jan 2013

Again, as Mucha puts it himself, ‘in terms of popularizing the idea I’d say Cullen Roche (got the Wall Street media guys like Weisenthal interested) & Jamie Galbraith (put the bug in the ear of economists like Krugman) took the leading oar.’ Mucha adds that ‘neither Roche and Galbraith really then identified as MMTers,’ and that “to be fair I did discuss it at [Brad DeLong’s] blog comments as well

Beijer’s alleged link to Beowulf’s comment is in fact a link to an article from Cullen Roche in his blog, Pragmatic Capitalism, about the comment, and Roche, sadly, does not give a link to the original comment on his own blog (let alone the original comment at Mosler’s Center of The Universe). However, the date on Roche’s post is July 7, 2011, not May 24, 2010. Beijer carefully does not say that Beowulf’s comment at Roche’s blog is the original comment; had he done so, he would simply have been wrong on the facts.

May 27, 2023. From Alex Carp, New York Magazine, “The Man Who Invented the Trillion-Dollar Coin“:

About a dozen years ago, a pseudonymous commenter on a financial website, writing under the name Beowulf, presented an unusual solution for a debt-ceiling standoff: If the federal government was at risk of default, and Congress couldn’t agree to either cut spending or raise the borrowing limit cleanly, couldn’t it simply mint a trillion-dollar coin?

As we know, there are two candidate “financial websites”: The Center of the Universe (May 24, 2010), and Pragmatic Capitalism (July 7, 2011). It would have been nice if Carp had been able to decide on the correct one.

“Congress screwed up,” Beowulf wrote [when and where?]. By passing the law, it had given the president the authority to direct the secretary of the Treasury to mint a coin of any value — say, $1 trillion — and deposit it in the Federal Reserve, which would be legally obligated to accept it. Ultimately, the coin’s deposit would result in $1 trillion in government revenue or, with a coin of a different denomination, however much was needed to continue to pay its bills and avoid a default. “The catch is, it’s gotta be made of platinum,” Beowulf wrote. “Ditto the balls of any president who tried this.”

There’s a lot of other interesting material from Mucha (nee Beowulf), but as far as getting The Coin’s origin story, I have to say that New York Magazine is even worse than Beijer, and Beijer was bad.

January 9, 2013. My post, Imminent Death of the Blogs Predicted, Except Not. My goal in that post was to refute Brad DeLong’s proposition that blogs were “no longer vital.”[3] I did so by using the origin of The Coin (on a blog) and its subsequent preservation and propagation until it reached the mainstream (through blogs). My post at NC was a cross-post from Corrente, the blog for which I was then the administrator. Corrente ran under Drupal, and I had actually been able to construct a database of all the articles on The Coin that I could find. (The database is now gone, along with the site, since I could no longer afford to run the server.) Interestingly, when I stacked up all the links, they formed a power curve that shows successful propagation:

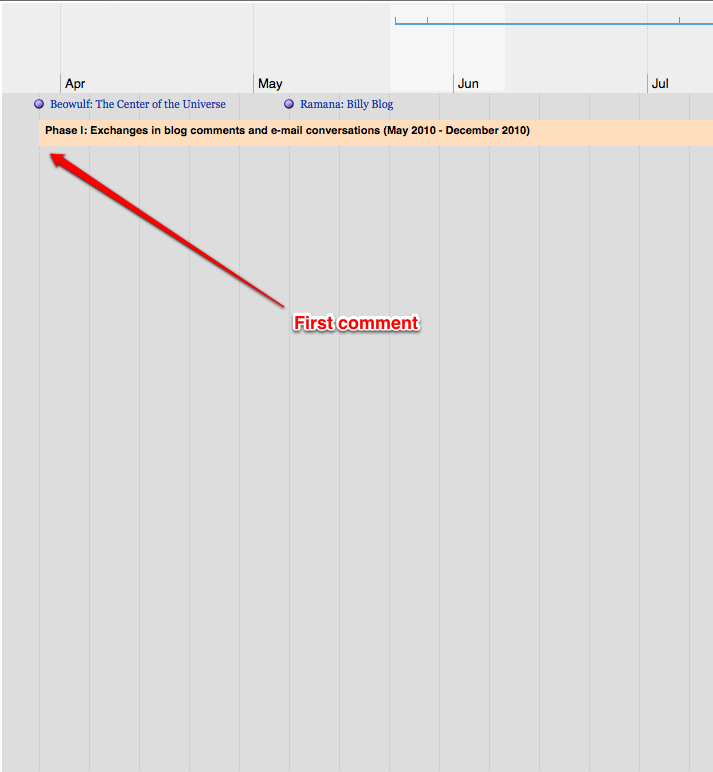

I also used the database to select by date — a few links at first (left hand side of the curve) then many (right hand) — and convert the results into “slides” (1–6). Here is the slide 1, illustrating that the origin of The Coin was at Warren Mosler’s The Center of The Universe:

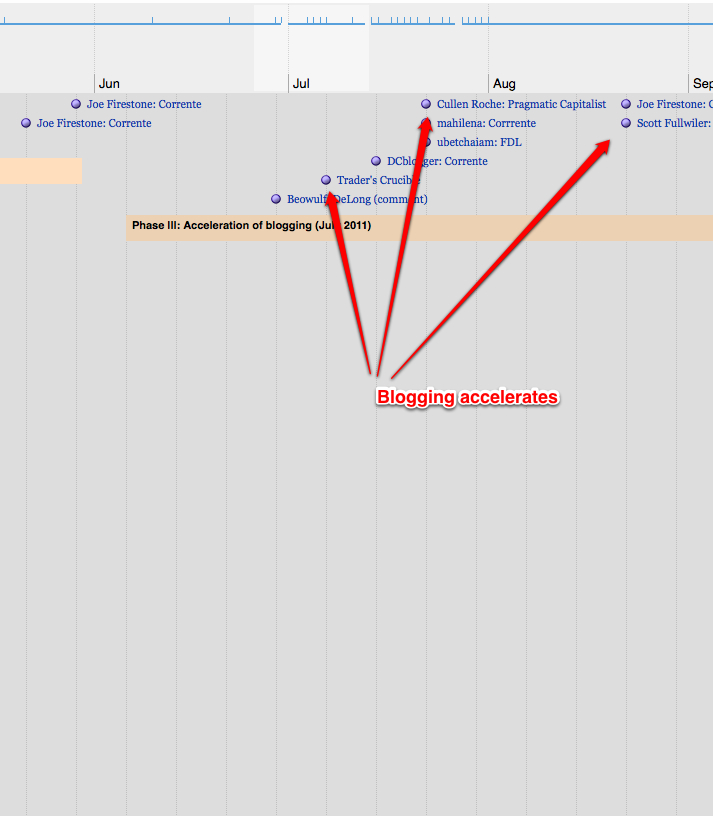

Here is slide 4, where we see (much later) Cullen Roche’s post at Pragmatic Capitalism:

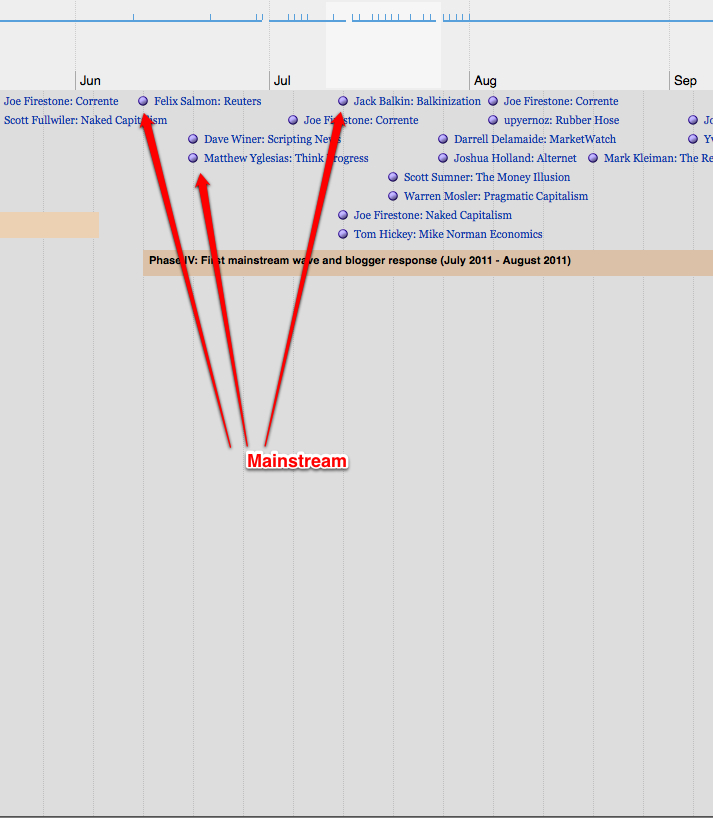

And here is slide 5, showing mainstream acceptance:

My comment on slide 5:

#5 Phase 4 presents an important inflection point, as PPC [The Coin] enters the mainstream through Felix Salmon of Reuters, Matt Yglesias, and influential law blogger Jack Balkin. I don’t think it’s a coincidence that PPC [The Coin] was presented in Naked Capitalism (third ranked econoblog by traffic) immediately before the new phase began. Felix Salmon linked to Corrente; Matt Yglesias was prompted to cover the PPC by a reader citing Beowulf at FDL; and Balkin cites to the same Beowulf post, as well as a post by letsgetitdone, this time at FDL. Other MMTers and econobloggers like Warren Mosler, Tom Hickey, and Scott Sumner pile on.[4]

In the post, I describe all the phases of The Coin’s successful propagation in similar detail.

* * * I was motivated to write this post partly to [looks heavenward piously] correct the record, partly to defend the blogosphere’s importance, then and now, and partly to defend the honor of my own blogs, Naked Capitalism and (then) Corrente. I was also, quite frankly, shocked at New York Magazine’s sloppiness, and I hope any Google search brings up this post along with it.

More importantly, however, dear members of the NC commentariat, Beowulf’s Coin began as a comment, and was nurtured by unpaid and obscure bloggers who believed in it, until it caught fire. Perhaps the same will happen for one of your comments! It really is possible, as I have shown! Beowulf’s comment sets a high baseline, however, do remember.

NOTES

[1] Other propagation story conflicts arise over the issue of whether The Coin is an MMT idea or not. Certainly Beowulf was not an MMTer (Rohan Grey is). The Coin is, however, certainly MMT-adjacent. MMTer Stephanie Kelton invented and propagated the #MintTheCoin hashtag, for example. Ideologically, The Coin makes it clear that Federal taxes don’t fund Federal spending, a key MMT insight. Marshall Auerbach and Joe Firestone were also MMTers. Which doesn’t make everybody who advanced The Coin project an MMTer!

[2] Anybody who jokes tendentiously about the physical characteristics of The Coin — and that’s a lot of people — doesn’t understand the issue. The issue is the law that permits The Coin to be minted. If the law said “giant stone wheels,” or “cardboard,” or “cheese”, instead of “platinum,” the implications of the would be the same.

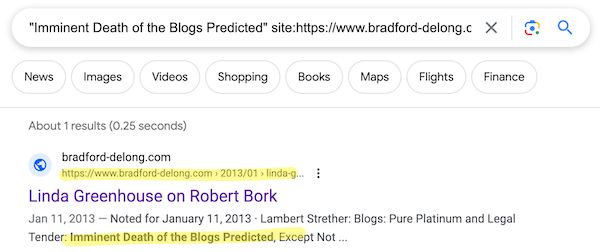

[3] My recollection is that DeLong has kind enough to link to my post with approbation, but here again we have link rot, and this is the closest I can come:

[4] I should have embedded all the links, but the links were all in the pages generated from the interactive database that I took screen shots of to create the slides, and it did not then occur to me that I would not be able to maintain the server.

This post has made me nostalgic for the New Economic Perspectives blog. Sadly, the last post there appears to be from April of 2020. I remember following along as Randy Wray was writing the MMT Primer (that I think he later turned into a book) and he was active with the comments section. Sadly, the link there gives me a 404 error so I can’t go back and read it again.

Funnily enough, I went straight there to see if I could dig up any other posts or comments inline with Lambert’s database research. However, it’s not just that the site is not active anymore, but it seems that search engine indexing and some link coding no longer work as well.

:(

Lambert got it right. Earliest comment inline with 2011 by Firestone.

Fascinating!

I have disscomfort with the coin, if it goes into the gaping maw and gullt of wall street directly.

I have no hesitancy, and maybe this is the genius way to fund baseline living stipends as labor and jobs dissapear in the future. I am only a fan of guaranteed income if it is associated with shared jobs/ labor… humans need the dignity of work and feel a contributive self-worth

Platinum coin funds workforce monthly stipend.

Workforce jobs are shared… ie essential workers, producing goods/ services/ utilities/ seven days a week, only work 2 days. Job-share. Funding for food, utilities, rent/ house payments comes from platinum coins and private sector business, as appropriate.

ONLY wage-earning labor is eligible… the 90% parasite I mean rentier ‘investor’ oligarch class who don’t work for a living are not eligible.

The money will still whoosh to Wall Street within a month of each funding cycle, but it will not have an inflationary effect on essential aspects of life for the everyday joe the plumber with the six pack abs and the low slung jeans.

Might be nuts, but we better start thinking this through… a frontline special on AI predicted most jobs would be gone in 10 years, and that was almost three years ago.

No worries, Congress and Presidential hopefuls are On It.

None of what you wrote has anything at all to do with the topic. The TgA’s balance must be sufficient at the literal end of the day to ‘cover’ payments made out of it by the USG. It being sufficient to cover any spending is a necessary but *insufficient* condition for the FRBNY to effect the payment. The order given to FRBNY by Treasury must be *lawful*. Until and unless US Govt spending has been authorized and appropriated for by Congress, specifically or broadly (“such funds as may be required”-style), Treasury is not at liberty to order it be effected out of TgA, nor is FRBNY authorized to effect it. Financing payments/spending e.g. BIG or UBI or FJG with HDPC is logically and legally subsequent to their being authorized and appropriated for, thus *funded*, by Congress.

It would be interesting to find out what generative AI has to say about this subject.

I don’t want to ask, but I’m curious.

Does bad prompting result in permanent pollution of the topic in question?

For instance, what would GPT have to say about “Russia Gate”, and does the volume of interest affect the output at all?

Interesting theoretical conversation. Let’s talk about CalPERS! Stop closing the comments! The corrupt mass of CA government is after you! Maybe you should PRA what elected officials are visiting the private market alternative managers!!

I retired from Fixed Income a few years ago. We had a strategy and tracked it against benchmarks. We did okay, but we made mistakes. The benchmark helped us improve – some times almost imperceptibly, and infrequently, dramatically. It was essentially a LEAN and Six Sigma approach even though investment people will not admit the Air Force and GE helped them…

A very disturbing event and contradiction to every standard of State of CA contracting standard just occurred. On Monday and Tuesday of this week a “Culture” session was held with a firm employing or subcontracting a former employee of Ontario Teachers Pension Plan who worked for the current CIO of CalPERS. Under my time, this would have never been permitted to happen due to the corruption that became apparent during the Apollo pay-to-play scandal and the hyper-vigilance afterwards.

Did CalPERS follow the full contracting process for the “Culture” session? Was it circumvented? Was the Ontario Teachers person added at the request of the current CIO of CalPERS? Was the contract a market rate? Unsolicited, many attendees expressed anxiety and fear to me after the sessions. There are also rumors about millions of dollars that the current CIO of CalPERS is trying to direct to former of employees to Ontario Teachers. Finally, there are rumors that some of the exiled founders of Apollo who worked with Villalobos and Fred B. are almost through the CalPERS investment process and will be granted billions of dollars to invest.

> Interesting theoretical conversation.

What’s theoretical about correcting the record? (And if you don’t want to threadjack, put a comment like this in Water Cooler, or Links, where Yves is more likely to see it.)

Six Sigma approach as you have found out does not incorporate political machinations aka ***corruption*** and hence useless …. you might get returns during normative periods and then boom ….

Watched this back in the 80s and some still play with models ….

Nice tease. “Here’s what you should do.”

If you really expect people to follow up on your ideas you need to offer enough detail to make action possible. Even better would be to do the PRA yourself since you know what you are looking for. You can always share what you get back.

Its a sophisticated insight. But it doesn’t need to be done with ‘substance’ meaning precious alloy or metal. A Bill of Exchange or Promissory Note will discharge a liability.

In Australia (1909) and UK (1864 IIRC) there is a Bills of Exchange Act, being the principal Act of the Commonwealth. With all the relevant provisions for creating and tendering Bills. Lord Denning (UK) famously stated the court recognises a bill of exchange as indistinguishable from cash

I heard someone was trying to discharge the collective debt of all veterans in the US this way.

I personally know plenty of people who have discharged liabilities to the Public (government etc) this way.

As I see it, this is a post about gardening ideas. A comment section is a place where brainstorming can safely occur, people can share bits of thoughts, and whole ideas. Then these can propagate.

There are competing idea generating systems, such as think tanks and universities. These are fairly controlled by funding. So one system is more freely creative, the other extractive.

Similarly the Amazon is getting clear cut to allow extractive agriculture (dead soil, inputs like fertilizer and herbicides, eventually loosing most of the fertility of the soil).

Is NC backed up?

Yes, very much so.

Lambert,

My memory isn’t as rock solid as it used to be, but I recall being a regular on several sites back then and one in particular where Beowulf was a regular including Cullen’s site. I definitely recall conversations about the coin long before Cullen’s 2011 post. In fact this paper (https://rohangrey.net/files/coinage.pdf) references a posting from Carlos (aka Beowulf) dated Jan 3, 2011.

What I do recall is that the conversations all started as part of the debt ceiling vote. What I wish I could recall better was did the conversations start as part of the run-up to the Feb 12, 2010 raising or shortly after that. It’s possible Beowulf first discussed this before the May 24, 2010 posting, but I just can’t recall and I can’t find any of the possible prior postings.

Anyhow, the platinum ball’s quote IS in that May comment posting. It’s timestamped at 8:29pm. The funning thing is there is a 2nd platinum balls reference in the same comments section that happened on the following day 5/25/2010 @ 5:34pm.

> Anyhow, the platinum ball’s quote IS in that May comment posting

You’re quite right. My bad. Making it all the more curious that New York Magazine never links to it, and says there are possibly two sources.

From a purely monetary perspective, the monetary impacts of the coin are relatively slow, even though it technically adds a lot to the money supply as i understand it. (I’m not an expert in economics and MMT)

Essentially, it does increase the monetary supply, but it’s sitting in a vault where it does not do anything, so any real increase in money supply, and hence any potentially monetarily driven inflation, occurs as US treasury bonds are are retired, which is a relatively slow process.

Personally, I would go with minting about a dozen $10,000,000,000,000.00 coins, and then just stop rolling over debt, which would also have the effect of making the US status as the world’s reserve currency less secure, which would have the effect of reducing the financialization of the US economy and driving down the exchange rate, which would favor labor over capital.

There are probably plenty of errors here, so feel free to correct.

Alert and attentive close readers, I apologize for messing up on “platinum balls” (a phrase I never imagined writing). I zapped the material (and associated comments). I can only plead that at the time I was experiencing bathyspheric levels of stress in RL.