Yves here. Satyajit Das, who has graciously published posts on banking, derivatives, centralized clearing houses, and economic issues, is providing a series on energy needs and the implications of energy transition proposals to NC readers. As he introduces this exposition:

Abundant and cheap power is one of the foundations of modern civilisation and economies. Current changes in energy markets, perhaps the most significant for a long time, have implications for society in the broadest sense. Energy Destinies is a multi-part series examining the role of energy, demand and supply dynamics, the shift to renewables, the transition, its relationship to emissions and possible pathways. The first part looks at the part played by power in the rise of modern societies and patterns of demand and supply over time.

By Satyajit Das, a former banker and author of numerous works on derivatives and several general titles: Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives (2006 and 2010), Extreme Money: The Masters of the Universe and the Cult of Risk (2011), A Banquet of Consequences RELOADED (2021) and Fortune’s Fool: Australia’s Choices (2022).

Abundant and cheap power is one of the foundations of modern civilisation and economies. Current changes in energy markets are perhaps the most significant for a long time. It has implications for society in the broadest sense. Energy Destinies is a multi-part series examining the role of energy, demand and supply dynamics, the shift to renewables, the transition, its relationship to emissions and possible pathways. Parts 1, 2, 3 and 4 looked at patterns of demand and supply over time, renewable sources, energy storage and economics of renewables. This part looks at the energy transition.

An energy transition refers to a major structural shift in energy systems. There have been several such historical transitions – bio-fuels, such as wood, to water and wind energies and then to fossil fuels. In its current usage, it is used to describe the attempt to replace fossil-based systems of energy production and consumption with renewable energy sources. This transformation is framed by the need to mitigate emissions to control climatic changes.

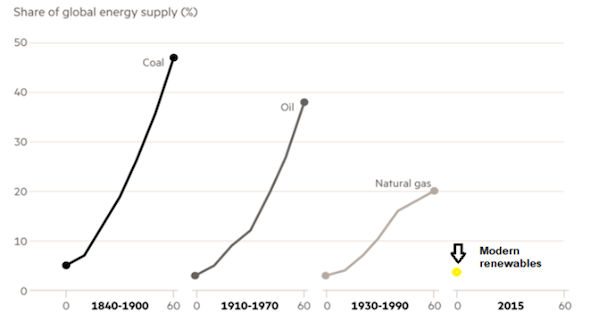

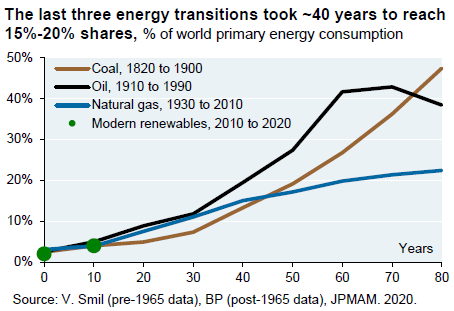

The arc of energy history is depicted below.

In Energy Transitions, Professor Vaclav Smil provides evidence that a new energy source has typically taken between 40–60 years to gain significant market share in previous episodes. The current proposals assume renewable energy will make comparable gains over a much shorter period.

This underestimates the complexity of the current energy transition:

- The scale is unprecedented requiring rearranging energy systems for more than 8 billion people and high levels of industrial and household demand.

- Generally, energy transitions entail shifting to more efficient sources of energy. The current process reverses the trend with a down shift to less efficient sources with lower EROEI, lower energy density, lower surface power density and large storage requirements.

- Unlike previous changes, it is probable that the cost of energy will increase rather than decrease.

- The urgency for the change due to the need to curb emissions is also without parallel.

- Previous changes in energy arrangements were undertaken before modern regulatory structures, particularly in advanced countries, which will need to accommodate large-scale changes rapidly within conflicting environmental, safety and competition standards.

- Likely disruption to societal and geo-political arrangements is also potentially greater than in previously transformations.

An Incomplete Transition

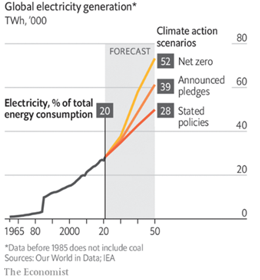

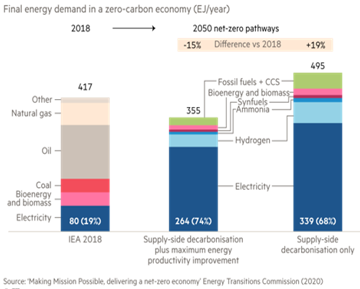

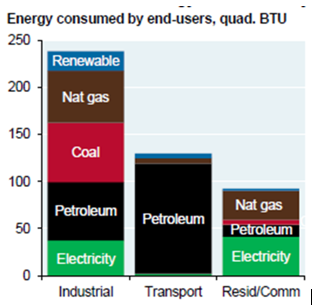

The current energy transition, as conceived, is heavily biased towards electrification focused on using low-emission renewable sources to produce electricity to replace fossil fuels.

Present transition plans envisage a large expansion of global electricity production by a factor of two to three times, without using fossil fuels.

|

|

But electricity, based on most estimates, makes up less than 20 percent of the current energy mix.

The high temperatures, power and energy density needs of heavy Industry (manufacturing, steel, cement, ammonia, plastics), freight transport and aviation favour fossil fuels will have to be electrified or re-engineered to use alternative fuels which may prove difficult without significant advances in science and production technologies.

There are daunting barriers. Direct reduction techniques for producing steel may consume 15 times more electricity than the equivalent current coking approach. It requires purer iron ore to melt fully in hydrogen-powered furnaces to skim off contaminants. Substituting fossil fuels in cement production and other industrial processes is also challenging.

The technical feasibility of electrification, the use of bio-fuels or other methods are at a developmental stage and likely to be significantly more expensive than current methods. Decarbonisation of aluminium production consistent with a net-zero or 1.5C pathway alone is estimated to require cumulative investment of approximately $1 trillion, primarily

Electrification, in any case, is insufficient to eliminate carbon emissions from many heavy industries because of the chemistry of the processes. Around half the carbon dioxide in cement manufacture comes from the conversion of limestone into clinker. In steel, the transformation of iron oxide into pure iron requires stripping oxygen atoms which combine with the carbon to produce carbon dioxide. Modification of the chemistry is required to reduces these emissions.

Problems of battery weight, power capacity and life remain constraints in the electrification of heavy transport. The space needed for hydrogen tanks sufficient to fuel medium-to long-haul aviation limits payloads significantly affecting the economics of these forms of transport.

Complete or even substantial electrification as a pathway to decarbonisation may prove elusive.

Material Intensity

The machinery of the energy transition – solar panels, wind turbines, energy storage, backup plants, re-configured transmission lines and grids, electric vehicles- require large amounts of metals, minerals and energy, ironically from fossil fuels. Renewables replace emissions intensity with materials intensity.

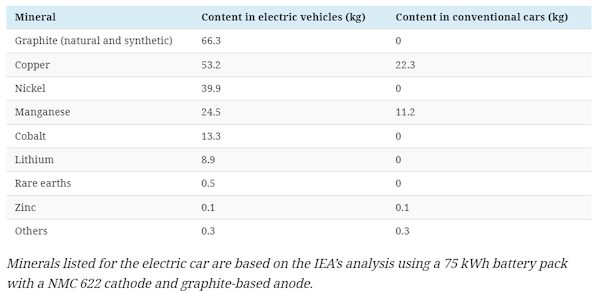

For example, EVs require up to six times more minerals than internal combustion engine powered conventional cars.

EVs are on average 340 kilograms (750 pounds) heavier. The additional weight affects power needs and efficiency as most of the energy in any form of vehicular transport is used to propel its weight.

Wind turbines require steel (66-79 percent of total turbine mass); fiberglass, resin or plastic (11-16 percent); iron or cast iron (5-17 percent); copper (1 percent); and aluminium (0-2 percent). Rare earths are key ingredients in the powerful magnets required. Estimates suggest that about 500 tons of steel and 1,000 tons of concrete are needed per megawatt of wind power.

Each 450 kilogram (1,000 pound) Tesla long range 80-kilowatt-hour battery module is made up of 6,000 individual cells, each containing 10 kilograms (25 pounds) of lithium, 36 kilograms (60 pounds) of nickel; 18 kilograms (44 pounds) of manganese; 14 kilograms (30 pounds) of cobalt; 80 kilograms (200 pounds) of copper; and over 250 kilograms (550 pounds) of aluminium, steel, graphite, plastics, and other materials. When scaled to the type of storage likely to be required at state or national level, the amounts needed are staggering. In aggregate, using battery modules to back up New York’s peak summertime electricity needs for 45 minutes would require 3,750 tons of lithium, 9,000 tons of nickel, 6,600 tons of manganese, 4,500 tons of cobalt, 30,000 tons of copper, and 82,500 tons of other materials.

As the metals and other substances needed require substantial energy to produce, the overall net effect on emissions (lower output from the energy sources adjusted for the higher amount from required materials) is unclear.

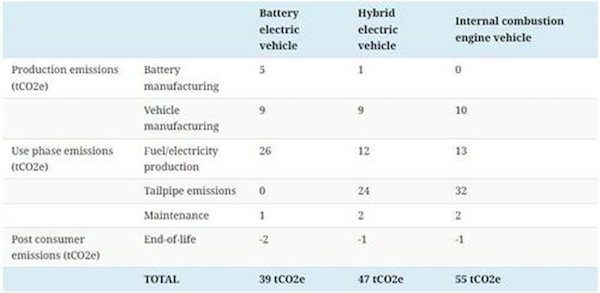

EV life cycle emissions, the total amount of greenhouse gases emitted throughout a product’s existence, including its production, use, and disposal, is revealing. Using a standardised measures (metric tons of CO2 equivalent (tCO2e)) of greenhouse gases, the comparative emissions of medium-sized electric, hybrid and ICE vehicles can be derived:

EVs have the lowest life cycle emissions but production emissions are approximately 40 percent higher than those of hybrid and conventional vehicles, primarily from extraction and refining of raw materials like lithium, cobalt, and nickel. Most of the emission benefits are in the use phase. These comparisons are based on 16 years of utilisation and a distance of 240,000 kilometres (150,000 miles). Where the vehicle has a shorter life or is used less intensively (which is likely to be the case as EVs are better suited to shorter travel distances), the high production emissions mean that the EV’s life cycle emissions approach that of traditional internal combustion powered vehicles.

Claims of lower material intensity of EVs frequently also assume the ability to recycle components, which, in reality, is unproven. Even if they can be designed to use less raw material many required are rare earths which need toxic production processes. The analysis assumes that EVs are powered exclusively by electricity from renewable energy sources which is not the current position.

This means the shift to renewables may not reduce emissions by the quantum claimed and, perhaps, not at all in some cases.

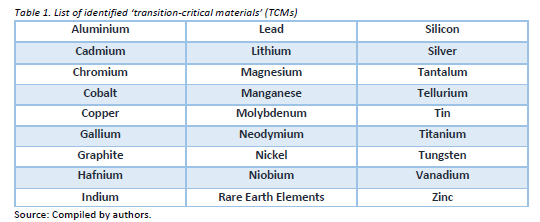

Transition Critical Materials

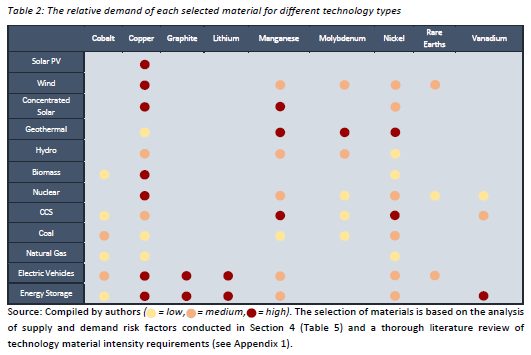

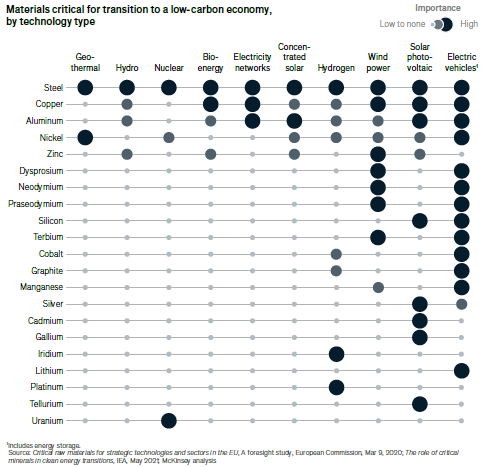

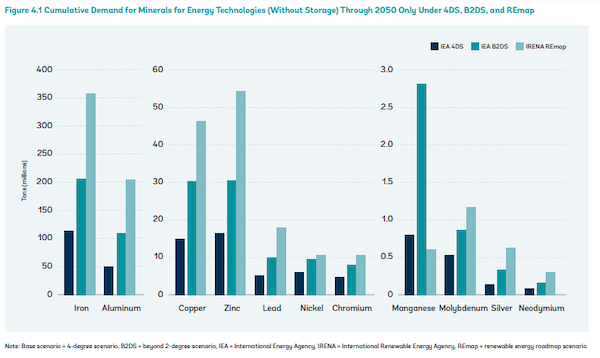

The key energy transition raw materials needed are summarised below:

The application of and relative demand for these raw materials are set out below.

In general, analysts focus on two groups of raw materials – first copper, nickel and cobalt, and second lithium and rare earths. In practice all required raw materials should be considered.

Resource Availability

The availability of the required raw materials at acceptable cost is assumed. Without the requisite supply, the energy transition will, at best, be impeded, and, at worst, not be possible. The key elements in availability include:

- Sufficiency of the resource.

- Feasibility of extraction and production.

It is unclear that sufficient amounts of essential raw materials currently exist. The quantity of many metals needed are larger than originally believed, current production levels are insufficient and, perhaps most critically, known mineral reserves for some materials may be less than the amounts needed. Additional investment can expand production and exploration may uncover new reserves but there are difficulties in overcoming the shortfalls particularly in the short-run.

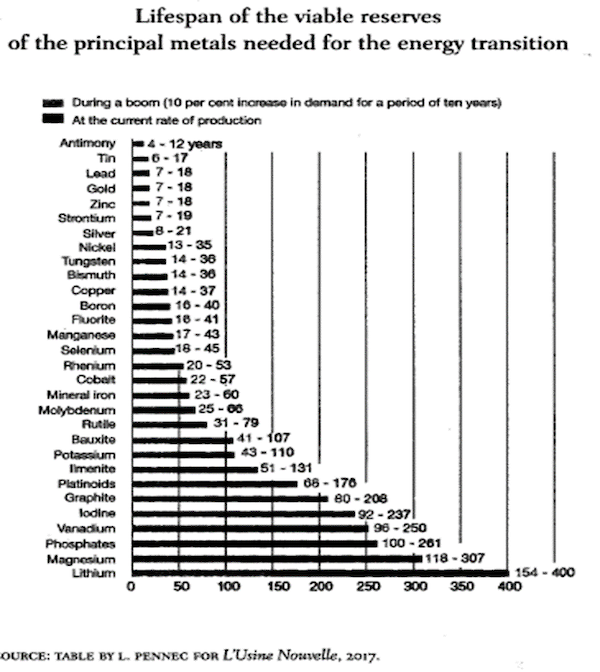

One estimate of known reserves of many essential raw materials is set out below:

Simon P. Michaux, Associate Research Professor of Geo-metallurgy Unit Minerals Processing and Materials Research, Geological Survey of Finland, compared required production to known reserves concluding that the total metals required for one generation of technology to phase out fossil fuels is insufficient for many substances.

|

Metal |

Required Production (Tonnes) |

Known Reserves (Tonnes) |

Reserve Coverage (Percentage of Requirements) |

|

Copper |

4,575,523,674 |

880,000,000 |

20 percent |

|

Nickel |

940,578,114 |

95,000,000 |

10 percent |

|

Lithium |

944,150,293 |

95,000,000 |

10 percent |

|

Cobalt |

218,396,990 |

7,600,000 |

3 percent |

|

Graphite |

8,973,640,257 |

320,000,000 |

4 percent |

|

Vanadium |

681,865,986 |

24,000,000 |

4 percent |

The study found there were sufficient reserves of some materials:

|

Metal |

Required Production (Tonnes) |

Known Reserves (Tonnes) |

Reserve Coverage (Percentage of Requirements) |

|

Zinc |

35,704,918 |

250,000,000 |

700 percent |

|

Manganese |

227,889,504 |

1,500,000,000 |

658 percent |

|

Silicon (metallurgical) |

49,571,460 |

Relatively Abundant |

Adequate |

|

Silver |

145,579 |

530,000 |

3,641 percent |

|

Zirconium |

2,614,126 |

70,000,000 |

2,678 percent |

Demand and reserves estimates are inexact and the subject of feverish disputes. However, the magnitude of potential shortfalls needs to be carefully considered in energy transition plans.

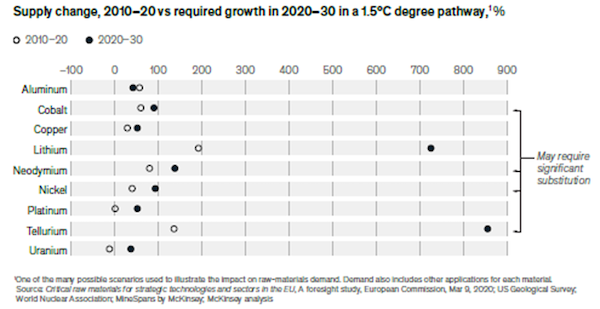

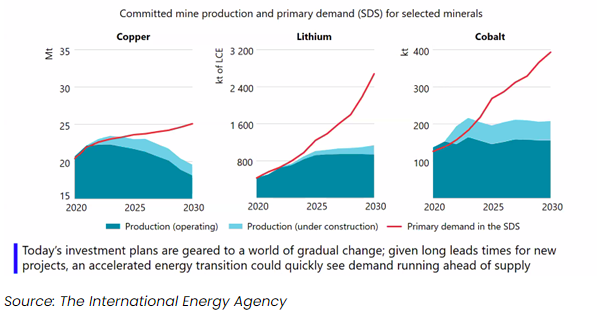

Extraction And Production

Even if reserves exist, then issues of extraction and production arise. The scale is challenging. The magnitude of the expansion in production required for some key raw materials is not to be taken lightly.

The quality of ore deposits that must be exploited is relevant. Grades have declined due to natural depletion at already existing mines which are, understandably, the most easily accessible and low cost. In the case of copper, the average grade of mines has declined from about 2.5 percent 100 years ago to about 0.5 percent today. There are few copper mines today that have copper content greater than 1 percent of the rock. The average grade of Chilean copper, one of largest producers, has fallen by 30 percent over the past 15 years to 0.7 percent. Some other required raw materials naturally occur at lower concentrations. Nickel, lithium, cobalt, and copper make up 0.002 percent to 0.009 percent of the earth’s crust. In contrast, more abundant metals like iron and aluminium make up 6 percent and 8 percent respectively

Lower grades and relative scarcity increase exploration, development, extraction and processing costs as well as energy needs and carbon emissions. In the case of copper, lower grades mean that around 16 times more energy must be used to produce the same amount of copper as was the case 100 years ago.

The belief that improvements in exploration and production technology can bridge shortfalls is misleading. Exploration techniques vary between raw materials. The technology for searching out ore bodies, such as copper, is complicated by the fact that deposits are dispersed often over large areas. Techniques such as seismic testing, which is an efficient means for searching for hydrocarbons, is less effective. Exploratory drilling, a slow process, must be used.

Areas which can be exploited are also different. Mining for most metals is concentrated in a few areas due to the economics. In contrast, oil and gas production can sometimes be undertaken on a smaller scale. Today, a lot of hydrocarbon exploration is in the ocean.

There are ambitious plans for deep sea mining for cobalt, nickel, manganese, and copper. But there are significant difficulties of operating in corrosive salt water, at near-freezing temperatures and under thousands of pounds of pressure per square inch. Overruns of capital and operating costs are frequent. The cost of the Gorgon gas project off the coast of north-west Australia increased from the budget of $11 billion to $54 billion.

Reserve-to-production ratios frequently overstate the amount of the minerals that can be extracted. The time from exploration to production is lengthy. It takes years to move from exploration to production for oil and gas. In contrast, a greenfield copper mine can take decades to bring onstream although they typically have longer lives some stretching to hundreds of years. This means that even if, as likely, prices rise sharply, it is unlikely that additional supply of transition required materials will become available quickly as they exhibit relatively limited price elasticity.

Environmental Constraints

Production of the required raw materials is likely to place significant pressure on other resources such as water and land.

Production of many raw materials requires large amounts of water. Copper mining is water intensive. This is complicated by the fact that 50 percent of the world’s copper supply comes from Chile, Peru and the African copper belt, all regions with issues of water scarcity. Common techniques for lithium production are water intensive, with areas like the high Andean plateau where large reserves exist being among the driest places on earth. Hydrogen production requires access to large quantities of water.

There are demands on scarce land which may be required for populations and food production. Bio-fuels require both large amounts of water and land. Biomass feedstock for alternative energy effectively mines the topsoil. Globally, as much as 90 percent of the Earth’s topsoil is likely to be at risk by 2050. The average depth of topsoil of the agricultural rich American mid-west has declined from 45 centimetres (18 inches) to 25 centimetres (10 inches) in the past 50 years. With a minimum of 15 centimetres (6 inches) needed to grow crops efficiently, the loss of topsoil is approaching critical levels. Solar facilities in deserts requiring bulldozing of areas destroying the natural eco-system and also release the vast amount of carbon stored underground in desert soils.

Other side-effects include pollution and environmental damage from mining for the required raw materials.

In effect, significant negative externalities are generally neglected and not incorporated in the cost computations. The energy consumption and emissions of these collateral effects are frequently ignored.

Investment Constraints

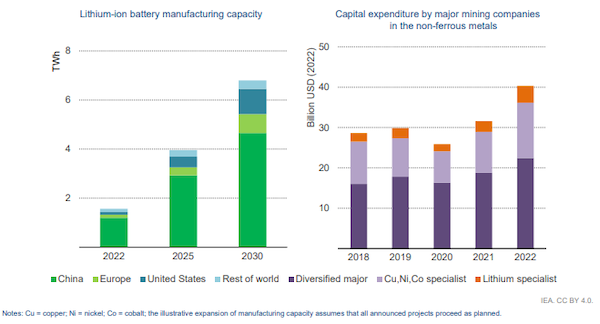

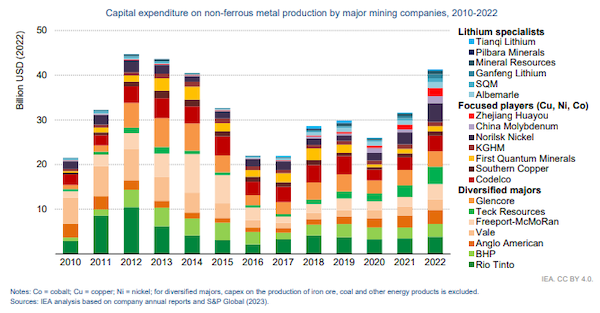

Investment is essential to assure sufficiency of supply. Over recent decades, the level of investment in transition critical materials has increased (although the opacity of data from mining companies especially diversified majors makes the areas targeted difficult to accurately identify).

Given that over 3 billion tons of minerals and metals will be needed to achieve a below 2C outcome and production of minerals, such as graphite, lithium and cobalt, will need to increase by nearly 500 percent by 2050, it is questionable whether existing investments are adequate.

There are several reasons for inadequate investment:

- Cyclicality of commodities.

- Low real prices.

- The large capital requirements of projects.

- Consolidation and greater risk aversion within large resource groups.

Activist pressure on resource companies to de-carbonise, especially exposed to fossil fuels or high emissions, is increasingly a factor. With most asset managers and investors keen to burnish their ESG (Environment, Social, Governance) performance, there has been a reluctance by public entities to invest in commodities production. A further influence is the seemingly unfashionable nature of resources relative to high growth technology industries, which ironically cannot survive without the materials that must be mined. Commodities can’t be summoned with an App from a smart phone

Without substantial investments and the associated emissions, shortages of some materials are likely.

Problems with increasing primary sources have encouraged a focus on secondary supply, such as scrap and recycled material. Recycling rates for most transition critical materials are currently low. This reflects engineering barriers as well as the limited suitable material and utility of recycled material for applications. Historically low prices are another factor creating disincentives for and affecting the financial viability of some recycling. The current scope of meeting demand from recycled supply is limited.

The Green Rush

The issues around sufficiency of investment are, in reality, deeper. Capital expenditure is inadequate but also not properly targeted.

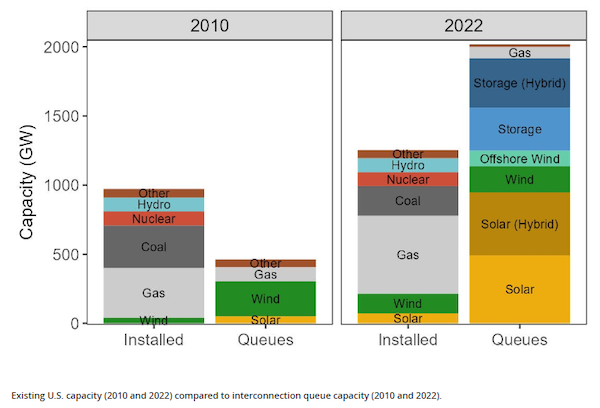

The energy transition has evolved into a speculative financial ‘green rush’. The enthusiasm for new energy technologies is oblivious to simple facts and basic planning is absent. Even when completed, renewable plants cannot be hooked up to the grid sometimes for several years. In extreme cases, projects are not pursued due to these shortcomings. The Lawrence Berkeley National Laboratory found nearly 2,000 gigawatts of US solar, storage, and wind waiting in transmission grid interconnection queues.

Added by government support, investor euphoria has grown. Investment in renewable related stocks and funds has reached new heights. Valuations of EV stocks, like Tesla, battery producers and hydrogen related firms have risen sharply. Most are priced at high multiples of earnings, sales and asset values. In 2020, green energy Special Purpose Acquisition Vehicles (SPACs) raised $40 billion with a mandate to acquire as-of-yet unidentified clean energy assets.

Funds have frequently flowed to businesses with untested technologies, unrealistic plans or simple flim-flam and quackery. There is an unhealthy lack of focus on the essential underlying basic science in favour of gimmickry. Much of this investment may be written off entirely with the rapid and large losses of capital leaving less money available for real needs.

For example, the current interest in the hydrogen economy belies previous investment busts. In 1997, media enthusiasm for hydrogen power brimmed over just prior to the end of that boom. One recent piece spruiking the ‘new’ hydrogen economy rationalised the failure of the wave of the 1990s as being the result of no clear market for the fuel and limited state and corporate backing. The sub-title of the piece tellingly was something that most people have learned to dread: ‘This time is different”. A historical analysis found that the serial attempts to drive a global hydrogen economy have largely been driven by hype and it remains to be seen whether the current wave is different.

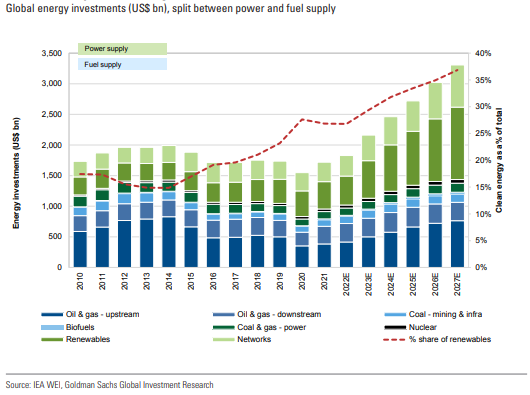

The speculative frenzy diverts funds away from traditional energy firms. The energy industry has under-invested, in renewables and hydrocarbons. Since the peak of 2014, investment in traditional energy (oil and gas) has declined 57 percent driving a more than 30 percent reduction in global primary energy investments, from $1.3 trillion in 2014 to $0.8 trillion in 2020. In parallel, total investments in energy have fallen around 22 percent from its $2.0 trillion peak in 2014 to $1.5 trillion in 2020 although this is now reversing.

The investment focus on renewables is insufficient to offset lower investments in traditional energy, especially given the smaller scale and higher capital intensity per unit of energy output. Underlying this pattern is conviction of the imminent end of hydro-carbon era. This was reinforced by a flood of analysis which forecast peak global oil demand and fall of around one-third of consumption by 2040. Interestingly, this is inconsistent with projections from the US Department of Energy that American demand will actually slightly increase, not decline by 2050.

Traditional energy firms have seen minimal investment despite proven records of activities and asset bases. Valuations are subdued ignoring record profits due to a spike in oil and gas prices resulting from the Ukraine war.

There is a need for capital expenditure on energy across new and existing sources, which will be required for a long time to come, as well as associated infrastructure and raw materials. The over-reliance on the roll-out of renewables, lack of investment in fossil fuels and constraints around transition critical materials creates the possibility of significant future energy shortfalls.

Political Constraints

The energy transition faces political hurdles.

While most citizens favour a shift away from fossil fuels, the intrusion from actual renewable energy plants and mining to extract essential resources may not be universally supported. Some minerals will inevitably be extracted under poor working conditions in emerging markets, including inadequate workplace safety, using child labour, no environmental safeguards and proceeds being used to fund conflicts. This may prove problematic both under existing laws and ethically. At a minimum, this will slow the supply of necessary transition materials.

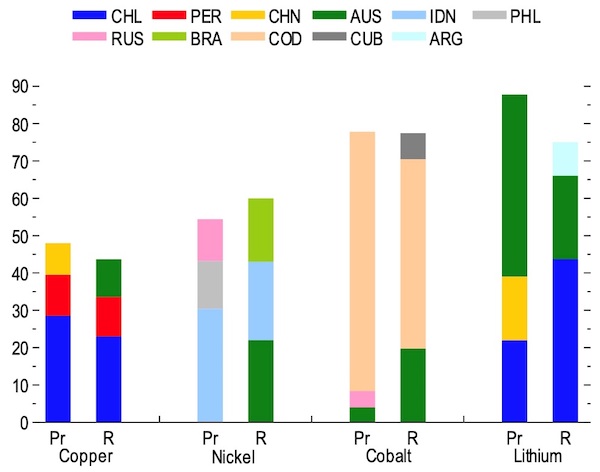

Geo-politically, the requirement for certain minerals will create tensions. Existing petrostates stand to lose financially and in terms of influence. At the same time, producers of essential materials will gain in importance. The graphic below sets out nations producing and possessing reserves of four key transition metals. The large representation of developing countries not necessarily sympathetic to Western agendas is noticeable.

Note: Data labels in the figure use International Organization for Standardization (IOS) country codes. Pr = production; r = reserves.

A central issue is China’s dominance in the supply and processing of transition critical minerals. China has a near monopoly on some minerals; for example, 90 percent of processed rare-earth elements. It is amongst the biggest processors of lithium. China supplies more than 60 percent of all natural graphite and most of the synthetised equivalent which is needed for Lithium battery anodes. The major issue is processing. Many required materials occur in low concentrations necessitating processing large amounts of ore and frequently polluting metallurgical methods. Processes are complex, energy intensive, hazardous and expensive.

This situation is not accidental. China’s long-term planning prioritised these industries over decades. Western buyers acquiesced as Chinese processers, supported by state subsidies and minimal environmental standards, drove down costs.

Plans to reduce dependence on China are, at best, likely to be slow or, at worst, near impossible in the relevant time frames. Current strategies for managing the supply chain for these raw materials include friend-shoring to create alternative suppliers, building stockpiles and spare processing capacity. This is unlikely to be easy and will be costly. Highly conditional subsidies (such as those in the US Inflation Reduction Act), financing, local opposition on environmental grounds and price cutting by existing Chinese suppliers have to date slowed several projects. Increasing recognition of the position is reflected in the noticeable shift in language from ‘decoupling’ to ‘de-risking’ in relation to the relationship with China. Whatever the outcome, the availability and cost of these essential raw materials will constrain the shift to new energy sources.

Control of certain supplies is already an economic weapon. Following on from early skirmishes, in mid-2023, China restricted exports of gallium and germanium compounds (used in semi-conductors and high speed electronics), both among minerals classified by the US government as critical to economic and national security. It was most likely in retaliation for US bans on Chinese purchases of advanced technologies.

The effects of such major global power realignments are unpredictable, especially during a time such as the present when various tensions are evident.

To Get There, I Wouldn’t Start From Here!

The energy transition is vital to reduce greenhouse gas emissions but also to supplement the declining supply of fossil fuels. But there are doubts whether such a transformation of the world’s energy systems is feasible.

The current narrow focus on electrification is limiting as electricity is only a small part of current energy systems. The requirements of industrial, heavy transportation and aviation applications would require a wide variety of these processes to be first electrified or converted to hydrogen cell technologies. The supply of essential raw materials for the energy transition is also not assured. Emissions and externalities from higher material intensity may not materially change overall greenhouse gas output levels. Current investment levels are inadequate.

Ultimately, the transition has ‘hopium’ built in. It is found on the Micawberian belief that something – scientific or technological – will turn up. Breakthroughs which improve production efficiencies, lower pollutants or allow substitution of transition critical materials with better alternatives are possible but cannot be relied upon.

At best, any energy transition may prove slower and more expensive than currently understood. At worst, the energy transition may prove impossible, at least, to the extent currently envisaged with a substantial residual reliance on dwindling fossil fuel reserves.

In assessing progress, former Russian Prime Minister Viktor Chernomyrdim’s formulation seems apposite: “we have completed all the items: from A to B.”

So what is it that Mr. Das suggests be done? I appreciate the sophisticated and detailed analysis of the problems associated with the energy transition, but if there have been proposed solutions I haven’t been able to grasp them.

I dunno…. Convince billions of people in developing nations that they cannot be allowed to have the same standard of living as we have in the West?

See, complex problems always have a simple solution – a perfect example is the business model of the Underwear Gnomes in South Park:

1 – Steal underwear

2 – ??????

3 – enjoy profits.

So the solution is:

1 – Tell billions of people they cannot better their standard of living

2 – ?????

3 – enjoy the harmony of nations

Similarly:

1 – Notice alarming rise in atmospheric CO2

2 – ?????

3 – enjoy new clean energy-powered world

So who’s going to tell China that they cannot provide for those many billions, especially if there is something to trade for?

You got it backwards. Convince millions of people in the developed world that they have to give up their standard of living. Much higher carbon savings.

During a planned power shut off, they can take cold showers, eat cold food from rapidly thawing freezers and use blankets in their all electric house with the capped gas line.

p.s. Massive amounts of lithium in Ukraine. What a coincidence.

https://kleinmanenergy.upenn.edu/news-insights/lithium-the-link-between-the-ukraine-war-and-the-clean-energy-transition/

What Das so eloquently describes isn’t a problem, rather a dilemma or predicament- ie, there is no solution. He is describing the present energy futures reality as accurately as he can.

The outlines of the dilemma have been well understood since the late 50s. Works like Lewis Mumford’s “Man’s Role In Changing the Face of the Earth,” Barry Commoner’s “The Closing Circle,” and the “Global 2,000 Report,” commissioned by Jimmy Carter are just a few of the many warning shots ignored by the power elite.

The reality of a near future with radically reduced access to energy and mineral resources, and with rising ecological constraints is difficult to accept, let alone address in a meaningful way.

Lambert’s quote and comment from today’s Links page seem apposite:

> “A spell of temporary nationalisation may be needed.” Why “temporary”?

Or, as Yves has repeatedly put it, a war-time level of mobilization is required.

I’m tempted to suspect that states like Russia and China may manage the transition better than the neoliberal West, for the simple reason that they (as I understand it) have retained a greater degree of State control or influence over the economy than western states have.

My simple-minded aphorism is that while markets can be pretty good at setting prices, they are often very poor at setting priorities. For that, an intelligent central authority may be needed. One hopes that those three words are not thoroughly oxymoronic when combined.

It is less about retaining control and more about the willingness to exercise control.

China and Russia to some degree at least seem to retains statesmen that put the welfare of nation and people ahead of financial oligarchs.

Question is if the system is resilient in the long run, or if finance will start to force cracks open once the current leadership retires.

For a start, we need to transition from the US ‘every person has a car’ model, to one where ‘every area has a viable public transport’ model. This is easier in urban areas, and in more awkward rural areas we need an ‘every person can hire shared transport for particular needs’ model, difficult as this inevitably will be. We also have to accept that there is a limit to growth, (capitalism) and furthermore, as poorer countries catch up with richer ones, that living standards (i.e. almost unlimited access to power hungry facilities, regardless of the environmental and other costs) will have to become more limited and eventually cease in the rich countries. In other words, the rich countries will have to become less rich as the poorer countries become more rich.

Either that or we all become Stone Age dwellers again – if there are any of us left.

Plus a host of other measures – wind-powered sea transport, no more ‘just-in-time’ delivery, lighter than air dirigible air traffic(?), timber housing and timber building methods to replace concrete as far as possible, much less farming directed at meat consumption, massive cuts in arms production,(!) production for use, instead of profit, . . . etc.

around my parts there used to be a combined use bus that had reduced passenger capacity but could also haul freight.

Since they drove a fixed route each day, farmers and such could rely on them both to ship smaller batches of produce etc off and get deliveries dropped off.

Radical conservation will be imposed by Reality. I think that’s the solution he neglected to mention. Overshoot is a thing. Think about it the next time you open a bottle of wine.

What about opening a bottle of wine relates to this post?

I find that opening a bottle of wine solves all sorts of problems. I just put problems out of my thoughts — although I do worry about overshooting my body’s wine maximum.

“”…isn’t a problem, rather a dilemma or predicament- ie, there is no solution. “”

Response to JS above (affordable housing in LA)

I have used this argument often, followed by “…only personnel problems.”

The incompetence is astounding.

(your example here)

Just a couple of quick thoughts:

1) Electrification of everything is not likely to be the solution, as indicated in Das’ essays. Liquid and gaseous fuels, whether derived from fossil sources, biomass or some other source, will be with us for the foreseeable future.

2) Radical conservation must be part any realistic solution. The whole world cannot bear the frivolous use of energy that is typical in the Anglosphere (and Europe, China, Russia, et al.) This does not have to mean a reduction of quality of life, tho’. It just means that we need to stop making tons of throw-away stuff and repair & reuse the stuff that we need. Fast fashion, yearly iPhone upgrades, bottled water and low-cost airlines, for example, should cease to exist. The private car will probably have to go as well – as it is a huge resource sink that spends most of its time in parking-lots and garages.

3) Stop the War Machine. This is a huge resource sink that produces huge GG quantities with little of benefit to humanity at large.

4) Destroy the Financialization Machine. Put finance back in its place as a facilitator of productive economic activity instead of an end in itself. IMHO, the idea that the goal of corporations is “making money for shareholders” instead of creating real wealth for the benefit of society as a whole is just insane. Financialization drives the whole extraction business and will not stop until either it is stopped or we are all consumed in the fire.

Well said.

“The whole world cannot bear the frivolous use of energy” – one mans frivolous use of energy is another mans paycheck. Will you be the one who makes those judgements.

“The private car will probably have to go as well” – oh of course, that is already the regulatory goal, but the funny thing is, people want cars and the freedom and convenience it brings them. Never mentioned is the truly vast physical restructuring of much of our society that would be required to return to the world where everything moves at the speed of walking, where everyone has to live within walking distance of the grocery store.

“people want cars and the freedom and convenience it brings them” – even at the cost of a liveable environment?

And everything does not have to go back to the speed of walking (although more walking would probably do a lot of us a lot of good) – shared communal transport can probably still be a possibility.

What a silly question! Of course not. These are decisions that must be made on a sociopoltical level. Options other than private vehicles must be available to citizens, because freedom to travel is fundamental to a democratic society. These are the things that need to be worked out.

Many people, especially in North America, due to the built infrastructure, need cars for anything.

people want cars and the freedom and convenience it brings them

Or the perceived freedom and convenience it brings.

I find that a car tends to be much more of an annoyance than anything useful most of the time. It, of course, depends on where one lives but I live in a small city with decent, in Canadian terms, public transit and picked a place to live fairly close to work and amenities.

A combination of walking, bicycle, public transit, the occasional taxi and very occasional auto rental handles my transportation needs. An auto would be an costly and close to useless item. The key things are a 15 minute city landscape and good transportation options.

Since most of the world’s population is urban it should be fairly easy through proper design of the city and provision of city services to make 70-90% of personal automobiles redundant.

so eco-socialist revolution, yes!

This excellent article gets rid of “But what about…” solutions to overshoot. I’ve seen this in operation in a Zoom course of people who keep running to their next “But what about…” idea as each hopium solution is eliminated by the numbers. It’s an experience akin to what terminal cancer patients go through. Denial comes to an end, and a harsh and probably short future becomes an inescapable reality.

No one is better at arranging and conducting interviews of the people in this field than Nate Hagens whose background includes Wall Street and a Ph.D. in ecology. He and his guests are unflinching in their assessments, yet manage to keep focused on what can still be done at this very late date. Here’s a few of his many podcasts that might be of interest to NC readers:

Kim Stanley Robinson: Robinson is still holding onto some hopium, but the interview is worthwhile nonetheless

Simon Michaux: Mentioned in the article above

William Rees: Keeps the focus on overshoot rather than the narrow carbon concern

Patrick Ophuls: Ophuls is a political scientist who explains why our political system can’t deal with this.

Doug Rushkoff Rushkoff, to whom the hedge fund and tech guys came asking about shock collars for their private jet pilots, talks about cultural adaptation.

Kate Raworth: The interview with the Doughnut Economist is the most upbeat of the ones listed.

As Das’s graphs and data point out relentlessly, the Green New Deal is a farce. Radical conservation, i.e. degrowth in the WEIRD countries, is absolutely necessary beginning yesterday to even allow us to make some of the things we’ll need in the transition that’s rapidly being forced on us by the realities of Earth’s carrying capacity. We are currently reducing that carrying capacity drastically, making the horrifying impacts of this catastrophe even worse.

One thing we can do is understand these realities and communicate them to family and friends (whether the latter will remain so after you’ve “testified” to them is questionable). Remember that delivering this message is akin to telling someone they have Stage 4 cancer. It’s devastating after what we’ve been taught about the meaning and mission of life, but it’s worth the effort and unpleasantness if this kind of grass roots effort could reduce the typical American reaction to anything that will raise the price of gasoline or restrict our precious freedumb to consume and waste.

The other thing we can do is dissent. We have two kinds of liars: the crude ones who still deny there’s even a problem; and the Eco-modernists types who claim we’ll innovate our way out of this with electric this and that. Das completely blows that out of the water, but they keep lying and stalling against doing what must be done, things like banning non-essential flying, rationing gasoline, cutting speed limits, banning cars from inner cities. In the absence of things like that which would actually help, we’re going to get Happy Electric Motoring, guilt-free flying and before long, untested Hail Marys like the Gates/Harvard/Keith shooting sulfur in the sky every two years. At least we can publicly dissent from such destructive policies in much the same way that Chris Hedges has been urging resistance against the depredations of neoliberalism.

Finally, we can prepare ourselves, our families and our neighborhoods against the coming Jackpot because nobody is going to land this plane.

Great series, keep it coming.

One raw material he left out is the types of sand that have the silicon to make semiconductors — including PV semiconductors — and the ecological damage caused to mine what remains.

Maybe we don’t need new iPhones every two years? Just saying.

Very discouraging. The lesson that I take from it is that we are screwed. The big energy conversion ain´t gonna happen, but if it does it will be ugly. In this series of articles Das takes great pains to put things as simply as he can, big picture. He focuses on the need for energy, where it comes from and where it goes. One thing that I have not seen addressed in this series, or maybe I missed it, is how the energy gets from where it comes from to where it goes. There is a vast energy infrastructure – the electric grid, the thousands of miles of pipelines. I wonder how much all of that is worth. It is an enormous investment. Do you suppose that it is all completely paid for? I suspect not. I would guess that there are bondholders all over the world collecting payments from those things. There is a strong incentive on the part of those who have their money invested in that infrastructure that, whetever the transformation entails, that their investment is protected. For this reason I think that there is not too much interest on the part of these folks in separating the heavy industrial users from the rest, the residential/light comercial users. This would entail breaking up the grid into smaller grids serving individual users – sort of a return to the old days of the municipal systems. Renewable sources seem to be more suited for those type of users. Obviously conserrvation would be required, and would be feasible when designed to meet the needs of a particular group of users. Lumping it all together results in the residential users paying for the massive generation, transmission and storage requirements of the big boys. Smaller grids could avoid that, but this idea will have to overcome the resistance of the cupon clippers..

He is also dead right about the hopium now being slathered on by the academics, experts, think tanks, etc about the ¨green new deal.¨ These are mostly snake oil schemes for sucking up subsidies. It does not take a genius to realize that the more times you convert one energy source to another, there is friction. The more hands a unit of energy passes through the more expensive it gets – those guys don´t do the buy and sell game for free. Enron was the poster child but we wtill haven´t learned. Although Das was more diplomatic, I agree that green hydrogen is a scam. Total electric is almost as bad. Electricity is important, but other sources have their place (how is the electricty generated?) We need to be realistic and make the best use of what we have. Now we aren´t supposed to use natural gas (Russian! Bad Bad!!) but use coal instead. The Canadian oil sands oil is the dirtiest in the world.

In short, in the absence of the pie-in-the-sky energy transformation we need to do our best to mitigate the mess we have created. We have made out bed and now we have to make the best of it. Plant trees, build railroads, more economic urban transit (it doesnt have to look like it came from outer space), restore flood plains, start to do some actual planning (horrors!) that results in settlements that do not depend so much on cars (a little late I know, but it could be a start). Sorry for geting away

I think more than radical conservation is necessary. We need to redesign our entire way of life. Fossil fuels should be conserved and used for the production of materials, both to produce the high heats required and also as a source of precursors for important chemicals and drugs, instead of the present use moving heavy vehicles around the country and across the oceans to serve the labor arbitrage, geographic spread, and other purposes of Corporate Cartels. The kinds of materials produced, their uses, and the ways they are used need a major redesign. The use and deliberate discard of metals, plastics, paper for packaging wastes energy and raw materials. The use of steel in concrete to build structures with an expected life of only 50 years should stop. Glass containers should be standardized, labeled using water soluble glues to attach their labels, cleaned, and re-used. Much more change and redesign is needed — more than I am able to imagine.

The population of Humankind must be reduced. That can happen gracefully over time or as a product of starvation, disease, war, and despair. Nation states cannot retain their present structures and limitations. The habitable zones of the Earth are already shifting and may not become settled for centuries or millennia as the climate leaves our temperate present and begins its transition to what we can only hope might be a new relatively stable state. Adapting to a new stable state — even an uncomfortable stable state — is much easier than adapting to a constantly shifting chaotic climate. Large scale migrations of Humankind will require flexible borders and States to assist and care for migrants. The present scale of population makes this necessity untenable. There must be universal social security to remove one of the reasons for large families. The world’s religions must reformulate their doctrines to fit the harsh realities of the situation Humankind faces.

The Earth is already making the transition to a new climate. Our most heroic actions can at best mitigate how bad things could become. As this post details, the enthusiasm for a “green” transition without radical changes, presently unthinkable, is little more than a new profit making opportunity some factions of our Power Elites hope to exploit … for as long as they can.

Humankind lives uncomfortable lives cramped in time, space, freedom, enjoyment, … room within ourselves to grow and become more human, more our potential selves. How change will come about I have no idea but great change will come. I am afraid the future promises change that will be jagged, bloody, unplanned, and ill-designed if designed at all.

I wanted to chime in about sand. Sand is a defined as a size not a material.

Quartz I think is what’s mined and then ground into sand sized pieces for easy transportation and manufacturing process to make poly silicon.

https://en.m.wikipedia.org/wiki/Sand#:~:text=Sand%20is%20a%20granular%20material,gravel%20and%20coarser%20than%20silt.

This is an excellent series; thank you very much for publishing it.

One of Das’s graphs has me puzzled, though. The table by L. Pennec seems to say that there are enough reserves of Lithium to last 154-400 years. This contradicts all other graphs, and surely cannot be correct. Is there a different way of reading it?

(I doubt there’s such a thing as a “greenfield” open-pit copper mine. Check out the one south of Superior, AZ. It is one of the most horrific things on earth.)

James Hansen, Sato and Ruedy posted a new brief today:

“The Climate Dice are Loaded. Now, a New Frontier?”

https://www.columbia.edu/~jeh1/mailings/2023/ClimateDice.13July2023.pdf

Given the acceleration of the Earth’s energy imbalance (EEI) in the past several years, we anticipate an acceleration of global warming. “It seems that we are headed into a new frontier of global climate.”

The brief makes the following statements which relate more directly to the post [combining a statement with its footnote]:

“Conformity leads to dogma,which is anti-science. For example, belief that we can still solve the climate problem via just greater reduction of greenhouse gas emissions. Or belief that borrowing enough money from our grandchildren to build solar panels and windmills as fast as possible will significantly reduce global CO2 emissions. Or that support for nuclear power is ‘not needed’ because solar power is so cheap (Nuclear power is a needed carbon-free complement to renewables and viable scenarios for decarbonized electricity include an increasing role for modern nuclear power, but there is a total disconnect with financing (Bowen, M. and K. Guanio, 2023: A critical disconnect: Relying on nuclear energy in decarbonization models while excluding it from climate finance taxonomies, Commentary, Center on Global Energy Policy at Columbia University.).”

I was born & raised in one of the 10 poorest countries on earth, where whole families lived in one-room mud huts. Then I transitioned through a 2nd-world country, which had multi-layers of social levels, it’s a place of several societies living side-by-side, where individuals in each of those feel like they have parallel lives to those in the others. Finally I ended up in a ‘rich’ country or the 1st world, in which the defining signals behind the 24/7 wall of marketing noise are greed, waste & inequality. Neoliberalism drives this conveyor belt & the process inevitably ends in serfdom; ironically the majority in ‘wealthy’ countries don’t have a good quality of life.

The world can cut a massive % of power used currently for wants/waste instead of genuine needs, but the hold the powerful elite has on the masses is so total that we will all crash before they ever allow it. They will die for their greed & lust for power – whether that is conscious or not is of no help to us …..& we are too conditioned on the whole to fight back against the system, we are the sheeple.