As college students across the country head back to school, they are struggling to find affordable housing. Here’s Forbes:

As millions of college students happily move into their campus or off-campus digs, some of their peers still don’t know where they’ll be living during the fall semester. Being admitted to a university does not necessarily guarantee campus housing; schools typically plan to house just 25% to 35% of students on-campus with an emphasis on providing beds for freshmen and sophomores, says Daniel Bernstein, president and chief investment officer at Campus Apartments, the student housing development company led by billionaire David Adelman.

The writers at Forbes decline to pull on that thread anymore and instead focus on the fact college enrollment is ticking back up following declines during the first few years of the Covid19 pandemic. Private equity has indeed been taking over student housing for years, and the result is usually higher prices and fewer services, but what explains the lack of housing? The go-to answer is always that new student housing construction has not kept pace with demand.

Here’s the problem with that response: Undergraduate college enrollment dropped 8 percent from 2019 to 2022. According to the Chronicle of Higher Education, enrollment levels remained steady in the Spring of this year, but were still one million below pre-pandemic numbers.

At the same time, we’ve still been getting stories of students sleeping in cars in recent years even as enrollment dropped. What gives? Here are four possibilities:

1. More competition for off-campus rentals from the general population who can no longer afford to buy a home. This has led more students to seek student housing. The homeownership rate was at its lowest level in decades in 2020. From The Hill:

Slightly more than 80 million out of 126.8 million occupied housing units across the country were inhabited by homeowners in 2020, putting the nation’s homeownership rate at 63.1 percent. This is the lowest homeownership rate since 1970.

(This data from 2020 is before the recent rise in mortgage rates that has made owning a home even more unattainable.)

2. Private Equity has moved aggressively into private student housing in recent years, tempted by its steady revenue and frequent turnover, which allows more easily for consistent rent-raising. Wall Street’s takeover of the American rental market really took off during Obama’s foreclosure jamboree as private equity snapped up properties at bargain prices. Since then more “innovative” tools are being used by the investment goliaths. They use computer algorithms to find houses that would be profitable to turn into rental properties, often snapping them up with cash bids within minutes of a property coming onto the market. And when areas no longer have affordable houses to buy, they can raise rents. That brings us to:

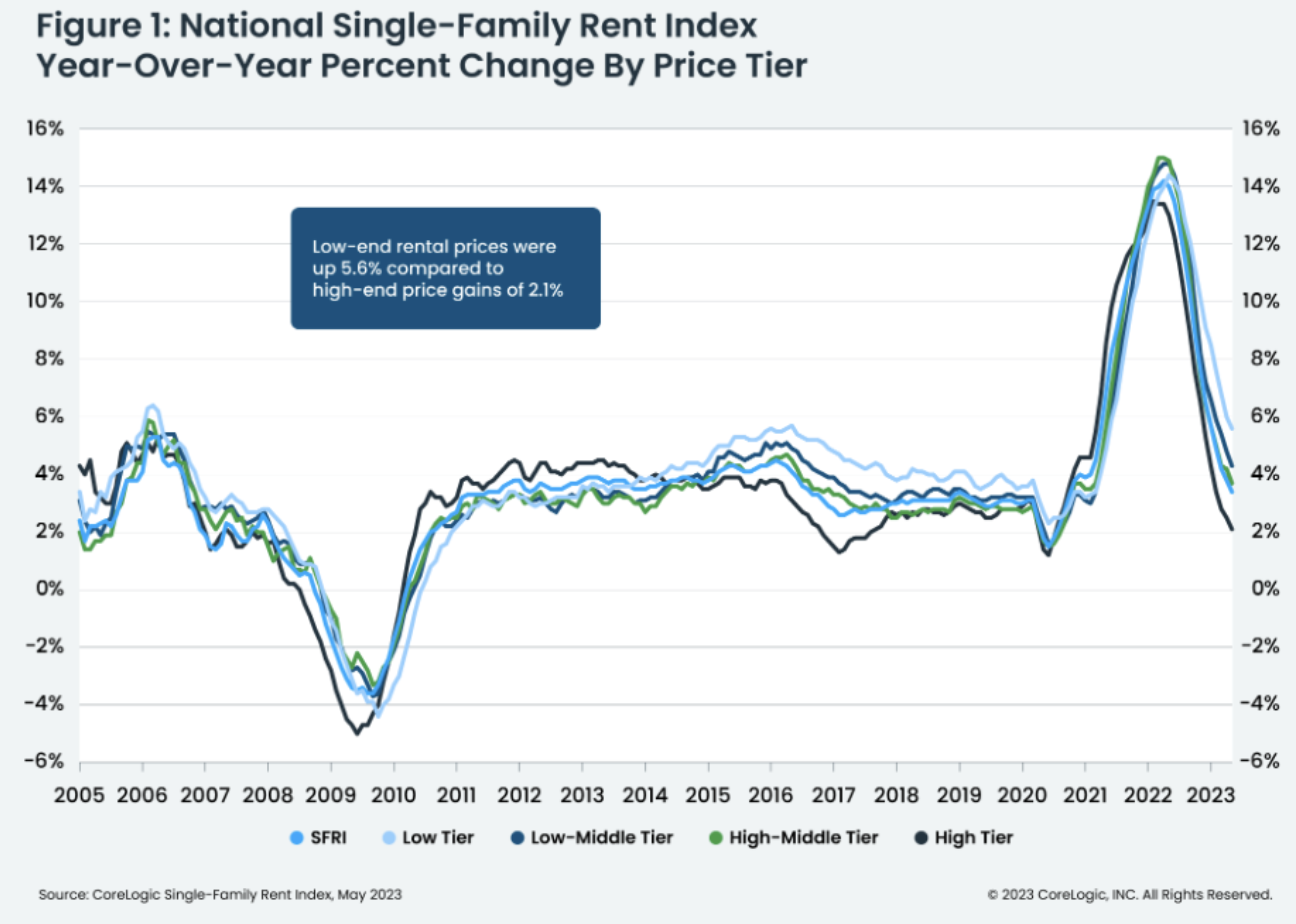

3. While the astronomical growth in the cost of rental housing early in the pandemic has subsided, prices are still unaffordable for just about anyone who is working class in many markets.

The situation is even worse in student housing. From Inside Higher Ed:

It’s no secret that housing costs across the United States are high—for students as well as for the general population. But from November 2022 to May of this year, the average rental cost for purpose-built student housing grew faster [8.8 percent] than rent prices for regular multifamily housing for the first time. As a result, some students are being priced out of apartments that were designed specifically for them.

That alone would likely be enough to explain the situation for college students, but an even bigger factor might be unfolding in a courthouse in Nashville.

4. That’s where a huge lawsuit against dozens of rental behemoths and a little-known Texas middleman company is moving forward after a federal judge in Nashville declined to dismiss the case earlier this month.

Texas-based RealPage is accused of acting as an information-sharing middleman for real estate rental giants. The lawsuits contend that that the property managers agreed to set prices through RealPage’s software, which also allowed the companies to share data on vacancy rates and prices in many of the US’ most expensive markets. The lawsuits also contend that the conspiracy has had an outsized impact on the student housing market.

Reporting, the lawsuits, and RealPage’s own statements showed that the company’s software said that it was often more profitable for mega landlords to have higher vacancy rates and keep rents elevated, which contradicted the old landlord practice of getting heads in beds even if that meant lowering rents.

Many of the rental markets dominated by large landlords have seen astronomical growth in rental prices in recent years (even before the pandemic), as well as a rising number of evictions and spikes in homelessness. The lawsuits against RealPage and the rental management companies contend that its software covers at least 16 million units across the US, and private equity-owned property management companies are the most enthusiastic adopters of the RealPage technology. From ProPublica:

RealPage’s influence was burgeoning. [In 2017], the firm’s target market—multifamily buildings with five or more units—made up about 19 million of the nation’s 45 million rental units. A growing share of those buildings were owned by firms backed by Wall Street investors, who were among the most eager adopters of pricing software.

…Somewhere around 2016, according to one trade group, the industry’s use of the pricing software began to achieve “critical mass.”

I’ve included this list gathered from the lawsuits in previous posts on RealPage, but I think it’s worth including again here. The following are some of the real estate goliaths named in the lawsuits who were using RealPage software to allegedly collude and keep rents artificially high. Many are also major players in student housing:

- Greystar: The nation’s largest property management firm with nearly 794,000 multifamily units and student beds under management. In December, it was nominated for six( count ‘em, six!) 2022 Private Equity Real Estate Awards. Roughly 100,000 student beds under management.

- Trammell Crow Company, headquartered in Dallas, is a subsidiary of CBRE Group, the world’s largest commercial real estate services and investment firm.

- Lincoln Property Co. Manages or leases over 403 million square feet across the US.

- FPI Management. Currently manages just over 155,000 units in 18 states.

- Avenue5 manages $22 billion in multifamily and single-family assets nationwide.

- Equity Residential, the 5th largest owner of apartments in the United States, primarily in Southern California, San Francisco, Washington, D.C., New York City, Boston, Seattle, Denver, Atlanta, Dallas/Ft. Worth, and Austin.

- Mid-America Apartment Communities, which as of June 30, 2022, owns or has ownership interest in 101,229 homes in 16 states throughout the Southeast, Southwest, and Mid-Atlantic regions.

- Essex Property Trust (62,000 units). This fully integrated real estate investment trust (REIT) acquires, develops, redevelops, and manages multifamily apartment communities located in supply-constrained markets on the west coast.

- Thrive Community Management (18,700 units in Washington and Oregon). Refers to its employees as “thrivers.”

- AvalonBay Communities, Inc. As of September 30, 2022, the Company owned or held a direct or indirect ownership interest in 293 apartment communities containing 88,405 apartment homes in 12 states and DC.

- Cushman & Wakefield, with a portfolio of 172,000 units.

- Security Properties portfolio reflects interests in 113 assets encompassing nearly 22,354 multifamily housing units.

- Cardinal Group Holdings, LLC. 89,000 units managed with more than 100,000 beds and a heavy presence in student housing.

- CA Ventures Global Services LLC. Manages more than 60,000 beds in 69 university markets.

- DP Preiss Co. Specializes in student housing and has more than 30,000 beds in 12 states.

If all these property management companies were colluding to fix prices, it would help make sense of why students are sleeping in their cars.

Let’s not stop there, though. All the money these rental management companies rake in also helps them to influence lawmakers and voters. Here’s Housing Is A Human Right on Essex Property Trust, Equity Residential, and AvalonBay Communities’ activities in California:

Those same corporate landlords shelled out millions in campaign cash to successfully stop California rent control ballot measures Proposition 10, in 2018, and Proposition 21, in 2020.

Essex Property Trust delivered a total of $26.2 million to kill Prop 10 and Prop 21; Equity Residential shelled out $17.9 million; and AvalonBay Communities gave $17 million. Housing Is A Human Right also broke the story that RealPage contributed $1 million to stop Prop 10 and Prop 21.

Private equity firms have been pouring into student housing for years, which they believe will provide better returns compared with other residential assets. For example, the private equity giant and corporate landlord Blackstone in 2022 paid $13 billion to acquire American Campus Communities, which owned 166 properties located on or around 71 large university campuses across the US. At the time Blackstone already had more than $7 billion worth of student housing in its portfolio. It wasn’t long before it got even more.

Here’s how that played out in California, courtesy of Jacobin:

As the world’s largest private equity firm faces potential losses from a cloudy real estate market, its executives blocked jittery investors from withdrawing their money from one of its real estate funds, while insisting that rent increases and evictions will bolster returns.

Now, the Blackstone Group’s real estate investment trust has received a multibillion-dollar bailout from a source whose employees and students are already suffering through the housing crisis: California’s public university system.

Just months after Blackstone’s real estate investment trust purchased America’s largest owner of private student housing, the same trust received a $4.5 billion infusion from the University of California’s Board of Regents, two of whom have close ties to the company. The investment rewards the financial firm only a few years after the company and its executives spent $5.6 million to kill California ballot initiatives that would have expanded rent control in the state. …

Effectively, University of California (UC) is funneling cash into privatized student housing and corporate landlords — doubling down on a controversial investment strategy that comes with a massive layer of fees and Wall Street profits — instead of doing its part to address a growing housing crisis, one that affects its students and employees.

One of the most attractive components of student housing for the likes of Blackstone is that rates often reset every year, which means prices can go up annually. Leases are also often co-signed by parents, and if students have trouble affording the higher prices, well, here’s some financial aid. And when students are paying off those loans for the rest of their lives, more than half of it could be the result of helping to enrich their private equity landlord during four years of education:

Off-campus rents have gone through the roof—nationally, they’re averaging $2,062 a month, up 28% from $1,614 at the start of 2021, according to rental data from Zillow. That raises both demand for on-campus housing and the difficulties students face when they can’t get it. …

Even campus housing isn’t cheap in the California system. For in-state undergraduates, tuition at UC Berkeley, one of the nation’s top colleges, is a comparative bargain—$15,600 this coming year. But living on campus (including a meal plan), costs freshmen an additional $16,000 to $20,000 per year.

Maybe that’s why Congress doesn’t do anything about the rising cost of housing or college, but it did manage to push through a bill to make it easier to apply for student loans.

Graduated college in 1995. Don’t know if I could afford the expense if I had to repeat the effort to pay much of it in today’s era. Bagging at Winn Dixie or driving sales routes in the summer might be enough to keep the mountain of required debt a little lower. What a great country! ( sarc )

RealPage is a familiar entity, this is dated from 2014 or 2015 but if memory serves they had a main office campus centrally located in the Dallas / Plano / Addison area, roughly speaking. Tip of the spear, as it were.

Stopping PE is now a matter of self-defense.

PE equity gets involved in some industry, enshittifies it, keeps raising prices. They don’t improve anything and these cretins have a tendency to get involved in areas that are life or death.

People have to go to the job to ask for a raise and prices of goods and sevices are raised constantly in a rentier economic system.

And the elected officials all around sit back like corrupt goobers.

Even when supply chains are mentioned as the cause of some inflation, that often is due to PE. The enshittification of supply chains comes with growing influence of PE in various industries.

I’m not engaging in hyperbole. Stopping them is a matter of self-defense. At this point, it’s.beyond any type of ideology.

Thanks Mikel. This is my reaction as well.

PE, like an invasive species lacking predators or other constraints, has insinuated itself into virtually every corner of life in the US, particularly into what, in a previous life, were deemed goods with a fundamentally “public” basis: health, housing, food production, education, water, security, defense, on and on. And those in the US who are currently unaware of PE’s reach and fundamental danger soon will be.

How can anyone, other than PE parasites themselves, think this is a good thing? If our “leaders” in government are unable — or more likely, unwilling — to grasp how this ends, then they are worse than the parasites. What part of “clear and present danger” do they not understand?

What is crazy is that old man Marx had a passage about the dangers about finance capitalism in the later volumes of Capital, suggesting that industrial capitalists should join forces with the proletariat against them.

Smart ‘parasites’ do not kill their hosts. The PE class do not qualify as “smart parasites.”

Any suggested ‘solutions’ to this crisis will eventually end up looking like a transcript of the deliberations at the Wannsee Conference.

“Things” will continue on as ever, until they cannot.

I feel sorry for today’s college students. Phyllis put herself through college back in the 1960s. She worked as a secretary during the summers and on ‘off years.’ (She still touch types pretty quickly.) She swears that the experience was a secondary course of instruction. She learned to set her own boundaries as to what she would and would not allow to be done to her, anywhere. One story involves a jealous wife of a Senior Partner and how Phyl had to convince her that she, (Phyl,) was not ‘the other woman.’ If I remember correctly, Phyl’s argument was along the lines of; If I wanted to ‘bag’ a high worth husband, I certainly would not accept any old philandering married man. That story would be sure to keep repeating itself, next time with me as the aggrieved party. Phyl says they parted amicably.

I seem to recall reading that the old advice at JP Morgan was to be long term greedy.

But this was back when Matrix was released, and Agent Smith likened humanity to a disease on planet earth.

Yet all that faded after Occupy was interdicted by intersectionalists…

A first step towards stopping PE would be to repeal whatever laws and reverse whatever regulations were passed and written from the Carter-Reagan period through to today which give PE various tax advantages and shelters and cloaks-and-shields against regulatory scrutiny or indeed any notice at all.

If cancelling all the changes which enabled the rise of PE as we know it today does not get PE stopped, then more extreme measures will be needed.

Young people are getting numerous enough that they could probably force a “young peoples’ party” into the sea lanes of electoral politics, if they were organized enough to do it and not too cynicalized by now to think it would even matter any more.

What would a “young peoples’ party” stand for and pursue? That’s for young people to say. Since I was young once myself, and still remember the warm fading afterglow of better days in the middle-distant past, I sort of hope the young people start making an intensive study of the real original Populist Movemen/Party, the Fair Deal, the New Deal, the Square Deal, etc. And successful Social Democratic policies in other places. And Huey Long’s “Every Man A King” Share The Wealth program, the program which terrified FDR into seeking Social Security legislation.

They might also study all the charts and wiring diagrams of the anti-New Deal movements attainments and successes. You can’t disarm a bomb if you don’t know all the inside parts and pieces.

I hope the young people decide that Bernie Sanders’s lacks and deficits were all on the character side . . . the lack of sufficient spiritual violence and hatred to be able to get things done in our hate-based political system. Hopefully the young people can learn to harness hatred and weaponize it in a good cause. Hopefully also they remember that the bed they make for old people will be the bed they lie in if they get old. That is also part of pragmatic social democracy.

It would be nice if the SanderBackers re-consituted their movement, and if the WestBackers keep together as a movement whatever happens to the West candidacy.

the pin to pop the balloon of private equity , would seem to be changing the tax laws.

Specifically, the laws/IRS rules that allow the PE firm to call all the debt they create when they have these companies “buy themselves”, and “expense”. Which gives them a revenue stream, while creating massive losses/ and debt for the entity with new PE owners; that they use to write down their tax liabilities, ad infinitum until said “new company” is totally cannibalized, and sold off as parts. Or , until the giant turd ball they create, rolls over and encapsulates everything it touches.

It is a real stick in the eye, that the taxpayers are the real “can do people” who pay to have these wall street yahoos do their dirty deeds. And the congressional enablers are the ones who allow the finance crowd to fleece the people… ad infinitum.

I’m sensing a conspiracy in restraint of trade here, but then I’m sort of old-fashioned about these things.

You do have to wonder what will be the effect on all those students having to sleep in their cars just so that they can get an education to get ahead. It may be that they will be bright enough to work out the part that private equity is playing to get them where they are but I doubt it. If they can’t work out what the war in Ukraine is all about and that Trump is not a fascist dictator, then how will they see and understand what is causing them to sleep in cars? You would hope that it might make them more compassionate about homeless people but it could go the other way where they decide that as they suffered so much, then they will make everybody pay for that and chase the fast bucks so that they are never in that position again.

I’m waiting for some Universities to institute “Safe Parking Zones” on campus. Set up a designated “Car Camping” area, preferably close to some sanitary facilities. Supply Campus Security and low ambient lighting at night.

Extend the above nationwide and call them “Semi Mobile Vulgus.”

“Full speed! Into the Past!”

The Politico article linked to above is about exactly that.

And I know — a friend is doing it right now — there are de facto student overnight parking zones at or near other schools. San Francisco State University even has an outreach office for homeless students. Their estimate a couple years ago was that 34% of students had no place to live. My hunch is that the 10% figure for California State University students given in the Politico article is a system average, and because one of the top priorities of anyone living in their car is to be undetected and safe, is likely an under estimate.

Maybe we can file this under Imperial Collapse.

Just in time for VW’s EV take on the Type 2 hippie van.

The western world is really stuck in some sort of nostalgia funk…

Some students are choosing to prepare for college by building mini-homes on truck and trailer frames. Van conversions are also popular, enabling students to have independence from the high cost of student housing by creating mobile housing. This is a viable alternative to falling victim to the rentier class.

The rentiers are alive and well and running RV and mobile home parks. They can and do raise cain with local police departments to roust ‘stealth campers’ parking vans on city streets, to force people to give them lot rent.

Already been done. Here’s an example from my alma mater, the University of Michigan. Link:

https://apnews.com/article/f392748040d24816ab45b1a040635cb4

Great article, thanks. My CIA-democrat house representative has Blackstone as a contributor. This will be a great resource to use in challenging his fake sincerity.

So you consider a REIT to be private equity? Also the property management firms seem disconnected from PE? It seems logical to me that a property manager would want to advise its client how to improve revenue/decrease expense.

US college system is now a predatorial venture. Been moving that way for years now, nothing new. It needs to be broken up

https://www.hbs.edu/faculty/Pages/item.aspx?num=63221