The Fed isn’t acting as if its heart is in taking regulation bank regulation seriously. Not that that is any surprise.

Earlier this week, the Wall Street Journal described how banks are sidestepping the more stringent capital requirements regulators plan to implement after Silicon Valley Bank and Signature Bank failed early this year. SVB, as it is often called, took the bone-headed action of loading up on low interest rate mortgages. The bank’s funding was skewed towards very large deposits, and then by wealthy individuals, as opposed to businesses. Keep in mind that quite a few venture capital funds who were investors in SVB required other investee companies to bank at SVB, so the prospect of those companies being unable to make payroll1 because they’d lose their uninsured balances became the rallying cry for Doing Something.

The denouement was that both banks had all their deposits guaranteed, and that the Fed created yet another emergency facility, the Bank Term Funding Facility, to provide relief to similarly-situated players, as in potentially a lot of banks. This was a more permissive way than the discount window to allow banks to access emergency funds, by virtue of not haircutting the collateral pledged for the loan. Remember that while SVB was an extreme case of wrong-footing the Fed’s interest rate increases, nearly all banks are sitting on losses on loans and portfolio investments due to their price going down as interest rates rise. There could be an argument for regulatory forbearance, as in looking the other way and/or finding ways to finesse the paper losses, on the assumption that the central bank will relent in the not-too-distant future and those interest-rate-induced losses will prove to be largely temporary.

This long-winded intro is to establish that the crisis this spring, and the Fed’s combo of relief but tighter capital rules was to solve a problem created by the central bank itself, that of having kept interest rates too low for far too long, and then reversing them though very aggressive rate increase. We’d heard in 2011 or 2012 from Fed-connected sources that the central bank realized its super low interest rate experiment had been a failure and they needed to unwind it. Bernanke talked the prospect of Fed tightening up in 2014, but lost his nerve in the market revolt that came to be called the Taper Tantrum.

Congress and the Fed exacerbated this underlying problem, of an excessively-low-interest rate time bomb that would eventually go off, with Congress voting through laxer rules in 2018 on the cutoff for being a large bank. Nevertheless, the Fed remained the primary regulator for SVB and even released a report on why the bank failed and admitted it had become too hands off with the mid sized banks under the new law.

So now, not at all far past the March upheaval, with new capital rules expected but not implement, the Fed going the other way, of being more permissive. It is allowing big banks to get relief from current rules, while enriching some notorious bad actor hedge funds and less unsavory private equity firms. From the Wall Street Journal:

U.S. banks have found a new way to unload risk as they scramble to adapt to tighter regulations and rising interest rates.

JPMorgan Chase JPM 0.49%increase; green up pointing triangle, Morgan Stanley MS 0.61%increase; green up pointing triangle, U.S. Bank and others are selling complex debt instruments to private-fund managers as a way to reduce regulatory capital charges on the loans they make, people familiar with the transactions said.

These so-called synthetic risk transfers are expensive for banks but less costly than taking the full capital charges on the underlying assets. They are lucrative for the investors, who can typically get returns of around 15% or more…

U.S. banks have found a new way to unload risk as they scramble to adapt to tighter regulations and rising interest rates.

JPMorgan Chase, Morgan Stanley, U.S. Bank and others are selling complex debt instruments to private-fund managers as a way to reduce regulatory capital charges on the loans they make, people familiar with the transactions said.

These so-called synthetic risk transfers are expensive for banks but less costly than taking the full capital charges on the underlying assets. They are lucrative for the investors, who can typically get returns of around 15% or more, according to the people familiar with the transactions….

The deals function somewhat like an insurance policy, with the banks paying interest instead of premiums. By lowering potential loss exposure, the transfers reduce the amount of capital banks are required to hold against their loans….

Banks started using synthetic risk transfers about 20 years ago, but they were rarely used in the U.S. after the 2008-09 financial crisis. Complex credit transactions became harder to get past U.S. bank regulators, in part because similar instruments called credit-default swaps amplified contagion when Lehman Brothers failed…

U.S. regulations have been more conservative. Around 2020, the Federal Reserve declined requests for capital relief from U.S. banks that wanted to use a type of synthetic risk transfer commonly used in Europe. The Fed determined they didn’t meet the letter of its rules….

The pressure began to ease this year when the Fed signaled a new stance. The regulator said it would review requests to approve the type of risk transfer on a case-by-case basis…

But it is not at all clear how stringent the Fed is being:

Fed guidance on bank credit risk transfers could double market size https://t.co/BjsVYox5lB

— Risk.Net (@RiskDotNet) November 1, 2023

And if the central bank is not doing such a hot job of overseeing banks, how can it possibly evaluate the counterparties that are taking on these risks? If they go bust or have liquidity problems, it is the bank that winds up holding the bag. Remember that LTCM was perceived to be super savvy and rock solid until it imploded, and world’s biggest insurer AIG was rated AAA until it started on its terminal slide.

Even worse, the players that the Wall Street Journal mentions first (as presumed market leaders) include hedge funds, which means their exposures can change quickly, and ones with questionable histories. Again from the Journal:

Private-credit fund managers, including Ares Management and Magnetar Capital, are active buyers of the deals, according to people familiar with the matter. Firms including Blackstone’s hedge-fund unit and D.E. Shaw recently started a strategy or raised a fund dedicated to risk-transfer trades, some of the people said.

Ares was one of the firms involved in the CalPERS pay-to-play scandal, which included the bribery of CalPERS CEO Fred Buenrostro. ProPublica won a Pulitzer for its extensive reporting on Magnetar’s sleazy behavior in the runup to the crisis.

However, it remains a sore point that ProPublica missed the real story. As we described long-form in ECONNED, Magnetar was a structured credit arbitrage specialist. Using significantly synthetic CDOs (the 20% of actual mortgages in their structure made them saleable to a much larger group of investors), Magnetar created credit default swaps on the riskiest rated tranches of subprime bonds. Its massively leveraged structure generated enormous exposure that wound up in the hands of systemically important, high leveraged banks. Its trade also had the effect of driving demand to the worst subprime mortgages in the toxic phase that started in June 2005. Experts estimated that from then to the final demise of the subprime market, Magnetar drove the demand for 50% to 60% of subprime mortgage bonds. The reason Magnetar did not get as rich and therefore become as visible as John Paulson was that Magnetar gave up a lot of its perfect subprime trade on a bad bet, rumored to be on gold.

And these are the parties the Fed is comfortable backstopping bank risk? Seriously?

____

1 Businesses of any meaningful size will inevitably have more than $250,000 at the bank. They receive large payments from customers. They have to have cash in the bank to meet payrolls. From an accounting and software standpoint, it’s far too cumbersome to try to manage these money flows across multiple bank accounts.

I’m new to this issue- could an explanation/clarification be offered as to “LTCW”?

I’m guessing that’s a typo for the “Nobel”-heavy LCTM (Long Term Capital Management), which did in fact “implode,” spectacularly.

Asian Tigers and hedge funds, anyone? During the Clinton admin? And Mark Middleton? Wasn’t his name in the news in the last year? Something about something regarding his unusual suiciding? There’s this from the 1996 LATimes.

https://www.latimes.com/archives/la-xpm-1996-11-16-mn-65315-story.html

The Asian Tigers back then, and there were more than 4 of then at the time.

https://en.wikipedia.org/wiki/Four_Asian_Tigers

The Four Asian Tigers (also known as the Four Asian Dragons or Four Little Dragons in Chinese and Korean) are the developed East Asian economies of Hong Kong, Singapore, South Korea, and Taiwan. Between the early 1950s and 1990s, they underwent rapid industrialization and maintained exceptionally high growth rates of more than 7 percent a year.

So, we are speeding towards a financial cliff yet again?

This feels like the standard Neo-liberal strategy. Run up huge debts. Offload debts to third parties, who further sub-divide the debts, repeat the offloading, etc. When debts come due, default, or go bankrupt, and throw problem into the laps of the National Governments. Retire to balmy location with previously ‘sequestered’ funds.

Then, wait long enough for the general memory to have mostly forgotten, not the crime itself, but how the crime was carried out. Repeat crime.

I wish I was wrong.

I wonder why fewer can afford homes? It’s as if money keeps leaking into the economy and goes…well nobody knows or they wont say. Just not to those who need it.

Magnetar has been dishing out funds to Coreweave (a company started in 2021) in the last year and half or so.

Another bubble driving connection there.

The 1930s will repeat itself, to the surprise of the dupes who take standard economic history seriously on the basis that the Fed “learned its lesson.” Balderdash.

The money supply will continue to collapse and credit will remain scarce for all but the chosen money center banks, just as happened under Roosevelt (who, as noone points out, was a banker).

The money center entities have been preparing for this since the creation of the DTC. In simple terms, the bankers are about to call in the collateral. This should be intuitive to the curious minds who’ve for the last 20 years been asking “whither all this insane financialization of everything?”

It’s all right here, in a book every person on the planet should read: thegreattaking.com

Magnetar?!?!!! !! Noooooo….! Simon Johnson’s 2009 (?) The Atlantic magazine essay The Quiet Coup is proving prescient about what would happen by leaving the bad actors in place instead of sweeping out the CEOs who created the GFC and restructuring the worst offending banks. / my 2 cents

Oh good G-d! Magnetar.

Now it’s time for that old favourite saying. “Fool me once, shame on you, fool me twice, ‘Up against the wall!'”

Obama isn’t in power to protect Wall Street from the pitchforks now. Biden looks not to be up to that task. Everyone else in positions of power is looking weak and or incompetent.

Fasten your seatbelts, it’s going to be a bumpy night.

See: https://www.youtube.com/watch?v=3vEEh0GF_C8

Yep. And for those who don’t recognize the name Magnetar, just do a search on ‘Pro Publica Magnetar’. Pro Publica did great work on the financial malfeasance during the GFC.

I am sharpening the tines on my pitchfork. In addition to the managers of the banks, and investment companies, and their corrupt minions, I believe it is time to go after the Fed, the Treasury Department, and the Department of ‘Justice’ prosecutors who let this crime slide.

And the SEC, in my book. / ;)

Its the dominate economics love and those that funded that agenda, swiping at the institutions that it effected is not addressing the actual agents [flexian] that brought it all about ….

Thank you, Yves for your analysis of the inflghting and maneuvering going on. Problem loans and problem banks remain a serious concern. However, as Chairman Powell has admitted, the macro story is simpler. The Federal Reserve crazily accelerated the growth of the monetary base and, in turn, the M2 money supply during 2020 and 2021, The growth then stopped completely, as if the economy were a sports car that the driver could rev up to a speed of 150 mph and then slam on the brakes. There has been no meaningful change in the monetary base and M2 for more than 18 months. The pressure on an overextended financial system will remain intense into 2024. The question now is whether the Fed will relent and initiate a series of interest rate reductions sometime next year. There will be a desperate cry for more liquidity.

Reading this post and re-reading portions of “Econned” in an effort to better understand what happened and what is going on, I believe it would be helpful to discard some jargon and detail of the many financial ‘innovations’ and describe events in plainer terms describing the frauds and crime involved. Recalling events from the 2007-2008 financial collapse — I would find it helpful to understand the nature and purpose of the banking regulations from the Great Depression contrasted with how the current non-regulation regime operates.

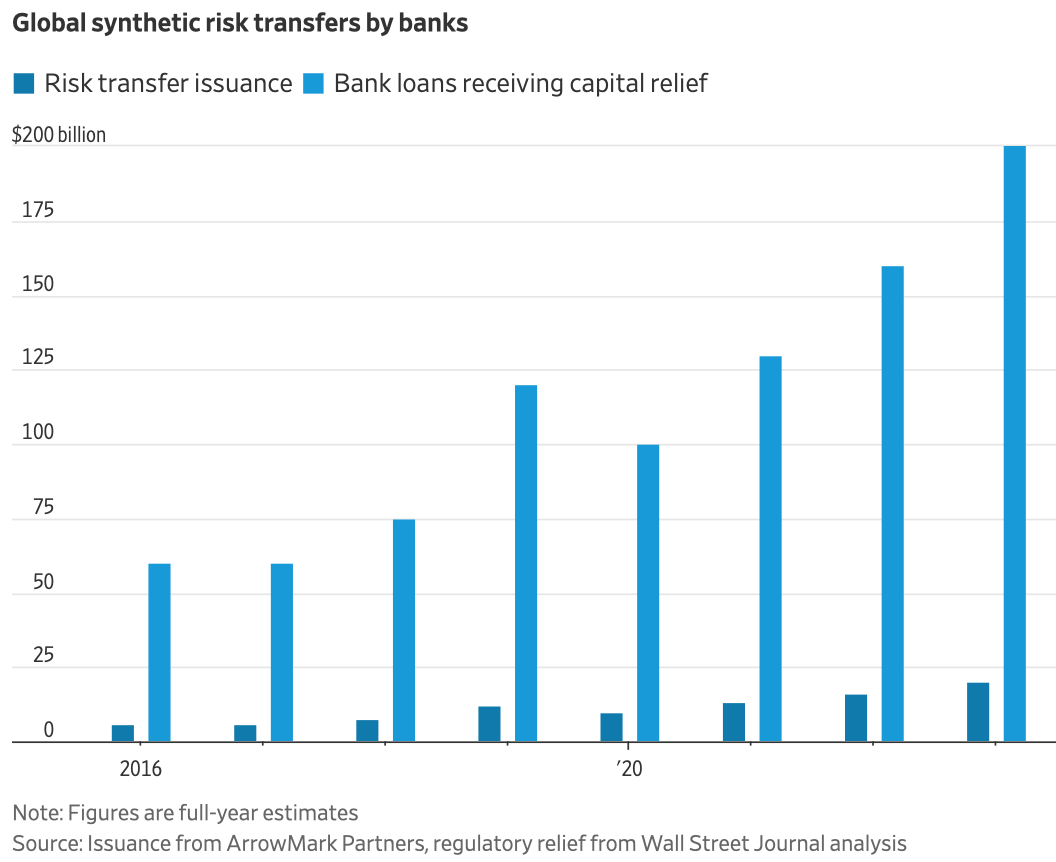

One of the features of the Great Depression I recall from long past reading, was the impact of leverage as a multiplier of risk and its downsides. One of the problems I am stumbling on in trying to understand events now and in re-reading “Econned” is how the financial ‘innovations’ could work to multiply risk to the multiple trillion dollar levels in the 2007-2008 financial collapse. I am not sure how to interpret the 10-12 fold ratio between current year risk transfer issuance and bank loans receiving capital relief. I believe the extensive, colossal, and high level crime we are being subjected to becomes lost in the details. Instead of worrying through what a CDO is or what synthetic risk transfers are — is there no way to more simply describe what is happening? I do not object to details, but at some point they are not helpful in understanding the Gestalt of the crime.

I have forgotten too much and remember too little, and much of what I thought I understood, collapsed in efforts to draft a summary of my ‘understanding’. I realize I did not understand what I thought I understood. I apologize if my ignorance is singular or a result of my natural sloth.

Dodgy hedge funds are writing notes guaranteeing the loans on banks books in exchange for a hefty interest rate payment. The banks no longer have to carry tier I capital to cover those loans, which are already leveraged at circa 10-1. If those loans go bust, the Fed will eventually be holding the bag, like they did in 2008. On top of that, the dodgy hedge funds made the problem exponentially worse by bundling it up and trading it in 2006/7 so who knows what they are doing now. The big difference here is the Fed actually created this crisis by raising rates too fast not understanding the impact to banks balance sheets holding short term notes.

The way they got out of it last time was to print bajillions of dollars, which resulted in huge asset bubbles and massive concentration of wealth at the top. There’s virtually no economy left that is not under the control of some corporate structure. We are just now in the last few years seeing the inflation of consumer goods as a result of that. And it’s not because of supply chain side issues, it is the everlasting thirst for corporate profits and now the oligarchies and monopolies can get away with it. They own the production side and the regulatory side.

Next time around will be more of the same.

Thanks. I believe I understand your comment and it helps, but I think I have to do a lot more study to fully understand what is going on. Meanwhile, I am going to keep sharpening the tines on my pitchfork.

“how can it possibly evaluate the counterparties that are taking on these risks?”

Who are these counter parties? And are the counterparties playing the market like Magnetar did, buying the risk while hedging that those risks will fail?