It is disappointing to see anti-globalist commentators who normally give astute commentary distort a story by force-fitting it into their existing framework, here the decline of the dollar. The widely-told tale, based on a Financial Times story, is that a paper by US officials to try to build G-7 consensus on appropriating the $300 billion of Russian central bank assets frozen in Western countries participating in the sanctions would be devastating to the dollar if its ideas were implemented. In fact, as the very same article showed, these assets are overwhelmingly Euro assets, in the hands of European depositaries and banks.

Moreover, the pink paper made clear that EU finance officials and bankers, particularly in France and Germany, which have big exposures, are leery of this type of US adventurism. And it’s not as if every US idea for aggression against Russia gets done, such as the $60 billon of spending stalled in the House.1 Recall the flop of a NATO summit last summer at Ramstein, where there was much discussion in advance of increased commitments to Project Ukraine. In light of that, it’s not hard to see the latest US ploy as an effort to change the topic from “And what happened to all the reconstruction funds you promises?” Remember that Penny Pritzker is in charge of the initiative to round up investor monies to rebuild Ukraine, with BlackRock in a leading role.2 On her last trip to Kiev, she effectively told Ukraine not to expect much from the US. From Ukrainska Pravda in November:

Penny Pritzker, US Special Representative for Ukraine’s Recovery, has suggested that officials imagine how the country could survive economically without US aid during her first visit to Ukraine….

Ukrainska Pravda stated that her first visit to Ukraine had left “a rather disturbing aftertaste in many government offices” here.

One of the sources, familiar with the course of Pritzker’s meetings, said that she tried to “lead [them] to the idea” of how Ukraine could survive economically without American aid.

Quote from the source: “At the meetings, Penny tried to get people to think, like, let’s imagine that there is no American aid: what do you need to do over the next year to make sure that your economy can survive even in this situation? And it really stressed everyone out.”

Now to turn to December 20 Financial Times article, The legal case for seizing Russia’s assets, which I confess to not reading at the time due other distractions and assuming it was accurately reported elsewhere, so there was no point in my weighing in late. Ooopsie!

One issue commentators stomped on, correctly, was the absurd pretext for an asset grab, that these would amount to reparations. But reparations, in the context of war, are paid by losers for the damage done. This war is not over (so in legal terms, the matter is not ripe). And more important, does anyone think Russia will lose, absent a black swan event or not credible redefining of terms? The Financial Times describes the latest attempt at a justification was a “countermeasure”. But again, the direct precedent suggested was “compensation” after Iraq invaded Kuwait…and then the US subjugated Iraq in Project Desert Storm.

But as for who would be most likely to be severely damaged with this sort of plundering, it’s the EU and Euro due to them accounting for the vast majority of exposures. Yes, Russia would probably make sure the US also suffered consequences, particularly given its role as presumed instigator, although Ursuala von der Leyen has made “Seize, not freeze” part of her brand. But it is European institutions who control the vast majority of the holdings, and they can’t pretend not to be independent actors (it’s not as if the EU depends on the US financially, as it does militarily with NATO). From the Financial Times:

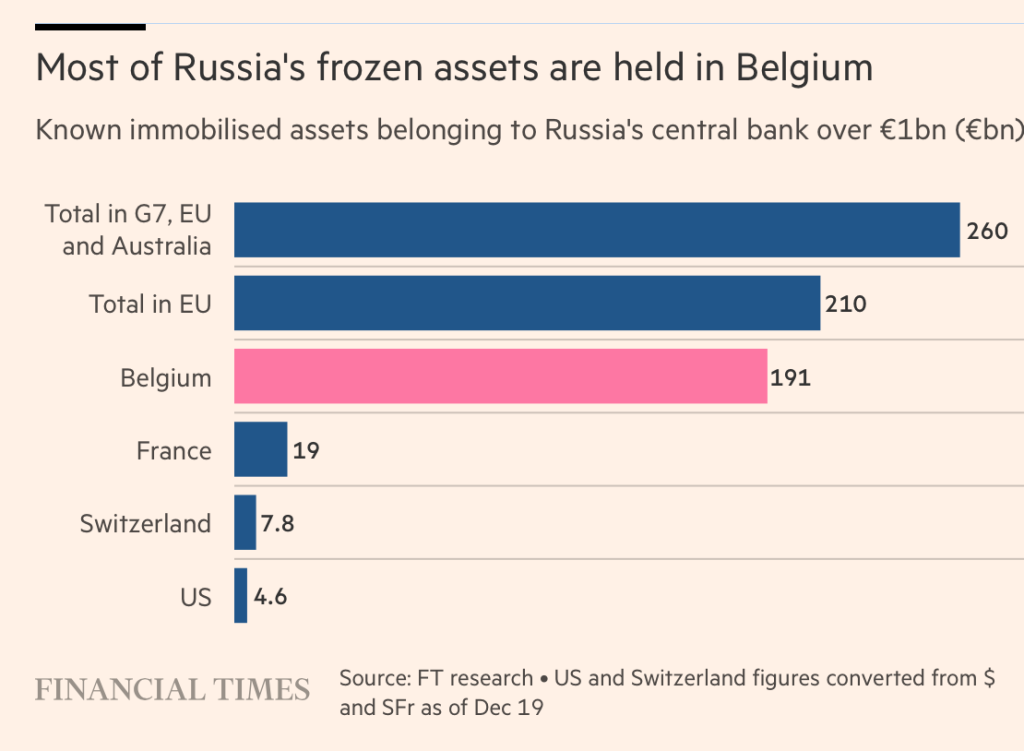

About €260bn of Moscow’s central bank assets were immobilised last year in G7 countries, the EU and Australia, according to a European Commission document seen by the Financial Times.

The bulk of this — some €210bn — is held in the EU, including cash and government bonds denominated in euro, dollar and other currencies. The US by comparison has only frozen a small amount of Russian state assets: some $5bn, according to people briefed on the G7 talks.

Within Europe, the bulk of the assets — about €191bn — are held at Euroclear, a central securities depository headquartered in Belgium. France has immobilised the second-largest amount, some €19bn, according to the French finance ministry. Other holdings are far smaller, with Germany holding about €210mn, according to people briefed on the figures.

A December Reuters story paints a similar picture, but is based on start of 2022 figures from the Russian central bank. The disparity between the total in dollars versus the total held in the US is likely due to the Russian central bank holding dollar balances in non-G7 central banks, such as Switzerland. From Reuters:

At that time, Russia’s central bank held around $207 billion in euro assets, $67 billion in U.S. dollar assets and $37 billion in British pound assets.

It also had holdings comprising $36 billion of Japanese yen, $19 billion in Canadian dollars, $6 billion in Australian dollars and $1.8 billion in Singapore dollars. Its Swiss franc holdings were about $1 billion.

So oddly, the Financial Times (presumably following the US concept paper) did not cite the British pound assets, which at least at the start of 2022, were bigger than the amount of dollar assets supposedly held by the US. So if this is directionally correct (UK banks now hold more in Russian frozen assets than US banks too), the UK is also volunteering to go ahead of the US in the “shoot yourself” line.

Note the Reuters story mentions Swiss Franc holdings of $1 billion equivalent; the Financial Times chart, which admits to being “known” as in potentially incomplete, shows a Swiss total of %7.8 billion. That means at least $6.8 billion in non-Suisse assets. It is conceivable that the Swiss dollar holdings are as large as the dollar holdings in US banks.

So where might the other dollars be? Recall there was a brief flurry of reporting a way back that (mumble, shuffle) the Western power actually could find only part of the $300 billionish that they’d frozen. That talk stopped and the story reverted to the notion that the Western powers indeed had $300 billion, as in how they’d supposedly lost and then miraculously found the missing assets was never explained.

Recall also that when the sanctions were impose, the rouble tanked to about 120 to the dollar. The Russian central bank engaged in stabilizing transactions to push it up. How could the central bank have done that, as in sold dollars to buy roubles if its assets were frozen? Presuambly nearly all its dollar assets were in institutions participating in the sanctions. This suggests, as we said at the time. that in fact the money was not all properly locked up when the sanctions announced and Russia was able to access, as in sell or move, a part of it. That could apply just as well to that at least once $37 billion worth of sterling assets, that Russia was able to extract some because the sanctions weren’t applied as hard and fast as they were supposed to have been.

The Financial Times article cites legal experts who point out that plenty of countries have grievances with others, and “countermeasures” are generally used to try to change behavior, not impose damages. Further, as most people know or intuit, bank assets, particularly central bank assets, are perceived to be in safe custody when placed with a foreign depositary. Recall the consternation in the US when Wells Fargo was caught out pilfering from depositor accounts. Even though the stealing was nickel and dime level across many many accounts, the press official reaction was fury. This is the same principle, just on a different scale.

Now it is true that the US making off even with a mere $4.6 billion of Russian holdings would such a bad precedent that it could make many investors leery of holding dollar assets. But again, it is EU states that would be putting themselves on the firing line. Again from the Financial Times:

The ECB earlier this year warned member states of the risk of undermining the “legal and economic foundations” on which the international role of the euro rests. “The implications could be substantial,” it said, according to an internal EU note. It warned the bloc of the risks of acting alone and recommended for any action to be taken as part of a broad international coalition.

One EU diplomat said: “Every major euro-denominated economy is treading very carefully on this because of the potential effects for the euro and for foreign investment and clearing in euro.”…

Officials are aiming for a consensus among G7 countries to seize the assets, but France, Germany and Italy remain extremely cautious.

European officials fear possible retaliation if state immunity is undermined. One noted the US holds only a very small amount of Russian central bank assets by comparison. “From an EU perspective we have much more to lose,” the EU official said.

The late December Reuters article suggests Russia has the means to retaliate directly:

Some Russian officials have suggested that if Russian assets are confiscated then foreign investors’ assets stuck in special so-called type “C” accounts in Russia could face the same fate. Some foreign assets were effectively locked in the C accounts.

It is not clear exactly how much money is in these accounts but Russian officials have said it is comparable to the $300 billion of Russian reserves frozen.

Finance Minister Anton Siluanov said last week that there were significant funds on the C accounts.

Kremlin spokesman Dmitry Peskov told reporters last week that Russia would challenge any confiscation in the courts.

“If something is confiscated from us, we will look at what we will confiscate,” Peskov said. “We will do this immediately.”

Given that some recent bright US ideas, such as Operation Prosperity Guardian, quickly became an embarrassment, says that US incompetence and over-reach have suddenly become glaringly obvious to its allies. That plus US loss of moral stature over its refusal to check Israel’s slaughter of Palestinians should help give Europeans the needed backbone to resist being put in financial harm’s way to damage Russia…even before getting to the wee complication that the last big effort to harm Russia economically boomeranged.

One lost big ticket proxy war should be enough of a lesson for Europe. Perhaps Europeans have a saying like the Yankee staple, “Fool me once, shame on thee, fool me twice, shame on me.”

___

1 The irony here is the spending in that bill is largely to replenish weapons sent to Ukraine, as in it is really a direct transfer to the military-surveillance complex. But Ukraine has become so toxic in some circles that even an arms pork bill dressed up as a Ukraine spending bill can’t get done. The flip side is with the Middle East hotting up and China still very much an object of US negative affection, it’s not as if defense contractors have to worry where their meal ticket is coming from.

2 Why BlackRock is beyond me, since BlackRock runs funds that overwhelmingly invest in liquid securities; it isn’t in the top 10 of infrastructure investors, which would be the germane market, and its position fell in 2023 versus 2022.

Didn’t the freezing of the assets run this risk in the first place, and why would outright seizure increase the risk? I’m guessing liquidity is almost as great a concern as redemption, but maybe a state beneficiary has a different priority.

Remember, the Russian economy was going to collapse and Putin would be toast and we’d install a compliant government? So some would be used as reparations (but not much since the war would not have gone far) and the rest would go back to Russia to be looted by the West.

How big of a threat to US/EU investment inflows will such a move create? I guess it’s very difficult to predict with any accuracy and it would be more of a medium/long term effect but I wonder where else the investments would go if not to the west.

I would imagine that there is a fight going on right now in the EU as Ursula von der Leyen will be in full Queen Boudica mode – complete with slashing blades attached to her chariot of righteousness – and saying that she has the right to decide on behalf of all the EU nations to steal all that Russian money, minus her commission of course. Meanwhile many of the EU nations will not be so accommodating, especially since she decided on the EU’s behalf that Israel had the total support of the EU itself to massacre all the Palestinians. So I bet that a lot of EU countries are arcing up because they know full well what the consequences will be for the finances of the EU if this goes ahead. I would imagine that in the end it will be done on a country by country basis but which will still crater the Euro through reputational damage. The Russians themselves can afford to lose that money and may think it worthwhile to see the EU crippled as a political and financial entity thus ending all future support for Project Ukraine.

And should it be mentioned that elections for the European Parliament take place 6-9th June this year?

In regards the European Parliament elections it will be interesting to see the percentage turn out versus the non-of-the-above contingent.

I have not looked at this aspect of the figures in regards individual EU State elections over time. However, the UK election statistics have consistently shown a growing majority which, looking at the false choices on offer, have opted not to bother with the charade.

The point being that with no realistic legal and democratic means of affecting the necessary change across Borrell’s ‘Garden’, at some point along the current trajectory of the unstoppable systemic car crash that is the Collective West the very obvious option of removing the causes of the unfolding debacle by non-legal and non-democratic means may very likely turn out to be the only realistic method to restore sanity?

“In regards the European Parliament elections it will be interesting to see the percentage turn out versus the non-of-the-above contingent.”

If you are referring to European citizens bothering to vote during that election cycle, our W. European friends have pointed out how MOST citizens feel about the EU Parliament. The vast majority hate, despise, and mock with much ridicule that Parliament system. That is a well known fact, if you live in W. Europe.

More like Joan of Arc, she’s gonna go up in flames!

No backbone in European leaders exist. I haven’t seen anything that remotely looks like independent thought in Europe’s leadership, and certainly no thinking through the consequences of the actions for Europe.

In terms of the leadership of the US, the deployment and failure of these too-clever-by-half-schemes (oil price cap anyone?) says it all.

Again, I refer you to Vilnius last July, the recent refusal by France and others to provide ships to Operation Prosperity Guardian, and Germany not sending more weapons to Ukraine because it needs all the ones it has. Italy refused to send weapons to I forget who to be laundered to Ukraine (I recall Italy sent some early on but then it became clear Ukraine would not refrain from using them on Crimea, and Italy did not want to be even indirectly involved in attacking Russia).

The Ukraine-boosting press severely under-reports US failures to get consensus.

It is hard to believe that the EU, which has been willing to do at any cost what Russia does not like, will now change its policy out of concern for Russian retaliation.

But it is no longer willing. Its latest scheme to get around the Hungary veto of more Ukraine funding will fail because the loan guarantees are country by country, and anyone can be a free rider.

And see from Politico last October:

https://www.politico.com/news/2023/10/02/ukraine-looks-to-arm-itself-as-western-support-slips-00119528

Swiss Federal Council on confiscating frozen russian assets (2023-02-15, english):

https://www.admin.ch/gov/en/start/documentation/media-releases.msg-id-93089.html

As of 2022-11-25, russian assets frozen by Switzerland amounted to CHF 7.5 billion, plus 15 real estate items (national languages only, i.e. french, german, italian):

https://www.seco.admin.ch/seco/fr/home/Aussenwirtschaftspolitik_Wirtschaftliche_Zusammenarbeit/Wirtschaftsbeziehungen/exportkontrollen-und-sanktionen/sanktionen-embargos/sanktionsmassnahmen/faq_russland_ukraine.html

Fascinating. Thank you.

It will probably take a significant shift in the electoral politics of Europe to force ‘real’ change in European policies towards Russia. The elections this year in the EU will show the way. Add to this a probable Second Trump Administration starting in 2025, and we see the political situation in the West moving towards something more “rational.”

Indulging in a little “realpolitik” for a moment; it is becoming clearer to the Elites in Washington that America is not up to the challenge of multiple ‘confrontations’ in the world any more. So, where to focus what resources available now? America is going to have to make some hard choices internationally, and fairly soon.

A somewhat more improbable possibility, but by no means out of the question, is that the American military might have to be redeployed back to the Homeland to impose order upon a fractious civil population. As the Emperor Mao is credited with saying; “Peace comes from the barrel of a gun.” Autocrats and would be autocrats the world over understand that maxim. The American Elites can do no less.

We think that 2024 is going to be an “Interesting Time?” Just wait for 2025, when the Wind Seeds sprout and grow.

Why would RUS central bank hold vast majority of its euro assets in Belgium? You steal our money and we hit your capital in return? SWIFT and European Commission as targets as they all reside in Belgium? Mutual assured financial destruction?

So the European version of Yves’ quote is,

“Fool me twice, I guess it’s become a habit.”

The problem is that the EU finance minister is Tony Blinken, and its foreign minister is an office assistant to Victoria Newland.

A spelling correction:

The problem is that the EU finance minister is Tony Blinken, and its foreign minister is an office assistant to “Victoria Neuland.”

[ The Biden Administration has had a range of carefully selected foreign policy militarists in control. The militarist approach was made clear from the beginning. ]

Good morning!

Always double check your spelling before correcting someone else’s spelling.

Commonly spelled Neuwoughoooeland, it was legally truncated to Nuland some time ago in order to fit better on her state department proximity access card, as well as other official government documents.

All this to say, she too is a victim of imperial assimilation, though perhaps a not unwilling victim.

Cheers!

Nuland is the daughter of famed author and doctor Sherwin Nuland.

Always double check your spelling before correcting someone else’s spelling.

[ Good grief; I am sorry for the additional mistake. I only meant to be helpful, since this name is important. However, I really do not understand what happened.

Thank you for the correction. ]

It’s childish but I have been internally referring to Nuland as Neo-con Queen Victoria Nuland as Neo-conmen can be women too and at a high level.

According to sources with knowledge of the subject, the correct spelling is Victoryin Noland.

I very much agree that Europe would be the one to loose more if the scheme goes ahead. So far, I believe that EU proposals were only about seizing the benefits that these assets produce not the assets themselves. Both kinds of actions would indeed mean stealing though the second option is the boldest.

Little I have heard about the objectives of such robbery apart from showing how raged and furious are some so-called leaders of the West. PR stuff, as usual, dominates but thinking of the practicalities of life doesn’t seem to bother our cosmic leaders. Is there anybody with a working brain?

Re: Penny Pritzker‘s imagine line. Every time I see it I have to ask myself what sort of fool would utter such a sentence. This is the best that the Biden administration has to help with the Ukrainian economy?

On the other hand, it is very mockable so there’s always that:

Imagine you’re a goat…

Imagine I actually cared about you think or do…

Imagine I actually have any expertise in this area… (works for Hunter Biden too!)

Please feel free to add to the list.

> it is very mockable so there’s always that

Remember that horrible song a group of celebrities did on Twitter, where they all got together and sang “Imagine” during the pandemic’s early peak?

It was rightly ridiculed, which no doubt came as a complete surprise to the idiots who participated. Perhaps we can get Nuland, Pritzker and a gaggle of neocon warmongers to do the same for the Ukraine curtain call.

The “oil price cap” was a harebrained scheme and everyone knew it, but the G7 did it anyway.

And the US has already demonstrated over and over that it doesn’t care what the consequences to europe are, and european leaders have on every occasion demonstrated their utter slavishness to Washington.

Yes, they sometimes balk at sending more arms. But, like F16 and Leopard tanks, Patriot missiles and Lord know what else, give them a couple of days. Europeans always knuckle under.

This is just going to be bad not just politically, but also for EU’s trade relations. If the EU decides to seize the assets of one country that gave it a very good deal with cheap energy, why would other countries’ companies willing to make good trade deals with the EU? Prices would need to include higher margins just to account for the risk of sanctions and confiscation.

The EU would never have needed to do more than just send humanitarian aid to Ukraine, but now it just looks like there is no clear consistency on who is sanctioned, and a foreign company might just itself in trouble because its government decided to do something elsewhere that never would have affected the EU, but just happened to make some EU official angry.

This is classic EU policy-making. Appear to agree, then find some technical reason why it’s not possible and kick the can down the road.

The ECB at least has its priorities right – warned in summer of 2023 that even creaming off the revenue was not a good idea (FT article, can’t click through) and on 4 December last year VP de Guindos appears to have repeated the warning since there is an article here https://infobrics.org/post/39993

Great post – I hadn’t realized that the frozen assets weren’t really in US$, but the totals given were just US$-equivalent.

If that’s the case though, wouldn’t seizing those assets cause Mr. Market to lose faith in holding too many euros, which, if it’s the US suggesting this tactic, may be the whole point?

“… it is true that the US making off even with a mere $4.6 billion of Russian holdings would such a bad precedent that it could make many investors leery of holding dollar assets.”

Didn’t Uncle Joe’s Treasury seize some $3.5bil from the Afghanistan government on our way out the door a couple years ago? 9/11 victims memorial fund or some such pretext?

To be clear, if the precedent has not yet been set, then the trail has at least been blazed. If “the powers that be” can finagle Russia’s euro denominated funds, it would be quite the kapla for the DC-tonians. After wedging themselves between the Russian and European energy economy, and subsequently tanking the EU industrial sector, if “they” can kill the Euro, wouldn’t that just mean more market share for USD?

Moreover, if BRICS+ is serious about a new-and-improved bancor note, wouldn’t killing the euro help their cause as well?

US will benefit biggly from this scheme because this effectively means taking money out of EU banks and use it to buy American weapons.

From the macroeconomic perspective, money frozen is money confiscated. When you take it out to buy stuff, you are injecting money into the market. What this will do is to increase EU’s trade deficit (vis-a-vis US) and exacerbates inflation.

Please do also an article on African assets seizure scheme based on looted funds by stashed outside Africa

We do not have the resources to do that. This piece was based on a careful reading of MSM stories.

Kano, if you have any leads or knowledge, you could post them here. Someone else might be able to follow up on them.

If this is about the infamous “bag men” (and women) associated with corrupt African politicians, I can try to did up some old articles. I seem to recall The Economist running a piece on this years ago.

https://www.nytimes.com/2020/01/19/world/africa/isabel-dos-santos.html

January 19. 2020

How U.S. Firms Helped Africa’s Richest Woman Exploit Her Country’s Wealth

By Michael Forsythe, Kyra Gurney, Scilla Alecci and Ben Hallman

LISBON — It was the party to be seen at during the Cannes Film Festival, where being seen was the whole point. A Swiss jewelry company had rented out the opulent Hotel du Cap-Eden-Roc, drawing celebrities like Leonardo DiCaprio, Naomi Campbell and Antonio Banderas. The theme: “Love on the Rocks.”

Posing for photos at the May 2017 event was Isabel dos Santos, Africa’s richest woman and the daughter of José Eduardo dos Santos, then Angola’s president. Her husband controls the jeweler, De Grisogono, through a dizzying array of shell companies in Luxembourg, Malta and the Netherlands.

But the lavish party was possible only because of the Angolan government. The country is rich in oil and diamonds but hobbled by corruption, with grinding poverty, widespread illiteracy and a high infant mortality rate. A state agency had sunk more than $120 million into the jewelry company. Today, it faces a total loss.

Ms. dos Santos, estimated to be worth over $2 billion, claims she is a self-made woman who never benefited from state funds. But a different picture has emerged under media scrutiny in recent years: She took a cut of Angola’s wealth, often through decrees signed by her father. She acquired stakes in the country’s diamond exports, its dominant mobile phone company, two of its banks and its biggest cement maker, and partnered with the state oil giant to buy into Portugal’s largest petroleum company.

Now, a trove of more than 700,000 documents obtained by the International Consortium of Investigative Journalists, and shared with The New York Times, shows how a global network of consultants, lawyers, bankers and accountants helped her amass that fortune and park it abroad. Some of the world’s leading professional service firms — including the Boston Consulting Group, McKinsey & Company and PwC — facilitated her efforts to profit from her country’s wealth while lending their legitimacy….

https://www.nytimes.com/2018/06/26/world/africa/mckinsey-south-africa-eskom.html

June 26, 2018

How McKinsey Lost Its Way in South Africa

When the godfather of management consulting landed its biggest contract ever in Africa, it made the worst mistake in its storied nine-decade history.

By Walt Bogdanich and Michael Forsythe

JOHANNESBURG — The blackouts kept coming. The state-owned power company, Eskom, was on the verge of insolvency. Maintenance was being deferred. And a major boiler exploded, threatening the national grid.

McKinsey & Company, the godfather of management consulting, thought it could help, but was not sure that it should, according to people involved in the debate. The risk was huge. Could McKinsey fix the problems? Would it get paid? Would it be tainted by South Africa’s rampant political corruption?

In late 2015, over objections from at least three influential McKinsey partners, the firm decided the risk was worth taking and signed on to what would become its biggest contract ever in Africa, with a potential value of $700 million.

It was also the biggest mistake in McKinsey’s nine-decade history.

The contract turned out to be illegal, a violation of South African contracting law, with some of the payments channeled to an associate of an Indian-born family, the Guptas, at the center of a swirling corruption scandal. Then there was the lavish size of that payout. It did not take a Harvard Business School graduate to explain why South Africans might get angry seeing a wealthy American firm cart away so much public money in a country with the worst income inequality in the world and a youth unemployment rate over 50 percent….

This is like some bizarre metaphor for the West committing Bretton Woods seppuku.

The damage to the dollar depends on what kind of damage the US does to its own legal system. The “small” amount of Russian assets in the US doesn’t necessarily mean the legal damage will be any smaller than Europe’s. Maybe the Biden admin comes up with some very creative legal solution, but their track record is hairbrained-but-disastrous, not ingeniously-limited.

Is this the same Penny Pritzker who pushed Claudine Gay into the presidency at Harvard? She is managing Ukraine as well?