The economic data for January, Milei’s first full month in office, makes for sobering reading.

Argentina’s latest descent into the economic abyss is as sad as it was predictable. In mid-December, I warned that Milei’s first dose of shock treatment, now being administered with relish by new Economy Minister (and ex-JP Morgan Chase banker, former finance minister and former central bank governor) Luis Caputo, risks wiping out what remains of Argentina’s fragile economy. Said treatment includes a 54% devaluation of the Argentine peso; a halt on all public works; the freezing of public sector salaries and pensions; a sharp rise in taxes, and the elimination of many public subsidies, including for energy and public transportation.

Now, the economic data is emerging for January, Milei’s first full month in office, and it makes for scary reading. But before we get into the nitty-gritty, a reminder: the economic pain currently being visited upon millions of Argentinean workers and pensioners is an integral part of Milei’s economic plan. It is not an unfortunate by-product or unintended consequence; it is the intended goal — to impoverish workers and pensioners to the point where they cannot fill their shopping basket or buy even the most basic of necessities. If you starve the economy of demand, inflation eventually has to go down.

Last week, El Economista published an article titled: “Due to the monetary squeeze, inflation and recession, savers sell dollars to make ends meet”. The article was harshly critical of the government’s brutal austerity regime but that didn’t stop Milei from proudly retweeting it. Presumably, he never bothered to read the text.

As I noted in my December 15 article, “Who Is Luis Caputo, Argentina’s New Economy Minister (Who Is Already Making the Economy Scream)?” most Argentinians, many of whom voted for Milei out of an understandable mixture of desperation, frustration and anger with the establishment parties, face a crushing loss of purchasing power, both in pesos and dollars, as the devaluation and rising taxes drive inflation even higher while wages and pensions stagnate and public subsidies on energy and public transport are withdrawn.

Stagflation on Steroids

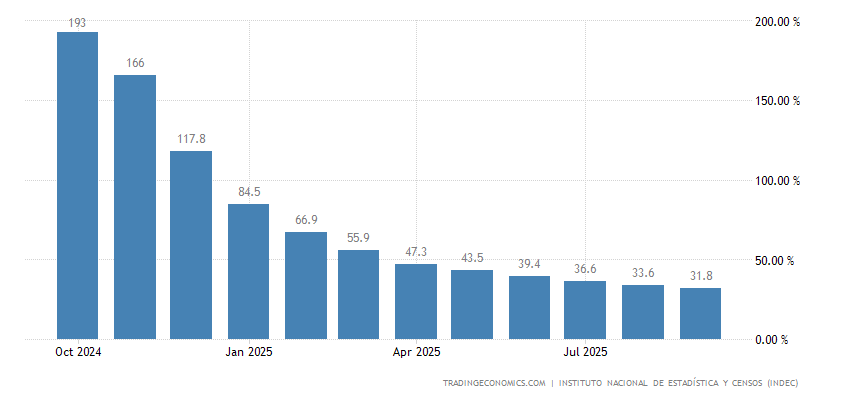

Prices are indeed surging. On a year-by-year basis CPI increased from 211% in December to 254% in January, its highest level since 1990 [Note to readers: the graph below, from Trading Economics, is somewhat misleading given the y axis begins at 100%]

The 54% devaluation of the Argentine peso obviously played a key part in this. So too has the removal of subsidies for many basic goods and services, including energy and public transportation, as well as the sharp rise in taxes, including import taxes — from a man who repeatedly said before the elections he would rather cut off an arm than increase taxes. The price of just about everything is surging — everything, that is, except salaries. In a country where the poverty rate is already above 40%. As NC has reported before, this kind of austerity literally kills, through desperation, suicide and lack of access to basic health services.

The one silver lining? Inflation did fall on a month-by-month basis from 25% in December to 20% in January. In other words, the price rises may be in the process of plateauing — which is perhaps no great surprise: when you throttle economic activity and opportunity, price rises tend to slow. But so too does everything else.

A Historic Collapse in Real Salaries

In December — and keep in mind, Milei only took over the reins on the tenth of that month and didn’t issue his Decree of Necessity and Urgency until the twentieth — industrial and construction output plunged 12.8% and 12.2% year-on-year, respectively. According to a Reuters survey, economic activity fell 2.5% year on year. In January, things got even slower. From Infobae (translation my own):

“All the available data — particularly those relating to the domestic market — show a notable deterioration [in January], not only in annual terms but also compared to the figures for December: car registration leads the decline, with a variation of 33% year-on-year ( vs. -5.8% in December), followed by retail sales (-25.5% year-on-year vs. -18.7% the previous month) and construction (-28.2% vs. -17.4% in December)”, reported the consulting firm Invecq. Cement deliveries also fell by 20% (-12.9% in December), motorcycle registration by 19.2% (it had increased by 16.7% in December), and car production by 16.7% (vs. -0 .4% in December). Finally, national taxes linked to economic activity fell between 15% and 25% annually on a real basis…

A similar exercise was carried out by the consulting firm 1816. The indices it included in its survey of preliminary economic activity data are the same as Invecq’s, but it added to the equation the fall in salaries, which has an impact on mass consumption. “Although inflation data marks a clear slowdown (25.5% in December, around 20% in January, most likely less than 20% in February), the flip side is the brutal recession signposted by high-frequency indicators…. In December, the real salary of registered private-sector workers suffered the largest monthly drop in at least 30 years, and it is highly likely that in January real salaries reached a lower level than that of the 2001 crisis.”

This is one of two stunning data points revealed by the research. For those unfamiliar with Argentina’s recent history, between 2001-02 the country went through what should have been a once-in-a-lifetime economic crisis (but this being Argentina it probably wasn’t). Three developments occurred in rapid-fire succession — a partial deposit freeze, a partial default on public debt and abandonment of the fixed exchange rate — triggering a near-vertical collapse in economic output, soaring levels of unemployment, and political and social unrest.

Families lost their life savings in the “corralito” of late 2001, when the then-Economy Minister Domingo Cavallo limited cash withdrawals to 250 ARS (1 ARS = 1 USD), and then the “corralon” of 2002, when most deposits were forcibly exchanged for a series of bonds denominated in heavily depreciated pesos. The corralito was supposed to be kept secret until it came into force but was leaked beforehand, causing a bank run in which few — mainly well-connected banks and corporations — benefited while millions lost more or less everything. The subsequent nationwide protests eventually brought down the De la Rua government.

Incidentally, it was Domingo Cavallo who set the stage for the 2001-02 crisis ten years earlier by establishing a fixed pegging of one-to-one parity between the peso and the U.S. dollar that had absolutely no basis in economic reality. Guess who Milei’s all-time favourite economy minister is? That’s right: Domingo Cavallo.

Now for the second stunning data point. Again, from Infobae (emphasis my own):

“The economic activity data for January may not be surprising, but they are no less eye-catching: sales of cars and motorcycles, cement shipments, sales of construction supplies, retail sales, tax revenues,… everything fell between 15% and 30% year-on-year,” reports 1816. “Food sales in retail stores fell 37.1% year-on-year in the month, something not seen even during the early months of the pandemic. This does not mean that 37.1% fewer calories were consumed, though there was certainly some of that as well as substitution for inferior goods and lower priced brands, given the index does not measure quantities but rather turnover in pesos.”

Remember the El Economista article: by January, many in the middle classes were selling their dollar-based savings just to make ends meet. Many of those without dollars simply ate less food. In January, food prices were up threefold on a year-by-year basis. In a perverse irony, as the social crisis deteriorates, more and more people are turning to soup kitchens, yet in December the Milei government froze all public funds to soup kitchens, food banks and pantries while the current system is audited.

CNN’s Spanish-language channel featured an interesting report comparing basic food prices and salaries between Argentina and Spain. What it found was that while both countries have similar prices for the different products that make up the basic food basket, the purchasing power of Argentinean salaries is roughly nine times lower than their Spanish counterparts.

In fact, Argentina has one of the lowest minimum wages in Latin America today. The current floor for the Minimum Living and Mobile Wage (SMVM) is just 156,000 pesos per month ($184). And it is not going any higher even as inflation rages, says Milei. In other words, workers at the very bottom of the income scale are about to get even poorer. Even the income of most higher paid workers is rapidly losing purchasing power. As prices continue their rise, people will inevitably consume a lot less, heaping even more pressure on struggling small and even mid-sized retail businesses.

All of this is necessary to bring inflation into line and balance the fiscal budget, says Milei. But as public anger and desperation rise while poverty levels surged eight percentage points in January alone, to reach an alarming 57%, time is one luxury his government does not have. Trade unions in many sectors, including healthcare and transportation, are calling for strikes to demand salary increases. Meanwhile, the government’s sweeping “omnibus law”, which the president once said “may well determine our country’s destiny,” was recently rejected by Congress.

As uncertainty reigns, most overseas investors are wary of parting with their cash just yet. Foreign banks are adopting a wait-and-see approach to investing in Argentina and advising their clients to do likewise.

“In order for us to support the private sector in Argentina, there is still a need for macro stability and a higher [interest] rate,” Jordan Schwartz, the executive vice president of the Inter-American Development Bank, told Clarin. “The social crisis is the frontier that must be crossed successfully.”

A similar message was relayed by a number of investment fund managers: the social crisis created by Milei’s economic policies must first be overcome before funding will be made available for businesses. Until then, said Schwartz, there will be no financial support for Argentina’s private sector.

Ominously, even the International Monetary Fund (IMF), whose second-in-command, Gita Gopinath, met with Milei this week to discuss Argentina’s economic challenges, already downgraded its economic forecast for the country in its January report, predicting a 2.8% recession in 2024. One can expect further downgrades in the months to come, as even Milei himself has warned that the worst is yet to come. By 2025, however, the IMF expects the economy to bounce back in spectacular fashion (+1.9%). But as the Greeks (and other long-suffering nations) well know, the Fund has an annoying habit of forecasting miraculous mid-term recoveries for hair-shirt economies that never quite materialise.

* Of course, this is Argentina we are talking about, a country that has, for a host of reasons, been in a near-constant state of crisis for most of its history, as Jeffrey Sachs said in a recent interview with The Duran. As such, another corralito-type event is not out of the question.

Prof. Sachs introduced “shock economic therapy”, basically mass privatization to Russia in 1991…it was refused 2 years later and prof sachs and another norwegian economist left Russia….it Russia some time, but they finally found what worked…a partnership of state owned natural resource companies and weapons companies with private partners….as for Milei, doesnt he know what US vulture funds and US courts did to Argentina with the debt crisis of 2000, 2001…Professor Sachs was correct when he stated, loudly, in the 90’s that the IMF should also be a bankrupcty court for desperate countries overloaded with debt….

The Take: Occupy Resist Produce

Fantastic documentary from Naomi Klein and Avi Lewis about Argentinian workers responding to the IMF caused economic meltdown of 2000. We seem to have learned nothing. “They” have learned that we have short memories.

https://www.youtube.com/watch?v=3-DSu8RPJt8

JFYI, Sachs denies he recommended the Russian privatization, and is now persona non grata amongst Washington’s PMC

In Jeff Sachs’ defense, he was working on the macro part, and he blames the West for failing to provide Russia with financial support while it was doing macro reforms. The privatization was being done by Chubais and Gaidar. https://www.npr.org/transcripts/1097135961

I’m thinking that we should set up a betting pool. On when a caravan of some ten thousand desperate Argentinians get together and start heading to the US border. You know it is going to happen. That won’t make Milei many friends in Washington but the guy will claim that you have to break a few eggs to make an omelette or some such rubbish.

There are plenty going there now… arriving to Miami airport… although the most desperate won’t get there… it’s quite a journey on foot…

“…By 2025, however, the IMF expects the economy to bounce back in spectacular fashion (+1.9%)…”

It’s the kind of degenerate extremism the IMF loves, so they can’t help but blindly cheerlead.

Families lost their life savings in the “corralito” of late 2021

This is a typo, since the corralito actually took place in 2001.

By the way, to complete the historical background:

1) Domingo Cavallo was the economy minister of Carlos Menem — whose neoliberal policies precipitated Argentina into the famous banking, debt, and currency crisis of 2001-2002.

2) Luis Caputo was the finance minister of Mauricio Macri — whose neoliberal policies threw Argentina into a financial, trade, and currency crisis 7 years ago.

3) As reported in the article, Luis Caputo is now the economy minister of Javier Milei, whose neoliberal shock policies have managed to plunge Argentina into a general economic crisis in a matter of weeks.

Menem, Macri, Milei — I know a Spanish word beginning with “m”, but why do Argentinians always fall for those vandals?

This has been ongoing for 40 years in Argentina-the hyperinflation.

I’d postulate that Argentinians have lost their life savings about 4 times before 2001.

For those of you not up to speed, here’s how things have gone in the past when they renamed their currency…

1983 and before: Peso

1983-85: Peso Argentino (10,000 old Pesos = 1 Peso Argentino)

1985-91: Austral (1,000 Peso Argentino = 1 Austral)

1992 and since: Peso Convertible (10,000 Austral – 1 Peso Convertible)

After the various changes of currency and dropping of zeros, one peso convertible of 1992 was equivalent to 10 trillion pesos moneda nacional of 1970!

So what is the way out of this for the general populace? They can’t perform every transaction in gold.

Revolution

Fixed. Thanks, Vao, for the heads-up, and the added background.

Also, the remark on the graph should say “y-axis begins at…”.

Thanks, Hickory. Fixed.

Milei is basically a new Menem, a creature of the Argentinian agricultural, extractive industry, and financial comprador oligarchs. Just as Menem did, Milei will crush the working class while facilitating state looting by the oligarchs. Macri already did that with the help of the IMF loan to fund elite capital flight at a high exchange rate before everything crashed and the IMF loan now becomes a liability of the general populace.

The history of Argentina is the oligarchs blocking industrialization so that they can keep the exchange rate low for commodity exports while foreign capital can buy things for cheap without Argentinian industrial competition. Then regularly an oligarch-tool president facilitates elite capital flight just before they pull the rug under the currency, then the elite can come in and buy things for cheap with their offshore foreign currency and rinse and repeat. Its like the US Confederacy won the US Civil War.

I have to admit this is brilliant. Looking over Latin America and Caribbean they are doing same play book but little bit less compare to Argentina. I always wonder why Jamaica haven’t industrialize, the elites like it that way and the population is not educated enough to ask for better, the country is even more expensive than most European country’s that don’t make sense when people are getting paid peanuts

https://fred.stlouisfed.org/graph/?g=k6cj

January 15, 2018

Broad Effective Exchange Rate for Argentina, 1994-2023

(Indexed to 1994)

https://fred.stlouisfed.org/graph/?g=jOwB

January 15, 2018

Real Broad Effective Exchange Rate for Argentina, 1994-2023

(Indexed to 1994)

https://fred.stlouisfed.org/graph/?g=1hp8X

January 15, 2018

Broad Effective Exchange Rate for Argentina, 2004-2023

(Indexed to 2004)

https://fred.stlouisfed.org/graph/?g=1hp9q

January 15, 2018

Real Broad Effective Exchange Rate for Argentina, 2004-2023

(Indexed to 2004)

Great comment. Any further recommended reading on this?

Nick, that graph is SO misleading, with the Y axis starting at 100%. It is verging on deceitful, and the people who produced it should be ashamed. Any chance you can add a comment pointing out that it gives – intentionally, I presume – that the axes need to be considered when looking at the shape of the curve?

It is from Tradingeconomics so I don’t think it is intentional. It’s a useful site for all sorts of economic indicators and you can get nice graphs too, but they automatically center the graph around the numbers within the series (understandably, since there is large variation and some series runs into negative numbers, for exampel real wage growth in Argentina, so probably the least bad option for autoatic graphs).

BRICS must be breathing a sigh of relief that Milei withdrew Argentina’s application to join.

This is well known in Argentina. Many Milei voters knew that if the accounts are put in order and the distortions created by subsidies, privileges, etc. are eliminated, and with a Central Bank with negative equity, the only way to stay afloat is to finish sinking and bounce off the bottom. A year ago, a consulting firm predicted that if poverty in Argentina is measured accurately and distortions are eliminated, the number would be close to 70%. It’s the economy resulting from 23 years of continuous socialism, corruption, and plundering of public coffers. With an almost unpayable external debt, there is no credit institution to which Argentina does not owe an astronomical amount, making it impossible to obtain external financing to “soften” the fiscal and monetary correction needed. Therefore, the only thing left for Argentines is “blood, sweat, and tears.”

“It’s the economy resulting from 23 years of continuous socialism, corruption, and plundering of public coffers.”

Twenty-three years of continuous socialism in Argentina? I had no idea this was remotely the case. Please explain what the 23 years years of Argentine socialism entailed, when possible.

Thank you so much.

Yes of course:

Since Eduardo Duhalde’s presidency in 2002:

Social plans were created to provide financial assistance to more than 10 million people without them being obligated to work.

Tax pressure increased from 37% to 59% currently, making it one of the highest in the world.

Major companies were nationalized such as YPF, Aerolíneas Argentinas, Aysa, etc., paying huge amounts; for example, the repurchase of 51% of YPF’s stock from Repsol cost $5 billion plus a lost lawsuit in New York for $16 billion.

Subsidies for energy and transportation were created for several billion dollars. Retirement was granted to 2 million people who never contributed to the pension system. In the year 2000, Argentina’s public spending was 25% of GDP, in 2020 it was 42% of GDP. In the year 2000, Argentina’s total external debt, which included public and private debt, amounted to 45.903 billion dollars (14% GDP), In 2023, it was $403 billion, 65% of GDP. In the year 2000, Argentina’s GDP was $317 billion, today is 621 billons. The Argentine GDP grew at less than 2% annually for 23 years! Of course, all of this has led Argentina to have the highest inflation in the world today, at 250% annually, which over the past 23 years has been attempted to contain with price controls of all kinds, businesses and industries have been closed by the government due to price increases, as well as a currency exchange restriction that generated a 100% gap between the real and official exchange rates. The Argentine peso has devalued by 90% in the last 23 years. Additionally, limitations and barriers imposed on all types of imports must be added, taxes (up to 50%!) on exports mainly of grains and oil, a poverty rate of 57%, and unemployment close to 30% (6% if unemployment benefits are not counted). Argentina is the clearest and most compelling example of the damage socialism can cause to a country.

Milie wouldn’t be President of Argentina if he some people with lotsa money didn’t support him *and* these policies which are wrecking Argentina. Who are they, and what the hell are they thinking?

I know squat about Argentine politics, but I’d guess most of his $ support comes from local Elites (pretty standard in Latin America, or indeed on Earth), though he could also be getting some money from overseas (incl CIA?).

But again, what are they trying to do? Will they really be able to kill off enough poors to avoid a revolution? Or are they counting on manipulating the inevitable revolution toward their own ends (presumably right-wing dictatorship controlled by Oligarchy)?

Ecuador, Haiti and Peru is good example that when the elite take control of most things in a country they can stay in power for a long time, the more people they make poor the longer they stay in power. The poor vote less than middle class and elites. There won’t be a revolution in Argentina, most party’s in Argentina is right and they took care of Krishna and her party. I don’t believe they will ever get back to power. From what I heard Milei have hire more Police and soldiers. He even gave security state more power.People will just become submissive to the elites.

OCCUPAR RESISTIR PRODUCIR …….only a ‘collectivist revolution’ with a popular, united national Convention Congress can save all those poor countries from the plundering of their social elites and self-decaying Capitalism at large. It demands a lot of political discipline, fortitude in spirit and utmost social responsibility from We the People who have mostly never historically expressed their REAL sovereignty, and mostly lack the level of education and understanding of the TRUE position they are in.

It’s a tough, tough call …….every human being on this planet wants a decent governing body that serves him/her well……..in a socially vertical society, horizontality becomes a necessity and must be become a constant demand, by words and by blows if necessary. Like a famous American man we all love once said in his famous speech ; ” IF THERE IS NO STRUGGLE THERE IS NO PROGRESS ”

it is time again for People everywhere to enter the struggle phase……….

Just as with past articles on Argentina, I find it curious that no mention is made of the dire economic situation that the Milei government inherited from Fernandez/Massa. I wonder just what the author thinks the alternative should be, if not austerity. There is little room for anything else, really.

Also, there is little mention of how bloated the state in Argentina has become over the last two decades, or how even with sky high taxes the government is incapable of covering its massive spending, and attempts to cover the gap via money printing.

The massive inflationary upsurge we are seeing was already baked in by the previous administrations economic policies, its not mainly a result of a government that has barely had any time to implement anything at all.

And please stop saying the devaluation of the peso is the driver of inflation, its exactly backwards. The official dollar exchange rate is almost always the laggard, so the government increasingly restricts legal access to dollars. If you live in Argentina you will notice that the black market rate (“blue dollar”) always rises first, and at some point the government must devaluate to have the official exchange rate catch up with the real one.