Lambert here: Hopefully a topic of purely academic interest!

By Silvia Marchesi, Professor of Economics University of Milano Bicocca, and Giovanna Marcolongo, Postdoctoral Fellow, Crime and Law Economic Analysis unit Bocconi University. Originally published at VoxEU.

Much of the current research on offshore financial centres has focused on the roles of tax havens in advanced economies, and less is known about the case of developing countries, especially after a financial crisis. This column shows that tax havens not only facilitate tax evasion and corruption in ‘normal times’, they also harbour funds during economic crises, slowing down recovery. This is particularly relevant for low income-countries characterised by high inequality. The diversion of capital to tax havens by the richest shifts the burden of the recovery onto the rest of the population, further exacerbating inequality.

Capital flight features prominently in contemporary debates about economic development. In developing countries, capital is relatively scarce and the same domestic investors may prefer to locate part of their assets outside of the countries’ borders (e.g. Cuddington 1986, Eaton 1987). Starting from the great financial liberalisation in the 1980s, wealth has been moving across the borders at higher frequency, often reaching offshore destinations characterised by a close-to-zero tax rate. Offshore capital is not employed productively in the country of origin. Furthermore, when offshore wealth is hidden from the tax authorities of the country of origin, or when regulation – such as bilateral tax agreements – is not in place or not enforced, the country of origin cannot levy any taxes on it. This issue becomes more concerning for low- and middle-income countries, where the rule of law and state capacities are typically weaker.

According to Zucman (2013), about 8% of all global financial wealth reached tax havens, corresponding to a tax revenue loss of $190 billion. More recent evidence suggests that firms book around 7% of their global profits in tax havens, resulting in significant revenue losses (Zucman and Wier 2022). This subtraction of resources, being it direct (through capital flight) or indirect (through non-levied taxes) becomes even more concerning at times of financial crises, when productive use of domestic resources could foster recovery. If, at the extreme, the movement of capital toward tax havens accelerates even more during a financial crisis, then two sets of negative consequences derive: slower recovery on one side, and higher burden of the crisis on poorer citizens on the other. Indeed, access to tax havens is skewed heavily towards the highest-income individuals (Alstadsaeter et al. 2018, 2019).

Our Study

In our recent paper (Marchesi and Marcolongo 2023), we focus on the cross-country relationship between financial (i.e. banking and sovereign debt) crises and ‘hidden wealth’. We measure hidden wealth using data on bank deposits in offshore financial centres provided by the Bank of International Settlements (BIS) and, as robustness, data from the Offshore Leaks Database (the Panama Papers and subsequent leaks such as the Pandora Papers and Paradise Papers) measuring the probability of observing the incorporation of shell companies in tax havens.

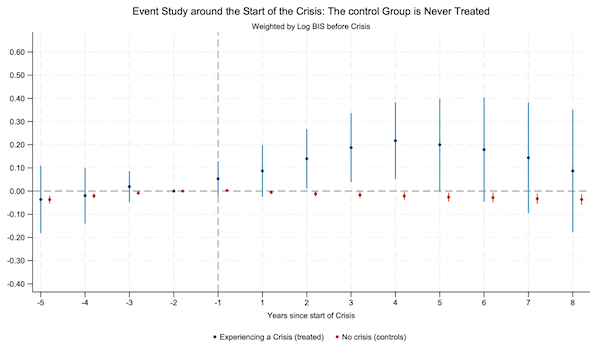

Figure 1 Financial crisis: Funds to tax havens

Notes: Stacked difference-in-differences. It shows estimates of funds flowing to tax havens around a financial crisis. Markers represent 90% confidence intervals.

Analysing 144 developing countries, using quarterly data and both a two-way fixed effects (TWFE) and stacked difference-in-differences methodology, we estimate the effect of financial crises on bank deposits in tax havens over the 1977-2020 period. We provide empirical evidence of a link between the beginning of a financial crisis and an increase in offshore bank deposits in the same period. Using an event-study analysis, we detect an increase in deposits of about 20% three years after the beginning of a crisis (Figure 1). The effect is economically sizeable: the average increase of deposits into tax havens corresponds to about $1 billion during the crisis (corresponding to slightly less than 1% of a developing country’s average annual GDP). The effect does not persist beyond the end of the crisis.

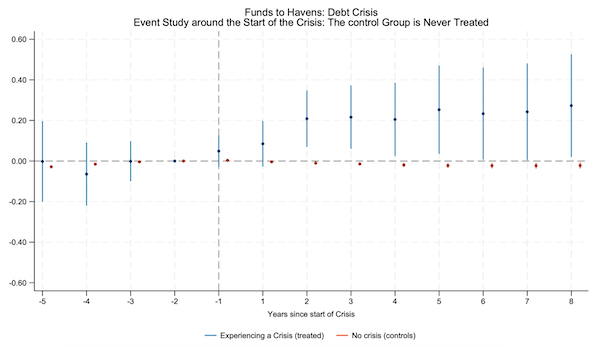

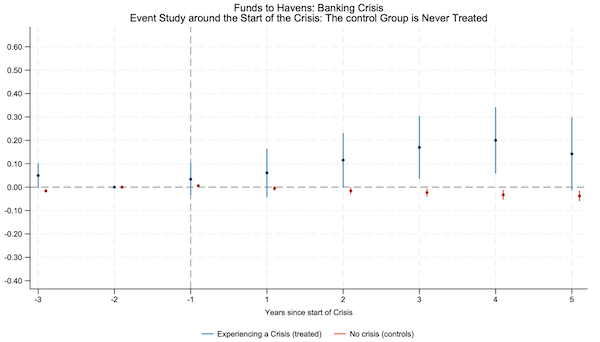

Given the different characteristics between sovereign debt and banking crises, we explore whether the flows of funds to tax havens differ during these two types of shocks. We find the results are qualitatively similar during banking and debt crises, even though the increase in bank deposits after a sovereign debt default is more persistent (Figure 2).

Figure 2 Sovereign debt and banking crises and funds to tax havens

a) Sovereign debt crises

b) Banking crises

Notes: Stacked difference-in-differences. Panel a shows funds to tax havens during a sovereign debt crisis, panel b shows funds to tax havens during a banking crisis. Markers represent 90% confidence intervals.

As far as possible mechanisms are concerned, we investigate whether the two main drivers of funds to tax havens suggested by the literature – namely, tax evasion and corruption – explain the increase in hidden wealth during financial crises. We document no increase in the effective tax on capital following the start of a crisis (tax rates are typically very low in low-income countries), while we find evidence of an increase in the expropriation risk, which is typically higher in countries with more fragile institutions.

Without Considering Tax Havens We Underestimate Inequality

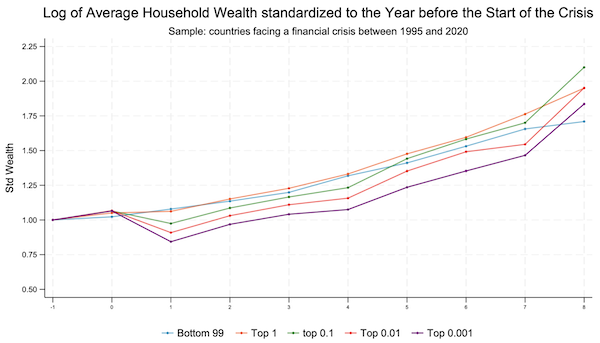

Ultimately, as emphasised by Alstadsaeter et al. (2019), it is important to take into account the role tax heavens play in underestimating inequality. When attesting the consequences of a financial crisis on inequality, it is important to consider both domestic (observed) as well as offshore (hidden) wealth. In fact, only the sum of the two allows us to construct a reliable measure of the wealth distribution. We provide suggestive evidence of the fact that the larger the amounts of funds a country diverts to tax havens during a financial crisis, the higher the reduction in the observed household wealth of the highest quantiles (top 0.01%) of the distribution (Figure 3). We show that this reduction is not a mechanical byproduct of the domestic effects of the financial crisis (such as, for example, falling prices on financial assets). At the same time, the effect of the financial crisis on the population’s (observed) average wealth decreases gradually as we move away from the richest segments of the population. This fact is consistent with the richest segments of the population harbouring part of their funds in tax havens.

Figure 3 Dynamic of average wealth by income quantiles after the start of a financial crisis

Notes: Standardised wealth of countries experiencing a financial crisis by different percentiles of average wealth over time

Conclusion

We add to previous works by investigating the relationship by financial crises and hidden wealth. To the best of our knowledge, this is the first time in this literature that the link is taken into consideration. Previous literature provided measures of net wealth positions and estimates of offshore tax evasion (Lane and Milesi-Ferretti 2007, Zucman 2013, Johannesen 2014, Johannesen and Zucman 2014). Moreover, Johannesen and Rijkers (2020), Andersen et al. (2022) and Andersen et al. (2017) have documented that tax havens can be facilitators of corruption. We show that tax havens not only facilitate tax evasion and corruption in ‘normal times’, they also harbour funds during economic crises, slowing down recovery.

Moreover, while much of the current research has focused on the roles of tax havens in advanced economics, we contribute to this literature by highlighting how tax havens attract funds from developing economies as well, especially from countries with weak institutions. In particular, we show that tax havens, besides allowing tax and sanction evasion and harbouring the proceeds of criminal activities, absorb resources at difficult times and may lead to a downward bias when measuring inequality in a country. To draw a complete picture of the costs of a financial crisis and its consequences for inequality, we cannot ignore the role of hidden wealth. As the pandemic and the more recent geopolitical turmoil have increased financial instability, it is important to understand how a crisis may affect the size of funds in tax havens, harbouring resources when most needed and shifting the burden of adjustment on poorer citizens.

This tax evasion scheme hides another reality – my opinion –

The ability to evade taxes represents a competitive advantage – since taxes are upon financial gains which are in the margins of profit.

Remember that the online sales of products came originally with the exemption of sales taxes and local taxes on sales of products leading to a huge competitive advantage over brick and mortar businesses – sometimes an immediate 10% cost advantage from tax favoritism alone. leading to much disruption at local scales and the financial whiplashing of various economies and disabilities to real economy markets- But I digress with this incomplete picture of the much larger disruptions these tax havens and evasions represent

In effect tax haven enable financial colonization.

Why overtly colonize with troops and administrators when one can convince locals to do it to their own by providing safe harbor for their siphoned off capital.

Indeed, why bother with the Turks and Caicos when we’ve got Delaware?

And this might be one of the reasons explaining why the fight against tax havens never goes beyond some pearl clutching now and then. You have spent time and money bribing leaders in developing countries and you want to make them feel sure their richnesses won’t be wiped out in the next crisis.