Yves here. Financialization cuts both ways, as a Texas fight over Net Zero commitments is demonstrating. Major banks and investment houses joined the ESG (“environment, social, governance”) trend, in large measure because it became popular among institutional investors. In addition, some retail investors are want to limit their holdings to various flavors of social responsible funds.

What is not often discussed is the reason the ESG bandwagon has become so popular is it is another source of profits to the fund management industry. Anything other than a plain vanilla index fund will have higher fees. Specialist consultants get to opine on the merits of these new offerings, collecting their cut. As we can see from CalPERS, boards would much rather engage in ESG virtue-signaling than worry about nerdy things like allocation, fees, returns, and risks.

But now Texas is throwing a spanner in the works, as least as far as trying to move capital away from fossil fuel investments is concerned. The article below insinuates that the blowback from what amount to sanctions might leave the state worse off, since municipalities are now suffering higher funding costs. By contrast big and middle sized energy plays don’t fundraise that often, so the benefits to them and by extension, Texas, may be less that the cost to municipalities and other entities.

The article points out that other states are looking at similar measures.

And regardless of the actual, as opposed to perceived, impact of what amount to Net Zero sanctions and state counter-sanctions, the Texas example illustrates how the lack of consensus over climate change (and who should bear costs of conservation and remediation) means doing anything with teeth is getting serious resistance.

By Alex Kimani, a veteran finance writer, investor, engineer and researcher for Safehaven.com. Originally published at OilPrice

- Texas has barred state entities, including pensions, from investing in roughly 350 funds that oppose fossil fuel investing.

- A growing number of red states are now pursuing similar legislation to boycott financial institutions over policies that appear to threaten their livelihoods.

- Five of the largest underwriters namely Goldman Sachs, Citigroup, JPMorgan Chase, Bank of America, and Fidelity exited the market, leading to lower competition for borrowing and higher borrowing costs.

Three years ago, Texas passed two laws in 2021 that restrict the state from doing business with companies that are deemed to be hostile to fossil fuels and firearm industries.The two laws are just a handful of the many new laws Republicans have been pushing that oppose environmental, social and governance aka ESG investing and financing. Many Republicans consider screening potential investments for their environmental and social impact as part of the left’s efforts to impose their “woke” political views on the masses and have labeled ESG investing as anti-capitalist.

“ESG is just a hate factory. It’s a factory for naming enemies,” Republican mega-donor Peter Thiel has declared, while former Vice President Mike Pence has lamented that firms have been pushing a “radical ESG agenda.”

And, the effects of those controversial laws are now being felt across the ESG universe. Texas has barred state entities, including pensions, from investing in roughly 350 funds that oppose fossil fuel investing while other firms have been blacklisted for opposing firearms. To wit, the Republican-leaning state has banned Wall Street behemoths BlackRock Inc., Citigroup Inc. Barclays Plc and members of Net Zero Banking Alliance that have committed to “financing ambitious climate action to transition the real economy to net zero greenhouse gas emissions by 2050.” Just days ago, Texas Permanent School Fund terminated its contract with BlackRock to manage $8.5 billion of state money due to the money manager’s hardline stance on fossil fuel investments.

Costing Taxpayers

The anti-ESG laws have also come at a considerable cost for the State of Texas and its residents. Five of the largest underwriters namely Goldman Sachs, Citigroup, JPMorgan Chase, Bank of America, and Fidelity exited the market shortly after the laws were enacted, leading to lower competition for borrowing and higher borrowing costs. Related: Why Do we Still Have Investor-Owned Utilities?

“This is a really big rule for the municipal space. This is not the first time we’ve seen states use municipal markets as a way to enforce bank behavior they want to see, but this is new in its scale in that five large banks left Texas. [They] used to underwrite about 35% of the debt in the market, so they’ve left a really big gap,” professor Daniel Garret, co-author of a Wharton paper on the subject, has said. The study estimates that Texas cities paid an additional $303 million to $532 million in interest on $32 billion in bonds in the first eight months alone after the laws were passed.

But the implications go beyond Texas because a growing number of red states are now pursuing similar legislation to boycott financial institutions over policies that appear to threaten their livelihoods. Last year, a coalition of 19 states, led by Florida, created the anti-ESG alliance that’s opposed to using ESG criteria in government investing. The coalition claims the Department of Labor’s final rule permitting the use of ESG factors when selecting retirement plan investments prioritizes a political agenda ahead of financial returns and will end up costing Americans money.

“The proliferation of ESG throughout America is a direct threat to the American economy, individual economic freedom, and our way of life, putting investment decisions in the hands of the woke mob to bypass the ballot box and inject political ideology into investment decisions, corporate governance, and the everyday economy,” they said in a joint statement.

ESG investing Losing Steam

Source: Visual Capitalist

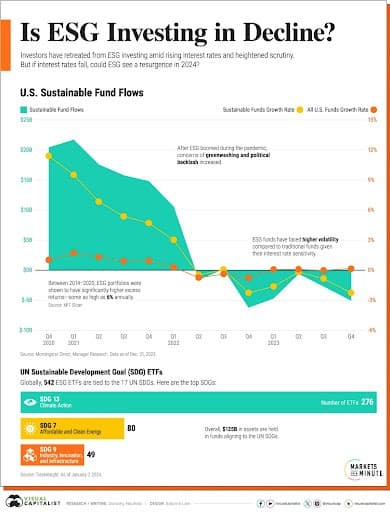

ESG investing spiked in 2020 and 2021 amid the COVID-19 pandemic with low oil prices driving more investments beyond fossil fuels. Unfortunately, the latest oil price boom and political backlash against ESG led by Republican politicians have made ESG investing lose steam.

Indeed, LSEG Lipper data showed that in the first 11 months of 2023, ESG funds only managed to pull $68 billion in net new deposits, a sharp drop from $158 billion in 2022 and $558 billion in 2021.

Big Oil is also pumping the brakes on its ambitious decarbonization drive.

A few days ago, Exxon Mobil Corp. (NYSE:XOM) announced that it will not move forward with one of the world’s largest low-carbon hydrogen projects if the Biden administration does not provide tax incentives for natural gas-fed facilities. Current guidelines provide incentives for projects that produce “green” hydrogen by using water and renewable energy, but Exxon wants them extended to”blue” hydrogen from gas by trapping carbon emissions. That’s an interesting take because last week, at the CERAWeek conference in Houston, Exxon CEO Darren Woods expressed his doubts about the efficacy of carbon capture at lowering emissions because ‘‘…the technology works for high concentration streams of gases but is too expensive for low concentration streams.’’

Last year, BP Inc. (NYSE:BP) unveiled a new [less aggressive] decarbonization strategy that entails (1) a slower decline in upstream investments and scrapped former plans to shrink refining; (2) focus more on higher-margin hydrogen and biofuels as well as offshore wind; and (3) higher spending in both oil and gas as well as low carbon. According to the company, the new strategy will offer higher shareholder returns, especially critical to the company after it severed ties with Russia’s Rosneft. BP’s nearly 20% stake in Rosneft helped to add several billion dollars to its bottomline.

Good luck telling financial institutions not to do risk management or governance. That’s just silly wishful thinking.

Also, the drive for NZBI and ESG is coming from within the banks. The banks are made of people, after all, and older generations within the bank are aging out, newer generations are more climate conscious, more informed, and doing their due diligence in thinking about coming eventualities, fitting what they know within their operating processes and frameworks.

Oil, tar sands, fracking, coal, etc., should be classified as higher risk, handled with enhanced risk procedures, it seems so obvious.

*Sigh*

These firms are mercenary and have no problem telling staff to stuff it. Financial firms have been the most aggressive in insisting employees suck it up and come back to work.:

https://www.washingtonpost.com/business/2023/09/29/why-some-banks-are-not-forcing-workers-back-to-the-office-and-keeping-wfh/fc3a1ac6-5e80-11ee-b961-94e18b27be28_story.html

The article showcases an itty bitty French digital bank and a couple of big Eurobanks’ European operations as exceptions.

And on Feb 12, in the New York Times:

https://www.nytimes.com/2024/02/16/business/dealbook/wall-streets-climate-retreat.html

NZBA, which is bank led, isn’t Climate Action 100+. JPM joining NZBA, while not a founding signatory, was probably the catalyst for very many other banks to sign on. JPM is still a signatory of NZBA, hasn’t withdrawn from it, nor do I see a mass exodus from it.

https://www.unepfi.org/net-zero-banking/members/

Banks were quick to follow JPM because they had already had in motion internal environmental and derisk initiatives, led from top down, bottom up and by client demand.

They also realized the NZBA and ESG goals amounted to what they were already doing in terms of risk management and governance – e.g. oil projects were already being flagged as higher risk and subject to enhanced/elevated risk protocols, because these are genuine financial risks in a world where climate change is a real thing, affecting the financial realities, as was true before ESG. They were already taking the steps, why not look good doing it?

JPM is noteworthy because they’re also the #1 fossil energy supporter, worldwide, for 8 years in a row. Why are they suddenly allergic to CA100+ but not to NZBA?

From last month:

https://www.reuters.com/sustainability/sustainable-finance-reporting/jpmorgan-fund-arm-quits-climate-action-100-investor-group-2024-02-15

So I don’t see an exodus. And nevertheess, even if much of it is for show, as in JPM’s case, NZBA and ESG has led to 49 banks decreasing investment in fossils, which is something rather than nothing.

You have shifted the grounds of your argument, which is bad faith. You explicitly stated:

So you made it sound as if the primary motivation was morality. People with high moral standards do not last long in that industry.

Then you retreated and made the banks’ actions were about risk management, as in not getting stuck with stranded asset exposures.

You have not disproven my contention that the banks are acting in a entirely mercenary manner., attentively watching regulatory developments and responding to changes in customer appetite.

Our entire economy is based on energy – there is a direct linear relationship between energy usage and GDP. Reducing energy use therefore necessarily entails reducing GDP. And, considering the extreme stratification of our societies in the West, where the bottom 50% of the population own less than 10% of the wealth, the cost of reducing GDP will fall mostly on the bottom 50%. This is what the Gilets Jaunes protests were about – the increase in fuel taxes fell almost entirely on the working poor and middle.

ESG is a luxury good, promoted by the wealthy.

NZBI and ESG is not anti-energy. Or anti-economy. Do you think the banks would have signed up for that?

But it doesn’t.

The US economy today is significantly less carbon intense than in 2000.

https://www.iea.org/data-and-statistics/charts/co2-emissions-intensity-of-gdp-1990-2021

Fascinating. The ostensible concern at play for Texas is a value judgment about ESG being based in “hate” and being used to “name enemies.” Taken at face value, Texas is saying that they are placing their values above the economic “bottom line.” That is, Texas is putting democracy before capitalism. So … yay!?

Whether one can take this at face value is another question altogether.

I am not unsympathetic to saying that Texas is putting democracy, or better government, before capitalism. ESG fits within the neoliberal framework of outsourcing to economic actors what the government is unwilling or unable to do. Depending on your viewpoint, it is a second best/worse alternative to governmental actions.

Without mentioning any names here, one can go to the websites of PFAS public enemy # 1 and Ethylene Oxide public enemy # 1 and see that they are just dandy on their ESG choreography. Harm was decades in the making, too. Whoocoodanoode?!!!

ESG is Wall Street grift designed to extract higher fees from well-meaning folks. Sheep meet shearer.