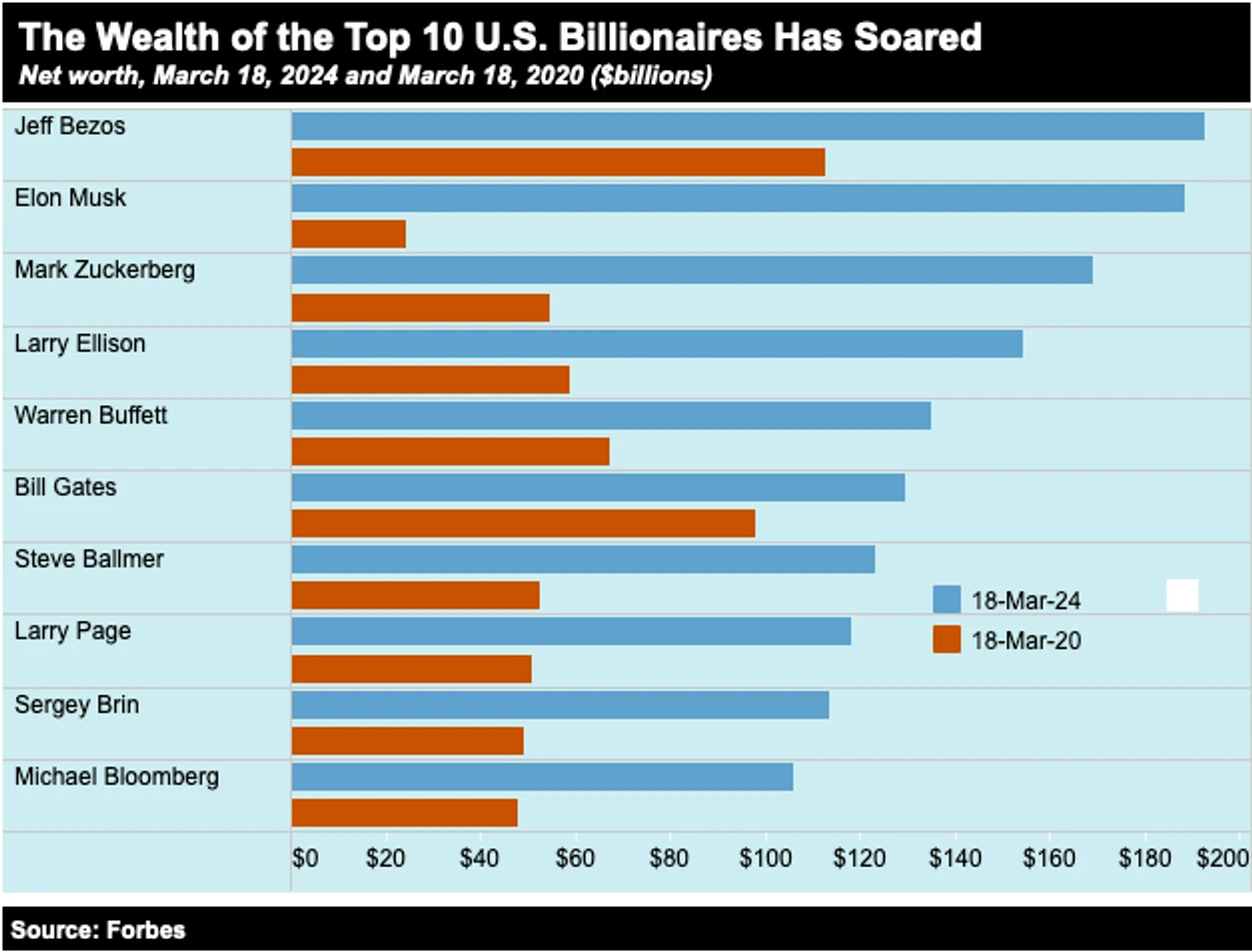

Yves here. The big jump in billionaire wealth was due to taking the starting measurement near the bottom of the Covid market swoon. Nevertheless, some of the prominent examples below did way better than just benefit from a big market bounce.

By Chuck Collins, a senior scholar at the Institute for Policy Studies where he co-edits Inequality.org. and the author of numerous books and reports on inequality and the racial wealth divide, including “The Wealth Hoarders: How Billionaires Spend Millions to Hide Trillions,” “Born on Third Base,” and, with Bill Gates Sr., of “Wealth and Our Commonwealth: Why American Should Tax Accumulated Fortunes.” and Omar Ocampo, a researcher for the Program on Inequality and the Common Good. Originally published at Common Dreams

So what’s not to like?

>So what’s not to like?

Indeed, trickle down economics baby! We’ll all get to share in this soon enough…

Trickle down economics? Yeah, that will be real gold showering down on us.

No no, that’s just the rain running down your back…

Your crumbs are over there serf.

A musical interlude anyone?

https://www.youtube.com/watch?v=5vO_8vflyQU

Urine, actually.

If you go back to an earlier name, horse and sparrow economics, it better describes the part we get.

See, the economy really is in a boom cycle upside thanks in large part to Bidenonomics. No Billionaires will go homeless!

Larry Summers twitter feed seemed spooked by a number of nearly 20% inflation when using old metrics from the 70’s. If Summers has figured this out, it wont be long before the rest of the DC rats start to get it. The praise of Bidenomics followed by these kind of data points means they can’t just get out of thus with better messaging.

Calling everyone dumb for complaining about inflation and then explaining the official definition of inflation is probably not a winning strategy.

I thought it is called piss?!

Shhhh, comments like that ruin the charade. Telling the truth takes the fun out of it for the TPTB.

It worked so well for the billionaires the first time I gotta think they look forward to another such event. ka-ching! / ;)

Democrats have shown us an easy avenue for addressing this: via lawfare.

Come on everybody, let’s go find a state-level judge and prosecutor, trump up some victimless charges regarding past paperwork, and then we can fine each of these guys billions of dollars, seize their corporations, and ban them from doing further business. /s (I think)

easy job that.

one would just have to say they congratulated putin on his latest election success

Or that they bought up all the politicians and judges to give them every damn thing they want, and there isn’t a damn thing that they don’t want.

Stormy Daniels, Savior of the Republic!

There is a way for the government to raise a few $trillion quickly. As I understand things, most of Trump’s 2017 tax cuts are set to expire in 2025. Moreover, IIRC back in 2017, when those tax cuts became law, every Democratic said they opposed them.

Though Biden was elected in 2020, and the DP controlled the House and Senate, there wasn’t much done about raising taxes on the wealthy.

The next president gets a chance to let those tax cuts expire, however, Obama campaigned in 2008 against the Bush tax cuts but he kinda sorta changed his mind after the election.

According to David Dayen, “While the Bush tax cuts had a few benefits for the middle class, the $3 trillion identified in Trump’s plan pretty much all went to the rich.”

Biden and the Dems should be pressured to promise to let these tax cuts expire, and while they’re at it, we can all debunk the nonsense about tax cuts for the wealthy spurring growth and innovation.

Did you consider the tax benefits of the state and local tax exemption in the Trump tax bill? If my friends and family in Westchester County are anything they are still furious that they are paying high real estate taxes, New York income tax and sales taxes and they are not able to deduct it any more. Same in New Jersey. No way they are voting for Trump. In some ways the Trump tax change was very populist. I do not know why no one seems to see it that way. I wonder why Dayen did not point that out and in fact ignored it. Maybe it is all partisan BS. One thing is for sure and that is when these cuts expire a lot of millionaires and billionaires are going to welcome letting Uncle Sam help pay their real estate and state income taxes. The muppets even will be happy.

Trump had nothing to do with the high levels of state and local taxes in NY or any other state. What his tax cuts did do was limit the deduction of these taxes on a Federal tax return to $10,000. You might interpret that as a middle finger to the blue states which benefited most from that deduction.

Nonetheless, the centerpiece of Trump’s tax cuts was it lowered the corporate tax rate from 35% to 21%, a massive windfall for corporations and which I’m sure he benefited personally.

You clearly have missed some very good examples in Europe on how “easy” it is to tax the rich lol. Dream on. I loved Trump’s tax cuts. I’m middle class. The rich can always evade taxes with their army of lawyers and accountants and I’ll never be poor enough to get benefits from the welfare state.

Wealth compounds. It’s a math issue not a moral issue.

It is inherehent in the mode itself. Capitalism tends towards monopoly, which is why anti-trust efforts are hilariously, and tragically misguided. If the rich didn’t hate/fear Marx so much, they might learn a thing or two which could keep them from the guillotine. Astonishing that they don’t seem to understand that they risk their lives the more with each dollar extracted.

We can only hope.

A rant.

Well, what are those guys going to do with all that money? They can only buy so many palatial houses, luxury cars, exotic meals, and the other things that class endulges in. What about the rest that they can´t spend? They give it to someone who will put it to use making more money. IMHO the problem with the world today is that there is just too much money. This is a correlary to Dr. Hudson´s thesis that there is too much debt (which adds to the problem of too much money on the part of the creditors). All this money is looking for a good rate of return. This is why public services the world over are being privatized, businesses are being bought, sold and merged for the purpose of being canibalized. Private equity is running wild with all this money creating cartels and monopolies everywhere we look. I can imagine the rooms in which men (and women) in suits sit around the mahogony conference table gleefully pushing pieces of paper back and forth to each other crying out ¨We´re Rich, We´re Rich!! What a Killing!!¨ Rather than recognizing this problem, governments that subscribe to MMT (it is valid up to a point, but this is a major flaw in its application) keep printing more money. Central banks with their QE and low rates do the same. Financial wizardry that gets more arcane every day allows the multiplication of assets in order to pump more money into the casino. Where are the brakes to all this madness? Is it as simple as taxes?

The Business Cycle is supposed to be a Feature, but it has been side-stepped, most notably by Too Big To Fail Banks (thanks, Obama! ). The “Maestro” (thanks Woodward! LOL) Greenspan Put, (didn’t he also say “perhaps the old rules do not apply”?), all the more examples I don’t know.

Richard Wolff and Michael Hudson talk about the ancient Debt Jubilee; a Wealth Jubilee sounds like a good idea also. China recently capped their squillionaires, the first thing to go in a revolution (after the monarch’s head) is the rich.

Carnegie and Rockefeller and their robber baron ilk gave away money so no one came for their heads. Giving dimes to children is a good way to look good, but does not stimulate the economy. Stimulating the economy would be more competition, which squillionaires don’t like.

Like JOC said in the comment above, it’s math. Once you allow compound interest, just having money makes more money. At an increasing rate.

No brakes. Greenspan and Clinton set the precedent, Obama etched it into law. Money makes more money, the old rules don’t apply, “everyone’s as rich as the Board”. “Commanding Heights” economics (thanks, Milton Friedman!) , the squillionaires looking down….

Here’s Mariner Eccles, one-time Fed chair (the current Fed building is named after him.) IMO, he agrees with you:

“It is utterly impossible, as this country has demonstrated again and again, for the rich to save as much as they have been trying to save, and save anything that is worth saving. They can save idle factories and useless railroad coaches; they can save empty office buildings and closed banks; they can save paper evidences of foreign loans; but as a class they can not save anything that is worth saving, above and beyond the amount that is made profitable by the increase of consumer buying. It is for the interests of the well to do – to protect them from the results of their own folly – that we should take from them a sufficient amount of their surplus to enable consumers to consume and business to operate at a profit. This is not “soaking the rich”; it is saving the rich. Incidentally, it is the only way to assure them the serenity and security which they do not have at the present moment.”

– https://fraser.stlouisfed.org/files/docs/meltzer/ecctes33.pdf

p.s. And, thank you, NC, for introducing me to Eccles, a long time ago.

The point of my rant is that it is NOT just as simple as taxing the rich. These billionaires are the symptom, not the problem. Corporations have charters that put conditions on their being allowed to exist and conduct whatever type of business they propose to do. Those charters can be taken away. The anti-trust laws need to be expanded and enforced to deal with private equity, mergers and buyouts. Stock buybacks need to be ended. Tax evasion needs to be dealt with. Can we deal with corruption? A while back in China a man was sentenced to death for corruption. Corporate fraud is everywhere (could it possibly be as big as government fraud? I think maybe so). As I understand it, when a corporation is fined for some kind of malfeasance, the fine and legal expenses are sometimes deductable as a business expense. When was the last time a corporate bigwig went to jail (SBF is there now, but there we are hearing noises about letting the nice boy from a good family have another chance). We have a lot of work to do to deal with the too much money problem. When the national religion is money, and one can tell who will go to heaven, all you have to do is look at their bank account because God favores the blessed while they are on earth. The economy is not about numbers like the GDP, nor is it about providing for some to become rich. It is about the ability of the people of a country to work, provide food, clothing and shelter for themselves that will allow them to find intellectual stimulation and something to look forward to.

We need a wealth cap.

IF it was 1000 times median household income,

AND 2023 household median* was appx. $74,000

THEN you’d have 74,000,000 for inventing penicillin, the Bessemer steel process, the semi conductor, hoola hoop, …

You could live on 10 times median, $740,000.00 for 100 years!

or, $1,480,000.00 for 50 years!

IF that is NOT enough, you could earn the community supplied $5 100 foot clothesline,

& with community support, find a tree branch & shuffle off this miserable mortal coil!

It annoys the crap outta me that there are NOT dynamic data sets showing how

MORE Rich Pig Stealing = Less Democracy (corruption) & Less community Health Care & less community EVERYTHING.

What is the highly educated ‘liberal’ policy cla$$ for, other than making excuses and making studies and making paychecks which keep ’em living in leafy neighborhoods?

With that, methoughts, a legion of foul fiends

Environed me and howlèd in mine ears

Such hideous cries that with the very noise

I trembling waked, and for a season after

Could not believe but that I was in hell,

Such terrible impression made my dream.

I seem to recall reading that at one point the US tax rate peaked out around something like 90%.

Even at that the likes of Bezos and Musk would be good for near 18 billion.

We used to think of ex Mayor Bloomberg as being stinking rich at $25 billion. So now he’s worth $100+ billion? From doing what exactly? Watching the paint dry on his art collection? Meanwhile, the pasta I used to get for $1.19 ($1.00 on sale) is now $2.49. My part D drug plan just went up 60%. Am I wrong to connect these phenomena?

If anyone wants to read the effect of wealth by just one of these billionaires, Bill Gates, and the negative effects of his “philanthropy” on the world, I suggest reading the book

“The Bill Gates Problem. Reckoning with the Myth of the Good Billionaire” by Tim Schwab.

$1 trillion in PPP given and forgiven tax free to the wealthiest was the economic crime of the century, the biggest plunder of public treasury.

Why forgive it tax free, even my lottery winnings are taxed?

That money is still running through the system as it gets recycled in real estate and other toys the rich like to buy.

Paul Krugman has an op-ed in the NYT today telling us that the economy is in good shape and that the masses who don’t think so are misinformed. Reading the comments demonstrates that the people are not experiencing the ” good economy” that Krugman portrays. I wonder why?

But ol’ Kruggie is good for laughs. And more important: He does a great job as Mouthpiece of Oligarchy at the “newspaper of record”. The economy is great! Debt is never a problem, we should worship celebrity oligarchs, the US govt. should spend more on wars, weapons etc. – he says it’s “good for the economy”. He has become boringly predictable.

My college roommate waded into it; I don’t agree with every assumption, but he finds numbers as a flip side to the narrative (figures don’t lie LOL)

https://inflationguy.blog/2024/03/08/understanding-bidens-poll-numbers-despite-a-strong-economy/

Krugman would be serving in Joseph Goebbel’s government without qualms if he paid his salary.

From NYT, July 14th 2006.

By Paul Krugman

Left Behind Economics.

I’d like to say that there’s a real dialogue taking place about the state of the U.S. economy, but the discussion leaves a lot to be desired.

In general, the conversation sounds like this:

Bush supporter: “Why doesn’t President Bush get credit for a great economy? I blame liberal media bias.”

Informed economist: “But it’s not a great economy for most Americans. Many families are actually losing ground, and only a very few affluent people are doing really well”.

Thank you for further documentation of the giant hoover of oligarchy sucking up all the wealth and resources to the top .001%.

It is hard not get angry and hard not to have a spike in blood pressure and cortisol levels. Keeping informed is crucial, yet can be bad for one’s health.

The source for this post at inequality.org argues for “…making the wealthy and corporations pay their fair share of taxes…” — which is a fine idea. I doubt that will happen. Money is power and that power has been applied over many decades to build the loophole riddled tax codes.

If that were accomplished, I doubt that making wealthy an corporations pay their fair share of taxes would address the Wealth and inequality the problems afflicting our Empire. Wealth and Money have always held undue stature in the Imperial polity. Their power designed our Imperial Society and makes a travesty of what we are so cunningly told is our wonderful democracy and freedom. The lies have grown too large, too plainly false.

We cannot enjoy democracy or freedom in a state controlled by Wealth and Money. Individual Wealth and Money beyond a point below the $400,000 mentioned at inequality.org should be taxed away to allow some daisies to stand a little taller than others but top daisies casting broad dark shadows over the other daisies. Corporate Wealth and Power presents a more difficult and insidious threat to our democracy. Individual billionaires remain somewhat human. Corporate Persons are alien and extremely dangerous to democracy and to the very survival of Humankind. Their power must be constrained by much stronger measures than taxes.

We need another revolution. We became as blue blooded and monarchical as the old country. I say Eat. The. Rich.

I’ve been reading Varoufakis’ TECHNOFEUDALISM. While he is quite superficial on a lot of issues, I think he has a point that the rentier class has taken over from the profiteering class and is using control of communications networks and the infinite cash reserves of central banks to secure control of the planetary economy.

He argues that even Tesla is a data-trawling operation rather than a car company.

According to some estimates there are 14 million millionaires in the US. Let’s pretend that each of these millionaires has 1 million dollars in the bank. That would mean they are “worth” 14 trillion dollars. Round it up a bit and that would make them 5 times wealthier as a group than the billionaires. An army of self-interested wealthy people 14 million strong. So maybe we need to talk about them even more than the 737 billionaires.