Yves here. This article delivers a damning finding, that Medicare Advantage grotesquely fails to deliver on its claim of being cheaper to the Federal government than traditional Medicare. Of course, intuitively that seems probable given the insertion of profit-driven insurers and then the behavior they engage in, particularly extensive advertising on TV.

But the “lower cost” pitch still seemed possible given that Medicare Advantage, despite gimmicks like no-fee plans or some dental coverage, offers less coverage via having restricted MD networks and gatekeeping. We’ve often described it as second tier coverage for those who can’t afford the monthly premiums of Medicare. But the fact that it grifts the government adds insult to injury.

By Grace McCormack, Postdoctoral researcher of Health Policy and Economics, University of Southern California, and Erin Duffy, Research Scientist and Director of Research Training in Health Policy and Economics, University of Southern California. Originally published at The Conversation

Medicare Advantage – the commercial alternative to traditional Medicare – is drawing down federal health care funds, costing taxpayers an extra 22% per enrollee to the tune of US$83 billion a year.

Medicare Advantage, also known as Part C, was supposed to save the government money. The competition among private insurance companies, and with traditional Medicare, to manage patient care was meant to give insurance companies an incentive to find efficiencies. Instead, the program’s payment rules overpay insurance companies on the taxpayer’s dime.

We are health care policy experts who study Medicare, including how the structure of the Medicare payment system is, in the case of Medicare Advantage, working against taxpayers.

Medicare beneficiaries choose an insurance plan when they turn 65. Younger people can also become eligible for Medicare due to chronic conditions or disabilities. Beneficiaries have a variety of options, including the traditional Medicare program administered by the U.S. government, Medigap supplements to that program administered by private companies, and all-in-one Medicare Advantage plans administered by private companies.

Commercial Medicare Advantage plans are increasingly popular – over half of Medicare beneficiaries are enrolled in them, and this share continues to grow. People are attracted to these plans for their extra benefits and out-of-pocket spending limits. But due to a loophole in most states, enrolling in or switching to Medicare Advantage is effectively a one-way street. The Senate Finance Committee has also found that some plans have used deceptive, aggressive and potentially harmful sales and marketing tactics to increase enrollment.

Baked Into the Plan

Researchers have found that the overpayment to Medicare Advantage companies, which has grown over time, was, intentionally or not, baked into the Medicare Advantage payment system. Medicare Advantage plans are paid more for enrolling people who seem sicker, because these people typically use more care and so would be more expensive to cover in traditional Medicare.

However, differences in how people’s illnesses are recorded by Medicare Advantage plans causes enrollees to seem sicker and costlier on paper than they are in real life. This issue, alongside other adjustments to payments, leads to overpayment with taxpayer dollars to insurance companies.

Some of this extra money is spent to lower cost sharing, lower prescription drug premiums and increase supplemental benefits like vision and dental care. Though Medicare Advantage enrollees may like these benefits, funding them this way is expensive. For every extra dollar that taxpayers pay to Medicare Advantage companies, only roughly 50 to 60 cents goes to beneficiaries in the form of lower premiums or extra benefits.

As Medicare Advantage becomes increasingly expensive, the Medicare program continues to face funding challenges.

In our view, in order for Medicare to survive long term, Medicare Advantage reform is needed. The way the government pays the private insurers who administer Medicare Advantage plans, which may seem like a black box, is key to why the government overpays Medicare Advantage plans relative to traditional Medicare.

Paying Medicare Advantage

Private plans have been a part of the Medicare system since 1966 and have been paid through several different systems. They garnered only a very small share of enrollment until 2006.

The current Medicare Advantage payment system, implemented in 2006 and heavily reformed by the Affordable Care Act in 2010, had two policy goals. It was designed to encourage private plans to offer the same or better coverage than traditional Medicare at equal or lesser cost. And, to make sure beneficiaries would have multiple Medicare Advantage plans to choose from, the system was also designed to be profitable enough for insurers to entice them to offer multiple plans throughout the country.

To accomplish this, Medicare established benchmark estimates for each county. This benchmark calculation begins with an estimate of what the government-administered traditional Medicare plan would spend on the average county resident. This value is adjusted based on several factors, including enrollee location and plan quality ratings, to give each plan its own benchmark.

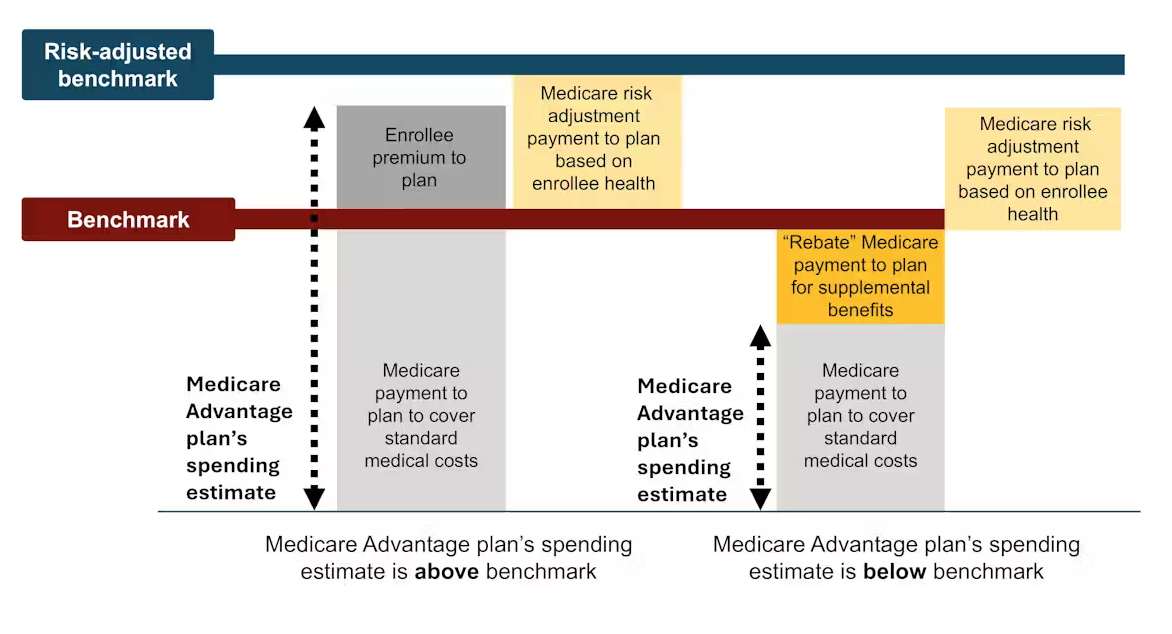

Medicare Advantage plans then submit bids, or estimates, of what they expect their plans to spend on the average county enrollee. If a plan’s spending estimate is above the benchmark, enrollees pay the difference as a Part C premium.

Most plans’ spending estimates are below the benchmark, however, meaning they project that the plans will provide coverage that is equivalent to traditional Medicare at a lower cost than the benchmark. These plans don’t charge patients a Part C premium. Instead, they receive a portion of the difference between their spending estimate and the benchmark as a rebate that they are supposed to pass on to their enrollees as extras, like reductions in cost-sharing, lower prescription drug premiums and supplemental benefits.

Finally, in a process known as risk adjustment, Medicare payments to Medicare Advantage health plans are adjusted based on the health of their enrollees. The plans are paid more for enrollees who seem sicker.

Theory Versus Reality

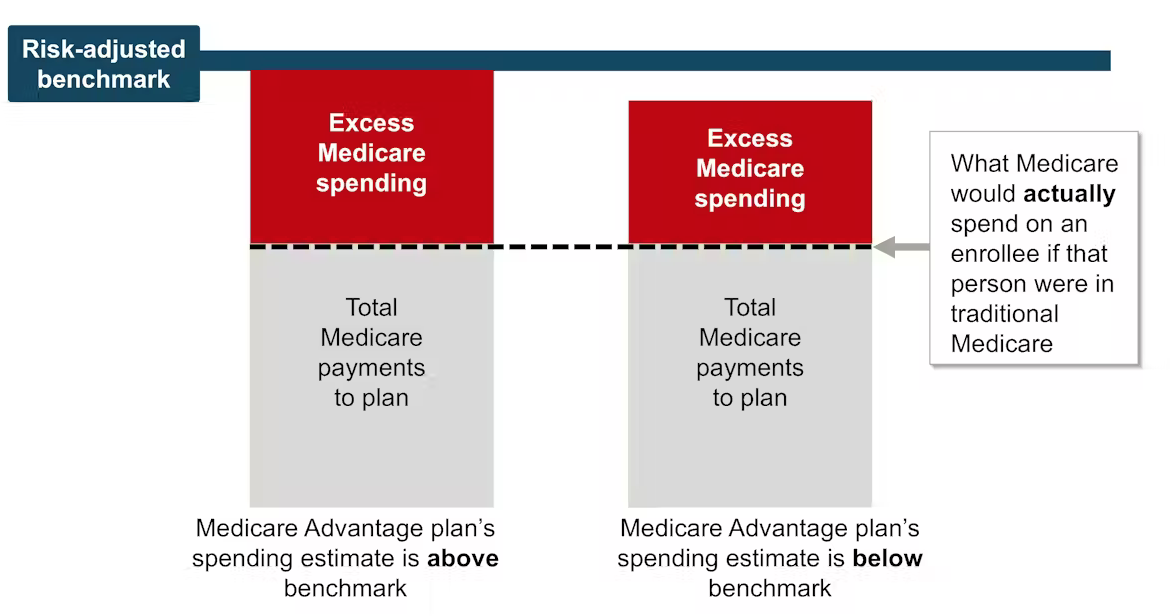

In theory, this payment system should save the Medicare system money because the risk-adjusted benchmark that Medicare estimates for each plan should run, on average, equal to what Medicare would actually spend on a plan’s enrollees if they had enrolled in traditional Medicare instead.

In reality, the risk-adjusted benchmark estimates are far above traditional Medicare costs. This causes Medicare – really, taxpayers – to spend more for each person who is enrolled in Medicare Advantage than if that person had enrolled in traditional Medicare.

Why are payment estimates so high? There are two main culprits: benchmark modifications designed to encourage Medicare Advantage plan availability, and risk adjustments that overestimate how sick Medicare Advantage enrollees are.

High risk-adjusted benchmarks lead to overpayments from the government to the private companies that administer Medicare Advantage plans. Samantha Randall at USC, CC BY-ND

Benchmark Modifications

Since the current Medicare Advantage payment system started in 2006, policymaker modifications have made Medicare’s benchmark estimates less tied to what the plan spends on each enrollee.

In 2012, as part of the Affordable Care Act, Medicare Advantage benchmark estimates received another layer: “quartile adjustments.” These made the benchmark estimates, and therefore payments to Medicare Advantage companies, higher in areas with low traditional Medicare spending and lower in areas with high traditional Medicare spending. This benchmark adjustment was meant to encourage more equitable access to Medicare Advantage options.

In that same year, Medicare Advantage plans started receiving “quality bonus payments” with plans that have higher “star ratings” based on quality factors such as enrollee health outcomes and care for chronic conditions receiving higher bonuses.

However, research shows that ratings have not necessarily improved quality and may have exacerbated racial inequality.

Even before fully taking into account risk adjustment, recent estimates peg the benchmarks, on average, as 8% higher than average traditional Medicare spending. This means that a Medicare Advantage plan’s spending estimate could be below the benchmark and the plan would still get paid more for its enrollees than it would have cost the government to cover those same enrollees in traditional Medicare.

Overestimating Enrollee Sickness

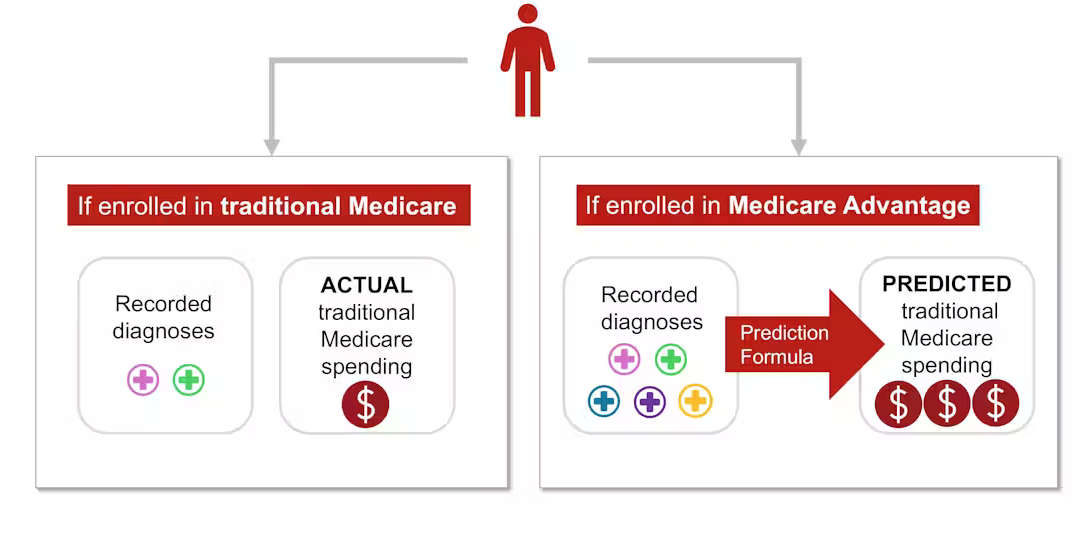

The second major source of overpayment is health risk adjustment, which tends to overestimate how sick Medicare Advantage enrollees are.

Each year, Medicare studies traditional Medicare diagnoses, such as diabetes, depression and arthritis, to understand which have higher treatment costs. Medicare uses this information to adjust its payments for Medicare Advantage plans. Payments are lowered for plans with lower predicted costs based on diagnoses and raised for plans with higher predicted costs. This process is known as risk adjustment.

But there is a critical bias baked into risk adjustment. Medicare Advantage companies know that they’re paid more if their enrollees seem more sick, so they diligently make sure each enrollee has as many diagnoses recorded as possible.

This can include legal activities like reviewing enrollee charts to ensure that diagnoses are recorded accurately. It can also occasionally entail outright fraud, where charts are “upcoded” to include diagnoses that patients don’t actually have.

In traditional Medicare, most providers – the exception being Accountable Care Organizations – are not paid more for recording diagnoses. This difference means that the same beneficiary is likely to have fewer recorded diagnoses if they are enrolled in traditional Medicare rather than a private insurer’s Medicare Advantage plan. Policy experts refer to this phenomenon as a difference in “coding intensity” between Medicare Advantage and traditional Medicare.

In addition, Medicare Advantage plans often try to recruit beneficiaries whose health care costs will be lower than their diagnoses would predict, such as someone with a very mild form of arthritis. This is known as “favorable selection.”

The differences in coding and favorable selection make beneficiaries look sicker when they enroll in Medicare Advantage instead of traditional Medicare. This makes cost estimates higher than they should be. Research shows that this mismatch – and resulting overpayment – is likely only going to get worse as Medicare Advantage grows.

Where the Money Goes

Some of the excess payments to Medicare Advantage are returned to enrollees through extra benefits, funded by rebates. Extra benefits include cost-sharing reductions for medical care and prescription drugs, lower Part B and D premiums, and extra “supplemental benefits” like hearing aids and dental care that traditional Medicare doesn’t cover.

Medicare Advantage enrollees may enjoy these benefits, which could be considered a reward for enrolling in Medicare Advantage, which, unlike traditional Medicare, has prior authorization requirements and limited provider networks.

However, according to some policy experts, the current means of funding these extra benefits is unnecessarily expensive and inequitable.

It also makes it difficult for traditional Medicare to compete with Medicare Advantage.

Traditional Medicare, which tends to cost the Medicare program less per enrollee, is only allowed to provide the standard Medicare benefits package. If its enrollees want dental coverage or hearing aids, they have to purchase these separately, alongside a Part D plan for prescription drugs and a Medigap plan to lower their deductibles and co-payments.

The system sets up Medicare Advantage plans to not only be overpaid but also be increasingly popular, all on the taxpayers’ dime. Plans heavily advertise to prospective enrollees who, once enrolled in Medicare Advantage, will likely have difficulty switching into traditional Medicare, even if they decide the extra benefits are not worth the prior authorization hassles and the limited provider networks. In contrast, traditional Medicare typically does not engage in as much direct advertising. The federal government only accounts for 7% of Medicare-related ads.

At the same time, some people who need more health care and are having trouble getting it through their Medicare Advantage plan – and are able to switch back to traditional Medicare – are doing so, according to an investigation by The Wall Street Journal. This leaves taxpayers to pick up care for these patients just as their needs rise.

Where Do We Go From Here?

Many researchers have proposed ways to reduce excess government spending on Medicare Advantage, including expanding risk adjustment audits, reducing or eliminating quality bonus payments or using more data to improve benchmark estimates of enrollee costs. Others have proposed even more fundamental reforms to the Medicare Advantage payment system, including changing the basis of plan payments so that Medicare Advantage plans will compete more with each other.

Reducing payments to plans may have to be traded off with reductions in plan benefits, though projections suggest the reductions would be modest.

There is a long-running debate over what type of coverage should be required under both traditional Medicare and Medicare Advantage. Recently, policy experts have advocated for introducing an out-of-pocket maximum to traditional Medicare. There have also been multiple unsuccessful efforts to make dental, vision, and hearing services part of the standard Medicare benefits package.

Although all older people require regular dental care and many of them require hearing aids, providing these benefits to everyone enrolled in traditional Medicare would not be cheap. One approach to providing these important benefits without significantly raising costs is to make these benefits means-tested. This would allow people with lower incomes to purchase them at a lower price than higher-income people. However, means-testing in Medicare can be controversial.

There is also debate over how much Medicare Advantage plans should be allowed to vary. The average Medicare beneficiary has over 40 Medicare Advantage plans to choose from, making it overwhelming to compare plans. For instance, right now, the average person eligible for Medicare would have to sift through the fine print of dozens of different plans to compare important factors, such as out-of-pocket maximums for medical care, coverage for dental cleanings, cost-sharing for inpatient stays, and provider networks.

Although millions of people are in suboptimal plans, 70% of people don’t even compare plans, let alone switch plans, during the annual enrollment period at the end of the year, likely because the process of comparing plans and switching is difficult, especially for older Americans.

MedPAC, a congressional advising committee, suggests that limiting variation in certain important benefits, like out-of-pocket maximums and dental, vision and hearing benefits, could help the plan selection process work better, while still allowing for flexibility in other benefits. The challenge is figuring out how to standardize without unduly reducing consumers’ options.

The Medicare Advantage program enrolls over half of Medicare beneficiaries. However, the $83-billion-per-year overpayment of plans, which amounts to more than 8% of Medicare’s total budget, is unsustainable. We believe the Medicare Advantage payment system needs a broad reform that aligns insurers’ incentives with the needs of Medicare beneficiaries and American taxpayers.

Not if the US takes a page out of Israel’s playbook and does bombing runs in service of the fent addicts we don’t actually care about.

America is a funny place. When it comes to health insurance, why in God’s name would anyone want options? Does the congressional committee believe people derive satisfaction from investigating fine print? Thank God I live in a civilized country where the state just pays.

A few months ago, , there was a report about the loses that CVS/Aetna had incurred

in the current plan year. The followup, I believe in the WSJ, as a report of the CVS CEO telling investors that they would cut off approx one hundred thousand enrollees from their plans and issue many more “denials of service.” That’s wha I recall reading.

It appears that that organization is invesor driven; not customer driven

Because I have PTSD from enrolling in Medicare, only to face the Medigap monsters stitched together to eat Medicare, I couldn’t finish the article. These bafflingly complex self-dug hole-fillers aren’t health insurance, they’re insurance health. And as long as we have Democrats, they’ll eat more of Medicare to our cost and distress. I have to get permission from an insurance algorithm (or intern) to fill a doctor’s prescription!

Many thanks for McCormack and Duffy’s very well sourced article. Advantage plans seem to have created a cesspool of dishonest business practices, from dishonest television advertisements to endless phone calls that begin with a robot and then switch you to a person who tries to trick you out of your medicare information so they can switch your insurance to some fly-by-night insurance company in Florida, South Carolina, Delaware, or New Jersey. I have been getting one particular robocall every day for weeks, and I am so familiar with their machine noise that if I answer the phone by mistake I just hang up while the switching “blip” is still sounding, before the robot actually answers. It seems that no harsh request not to be called again, or string of insults, can discourage this robot. I have a no-frills landline so I can’t block the caller. I have come to feel that every time an Advantage plan is touted, a congressman and his/her family should go to the guillotine.

Job for DOGE?

I was able to qualify for Medicare two years after I had been on Social Security Disability, but I still had to pay Medicare Part B Premiums, at least until I was impoverished enough to qualify for Medicaid. These Part B Premiums are adjusted for income: I paid the lowest bracket (~$2K/year then), but I understand that higher income retirees can pay five times higher premiums.

I chose a Medicare Advantage plan in order to actually get relatively affordable care, since most private doctors offices where I live (SF) either don’t accept Medicare patients or decline to agree to limit co-pays to 20% over what Medicare will cover. Before Part C and Medicare Advantage plans were created, my elderly parents faced co-pays of as much as 30% or more, and I tried to help my mom sort out all the bills and reimbursements resulting from my dad breaking his hip due to metastatic prostate cancer weakening his hip bones.

My Kaiser HMO Senior Advantage came with perks that, for me, offset the modest premium, which went down over the years to zero. So I’m confused by Yves’ introductory statement about MA plans: “We’ve often described it as second tier coverage for those who can’t afford the monthly premiums of Medicare”, since I still had Part B Premiums deducted from my Social Security Benefit– until was poor enough to qualify to enroll in Medicaid.

Of course, nobody told me anything, and I was just reading online federal government websites to learn about asset limits for Medicaid, so I was unaware that the California legislature greatly raised the asset limit in late Summer of 2022. I only found out after a contractor working for Kaiser sent me a letter offering to help me find public benefits. They did a telephone interview, and applied on my behalf, and it turns out that I qualified for MediCal (California’s Medicaid program), SNAP food benefits, and an federal program that pays my Part B Premium, and caps most prescription co-pays at $1.45 (!).

I don’t doubt that many Part C providers may be ‘gaming’ the system, but the article makes it sound like Medicare is actually incentivized to be gamed thru Part C. Unfortunately, from my experience, one of the biggest tragedies of US health care is the lack of affordable quality dental care. For instance, my Kaiser plan includes DeltaCare USA network coverage for preventive dental care only– x-rays and cleaning– but the fact that I have this thru the MA plan– which is the primary insurer of my dual insurance coverage– seems to prevent MediCal “Denti-Cal” from paying for needed care, even though my SF Health Plan (MediCal via Kaiser) claims to cover all dental care. I’m still waiting to hear back from the billing clerk at the Periodontal Clinic whether they can bill Denti-Cal, but she apparently needs to contact Kaiser to figure this out. While I’m in dental limbo after a failed root canal– all paid for out of pocket (a bargain at ~$1K). Ugh!

I have pointed out that the one exception to Medicare Advantage being second tier is when the plan is offered by a large HMO affiliated with a major hospital system. Kaiser is that. Kaiser is also losing a lot of money and is expected to have to degrade service.

https://www.beckershospitalreview.com/finance/kaiser-permanente-posts-608m-operating-loss-in-q3.html

My parents were in one of those supposedly better HMOs. Their specialist triggered the terminal slide in my father’s condition by refusing to try a treatment with a lot of experimental data supporting it, and using only tetracyline (a very well tolerated drug) and instead tried a different one based on a single paper with n=8.

My father despite having more than enough money to pay full costs, refused to consult doctors outside the HMO. He was cowed.

Thank you for posting many times about MA plans potentially bankrupting traditional Medicare. The study you posted above explains the complex mechanisms of how and why. US health care is huge example of market failure, largely due to intrinsic problems of adverse selection and moral hazard. The logical solution is Medicare for All, which would lead to resources at the front end instead of a lifetime of rationed care leading to chronic health burdens down the road, where it is too late for Medicare and Medicaid to undo the consequences of profit/rent seeking and supervised neglect.

I’m a DES Son, born with birth defects from a dangerous FDA-approved drug used off label to prevent miscarriage, based on one clinicians claim that it was effective. At age 45 I was diagnosed with painful end-stage bone-on-bone hip arthritis. I was referred to a bone doc who offered me his experimental procedure (n = 14), which had not been written up and published. All the Ortho folks I spoke to told me to put off hip surgery– total hip replacement– as long as possible but they never said why. Truth is that a THR/THA for an active person under 50 will likely fail in a decade, and while the first revision has 70% chance of success, it will likely fail sooner, and data from Japan suggest one will end up in a wheelchair in a nursing home if one needs a second revision. My job and facilities career ended several decades prematurely because I could not get appropriate hip surgery when I needed it. If I had fallen down in the street on vacation in Montreal and was picked up by EMT ambulance, I probably would have gotten the surgery I needed, for free. Btw, my BHR is 16 year old, feels like part of my body, and I’ve had no major problems with it, and I can now shoot baskets (like Steph Curry — lol), jog (don’t like too), dance, etc., but I do have range of motion limits.

Instead, for the next six years, I continued to try to work at whatever part time jobs I could find and do. Three years in, I saw a report about Birmingham Hip Resurfacing on 60 Minutes, which told the story of how Floyd Landis was able to get a BHR after he broke his hip on a training ride. He had bone necrosis and had lost and inch off his femur, probably due to doping with the USPS cycling team, where he won the Tour De France during the time that Lance Armstrong was getting testicular cancer treatment. I asked Kaiser for another ortho consult about a possible BHR, and an Ortho Surgeon and his P.A. both claimed that I would not benefit from the BHR “because my arthritis was too advanced”– yet neither one had any direct experience with the BHR. I mentioned that Blue Cross actually paid for patients to get BHR surgery in Thailand or India. They replied that Kaiser would not pay because the procedure was not (yet) approved by the FDA. I left with my head down.

I also had (and still have) terrible lower back pain, also probably related to fetal DES exposure, and within two years developed refractory peroneal peripheral neuropathy, and severe chronic pain, that made it impossible to do any of the jobs I had been trained for. I got a referral to Kaiser Pain Clinic and was advised to take methadone, and my request for a medical cannabis letter was denied. I had looked up the Neuropathic Pain Treatment Guidelines, and found the lethal dose (LD50) for methadone was very close to the therapeutic dose, whereas cannabis has no LD50. I had been taking DM cough syrup based on the Guidelines showing no LD50 for DM, but again, the Pain Doc would not help me get an affordable supply of dextromethorphan (also known as DXM).

I finally, did my own online research about the BHR, and found that unlike Floyd Landis ( a drug addict with serious bone necrosis), I was a good candidate for the BHR. I drafted a six page letter to the Kaiser ‘death panel’, the committee that reviews appeals of denied patient care requests, with numerous medical journal cites and quotes, and they agreed to the BHR, but referred me to a surgeon who was not trained to d the BHR. So I wrote another long letter, this time estimating the unmet need of Bay Area Kaiser patients for the BHR at 200-400 annually– essentially a potential class action– and within a few days I got a call from the office of the only Kaiser doc in the Bay Area who is trained (in Birmingham England) in the BHR, and his nurse offered to put me at the top of the list. I said I’ll wait my turn, because I needed to get in shape for major surgery (esp. to quit smoking!). The surgery was brutal but successful.

Unfortunately, it took me two years of physical therapy– most of which I did on my own– to be able to fully straighten my leg and walk without a limp. And I had had to apply for SS disability before the surgery because I could not work and my huge medical bills (> 60% of my previous income) would bankrupt me. It is sad that patients, like your dad, have to ague to get appropriate care in the broken US system of disease care, which I often say is ‘twice the price and half as nice’.

I’ve had to file CMS complaints and appeals on several issues, including getting Xiaflex treatment for severe Dupuytren Contracture. Sorry to hear that Kaiser is losing money on their MA plans, but that explains why they have already cut back on some benefits and raised some co-pays. Bottom line for me: don’t get ill (or old) in the US, and don’t be born with birth defects. I don’t expect the Trump administration will be able to fix this, even if they wanted too. Too profitable to big pharma and appliance makers to overcome their army of lobbists and piles on money to donate (bribe) pols in Congress. Thanks again for all the great work you and Lambert do to seek and discuss the truth on so many important subjects, which has also led to the best commentariat I’ve found online!

Yves, you know how fiat money works yet you allow “Taxpayers Spend” and similar to be stated. No taxpayer spending ever occurs. It is always new public money being spent when government spends. Absolutely identical to when spending on war toys from the MIC is effected.

Words matter.

This is a headline from KFF Health News, as you can see if you had adhered to our written site Policies and read the post in full. I suggest you take it up with their editors. I am not going to withhold such a substantively and politically important post from readers based on a MMT misconstruction.

Apologies. Point taken.