Trump is so desperate to show progress on the immigration front that’s he’s prepared to harm US consumers and the economy in a big way to do so. As many of you have heard via lead story coverage, Trump has said he will impose 25% tariffs on Canada and Mexico and 10% more on China his first day if the US neighbors don’t stop illegal border crossings, and China, crack down harder on fentanyl:

Trump says he will implement a 25% tariff on Canada and Mexico on "ALL products coming into the United States" on his first day taking office. pic.twitter.com/lqt4AynhDN

— Kaitlan Collins (@kaitlancollins) November 25, 2024

Note that Nick and I have overlapping posts today, but the focuses are different. Nick looks at the impact on Mexico, Canada, their trade deal and the relations among them, while the focus below is mainly on the effect on the US.

Mind you, we pointed out earlier that Trump has a comparatively easy way to make a lot of progress on immigration quickly, which is going after employers. Making an example of a big but not critical miscreants like Marriott and then conducting a few regional raids on employers in other industries would focus a few minds. But Team Trump apparently does not want to cross swords with US businesses; he’d rather pressure others to do his dirty work.

But instead, Trump is fond of grabbing blunt instruments and breaking china rather than solving problems. This is one of those occasions where conventional wisdom is correct. Whether or not you think a big reduction in immigration is a good idea (as in what side you are regarding US worker costs), these proposed tariff increases will push up inflation without doing much to achieve Trump’s aims. The best hope here is that the “Trump is a madmad” performance will lead Canada and Mexico come up with sufficient optics to make Trump able to declare a win, regardless of what actually happens. But could or would either country be able to engage in appeasement theatrics on a fast enough timetable?

Below we’ll provide some hot takes on the Trump scheme. Perhaps readers can also provide examples of expected effects in their industries.

“Stiff new tariffs on imports from the US’s three largest trading partners would significantly increase costs and disrupt business across all economies involved,” said Erica York of the Tax Foundation, a Washington-based think-tank. “Even the threat of tariffs can have a chilling effect.”

Reuters points out that if Trump acted on his threat, it would violate agreements with Mexico and Canada:

Trump, who takes office on Jan. 20, said he would impose a 25% tariff on imports from Canada and Mexico until they clamped down on drugs, particularly fentanyl, and migrants crossing the border, in a move that would appear to violate a free-trade deal.

The Wall Street Journal elaborated on the treaty issues:

The threatened tariffs on Mexico and Canada are the bigger surprise, and suggest Trump is eager to reopen the U.S.-Mexico-Canada Agreement, a free-trade accord that came into force in 2020. The USMCA replaced the decades-old Nafta pact, which Trump repeatedly described as the “worst trade deal ever made” for widening the U.S. trade deficit and costing America millions of manufacturing jobs, especially in the auto sector.

The tariff threat suggests Trump is seeking to include immigration, security and drugs in a negotiation that usually revolves only around trade, as well as accelerate a planned review of the USMCA scheduled for 2026, said Alberto Villarreal, managing director of Nepanoa, a Chicago-based consulting firm that provides services for companies wanting to set up shop in Mexico.

“If Trump follows through with imposing immediate and unilateral tariffs, this would mean ‘going nuclear’ on USMCA,” he said.

Tight economic links between the U.S., Canada and Mexico mean that disrupting trade with tariffs would have far-reaching effects.

BBC reminded readers of an additional Trump threat, of ending China’s most favored nation status with the US. However, since this was codified by treaty, as in approved by Congress, it would not appear that he has the power to revoke most favored nation status on his own:

The Canada and Mexico tariffs would hit both countries’ exports hard, as well as damage US manufacturers who use Mexico as a production center for the US. Reuters again:

The U.S. accounted for more than 83% of exports from Mexico in 2023 and 75% of Canadian exports.

The tariffs may also spell trouble for overseas companies like the many Asian auto and electronics manufacturers that use Mexico as a low-cost production gateway for the U.S. market.

A quick look in search provides estimates that Mexico’s exports of goods and services in the 36% to 43% range, and for Canada, 34%.

Note that China may be getting a relative break. From CNBC:

A 10% tariff on China is lower than the 20% to 30% that markets expected, Kinger Lau, chief China equity strategist at Goldman Sachs, said Tuesday on CNBC’s “Squawk Box Asia.” He expects China will cut rates, increase fiscal stimulus and moderately depreciate its currency in order to counter the economic impact of increased duties.

Even though the projected inflation impact may not seem dramatic:

A 25% across the board tariff on Canada & Mexico imports is basically an 0.6% increase in inflation or ~$950 additional annual tax on every American household. Housing & home remodeling prices are going to explode. Produce too.

— Just 1ncent1ve (@1ncent1ve) November 26, 2024

Or perhaps it will be, but this study almost certainly does not allow for substitution:

Researchers have warned that another major round of tariffs would risk another spike in inflation in the US.

Think tank "Centre for American Progress" predicted that a middle-income family would have lose $2,500 to $3,900 each year due to Trump's Tariff.

https://t.co/iPeL0moibV— Kite🪁 (@MayMayln) November 26, 2024

Some Twitterati are contending that Trump’s past tariffs didn’t increase inflation. Others say that was because they were limited:

Context matters with #tariffs. Trump's previous tariffs targeted specific industries in order to raise prices. That is fine. Blanket tariffs when inflation is already a concern will raise the price of consumer goods drastically. Tariff – Wikipedia

— Mirror (@Mf99k) November 26, 2024

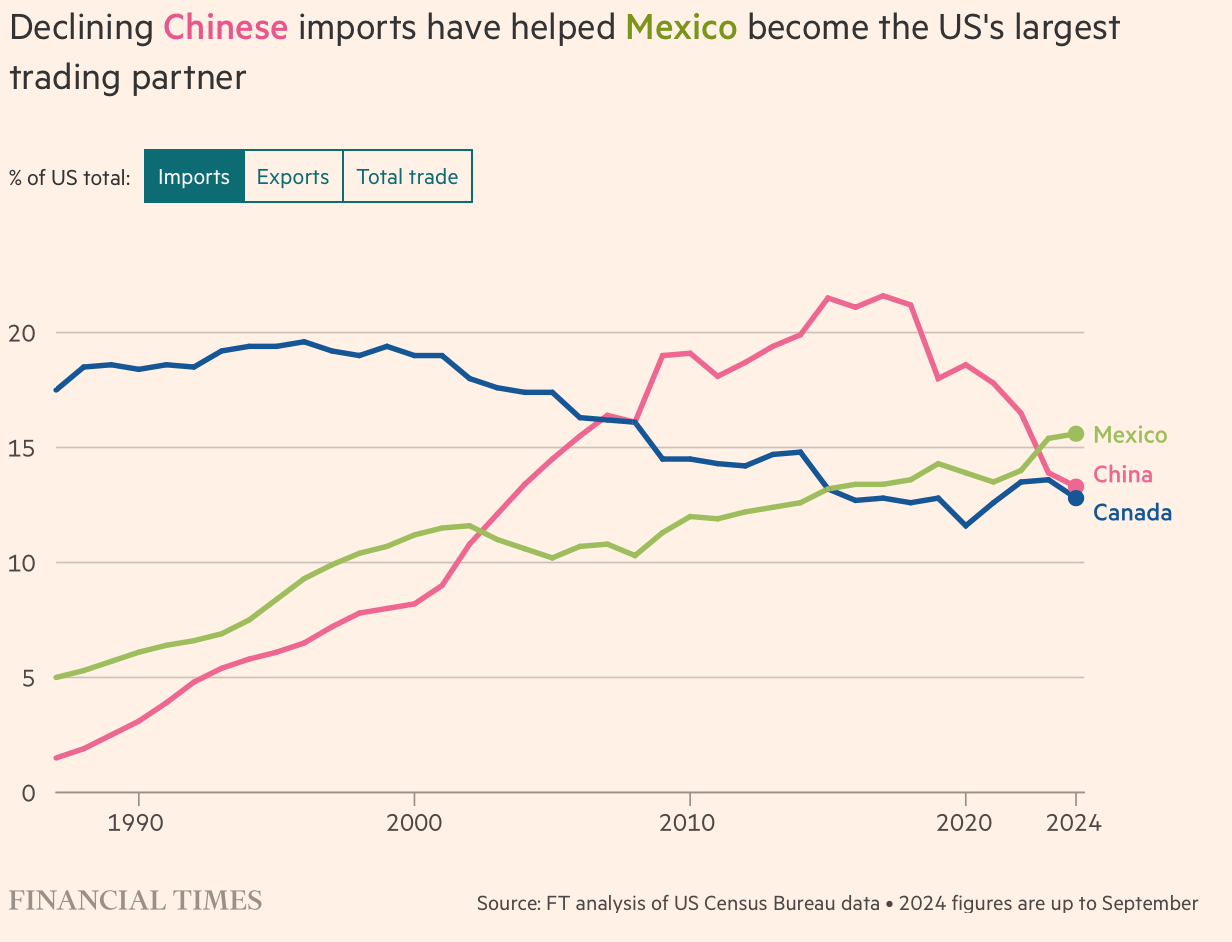

And as you may recall from the Financial Times chart above, another mitigating factor was the shift of imports from China to Mexico.

It will hit fuel prices, which are a sensitive category since consumers pay for gas regularly and the impact on lower income groups is disproportionate:

if you take Trump's threat to put a 25% tariff on all Canadian goods seriously, one of the first results would be an immediate increase in gas prices, especially in the midwest—Canadian pipeline-transported crude feeds key refineries throughout the US pic.twitter.com/hbKXFXGtOa

— Joey Politano 🏳️🌈 (@JosephPolitano) November 26, 2024

They would also hit food prices, visible both to consumers at stores and through restaurant prices (although they try to adapt via menu changes):

Trump just promised to tariff America's largest agricultural trading partners.

Here's a list of groceries you can expect to significantly increase in price after Trump takes office. https://t.co/w1JsPBcBfq pic.twitter.com/uFx0ppGUGj

— Joshua Reed Eakle 🗽 (@JoshEakle) November 26, 2024

The Journal, in the article cited above, listed other products that would see considerable increases, particularly cars. Note the point about administrative complexity by some supply chains being hit with tariffs multiple times:

Tariffs would likely drive up the price of steel and aluminum in the U.S. because Canada and Mexico are major suppliers of those metals to the U.S. market. The U.S. also buys almost all of Canada’s oil.

U.S. automakers including General Motors and Ford Motor have spent decades planning their factory footprints around free trade between the three countries. About 16% of vehicles that will be sold in the U.S. this year will have been built in Mexico, or roughly 2.5 million cars, trucks and SUVs, according to a forecast from research firm Wards Intelligence. Vehicles manufactured in Canada will account for about 7% of U.S. sales.

Tariffs could hit the automotive supply base hard, potentially pushing up prices in the U.S. Hundreds of parts suppliers operate in Mexico, feeding both local factories and U.S. plants. Some parts cross the border several times in various stages of production before landing in a finished vehicle, said Mark Barrott, head of the automotive and mobility practice at consulting firm Plante Moran.

And we have not even gotten to retaliation by Mexico and Canada.

Let us not forget Mr. Market. If Trump goes ahead, the dollar will rise (as it has a bit already) due to the expectation that the Fed will increase interest rates to try to tamp down inflation. Mr. Market does not like higher rates. And banks may be wrong-footed badly again, by making longer-dated bond investments again on the expectation that the trend to lower interest rates was baked in.

Scott Ritter, in his latest Judge Napolitano talk, made some embittered remarks about Trump engaging in a bait and switch by promising dis-engagement from Ukraine, as in de-escalation, yet naming some particularly retrograde Russia hawks to his team. Ritter opines that Gorka’s remarks make it impossible for Putin to talk to Trump:

Trump’s newly appointed counterterrorism adviser Sebastian Gorka calls Putin a “thug” and says Trump plans to end the Ukraine war by threatening to flood Ukraine with military aid, making current U.S. support look like “peanuts” pic.twitter.com/jKkfmmzvoK

— jeremy scahill (@jeremyscahill) November 25, 2024

We look to be seeing a similar bait and switch on the inflation front. There was admittedly always tension between Trump’s promises to end illegal immigration and curb inflation. Many though these plans had a lot of hot air in them, since Trump would not want to unduly discomfit a traditional Republican constituency, of small to mid-sized business operators and thus would not go all that far in his immigration curbs. But the Mexico-Canada tariffs came out of left field and look to be a clear economic net negative for the US, and even more so for many consumers.

Trade wars are good and easy to win.

— President Trump in 2018

When you are playing 4D chess, you are always a legend in your own mind.

well, we are in an atypical time in which the EU and China and Japan have (arguably structural) domestic demand problems.

The US is the most creditworthy consumer left standing. They need us (to keep the factory running), we need them (to keep inflation reasonanle, and take some federal debt).

PS, regardless, shock therapy is bad.

Trump’s introducing tariffs, so inflation will not be reasonable. Heck, even without tariffs, prices have gone up a ridiculous amount after Covid. Inflation going down just means that prices are not increasing as fast as before, but they are still rising.

I agree,in order to keep the aura of “Full-Spectrum Greatness,” the US keeps creating money to inject into the economy in order to pump it up. The math is interesting, it takes about 9% of GDP in pumping in order to create about 2.8% in GDP growth. It’s not free, 90-day US T bills are at 4.43% and Canadian ones are at 3.5%, so the US is paying a bit of a premium for its ability to need so much credit. With the national debt over $36 trillion, each 1% increase in interest rates eventually means $360 billion in interest payments.

Michael Hudson’s balance of payments analyses suggests your 9% GDP fiscal stimulus is the cost of Empire (bases, military, navy etc.).

Makes sense, so I guess we also need to identify the ROI, or Return on Imperialism. I don’t think it has been a positive value lately.

Re Trump’s newly appointed counterterrorism adviser Sebastian Gorka. It is disturbing the number of believers of Project Ukraine that Trump is bringing on board. However, and this is a big however, is the military aid even there? Weapons stocks for the Pentagon are running low and they will not see them totally depleted for a lost war. Even if weapons were sent, the Ukrainians no longer have the soldiers to use them or the time to train them. Some of these Trump neocons have even been boasting how the US killed scores of Russian mercs in Syria so of course Putin will buckle to Trump’s threats. So I’m thinking that when Trump’s team negotiates with Mexico and Canada, it will be with this extreme level of arrogance with no thought of blowback or consequences. For them, any negotiations must end in the US getting everything that they want. Anything else is not acceptable.

Let that and other appointments Trump is making, cool the jets of those saying Trump will “end the war” in Ukraine. Just wait until Trump has some sort of conversation with Putin/The Russians. At some point he’s likely to feel he lost face as he talks to that brick wall. The only risk is, that Putin does a Putin and needlessly gives ground. Sure do hope the Russians are rushing into mass production their new missles. Theres a lot of US aircraft carries and bases in Euro.

Yes, it is disturbing that Gorka doesn’t understand the consequence of the missile attack in Dnipro. Putin/Russia does not bluff! The underground ‘havens” in DC are on the board. Gorka has a death wish; for you and me.

(And most of my friends are mostly concerned with Black Fiday (shopping).)

Seems like Black Friday is everyday now, according the the crap ads I get in my inbox

He’s just quoting Trump’s ludicrous plan for ‘ending the war’ that he said months ago. We don’t really know yet what Trump will do once he figures out all the points you mentioned, although blaming Biden seems like a given.

I suspect Putin probably understands this language better than the pearl-clutching Democrats do. Trump did the same thing with Kim Jong-Un (“fire and fury like the world has never seen” followed rapidly by detente). It’s clear to anybody who has been paying attention that the US is scraping the barrel on weapon deliveries – Biden even admitted it a couple of times – so this is not a serious statement.

I think Trump did listen to the military briefings in his first term, even if he occasionally picked options other than the one he was being railroaded into (the Soleimani assassination). So there’s hope that he will do something not entirely out of touch with rationality, which would be an improvement over Biden. Whatever he does, he’ll come up with some mutually contradictory set of explanations to justify it. I wouldn’t be surprised if he adopts the Russian framing on some points, just to needle Democrats and bait them into doubling down on the failed Russiagate strategy.

Trump is trying to tank the economy. That’s why he is posting on social media about tariffs today. This is the economic hardship he and his advisors promised would be inflicted on Americans. He wants to crash the markets before he officially takes office.

Ben Meiselas 🇺🇸🦅

@meiselasb

gold, bitcoin, nvidia tanking

Stonks not tanking.

U.S. farm industry groups want President-elect Donald Trump to spare their sector from his promise of mass deportations, which could upend a food supply chain heavily dependent on immigrants in the United States illegally. Like he did before, although chicken processors were raided in Nebraska and Mississippi.

Also in Postville, IA. They even put the Jewish execs in jail. Still not sure what that was all about.

This could plausibly give corporations another reason to jack up prices (even more then they need to). The US has become an economy of monopolies. The only thing keeping them inline is the threat of government action. Having an excuse to raise prices allows them to do so without being castigated for taking advantage of their position.

So Trump is a closeted secret Mellonite?

Here’s the Andrew Mellon quote from just after the Crash of ’29 . . . ” Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.”

Here is the link. https://www.azquotes.com/quote/747203

Might be a good time to read ” How to Profit From the Next Great Depression” by John L. King.

https://archive.org/details/howtoprofitfromn00king/page/n5/mode/2up

Tariffs and sanctions on Mexico and China at the same time seems like a great reason for them to realign their trade to each other. Mexico is basically the only country in Latin America that doesn’t have China as its largest trade partner. Arbitrarily breaking NAFTA seems like a great reason for Mexico to get on the bandwagon. Mexico also has the domestic manufacturing capability built under NAFTA to quickly take on Chinese investments and sell to the rest of Latin America. Is there a location to build a nice deep water port on the Pacific side of Mexico?

Ten years down the line, Mexico may well have better infrastructure and far nicer electric cars than the gringos up north

There is! And a project to build one too: Puerto Punta Colonet, 6 hours south of San Diego.

“We look to be seeing a similar bait and switch on the inflation front.”

Exactly, regardless of how you feel about the tariffs they are overwhelmingly inflationary as is clamping down on illegal immigration and more specifically their employment and the role that played in wage suppression. You can think these goals are worth running inflation hot for a while, that’s at least a coherent argument with realistic pros and cons. Trump has basically told his voters they can have their cake and eat it too. Jury’s still out if this is all empty rhetoric, he really plans on following through, or perhaps he follows through and immediately walks most of it back while trying to save face. We’ll all find out soon enough.

Personally, I recently bought a house (was somewhat forced into it) with a substantial mortgage attached to it this year. I am well insulated against inflation, and wouldn’t exactly be sad to see some of that mortgage debt inflated away. Doubly so if Trump leans on the Fed to get a rate cut or uses some other method to lower mortgage rates, even if briefly so long as the rates stay low long enough to refinance. Everyone needs a survival strategy.

Making an example of a big but not critical miscreants like Marriott and then conducting a few regional raids on employers in other industries would focus a few minds. But Team Trump apparently does not want to cross swords with US businesses; he’d rather pressure others to do his dirty work.

It doesn’t take a big imaginative leap to see this as the start of a shakedown aimed at employers. Pay off to Donnie & Co. and we’ll leave your business alone, undocumented workers and all. Anyone who doubts this can read a history of Prohibition in the US.

Sorry, selective crackdowns, particularly of companies with brand names or local reputations, will have an impact. And part of the enforcement would be done through the IRS, so you’d have an independent bureaucratic check.

The last time Trump merely made noise, I heard of several large grocers quickly dumping their immigrant cleaners and stockers.

What’s the point of having laws on the books that are never enforced? To pick a distasteful analogy, the current enforcement regime is the equivalent of only going after prostitutes but never the pimps or Johns.

How much of the new tariff talk is a signaling device? Threaten something and get a desired reaction, prior to any actual collections?

Blunt instrument approach, crude and will see how effective as Mexico, Canada and China react.

Trump talks about a lot of sh!t — we’ll see. The guy is a blowhard.

He should introduce VAT at 20%.

I would wager that domestic producers not affected by the tariffs will raise their prices shortly after the tariffs are in place. There is no good reason for them not to since the price floor for their goods was just raised higher.

It’s not hyper-imflation but…. to the average American it’s going to feel like hyper-imflation.

Canadian oil is critical for US refineries. Almost half of the oil produced in the is very light crude derived from tight oil (shale) production, which is not compatible with US refineries. In order to be used this light crude must be blended with the heavy tar sands crude (or alternatively, Venezuelan heavy crude). Gasoline costs would skyrocket unless Trump exempted oil.

Another factor to consider were Trump to actually impose draconian sanctions on Mexico would be the risk of it going into a recession/depression, which would drive more desperate Mexican workers and campesinos to migrate north.

But the DT and his faithful followers say that those shithole countries stole our jobs and that the tariffs will bring the jobs back and the DT, like Orange Saviour riding a white horse, will magically lower grocery prices by 40%! Hoorray! (a DT supporter friend of mine told me just yesterday) Our savior is a magician who can perform miracles in front of our eyes.

The economic siege warfare against Cuba, Venezuela etc., creating failed states like Haiti, and and the Washington Consensus will continue to produce more desperate migrants here in the western hemisphere, while the continued bombing West Asia into the Stone Age produces massive death and displacement. The problem is not going to disappear, just swept under the rug, like the homeless population.

Maybe a better idea would be to turn the “surplus population” of “useless eaters” into Soylent Green and sell it as a new commodity? We could make a killing!

If we connect some dots of foreign policy, domestic policy and migrant policy it all makes sense, the oligarchy benefits, while the working-class gets shafted. That’s why nothing has been done to solve the problem: there is a strong disincentive to do so. The Orange Conman is just bullshitting as usual, that’s what he has done his whole life. Why do “there’s a sucker born every minute” “merkans believe the same BS over and over?

As prof. Richard Wolff said a few weeks ago in a discussion with Michael Hudson: “Trump had 4 years, and he didn’t do shit”. Folks get fooled over and over, yet expect “it will be different this time”. Yeah sure, you betcha.

And as for ISDS clauses strengthened in NAFTA 2.0?

Hello? The “Open Borders (to goods)” USMCA is Trump’s own treaty! The American economy can’t function without foreign manufacturing. I’m less interested in Trump’s shouting about demand-driven immigration and illegal drugs than I will be about how other countries choose to retaliate.

This carnival barker can’t simply wave his magic wand over all the factory sites that were converted into housing developments and greenfields and recreate American industrial manufacturing in 12 months. NaGaHappen. Asia Times reported yesterday that U.S. Factory Job Openings increased from 85,000 in 2007 to 500,000 today, while the number of qualified American machinists has nearly halved since 2000. They conclude that, “… a quarter-century of industrial outsourcing, workforce shrinkage and underinvestment in capital equipment can’t be undone in a matter of weeks or months.”

This is simply more evidence that the U.S. is agreement incapable.

Trump has said the tariffs would be paid by the exporting countries; result in jobs coming back to the US; and provide the revenue to pay for his tax cuts. Now he’s saying tariffs would (force Mexico and Canada to) stop illegal immigration and illegal drugs from entering the US. Magical tariffs.

This is the other elephant in the room. Even if I were charitable and said that tariffs would bring manufacturing jobs back to the US, this is a process which would take years, longer than any one presidential administration. In the near term it’ll just mean everything costs more. There’s also the subject of the dollar getting stronger and higher interest rates to combat the inflation which will further hamper any attempts made by the US to export more goods it manufactured.

None of the pieces of this puzzle fit together. I guess this is the point where campaign rhetoric meets reality.

Good point, it would take many years to reverse a decades-long process. And also the tax breaks and incentives of offshoring need to be addressed, by Congress.

And what about all the overhead costs in the US: expensive insurance, housing, health care, child care, transportation etc. And the infrastructure is a notorious joke. Even with subsidies, tariffs and tax incentives to “onshore” production, the re-industrialization of the US looks very unlikely.

Not to mention that the US has substantially higher costs than any other country for production. Our elites have allowed healthcare, real estate, and education to be so financialized, that a 25 year old worker is looking at carrying $200K of education debt, paying $2K a month to rent a basic one bedroom apartment, and a couple hundred a month for their portion of health insurance. And because our transportation infrastructure also sucks, he or she may also be paying $600 a month to lease a daily driver and paying for insurance and gas on top. How can they compete price wise with young workers in Asia who have minimal educational debt, live with parents or in company dorms for free, low health care costs, and rely on cheap public transportation?

Health insurance and high costs of living also means that people who might otherwise venture to start new businesses are forced to cling to their safe jobs. So all this talk of bringing jobs back is just going to be a corporate giveaway to existing monopolies and ax whatever is left of employee protection and environmental protection laws.

Canada will reorientate, as always. Always ready to shift in the wind and prepared for a cold, cold winter.

Canadians honestly hated NAFTA when it was signed and can take it or leave it now. Canada went from being a mixed economy to a resource extraction economy due to NAFTA and would much prefer returning to the former if possible. But Canada’s always had its fate dictated to it by either the British Commonwealth early in its history or by America later on. If Trump is serious about these tariffs, then Canada will have to pivot. It has always done that and will always do so.

My guess is policy analysts right now are busy writing up proposals to their directors to take to the Cabinet to determine how to react to this. Counter with tariffs across the board if they come into effect. Plan on figuring out the border situation. How to even do tariffs? Do we gotta create warehouses where they’ll need to be off-loaded and inventoried? Customs agents on-site in warehouses to do the inventory checking there?

We would probably need to invest billions of dollars into research, development, and manufacturing. Plan infrastructure. Plan freight. Shipping. Rail.

Fortunately, Canada controls its own currency and produces its own foods with surplus, so we won’t suffer for too long if it comes to that. We’ll probably end up burning through our American reserves shipping in anything that is too costly to bring in from America though, because America’s in worse shape than Canada. Canada at least still has engineering and construction companies that can build things in a timely manner. We have the resources but we just don’t have the manufacturing anymore: the know-how nor the machinery. We’ll need to build or import that all and its doubtful that America will sell that stuff as it’s figuring out to do that all again as well.

It’ll be a painful 2025 for Canada, but Canada can and will adapt within the year likely and 2026 will be a better year. We’ll adjust. We’ll adapt.

John Steinbach @ November 26, 2024 at 11:17 am mentions that Canadian oil is critical for US refineries. I believe that Canada is a net exporter of electricity to the USA especially to parts of the US North East from Québec. A massive, unexpected, hike in US electricity prices in the middle of the heating season sounds interesting.

Donald Trump disliked NAFTA and insisted that it be renegotiated as the United States-Mexico-Canada Agreement (USMCA) . Now even before he returns to office he is promising to violate it. I suspect that both Canada and Mexico have been working on contingency plans about what to do if and when a US president broke the agreement since it was always likely, but I wonder how this is being received in other world capitals?

I wonder how many heads of government around the world are asking themselves,”Can anyone trust the USA to keep to an agreement?” I imagine that the USA has forfeited the slightest vestiges of trust with Russia after the NATO expansion and the Minsk Accords but I wonder if this may be one more reminder to President Xi Jinping to be very wary of US promises. While it is a minor trade dispute when viewed from outside of North America, I wonder how Mohammed bin Salman or, perhaps, Narendra Modi are looking at it as an indication of US reliability?

I wonder if anyone in Africa, or South America, especially BRICS members, will keep trusting the word of the USA.

Why is any of this surprising? Trump has said for months that he is going to put large and substantial tariffs in place immediately. Whether or not he has the legal authority and can actually do this is another matter entirely, but some type of large-scale tariff system is coming.

GOP has wanted to move to more of a tax-based consumption system in lieu of income tax for a long time. Steve Forbes floated and ran on a low flat income tax and some type of VAT in the 1990s when he ran for President a few times. This would hurt most Americans financially unless it was offset by notable income tax cuts and even then, they’ll likely be hurt by reduced federal programs which transfer income & cuts in services and programs.

Still see this at the state level. In Louisiana, Landry wanted to reduce the state income tax to 0% and was very explicit about it. Several other GOP state governors have expressed a similar desire. Never mind about the impact that would have on state services & infrastructure or the goods and services which would be subject to local and state sales taxes. Already LA residents in some parishes face a combined local & states sales tax approaching 13% before the recent budget agreement this month.

What I’m shocked is how many Americans seem to be stupefied by this and if Trump does ultimately put in a 20% universal tariff than Americans then we will be paying among the highest rates in the world. This is in addition to local & state sales taxes which I expect in some GOP states will hit 15%+ in the next several years and be on almost all services as well.

The only sure way to stop excessive migration into the US is to stop US aggression and depredation in Latin America and the Caribbean, perhaps the whole world. We Americans have exploited, damages, and sanctioned countries so much that people who find it impossible to live where they are travel to America so that they won’t die. It is that simple.

Of course, doing something to mitigate climate disasters would help as well.

Neither will happen because of American commitment to Exceptional neoliberalism and it cannot change without removing its corrupt owning class.

I grant you that this is an important issue. In principle, tariffs are supposed to promote domestic production by pricing imports out of the market. That was the way that the US became a major manufacturing power in the first half of the nineteenth century. It remains to be seen whether the current financialized business model prevailing in the US can fulfil this requirement; if you don’t have a massive surge in domestic production, you will end up with the problems which the corporate media say that it will. But on the other hand the corporate media are in the pay of those promoting the current financialized business model, so they are naturally for the status quo.

I suspect that a big problem is that a Trump administration is unlikely to back up tariffs with substantial subsidies for domestic productive industries, as would have been done in the first half of the nineteenth century.

However, isn’t this just an extension of what the Biden administration has already been doing, not only to China but also to various other countries? In other words, the damage which Trump may well do in North America is quite similar to the damage which the Biden administration has been doing in western Europe – I realise that there are differences, but the important thing seems to be that the policy programme is to weaken other countries by promoting short-term gains to the US. It’s ascribed to Trump because he’s an easy target and because he is more open about his agenda. But I suspect that much of this is fairly bipartisan and endorsed by a lot of the oligarchy.