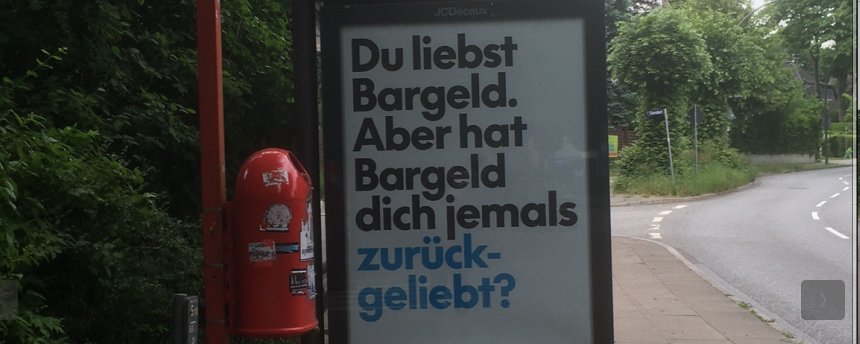

“You love cash. But has cash loved you back?”

This was the message on an advertising board at Duisburg Central Station, in Western Germany. It can also be seen in the following roadside picture:

As Rev Kev notes in the comments below, cash has loved us back in its own inimitable way:

When the internet goes down, cash is there for me. When the grid goes out, cash is still there. Cash never phones home telling corporations/government how I am spending it. Having cash on you gives you a bit of security and lets you take advantage of any bargains that you come across. Cash does not care what your status is and treats all spenders equally. And when you get bored, you can even spend some time examining the intricate designs on those notes.

Similar billboards seen in Frankfurt declare that “Cash is no longer King” — which is true in many European countries but not Germany — or bear the slogan: “Pay later? Cash can’t do that.” These anti-cash messages have been cropping up across German cities and along roadsides in recent days. But no one has taken responsibility for them.

As such, this is a necessarily speculative post. But there are clues pointing in a particular direction. According to the German financial journalist Norbert Häring, the most likely culprit is the US fintech giant PayPal. The circumstantial evidence is certainly striking. In early May, PayPal published a press release (in German) announcing plans to launch a mobile phone wallet for paying at checkouts in German brick-and-mortar stores (machine translated):

In the coming weeks, PayPal will launch its first contactless mobile wallet – with Germany as its first global market… In the future, consumers will be able to pay securely and conveniently via smartphone, tapping to pay wherever contactless Mastercard payments are accepted. In addition, for the first time they will receive a complete overview of their online and offline purchases on the PayPal app.

Even the style and colour scheme of the font used in the ads roughly match those used in previous PayPal ads:

Buy Now, Pay Later

Another clue comes from the billboard slogan:

“Pay later? Cash can’t do that.”

Unlike most rival mobile wallets, the PayPal app won’t be limited to instant transactions. Shoppers will have the option to split their payments into 3, 6, 12 or even 24 monthly instalments. As the billboard brags, cash can’t do that!

Another curious coincidence: in its press release, PayPal does not mention even once its two main rivals in the mobile wallet space, Google and Apple Pay. Instead, its pitch is focused almost entirely on the limitations of cash and its declining use in Germany:

“The more the technology develops, the harder it is to ignore the advantages of digital payment,” says Jörg Kablitz, Managing Director, PayPal Germany, Austria and Switzerland. “Cash continues to play a role, but we know that many consumers and businesses are ready for innovative alternatives. We are convinced that PayPal has more to offer than cash. Our app makes paying by smartphone in the store easy and secure. Customers have the flexibility to decide how and when they pay – and can even save money in the process.”

It is not unusual for a fintech firm or payment processing company to aim their sharpest invective at cash, as opposed to their direct corporate rivals. For the US payment duopoly of Mastercard and Visa, which generate fees by facilitating money transfers between bank accounts, cash has long been their main rival. In 2010, the then-CEO of Mastercard (and current president of the World Bank), Ajay Banga, openly declared war on cash:

“In today’s terms, only 3% of retail spend in India or in China are through electronic payments. The rest is cash. I have declared war on cash; I believe MasterCard will grow by growing against cash. If you keep looking at 3%, everybody’s a rival; if you look at the remaining 97%, everyone’s a partner.

Mastercard and Visa have played arguably the biggest role in demonising cash over the years. But it seems that PayPal is joining the bandwagon now that it, too, is offering a digital payments app for physical retail checkouts, putting it in direct competition with physical notes and coins. And it has decided to launch its app in Germany, one of the most important bastions of physical currency in Europe, just as the war on cash there is escalating rapidly.

Cash’s Last Stand?

Though cash use in Germany has declined in recent years, physical notes and coins are still the main payment method, much to the chagrin of the financial and political establishment. After all, Germany is Europe’s biggest economy and together with neighbouring Austria and some countries in Southern Europe, particularly Spain, it is holding back Europe’s transition into a fully digital economy.

In 2023, 51% of all transactions in Germany were still being made with cash, with debit cards in a distant second place at 27%, according to the Deutsche Bundesbank’s annual payments survey. In many advanced economies, including the UK, Australia, Norway, Sweden, Finland and Denmark, around 10-20% of transactions are made with cash. In a survey by the European Central Bank, 69% of Germans said that cash was “important” or “very important” to them.

However, a loose alliance of banks and payment card companies is determined to change this. A few months ago, some of Germany’s biggest banks announced that they were joining forces with large credit card companies in an attempt to force cash out of the market through cartel pricing and unfair competition. From Häring’s article, Banks Form Discount Cartel to Displace Cash – Bundesbank Provides Cover (in German, machine translated):

The new initiative “Germany pays digitally”… is not an “initiative”, but a cartel. It consists of Commerzbank (Commerz Globalpay), Deutsche Bank, Volks- and Raiffeisenbanken (VR Pay), Mastercard, Visa, Flatpay, Unzer and SumUp. Further cartel members are expressly welcome to join. The aim is to displace their main competitor, cash, and the cash service providers through price dumping… cash incurs costs that are often lower for small merchants than the costs of digital payments, but not zero.

Here’s how it will work: the cartel will be offering small merchants and retailers with up to €50,000 in annual turnover free installation of a payment terminal and free use of it for all transactions for up to one year. No fees, no commissions. Those will obviously kick in during the second year. As Häring notes, the cartel members are willing to accept temporary losses in order to incentivise small businesses to accept digital payments instead of cash.

Meanwhile, the availability of cash and the ability to use it to pay for basic services is being squeezed from all sides. Earlier this week, it was announced that bank customers will soon no longer be able to get cash back from Shell petrol stations. According to a report by Frankfurter Rundschau, as of June 30 1,300 Shell petrol stations will no longer provide the cash back service to customers of Deutsche Bank, Postbank, Commerzbank and Hypovereinsbank.

For many people, the cash-back service was a simple, round-the-clock solution at a time of increasingly scarce banking services. Bank customers were able to withdraw up to €1,000 with each purchase. The move is likely to hit rural communities particularly hard since many of them no longer have bank branches or ATMs, in part due to the recent rise in ATM bombings. In the absence of banking services, many of these communities had grown to depend on Shell’s cash back services, notes the Frankfurter Rundschau report:

The vanishing options for withdrawing cash… are becoming a problem, especially in rural areas, due to the lack of bank-Shell cooperation. There, the gas stations were an effective means of withdrawing money.

Banks such as Deutsche Bank and Post Bank say they are offering alternative options in its place. Post Bank, for example, has been offering its customers a “Cash Code”, which is essentially a bar code that allows them to deposit or withdraw cash sums of up to €1,000 at over 12,000 retailers nationwide. But there’s a catch: in order to use the code, you must have a smartphone, an internet connection and the corresponding bank app.

Deutsche Bank is looking to adopt a similar approach in the coming months. As the Frankfurter Rundschau article notes, many older people still do not have a smartphone. Many of those that do will struggle to use the bank app, meaning that accessing cash is becoming more and more difficult for the one key demographic that most uses it.

Yet the same banks that are driving this trend will claim that the public’s gradual shift away from cash is purely the result of technological trends and shifting customer preferences. As the pro-cash activist Brett Scott notes, the financial sector’s escalating assaults on cash have created a feedback loop that constantly reinforces the impression that people are turning their back on cash when, in actual fact, banks are making it harder for them to access it while both bricks-and-mortar businesses and governments are making it harder to use it.

This is all happening as the European Central Bank prepares to launch a “digital euro”, which will be competing directly (and probably unfairly) with cash. As we warned in March, there are myriad reasons why Euro Area citizens should be terrified of the stealthily approaching central bank digital currency, including the threat it will pose to financial privacy and anonymity as well as the programmable features it is likely to offer, which have the potential to revolutionise the very nature of money.

Increasing Competition in Europe’s Digital Payments Market

It is against this backdrop that the online payment giant Paypal has chosen Germany as the first national market to launch its contactless payment app. As Euro Weekly reports, to make this happen, PayPal is introducing its own virtual debit card, fully integrated into the app:

This means users can pay in-store without needing a physical card or even opening a third-party digital wallet. Everything happens within PayPal’s app. It’s clean, simple, and in line with how consumers already use the platform…

What’s more, PayPal is also introducing a cashback system, rewarding users who choose to pay via their smartphones in-store. While full details on rates and conditions are still to come, it’s clear that partner retailers will play a key role, and the incentive may be enough to get users to leave their other digital wallets behind.

This launch also reflects a growing shift in the digital payments landscape, particularly in Europe. Thanks to the Digital Markets Act (DMA), which forces tech giants like Apple to open up their NFC systems to third-party apps, PayPal can now access iPhone hardware that was previously locked to Apple Pay. In short: Apple no longer has exclusive control, and competitors like PayPal are finally able to innovate on equal footing.

While this is a welcome step, it is still telling that in its press release PayPal aims its competitive focus squarely on cash and not on its other rivals in the mobile payments space. Whether PayPal is behind the dissemination of anti-cash ads that have sprouted in recent days, it is impossible to know, for the simple reason that nobody has taken responsibility for those ads. But if it is, it is taking on a form of payment that endured centuries of use and continues to enjoy strong public support in Germany, as well as many other European countries.

If German cash advocates wanted to respond in kind by launching their own counter-information campaign, they would have plenty of material at their disposal (albeit probably a far smaller marketing budget). Here are a few examples of billboard ads they could run:

Does Cash Spy On You?

Because PayPal certainly does. For well over a decade the company has been criticized widely for its practice of amassing huge files of data on just about every aspect of their customers’ lives, much of which it then shares with its partners and merchants — for “marketing and PR purposes.” Partners include companies like Axciom, one of the world’s largest data aggregators, which has compiled a detailed dossier on pretty much every European and sells it to anyone willing to pay the price.

In September last year, PayPal updated its privacy policy in order to allow the automatic sharing of user data with third-party vendors unless users actively opt out. Needless to say, there is no need to opt out of any data sharing policy when it comes to using cash.

Does Cash Accidentally Leak Your Data to Criminals?

PayPal’s systems have been breached on numerous occasions. It recently paid a $2 million fine for a 2022 breach that resulted in the exposure of sensitive customer information, including some individuals’ Social Security numbers. Last week, the company was among a number of large platforms (Google, Apple and Meta…) implicated in a massive data breach involving 184 million login credentials found on a “mysterious database”. Again, cash will not leak your data to anyone though it can, of course, be stolen.

Does Cash Freeze Your Account Due to Your Political Views?

As readers may recall, in 2022 PayPal included within its fine print a new policy to impose a fine of $2,500 any time one of its 429 million consumers and merchants expressed what the company’s C-suite executives deemed to be misinformation. It had essentially awarded itself the right to loot the accounts of customers whose political views it found unsavoury. When the news triggered an inevitable storm of protest, the company backtracked claiming it was just an “error”.

Critics included the company’s former President David Marcus, who described the company’s new Acceptable Use Policy (AUP) as “insanity”.

“PayPal’s new AUP goes against everything I believe in,” he posted on Saturday. “A private company now gets to decide to take your money if you say something they disagree with.”

Of course, PayPal has been at the forefront of the “debanking” trend ever since it froze Wikileak’s account in 2010, arguing that its payment service “cannot be used for any activities that encourage, promote, facilitate or instruct others to engage in illegal activity.”

And lastly, my favourite:

Does Cash Crash?

Because PayPal certainly can. In November last year, its systems went down for around two hours, affecting thousands of customers. By contrast, just over a month ago cash helped to cushion the impact of Spain’s worst power blackout in recent history. The blackout exposed critical vulnerabilities in digital payment networks, disrupting mobile wallets, POS systems, and ATMs.

By contrast, cash helped to reduce the fallout by providing a backup payment option, as even most mainstream media outlets in the country admitted. Yet in both Spain and Germany, the war on cash is not just continuing, it is intensifying.

‘You love cash. But has cash loved you back?’

Why yes it does. When the internet goes down, cash is there for me. When the grid goes out, cash is still there. Cash never phones home telling corporations/government how I am spending it. Having cash on you gives you a bit of security and lets you take advantage of any bargains that you come across. Cash does not care what your status is and treats all spenders equally. And when you get bored, you can even spend some time examining the intricate designs on those notes.

Thanks Rev. Hoisted!

I’ve got to hand it to the credit companies. They have this ingenious system to shake down merchants for several percent of their gross revenue, vastly more than the cost of the card processing, then convince customers that the credit card company is the hero by giving the customer “cash back.”

This all reminds me how per se Apple sold its Iphones less than costs just so it could build its own payment system. It was a long term goal that justified the temporary loss of profits. In addition they were heavily involved in the gaming/app/comp scams which targeted children via upgrades/lock boxes etc. They tried to charge me over 1.5K on month and ended up getting it all back. That was just before they settled a civil suit against them for $MM.

It would seem it was used to offset losses on Mfg to keep equity price high whilst the platform was established. Then those flow of funds then would buff their balance sheets and its resulting lower risk credit terms which then would be used for more financial WS earnings. All of which then culminated in them becoming a Hedge Fund run out of Reno of tax reasons.

Its been wild watching all sorts of businesses from Mfg to civil/industrial construction focus on becoming financial institutions – first and foremost – over the last few decades. All whilst destroying the knowledge/experience base in providing positive social economic outcomes and making stuff.

Don’t know how many NC viewers are aware of Prof Richard Wolff@University of Massachusetts Amherst but, he has been prolific in expressing his views on YT. Not that anyone is an oracle on economic matters, yet he does seem to have a grounded view on the Natural History leading up too and currant events. Best part is he does acknowledge, Mea Culpa, his part in it all. I won’t bother to link as anyone can have a peak for themselves.

Yes, Apple used iPhone ‘tap to pay’ to facilitate contactless digital payment ton the Apple Pay platform. Even though Privacy is used by Apple as a marketing USP, its deeper instinct and need is to ensure its own part in the broader data surveillance economy.

An Apple user most of my life, I now severely distrust Apple and every other technology company which benefits from Surveillance Capitalism, particularly Meta, Google and Amazon.

CASH is the main antidote to these predators.

Its not just tap to pay mate, its all the transactions that flow across their balance sheet via app/game markets et al. Those flow of funds buffs it, massively lowers its credit risk, and with it insanely low borrowing costs which it then can use to play self licking FIRE sector WS games which have no social productive aspects and accrues to the top 20%.

Ugh at apple and the walled garden, hotel calif level stuff, zero means to migrate and with it consumer or personal freedom/s.

I have spent all day in various supermarkets and had enough time to come up with a conspiracy theory:

Cashiers of all German major supermarket chains such as REWE, EDEKA, PENNY, KAUFLAND, NETTO, ALDI, or dm (drugstore with a huge food section) – have delibaretly been slowed down to nudge customers use their cards at machines instead.

Bad service with clear intent.

It is noticeable that even ALDI once famous for their speed have slowed down.

It reminds me of what US car manufactureres in the interwar years did with US public transport after taking over city public transport services – they let them deteriorate so that people would eventually switch to using cars.

(Better known as “streetcar conspiracy”).

I know it’s hot today and I appear to be out of my mind (like mostly) but what is happening is crazy…and when I address above issue customers seem to not really grasp the danger. They might feel it but have way too many other problems to care. And those among my own friends who are rich (unlike me) are happy with Paypal. They simply don’t get it. Speaking of wealth providing for a meaningful education – very funny.

The classic death by a thousand cuts — not dissimilar to what decades of British governments have done with the NHS. This is the only way to destroy something that has huge social value and is held in high esteem by the general public.