Yves here. Liberation Day weirdly seems more distant in time than it really is, and with that, some of the reactions to its immediate impact have also faded. Market-oriented readers may nevertheless recall the shock at the selloff of the dollar. The economists below explain that via the impact of retaliation, something many models do not factor in.

However, they seem more mystified by the fall in Treasuries. One wonders why. It cane about in no small measure due to an unwind of a hedgie trading strategy (the equivalent of picking up pennies before a steamroller). But another factor not widely enough acknowledged is that the US under Trump is a much riskier proposition for global money managers. More risk means a higher required return. Prices have to adjust downward to reflect higher discount rates.

By Giancarlo Corsetti, Pierre Werner Chair and Joint Professor, Department of Economics and Robert Schuman Centre for Advanced Studies European University Institute, Simon Lloyd, Research and Policy Advisor Bank Of England, and Daniel Ostry, Research Economist Bank Of England. Originally published at VoxEU

To many, the US dollar depreciation following the ‘Liberation Day’ tariff announcement on 2 April 2025 defied conventional wisdom. However, open-macro models predict that the impact of tariffs on exchange rates depends on how trade partners respond. Accounting for retaliatory threats, this column explores the effects of tariffs on the US dollar by revisiting the impact of US tariffs announced or levied between 2018 and 2020, in comparison to those in 2025. When tariffs are met with retaliation, the US dollar weakens, in line with the experience after Liberation Day. The spike in long-maturity US Treasury yields since 2 April is, however, more unprecedented.

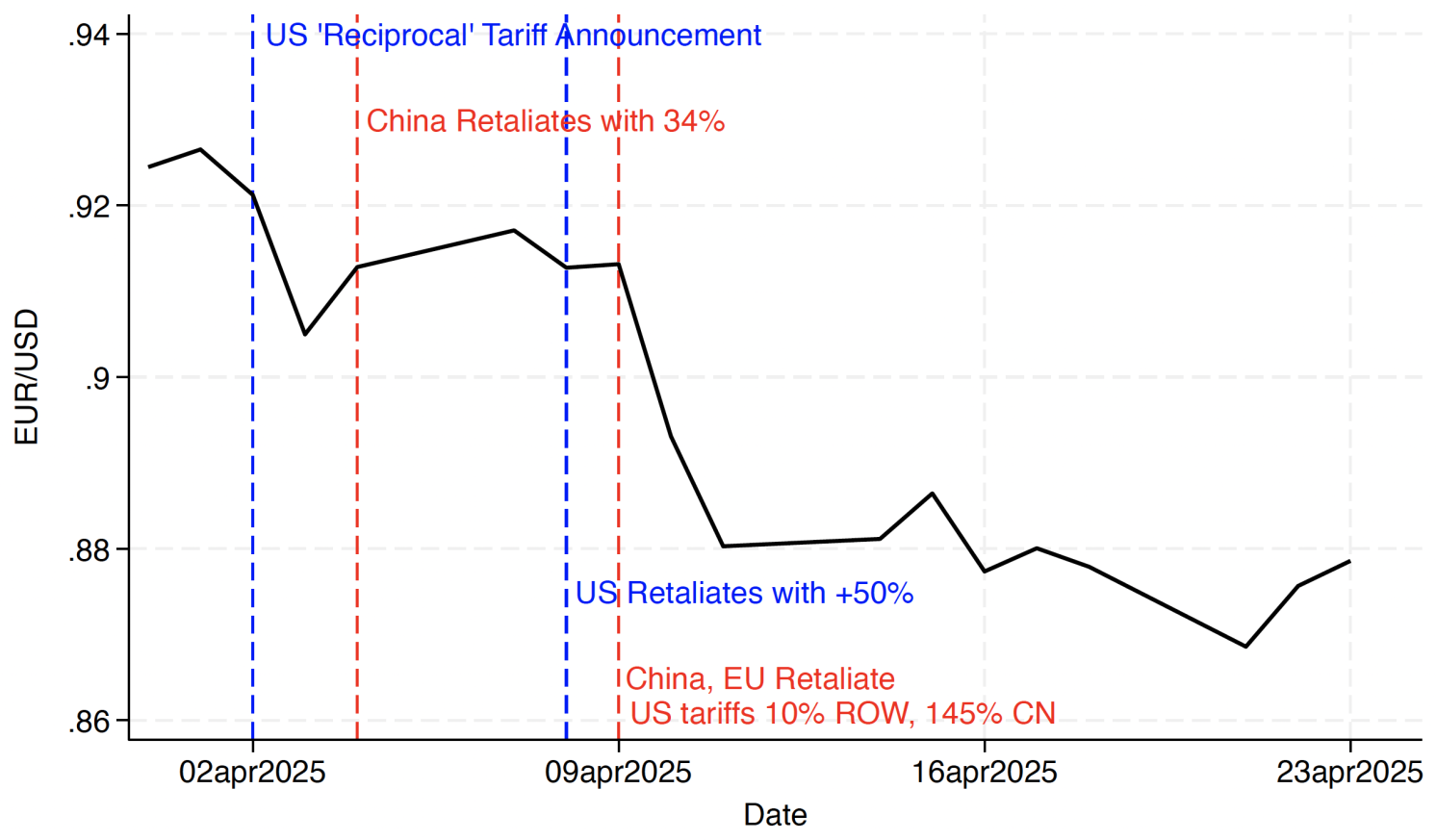

The sharp depreciation of the US dollar (USD) following the ‘Liberation Day’ tariff announcements on 2 April 2025 appeared to mark a break from past patterns. The US dollar weakened significantly, both against the euro and in effective terms across a basket of currencies (see Figure 1). Many argued that this reaction goes against the conventional wisdom (Hartley and Rebucci 2025, Cardani et al. 2025), which holds that, by shifting global demand, tariffs should appreciate a country’s currency. Others have interpreted the dollar depreciation, coupled with a spike in long-maturity US Treasury bond yields, as a ‘reserve-currency shock’ (Jiang et al. 2025) – a shift in investor perceptions about the safety premium traditionally associated with US assets and the US dollar.

Figure 1 The US dollar depreciated substantially against the euro (and other currencies) in the days after Liberation Day

Source: Ostry et al. (2025)

However, open-macro theory predicts that the impact of tariffs on exchange rates will depend on how trade partners respond to such measures. That is, the US dollar’s reaction to tariffs depends crucially on whether tariffs are met with retaliation, appreciating when tariffs are imposed unilaterally but depreciating otherwise. As Bergin and Corsetti (2023, 2025) show, this result can emerge from the combined effects of trade policy and optimal monetary stabilisation – both in the US and abroad – when exports are invoiced in dollars. Through that lens, the post-Liberation Day US dollar depreciation is not so surprising after all.

In a recent paper (Ostry et al. 2025), we test whether this theoretical prediction is borne out in the data.

Revisiting 2018-2020

To do this, we revisit tariff exchanges from the 2018-2020 period and use these to ask: do tariffs necessarily lead to a stronger currency? Relative to the existing literature, our innovation lies in distinguishing between tariff shocks that do and do not feature foreign retaliation.

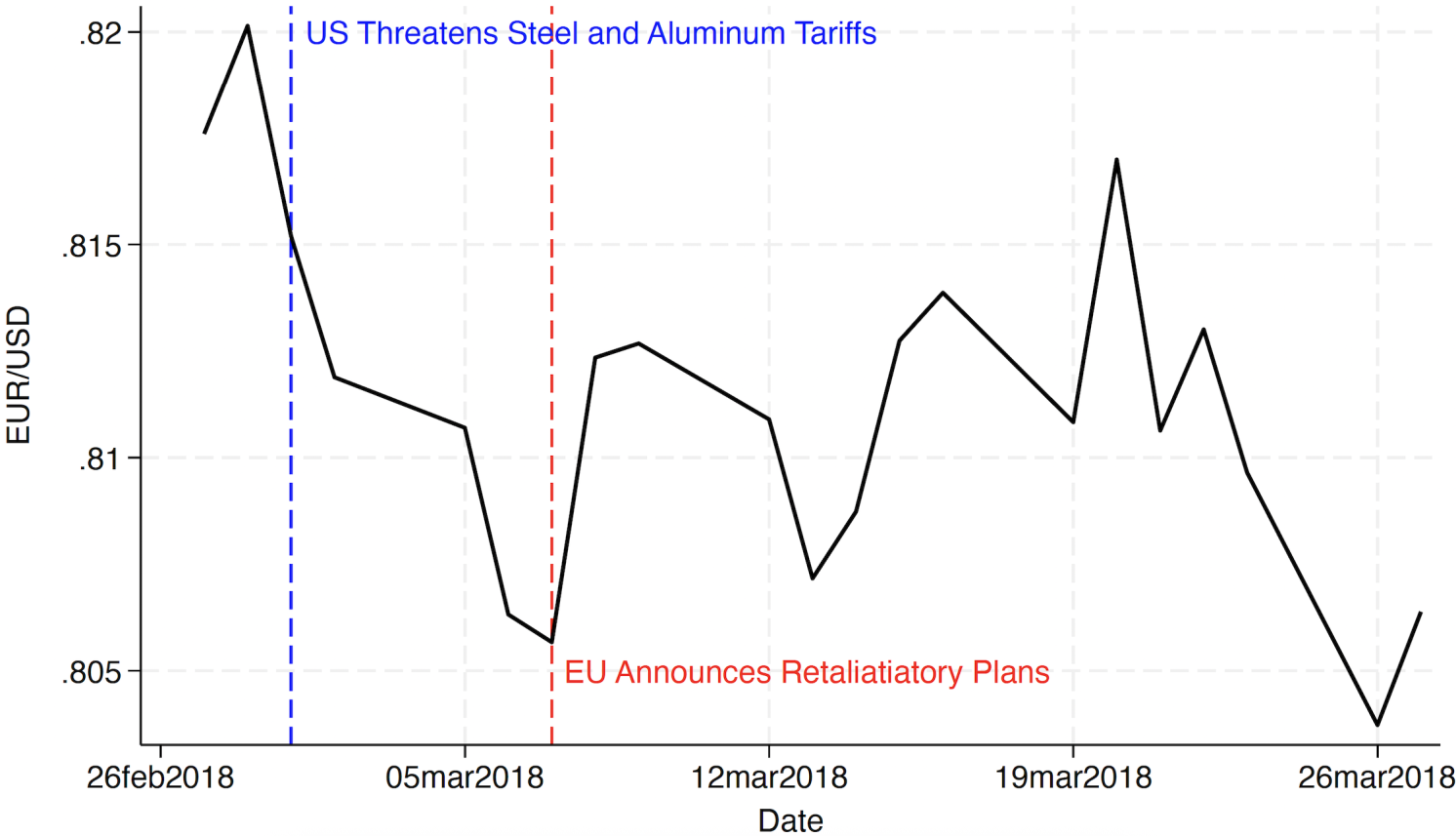

An illustrative example from 1 March 2018 best motivates our analysis. On this date, the US announced tariffs on steel and aluminium imports from the EU. A retaliatory response was quickly anticipated. For example, a Financial Times headline on 2 March read: “EU considers imposing ‘safeguard’ import tariffs in response to US”. And, on 7 March, the EU formally announced retaliatory measures. As was the case after Liberation Day, the US dollar weakened immediately after the US announcement and remained lower throughout March (see Figure 2).

Figure 2 The US dollar also depreciated against the euro after 1 March 2018 tariff announcements

Source: Ostry et al. (2025)

Our econometric analysis, using daily data, confirms that this pattern is systematic. The key takeaway is that US tariff announcements are not necessarily associated with a stronger US dollar. In fact, a depreciation is common when markets anticipate foreign retaliation.

A Novel Dataset

To carry out our study, we constructed a novel database of US tariff announcements, threats and implementations from 2018-2020 and, for comparison, from 2025. This also includes corresponding responses from the EU, China, and Canada. We relied on detailed event timelines compiled by the Peterson Institute for International Economics, supplemented with real-time news coverage.

The resulting dataset includes 35 US and 15 foreign tariff events from 2018-2020, and 13 US and ten foreign events from 2025. We quantify the economic size of each action with an ‘effective tariff rate’ – a weighted average combining ad valorem tariff rates and import shares. This captures the economic relevance of each event.

Each US tariff event is treated as a ‘shock’ – containing information largely unanticipated by markets, in terms of tariff rate, sector, and coverage. Since rest-of-the-world events represent retaliations, the unanticipated nature of these events is less clear. We therefore use the foreign responses to distinguish between US tariff shocks that were and were not retaliated against. In our baseline, a US tariff shock is labelled as ‘retaliated against’ if another country threatens or imposes a tariff within seven days (we test the robustness of this definition).

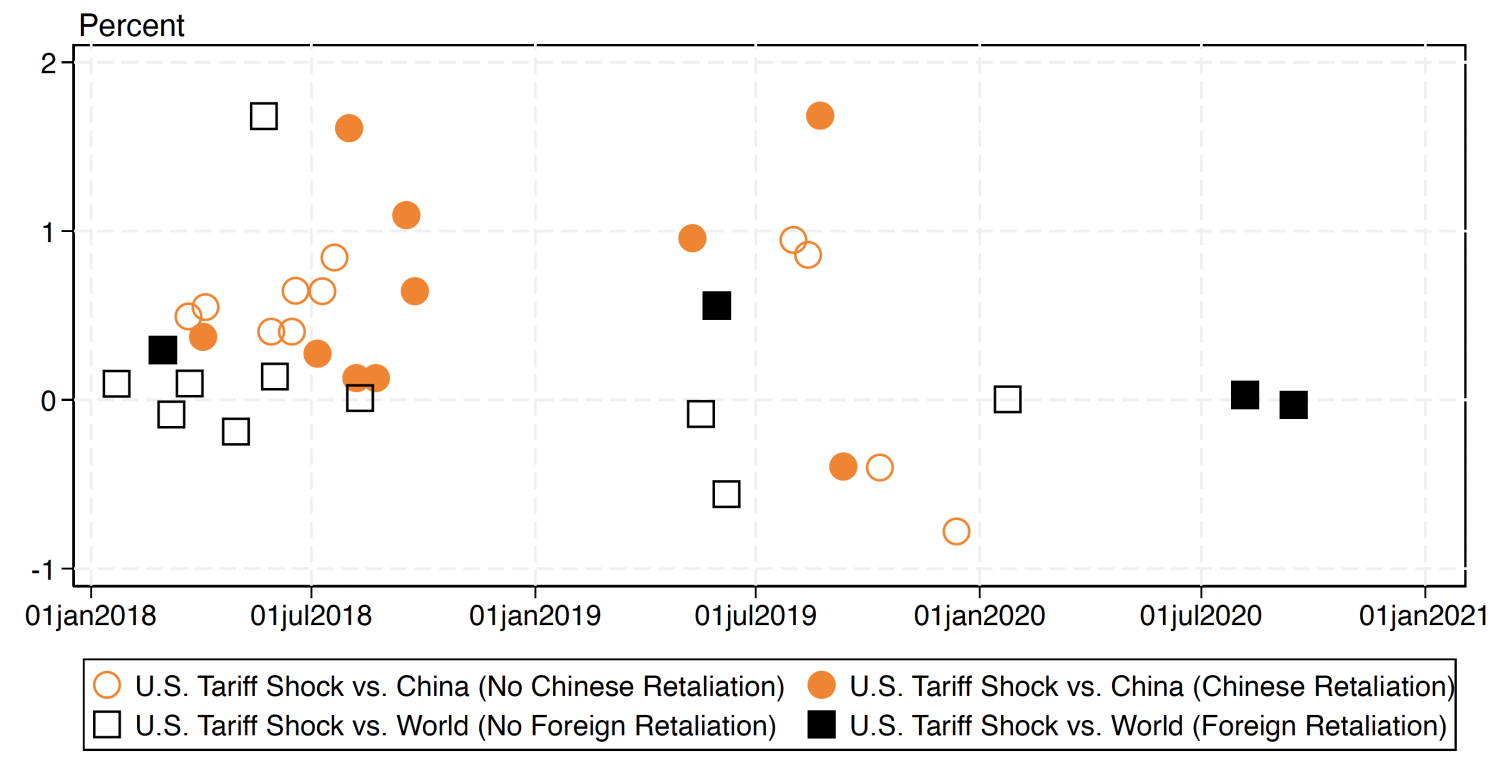

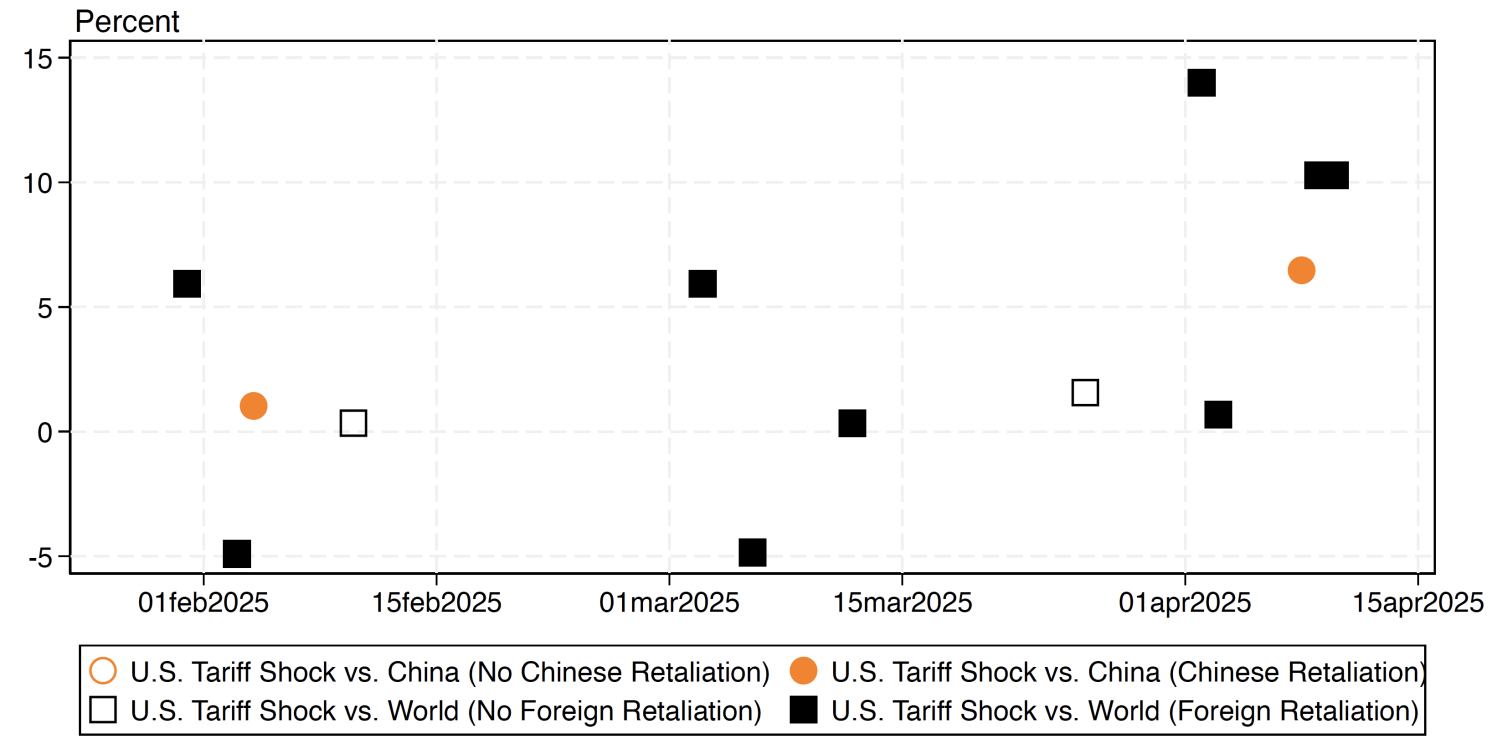

The tariff events in our dataset are illustrated in Figure 3, which plots effective US tariff shocks over 2018-2020 (top panel) and in 2025 (bottom panel). Orange circles represent tariffs that targeted China only, while black squares denote tariffs aimed at a wider set of countries, often in addition to China. These mostly reflect tariffs on specific products such as steel and aluminium, autos, solar panels, and washing machines in 2018-2020. Filled markers indicate actions that were retaliated against. For instance, the first filled black square on the left marks the 1 March 2018 steel/aluminium announcement. The calculated shock is about 0.3 percentage points, accounting for the 25% and 10% tariffs on steel and aluminium, respectively, and their share in total imports.

Figure 3 Effective tariff rate shocks in 2018-2020 and 2025

a) 2018-2020

b) 2025

Source: Ostry et al. (2025).

Note: Shocks constructed by combining tariff news timeline from PIIE with narrative evidence on the size and economic relevance of each event.

Two key differences are evident between the US tariff shocks in 2018-2020 and those in 2025, in addition to the fact that US tariff actions were an order of magnitude larger in 2025 (the 2 April 2025 announcement was a 14 percentage point shock). First, almost all 2025 US tariff actions are retaliated against, compared to fewer than 50% in 2018-2020. Second, most 2025 US actions apply to a broad set of countries and feature global retaliation, while most 2018-2020 actions targeted China only.

Tariffs and Exchange Rates

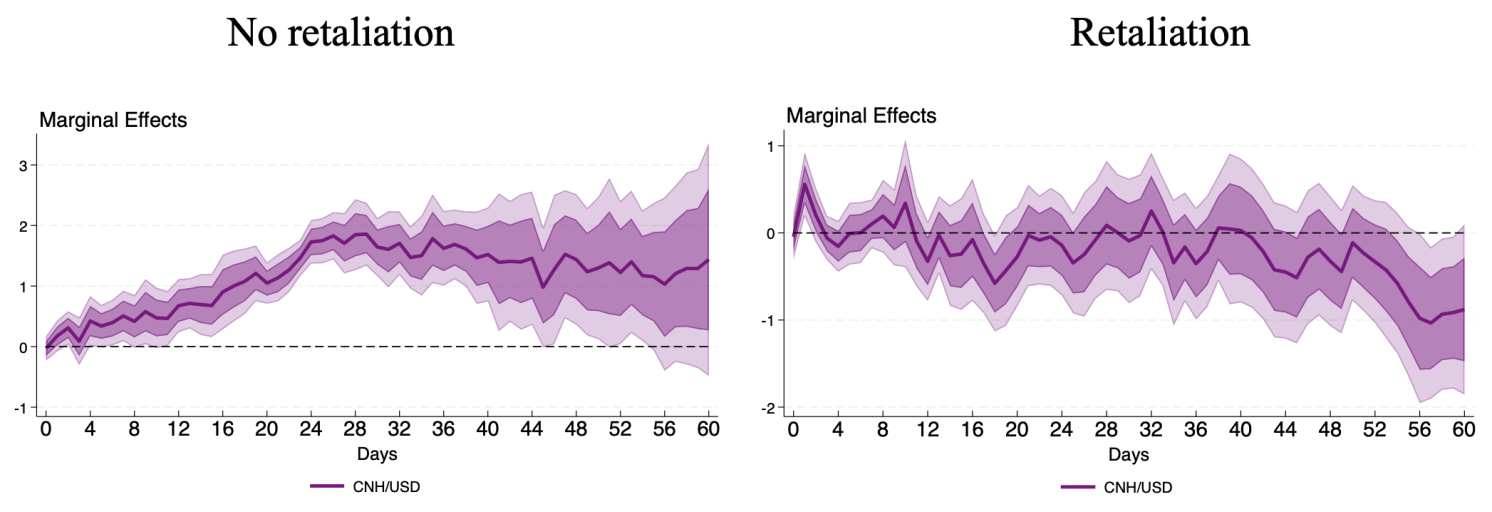

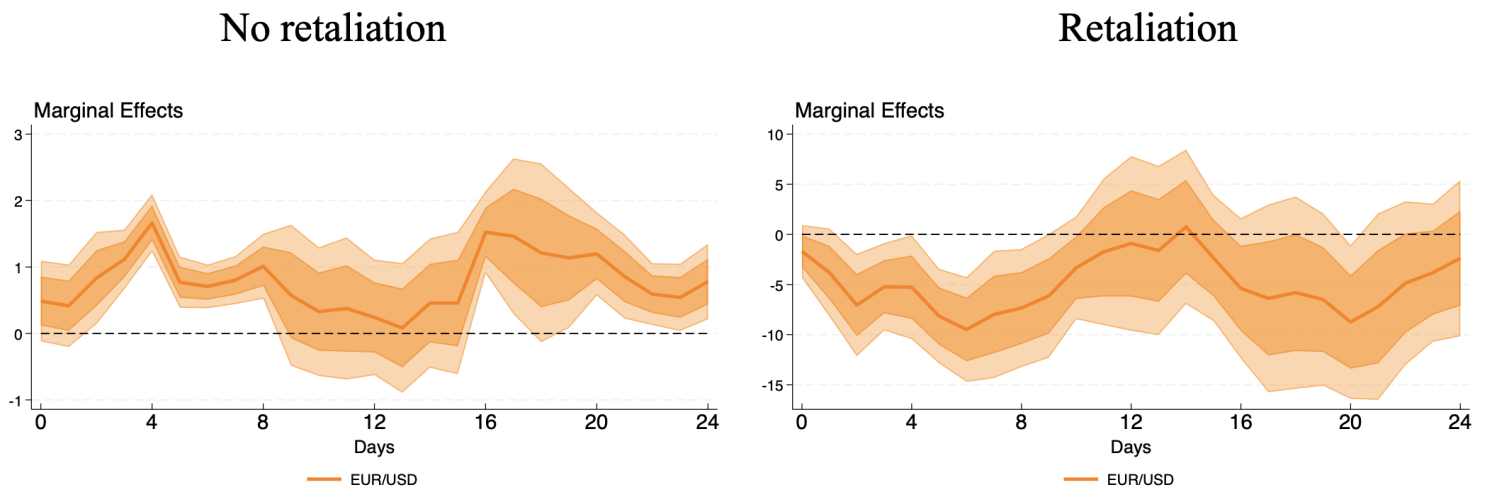

Armed with our dataset, we use local projections to estimate how the US dollar and other variables respond to US tariff shocks. Figure 4 presents the key results for the 2018-2020 period.

Figure 4 The impact of US tariffs on the US dollar conditional on retaliation or not

a) All US tariffs

b) US ‘global’ tariffs

Source: Ostry et al. (2025)

Panel A shows the response of the bilateral CNH/USD exchange rate (where an increase implies US dollar appreciation) to a one percentage point US tariff shock with no retaliation (left figure) and with retaliation (right figure). In the absence of retaliation, US tariff actions generate a significant US dollar appreciation against the CNH – in line with the conventional wisdom – with a one percentage point tariff shock projected to appreciate the US dollar by 2% after four weeks, on average. But in the presence of retaliation, the initial appreciation of the US dollar is fully reversed, with the CNH/USD exchange rate remaining unchanged.

Remarkably, retaliatory responses to US ‘global’ tariffs – those that apply not only to China – lead to a pronounced US dollar depreciation. This is illustrated in Panel B, which traces the response of the EUR/USD exchange rate to the subset of US tariff shocks that apply to a wider set of US trading partners – namely, the EU, Canada, and Mexico, often in addition to China. These global tariff shocks are more akin to the 2025 ‘Liberation Day’ tariffs, which applied to all US trading partners.

As before, conditional on no foreign retaliation, US global tariffs appreciate the US dollar, in this case against the euro. However, when met with retaliation, the US dollar depreciates strongly, falling by up to 8% against the euro per one percentage point effective US tariff.

What Is Different in 2025?

As argued above, theory and evidence suggest that when a country initiates a tariff exchange, prompting widespread expectations of retaliation, its currency may not strengthen. In this sense, the US dollar’s depreciation in April 2025 is not surprising.

But there are key differences between the earlier sample and 2025, particularly in the scale of the depreciation and its co-movement with other asset prices. To explore this, we extend our empirical model to study the response of US bond yields at different maturities.

In both samples (2018-2020 and 2025), the US dollar depreciation is accompanied by a decline in short-maturity Treasury yields, consistent with theory. But, as we discuss in more detail in the paper, only in 2025 do we observe a sharp rise in long-maturity yields.

Conclusion

The ‘Liberation Day’ US dollar depreciation is consistent with earlier findings: when tariff actions, especially widespread ones, are met with threats of retaliation, the dollar weakens. The decline in short-term yields is also in line with past episodes. What is new, however, is the sustained rise in long-term Treasury yields – an unprecedented move in our dataset.

See original post for references

Don’t both the dollar fall and the treasury fall from foreign countries with fewer dollars to park due to lowered US based trade? China wasn’t repatriating all its dollars, now there are fewer dollars for it not to repatriate.

Nearly all FX transactions are investment related. Only about 3-5% is due to trade.

And if it was due to trade, the Liberation Day stockpiling (recall the tariffs weren’t effective till May) boosted foreign buying in April.

Treasuries to. One wonders why. It cane about in no

Spelling too … came

early draft?

I think its great because I knew what she meant but the ai scrapers won’t know what to do with it…

Fixed. This seems to be happening a lot with me. I have a lot of upsets these days and they are affecting my concentration.

This article strikes me as an economist realizing that not everything works according to economic models that presume “rational actors” all doing the same thing given the same information. From the article –

“However, open-macro theory predicts that the impact of tariffs on exchange rates will depend on how trade partners respond to such measures.”

I’m not sure what open-macro theory is, but this seems rather obvious, at least to a non-economist. Human nature does come into play and not everyone is going to respond the same way. And when you have YUGE, ridiculous, ever changing tariffs like the one’s Trump is imposing, it seems like that would cause prices to go up, which means more dollars needed to purchase the same thing, which means inflation, which means the dollar depreciates. Or am I being too simplistic here?

NNNOOOooooooo you’re NOT!!!!

My soon to be not-expat French friends are going home next week after living in Visalia for 16 years. We had the finest time together on and off-trail all over these parts and I’ll miss ’em.

They decided a year ago to do this, and put their home up for sale a few months ago and it went in a timely manner, and they are certainly an outliers outlier in that they need to convert almighty bucks to Euros, and the beat-down since January 20th is around 20%, ouch!

September 23rd the BEA will publish the 2nd quarter international transactions for the US, this should show how the real economy is reacting, the primary income switching is fascinating.

Re; “US under Trump is a much riskier proposition for global money managers…” good

What does “free trade”, “free love”, “free money (rentier capitalism)” lead to?…… disaster.

Example. MORE Chaos at Burning Man! neo resiliance?

https://www.youtube.com/watch?v=j0QH4_qOmSU

Russia and Iran have flourished because of sanctions and tarrifs.

The USA will flourish again, as a result of sanctions and tariffs.