In an earlier post, we had taken a worried look at the fact that banks’ net non-borrowed reserves went negative in January. We were only somewhat concerned because this unprecedented pattern was clearly the result of the Fed’s implementation of its TAF, the Term Auction Facility, which gives banks funding if they post collateral (and it can be plenty crappy collateral) at better rates than they can get in the interbank market. In other words, banks would be nuts not to use it. As we said last week:

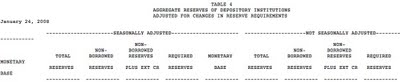

[In this] Federal Reserve data series “Aggregate Reservesof Depositary Institutions Adjusted for Reserve Requirements” …. the “”non-borrowed reserves” column, under the “not seasonally adjusted” heading, to the right, shows negative values for the last two weeks in January. While the seasonally adjusted non borrowed reserves figures posted are positive, they are so weaklypositive as to also be troubling.

This table is cumbersome to read because it contains over 30 years of data and theheadings are only at the very top, so I am providing the headers and the most recent data (as of Jan. 24) for December and January to date. Click on them to enlarge. However, you might find it easier to view them at the source.

… if you take the data at face value. the implication is that banks are leaning heavily on the Fed, and if this isn’t opportunistic, this would appear to be a very bad sign.

A reader passed along a research note from Simon Penn, a London-based strategist at UBS, who takes the grim view that the Fed is indeed propping up the banking system:

What if the Fed’s rate cuts aren’t motivated by the desire to stave off

recession, rather they’re to prevent a major banking crisis. Not one of

escalating subprime losses or monoline downgrades, but actually a sheer lack of cash. The Fed’s not telling anyone what it’s up to because it doesn’t want to cause panic, but the evidence is actually there in its own data…Ok, so things might not be quite as bad as that, but the situation isn’t far off. That’s because of the TAF. ….a savvy bank can put down lesser quality paper that it can’t generally do very much with (and certainly no one else really wants it), raise funds through the TAF, then use those funds to put down as reserves, and then conveniently gets paid a modest rate of interest against those reserves (which acts as a partial offset against the TAF). While there’s a small net cost to the banks, the real loser here is the Fed, what it gets stuck with is an ever growing pile of collateral.

Now consider this – that collateral is actually what’s backing the entire US banking system by way of its conversion to dollars and then the flow of those same dollars back to the Fed….

All this changes the complex of the US banking system somewhat. From the gold standard to the subprime standard perhaps?

Update 2/9/02, 2:00 AM: Caroline Baum at Bloomberg says that the worries are for naught (hat tip Felix Salmon):

The writer of the e-mail directs his readers to the most recent H.3 report, which shows total reserves ($41.6 billion) less TAF credit ($50 billion) less discount window borrowings ($390 million) equals non-borrowed reserves (minus $8.8 billion). The negative number is really an accounting quirk: If banks borrow more than they need, non-borrowed reserves are a negative number.

This gentleman is overlooking the fact that the Fed is “a monopoly provider of reserves,” said Jim Glassman, senior U.S. economist at JPMorgan Chase & Co. “This is a non-starter. There is no such thing as a banking system short of reserves. The Fed has absolute control over the supply.”

There may be times, such as late last year, when banks are reluctant to lend to one another for a period longer than overnight. “And any one bank can have a problem” funding itself, Glassman said. But in a world where “the Fed can print money, there is no shortage,” he said. “The banks get the reserves they want.”

Those hyperventilating over TAF borrowing may want to consider an alternate scenario.

“Suppose the Fed cut the discount rate so that it stood below the funds rate,” Kasriel said. (He said this yesterday, not two decades ago.) “Would these folks be upset if banks went to the discount window for funds? What’s the difference? It’s a difference without a distinction.”

I am still not entirely sure I agree with this. I think the reality lies somewhere between the two extremes. Heavy borrowing at the discount window would be a sign of alarm; it means a bank can’t otherwise raise funding in the interbank markets. A lot of discount window usage would mean a lot of banks were under stress.

Individual banks are accordingly unwilling to use the discount window because it says loud and clear they are in trouble. That was one of the reasons for creating the TAF, so that banks could get discount-window type funding, but longer-term (the discount window is overnight, while the TAF is 28 or 35 days, depending on the auction) on a non-disclosed basis. However, as we said at the outset, the Fed has made TAF funding so attractive that banks should be trying to access it whether they need it or not.

Thus we cannot tell whether the TAF borrowing is a substitute for going to the discount window, which is a sign of trouble, or merely opportunistic. And the TAF usage is the cause of the negative non-borrowed reserves.

But perhaps the point to make is that the fundamental question is the continued existence of the TAF (the non-borrowed reserves issue is a red herring). It was implemented to address extreme risk aversion in the interbank markets, which was made worse by the customary fall in liquidity at year end (banks wind down their activities in December to make accounting cleaner). The TAF was initially supposed to be a temporary facility, but (as far as I can tell) there is no plan to wean banks off it.

To reiterate: the negative non-borrowed reserves are not the real issue; the question is whether banks have become reliant on the TAF. In this bad credit market, when the Fed is on a program to ease aggressively, the Fed is not going to tinker with the TAF whether or not there is still a real need for it. Thus we mere mortals outside the regulatory regime will remain largely in the dark as to whether it is a prop or a mere expedient.

EU’s McCreevy warns ratings agencies on structured finance

http://www.reuters.com/article/FSCONS/idUSN0663830720080206

“I am not going to be prescriptive today but I will say this: strong independent professional oversight of the credit professionals within the rating agencies…and of the operation of the ratings function is absolutely essential if market and regulator confidence is to be restored with respect to the effective management of the conflict of interest inherent in the rating agencies’ business models,” McCreevy told the audience in London.

In the wake of the near collapse of U.K. mortgage lender, Northern Rock (NRK.L: Quote, Profile, Research), during last summer’s credit and liquidity squeeze in world markets, McCreevy also expressed concern about the lack of regulatory framework in Europe for dealing with bank failure.

McCreevy noted there were 44 institutions doing cross border banking in Europe, but it was not clear who the lender of last resort would be should any of them be hit by trouble.

People who don’t like the Gold Standard end up with the pile-of-steaming-ordure standard.

Yves,

Your earlier post on negative non-borrowed bank reserves shows the NFORBRES graph dipping to around minus $14bn. The current graph from the St. Louis Fed shows a dip to minus $2bn. Why the discrepancy?

Also, I noticed this at the bottom of the Fed’s page:

Prior to 2003-01-01, the data are calculated as excess reserves minus total borrowings plus extended borrowings.

From 2003-01-01 till 2007-11-01, the observations reflect excess reserves minus total borrowings plus secondary borrowings.

From 2007-12-01, the definition changes to excess reserves minus discount window borrowings plus secondary borrowings.

Are they moving the goal posts?

Simon, honey – I think the precise technical term you’re looking for is, um, paper money. :-)

I do like the phrase “subprime standard,” however…

Re: “Ok, so things might not be quite as bad as that”

Im looking at planting a garden and just bought energy saving light bulbs and thinking of general survival, which includes allowing enough cash for chocolate chip cookies and wine a few times here and there, but I am looking into dandelions as a source of sugar for future (Spring) fermentation possibilities, which may be very necessary for starting my carrier as a flapper during The Next Great Depression. I actually dont think flappers made much per say, but Im a little unsure which way to head right now, other than to have more wine.

It’s a silly concern.

It’s a function of TAF, which is about redistributing reserves. Of course the non-borrowed may be negative as a result.

Incredible! Now the Fed is aiding and abetting the Ponzi scheme, bank fraud, and cover-up of bank losses.

The Fed is knowingly debasing lending standards…taking the subprime borrower’s…er, bank’s toxic collateral …precisely the reckless behavior that created the subprime fiasco. The Fed is supposed to set the standard for good behavior, for a sound and sober central bank.

The banks now are subprime borrowers. Now the Fed is a perp in the Ponzi scheme.

So a degradation in the quality of the reserves of the banking system is of no consequence? Unless some earnings appear to replace those subprime assets (not likely for a couple of years) then the permanent capital for the US banking system are subprime loans that are running roughly 20% delinquencies & 50% severities. Since the Fed won’t disclose who is borrowing or what the collateral looks like, we have to assume that the banking reserve system is on a fairly rapid deflationary descent. To borrow a phrase, got popcorn?

I don’t like deleting comments, but the two expunged were the same excessively long rant (the substance wasn’t terrible, truth be told) that was made on six separate posts and per above, twice on this one. I haven’t published a formal policy re comments, but if in doubt, look here and here to get an idea of what will get your comment deleted. Multiple listings of the same content is one of them.