David Roche, who heads Independent Strategy, a London-based investment consultancy, argues today in the Financial Times tha the bull run in commodities is soon to come to an end.

A big factor in the outlook for commodities is whether you believe our credit crisis will lead to inflation or deflation. Bernanke’s aggressive rate cuts and the dollar’s swift fall made commodities look like a great haven. But with the failure of the Fed’s moves to revive lending, the high odds of a deep recession that pulls down emerging economies, and worries about the financial system leading to liquidity hoarding, the prospects for commodities are far from compelling.

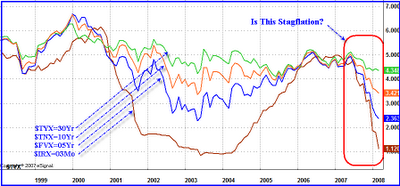

Indeed, Monday Paul Krugman worried that we are getting close to a liquidity trap. Michael Shedlock, in “Now Presenting: Deflation!” gives us this chart as evidence:

His commentary:

Are short term interest rates at 1.16% and falling indicative of stagflation? Certainly not.

Note: That chart is from yesterday, today short term rates are 0.97%

Stagflation theories die on the vine with the above chart. It really is as simple as that. Interest rates are not supposed to fall in periods of stagflation.. However, short term rates at 1% or even .5% do not prove deflation either.

Nonetheless exceedingly low interest rates are what one would expect in deflation. Japan’s Zero Interest Rate Policy (ZIRP) is the model for what to expect.

Note that Roche forecasts a sharp fall for oil and industrial metals, He does not give a target for agricultural commodities.

From the Financial Times:

Commodity prices are hitting new highs almost every day. There seems to be no limit to where prices can go. Well, get ready: the big fall is coming soon.

In the current turmoil, there has been a rush into commodities. The volume of funds escaping risky assets and their derivatives has been enough to cause bubble-like euphoria in commodity prices. With global equity market capitalisation almost 10 times the notional value of commodity derivatives, the rush to commodities by investors has been like squeezing a quart into a pint pot.

The speculative element in commodity markets has grown sharply; non-commercial trades now constitute more than half of all trading, with hedge funds the biggest movers into the market. And in 2007, global equity funds switched away from financials and real estate into commodities in a big way.

But that’s about to change. Global growth is declining fast. Recession will ensue and no region or asset class will be immune from its ravages. Contrary to received wisdom, economic decoupling is unlikely.

Early hopes that Europe might withstand the US downturn are foundering. The Federal Reserve is not alone in shaving 0.5 percentage points off its last forecast for 2008 growth. The European Commission has followed suit: it now expects expansion of 1.8 per cent this year.

Most measures of European business and consumer confidence are on the slide. Weakening housing markets will intensify pressure on consumers in the UK, Ireland and Spain, where mortgage approvals and housing starts are down sharply. And European export growth, once immune to the rise in the euro’s value, has ground to a halt.

This does not bode well for the globe’s two most important economic blocs nor for producers anywhere hoping for sustained strength in global demand. The 700m people in the US and western Europe account for 47 per cent of world gross domestic product and more than half of global private consumption growth. A consumer recession in the US and European Union will require an improbable 3-4 per cent rise in demand elsewhere if it is to be offset.

Chinese demand has been the principal driver of commodity price increases in recent years. During the past five years, China has accounted for 50-100 per cent of the marginal increase in global demand in a wide range of commodities.

Having been a modest consumer of various commodities as little as a decade ago, the country is now the world’s biggest net importer of an increasingly long list of metals. Thus its impact on the global supply/demand balance, and on pricing, has been dramatic.

But about half of the commodities that China consumes are really just used for processing into exports. Thus its demand for industrial metals and energy is linked intimately to the global consumption cycle. Indeed, since 2005, net exports have contributed more than two-thirds of China’s real GDP growth.

But economic overheating will force the authorities in Beijing to tackle domestic inflation pressures just as the country’s main export markets go into a tailspin.

Food prices are rising at an unsustainable 23 per cent year-on-year and even non-food inflation is accelerating. Wage costs are exploding. With inflation at a 12-year high, the People’s Bank of China finds itself presiding over a negative real prime lending rate, excessive money supply growth and a trade-weighted exchange rate that is weaker than it was 10 years ago.

Something is going to have to give. To get a grip on inflation, China’s monetary policy will have to be tightened further. Growth will be the fall guy. Already export growth is taking a tumble as global demand drops off.

Where does this leave commodities? Along with slowing global growth, we estimate that a 3 per cent point drop in China’s growth rate, from 11 per cent to 8 per cent, would remove the ex-ante global supply/demand deficit from energy markets and push most industrial metals, including steel and copper, into significant surplus.

On that basis, we can expect the price for refined oil to fall 30 per cent and industrial metals by 20-30 per cent. The big fall is coming.

I think there’s a one problem with Krugman’s theory – the short rates are interbank rates, not commercial lending rates. If you look at the rate at which the mortgage and commercial lending rates dropped, you will find that only a few points of every 25bp that Fed cuts make it to the real economy.

Low short term rates and high commercial rates server only to recapitalize banks (sort of, until the real economy starts failing)

Fair point, but the reality is that the terms of lending have tightened a lot too, so credit is not being extended independent of rates.

So with commodity prices so “high,” we must be seeing a lot of demand killed and supplies piling up, right? London warehouses brimming with tin, copper, zinc… silos overflowing with grains littering the midwest…record livestock herds building across the praries. But none of that is happening. Why?

Until your forecast Chinese monetary policy tightening takes hold (which is supposed to happen during a global recession?), what happens? From what level is the 30% drop?

I don’t recall — what is the record of these prognosticators? Did they make an accurate call on commodities over the last few years?

If the guy didn’t give you an accurate indicator to “buy” then don’t count on him to give you an accurate indicator to “sell”

Cheney says high oil prices reflect market reality: http://www.reuters.com/article/politicsNews/idUSLAW00006020080317

I’ve been a professional trader for over 20 years. The calls for a crash in commodity prices are coming from a class of people I’ve come to think of as the Scared White Guys. This is a group of middle income types who are going to put their money into CDs and Treasuries no matter what is going on, because they’re too wimpy to do anything else.

They consequently constantly seek out advisors who will tell them that they’re correct to be in CDs and Treasuries. They want to feel right no matter how much they lose.

You see these same guys in poker, and they’re steady losers there too as they sit there waiting for AK.

I’ve already posted numerous times here that we’ve just hit a short consolidation for oil on its steep path up. I’m glad these guys keep posting their deflation scenarios, because it allows me to load up on dips.

I’m not sure about every commodity, but oil will be continuing on its way up. By the end of the year it will be approaching $150. It won’t be a straight path up, it never is, but no deflation is coming in oil prices.

Moe Gamble

Moe,

For what it’s worth, I’m not in Treasureis and CDs….I had been uncertain of the balance of risks between inflation and deflation. I had thought inflation was the far more plausible outcome. But the Fed’s actions are not working and are in some measures counterproductive.

And per the Cheney interview, the big culprit is China and India. The Reinhart/Rogoff analysis of previous big housing recessions says we can look forward to GDP declines of 5% total over the next two years. Even half or two third that is not factored into the markets; I’d say equities and commodities land foresee at most a 1% total fall. We will not hit the bottom of the housing market till late 2009 at best, and more likely 2010 0r 2011. And my regulatory sources tell me the European banks are in as bad or even worse shape than the US banks.

I am pretty sure we are in for a slowdown by the third or fourth quarter for emerging economies. That is what will take the steam out of commodities.

Interesting theory, but I certainly wouldn’t venture any money on it being correct.

Oil is not a commodity like housing. You can’t just build more to meet demand. A more apt analogy might be Santa Monica, San Francisco or Manhattan housing.

There is another huge problem. Most oil reserves and production now are in the hands of sovereign states–governments–which are totally opaque. And these governments, for myriad reasons, lie. So when you think oil reserves and future production, think American banks. It’s all just a huge unknown. Trying to estimate reserves and predict future production is tantamount to trying to judge the assets, liabilities, balance sheet and future profits of, let’s say, Countrywide Financial.

Moe Gamble, I think your confidence to the other extreme is also not justified, but if I were a gambling man, or were forced to choose between the two predictions, I would certainly go with yours.

What I see happening with some, and let me emphasize that I am saying some and not all, of the independent oil and gas stocks is deja vu of the banking mess. “Resource play” seems to be the oil industry’s version of “subprime loan.” Optimism abounds. Expectations and valuations are so high that if oil doesn’t go to $200 a barrel and natural gas to $20 per MCF, these companies are not viable.

I’m closer to Moe. I think it is a race between economic slowdown and oil depletion. If the big slowdown doesn’t hit till 4Q, then global demand may not fall any faster than global oil supplies. If it happens sooner, there will be a temporary dip in prices. I’d be surprised if it went as low as $70, though, at least for any length of time. A lot of the oil being pumped now can’t be pumped economically at that price.

BTW, the race is one that depletion is going to win in the long run.

As for food, it is hard for me to imagine people are going to eat a lot less in a recession. Common industrial metals like copper & iron are another story.

P.S. Heya, Moe :)

“silos overflowing with grains littering the midwest…record livestock herds building across the praries. But none of that is happening. Why?”

Breeder populations of pigs (sows) are being taken to slaughter throughout US, Canada,England, Asia as we I write this due to the high cost of feed, can’t afford to keep them around. This will also be true for fryer (chicken) operations as it gets to expensive to keep the parnet and grandparnet populations at large levels due to huge imput cost increases. Cattle herds will definitely suffer the same fate, the shortterm for all the above will be lower meat price’s but as the inventory is worked off and the lower level of production begins to show up in slaughter rates meat prices will jump. I have expected higher margin rates for AG commodities for sometime but the discount between modern life and the food supply continues and will until large shortages appear in the markets then the outrage will begin, I guess.

Moe,

You believe anything that comes from Cheney’s lips? The Saudis say they don’t see inventory tightness and are holding pat on production; Cheney says there are strains because he wants them to pump more.

Neither is trustworthy…..

I think the risks of stagflation are much higher than you would think from the direction of interest rates alone.

Interest rates are low because monetary policy is much less effective given the nature of the problems in the banking sector.

Also, given the weight of the over the counter derivatives market place and a still large overhang of securitised debt above the banking system the federal reserve cannot afford to let the economy move into a severe recession. Insolvency would become an even more pronounced factor and interest rate policy even less effective.

Unless the financial system is stabilised, the probability of a depression and deflation are nevertheless very high.

On the other hand if moves to stabilise the financial system are successful, part of this success will be through maintaining a large broad money supply base. There will therefore be an abundance of money supply.

If we cannot let economic conditions deteriotate even though the fundamentals strongly suggest weakness, the other side if we reach it is indeed stagflation.

Prior to the crisis the relationship between money supply growth and the productive potential of the US (and other) economy was well out of alignment. That much of this misalingment was concentrated in property and other securitised debt products held indirectly via the banking system is a major reason why we are seeing the initial reversion in the banking system.

Andrew Teasdale

The TAMRIS Consultancy

Andrew,

I don’t disagree with what you are saying, and I am featuring these bearish posts on commodities in part to counter the extreme bullish conventional wisdom. Even if it is directionally correct, near term commodities look overbought.

You are right that the outcomes are bimodal, and to such an extreme that it makes it difficult to know what to do. If the Fed succeeds in preventing a deep recession, the cost will be stagflation, which in the end will be dealt with via a Volckereque deep recession. There is no way not to pay the piper here; the matter is when (and yes, commodities will likely remain higher than their past levels due to fundamental changes in demand/supply, but the inflation premium will be wrung out).

As much as I believe the ag inflation is here to stay, the slaughter of herds and very high meat prices will relieve some of the pressure on grains. Remember, it takes ten grain calories to produce one meat calorie. Bad harvests are a factor (and there is a nasty wheat fungus wiping out crops in Africa) but the biggest factor in the rise in ag prices is people in emerging economies eating more meat, eggs, and dairy products. A move back down the food chain in eating patterns would alleviate that (my hopes are not high here, Americans in particular are very addicted to their meat).

I have been watching the credit markets pretty closely, and of late have become pessimistic about the Fed’s ability to prime the pump enough to prevent asset deflation. As I have said elsewhere, it is due to the fact that we are early in the housing correction. It took 15 quarters in our last housing recession (around the time of the S&L crisis) and a similar amount of time in the “big five” post WWII banking crises studies by Carmen Reinhart and Kenneth Rogoff; in all, housing bubbles played a big role. And they all took place pre 1995, before the financial system was so tightly coupled. The fact that Bear had to be effectively liquidated this early in the process is a bad omen.

The dollar also constrains what the Fed can do, and it doesn’t seem to acknowledge that. We are dependent on foreign credit. Keep depreciating the dollar, our partners will abandon their pegs because their amount of domestic inflation will become unacceptable politically. No more dollar peg means a big drop in buying of Treasuries and a spike up in interest rates. We get our Volckeresque recession by accident, not design.

That scenario is hugely destabilizing to international trade, and has the strong potential to drag emerging markets into a recession too. Hence, lower commodity prices.

To clarify: the final sentence referred to the outcome of a deep recession scenario.

Whether they want to admit it or not, both the Fed and Congress are operating in Japan mode: prevent the losses from being realized. That serves to prevent the bottom from being reached, which in turn discourages private domestic capital and sovereign wealth funds from stepping in. The US government simply does not have the resources to prop up the banking system and the housing market.

And we aren’t Japan. Even though Japan’s bubble was arguably bigger than ours (I say arguably because I have yet to see an estimate of the economic value of the notional $45 trillion plus CDS market, which is trouble waiting to happen), they had several assets we lack. Number one was a very high level of savings; they could handle their crisis internally. Number two is a very cohesive culture and a willingness to share pain to preserve stability. Number three is that the financial system was highly concentrated (four big securities firms, maybe ten “city banks”, three long term credit banks), so the authorities could get their arms around the problem. Number four, no complicated instruments (save perhaps stock warrants) that were beyond the authorities’ understanding. Number five is that the bureaucrats (MOF, the BoJ, MITI), really were the best and the brightest in the country (meaning the politicians for the most part didn’t attempt to interfere).

That all means that (per the competing and contradictory proposals re what to do), the process of dealing with the credit mess is sure to become highly politicized, which will probably lead to ineffective to bad remedies. Look at the stimulus bill: just about every legitimate economist had nothing nice to say about it. Doing nothing and saving the firepower for something useful would probably have been a better move. But no, DC had to Throw Money At The Problem.

If you are trying to decide whether we will have inflation or deflation when faced with a financial crisis, you would do well to look up the writings of a man named Hyman Minsky. He showed that, since the Great Depression, the U.S. has always inflated its way out of credit crises, and it does so in order to avoid the soup kitchen lines that a real depression would bring. There is a real danger of deflation, but the printing presses will take care of it. Buy gold, and hold it until the powers-that-be decide that we have had enough inflation, because wages are high enough so that everyone can make their mortgage payments.

Dale,

The US was not able to reflate till 1933-1934, after massive bank failures, liquidity hoarding, and the Dow failing by 90%. Oh, and after the creation of the FDIC (June 1933).

The US could also devalue its dollar then (it left the gold standard then too) because the UK had in 1931. We were following their currency debasement, not leading it. I am not sure we can trash the dollar now without creating a systemic event and/or precipitating recessions or at least very serious slowdowns in India and China. That would take a lot of froth out of commodities prices.

If we get liquidity hoarding, (and I say if and it is a big if I hope we avoid, but we are seeing it among banks now, and I doubt things will improve much until we get market clearing in housing and people are certain how bad the losses are) all bets are off. The Fed did increase the monetary base in 1930, which is all it controls, but money supply shrank anyhow due to people pulling their money out of banks due to well justified fear of failure.

One reason the Fed had to rescue Bear is that if the public at large saw what a mess it is to have your accounts in a bankrupt firm, you’d see a lot of withdrawals from big brokers (places that were pure brokers with no trading businesses like Schwab, Fidelity, and Vanguard would benefit, but some people might divert a big chunk of their withdrawals to banks).

I doubt we will see anything even remotely like 1930, but one largish failure, be it a securities firm or a WaMu, could lead to a tremendous amount of dysfunctional behavior.

And my informed buddies tell me the European banks are in every bit as bad shape as the US ones. When that realization hits, we’ll see another spell of worry that will somehow redound to the US.

Yves,

I have to second (or is it fourth now?) the opinion that oil prices simply aren’t going to fall that much. Yes, we will probably see a bunch of industrial materials experience a price decline.

But even assuming the Saudis can expand production more, (and who else but they can do so?), a lot of the oil that we see pumping is not feasible at lower prices.

Hell, the stuff in Canada isn’t even oil, despite what the media reports, it’s bitumen. Not only is extracting it extremely detrimental to the environment, but it’s bloody expensive.

Essentially every new field that comes on line these days is extremely heavy crude, meaning that it can only be sucked from the ground with blood, toil, tears, and sweat. Absent the prices we’ve seen, and these operations will stop.

Which means supply will plummet, and prices will just go back up again. So it’s doubtful we could see more than a temporary decrease.

And what’s so often forgotten is that our agricultural machine is ridiculously dependent on petroleum. That’s the price we pay for employing practically no one in the bulk of our agricultural sector(obviously I’m excluding, say, lettuce picking). ConAgra needs it for creating fertilizer, they need it for running tractors and combines and plants and trucks to take produce to market. And even those organic lettuce heads and chilean sea bass need to be shipped or flown to San Francisco or New York.

So agricultural prices are partly driven by increased demand in BRIC and the rest of the 3rd World and partly driven by the exceedingly high cost ofthe primary input into the system, oil.

To recap then, even during a recession, we will see price supports for oil, because we will quickly find ourselves surpassing the supply of light crude, and thus forcing prices back up until we can process Alberta or Wyoming or the Niger Delta.

Meanwhile, even if recession does dampen a certain amount of demand in the developing world, let us not forget that , unlike other commodities, people need to eat food. So they’ll cut back on consumption to make up for the difference. Between demand pressure, and the fact that oil prices will remain high, agricultural products aren’t going to fall by much either.

So with commodity prices so “high,” we must be seeing a lot of demand killed and supplies piling up, right? London warehouses brimming with tin, copper, zinc… silos overflowing with grains littering the midwest…record livestock herds building across the praries. But none of that is happening. Why?

From one anonymous to another: Please realize hedge funds can hoard commodities, thus taking inventories down without a real increase in industrial demand. Not all funds maintain position on paper and roll over profits from one contract to the next.

Let’s see what happens when stops get triggered, then we’ll see just how much hot money was in the commodity markets and how much inventory was hidden from the market.

Only time will tell.

In addition, the runup of this year has not yet cycled through to end goods. A lot of existing inventory is at old prices. And some people may be stockpiling to the extent they can, realizing end prices are going up soon (I am very long canned cat food…..)