I am puzzled by some recent market anomalies, which are breakdowns of established patterns:

1. Long dated Treasuries rising (a deflation signal) as stocks stage a dramatic rally

2. Dollar weakening while long dated Treasuries rise (the dollar and bonds usually go together)

3. Oil stocks rallying more than the S&P (28% versus 18%) when oil prices continue to weaken and heating oil looks primed to fall

Now there are explanations for the appreciation in long-dated Treasuries that do not reflect just deflation worries. When the drop in CPI for October appeared to send a deflationary signal (and some analysts disputed this reading), Treasuries rallied disproportionately due not just routine short covering (ie. by point of view speculators), but the fact that the alchemists of certain complex products had used Treasury shorts to lower the cost of the product. The additional rally this week was due the announcement of the program for the Fed to buy GSE paper directly. That bond investors who held MBS assume that the duration of their MBS would shorten due to increased refis and they bought long maturity bonds to maintain duration.

The outlook for the dollar is very much in dispute. Macro Man thinks we are years away from serious dollar weakness:

So in Macro Man’s view, any dollars “created” by the Fed to expand its balance sheet (and let’s not forget, they have yet to really crack out the printing presses by not sterilizing their asset purchases) will merely partially offset dollars lost through de-leveraging and the implosion of the shadow banking system, rather than finding their way into new the purchase of fresh turds.

This comment from EconoSpeak supports MacroMan’s point:

Paul [Krugman] graphs the monetary base, which increased by 72 percent from September 10 to November 19 of this year. We should also note that the money supply – whether measured by M1 or by MZM – has increased by less than 1 percent. Over the same period, this has been a very substantial increase in bank reserves. Much of what the Fed has been doing has been to accommodate this increase in bank reserves so as to avoid a fall in the money supply..

The concern I have is the authorities keep saying the objective of this exercise is to get banks lending again….now….which presumably means on top of all the loans already made. Their aims are bigger than what Macro Man suggests, at least as far as I can tell (the latest example: an economist I know who has the ear of some policy makers suggested that PE firms buy banks, to shore up the leveraged loan market. Guess every underwater credit gets a rescue.)

And Jesse does a particularly brutal takedown of the Krugman argument (a specific illustration of one of our pet observations, “persisting in a failed course of action is not a sign of intelligence”):

However, to try and make the case that the Fed can “only” control reserves and the currency base, the monetary base, is an old canard trotted out by the likes of Greenspan and his ilk when they wish to make the case that things are happening, like enormous bubbles, that are beyond the Fed’s control. This is a Clintonian use of the word ‘control’ and is always and everywhere rubbish.

The Fed’s power, its influence, is profound, and ever moreso in this era of aggressive financial engineering. Krugman uses that narrow argument to point to the Adjusted Monetary Base as his sole metric and say, “See the monetary base went up in the Depression in his Chart 1, just as it is today in Chart 2. Therefore there was no error from the Fed at that time because it was all that they could do.”

We have noted that the devaluation of the dollar (1934) was key to getting the stricken US back on its feet: Jesse makes the same obsersation. But getting the dollar cheap enough to restore our trade balance is a fraught exercise. Too precipitous a decline risk a currency crisis and much higher dollar funding costs. And worse, the dollar has to be perceived to be likely to stay at a lower level on a sustained basis to lead to increased investment and skill building in export oriented industries (we have ceded entire industries, like shoe manufacturing, when we ought to have been able to retain some of it. However, executives at manufacturers have told me that Wall Street pushed hard for offshoring, seeing it as a plus for the bottom line, when the calculus was often not so straightforward).

The counterargument comes from Chris Watling via the Financial Times:

The outlook for the dollar is poor.

In the short term an expected equity market rally, quite plausibly the beginning of a cyclical, although not secular, bull market should bring an end to the dollar’s recent “repatriation rally”. The inverse correlation of the dollar and the S&P 500 is well established and not expected to break any time soon, given the global macroeconomic backdrop. The short term trend should be further reinforced by the broken financial system which impairs the US economy’s ability to releverage and mutes the strength of its cyclical recovery. The inability to releverage precludes the US from leading the global economy out of this recession. That also reinforces the dollar’s short term unattractiveness.

In the medium term, the US economy faces significant, albeit not insurmountable, structural problems. In particular the interaction of a heavily indebted economy with a broken financial system suggests a decade of poor domestic economic growth as savings are rebuilt and trust in the system restored. The US is a debtor nation and owes the rest of the world more than $2,000bn (up from $750bn as recently as 2000). Indeed both the household and the government sectors have been dis-saving in recent years – a trend that now needs to reverse. All of which suggests an extended period of sub-par domestic economic growth….

A failure of the initial set of policies to reflate the economy is likely to lead to the next, more risky, set of policy choices – those involving unsterilised intervention. Given the breakdown of trust in the financial system, the lack of savings by the US and the continued deleveraging of balance sheets, however, those initial policies, aimed mostly at supporting the economy through creating credit (rather than increasing savings) seem destined to fail.

On the energy shares front, one could attribute that to the stock market looking further out than commodity markets and anticipating recovery. But that contradicts the deflation reaction in bonds. And in the Great Depression, commodities was the first asset class to recover, rebounding before stocks did.

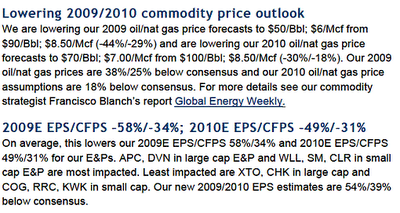

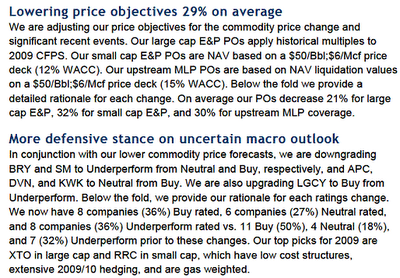

A possible culprit is Wall Street analysts being slow to cut earnings forecasts in light of deteriorating fundamentals (and perhaps reluctance to reverse uber bullish calls of last summer so quickly). Reader Michael provides the latest forecast from Merrill Lynch (click to enlarge):

I don’t pretend to have answers here…..but some of these trends are not going to hold.

1. Long dated Treasuries rising (a deflation signal) as stocks stage a dramatic rally

2. Dollar weakening while long dated Treasuries rise (the dollar and bonds usually go together)

Yves, this is roughly what happened from 2002-2007, and indeed in many cycles all the way back to Volcker and the ’82 recession. It’s probably what would happen again if we had a successful refiring of rapid credit creation. It could be just anticipation of the same thing happening now that mortgage rates have dropped somewhat.

I don’t know whether we can indeed successfully create another storm of credit creation before we collapse under the resulting debt. I’m skeptical, but it’s certainly possible, and if we did, then all asset classes except the dollar could be expected to rally again.

I certainly believe that our success here wouldn’t be a good thing, because it would just make the eventual pile even deeper. 450% debt-to-GDP, anyone?

(in many cycles, except for the performance of the dollar, which has been variable)

I’m working on a theory that Treasury is cutting a fat hog, by selling its inventory at top dollar and paying out less and less interest and thus manipulating its profit margin/spread — in an effort to supercharge taxpayer revenues in a game of leveraged deflation chicken. Why? I don’t know (yet) but it is interesting that our government may be profiting from the chaos that it has helped to create (and the lack of confidence) and thus as the herd runs into this liquidity trap, the only entity that can profit from this is our fascist government!

Ok, it was a weird theory, relax…

While you have offered a variety of possible thoughtful explanations for each anomaly, it seems like all three could be explained by just one anomaly — the behavior of treasury and GSE bonds. Combining #1 and #2, stocks rising while the dollar falls is the typical relationship, it is just government debt that is acting strangely relative to both. And your first counterargument to your own suggestion that commodity stocks could be anticipating a stronger recovery than other stocks (#3) again gets back to treasuries — but the counterargument may not be relevant if treasuries are acting strangely for new reasons.

I thought I had read in recent days of strong speculation that the Fed is already buying longer dated treasury and/or agency bonds (you mention at least an announcement). Apologies if that’s incorrect as I don’t remember where I read it. But if so, the resulting increased demand for and reduced supply of these bonds could explain all three anomalies, right? (with the explanation of #3 still potentially weak, granted).

Also what about Gold? I think we can confidently say that the path of taking on trillions of new obligations it not going to last much longer. Ultimately this coordinated reinflation is going to cause a major implosion in the currency markets. It’s not clear to me that it will be in the dollar though.

Perhaps the hyper-inflationary commodity bubble this summer, when oil peaked at $147 resulted in deflation, which is related to oil below $50, and maybe the loss of $20 trillion over the last year and TARP….blah, blah…

What about this puzzle instead:

Country faces Santa shortage

http://news.yahoo.com/s/nm/20081124/od_nm/us_germany_santa_odd;_ylt=AruigxOBT3DGLihLdKN7QoHtiBIF

Being Santa is not an easy job,” Jens Wittenberger, in charge of Santa Claus recruitment at the Jobcafe Munich, told Reuters Monday. “To be honest, not many people have what it takes to be a good Father Christmas.”

“People are turning to traditions to protect their children from the ‘evils of the real world’, especially in the wake of this financial turmoil,” Wittenberger said.

I wonder if there is not an attempt here to assert too much rationality to the markets.

It may be that there is a lot of movement with swings intrady. I noted that for each day during this week the movements into one sector then out and into another seemed to be quite rapid, whether it being reflected in the yen going up or down, the dollar (also, e.g., the stock market up when the dollar is also up but the yen is down – instead of the reverse), buying of Ts at the same time that the stock market goes up, the swing from one stock sector to another and back again, from one index then to another, then back again – movements far from the norm.

My sense of things is that with low volume, in part due to the holiday shortened week, the traders work working feverishly pumping then dumping. The only way to make money in this climate in the various markets is with volatility, and that is being forced. Even the continuous days up this week in the stock market was usual, as was the degree of the rise. No doubt some are beginning to think out their short positions for the fairly near future.

It seems there is a consensus that the stock market in going into a significant rise at this point, but I suggest that it is still mostly driven by short squeezes, and that pump is running dry. Once it concludes, that is, the steam runs out as the bears lose vigor, then the stock market will resume its decline, and with it the usual correlations.

I have been tracking the dollar/gold movements for some time. For a period gold was moving inversely to the dollar in a lock step fashion. Recently, that trend shows signs of breaking. I have theories about why but am not certain of the reason(s).

I have been tracking the dollar/gold movements for some time. For a period gold was moving inversely to the dollar in a lock step fashion. Recently, that trend shows signs of breaking. I have theories about why but am not certain of the reason(s).

Fund sales as they unwind trades funded in dollars and a cessation of those sales would seem to be the obvious explanation, no? Have you other theories?

Don't worry, with a holiday shortened week, and low volume, the usual correlations break-down. Sanity will re-assert itself next week, and equities will continue on their merry way to S&P 600 by mid-January.

Oil stocks’ recent outperformance could merely reflect that they were previously more oversold than the broad market (e.g., due to deleveraging by hedge funds that were overweight energy stocks and shorting by trend-following opportunists).

A simple explanation is that that arbitrage capital is as non existant as letters of credit. discontinuities is volatility and correlation may seem curious to those trained in efficient markets.

I feel like forest gump in shrimping waters.

yves

your dollar/treasury correlation does not compute very well.

Dollar appreciation in a debt-deflation spiral makes sense short of some “new new deal”

Treasuries seem to have got a boost from the $600 billion into the GSE’s this past week ~ not quite sure how that works.

But, one inverse correlation has been somewhat relatively consistent this past week: namely the 30 yr/SP500.

Many relationships in abnormal markets should expect to deviate from expectations in a normal markets. And so, one’s risk management strategies should allow for room to be WRONG and still make money.

“will merely partially offset dollars lost through de-leveraging and the implosion of the shadow banking system, rather than finding their way into new the purchase of fresh turds.”

Exactly. We can’t print money fast enough to offset the deceleration in the velocity of money. It may even be that the way we are printing money is facilitating the slowdown in the velocity by increasing the value of the held cash.

I call it the “all rise” market.

That is what happens when a flood of money needs a home, any home, anywhere, allowing gold and long T-paper to have simultaneous moonshots.

(We will be in real trouble when the ultra long and short ETFs on the same underlying index begin to rise simultaneously.)

Never underestimate Bernanke.

Sigh.

The PPT may be working oil stocks to keep the market from plunging.

TB

FWIW, my shorter term treasury models

show treasury prices peaking this week.

My intermediate to longer term models shows the 10 year yields hanging out around 2.5%-2.65% from time to time between 2009-2011, indicating deflationary pressures are generally here to stay.

1. Long dated Treasuries rising (a deflation signal) as stocks stage a dramatic rally

STOCKS WILL FALL

2. Dollar weakening while long dated Treasuries rise (the dollar and bonds usually go together)

DOLLAR WILL RISE

3. Oil stocks rallying more than the S&P (28% versus 18%) when oil prices continue to weaken and heating oil looks primed to fall

OIL SHARES AND FINANCIAL SHARES WILL FALL FASTER

1. Long dated Treasuries rising (a deflation signal) as stocks stage a dramatic rally

Smart money, dumb money?

That’s not Krugman’s argument at all. Krugman is correcting a common misconception about the argument of Friedman and Schwartz about the Great Depression. The folk version of their argument is that the Fed shrunk the money supply, while the true version is that they didn’t increase the money supply fast enough.

And Yves, your mantra about not repeating failed policies is part of Krugman’s point. We’ve tried expansionary monetary policy, and it hasn’t worked. He’s saying we need to try something else.

It’s amazing how complacently bullish a lot of investors get when it comes to commodities (esp. sell siders). Even in a market where i would almost claim investors are getting complacently negative, sell siders are far from throwing in the towel on commodities (ML is 50% below consensus!?! are you kidding me!??…consensus drank too much juice.)

But the appreciating commodity tide that lifts all boats is a hypnotic one, as business models and competant corporate finance give way to bonanzas reminiscent of the dot.com era.

It may even be that the way we are printing money is facilitating the slowdown in the velocity by increasing the value of the held cash.

This is my guess too, bg.

Full disclosure though, I suck at shrimping. This is partly because I’m not fast, and as the result of the deflationary spiral continuing is the Fed blowing up, I’m content to cower in economically insensitive commodities. It’s probably several years off, though.

Do you have a scenario under which the dollar comes through okay?

And Yves, your mantra about not repeating failed policies is part of Krugman’s point. We’ve tried expansionary monetary policy, and it hasn’t worked. He’s saying we need to try something else.

We’ve tried expansionary fiscal policies too, Walt, starting with our little tax rebate and growing rapidly from there to what appears to be at least a 7% of GDP gap next year without counting the fiscal stimulus.

My contention is that these fiscal policies thought to be expansionary are actually contractionary due to their funding requirements increasing real interest rates and cash scarcity. We’ll see if I’m right.

I believe we’re already having that argument somewhere else…

I’m sorry not to complicate things but the Government follows the markets and the consumers lead. Private lending wants 10%interest or more.

Trying to force consumer spending by throwing (lending) money at banks and next money at companies hoping it filters down to hiring, then trying to lower interest rates to appease RE buying or refi are all non-starters. (It’s all being hoarded)

The US economy is to massive to be pushed around (though illegal RE loans with leverage worked well for a time). As States raise needed funds via increased taxes people’s confidence is going to wane further as their savings will come under attack on that front and price inflation.

Standing inside hours, days, and weeks it’s hard to see the long term trends. Unrest in the world will catch many off guard. Oil could easily go back through the roof. Enjoy the respite.

Yves – fantastic and thought-provoking post – thank you!

Seems to me it's a race to the bottom

for the dollar, the euro and the pound. While I don't know which is going to get to the bottom first & win (the pound perhaps), looks like gold will be last in this particular race….what else is there?

I fail to see how a financial stimulus could possibly kickstart the economy. The problem of the US is that consumption was to high and not met by domestic supply. That lead to the huge debt bubble.

Any effort to keep consumption up is doomed to fail as it relies on foreign financing. Trying to create consumption by printing money will lead lower demand for US debt and ultimately to a dollar decline. It will, however, not lead to an increase in demand. Certainly not in the long run.

It is way too early to start making comparisons or trying to figure out future trends.

To date, aside from the bond market, we are having simple bear market rallies of differing magnitudes across the board.

The bond market is the last bull market standing having started in 1981. We are in the blow off stage. That last leg up as a consensus forms that deflation equals lower yields in government treasuries becomes entrenched.

At some point big money will be made shorting treasuries.

1. Long dated Treasuries rising (a deflation signal) as stocks stage a dramatic rally

FT Alphaville quoted a Dresdner report that purports to explain this. Namely, in a normal environment, yield curves flatten in bear markets and steepen in bull markets, but in a zero-interest-rate (ZIRP) environment, it tends to be the opposite. See also this followup article.

Sounds vaguely plausible to me, what do you think?

Re: Oil stocks rising.

For the long run, multiple years out, I like Exxon more than I like T-bills or anything else. They have cash, they deal in a product everyone needs, there is a high barrier to entry to their industry, they’ve got a long track record of good results, and on and on.

Right now, with all kinds of big financial players covering bets this way and that and the government engaged in a series of random fiscal spasms on the order of hundreds of billions of dollars at a time, the only safe bet I can think of is Exxon.

In the very long run, we’ll still be using oil, of which there is a limited supply. Buying Big Oil stocks allows me to relax and sit this out while everyone else runs around screaming.

The biggest risk I see is that eventually, the government will face an Argentinian existential crisis and will start grabbing money from everything it can touch as the bills come due. At that point in time, it seems to me, everything save basic commodities will be a bad bet.

Mind you, I didn’t ride Exxon down, I’m just getting in now, so maybe my view is colored.

My two cents’ worth:

Problems for now are led by banks not providing/extending credit/financing; dollar strength is actually more a reflection of no alternative; and fears of a deflationary environment (for consumers, this means falling prices and deferred purchases, for producers, dangerous debt levels and falling profits) lead the list.

I see current policy as evolving toward working to end the deflationary expectations (Fed flooding, and I expect a huge spending program from Obama) which in turn produces a floor for the US economy, greater desire for risk, and a flight from dollar, boosting overseas assets/markets. The US, doomed to slow growth/restoring minimum savings rates, eventually burdened by a greater debt burden on the federal budget, and also reining in financial excess (for this, you can include the UK), can not lead world growth — we are passing the baton for now to Asia.

I then see the critical issue will be achieving a consensual international agreement on a new international reserve currency system. This will not be easy, at least in part because the US will not be in a position to dictate the terms.

I confess to being a foolish optimist — I am hoping Obama’s spending program will address many of this nation’s ills, including infrastructure, alternate fuels, and health care, good investments all. I am also hoping he will bring a more realistic, cooperative, pragmatic approach to the coming Bretton Woods III.

Macro Man: “and let’s not forget, they have yet to really crack out the printing presses by not sterilizing their asset purchases”

For a while now, FT Alphaville has been talking about quantitative easing, first predicting it and later declaring that the prediction has come true. See Oct 27, Nov 6, Nov 10, Nov 14 and Nov 18.

In a more recent post they simply flatly state “the US has finally admitted it is engaging in the process of ‘quantitative easing’”. I don’t recall a press release in so many words or headlines to that effect, but I think it’s an open secret now. Surely we will be seeing the term “quantitative easing” a lot more often in financial headlines in the future, following in the footsteps of “CDO” and “auction-rate security” and other once-obscure terms.

The previous bailouts up to the $700 billion TARP were to be paid for by issuing debt, but the more recent ones (the Citigroup bailout) are in effect being paid for by printing money. I believe the argument is that the Fed’s scrapping of the “SFP bill program” (I freely admit I don’t know what this is) marked the transition to the new way of doing things.

More about SFP:

In a comment by “soxfan” in Brad Setser’s blog, winding down the SFP (Supplementary Financing Bill) program, which has now happened, is equated to net money creation, the printing of money. Another blogger posts on the same topic.

I suppose the only reason this isn’t leading to inflation is because none of the banks are lending all this freshly printed money, it’s just accumulating as reserves.

I’m not as knowledgeable as I’d wish, but is Macro Man correct in asserting that the Fed is still sterilizing their asset purchases?

As ndk said, falling rates and rising stock prices commonly occur at the same time. When long-term interest rates fall, present value of corporate earnings streams.

There is bound to be ambivalence about the dollar and Treasury securities as we wonder about when bailouts and stimulus packages will cease to be consumed in deleveraging.

The present value of earnings streams increases.

Yves,

As per the commods recovering before stocks in 1932-1934, there is some evidence that they were concurrent.

At the bottom of the depression in 1932, the RFC made lones of $175m to farmers in every state of the union through the Regional Ag Credit Corp.

But in Jesse H Jones view what really saved the farmer was the CCC or commodity credit corp (created Oct 16 1933) after Secretary Wallace’s missteps ~ Wallace had paid cotton farmers to destroy every third row of crop to reduce supply in order to prop up prices, but cotton farmers still brought in a bumper crop.

The cotton farmers faced the prospect of bringing to an already depressed market a huge new supply which would depress prices further.

Cotton at the time was selling for 6 to 9 cents a pound. Roosevelt told Jones “Jess, I want you to lend 10 cents a pound on cotton.” In essence, FDR was implementing his own TARP plan to artificially inflate/ or price fix farmers troubled assets.

Jesse H Jones for his part felt that teh contton was worth more than 10 cents a pound, on the premise “that to lend on that amount would be very helpful and entail no loss to the govt.”

Jones justification or rationale was that this would entail no loss to the govt.

Paulson’s TARP plan stole the same script…and we know now how that is playing out…inside two months $700b has exceeded $7.4T and rising….

“For long periods we carried a large paper loss on our farm-aid program” said Jones. “Whatever teh season, whatever the size of the crop or teh loan, the interest rate to the farmer remains the same 4% for several years. Then it was reduced to 3%.”

In 1934 FDR jumped the price of cotton to 12 cents. The cotton was stored in the 12 cent loan warehouses instead of taking them to market. effectively, the govt took over the supply of cotton production, and in doing so was able to manipulate the price of cotton higher.

The govt did not take over the supply of shares in the stock market in the 1930’s. From the foregoing we can surmise that commod prices began to rise due to govt controls. Stock prices began rising in 1932-1933 independent of and without gov’t control. Which came first the chicken or the egg is tough to say precisely from my anecdotal stories from Jesse H Jones.

@ ndk,

“I’m content to cower in economically insensitive commodities”

are you suffering a bit too much from “bunker mentality disorder?”

very funny stuff :-)

In your earlier post on quantitative easing, you mention that “The object of this exercise is to lower the long end of the yield curve, as Bernanke described in a paper on Japan.”

Perhaps the markets are simply deciding not to fight the Fed?

We have noted that the devaluation of the dollar (1934) was key to getting the stricken US back on its feet

In the China’s Smoot-Hawley article, it was noted that the pre-Depression US was similar to today’s China: a source of global manufacturing overcapacity and generator of large trade surpluses.

Would that imply that a devaluation of the Chinese yuan is in the cards? Or is that no longer applicable in a post-gold-standard world?

are you suffering a bit too much from “bunker mentality disorder?”

very funny stuff :-)

Probably, john, yes. :D

Would that imply that a devaluation of the Chinese yuan is in the cards? Or is that no longer applicable in a post-gold-standard world?

I don’t think China can devalue the yuan. It would be politically devastating.

There would be two immediate effects. The first is a dramatic decrease in export competitiveness, at a time when there are riots in toy factories and widespread closures of export firms.

The second is the write-down of the assets on the PBoC’s balance sheet by, say, 30%, which bankrupts it overnight. Remember that due to intervention and sterilization it holds foreign currency as assets, but RMB bonds as liabilities. It would need to be recapitalized through a direct injection from the government on the order of 25-30% of GDP. Imagine, as an American, being told by Hank Paulson or Tim Geithner that your income taxes would be increased by 5% to pay off bad investments in Russia or China, at the same time that you just lost your job…

My hunch was always that they would revalue quietly through inflation, and make up the loss on seigniorage. Now it’s a virtual lock.

ndk,

I think you misread the question. Devaluing the yuan would make exports more competitive and make the PBoC’s dollar assets worth more.

And that means we try to continue this game until it blows up so completely that the pieces cannot be reconstituted.

Sy Krass said…

Yves,

Everyone,

Isn’t it possible through massive infusions of money that a hyperinflationary burst could be starting even now (and if not, in the near future)? It seems that the rise over the last week in the stock market was a bit unusual; not just bouncing, but rocketing off of DOW7500, world stock markets going up AFTER a mulit-day well publicized terrorist attack. We could see 1,000 – 2,000 point melt ups weekly in the DOW over the next few months (Im not saying we will, just that its possible) on our way to a great inflation instead of deflation (which will end in the same way by the way).

I think you misread the question. Devaluing the yuan would make exports more competitive and make the PBoC’s dollar assets worth more.

And that means we try to continue this game until it blows up so completely that the pieces cannot be reconstituted.

You’re right, I did, sorry. Devaluation may very well happen. And yes, you’re right.

Isn’t it possible through massive infusions of money that a hyperinflationary burst could be starting even now (and if not, in the near future)?

Yes, that’s possible. There’s some inflection point out there, and we don’t know where it is. In my opinion, intervention up to that inflection point is probably deflationary, because of real interest rates rising due to risk premiums increasing and portfolio crowding out occurring. Beyond that point, monetary expansion suddenly gains traction, and we lack our normal tools to fight it.

The long end of the curve — 30 year at 3.45% — doesn’t seem to think we’re going to get to that point.

Am about to run to airport, so apologies for brevity, but I am pretty sure that in a recent post discussing the dollar, I put a link and a quote that despite the massive liquidity measures, M1 and MZM had barely grown, either 1% or under that but positive.

Now stocks may be discounting a return to normalcy, when we tear through that into nasty inflation, but we don’t appear to be there yet.

Also, some observers make a distinction between disinflation (rates declining but no apparent risk of price decreases in aggregate) which is helpful to asset values, versus deflation, which bad for asset values.

ndk –

I think you simply skipped a step in discussing the PBoC balance sheet. We’re really discussing two of the world’s economic powers engaging in competitive devaluation of their currency, both to further their economic interests. So China would respond to a perceived weakening of dollar assets sponsored by the US gov’t by a competitive weakening of the CNY.

I don’t know if there’s any research on the game theory involved in such a situation, but I will say that both country’s demographics make this a dangerous cocktail.

(I’m not the 2:39 anon.)

The 4:31 anon here again.

So the US financial system has experienced the loss of something like $1 trillion in equity (I know the reported amount is a few hundred bb south of that but I am addressing this in economic terms), which levered at a rate of 15-20x means the decrease in money supply of conservatively stated $15 trillion. In such a massive credit destruction process, how is the Fed promise of $7 trillion (with $3tr accomplished so far) supposed to lead to inflation. I’m not even factoring in the problems of international financial firms operating in the US into this back-of-the-envelope calculation.

So I am having a hard time understanding how the gov’t actions so far are supposed to lead to an inflationary surge, no matter what MZM does.

I don’t know if there’s any research on the game theory involved in such a situation, but I will say that both country’s demographics make this a dangerous cocktail.

If it comes down to the economic warfare scenario you describe, then I agree, this is plausible and dangerous to the global economy and possibly more. I guess we’re seeing the end result of China’s mercantilistic policies here. It’s not at all the form anyone expected, but it’s just as bad.

So I am having a hard time understanding how the gov’t actions so far are supposed to lead to an inflationary surge, no matter what MZM does.

You’re right, 4:31. Don’t forget the feedback from higher real interest rates into asset pricing, too. We can’t see much of this directly since broader money aggregates have been discontinued and a lot of this credit was outside the standard banking system anyway, but it’s all about the velocity and the multiplier, as you highlight.

They’d have to buy a lot, and I mean a LOT of assets to cause an inflationary surge. The government can do it, but I’m pretty sure they’d be insolvent if they did.

1. Money and credit aren’t the same thing. Dollar and Yen rising as carry trades unwind.

2. Fed buying long end attempting to jump start housing market.

3. 2 Won’t work because of 1, lack of quilfied buyers, oversupply and home prices which are still to high.

4. Commodities are falling because that was done on purpose by the banks who are trading against the hedgies while also crushing them by increasing margin requirements which also results in 1.

The car is going up the hill Benny is goosing the throtle while Hanky is leaning out the window pouring gas in the carburator but clutch is on fire and the car silp backwards. Watch out for that curve.

Did we really have disinflation after the commodity bubble this summer? There was a massive climb in inflationary-related cost of living impacts that drove people away from purchasing gas, food, homes, electronics and this was primarily the result of demand destruction related to deflation. Most of the hyperinflation prices for food have obviously not fallen, so in that regard, that might be disinflation, but how does one account for deflation then and the destruction of money?

FYI: Disinflation or even deflation on a monthly basis is fairly common (i.e. once or twice a year) Disinflation is less common on an annual basis and Deflation on an annual basis is extremely rare. The last time an annual inflation rate was negative, i.e. deflation occured, was in 1955 and then it only lasted for a brief period before prices began climbing again.

It is dangerous to try to rationalize the markets over the past six – seven years. The markets remain synthetic, with rogue investment cartels (unregulated hedge funds) being formed to achieve a common goal, with no oversite what so ever. I point to the oil bubble as exhibit A.

Remember, Chris Cox and his radical libertarians are still in control of the SEC, taking their cue from the likes of John Kyle, Mitch McConnell, John Boehner, and of course the GW handlers.

“export oriented industries (we have ceded entire industries, like shoe manufacturing, when we ought to have been able to retain some of it. However, executives at manufacturers have told me that Wall Street pushed hard for offshoring, seeing it as a plus for the bottom line,”

That’s right. These scumbags were off-shoring American industry that was actually more competitive in America. The re-election of GW in 2004 by states reliant on manufacturing blew me away. What a bunch of dumb f$#@ suckers we have become. Free trade, yea right.

… However, executives at manufacturers have told me that Wall Street pushed hard for offshoring, seeing it as a plus for the bottom line,”

This process began during the 1970s when, for example, U.S. steel producers such as Youngstown Sheet and Tube were rundown through disinvestment.

“since the Lykes Brothers took us

over in 1969,1970, 1971, we spent very little money on the upkeep of our mills…A lot of repairs that should have been done were not done… You just pushed it further and further and further until you got your very last ounce of steel out of each furnace and out of each pit.” (1989 Interview of former YST manager)

Same time, Banks like Mellon National were investing in Japan’s steel industry,,,

“Mellon National has poured about $20 million into Sumitomo Heavy Industries”… “They’re taking money out of this area and financing industries in other countries, paying workers there lower wages while putting people here out of work.” To complete the circle, U.S. Steel is investing in a new continuous caster (a highly efficient furnace that conserves energy) at its Fairfield, Alabama plant while Jones and Laughlin is putting in a caster at Indiana Harbor near Gary. Both companies are buying their casters from Sumitomo “to the tune of $65 million,” (MNM, June 1983)

No one looks at TIPS here? Look at the constant maturity real rates:

5 yr. 4.17% vs. 1.93% for nominal

10 yr. 2.6 % vs. 2.93% for nominal

The 5 yrs. are “upside down” and what’s happening next is uncertain.

Somewhere in this spirited thread, the specter of the Fed blowing itself up was raised.

While I have gleaned greatly from exchanges on economic theory as well as empiricism, I am posing a fundamental question. To allude to a Doors album (unlike Wall Street and its CDS dope, Morrison limited his risky addictions to himself and spared the US economy),

are we going to make it out of here alive?

3. Oil stocks rallying more than the S&P (28% versus 18%) when oil prices continue to weaken and heating oil looks primed to fall

Stock prices look ahead to future earnings. A few weeks ago, FT Alphaville noted that oil is in “super-contango”.

A wild card is if the Somali pirate situation gets further out of control, or Al Qaeda gains a safe haven in that country and a base for disrupting oil shipments to the West.

What is the end game here for the little guy? Lose your shirt in the stock market, lose your credit lines, rock bottom interest-bearing accounts in banks and T-bills. Yet in 2009 we will pay the same or more for food, property taxes, income taxes, heating bills, cooling bills, electricity, car insurance, college, traffic fines, etc. Can the lowered cost for a gallon of gasoline cover all of this?