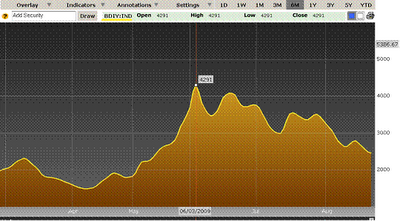

Some investors see the Baltic Dry Index, a proxy for the shipping rates for dry bulk cargoes, as an indicator of international trade activity. BDI is admittedly noisy, and so needs to be interpreted along with other information.

Chinese imports have been a driving factor in commodities demand, which drives the BDI. The price of imported iron ire has dropped below $100 a ton and may fall further. From Cajing.com (hat tip reader Michael):

The slump had sparked panic among iron ore traders, who might now rush to clear their stocks, which could drive prices even lower….

The price for 63 percent grade Indian fine ore was US$95 to US$97 per ton on August 24 on a cost and freight basis, down from US$110 per ton on August 10, according to industry consultancy Mysteel.

“The price drop was caused by an increase in steel and iron ore stocks at mills and sea ports and a decline in steel prices,” Xu Guangjian, analyst with the Umetal Research Institute….

The slump had sparked panic among iron ore traders, who might now rush to clear their stocks, which could drive prices even lower, he said.

Mysteel analyst Xu Xiangchun said iron ore prices were still high compared with revised steel prices.

“The steel price has fallen to its early July level, but iron ore is still US$20 a ton higher than it was in early July,” he said, adding that iron ore will likely fall to about US$80 a ton.

The total stock of iron ore in 19 major Chinese ports was almost 73 million tons as of August 22, up 48 million tons on a week earlier, according to Umetal.

Could we save billions by making our Toyota Prius's out of Iron instead of Steel? Thank you deflation!

Can anyone support/refute the notion that the Chinese are buying commodities like iron to get out of holding US dollars?

The only other reason I see for higher commodity pricing is the QE policies are driving commodity prices higher. Does that make any sense at all to others more knowledgeable?

48 million tons in a week? sorry, something wrong with those numbers. not even in China where everything you read is like contemplating stars could they unload that much in a week.

@asphaltjesus

The Baltic Index rose mostly because of:

A. Chinese Commodity Buying (due to their uber-relaxed lending standards that created a large speculative bubble. Buying physical commodities to replace dollar assets is no long term solution to diversifying away from the dollar. Actual commodities are not income producing assets and you cannot control the supply/demand as easily with already produced assets (as producers can always make more in high price environments); the correct strategy is to buy commodity producing assets, not the actual commodities.)

B. The clearing out of the supply of ships as forced liquidations into a dying marketplace has caused many older ships to go to the breakers. Supply is taking a short term hit, perhaps too great a hit.

Aside from NC, some dedicated steel/metal sites and a bbg article, i haven't seen this get much airplay (esp in msm)…can't imagine this decline is embedded in the western mkts…commods haven't budged since the bdi started tanking…given the bdi's relatively high correlation with commods over the last cycle maybe we're in for a correction?

Furthermore: "The reduction in steel prices during last 15 days has already wiped out more that half of the price increase since late March…The fall is attributed to several factors including increasing stocks, less demand and a subtle change of the policy tone. According to some traders, the demand is still low, specifically showing that the end users need of steel will be low."

On a more infuriating note:

"At the same time, the trade between the traders is less in the spot trading platform. The trading volumes of daily average rate of spot steel this week is less 8.9% than that in last week"

So the summer vacation in the hamptons has reached all the way to beijing. what a joke.

Here's a real time economic indicator for the United States similar to the Baltic Index, the Association of American Railroads (AAR) monthly carload traffic report. Here's the link to the latest report, and an excerpt–

http://www.aar.org/NewsAndEvents/PressReleases/2009/08/082109_AARAugustRTIRelease.aspx

WASHINGTON, D.C. – Aug. 21, 2009 – The Association of American Railroads (AAR) today reported that while there may be signs of incremental, month-to-month gains in carload traffic, year-over-year traffic remains down for July by 17.5 percent. According to AAR’s “Rail Time Indicators” report and video summary, intermodal rail traffic also remains down for July by 18 percent compared with the same month last year.

““While rail carloads are up incrementally in recent months, things have yet to fully rebound,” said AAR Senior Vice President John Gray. “Looking at the data, we can certainly say traffic seems to be heading in the right direction – but we still have a long, long way to go.”