Served by Jesse of Le Café Américain

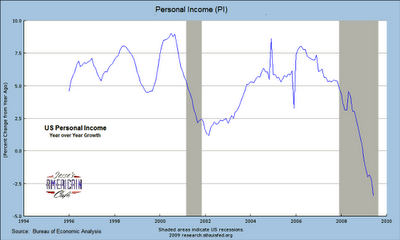

US Personal Income has taken its worst annual decline since 1950.

This is why it is an improbable fantasy to think that the consumer will be able to pull this economy out of recession using the normal ‘print and trickle down’ approach. In the 1950’s the solution was huge public works projects like the Interstate Highway System and of course the Korean War.

Until the median wage improves relative to the cost of living, there will be no recovery. And by cost of living we do not mean the chimerical US Consumer Price Index.

The classic Austrian prescription is to allow prices to decline until the median wage becomes adequate. Given the risk of a deflationary wage-price spiral, which is desired by no one except for the cash rich, the political risks of such an approach are enormous.

On paper it is obvious that a market can ‘clear’ at a variety of levels, if wages and prices are allowed to move freely. After all, if profits are diminished, income can obviously be diminished by a proportional amount, and nothing has really changed in terms of viable consumption.

The Supply side idealists (cash rich bosses, Austrians, neo-liberal, monetarist, and deflationist theorists) would like to see this happen at a lower level through a deflationary spiral. The Keynesians and neo-classicals wish to see it driven through the Demand side, with higher wages rising to meet the demands of profit in an inflationary expansion. Both believe that market forces alone can achieve this equilibrium. Across both groups runs a sub-category of statism vs. individualism.

Unfortunately both groups are wrong.

Both approaches require an ideal, almost frictionless, objectively rational, and honest economy in order to succeed. The Keynesians have a bit of an edge in this, because it is easier to control inflation than deflation in a fiat regime, and the natural growth of inflation tends to satiate the impulse to greed. They don’t care if they can buy more as long as they can say they HAVE more. People tend to be irrational, and there is a percentage of the population that is irrationally greedy and obsessively rapacious. People are not naturally ‘good.’

The greatest flaw in the many studies that come from each of the schools to prove their point is the brutal way in which they flatten the reality of the markets and make assumptions to allow their equations and analysis to ‘work.’ They spend most of their energy showing while the ‘other school’ is a group of ignorant fools, doomed to ignominious failure, in an atmosphere reminiscent of a university departmental meeting.

This has quietly scandalized those from other scientific disciplines who review the work of many of the leading economists. Benoit Mandelbrot was poking enormous holes in the work of the leading economists long before Nassim Taleb made it more widely known. The ugly truth is that economics is a science in the way that medicine was a profession while it still used leeches to balance a person’s vapours. Yes, some are always better than others, and certainly more entertaining, but they all tended to kill their patients.

The most intractable part of the current financial crisis, and the ongoing problem of the US economy is the huge tax which is levied on the American public by its corporations, primarily in the financial and health care sectors, and a political system based on lobbyists and their campaign contributions.

There are hidden taxes and impediments to ‘free trade’ at every turn. The ugly truth is that capitalism-in-practice hates free markets, always seeking to overturn the rules and impose oligopoly if not outright monopoly through barriers to entry, manipulation of the political process, distortion of regulation, predatory pricing, brute force, and the usual slate of anti-trust practices.

Some of these ‘hidden taxes’ are the bonuses on Wall Street which require an increasing percentage of the financial ‘action.’ The credit cards fees and penalties levied by banks to support profits in a contracting economy. The Sales General & Administrative portion of the Income Statements of the pharmaceutical industry which only American consumers seem willing to pay. A health care system which is a monument to overspending, outrageous pricing, and greed.

The notion that “if only government would not regulate markets at all everything would be fine” is a variation of Rousseau’s romantic notion of the noble savage which no one believes except those who wish to continue to act like savages, and those who get no closer to the real work of an economy than their textbooks. Economic Darwinism works primarily to the advantage of the sharks. Anyone who believes that ‘no regulations’ works well has never driven on a modern highway at peak periods.

Yes, a certain portion of the population are adult, and generally good and fair. But there is a percentage of the population that is not. And since the 1980’s they have been encouraged by the culture of relativism and greed to ‘express themselves’ and so they have, with a vengeance.

Discussion rarely proceeds very far because of the dialectical nature of American thought. Both extremes are wrong, but they seem to content to merely bash each other, pointing out their errors, while repeating the same mistakes over and again.

The engineering of the economy has become married to the engineering of the political dialogue by the corporate media and their political parties. “The engineering of consent is the very essence of the democratic process, the freedom to persuade and suggest.” Edward L. Bernays 1947

The condition of the American economy is strikingly similar to the Soviet state economy of the last two decades of the 20th century. People are trying to sustain a system “as is” that is based on bad assumptions, unworkable constructions, conflicting objectives, and a flagging empire laced heavily with elitist fraud and corruption. The primary difference is that the US has a bigger gun and its hand is in more people’s pockets with the dollar as the world’s reserve currency. But the comparison seems to indicate that the economy must indeed fail first, before genuine change can begin, because the familiar ideology and practices must clearly fail before they can recede sufficiently to make room for new ways and reforms.

A new school of Economics will rise out of the ashes of the failure of the American economy as happened after the Great Depression. Let us hope that it is better than what we have today.

In the short term, what does all this mean?

There is NO system that will work without substantial, continuing effort, and continual adaptation and commitment to a certain set of goals that are more about ‘ends’ than ideological process.

Because our system has been abused for so long, and is so distorted and imbalanced and dominated by a relatively few organizations beholden to a self-serving status quo, reform is not an afterthought, it is the sine qua non.

It means that until the banks are restrained, and the financial system is reformed, and balance is restored, there can be no sustained recovery.

So, being a reader of many of the recognized blogs, such as Mish, yourself, Denninger, ZH etc., I broadly subscribe to the premise that we will be in steady deflation for an extended period.

Ok! What factors will mean that we stay in this mode, and what factors will kick us out of it?

– Continued low interest rates will help to keep prices low.

– Continued pressure on the banks will restrain industry from expanding.

– Continued high unemployment will pressure consumption.

– Continued low growth in the world will restrain trade growth / commodity inflation.

– Low spending in the US will support the USD / treasuries.

This is a fairly unless post. To recap, everybody is wrong because the system is too screwed up by corruption to work. Is this intended to add to a larger conversation or simply whine?

Jesse, you are a master of the pessimistic reality check. Thanks.

I would like to point out that this deflationary spiral would matter less if there were some indication of a vision on the part of American business and government to use this lower cost structure to rebuild after decades of underinvestment relative to the rest of the world. Sadly, there is no indication that this is on anyone's radar in Washington.

Politically, I think people would be willing to take quite a bit of pain if there was a vision for how we come out of this stronger and richer down the road. Absent that it is every man and woman for themselves, bankers and oligarchs first and foremost. This is a recipe for disaster, fiscally and politically.

By way of comparison, read what the German government is saying and doing to dig that country from out of its hole. They aren't perfect, by any means. But they are devoting as much, if not more attention to the stability of the industrial sector as to the banking sector. Again, the proper role of the banking sector is as the handmade to the "real" economy, the economy that provides jobs and trades with other countries. A full year into this crisis no one even talks about the "real" economy.

Now tell me what's wrong with this picture?

nice piece

To anon 1:44

The first thing is to understand you have a problem, then and only then can you fix it.

It's a little bit more mature than "Morning in America" and untethered optimism, and it might even let us get talking about real solutions..errrr… though maybe that's untethered optimism.

If it makes you think, to question your assumptions, to be skeptical of 'authorities,' to view the solutions being marketed by well-funded public relations campaigns, to look at the facts as they are, then the effort is not in vain.

If it cannot, then be wary of the next great leader who approaches you with the final, perfect solution.

This is why I view the 'heat' that Obama is taking to be most healthy for now, as long as it remains peaceful and constructive.

"The ugly truth is that American capitalism hates free markets, always seeking to overturn the rules and impose oligopoly if not outright monopoly through barriers to entry, manipulation of the political process, distortion of regulation, predatory pricing, brute force, and the usual slate of anti-trust practices."

Relative to our trading partners, i couldn't disagree more. see the chart halfway down this post. if anything, the US is engaged in "unilateral" free trade.

MXQ:

I am changing that to 'capitalists' to take out the implication that I am referring to US trade relations, which I am not.

There is no doubt that mercantilism is broadly being used by our trading partners particularly in the Asian command economies.

But make NO mistakes, it happens because it benefits US and multinational corporations. If you understand that, then you understand what is happening.

Post Keynesian economists completely refute the basis of the mainstream economics which guide policy both in the U.S. and in the rest of the world. However, there is definitely a convergence of economic thought between Paul Krugman’s economics, Post Keynesian economists and the specialized media (see here and here). Keynes's and Minsky's economics provide the basis for the next generation of economic models.

Read more here: http://neweconomicperspectives.blogspot.com/2009/08/keyness-relevance-and-krugmans.html

Jonathan,

An interesting and somewhat broadly held set of view within certain circles.

Let's take them one at a time.

Continued low interest rates will help to keep prices low. (as long as the Fed can monetize the Treasury Debt which is what they doing, directly and indirectly. Also deals being made with foreign entities that disadvantage American industry).

– Continued pressure on the banks will restrain industry from expanding (they will expand. They will expand into areas non-productive for the real economy, e.g. Goldman Sachs.)

Continued high unemployment will pressure consumption (Yes. And if it continues, it will pressure a lot of other things in the fabric of society.)

Continued low growth in the world will restrain trade growth / commodity inflation (it will force changes, and foster new relationships that will destabilize the status quo.)

– Low spending in the US will support the USD / treasuries (oh really, and when does this 'low spending' show up? The US economy is hanging by a thread. Those who are of the persusasin that 'implosion is good' are generally those who think it will not affect, will benefit, them. And they are the cash rich. ONe might call it the 'Tsar Nicholas' school of socioeconomics).

Quite so. A czar-inspired school of economics is to be expected from a government containing so many of them.

The most intractable part of the current financial crisis, and the ongoing problem of the US economy is the huge tax which is levied on the American public by its corporations, primarily in the financial and health care sectors, and a political system based on lobbyists and their campaign contributions.

That's the right way to put it. It's self-defeating the way reformers allow the enemy to monopolize the word "tax" and apply it only to government levees.

Clearly the most onerous, worthless, and costly taxes by far are the rents collected by feudal corporate parasites.

I would recommend that people consistently see and label such unnecessary levees as neo-medieval privatized taxes.

We should also see the donations of wealthy individual and corporate donors, and the salaries of lobbyists, as the equivalent of taxes upon us, since every cent of that (and with one heckuva multiplier) will be mined out of us to grotesquely recompense that donor.

When you think of it that way, getting private money completely out of elections and replacing it with public funding sounds like quite a bargain.

It would certainly cost FAR less in taxes.

"Both extremes are wrong, but they seem to content to merely bash each other, pointing out their errors, while repeating the same mistakes over and again."

+1.

Though I would say that this is much more true of politics than economics. It makes me sick to read about the nonsense that passes for real debate on, for instance, health care reform.

However, in the economic sphere, the evidence seems overwhelming that the Austrian school (with refinements) offers by far the best foundation for a future economic system. Keynesianism, Marxism etc are total dead-ends.

How to get from here to there is another question – but the difficulties here are a function of politics rather than our lack of knowledge about the economic side of things. No politician is willing to say that living standards have to fall, or that a recession is necessary etc. and they are struggling mightily against the forces of reality. The end result is going to be all-around stagnation.

jesse-

Good read.

Implicit in the piece is a need to get rid of *all* ideology when dealing with policy. We shouldn't favor one versus the other, unless it has been empirically proven to be true.

Most of the people who "Get it" aren't part of any large agenda (Bair, Taleb, Roubini, Ritholtz, Whalen, Henry Liu, etc.) Though the people who got things dead wrong (Kudlow, CNBC, policy wonks, & hyperinflationists to a lesser extent) were deeply entrenched in the supply-side/austrian/marxist/keynes/neoclassical nonsense.

We need people who are open, flexible, and willing to adapt. The most striking thing to me about this situation is how *consistently* people choose to ignore the facts in front of them.

And no matter what the situation is, the ideologues always know the source of the problem, even if it has yet to occur, irrespective of what the problem may be.

Keynsian:

"The problem is you didn't spend enough"

Supply-side:

"The problem is you didn't cut taxes enough."

Austrian:

"The problem is interest rates are too low."

Free-market/Chicago School:

"The problem is the gov't is too involved."

You can't solve a problem if you're spitting out the answer before it has been identified. Yet these idiots do this daily.

This was a well written and informative post. Occams razor.

Ideology is such a destructive force, and so many get pulled into its clutches.

That Bill Black video posted the other day was another example of occams razor getting to the heart of things. The most powerful comment in that video was him expressing disappointment that the Obama administration has not contacted anyone from his group of very successful prosecutors. They obviously have an excellent grip on what has taken place, and over 800 prosecutions of financial criminal wrongdoing under their belts.

Forget regulatory capture; we are under organized criminal capture. We could RICO all the ratings agencies for starters.

What has been lost is social concern and political pragmatism. One can see it in dog eat dog society, in success at any cost, in bimodal political opinion, and in the disintegration of discourse into lies, shouts, and parades. This is to be expected in societies with declining living standards. There may be a market for a new progressivism just below the surface.

"The ugly truth is that economics is a science in the way that medicine was a profession while it still used leeches to balance a person's vapours. Yes, some are always better than others, and certainly more entertaining, but they all tended to kill their patients."

Hopefully this line of thinking about economics will be one of the major benefits of this recession not overly hopeful but it may at least be a starting point.

I think the idea that Austrians are looking to "chain-saw" regulation is misleading.

The uniting principle of Austrian economics is simple: Don't artificially goose markets, as it causes bubbles and inefficiencies.

If you are going to "debunk" Austrian economics, disprove that. Rothbard blamed the Great Depression on loose money, not regulation.

Likewise, loose money under Greenspan led to our current mess. When people have no "skin" in the game, and can lend money recklessly, it causes problems. Every single time.

Matt — Please post sources for your "overwhelming" evidence. I'm intrigued.

Don't tell us what we ought to have done then. Or what Rothbard said in the 1930's. What should we do now?

And from everything I have read, and I have read them all but not everything, they are liquidationists, believers in natural markets.

And I am more sympathetic that you might imagine to that point of view, but they are still wrong, and dangerously cult like now that all their leaders seem to be dead, and quoted more like scripture than a dynamic school of thought.

Intellectually easy and useless. Truly. Economics is a science in which there are tools that sum up to this: 1) people (and firms and all the other "economic agents") respond to incentives; 2) scarcity, however relative and philosophically debateable, is indeed a harsh reality that ALL living beings are subjected to; 3) when you are doing, you can't do something elese (opportunity cost); 4 there are overriding principles that can be used to represent these basic realities.

This post seems to criticize no. 4 : the tools used to represent reality and the wisdom we extract from what these tools tell us.

I will say that the theoretical framework of economics is MUCH richer than most (including the post author) seem to appreciate. The fact that humans are a major f**** up, that societies wage wars, that famine exists, etc. has NOTHING to do with the economics profession. The world is NOT worse than it used to be. Those doubting this have severe hole in their history knowledge… I mean BEFORE WWII… yes, those 80 000 years in whgich modern humans existed pretty much as they are now (in terms of at-birth predispositions and potential).

This post goes in the slot of all those others who just bitch at everything so much that they are un-critisizeable, as they will simply put you in a "box" and tell you "oh you are so … (monetarist, keynesian, marxist, etc.). Cheap and waste of time and energy.

PascalB

Matt,

The Austrian school has possibilities, but it really is not a vibrant school of thought. It is like Latin. And I learned Latin, and enjoyed it, but I don't use it very often.

I have read the main books. I was on the Austrian chat boards, long before it was 'cool.'

It is very stuck on ideology and dogma in my opinion, which often happens to a school that has been out of favor for a long time.

The Austrian School is going to need a serious update and new and more dynamic leadership that does not relish its eccentric and exclusive persona so deeply, and quoting Rothbard and von Mises like St. Paul, seeking to end all discussions.

I would hazard a guess that 90% of all those who identify themselves as Austrians are really libertarians at heart who dislike the Fed, and have the unifying principle that the government ought not to 'goose the markets.'

That is a bit narrow for a school of thought.

That may seem harsh, but that's how I see it.

The Austrians are more right than you suggest. They reject the very notion that anybody's equations and analysis, not even their own, can capture the complexity of the economy. Nobody's smart enough to understand it. Hence we need to minimize interference in the economy, and abolish the notion that governments can manage the economy. A few simple principles are all we can reliably use.

The most important one is how cheap money corrupts the economy. And a lot of what we've seen can be directly traced to that one cause. What most non-Austrians miss is just how destructive this Fed injected money is. It corrupts the entire economy, and the only real solution is painful and politically impossible. Hence we're doomed to a slow decay.

Your spile, while interesting and worth the time, show a central flaw in the application of economic analysis by most these days. The current results or ongoing status of the economy, just because someone says they are using this or that type of economic thesis, has little to do with the validation of that particular economic thesis cited.

To the best I can figure out the current economy is working to an absolutely classic Keynesian script, especially if parsed by Minsky. It should be pointed out that little of the current adminstration response to this crisis has been Keynesian so only the downfall should be considered in validating any economic school -and that of course is Keynes a la Minsky.

While Democrats like to cite Keynes and are suspected of being Keynesian, the only adminstrations that have provided classic Keynesian policy are Eisenhower, Nixon, and Reagan (and maybe Clinton pops in a bit). Certainly what Kennedy, LBJ, and Carter did was not Keynesian – it was power politics and statist policy. So too the current administration.

If anything the last 2 years have been a complete vindication and "proof' of Minskian reading of Keynes. The drop in personal income, the increase in savings, the drop in inflation and so on are working absolutely true to script. So as soon as we see some honest and real public sector investment (notice I do not say power politics transfer payments) we should see the Keynesian results.

So what would Minsky do?

My thesis is that all the economic schools are blinded by ideology and basically full of it.

To say that they Keynesians are full of it is predictable, but a bit in the vein of what I thought I was describing as a major shortcoming.

This:

"The most intractable part of the current financial crisis, and the ongoing problem of the US economy is the huge tax which is levied on the American public by its corporations, primarily in the financial and health care sectors, and a political system based on lobbyists and their campaign contributions"

well said and to the point.

As to 'whiners', until certain problems are addressed, there is a palatable need for complaints…and it is nice occasionally to read a unsanctioned take/summary on current events and yes, particularly if you share the sentiment (or logic) but haven't found vocabulary to match.

On a side note, it has been noted that China has a particularly effective Capitalistic superstructure, somewhat ironic in that it has a Communist political apparatus (with its abilities of centralized action and distribution of wealth). Formally the enemy of capital, Communistic Capitalism is now the beast not trifled with on the 'free market' plane.

BTW I don't want it to seem like I am picking on Minsky, or the Austrians. Their supporters are just vocal and spend a lot of time on the web since they tend to lack meaningful employment at the current time. (LOL sorry I could not resist).

Lots of people including myself predicted this situation and Greenspan's policies would end in tears. They really did. It was not that hard, especially if you were an outsider.

But, for example, what would the Austrian school do as opposed to the neo-classical school like that of Michael Hudson?

And not to be quibbling but I would hardly characterize this crew under Obama as really Keynesian at heart. Certainly not Bernanke.

We are all Keynesians after the Great Depression, because doing SOMETHING to alleviate the public suffering through assistance and spending is a generally accepted thing to do in a modern society but it hardly makes one a real 'keynesian.'

But as I said, the thing the schools do best is bash each other on theory and snipe.

What would Minsky do now. What would Rothbard do now.

Until they can articulate that intelligently, who the heck is going to take an Austrian on as a economic consultant and not doom themselves to obscurity?

Kucinich had Michael Hudson, who is a neo-classic.

Personally I think the Obama crew are all monetarists with a tinge of crony capitalism, but Geithner is no economist and is probably just a crony.

When Bill Gates came back from the People's Republic of China and said, "This is how capitalism ought to work" I wanted to slap him.

But the sad truth is, that is how a lot of capitalists I know like to think. They really do. They have the Tsar Nicholas syndrome or something.

"And I am more sympathetic that you might imagine to that point of view"

Jesse, I read your blog daily, and suspected you were Austrian-leaning, which is why I was surprised. Sorry, didn't mean to come off as an ass. I'm a big fan of your stuff (financial jenga 10/10).

As to now… Damn, was hoping you wouldn't ask that. The bubble may have inflated too far to go cold-turkey without chaos ensuing. And maybe that was part of your point.

Let more bad banks fail, raise rates slowly, and stop pumping so much money into the system. Allow some deflation to happen as we transition to a more free-market system without a banking cartel in charge of our central bank.

Saying Austrian economics is wrong because their solution doesn't perfectly fix this seems unjust.

["The fact that humans are a major f**** up, that societies wage wars, that famine exists, etc. has NOTHING to do with the economics profession."]

This is perhaps the least-truthy thing I have ever read here. Economics is deeply mired in politics, oligarchy and corporatism. Humans are not f*** ups, humans are just trying to survive the constant onslaught of corporate abuse and are failing. More violence has been done to workers, wages, information flow and the entire middle class for the purpose of economic growth — and according to sound economic theory — than probably for any other reason humans do anything to each other, the possible exception being the call to blind hatred.

Economics is not a science. It has no scientific basis and moves humanity neither forward nor even sideways, but backwards toward Feudalism. Economics focuses the political mind on finances above matters of greater import — such as human dignity and environmental justice — and makes a mockery of 3000 years of human accomplishment by forcing otherwise intelligent people to come up with the ROI in everything including the natural right to clean air and fresh water.

Economists are most useful as fertilizer. Their craft as a target for comedy.

cougar

I am surprised that neoliberals and Keynesians get lumped together considering that neoliberals are more deregulation, monetarist/market-oriented and the two schools are fundamentally opposed.

"Until the median wage improves relative to the cost of living, there will be no recovery" This is true but your idea that the various schools all have ways of getting you there isn't. If prices have to deflate to chase declining wages what you have described is not an equilibrium but a deflationary spiral. Monetarism was a prime instigator of this crisis. Sure some can argue that the monetary supply could have been handled differently but the point is that given monetary goals what was done was consistent with them. The monetarists at the Fed simply missed or ignored what was happening in the rest of the economy. Subsequently, monetarist efforts to control the fallout through quantitative easing have shown to be ineffective. Monetarism in other words failed to stop or reverse this crisis.

In this instance, I am a Keynesian. The only way to avoid a deflationary spiral is to increase demand. And no, Keynes is not about rapacity and people wanting more. It is about setting people who don't have jobs back to work because they will spend their earnings and bring demand back into balance with supply or as you formulate it wages back in line with cost of living. That this will also restore some of their self-respect and increase social stability are uneconomic add ons which often gets lost in these types of discussions but good reasons to pursue this course. And who but the government has the resources this operation. Yes, the banks need reform. I would turn them into strictly regulated public utilities engaged in plain vanilla banking. But reform and restraint of the banking system are not going to put Americans back to work. Private enterprise can't do it either. That leaves the government and it can. Whether it will or not captured and controlled as it currently is is an entirely different question.

There are problems with pragmatism. An ideology must, as a minimum, reconcile its concepts in a logical format. Thus an idealogy can't believe something can be looking left and right at the same time. Most ideological disagreements I see are over the initial assumptions from which the ideology is derived, not from the logic that flows from it.

Pragmatism does not have to be logical or reconcile its different ideas against one another. It is simply a collection of different ideas that don't necessarily make sense with one another. A pragmatic outcome can be to dig a ditch and then fill it back up again, as long as the ditch digging and ditch filling lobbies are both satisfied.

In American politics pragmatism means the way of least resistance. Congress is not an entity but a collection of individuals. It is pragmatic for each of those individuals to do what is best for themselves, and most "pragmatic" bills that come out of Washington amount to 1,000 page special interest grab fests. All the special interests are happy getting their cut, but the the whole of the bill is less then the sum of its parts. That's how we end up with financial bailouts without financial limitations, or health care reform without any actual reform or cost control.

Without overarching principals, goals, or values (ideology) your just left with a bunch of squabbling children trying to get their cut whatever way they can, because its the most pragmatic course of action for themselves.

cougar: you might want to give a call to the Queen of England. I think you 2 have something in common. In the mean time, I will go fertilize my lawn with my theories :)

Jesse,

Claiming that the Austrian school is political in nature is absurd. One of the core tenets of its analytical framework, praxeology, is that its economists ask whether the policies have their intended effects. (They do not look at whether a policy should be implemented for value-based reasons) And unsurprisingly, most of the U.S. Congress's "work" for the past century has not.

"The Austrian School is going to need a serious update"

The Austrian school operates under the principles of deductive reasoning, while the other schools use inductive reasoning. Unless logical reasoning somehow changes, the Austrian school is locked in. However, the other schools can arrive at different conclusions using all the new data available – which also enabled them to make the "Black Swan" error that Taleb spoke of. (Interestingly, Hayek addressed the problems of trying to address economics as a science in his Nobel speech.) The new school you speak of can incorporate the data from 2007-2009…

"Until they can articulate that intelligently, who the heck is going to take an Austrian on as a economic consultant and not doom themselves to obscurity?"

As mentioned above, in our age of data, a corporation or government is looking to use inductive reasoning, which eliminates the Austrian school right off the bat. Telling them that you won't use statistics because it might arrive at the wrong conclusion guarantees you'll join part of the unemployed.

I highly encourage everyone to head to Wikipedia, since there are excellent write-ups on all the schools of thought.

Marxist are supply side idealists?

Now . . . that's a first.

Jesse,

I've read some of Michael Hudson's stuff, but I never suspected he was a neoclassical. I thought he was more old school Classical, with some Marxism thrown in.

Also, what's your opinion of Henry C.K. Liu? He seems to have lots of respect for his mysterious underexposure along with the long pieces he writes. I've been reading him for a while, and he appears to have extensive knowledge of economic history, but lately I've become more skeptical of his ideas. Along with outright Marxist ideas, he seems to revive old inflationist ideas i.e. Major Douglas, Ezra Pound's "Social Credit", free silver, etc. He calls his version "Sovereign Credit" and it's basically the idea that since we have fiat currency the government can through inflatino solve all kinds of economic problems. Warren Mosler, and some Kansas City economists promote this as well.

@Matt:

"No politician is willing to say that living standards have to fall, or that a recession is necessary etc."

I'm OK with a shared living standard falling, but it must be SHARED by the top – the very thieves that are even now robbing us blind.

What I will NOT stand for is seeing the living standards of "the little people" falling while the top remains fully gilded and comfy. One way or another, the pain WILL be shared.

I generally agree that economists have to become more practical and empirical rather than theoretical, but we are never going to seperate politics from economics and finance. In fact, it is the notion that economics can be some pure form of science (when clearly it is not) and so can somehow be divorced from the social habitat of mankind that currently makes a mockery of both economics and politics. This notion engenders the idea that an elite, comprised of those who by dint of their ability to create complex economic theories or the shere capacity to accumulate capital, deserve the right to excercise almost complete control of both politics and economics without attention to necessary social checks and balances.

As democracy was (and hypothetically still is) a perceived advancement of humanity, however imperfect, which endeavours to engage all adults in the polity of the state, equally economics should be geared towards engaging all adults in the rational production and distribution of wealth engendering a broader sense of achievement and opportunity. The goals of economics determine the outcomes. The goals will have to change with circumstance. Failing this, history in its broad sweep informs us that change will occur by more tumultuous means. There seems to be an inherent human gravity which when pulled out of alignment will find the means to realign itself.

The simple fact of the matter is that humanity has the technological means of survival but increasingly lacks the vision, and seems to have abandoned any moral compass to achieve the further advancement in our shared lot.

A common theme runs through Marxism to Kenysian to Austrian schools of thought. This theme is the freedom of humanity – whether the freedom from want and fear or the freedom to pursue and achieve one's goals unfettered by 'artifical' constraints. Never before has humanity been so capable of creating wealth and huge liquidity while at the same time somehow being able to marginalise more and more wage earners and curtailing individual initiative. The financial freedom of the relatively few, however meritorious their individual accomplishments, cannot be sustained. (And we can also increasingly question the effficacy of the meritorious these days given current circumstances. Maybe, just maybe, they are as frail and full of foibles as the rest of humanity.)

Until we realise that humanity isn't made up of machines nor computer programmed actors, but comprised of quirky and often non-rational economic beings, and deal with fact in our polity and economic anlysis we won't be moving forward. Stagnation and common complacency of polity and economics, however, is not a long term option.

This is the biggest piece of nonsense in the equation: "The Keynesians have a bit of an edge in this, because it is easier to control inflation than deflation in a fiat regime, and the natural growth of inflation tends to satiate the impulse to greed".

This is the mistake that most make, that inflation is controllable. It is the inflation that has set up this situation of deflation. In fact, I believe today that Paul Volker was more responsible for this bubble than anyone on the horizion, including Greenspan. It was the hiking of interest on the monetary base, something that had to expand to avoid collapse at a minimum at the rate of interest that was most inflationary of all. The run in prices on consumer goods, the run in government spending through Reagan cutting off the revenue and reforming the tax code had run their course. But, the initiation of massive interest charges created a new animal, income expectations off money held in saving.

Few understand what a credit bubble is, or so it appears from what I can see in the mainstream media. Doug Noland of Prudent Bear has been on this subject that no one saw coming since beforeI began reading his weekly posts in 2001. The deflation happens, not because there isn't inflation, but because the bubble has to consume more and credit to remain intact. Thus, the fallacy that inflation can be controlled is just that, fallacy. This is how inflation is controlled, collapse.

Jesse,

I don't have anything to contribute to this discussion at the moment,but since you don't let us post on your site I would like to take the opportunity to tell you how much I love your blog.

My son and I sat down and shared the entirety of "The great American Bank Robbery" together and learned a lot.

I wish I could put it better, but there is a humanism in your perspective that is lacking most other places and it's an extremely important contribution.

Thanks

I have been reading the blogs of Simon Johnson, Paul Krugman, and Brad DeLong for close to a year now and I'm having a hard time reconciling their views with your post. I certainly don't see the "blinded by ideology" you speak of. Mac Robertson's comment on Minsky helps show the fatal flaw in your "blinded by ideology" premise — and that is what if one of the ideologies is actually correct? Are the followers of said ideology "blinded by it"?

Hugh:

The "deflationary spiral" is largely a myth (and where do they expect the spiral to end? In the Stone Age?). There was a massive recession in 1920 that saw prices fall by something like 30%… and then, even without the government to rescue us, we were off to the Roaring Twenties. People don't (indeed, can't) put off purchases indefinitely simply because prices are falling, any more than rising prices cause people to spend every cent of their income. It took nearly 30 years of tireless effort by the government and the finance industry to drive the savings rate negative.

Keynesian pump-priming also does not work. Government spending can create artificial demand or bring genuine demand forward, only for the duration of the spending, and only at the expense of growth in general by raising taxes (or in the case of borrowing, at the expense of future growth). If stimulus spending is to have a meaningful effect on employment, GDP growth, etc. then the withdrawal of the spending will also have a meaningful effect, in a negative sense.

In recent years we've tried to get around this by using credit expansion and inflation. Those days have now come to an end. Not that the government has recognized it, of course, and they might never do so. Japan's been hammering away with Keynesian countercyclical policies for twenty years, with nothing to show for ut.

Most of these arguments are meaningless, though not quite for the reason the OP said.

Here's the basic history of civilization:

For thousands of years it went along at pretty much the same technological level and with the same basic kinds of economy.

(And there was no such thing as economic ideology.)

Then c.300 years ago cheap plentiful fossil fuels powered this surge in material development.

We now reach Peak Oil, cheap plentiful energy is over, and the material surge will unwind until civilization descends to its pre-fossil level, and continue from there, as it had before. The oil civilization was a blip.

"Economics" was only a silly parlor game of arguing about the flows of oil-generated money, "growth" was just a nasty oil-provided outlet for greed and violence.

Think of the whole thing as one big oil-blown bubble, and now it's popping.

It seems to me every economic ideology ignores one key factor, that being people. Every ideology is implemented by people and people are susceptible to greed, corruption, selfishness and many other characteristics of human nature. Perhaps many economic ideologies are capable of working if only we could implement each with unbiased robots running the show. Only when the people at the top running the show can be regulated and prosecuted do we stand any chance of surviving as a society. It simply comes down to the question "who is regulating the regulators?" The American people have been asleep at the wheel far too long.

"monte carlo modeling" is the only contribution to modern economics in the past 100 years that holds any water.

In the end it all comes down to the luck of the draw, we just don't know how many cards are in the deck.

That's progress.

All I know is what I am seeing..

The "gamers" "scammers" win hands down..

1. Bulk reo sold to bank buddy's for next to nothing..

2. Above flip in 10 days for double the amount to a low-income Hud assistance family

3. Realtor making easy money still with bidding wars and foreclosures held off the market and complaining about low assessments and pressuring the govt to overturn HVcc so we can sell some overpriced low end home to someone with a low fica backed by the government..

4. Mortgage brokers constantly reaching around the rules to push fha loans and no down payment loans out the door to buy the flips. (visit a mortgage broker forum and get the real story.)

5. Credit Card practices are just downright embarrassing for this country.. No recapture provisions coming out of congress

6. Wall Street and the rest paying huge bonuses..

7.. No help for small business or independent contractors. No unemployment benefits nor are we counted in the ue numbers..

8 People not paying mortgages yet living for free up to a year or so.

Moral Hazard is deeply embedded in our society I don't see where we can turn back.. You better believe I will walk over my neighbor at any moment to make a dollar to feed my family.. Anything and everything goes and if you get caught then cry victim..

"It seems to me every economic ideology ignores one key factor, that being people."

Let me point you to the first paragraph, here (http://mises.org/etexts/austrian.asp):

"The story of the Austrian School begins in the fifteenth century, when the followers of St. Thomas Aquinas, writing and teaching at the University of Salamanca in Spain, sought to explain the full range of human action and social organization."

Shame the article is couched in terms of economic schools, because it pinpoints the central fact, parasitic commercial corruption of the state. And we all know how to deal with corruption: you can deal with it in the authoritarian way, by making dreadful high-profile examples of some, or you can deal with in the IMF's gentler way. There's a reason why IMF guys like Simon Johnson are the only ones making sense – they clean up bent benighted cesspools for a living. There's a reason why Johnson is being ignored – our betters don't want to think that they've degenerated to the condition of neo-colonial African hellholes. Once we've accepted that's happened to us, the way ahead is clear. Anticorruption is simple. Simple, not fun.

When I started to read Yves's blog about 2 years ago I valued her postings because of the sober analytical thinking in it.

Not much to notice about any deeper analysis in this post. Just some pointless, general ranting w/o any specific criticism of the various groups of theorists. Such generalized criticism can't be disproven, since there isn't anything specific to disprove. It itself is just metaphysics.

Marxists are allegedly supply-side idealists, according to Jesse. That's news to me. Neither are they demand-side economists. As far as I know, theorists who lean toward the Marxian analysis (like I do, although I am not an economist by profession.) criticize the economic system that is based on capital accumulation on a much more fundamental level, on the level of the inherent contradictions of capital accumulation that lead to cyclical and generalized crises of capitalism. They are not so much about finding policy choices with which capitalist economy could be engineered and improved best. Neither from the demand side, nor from the supply side. That distinguishes Marxian economists from the other groups.

As for debt deflation. I don't think it is so much about wanting it. It's more about it that is inevitable. The world is sitting on mountains of debt. Some on higher ones, some on smaller ones. US is sitting on the highest one. The total debt in the US-markets (private, companies, and government debt all together) to US GDP ratio was at about 375% as of Q1 2009, a new record and far higher than the debt bubble before and during the Great Depression, which deflated back then.

Assuming that 75% of the about 50 trillion US-dollars of debt is debt of the net debtors and the rest is debt of the net creditors, then the net debtors owe the net creditors 37.5 trillion US-dollars. Further, assuming 5% average interest rate. Then the net debtors have to pay interest amounting to 1.875 trillion US-dollars a year alone. This interest has to be paid from increased income, if the capital stock is not to be depleted or other expenditures be cut. To generate an additional nominal income of 1.875 trillion in an 14 trillion US-dollar economy, the nominal GDP would have to rise more than 13% a year, if the total income increase would solely be made by the net debtors, just to maintain the nominal debt level. In reality, the needed increase would be even much larger, of course, since the income of the net debtors is only a fraction of the total income in society.

How could this biggest debt bubble maybe in history be engineered away? I very much doubt that even the best intentioned and crafted policies implemented by politicians with highest moral integrity could achieve this and prevent major social disruptions in society at the same time. 15 to 20% annual increase in GDP or even more that is needed to generate the additional income of the net debtors just to pay of interest is beyond anything that Keynesian policies could achieve by demand creation based on additional debt, unless we have inflation at about these magnitudes by which the debt is devalued. Such high inflation rates don't sound so healthy for society either.

Interest collusion and corruption are just offsets to a much deeper problem here.

BTW: There wasn't any Soviet state in the last decade of the 20th century anymore.

rc

Ideology also ignores facts. It was the Fed that ended the 1920 recession by preventing prices from collapsing to their pre war levels. It was Austrian liquidationists that led to real debt loads increasing all through 1929-1933 leaving the country worse off than when it started. They were never able to face their failure and try to shift the blame they deserve.

Nuh uh, as I would say if I was a 12-year old girl, corruption is essential for the kind of soft-credit system that churned out all those granite countertops for striving sad sacks; just as the stellar success of COMECON Five-year plans would have been impossible without pervasive societal rot. This debt is a macro consequence of diseased markets and institutions.

Marxists wish to approach the problem of economics through the supply side, to control the means of supply. That should be fairly obvious. Marxist societies are hardly consumer driven.

Marxism is idealistic because it begins with theory and works top down from there. A Priori reasoning. Idealism.

I hope this helps.

Jess

P.S. I despise Marxism. But then again, I don't think it is fair to judge it by the distortion of its implementation, along with its horrible aspects of Leninism and Stalinism, but it is a 'statist' approach, and I reject statism in general.

Not so much a hidden tax as a private tax — a rent. Yes?

Economist,

"Keynes's and Minsky's economics provide the basis for the next generation of economic models."

I tend to agree and I thank you for your link to the essays.

I also believe monetarism is not to be ignored as it offers many useful insights, ignoring a few of Friedman's more broad conclusions.

Keynes is vastly underrated by those who only think of him as the father of the welfare state, which is a caricature.

I like Minsky. I would like to see a more dynamic expansion of some of his theories.

You could call them 'rents' except they appear to be more like tax because of the lack of choice and the imbalace of the exchange.

By implication in my essay, what might have been 'rents' start becoming 'taxes' when the corporations start allying and coopting the regulatory and political process.

The example I think I used was the positioning of broker/dealers into the order flows of the market, skimming a 100 million or so in 'taxes' for basically doing very little value added.

I think the companies protected by regulation of patents also begin to approximate the 'taxes' by overcharging for their drugs significantly as measured by their outsized SGA. These were just two illustrative examples.

Capitalists like to avoid real free market capitalism because as we all know profits tend to zero, unless one can do something about it, like establish monopolistic pricing, rig markets, etc.

And believe me, they do, and try to do it all the time. some just do it much more aggressively and egregiously than others, and need to be put in check by some regulatory body, and the goverment.

Some are honest, and make a great living for an extended period of time, through innovation.

The problem is that in a kind of Gresham's dynamic, the less aboveboard monopolistic companies tend to crowd out the entrepreneurs.

Microsoft does come to mind…

The most intractable part of the current financial crisis, and the ongoing problem of the US economy is the huge tax which is levied on the American public by its corporations, primarily in the financial and health care sectors, and a political system based on lobbyists and their campaign contributions.

This is really the nub of the problem.

The competing ideology of the different economic schools are in reality little more intellectual window dressing to cover the naked greed of competing political and business groups.

Much of what purports to be economic debate is really just various vested interests trying to bolster their position in society.

It is at best propaganda and at worst dishonest.

Jesse,

Your use of the term idealism as applied to Marxism is in error.

I suggest you study what idealism means from a philosophical perspective. Marx was a materialist (and that didn't mean some simplistic notion that he valued the material world over all else). In essence, social relations of production constitute social consciousness. The reverse is idealism.

Also, your notion that Marxism is supply side is simply mistaken. I'll side with rootless cosmopolitan's comments.

I'd be curious, what Marxist economists (or economic historians like Robert Brenner, who teaches at UCSD), have you studied? None, I'd bet.

Jesse,

A terrific post. I'm totally down with the comments of Anonymous at 5:12 pm.

I admit to being perplexed by the number of comments characterizing your post as useless whining. An effective summary of the situation, whether an economy, renovations to a home, or an endless war in, say, the Middle East, is always quite useful.

And your closing remarks about the need for reform as the sine qua non as well as your oft stated assertion that the banks need to be restrained, is spot on.

Thanks for the continuing education.

Tim

I used to read the Mises blog and posted a few times trying to better understand their philosophy which came across to me as irrational abhorance of common sense regulation and dismissing concern about abuses of the environment as environmentalist conspiracy.

As I live in a drought area I asked why should my community have to be faced with consuming and bathing in reconsituted sewer water by continual approval of mining and water intensive corporate operations….

I couldn't get an answer and any suggestion that environmental abuse should be curbed or the dread word 'regulated' was flatly rejected.

Ping

Jest's post at 2:39, breaking down the different economic schools of thought reminded me of the final beats of the West Side Story number, Gee Officer Krupke!

To wit, I humbly offer the following (for entertainment purposes only):

Keynsian:

"The trouble is the spending."

Supply-side:

"The trouble is the tax."

Austrian:

"The trouble is the lending."

Free-market/Chicago School:

"The gov't should be lax!"

ALL

E-CONS, we've got troubles of our own!

Gee, Mr. O-bam-a,

We're down on our knees,

'Cause no one can afford

to treat their social disease.

Gee, Mr. O-bam-a,

What are we to do?

Gee, Mr. Obama,

… um … well … I ran out of ideas

Tim

Jesse,

I think your analysis is superb and your comparison with the Soviet Union at the fin de la vingtieme ciecle is apropos.

Until we have complete failure of the American financial system–or complete change at the top of government and private industry–we will not get reform that is needed. I don't know when it's going to come, nor what form it will take, but people who think we're in recovery, or that "the recession" is over, etc, are either delusional, incompetent, or spreading lies. This epoch in American history cuts to the very core of our existence and stature in the geo-political and world economic landscape. I just wonder who is going to step into the breech and provide a way forward that preserves the fundamental tenets of our original framers. The lunatic fringe has spread like a cancer on the right, turning conservatives into fear mongering demagogues, and the left is so disconnected from reality they are foundering and can't sieze the moment to galvanize disenfranchised and defeated middle class and working class Americans. Independents and Libertarians like Ron Paul have been come polemicists and are only fanning the flames of fear and uncertainty. People have seemingly lost the capacity for reasonable discourse and have become subservient to spoon fed pablum that keeps them ignorant of what is happening all around them.

I appreciate your poignant and thoughtful analysis. Please keep them coming.

Jesse,

"Marxists wish to approach the problem of economics through the supply side, to control the means of supply. That should be fairly obvious. Marxist societies are hardly consumer driven."

Apparently, you draw your conclusion that Marxian economic analysis of capitalism is wrong and supply-side idealism from the empirical state of what you call "Marxist societies", but not from the content of the economic analysis itself. This is just a logical fallacy, though, since the state of these "Marxist societies" doesn't invalidate any analysis whose subject is capitalist economy.

"Marxism is idealistic because it begins with theory and works top down from there. A Priori reasoning. Idealism."

This claim is funny, since the empirical and materialist approach to understanding society and its history, including its economy, were central for Marx's thinking. He was one of the sharpest critics of idealist explanations and thought systems. Thus, I doubt you can substantiate your claim with actual content from Marxian analyses, or you talk about something different, when you say "Marxism". Something that doesn't root in Marx's approach.

"I despise Marxism. But then again, I don't think it is fair to judge it by the distortion of its implementation, along with its horrible aspects of Leninism and Stalinism, but it is a 'statist' approach, and I reject statism in general."

Well, Marx was a theorist who analyzed capitalism. He didn't draft a template how "Socialism" or "Communism" were supposed to look like. Thus, there wasn't really anything to implement there. As I said. Whatever the state of these societies was or the state is of what is left of them, it doesn't say anything about the validity of the economic analysis of capitalism.

You say,

"… but it is a 'statist' approach, and I reject statism in general."

This is just a statement from a believe system in which something is judged by measuring it against a given ideal, isn't it?

Anyway, I would have been interested in a comment to my reasoning why debt deflation was inevitable, and not just something that was wanted by someone, like you claimed. This might have been a more constructive discussion about what is than putting out some unfounded claims what others allegedly think and how wrong they were, which are rejected then.

rc

Allowing "liquidation", including bank runs and failures, collapse of money supply, panic and deflation, was the outcome to 19th century credit bubbles. Somehow, the market adjusted and the economy recovered without 20-year Japanese malaise or permanent depression. No fiat dollar required, no Keynesian deficit spending, no quantitative easing, no Federal Reserve, no propping up wage rates, world tariff, world war, or works administration. No endless negative-feedback loop. Of course, liquidation is not acceptable today, and we may have a better approach now, but "liquidation" was not historically a recipe for permanent stagnation.

Austrians, and many others, predicted a bust following the credit bubble. How are they discredited? Perhaps there is no attractive or even viable solution to the current problems, given the application of human nature to our political institutions, but is that truly an indictment of economics?

@attempter: Too right, how far back must we go to envision the true scope of our woes. Until a beginning point to which all data must be examined, we will dance like ravers (everyone following their own inner beat).

@Ruthless Cosmopolitan: Size does matter, no matter what empathetic Lady's say, hay. Capitalists in their need to satisfy their financial libido strapped on one hell of a prosthesis. Now the old lady is getting a bit tired and the stimulant induced need for more has not abated. Well we all know what happens when meth/cocaine induced highs come crashing down, Valium parachutes and a week long sleep for the perp and tears for the Lady.

There will not be enough jobs to facilitate a stable global economic expansion some where soon down the road, if were not already there. I see the GFC as only one symptom of the larger problem, our mass and weight upon this world is reaching a tipping point. That in its self will determine all out comes with regards to our state of existence. We may push against the forces of the natural world, to shape it to our desire, but ultimately the laws of physics/the natural world will over come all of our efforts.

Skippy…We are masters of nothing and until we recognize this one simple truth we will suffer from our collective delusion.

PS. Jesse thanks as aways for your though provoking posts. Now if I haven't truly pissed every one off this should.

Kinky Friedman:

http://www.youtube.com/watch?v=ESNCWrks6vQ&feature=related

Jesse,

"Capitalists like to avoid real free market capitalism because as we all know profits tend to zero, unless one can do something about it, like establish monopolistic pricing, rig markets, etc."

Is this "real free market capitalism" w/o any "statism" your idealized yardstick for your judgement about other's economic analysis and policies? If it is don't you practice yourself what you complain about others? Deriving your criticism of what is from an idealist world view how it should be.

Has there ever been any "real free market capitalism" anywhere? If there hasn't what does "real" mean in this context then?

About your statement,

"we all know profits tend to zero, unless one can do something about it, like establish monopolistic pricing, rig markets, etc."

I don't know that profits tend to zero. You falsely state something that just follows from certain economic models (like the neo-classical ones) as a fact. I can explain profits > 0 w/o assuming something like monopolist pricing, rigging markets etc.

rc

@David:

"Allowing "liquidation", including bank runs and failures, collapse of money supply, panic and deflation, was the outcome to 19th century credit bubbles. Somehow, the market adjusted and the economy recovered without 20-year Japanese malaise or permanent depression."

Right. Countries were just at war all the time, including two world wars in the first half of the 20th century. What about this as a measure for the political and social stability of capitalist society and as a way to solve your problems?

rc

matt, a deflationary spiral takes you to depression. There have been massive but poorly targeted injections of money into the financial system. When these injections stop and/or money from previous injections starts getting repatriated, then we will be looking at depression. We have already seen some deflation in the collapse of the housing bubble. There is also the collapse of credit. Deleveraging had begun but has been put on hold to some extent by the government bailouts. When the suckers market goes south, we will see deflation there as well. If and when depression hits we will see debt deflation with a vengeance. There are many aspects to deflation and we are already seeing some of them.

Keynes at least how I take him is not about pump priming. That was the great lesson of 1937. You need effective stimulus for as long as it takes. But it helps if there is a direction to the stimulus. We face major problems with de-industrialization (30% of manufacturing jobs lost since 2001), healthcare, energy, global warming, education. We could Keynesian stimulus to promote a new, sustainable, and less environmentally damaging industrialized base.

Deflation in a compounding interest banking system leads directly to liquidation.

As electronic debt creation continues unabated to cover bad bet obligations the question is, "How do you remove the excess currency from the system?" Taxes? Higher interest rates? No more credit? All these spell doom for this banking system. A painful reset is necessary, no way around it.

rc,

War is a function of government, not the market. Mass war accompanied mass government. Somehow, those who favor open market competition, without government-sponsored cartels, monopolies, "oligarchs", central banking, fraudulent fractional-reserve banking, and the like, always see the market blamed for government actions.

I don't see any operational answers, given human nature and the political system, but an actual open market, which we don't have, has gotten/is getting a bad rap.

This is an excellent analysis of situation. And an insightful discussion.

Some apt observations made:

Anon @ 1.44 noted that "wrong because the system is too screwed up by corruption to work". IMHO that's a common misconception and Jesse point is more subtle: ideology is a trap, which makes "change", especially structural change impossible without collapse.

jest: "You can't solve a problem if you're spitting out the answer before it has been identified."

K Ackermann: "Ideology is such a destructive force, and so many get pulled into its clutches… Forget regulatory capture; we are under organized criminal capture. We could RICO all the ratings agencies for starters."

Jesse: "The Austrian school has possibilities, but it really is not a vibrant school of thought. It is like Latin. And I learned Latin, and enjoyed it, but I don't use it very often. "

Mac Robertson: "little of the current administration response to this crisis has been Keynesian so only the downfall should be considered in validating any economic school -and that of course is Keynes a la Minsky."

Hugh: "I am surprised that neoliberals and Keynesians get lumped together considering that neoliberals are more deregulation, monetarist/market-oriented and the two schools are fundamentally opposed. "

Attempter: 'We now reach Peak Oil, cheap plentiful energy is over, and the material surge will unwind until civilization descends to its pre-fossil level, and continue from there, as it had before. The oil civilization was a blip.

"Economics" was only a silly parlor game of arguing about the flows of oil-generated money, "growth" was just a nasty oil-provided outlet for greed and violence."

Rootless cosmopolitan questioned Jesse views about Maxism school and provide some interesting calculation about unsusteinable level of debt. he also suggested that "Interest collusion and corruption are just offsets to a much deeper problem here." I would agree with Jesse that Marxists were "supply siders" or more correctly "supply pushers" who favored "production for the sake of production".

Jesse: "By implication in my essay, what might have been 'rents' start becoming 'taxes' when the corporations start allying and coopting the regulatory and political process."

A deflationary spiral is going to happen because of simple laws of gravity. We've reached peak debt and we can't shove any more debt into the system. It just won't accept anymore, even government debt refinanced at near zero rates. The marginal utility of additional debt issuance has plummeted. There is no more multiplier.

Since it can no longer expand it must contract. The government can't support moving the entire private debt balance sheet on the public debt balance sheet. Even if they could it wouldn't do much good. Japan leveraged its government up something crazy over the last two decades and they have nothing to show for it. 20 years of stagnation and they still may end up in the depression they tried to avoid building bridges to nowhere.

rootless cosmopolitan,

"Right. Countries were just at war all the time, including two world wars in the first half of the 20th century. What about this as a measure for the political and social stability of capitalist society and as a way to solve your problems?"

How did they fund those wars? By

debasing their currencies through printing money. That's not capitalistic at all.

"They are not so much about finding policy choices with which capitalist economy could be engineered and improved best. Neither from the demand side, nor from the supply side. That distinguishes Marxian economists from the other groups."

Marxist want to control production by denying "capitalists" the right to own private property in favor of common ownership = supply side, no?

The idea that Marxists are unique because they do not desire to engineer the capitalistic society is questionable. Do not Marxists want to *engineer from* a capitalistic society>

Aren't the Austrian the one's who do not desire to engineer capitalism?

===============

"on the level of the inherent contradictions of capital accumulation that lead to cyclical and generalized crises of capitalism."

What is the Marxist explanation for this, other than the vague "its endemic to capitalism"?

===

As a Marxist leaning fellow, do you believe the labor theory of value?

Or you a modern Marxist who, while admitting the labor theory of value is wrong, thinks there is lots of good stuff in Marxism, even though it was all predicated on the labor theory of value?

Or do you reject the idea Marxism is built on the labor theory of value?

Thanks for taking the time,

Hi Jesse,

I truly love you blog. Thanks so much for all your efforts, they are spectacular.

I, too, appreciate the opportunity to thank you, Jesse, for a great blog that I read daily.

You're asking the right question in today's post: what should we do to lift personal income and rein in the sharks?

Personally, I think it's a common law problem. Yves rightly argues that i-bank partnerships were less reckless than public superbanks. I'd like to yank all corporate charters and legally attribute all economic action to individuals or personally liable partners (like Lloyd's Names).

No way that's going to happen.

Nik wrote: "Until we have complete failure of the American financial system — or complete change at the top of government and private industry — we will not get reform that is needed."

I try to be realistic. If there is a complete failure (which I deem uncomfortably likely and a growing threat), then it's a one-way door to real trouble, like 1933 in another place with Communist True Believers marching for revolution and Born-Again Fascists demanding control of the army and police to 'preserve' order.

So, Jesse, your article comes at the right moment and asks the right question: What should be done, because the stakes are high and historic?

I think the answer is 'to shrug' and let it go completely to hell. Goldman and Team Obama have no intention of fixing anything.

So let me get this straight: because I lived within my means for the past 20 years, didn't succumb to the almost weekly come-ons from the banks to cash out the equity in my home, and am now relishing the return to sanity in the prices of many things, I'm the cash rich greedy boss.

Nope, not a boss and/or business owner. Yeah, own home outright and have some stashed away after years of watching expenses carefully and avoiding the house upgrade treadmill. Guess I'll have to find a way to live with the guilt.

@kievite,

IMO economics is the study of the stars of which its light is hundreds of million/billions of years old and by the time we observe its state, much has transpired with out witness in its now.

As show above none can explain or find consensus to what was wrought, only to dicker over interpretations of fuzzy and incomplete data. We are trading in Milliseconds now and in massive volume globally with gamers thwarting rules to their advantage at every turn, and we contend to have knowledge, usable knowledge, bah!

The little train that is *us* has toiled up the incline, occasional breaking down under the increasing strain, now when we peak and start our descent will we have sufficient breaking ability to cope with our increasingly exponential mass, I fear not.

To many conflicting view points and distractions to reach consensus on anything, with reputation's and wealth at risk.

Jesse,

Great post. You raise some very valid questions that many with their heads in the sand will find troubling, and thus simply label your cogent analysis as "whining".

What should be done, you ask? I don't know, but it may be more important to re-frame the question. Many of the arguments above about the relative merits of the different economic schools of thought seem to this layman completely pointless. None of them adequately address the root causes of this depression (hence the title of your piece).

I don't know how we get it back, but it seems to me that confidence has been destroyed in our markets. We are seeing a trickle of capital outflows from this country. It wouldn't take much to see this trickle turn into a torrent. Constructing a rosy picture of "recovery" when everyone with more than two brain cells knows it's b.s. is NOT how one builds confidence.

Leveling with people about the truly dire straights we're in does.

What a nice, spirited comments section.

My reading of one of the Austrians was that quality of life is unquantifiable– a beautiful environment has value– and standard numbers-analyzers miss all that.

In deference to Mother Earth, perhaps we all need to (re)read Small Is Beautiful.

It's not all about production.

Plus we need to consume less than we produce . . .

Hi all,

I seem to recall that, before economics re-branded itself as a science, it was called 'political economy'. The idea was that the political and economic systems are two sides of the same coin, that neither can be studied in isolation from the other.

So whatever category (Marx, Keynes, Mises, etc.) you favor, you have to ask political questions, such as:

1) What are the attitudes of the population in question? Do they have a culture of thrift and saving (Holland, China) or do they prefer greater leisure to greater wealth? Either choice is valid, but it will affect the choice of optimal economic system.

2) How well does the average person understand the questions involved? What is the education and skill level of the population? What historical traumas (if any; Americans have none, and thus fear nothing), such as famine or war, still linger? (The German hyperinflation of 1923 is beyond the memory of the living, but its influence is manifest.)

… and so on.

This post does a good job of making the case that the U.S. political system is too corrupt and too stalemated to achieve an incremental solution on its own. This acknowledges the problem without taking on the thorny issue of "What decent system would work in America, today?" Sadly, or perhaps happily, my wisdom is insufficient to answer this question.

What if no decent system will work? I got out of the U.S. in the 90s; That was the best I could do. I recommend it for anyone who has the same opportunity.

"The ugly truth is that economics is a science in the way that medicine was a profession while it still used leeches to balance a person's vapours"

I have heard it said in dozens of ways, but I never get tired of hearing it.

Most of economics appears to be about patterns of solutions to specific problems in the past. Each pattern has merit in its context, but generally gets applied at the wrong time in the wrong way. The problem appears to me that economics tends to be about solving problems, rather than describing a desirable social economic model with perhaps the exception of Marx (whose model mostly failed).

The problems are compounded by obfuscation of facts for political reasons such that identification of the problem becomes difficult along with the remedy. What we see is the wrong countries applying Keynesian ideas in the wrong way and that applies equally to the Austrian school of ideas. Perhaps it is just that politicians generally are economically illiterate and like to cherry pick economic ideas.

Global wage capping/control with a global currency seems like a much easier way to achieve the aims of all schools of economics. It cannot occur off course because the whole global balance of trade depends on the imbalances.

@Brick

"Perhaps it is just that politicians generally are economically illiterate and like to cherry pick economic ideas."

Politicians are economically illiterate, but who can blame them? After all, which school should they follow? But they probably have enough street smarts to know that if economists really knew what was going to happen they'd all be rich.

As for cherry-picking, that's the essence of the game. You pick the school that backs up what you wanted to do anyway, rather than tailor your policies to the most-plausible-sounding school. You even pervert the message if you need to.

Why has Keynes been so popular for 70 years? For one thing, he advocated inflationary govt spending in emergencies. Drop the 'emergency' part (which JMK was always at pains to emphasize) and you have intellectual cover for govt policy everywhere since WWII.

@rootless cosmopolitan,

Marx was, without a scintilla of doubt, one of the greatest economic theorists of all time. And, as you say, he has been greatly praised or maligned for things he never said or did. But, as Hannah Arendt points out, it isn't just his detractors who are guilty of this, but his admirers as well. For, as she wrote, "Marxism…has done as much to hide and obliterate the actual teachings of Marx as it has to proagate them."

Marx in his analysis made two fundamental errors which have not stood the test of time: