Time Magazine still gets first prize for shameless pandering to the interests of the elites (in my childhood, it was called the Establishment) with its designation of Bernanke as “Person of the Year” and the fawning accompanying story. But the FT has a piece tonight that is almost as bad, because unlike Time, the FT knows better.

It starts with the headline: “Fed makes ‘a killing’ on AIG contracts“. Huh? That says the Fed made money, a lot of money. But read the article, and the claim is patently ridiculous:

The Federal Reserve is sitting on billions of dollars in paper profits from its controversial effort to unwind credit insurance contracts that AIG provided to banks such as Goldman Sachs, people familiar with the matter said….

Yves here. So who are these people? Presumably at the Fed, or BlackRock, the asset manager. Hardly independent, in other words. But when you dig, the representation is vastly worse than even this lame bit of cheerleading suggests.

The way this deal worked is the Fed paid 100% of the notional value of CDS written by AIG on AAA to AA- rated CDO tranches held by various banks. The Fed then took the CDOs, which were worth a good bit less, and stuffed them in Maiden Lane III, which is an off balance sheet vehicle of the Fed. Sorta like Gitmo, “assets” go in and nothing will ever come out (or maybe not, as we discuss in due course).

Those CDOs were initially valued at $29.6 B. Now mind you, this stuff is all marked to model, so the idea that its model value will be realized is a stretch to begin with. Recall when Merrill Lynch tried to unload some CDOs. The wound up with a hedge fund, Lone Star. The deal was widely reported as yielding Merrill 20 cents on the dollar. Wrong. Merrill got only 5.5 cents in cash, the rest of the “proceeds” went back loan to Lone Star, secured by the CDO! (the transactions were netted, but this gives you a better picture). That means if the CDO does badly, Lone Star will simply default, and Merrill will get a worthless CDO back.

Now this is what we get from the Financial Times:

At the time of their purchase, the CDOs had a face value of $62.1bn and a market value of $29.6bn. Now, the estimated market value of the CDOs is at least $45bn (£27.5bn), according to several people with direct knowledge of the portfolio.

Now even if this were true, this turn of events hardly constitutes a “killing” That expression implies a large profit. At best, this is the reduction of a loss. The claim is that the Fed initially lost $32.5 billion; now, if you believe this plant, the losses have been shaved to $17 billion.

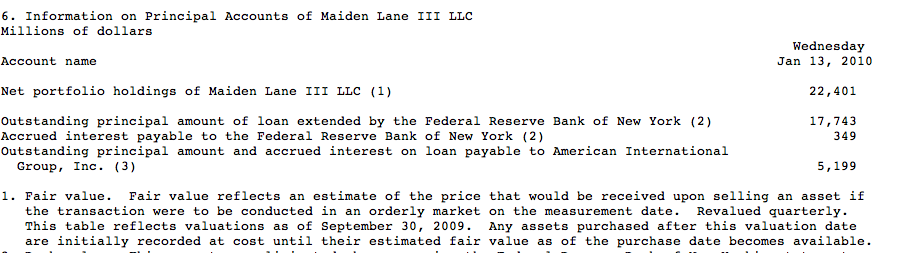

But that is inconsistent with everything the Fed has reported officially. Per its H.4.1 release of January 14, 2010 (click to view full image):

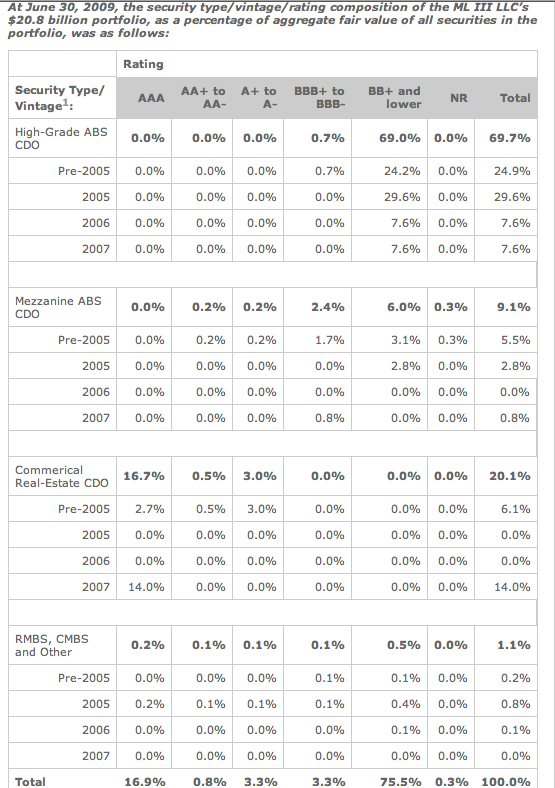

The table shows a value of $22.4 billion. That’s a far cry from $45 billion. Let’s do some very basic forensics. First, let’s look at the portfolio as of June 30. Note it comes to a total of $20.8 billion; Maiden Lane LLC as of then held about $1.6 billion in cash, which is not reflected in this tally. Look at the ratings columns:

It does not take much in the way of powers of observation to see that the Fed is claiming that securities rated BB- or lower have a value worth 69% of the portfolio. Recall that CDS written by AIG were against CDOs originally rated AAA to AA-. This stuff is largely, if not entirely, toxic sludge. I can’t comment on these particular vintages, but most AAA ABS CDOs that have been this severely downgraded are trading for somewhere between 20 cents on the dollar and zero. And the “high grade” label is more than a bit misleading. “High grade” CDOs did start with higher quality assets than “mezz” CDOs (high grades used AA and A subprime tranches, mezz used BBB), but high grade structures were much more aggressive (lower loss cushions, much higher percentages of lower rated CDO tranches permitted, much lower quality “other” collateral tolerated), and so tended every bit as bad, if not worse, losses than “mezz” subprime CDOs.

But note, in the AAA column, that it claims that 16.9% of the portfolio value is in AAA instruments, and that is almost entirely commercial real estate CDOs (16.7%). Frankly, this stuff is probably the only stuff worth anything…. you’d think its percent of the total would be higher.

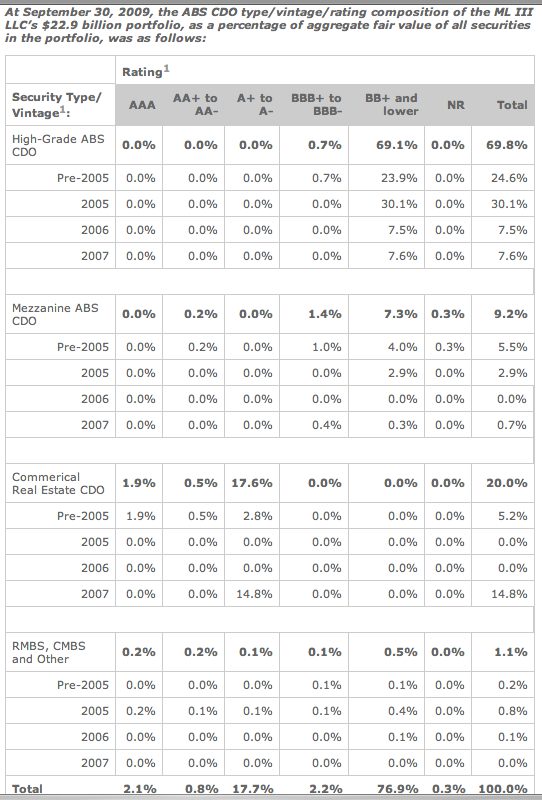

Now notice the commercial real estate CDOs look to be in pretty good shape, ratings-wise…but that was then. Now let’s look at Sept 30. This time, the Fed reports a fair value of roughly $23.5 billion, which includes a tad over $500 million in cash. That gives us net value of $22.9 billion for the instruments. That’s already noteworthy, the Fed is claiming a 10% gain in a mere quarter. But look what happened to the commercial real estate CDOs:

Before, 16.7% of the “fair value” of the portfolio was commercial real estate CDOs; most have apparently been downgraded. That amount has fallen to 1.9%. And the amount of A rated CDOs has increased, from 3.0% to 17.9%.

Now this looks really peculiar. It would be reasonable to think that that much moving form AAA to A would also have an impact on the value of the assets. Yet it appears that 14.8% of the portfolio was simply moved from the AAA to A bucket with no meaningful revaluation (in fact, 14.8%, the reduction of the AAA bucket, plus 3.0% is actually 17.8%. so they decided to say it was worth more, or this may be a function of rounding. Note the AA commercial real estate CDOs percentage remained unchanged.) This outcome is simply absurd, particularly given that the portfolio is also alleged to have increased in value over this period.

Why is that contention utterly unbelievable? And the one we highlighted in from the FT, that the assets were worth $45 billion, even more absurd? While AAA subprime bonds have rallied, the toxic sludge (and per the Fed’s own admission, 75% of the portfolio is toxic sludge), has not moved much. Here are the values for Markit’s ABX 06-1, which would approximate the collateral value of a good chunk of the CDOs, and which is much more credit sensitive:

12/20/07: 34.5%

9/18/08: 9.03%

6/25/09: 4.00%

10/1/09: 4.23%

1/15/10: 4.28%

Do you see any 100%, or even 10%, price appreciation in this series? And we’ve looked at some of the initial marks on the AIG exposures we can identify, and as of November 2007, they correspond pretty well with the ABX, so that appears to be not a bad proxy.

So we have every reason to believe the values reported to date have been high, and absolutely no reason to believe these probably inflated values are actually half the “real” value, as the FT’s sources claim.

There’s another curious item here. The FT reports, which partially confirmed with the Fed’s reports, that:

Maiden Lane III was funded with a $24.3bn loan from the New York Fed and $5bn in equity from AIG. Because the CDOs have continued to throw off cash, the balance on the Fed loan is now about $17bn, people familiar with the matter said.

The Fed’s reports on AIG and its H.4.1 reports do show a principal balance for the loan to Maiden Lane that is now $17 billion, which implies a substantial paydown. But the idea that those came merely from “throwing off cash” is quite a stretch.

If you look at the March quarter report, it shows a loan repayment of $304 million. It also shows an increase in cash and cash equivalents of $1.1 billion. That is already peculiar.

AAA and AA CDOs, whether cash or synthetic, have very low yields, say 20-30 basis points over Libor. So even if these deals were all paying interest, Libor is now at record lows, a mere 25 basis points for three month Libor on January 20. If you go back a full year, it was 1.13%, but six months ago, was 50 basis points. So if you assume $62 billion, and even the value of Libor a full year ago, plus 30 bp, you get about $900 million in interest, or about $225 million a quarter. That is as good as it gets. And Libor has fallen sharply since then.

Well, you might say, principal repayments! Good guess, but wrong. The high-grade CDOs consisted to a large degree of AA suprime paper. Any principal payments on subprime bonds are still going mainly to the AAA tranches. Any payments to AA tranches would be not high at all.

So the only explanation is that the Fed, or BlackRock, the asset manager, is liquidating the CDOs, which calls the valuation of the remaining holdings even more into question. But liquidation is consistent with the rising payouts in a deteriorating real estate environment.

The June 30 report shows a $1.6 billion repayment, as well as an increase in cash and cash equivalents of over $100 million. The September 30 report shows a repayment of $2.8 billion. Since cash and cash equivalents dropped by $1.1 billion, we still have $1.7 billion coming from somewhere, and that somewhere does not appear to be readily explained by interest and principal payments.

I’d love to hear any other ideas as to how these CDOs are paying down the loans (from people who know CDOs, this is pretty specialized terrain), but I discussed this with Tom Adams, a former monoline executive (which means he is familiar with vagaries of how these deals were structured and perform) and he is at a loss for an explanation.

Very interesting piece. What is funny about the FT perspective is that they should know that everyone is cooking their books and that profits are either bubble-related, skimming off the top à la Goldman, or the result of moving something (already misvalued) from column A to column B. What this post is also telling us is that we need a full, complete, uncooked, and transparent audit of the Fed.

The descriptions in the FT article (including the valuations and the $7B that has been repaid) seem about right. Based on the $45B valuation, the Fed’s paper gain would be around $10B (two thirds of the difference between $45B and the sum of the Fed’s loan and AIG’s investment).

AIG’s CDOs are not comparable with the monolines’ when it comes to loss potential. Several of the monolines’ more recent CDOs are nearly complete losses, whereas an average recovery of 75 cents on the dollar is entirely plausible for AIG’s CDOs.

Most of AIG’s ABS CDOs are “high grade” (i.e., mainly collateral that was originally rated A or AA). In addition, there is a lot of RMBS from the first half of 2005 and earlier. Many of these tranches (especially from 04 and prior) are being paid off.

I have not been able to find the details in recent releases, but the supplements for some older earnings announcements provide a fair amount of detail about the underlying collateral of AIG’s ABS CDOs. For example, as of year-end 2007, almost 50% of the subprime collateral on AIG’s mezzanine CDOs was from 1H05 and prior (20% from 04 and prior). For the high grade CDOs, the percentage is closer to 30% from 05H1 and prior (15% from 04 and prior). In addition, the CDO collateral within AIG’s ABS CDOs is mostly from 2005 and prior.

It would be interesting to hear from a bona fide CDO expert. I am definitely not one.

Mark,

With all due respect, your comments on high grade CDOs are not correct, and you are quite wrong on “high grade” CDOs. I’ve been in contact with various experts. And monolines most assuredly DID guarantee high grades, in fact, they like AIG looked more favorably upon them. Thus Tom does know the structures, so his comments on structure and yields are relevant.

High grade CDOs were composed of AA and A tranches of RMBs. Without getting into overwhelming detail, they had much lower loss cushions than “mezz” CDOs. They also called for much less “decent” stuff to be in the non-RMBS potion, and in general, the non-RMBS portion had much higher percentages of BBB ABS CDO tranches. So much of the other “stuff” in a high-grade CDO was on average LOWER grade than the RMBS paper.

You blow through the BBB tranche when losses on the mortgage pool reach somewhere between 8% and 12%, depending on the particular deal. The A tranche typically is the next 4%., the AA tranche is 11%.

I haven’t gotten more current data, but as of end of September, Moody’s had pipeline losses (pipeline loss estimates are close to certain, they are based on current delinquencies) across subprime RMBS mortgage pools running at 23%, with total losses projected at just under 26%.

12% (max level of losses before BBB is wiped out) + 4% + 11% = 27%. v. recent loss projection of 26%. And that is the maximum level before the AA is wiped out, it can occur at 23%.

Most AA tranches are close to total wipeouts. CDOs are so diversified (typical CDO constitutents ultimately include exposures to around 600,000 mortgages, so you might as well view it as a supbrime index). I am told for that former AAA high grade ABS CDO tranches trade for at most 20 cents on the dollar. I can’t imagine where you get a 75% number from

The ratings alone tell the story. Did you not look at the ratings table? AAA CDOs downgraded to junk levels will never trade at anything remotely resembling 75%.

Yves,

You misunderstood my point about the quality of the CDOs. This did not refer to the classification as “high grade”, a description that is humorous at best. Most “high grade” CDO tranches originally rated AAA from 2006 and 2007 are generating huge losses. AIG has similar exposure to mezzanine CDOs vs. high grade relative the monolines. The difference lies in the origination year of the deals (and more importantly the underlying collateral). AIG slowed down toward the end of 2005, whereas the monolines kept writing.

Fitch’s lifetime subprime RMBS loss projections by year illustrate this: 5.8% for pre-2005, 16.9% for 2005, 38.8% for 2006, and 46.9% for 2007. Interest spread also helps the older transactions. A typical transaction from early 2005 might have built up an additional 5 points of subordination for the BBB tranches on top of the 4% initial subordination (9% total) by the time losses started being realized in 2007-2008. For an early 2007 deal, the subordination might not be much more than 4%.

The point about ratings being irrelevant was not made to imply that these products are interest rate sensitive. The point is that, even though the ratings have improved somewhat, they are nearly worthless when it comes to evaluating loss potential, and the remaining buyers of these securities largely disregard the ratings. There are tons of examples of this. JP Morgan 2006-CH2 is one. S&P maintained a AAA rating on tranche AV5 from this pool for a very long time before downgrading to deep junk (no stair-stepping). At the time of the downgrade, this security was already trading as if it were deep junk, so the downgrade did not bring about a price correction.

It is not hard to get to 75%. This will be outlined in a separate post.

I posted this later, I don’t know where you get that 5.8% estimate, but it is disputed by other sources.

JPM projects cumulative losses for the 2005 vintage ABX at 21%. even if the 2004 performs 25% better than 2005, it would still mean losses in the 15-18% range, which would wipe out the A and a good chunk of the AA bonds.

i would note that the 2005 vintage deals in ABX 06-1 have passed their stepdown dates and presumably would be eligible to receive principal if the triggers are passed. despite this, JPM’s loss projections are still very high for the bonds, so i don’t think it changes the dynamics much.

And that is before we get to the fact that high grade CDOs included 15-40% “inner” CDOs, meaning lower rated CDO tranches. Those are worth zero. So you start that these CDOs are worth 85%-60% just from that alone. Now admittedly older vintages will tend to the lower end of that range.

Two more comments/questions:

First, the ABX 06-1 AA index has increased from the 20-25 range earlier in the year to 35 now. The 06-1 AA tranches are reasonably similar to A rated subprime tranches from the first half of 2005 when it comes to loss potential, so valuations of 05H1 (and prior) collateral probably increased similarly.

The monolines’ models used ratings, but are you convinced that ratings are used as a valuation input for the carrying value of the CDOs in Maiden Lane III? I doubt that the remaining buyers of toxic MBS pay any attention to ratings when valuing these securities, so it would make sense for AIG/Fed to similarly ignore ratings for valuation purposes.

Mark,

Please see my comment above.

The Moody’s loss projection is across all subprime.

The fact that the AIG deals have been downgraded to junk virtually without exception says their deals have been severely impacted.

AIG’s deals in fact included a lot of 2006 and later vintages. First, as borrowers in older vintages refinanced or sold, they would be replaced with current vintage paper. So refinancing 2005 paper was replaced with 2006 and 2007 mortgages in managed deals. Second, and more important, contrary to its PR, AIG did quite a few 2006 ABS CDOs, and subprime, not just commercial real estate. They had deals committed in 2005 which were not structured and closed until 2006, and I don’t mean January 2006 either.

A simple benchmark: AIG ITSELF was valuing its high-grade CDOs at an average of 84 cents on the dollar in November 2007 based on dealer input (and there is reason to think 82 cents was a better number). The subprime crisis was only beginning to get serious then. We’ve had more than two years of accelerating subprime losses since then. How can you possibly think 75 cents on the dollar is remotely realistic?

I’m puzzled by your comment re the ratings. CDOs are credit sensitive. The payouts are the main driver of value. They are not interest rate sensitive. So if you don’t use ratings, you need some other method that does the same job. If a rating agency (and the rating agencies if anything have erred in the direction of being too generous), pray tell how can BlackRock justify a valuation that ignores the fact that the asset’s payout is severely impaired?

Most buyers are not touching these deals because it is very costly to analyze them and most are worthless anyhow. (it takes a great deal of time and effort, which is wasted if it concludes the deal is valueless). So if the ratings say they are worthless, and the lack of a bid says they are worthless, how can BlackRock defend these numbers?

When you say …

“First, as borrowers in older vintages refinanced or sold, they would be replaced with current vintage paper. So refinancing 2005 paper was replaced with 2006 and 2007 mortgages in managed deals.”

Are you suggesting that prepayments resulted in new mortgages replacing those mortgages in the pools? I only know from REMICs (so I may be way off in another world here) but I never have seen that. Only mortgages that didn’t meet the underwriting standards, were found to be fraudulent, or did not meet the characteristics of any of the pools in the deal were subject to replacement. That is why for subprime the combination of default risk plus the prepayment risk was fatal rolling into 2007/2008.

If I can find it again there was a Bear Sterns subprime beast of 522 million, 95%+ Cashout/Refi, 70%+ subprime – I can’t recall exactly but things like a 250,000 cashout to a borrower with a 530 FICO and 45%+ DTI.

The thing was so bad that Bear Sterns wouldn’t even hold the most senior tranche. The credit support pools were quite small (about 3% of the principal each) so that is why the senior pools – the super senior was over 40% of the total – were also going to get hit. They took that plus the most senior tranche of another disaster and fed them through another ABS to offload what likely would be losses at AAA no less. 6 months out of the gate the thing had over 20% (in dollars) that were 3+ months past due, in foreclosure, bankruptcy or REO. And the prepayments for refis were rolling in on the order of 60 a month (low 2000s so about 3% a month). Both the losses and the prepayments were accelerating but since they had less than 300 suckers they no longer had to report results via the SEC.

But the reason that 2005 vintage holds better than 2006 and so on up the line is because there was quite a bit of refinancing going on almost straight out of the gate. So the older vintage got full principal plus accrued interest and that wreck of a new loan ended up in say a later in the year pool or next year pool.

If you were talking about something else I apologize for the distraction.

Big difference between REMICs and managed CDOs is the way prepayments are handled. In REMICs as I understand it (and if I am wrong I will defer to you in the most grovelling fashion since that’s evidently your metier and it certainly ain’t mine), the prepayment risk is handed out to different tranches (presumably in accordance with investors’ stated risk appetite) by varying the entitlement to interest and principal between the tranches. But basically the investors have the prepayment risk.

With managed CDOs by contrast there is a reinvestment period during which prepayments are reinvested into new credits. Fine if credit quality is constant across pools, not so great if it gets worse over time. Thus how fast, say, a 2005 CDO turns into something nastier than it was to start with depends on the rate of prepayments and the steepness of the decline in credit quality. But it certainly happened a bit.

Prepayment risk kind of mutates into portfolio manager risk, or actually, if you like, credit risk. Ironically, the whole idea of a managed CDO was that it would allow better management of credit risk than a static structure.

Yves

What did you think of the WSJ story this morning. It seems Benmosche owns US$20M worth of Metlife stock and 2M Metlife stock options worth who knows what.

I wonder how many S&P 500 CEOs own large stockholdings in their competitors.

Seems AIG is about to sell Alico for less than five times operating income before 2008.

until those CDOs reach par, the Fed is at a loss. that’s because the Fed paid 100 cents on the dollar to terminate the CDS with some broker/dealers.

Yves said….I’d love to hear any other ideas (from people who know CDOs, this is pretty specialized terrain), but I discussed this with Tom Adams, a former monoline executive (which means he is familiar with vagaries of how these deals were structured and perform) and he is at a loss for an explanation.

……….

You can try any of these folks but, me thinks they would fail to find any mathematical reality or postulate other wise.

MIT physics faculty

http://web.mit.edu/physics/facultyandstaff/faculty/faculty_alpha_listing.html

The ultimate flim flam job…some thing so complex and ever changing, that only a few are professed (willing to be proved wrong) to understand ie: I can spout what ever rubbish I like and get way with it and if you don’t understand, your a moron.

Skippy…truth be told…I would rather take my chances with above ground nuclear testing, than with financial gimmickry…at least you can see the mushroom cloud and check wind direction and speed. These bloody things just go boom and take out every one, in a blind side. Can’t even do a post energetic forensic account report!

How is it that the people that never invested in or knew about the existence of such rubbish could be the ones most affected by it, pay for it, robbed in broad day light for it. Yet told that they were at fault or it is in their best interest to make hole the buggers that crated the calamity in the first place and make room for more of it.

Sadly it seems to be the culmination of the 80s real estate seminar scam. Buy as much real estate as you can in short period of time, play with deprecation and negative gearing, live off skimming the cash flow and equity with draws and when you die what the hell in loan protection for, fk the kids they can make their own. All seconded by Rush and wealthy religious types…amen and god bless our country.

Thanks skippy on the flim/flam job. Sometimes when I read this I feel like an idiot for not getting it but when even Yves is asked to talk to an ‘expert’ (the best flim flammer) I know that i am not alone.

I understand that what I don’t understand is invariably bullshit and when I am asked to pay for it, I am being muzzled with an M16 trotting black helmet agent.

Yes we can – yeah sure you can too.

“Moody’s had pipeline losses (pipeline loss estimates are close to certain, they are based on current delinquencies) across subprime RMBS mortgage pools running at 23%, with total losses projected at just under 26%.”

I’m certainly not going to argue for a 75 cents valuation, but I do think you’re overly discounting the vintage angle, especially for the high grade CDOs. Bear in mind that the thing that really got those structures in trouble (beyond the simple fact that their assets were crap) was the faulty correlation assumptions. The effects of that mistake are far more profound on a) mezzanine CDOs, and b) more recent vintages, as those were the deals where correlation on the underlying assets was closest to 1. Consequently older vintage high grade CDOs are performing pretty well (comparatively, of course – I wouldn’t buy one at anything close to par), even if the rating agencies have become belatedly super-conservative in their rating assumptions.

As for the CMBS thing, again, I’m not going to defend the specific Maiden Lane valuation, but a) CMBS spreads rallied enormously after the TALF was opened up, and b) the change in ratings almost certainly happened because of the big S&P methodology change, rather than (new) specific performance issues. So it’s not particularly surprising that their fair values would have held up despite the downgrade. Note – without knowing the actual tranches, obviously this is just one possible explanation, not a definitive judgement.

Ginger,

Did you read the comment earlier in the thread?

The idea that high grade did much better than mezz is largely an urban legend.

1. As of November 2007, AIG had ALREADY marked down its high-grade CDOs to an average of 84%, and one of the bank marks was a clear outlier (there are good reasons to think that bank in particular was overvaluing). Excluding it gives you an average of 82.

2. The Maiden Lane high-grade CDOs have ALL been marked down to BB or worse. This is inconsistent with your view that these CDOs would fit under the rubric that “Consequently older vintage high grade CDOs are performing pretty well (comparatively, of course – I wouldn’t buy one at anything close to par)..”.

3. The TALF was extended to commercial real estate as of March 1, 2009. So any improvement in spreads would already be reflected in the values as of June 30, 2009. The implausible “no change in value despite downgrades” took place between June 30 and Sept. 30. So your theory here would not appear to be germane.

The Notes for the accounting says that cash and cash equivalents are defined as “highly liquid investments with

original maturities of three months or less, when acquired”.

So apparently BlackRock is doing some sort of short-term investing with the cash flow from both the loan repayment and the CDOs. Treasuries? Short-term paper?

The NY Fed Notes that:

http://www.ny.frb.org/markets/maidenlane3_090930.html

Other than assets that may be acquired by ML III LLC as part of a portfolio liquidation of one or more CDOs held by ML III LLC, cash proceeds from the Asset Portfolio may be invested solely in U.S. Treasury or agency securities with a remaining maturity of one year or less, U.S. 2a-7 government money market funds, reverse repurchase agreements collateralized by U.S. Treasury and agency securities and dollar denominated deposits.

Still seems like too much movement in cash and cash equivalents though even with that kind of investment mix and their yields.

There is another item in the notes (note 6 pg 17) in the 1st Annual financial statement at the end of 2008

http://www.newyorkfed.org/aboutthefed/annual/annual08/MaidenLaneIIIfinstmt2009.pdf

ABS CDO issuers can issue short-term eligible investments under Rule 2a-7 of the Investment Company Act of 1940 if the ABS CDO contains arrangements to remarket the securities at defined periods. The investments must contain put options (“2a-7 Puts”), which allow the purchasers to sell the ABS CDO at par to a third party (“Put Provider”) if a scheduled remarketing is unsuccessful due to reasons other than a credit or bankruptcy event. As of December 31, 2008, the total notional value of ABS CDOs held by the LLC with embedded 2a-7 Puts for which AIGFP was, directly or indirectly, the Put Provider was $2.7 billion.The LLC has agreed, in return for the put premiums, to either convert the ABS CDOs to long-term notes and extinguish the 2a-7 Puts, to not exercise the 2a-7 Puts, or only to exercise the 2a-7 Puts if it simultaneously repurchases the ABS CDOs at par. The maturity dates of these agreements are on or before December 31, 2009.

Maybe some cash is flying around with the 2a-7 Puts? All of these have matured by now. The next annual report released may shed more light on these and maybe other investment transactions that are allowed per what I posted earlier from the NY Fed.

I haven’t seen anything that allows Maiden Lane III to borrow beyond the initial funding but perhaps if in its mark to fantasy the assets are valued higher than the Fed Loan that the excess value (over collateralization) can then be used to borrow from the Fed window using the excess as the collateral and invest the borrowed money in any of the above mentioned short-term vehicles and skim some bps there?

Is it possible that some large prepayments are coming in through the underlying RMBS or CMBS (as the ABS CDOs hold either/or/both) due to refinancing of the mortgage held by those entities?

Certainly the stand-alone CMBS/RMBS assets aren’t large enough to generate a half billion or more in movement.

If we only knew what underlying tranches were included in the “Other” ABS CDO category (see the 2008 annual pdf) it would be possible to find what the underlying RMBS/CMBS held and what might have come through as a prepayment.

Is it possible that any of the CDO tranches that Maiden Lane is holding are part of a CDO that is going through an acceleration or liquidation? Without knowing the majority of tranches held and what securities they are a part of makes this difficult to know. Who knows if this is a source of bursts of cash?

Mindrayge,

The most obvious idea does not seem plausible:

“Is it possible that some large prepayments are coming in through the underlying RMBS or CMBS (as the ABS CDOs hold either/or/both) due to refinancing of the mortgage held by those entities?”

With so much of the portfolio in subprime CDOs, it’s pretty much impossible that prepayment or refis would have gotten down to the AA tranche except in an odd deal here and there, and even then, not very much. Given the very large number of ultimate mortgage exposures in any one deal, you can’t get to meaningful numbers.

To liquidate, they’d have to declare an event of default. That would seem to be an event that would require disclosure. My sources can find no evidence of that. But I am also told that CDOs are trading at a discount to the probable value of their constituents because they are too difficult to value and no one wants to deal with the hassle and expense. So liquidation would be completely rational. The issue is the lack of disclosure.

Your idea that they might be playing games with borrowing against fantasy valuations in an interesting one. But again, not certain how you get enough interest (particularly in this environment!) to make a difference.

I know you know this stuff but let me just run with something …

The thing about the Maiden Lane III assets is that very few of them were AIG owned. In particular the asset buyout of the underlying securities that are not redacted in the AIG filing are those in which AIG or their counter party held an interest other than the CDS bet. The rest of them – like almost all of them – were tranches of CDOs with neither party having any ownership. The 2a-7 related CDOs from note 6 were certainly in AIGs possession at the time ML III came into existence.

Since we don’t know exactly what tranches and in what CDOs ML III is now holding it is always possible that a loan within an underlying CMBS was rolled over/refinanced out of the pool bringing in a large prepayment and at the same time leaving that pool with a larger percentage of junk leading to a subsequent ratings downgrade against that tranche. Sort of like the light bulb getting brighter just before it goes poof.

TALF backing would boost prices. there are 33 TALF roll outs for 2005 vintage CMBS. There are around 125 CMBS rolled through of all vintages. Around $66.6 billion total. All they had to be was highly rated when they hit TALF so it is conceivably possible that ML III owns a tranche in one of these. When you look at that collateral_b.pdf file some of their payouts kicked in immediately when 100% was broken so for example with the Bank of Montreal some of those were at 99.55 and perhaps could of recovered. Its a long shot really that anything would have recovered.

By the way most of TALF is Small Business Loans – more than 500, over 70% of all TALF issues. If you recall the point of TALF was to free up lending for autos, student loans, credit cards but surprise, surprise – they make up about 4% of the TALF issues. Small Business and CMBS in number of issues is 90% of TALF. SunTrust dumped a hefty number of Small Business loan pools so I would assume they had a low outlook on that front within their footprint.

Hi Yves,

I don’t think that you are correct that principal prepayments always flow to the senior tranches first. That will depend on whether the underlying MBSs in question pass credit enhancement tests. If the triggers don’t force prepayments to flow to senior tranches, the lower tranches will also get principal payments. (Yes, this makes a nonsense of the fact that CMOs were originally created to deal with prepayment risk, but that’s another story.)

See slides 12 and 13 of this Fitch presentation:

http://www.fitchratings.com/web_content/sectors/subprime/Basis_in_ABX_TABX_Bespoke_SF_CDOs.ppt

re: 3-month maturity for cash: that’s just accounting boilerplate. It’s the GAAP definition of “cash”, and will be in notes to financials even when the entity just has a checking account.

Just a part of the BB reelection campaign–as was the statement yesterday that the Fed welcomed the GAO looking into the AIG mess. They are in full a**-covering mode and figure they can baffle their critics with “independent” appraisals of their BS. . .

Nice work, Yves.

I actually think the FT is secretly/sneakily trying to get this info out in a way that appears that it is establishment-friendly but actually is trying to get the public eye to focus on such minutiae to provoke some kind of accountability investigation

they don’t really support Lloyd Blankfein, they just want the average guy in the street to be truly aware of how egregious LB and his compadres have been

they don’t really think the Fed has done a good job, but if they are able to create public interest and thus debate around the issue, who knows, perhaps someone may actually get convicted for the 21st century financial crimes against society

That’s exactly right. From an accounting standpoint, there’s an unrealized gain (value of loan for CDS cancellation payments + cost of CDOs + unrealized gain). From an economic standpoint, though, I don’t think many people expect that loan to AIG to be repaid. The accounting will catch up eventually when a reserve is booked.

That reply should’ve have been to Matt Franko.

Yves,

I think the Treasury/AIG (not The Fed) bought out the CDS from the banks via fiscal transfer from TARP (outrageous but separate issue). Then The Fed loaned MLIII 29B against a portfolio with a face value of 62B. Since The Fed is a bank, their asset is the loan value (29B). If the collateral is increasing in value to that in excess of the 29B loan and The Fed also has some form of rights to it via MLIII, then The Fed could have an unrealized gain. Is the collateral worth more than 29B, I suppose it could be.

This is all moot as The Fed has just credited the treasury account for 45B of profits it made last year, and now with 1.5T of MBS and Agency bonds looks ready to send Treasury another cool 50-60B next year. this should cover all the “Maiden Lanes”.

the real issue is that the Treasury and Fed are decreasing the wealth of the non-govt sector in all of this due to the fact that these operations ultimately result in fiscal transfers from the non-govt sector back to the govt sector thus making us “poorer”. resp,

Basically a CDO is pool of mort loans that has what is called a waterfall whereby they assign collateral to various tranches and the trust diverts the income stream of this collateral to the various tranches. They are rated

on the basis of overcollateralization starting with AAA at the top. Towards the end of the life of CDO/ABS much of the

collateral was swap and derivatives once these structures are unwound there is very little corpus left much less the

corpus contained are subprime obligations that are now most

likely in default with no buyers of the homes. Now the Fed

is basically long alot of homes in a dismal market.

the corpus contained are subprime obligations that are now most likely in default with no buyers of the homes. Now the Fed is basically long alot of homes in a dismal market.

This was pretty much the end game of the 1980s early 1990s S&L Crisis. FSLIC ended up holding the REO assets of the busted S&Ls. FHLBB was abolished, OTC was set up and these REO ssets were then dumped into the Resolution Trust Corporation for an “orderly” liquidation, meaning limiting r.e. price declines by flooding the market.

This time we’re having a much larger disorderly liquidation. imo this is part of The Plan. Liquid cash buyers are appearing once prices are deep enough. Typically about 50% of new construction cost. The two rules for making money in real estate are to Buy Low and Sell High so you can pocket the difference. (or sell high short and buy low to cover if you’re GS).

YS:

Good show! I read the FT article this morning and my first thought was, “This is the stress tests redux”. More nonsense from Zimbabwe Ben & Co. My second thought, “Will YS kick this obvious Fed PR piece to the crub”? Well done!

IA

The FT definitely got the memo.

I found it odd that with all the inflation stories pumping the inflation scare in the FT lately, they completely ignored the super-tame US CPI out last Friday. Nary a mention in the Saturday edition, but they found room for scare stories on the real estate in China and general Chinese and Indian inflation.

It seems they are part of an overall agenda to push inflation expections up through fear-mongering and underplaying the true deflationary reality of the largest consumer group in the world, the US consumer, not buying much of anything, let alone the fear of inflation. The FT underplayed the lower December retail sales last week, also.

Check out this search on FT.com for consumer price index

http://search.ft.com/search?queryText=consumer+price+index&ftsearchType=type_news

They found it important to print a full story in December on the US CPI increase (it fit the agenda), but have completely ignored the December number, even though it included a huge jump in oil prices.

There is real fear out there, just not inflation fear in the consuming public, but rather deflation fear in the central bankers throughout the globe.

This idea that they can game inflation like they are attempting is disastrous. With the attempts to justify $80/bbl oil to feed through inflation, the lies are getting overwhelming.

Justify this:

http://tonto.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=a103600001&f=m

Real gasoline demand in the US just keeps dropping! Why is oil really at $80/bbl? We know it isn’t Chinese demand:

http://www.marketwatch.com/story/chinas-car-sales-gas-consumption-dont-add-up-2009-11-23

They are trying hard to push inflation in a deflation world. They will lose in the end.

They are trying hard to push inflation in a deflation world. They will lose in the end.

Letting deflation take hold is widely accepted in Economics as *far* worse than inflation. The general plan HAS to include attempts to maintain some inflation.

Maybe what’s going on for you is the notion that deflation will somehow make a potentially cash-rich bottom 98% individual richer?

Nice parsing of the BS surrounding Maiden Lane and the rest of the AIG Bailout. Too much attention is given to the tranche ratings. What needs scrutiny is the applied rates of subordination.

As to CDO’s, can’t see any tranche being worth more that 5% to 10% of face. I take that view because CDOs were constructed from income streams attributable to subordinate streams that would go to zero as defaults increased. In fact, I find it reasonable to assume that most CDOs have an expected value of zero.

What you have pointed to is the very serious need for a full audit of the both the actions and the reporting of the both the Treasury and the Federal Reserve. While there is increasing awareness of the irregularity of the AIG bailout.

I am reinforced in my view that AIG commited, at the least, a massive tort if not a fraud. I am convinced that the missguided efforts of the Treasury and Fed are sufficient cause for the removal of both Geithner and Bernanke.

I’m “Mad as Hell . . . “. I wonder is the public mad enough to begin to vote out incumbents in the coming mid-term and Presidential elections? I wonder, when will audits and inquiries lead to referrals and prosecutions? When will we, as a society, go back to honoring the contract and to renegotiation and repricing when the contract fails? We’re pissing away 200 years of established law in the excuse of expediency and a means to a desirable end.

I am reinforced in my view that AIG commited, at the least, a massive tort if not a fraud

What is the exact fraud/tort though? The SEC certainly isn’t going to prepare the case. Even if *someone* could reasonably build a case, you need a State/Fed? Attorney General to prosecute.

I actually agree with you, I just don’t have any faith the Right Thing would ever get done.

What we don’t know …

According to several people with direct knowledge, one person familiar with the matter said, “I’ve been in contact with various experts and they said to ignore ratings for valuation purposes because most are worthless anyhow as there was quite a bit of refinancing going on of what is largely an urban legend since we don’t know exactly what the fuck happened.”

What we do know …

The wealthy ruling elite, through graft and corruption, hijacked the government and had their puppet stooges — who knew very well what they were doing — create an intentional global credit bubble and at the same time deregulate finance so as to create esoteric derivative products that functioned as little understood ‘head fuck’ counterfeit currency, all for greater control and consolidation of global banking, geopolitical gain, and elimination of the global middle class so as to reduce global resource consumption.

Ass maiden FT sucks!

Deception is the strongest political force on the planet.

Yves, I only understand about 20 % of your erudite discussion with the comment respondents but one thing is certain : the emails from the NY Fed to AIG are a gold mine of damning information and undoubtedly lead to further ties between BlackRock and the Fed. In the world of national defense many private contractors are performing national security work on counterterrorism that was once the sole purview of our government apparatus. It is an appalling conclusion from your analysis that the Fed has become like a jellyfish where all the tentacles are indistinguishable from each other. I hope you can get on Dylan Ratigans show with a brief overview of this CDO things that go bump in the night. Cheers.

When originally reading the article, I inadvertently ignored the word “market” in the description of the CDO valuation. I agree with you that a market valuation of 75 cents on the dollar for these CDOs seems ridiculous, and completely inconsistent with the 9/30/09 valuation.

It is not difficult to see how the high grade CDOs might ultimately recover 75% of the face amount of the principal. Even if it were certain that the CDOs would recover 75 cents on the dollar, the market value should probably be less because the CDOs (at least the ones I have seen) pay interest based on short-term LIBOR, which is almost zero.

To get to a ~75% recovery (25% loss), I started by looking at the breakdown provided in AIG’s 2007 credit supplement (link pasted below). The high grade CDO collateral is described in slides A-16 and later. Most of the ratings had not been downgraded at this point, so the ratings are reasonably close to the original ratings.

Adding subprime with other RMBS collateral, you get 8.5% of total CDO collateral from 06-07 RMBS, 42.5% from 05, and 24.4% from 04 and prior. Assuming a 20%-25% recovery on 06-07 RMBS (about a third was rated AAA), 60% for 2005 (mostly from 1H05), and 85%-90% for 2004 and prior, it produces a total estimated recovery of 49 cents for the RMBS collateral.

A 60% average recovery on 04 and prior CDO collateral and 20% for 05 adds another 6 cents.

It looks like the CMBS and other collateral was mostly AAA rated at inception (probably weighted toward 05 and prior, like the RMBS and CDO collateral). A recovery of 85-90 cents on the dollar does not seem unrealistic. This adds another 8 cents.

If you add the pieces, it gets you to a total recovery of 63 cents, or a 37 cent loss. Subtract 15 points of subordination, and you get 22 cents of loss. This is a 26% loss on AIG’s 85 cent of the entire CDO, equivalent to an ultimate principal recovery of 74 cents on the dollar (close enough to 75%).

http://media.corporate-ir.net/media_files/irol/76/76115/CallSupplement.pdf

You are ignoring the CDO squared-ness of high-grade CDOs, which I flagged in the post. The “inner” meaning lower tranches of other CDOs were the typical constituent. They could account of 15-40% of the value of the CDO.

They are pretty much worthless. as a result, the starting point for valuation is 60-85% and works down from there.

Just to doublecheck, I looked at the most recent servicer reports for a 7 GSAMP pools from 2004 and 2 from 2003. Principal is being repaid on the subordinated tranches on all of them (mostly to the BBB and A before the AA). For three of the 2004 pools, the AAA tranches have not been repaid in full, but principal payments are not being made to the AAA tranches.

I also looked at 7 Morgan Stanley transactions from 2005. Principal is being repaid on the subordinated tranches on all 5 from the first half of 2005, but neither of the two from 2H05.

In most or all of these transactions, the cash flow diversions should work (the AAA tranches will be repaid in full). But there are a number of negative amortization Harborview transactions where the AAA tranches will get tagged with big losses, but the subordinated tranches (those that have not been wiped out by losses) are receiving principal payments along with the senior tranches.

Around 30% of the collateral on AIG’s CDOs from 1H05 and prior, and it seems like a good bet that principal is currently being paid down on most of this.

Mark,

You are missing a key point here.

If a bond in a cdo portfolio amortized or prepaid, the deal manager could reinvest the principal in other deals (new issue or secondary market). The reinvestment period could be up to 5 years long, subject to triggers. The triggers on moat of these deals were likely tripped back in 2007 or early 2008 – they were based on bond values, ratings and cash flows.

My understanding is that the CDO manager generally would reinvest, certainly through 2007 (the dips in subprime through July were touted as buying opportunities among the true believers). Thus any 2004-2005 mortgage paydowns prior to that date would lead to reinvestment in later vintage, dreckier deals. I can confirm my understanding of typical practice.

A few of the deals in the AIG portfolio were static, rather than managed, so they would just apply any principal received in accordance to the deal waterfall (after triggers are tripped it would all go to the senior class).

This comment comes from Tom Adams:

there might be some principal paydown, but i would argue that it is limited. first – the MBS deals are prepaying slowly (voluntary prepayments are below 5% per annum for the 2005 ABX). most of the amortization is coming in the form of liquidations. defaults are running at about 20% for 2005, with severity of 70-75%, which means there isn’t a lot of principal being distributed from this amortization either.

i don’t think that principal amortization, if it is occurring, should change the valuations – it just changes the amount that the marks and the FMV calculation is applied against. the portion that isn’t amortizing (that’s left behind) is just as bad if not worse (adverse selection might indicate that it will have even higher percentage losses).

JPM projects cumulative losses for the 2005 vintage ABX at 21%. even if the 2004 performs 25% better than 2005, it would still mean losses in the 15-18% range, which would wipe out the A and a good chunk of the AA bonds.

i would note that the 2005 vintage deals in ABX 06-1 have passed their stepdown dates and presumably would be eligible to receive principal if the triggers are passed. despite this, JPM’s loss projections are still very high for the bonds, so i don’t think it changes the dynamics much.

Tom/Yves,

The difference between 05H2 (ABX 06-1) and 05H1 is significant, and the difference when compared with 2004 is even larger. This can be illustrated using two GSAMP pools, GSAMP 2005-HE4 (in the ABX 06-1) and GSAMP 2004-HE2.

For 2005-HE4, 22.7% of the original balance remains outstanding. Cumulative loan losses as a percentage of the original principal are 10.3%. 50.2% of the remaining loans (by principal balance) are 60 days delinquent or worse. Unless performance improves, lifetime losses will grow to over 20%.

For 2004-HE2, 15.8% of the pool remains, cumulative losses stand at 3.3%, and 33.2% of the remaining balance is 60 days delinquent or worse. Severities are also lower for 2004. Lifetime losses on 04-HE2 might reach 10%

For the 2004 and 05H1 transactions I have examined recently, about 10% of principal (one the notes) has paid down in the past year (actual loan repayments have been lower). This equates to around $4B (10% * 50% RMBS from 05H1 and prior * $80B — total notional value on CDOs, not just AIG’s piece).

I am not sure how to get from $4B to the $7B mentioned in the article. Maybe some of the other collateral is also paying down gradually. The $7B is basically consistent with the quarterly amortizations disclosed in some of AIG’s older disclosures.

The 2007 disclosure shows that a little more than 60% of the ABS CDOs were static. However, I had assumed that most of the worst managed transactions have effectively become static after failing overcollateralization tests that prevent new assets from being purchased. This is based on a few rating agency reports that I have read. I have not ever reviewed the transaction documents for a managed CDO in detail, so I don’t really know if this is correct. Do you know?

If new assets were acquired (or positions taken via CDS) by managed CDOs after 2007, isn’t it possible that these would help the overall economics because the assets would be purchased at distressed prices?

I’m not sure where you’ve gotten your idea that 60% of the ABS CDOs were static. We’ve looked at disclosures on the underlying transactions and that is just not the case. AIG in many of its presentations included CLOs as “CDOs” which technically they are. But the press typically calls CLOs “CLOs” and restricts the use of “CDO” to ABS CDOs.

The disclosure at the link I provided lists the number of ABS CDOs by type (mezzanine vs. high grade) that are static vs. managed. A little over 60% (by count) were static. This increased to a little over 75% in the first quarter of 2008 (link provided below).

http://media.corporate-ir.net/media_files/irol/76/76115/ConferenceCallCreditPresentation_05_09_08.pdf

Do you know roughly what percentage are managed? Would the economics of the managed transactions be any worse than the snapshot at year-end 2007?

Frankly speaking I don’t understand what they are talking about in this article…they need to be more simple for a normal person to understand…

You are thinking too much. The FT headline already did its job, the majority the public now believes banks have paid back TARP etc.

Yves- has any work been done looking into fraud and the possibility that mortgages were placed multiple times into different MBS/CDO’s, ot that some properties included don’t really exist or are empty lots?

Lee S.