Independent Strategy’s latest report, “China’s credit bubble: the missing piece in the jigsaw” makes a persuasive case that China’s debt fueled growth model is due for a hard landing, but the timing is uncertain, since the debt is funded internally.

China is barely past an episode of dealing with banks chock full of bad loans (there were debates among Western analysts in 2002 and 2003 as to how bad the damage was and whether the remedies were sufficient). On a more fundamental level, China has copied the Japanese mercantilist development model pretty much wholesale. It arguably hit the wall with the 1985 Plaza accord, when the US found the continued trade deficits unacceptable and succeed in organizing a G5 intervention to drive up the yen (that succeeded too well, the yen overshot, leading to the Louvre accord to push up the greenback). Japan’s central bank lowered interest rates to stoke asset prices in the hopes that the wealth effect would produce higher domestic consumption and offset the effect of the fall in exports.

We all know how that movie ended.

This piece does a concise job of recapping some of the troubling conditions undergriding the seemingly robust Chinese economy. A particularly striking one is the dramatic fall in the productivity of borrowing. In 2000, it took only 1.5 RMB of credit growth to produce an additional RMB of GDP growth. It now takes 6 RMB of credit to produce 1 RMB of GDP growth. It has become conventional to decry borrowing in the US because it has supported consumption, but debt that supports unproductive investment (factory overcapacity, overbuilding of high end housing, land speculation) is no better.

Some key sections of the report:

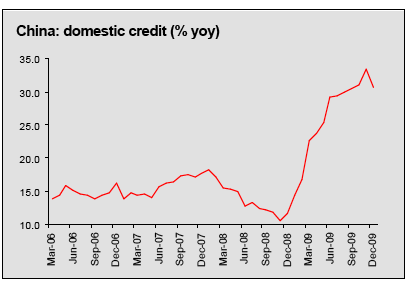

We now know that much of the credit explosion in 2009 that boosted economic growth went into local government entities where it was wasted on unproductive real estate and infrastructure projects. These entities are mostly insolvent and will create huge bad debts for the banks as credit is tightened this year….

China is an economy where bank credit equals 130% of GDP — twice the penetration of peer emerging markets and where credit grew by one-third last year, adding money to the system equal to nearly 40% of GDP….

…the total borrowing of LGFVs [Local Government

Financing Vehicles]is Rmb11trn ($1.6trn), which breaks down roughly into Rmb7trn borrowed for infrastructure spending and Rmb4trn for ‘other’ purposes. These

figures match China’s domestic credit growth in 2009 of about one-third of GDP and go a long way to explaining the credit bubble (we knew about the lenders, but little about the borrowers).LGFV debt is big enough to be a potential source of major macro-economic instability. LGFV borrowing adds about another 30% of GDP to public sector debt; is equivalent to 25% of outstanding bank credit; and more than 80% of new bank loans during the 2009 credit bubble. This hidden debt is equivalent to 225% of bank equity capital, meaning that a loss-given-default ratio of 30% would wipe out two-thirds of existing bank

equity.If you add in LGFV debt (and other unconsolidated forms of state credit) to total government debt, China’s gross sovereign debt to GDP is closer to 70%. And remember that 60% of GDP in government debt is the level at which Reinhart and Rogoff estimate that average GDP growth rates in emerging economies will be reduced by 2% pts after a financial crisis.

This LGFV edifice will not survive credit tightening, because it is a Ponzi-type pyramid built upon borrowing more to service existing borrowings….the problem is economically huge. LGFVs are not going to be borrowing and spending any more. And if infrastructure investment drove 90% of 2009 GDP growth and 70-80% of this was down to insolvent LGFVs, where will the growth in credit and GDP come from now?

The report forecasts a large decline in growth rates, as well as land and real estate prices, since LGFVs will need to liquidate holdings to try to pay off non-performing loans.

The lesson of the great depression is that debt deflationary environment centrally planned economies do much better than market economies ( ie nazi Germany, Soviet Russia, USA 1942–>)

Capitalism is destroyed by excess surplus, socialism by shortage. Massive excess capacity is not a problem for a socialism society. The Chinese government is not bound by property rights in the same way the West is (although the legitimacy of the government does require some sense of natural justice), and so conventional rules of economics do not apply.

It is within the power of the government to cancel all the debts, shoot the resistors, and order the workers to get back to building schools, hospitals and semi-conductor factories

“It is within the power of the government to cancel all the debts, shoot the resistors, and order the workers to get back to building schools, hospitals and semi-conductor factories”

While this is possible it doesn’t necessarily play out that way…

A) The only difference between a revolt and a revolution is who writes the closing chapter;

B) If those in power are the ones that have to take the loss with debt cancelation, they’re likely to not do it until its far too late – see A.

“The lesson of the great depression is that debt deflationary environment centrally planned economies do much better than market economies ( ie nazi Germany, Soviet Russia, USA 1942–>)”

But China is no longer a centrally planned economy in the same sense that it was. They rely on their peculiar version of markets for much of their prosperity.

As for your historical examples, the USSR had no surplus to worry about. In the 1920’s they had a civil war instead of a consumer boom. Similarly the German economy wasn’t great in the 1920’s. Nor was it centrally planned in the 1930’s – the Nazi’s did a good job with Keynesian stimulus. Your USA in the war years may be a better example. Ironically our central planning in that period was far better than the Nazis, and it contributed greatly to our victory.

Your thesis that centrally planned economies handle surpluses better may be true, but it’s hard to say as I can’t think of examples of centrally planned economies having a surplus to deal with. And their problems with shortages are largely self-created. An exception is the otherwise ‘free market’ economies in WW2, where central planning for the duration did work well (rationing, frozen prices and wages, war production board, etc.).

As for ‘free market’ economies dealing well with shortages, I think it depends on the severity of the shortages and other conditions.

ding – ding – ding…

somebody gets the basic picture!

It is the notion of “wealth” and ownership, therefore what all those transaction means for a nation.

To put it simply, imagine US military industrial complex (the entire complex. The legislation, the subsidy, the knowledge structure, the international market creation) is applied to all part of society.

“free market” is for a fool (at national level)

“it is a Ponzi-type pyramid built upon borrowing more to service existing borrowings”

http://mgiannini.blogspot.com/2010/02/sovereign-debts-markets-for-lemons-and.html

What about Greece and its foreign lenders?

I think the tightening has already been put in place when the Chinese government annouced that it would not guarantee payment of local government loans. Where all those local banks were making loans to local government they will now have to look very carefully at making new loans and take steps to ensure existing loans can be serviced. The end result will be a contraction in new infrastructure projects over time and probably a consolidation of banks. The question will be whether china lets outside banks take part in the bank consolidation as this may have unexpected results on capital flow if they block it. I wonder if the expansion may have as a result underminded the slightly protectionist policy china has to finance to the extent that they may have ceeded a margin of control.

If China tries to cut back investment it will have a multiplier effect downwards on GDP growth because savings will start to out run investment in a big way. Savings are very high in China because of the lack of a supporting welfare structure, the one child policy, low interest rates and mistrust of the regime. They are in cul de sac.

i read this a few times trying to decide if it was an April Fools joke, since it seems that “China” can be replaced with “United States” and “RMB” with “USD” without changing the facts much at all…

While your substitution works, if it’s an April Fool’s joke, then the joke’s on us.

Kid, I had the same thought, and have had for many months now.

As I lack knowledge about China (just read MPettis), I hesitate to express the argument.

It is along the lines that Chinese officials realized when Bernanke started huge QE (QUANtitative as well as QUALitative easing), that — given their desire of a peg — they needed to effectively devalue the yuan, and chose to do it by commandeering a 30% GDP credit increase.

I don’t think Western economic analysis applies to China. China is a command economy (like the old USSR). It fabricates its public data. It makes “economic” decisions on political criteria. And so on…

So, if one is looking for an economic forecast for China, such as a fall from its boom, one is likely to be very disappointed. Like the current “boom,” the fall will also be imaginary (as in, not reported).

Talk all you want about China debt, but it takes a 30% down payment to buy a house in china, 50% for a rental unit.

China still has a lot of internal demand that is still in the infancy of its development.

I would not hold my breath waiting for the Chinese economy to tank, I would bet this blog and the American recession will be long over (even if it took ten more years for the U.S.A. to recover). When the U.S.A. recovers it will mute any Chinese’s recession as well.

That’s my prediction.

meh,

China can always open its real estate market to rest of the world to inflate the price when it ever collapse in the future. Hey it works so well in hong kong, why not try it in mainland, with that much more market potential.

I for one don’t think real estate bubble pop japan style will happen in china in the next 10 years. after that maybe… but not until they hit $12-15K, GDP percapita. (that’s when everybody is tapped out and society stabilize into urban middle class)

“but it takes a 30% down payment to buy a house in china”

Yes, I read that many times.

However, some places in China now have very high prices in terms of $/sqft, i.e. not all that much below some main stream cities in US and EU. Those appartments costs 80x average yearly income.

Granted, income inequality in China is huge, but still….. one wonders how middle class Chinese can come up with those down payments (other than extracting the speculative profits from the stock-market runup).

Any inside info?

Not really inside info, it is quite public :

As China is quite a populated country, there aren’t many empty places to build on (especially in coastal cities. Beginning in the 1990’s, there was a policy of granting property rights to tenants of formerly collective property. As a consequence, home ownership rates are extremely high in China (more than 80%). Put these two facts together, and it means developers, or the local municipalities who fund the developers, must compensate evicted tenants when they want to build something new. It is this compensation that forms the bulk of the fabled 30-40% downpayment that is supposed to reflect the sustainable nature of the real estate boom.

The problem is that, according to sound banking practice, a downpayment is supposed to reflect the capacity of the borrower to generate cash-flows to pay back interest and principal. It is not the case in China because people are not paid enough, they have just been given this money “for free”. It is quite similar to the situation during the US bubble when the downpayment was given by a “charity” to the borrower, with the said “charity” being funded by the seller who was just grossing the “donation” into a higher house price.

Two options are therefore on the table for the Chinese Middle Class :

Option 1 : End up paying up a large part of their meagre salary to pay back a 30Y+ mortgage on the new flat they will buy (one has to live somewhere after all…), which means it is screwed because it ends up paying big money for a dwelling whereas before they had a place to live free and clear ! Not many are wise enough to see through this trap and refuse to surrender their old place, and for the few that are, there are many ways to pressure them in official and unofficial ways.

Option 2 : Jump in the game and leverage to the max to buy several flats, and hope to be able to sell at the top. enough said…

It is clearly a Ponzi scheme.

You may ask, who is crazy enough to finance it, especially after what happened in the US ? To understand that, you have to realize that there is two components in the financing :

– The mortgage to buy the new flats, where the banks blind themselves to the poor cash-flow generation of the borrower thanks to the large downpayment. Note however that even if prices were halved, household would still struggle to repay the mortgages, such is the overvaluation in China.

– The developer loans to fund the relocation compensation : these loans comes mainly from corporations that are guaranteed by local municipalities that the banks deem as good as the Central Governement for Credit Risk purpose. It ends up being a huge hidden liability for the Central Government, estimated by Victor Shih around 20% of Chinese GDP if prices really crash. Think Irish situation.

Unsound Leverage, Massive moral hazard in the banking sector. Do you have a sense of déjà vu ?

Nice comment Charles, thank you!

second that, i.e. Thanks Charles.

They borrow the money to make the down payment.

A bubble of any kind is yang.

A black hole of any kind is ying.

When you are able to balance a financial bubble delicately against a financial black hole, you are in harmony with the Way, with Tao, and you can go on buying the Volvos of the universe for a long, long time.

I have a dumb question. Does the Chinese financial system charge interest on the creation of credit as our Federal Reserve does to the US government? How is their system different, if at all, from our Capitalist finance system? Do they have a national debt?

In China, local government borrowings come from banks (which are 51% or more government owned) or from private capital. In China’s semi-socialist system, default is postponed by the banks being ordered to roll over the loans, and by the state encouraging private capital to do the same. If default does occur, writedowns are imposed on bank balance sheets. As long as there is a sufficient social pool of private savings and a surplus from international trade and capital flows, insolvency remains an accounting problem. The physical capital deployed in the bankrupt projects (workers,cranes, earth movers, etc.) was redeployed and real growth continued without any serious interruption. This time the world economy is sluggish, so widespread default will prove more of a drag, but not even close to a system-buster.

Some claim that the RMB is undervalued because China’s reserve growth is excessive. Others say that the government is drowning and debt and will go under next week. Both of these cannot be true. I tend to believe that the first camp is correct.

The ability of this political economy to handle insolvent banks was proven in the aftermath of the growth spurt of the early 2000’s. The People’s Bank of China bailed out the half-dozen biggest banks to the tune of several hundred billion dollars. Productive capital was redeployed smoothly and growth continued in the real economy. It is true, this time the world economy is sluggish and the domestic economy in China will receive less support from exports. But to analyze the impact of government debt, doesn’t one need to consider the savings pool, tax base, financial reserves, and small details like these on the other side of the ledger?

Franz Kafka A Message from the Emperor

The Emperor—so they say—has sent a message, directly from his death bed, to you alone, his pathetic subject, a tiny shadow which has taken refuge at the furthest distance from the imperial sun. He ordered the herald to kneel down beside his bed and whispered the message in his ear. He thought it was so important that he had the herald speak it back to him. He confirmed the accuracy of verbal message by nodding his head. And in front of the entire crowd of those witnessing his death—all the obstructing walls have been broken down, and all the great ones of his empire are standing in a circle on the broad and high soaring flights of stairs—in front of all of them he dispatched his herald. The messenger started off at once, a powerful, tireless man. Sticking one arm out and then another, he makes his way through the crowd. If he runs into resistance, he points to his breast where there is a sign of the sun. So he moves forwards easily, unlike anyone else. But the crowd is so huge; its dwelling places are infinite. If there were an open field, how he would fly along, and soon you would hear the marvellous pounding of his fist on your door. But instead of that, how futile are all his efforts. He is still forcing his way through the private rooms of the innermost palace. Never will he win his way through. And if he did manage that, nothing would have been achieved. He would have to fight his way down the steps, and, if he managed to do that, nothing would have been achieved. He would have to stride through the courtyards, and after the courtyards through the second palace encircling the first, and, then again, through stairs and courtyards, and then, once again, a palace, and so on for thousands of years. And if he finally burst through the outermost door—but that can never, never happen—the royal capital city, the centre of the world, is still there in front of him, piled high and full of sediment. No one pushes his way through here, certainly not someone with a message from a dead man. But you sit at your window and dream of that message when evening comes. [1] via wikipedia.

I suggest that Kafka’s artistic vision is more correct then the command state analogies That is the reason that the LGFA is so huge and such a problem. The basic unit of power is the party structure in each Village. And in much of rural China even the next level of power may be a long days ride along bad roads. And if the gov’t sends money to your village and you are in power of course you are going to redirect it for your family’s use.

Don’t think command state. Think feudalism

The entire world economy is a Ponzi scheme, because all nations followed the lead of USA into this scheme.

The US elite may wish for every other major economy to unravel but not its own. That’s extremely hard to accomplish in this interconnected global economy. I have a feeling American exceptionalism won’t work this time. For one thing, the USA of late hasn’t been that exceptional beacon of hope people used to aspire to.

Wouldn’t we expect the credit:GDP ratio to be higher in this cycle since so much of current credit expansion is for long term capital projects (highways, high speed rail, airports)? These projects don’t deliver economic benefit until completed several years from now. On the other hand previous credit expansion was probably much more closely linked to immediate consumption (including export oriented investment that quickly resulted in export sales).

We would expect the ratio in the U.S. to be much lower, since most of the stimulus is resulting in consumption, which is immediately measured in GDP.