When the SEC filed its civil suit against Goldman, the firm and its stalwarts argued that the firm would come through with its reputation intact.

Anyone who watched Goldman over the last decade had reason to doubt that cheery view. The firm has undergone a remarkable change, from one that was notoriously aggressive but had a keen sense of where the boundaries of propriety lay, to one out to maximize its bottom line with little regard to the long-term consequences. Greed and short-termism won in 1999 when the firm went public. At most times in the preceding 15 years, if not even earlier, Goldman could have gone public or sold itself, producing a nice killing for its current partners. But most saw Goldman as an institution and felt that selling it would be an act of opportunism, of cashing in on what others had built without compensating them fairly.

I would occasionally have dinner with a senior staff member, one in an influential position that put him regularly in front of the CEO and the management committee. He had been with the firm a very long time and had institutional memory, a very scarce commodity. He was always discreet, but his unhappiness with the devolution of the firm was palpable. He did not have much respect for Hank Paulson, but it appeared the other members of the management committee, particularly John Thornton and John Thain, were thoughtful and acutely aware of the tradeoff between short-term profits and maintaining the firm’s franchise. By contrast, after Blankfein took the helm and the management team came to be dominated by traders, I could see him do everything in his power to steer our conversations away from Goldman, even the Goldman of long ago. And it became obvious why: the times we did wind up on that topic, he would be unable to contain his contempt for the people leading the firm, and the damage he was convinced they were doing to the firm’s culture, which he was also certain would play out in its reputation. It has taken a few years for him to be proven correct.

The New York Times chronicles how some of the firm’s corporate clients are increasingly uncomfortable with how Goldman will use the information the firm gains from its business dealings (meaning its corporate finance relationships and underwritings, where the banker is expected to treat its customers as a relationship, not a trade) for its own profit, particularly to bet against the client. This would have been completely unthinkable when I was briefly at Goldman (the early 1980s); Sidney Weinberg would spin in his grave if he could read this story.

The article describes in particular how the firm both represented WaMu as a manager of its mortgage-backed securities offerings, yet shorted its bonds and its stock. Goldman maintains, in effect, that the short wasn’t “personal” but was part of a broader portfolio management strategy. If you believe that, I have a bridge I’d like to sell you.

The suspicions of WaMu’s CEO Kerry K. Killinger appear well founded:

In that [e-mail] message, Mr. Killinger noted that he had avoided retaining Goldman’s investment bankers in the fall of 2007 because he was concerned about how the firm would use knowledge it gleaned from that relationship. He pointed out that Goldman was “shorting mortgages big time” even while it had been advising Countrywide, a major mortgage lender.

“I don’t trust Goldy on this,” he wrote. “They are smart, but this is swimming with the sharks.”

One of Mr. Killinger’s lieutenants at Washington Mutual felt the same way. “We always need to worry a little about Goldman,” that person wrote in an e-mail message, “because we need them more than they need us and the firm is run by traders.”

Yves here. WaMu is not an isolated case. I have had a former financial firm executive tell me that when Goldman was pitching to manage an offering, its executives asked point blank, “Are you shorting our company?” They did not get a straight answer, which they took to mean, “Yes”.

The article also contends that the firm encourages its staff to ignore conflicts of interest, a charge the firm’s spokesman, Lucas Van Praag, denies:

When new hires begin working at Goldman, they are told to follow 14 principles that outline the firm’s best practices. “Our clients’ interests always come first” is principle No. 1. The 14th principle is: “Integrity and honesty are at the heart of our business.”

But some former insiders, who requested anonymity because of concerns about retribution from the firm, say Goldman has a 15th, unwritten principle that employees openly discuss.

It urges Goldman workers to embrace conflicts and argues that they are evidence of a healthy tension between the firm and its customers. If you are not embracing conflicts, the argument holds, you are not being aggressive enough in generating business.

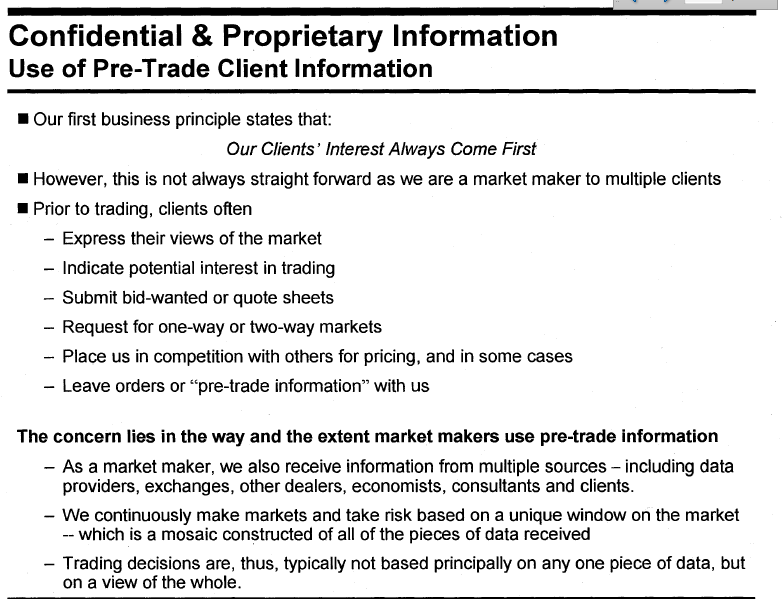

Yves again. The article alludes to two of the 901 pages of exhibits released by the Senate Permanent Subcommittee on Investigations. I’m puzzled that the web version did not point to them directly; they are a revealing example of Newspeak in action (click to enlarge, or see pages 259-260):

Yves here. Van Praag reportedly contends, “This policy and the excerpt cited from the training manual simply reflects the fact that we have a diverse client base and give our sales people and traders appropriate guidance.”

Ahem. Anyone who has lived in Corporate America will recognize these pages as CYA. One thing Goldman has long-ago mastered is getting its story straight BEFORE it engages in questionable behavior. I saw that first hand when I worked for Goldman in the 1980s. For instance, I once walked into the Syndicate department well after normal hours for that group to find two junior staffers being briefed by one of the most powerful partners from Goldman’s main law firm, Sullivan & Cromwell (i.e., someone who would normally never deal with people so far down the totem pole) walking them through the party line on an upcoming deal. It was an unusual type of underwriting; the head of Syndicate had crowed, “I’m going to make that stock sing!” but that was not the sort of thing you say to the SEC should they happen to come calling.

Similar legalistic positioning in the excerpt is obvious to anyone who has an operating brain cell. The Goldman argument is that trading decisions are not based on “any one piece of data” which seeks to claim that no one piece of information (which of course could come fro a client and hence constitute front running or simply abusing a presumed relationship) would lead to a trade. Huh? Traders often jump to take or lighten a position PRECISELY because they have gotten a SINGLE piece of information which they see as significant and believe the market does not have yet.

The story accounts other examples of less than savory conduct by Goldman. One case involved the auction rate securities market. Goldman refused to to waive a contract provision, as other banks had, after they abandoned the auction rate securities market. The article does not state as clearly as it might that the reason the issuer in question, a hospital, wanted a waiver was because it was paying a penalty rate precisely because Goldman and other firms who had once been willing to act as market makers, were refusing to do so. This is more serious than it might seem because an underwriter is expected to continue to make a market after an issue is sold; this is an important service to investors and issuers. But there is no contractual obligation, even though it is widely regarded as an essential part of the business. Hence the hospital’s outrage when Goldman welshed on its part of the deal but insisted the hospital adhere to its contract.

Another juicy item: Goldman recommended shorting the debt of six states….the same year it had underwritten bonds for those states, which meant it sold them to (presumably) other investors.

The article describes more incidents: how Goldman sold a notoriously toxic CDO, Timberwolf, to a Bear Stearns hedge fund (the one that blew up in July 2007, ushering in the first acute phase of the credit crisis) and then shorted Bear’s stock, and how aggressive collateral calls might have led to the demise of Thornburg Mortgage.

While Goldman is a sufficiently embattled firm these days it is well nigh impossible for outsiders to get candid answers, the firm’s conduct in the Senate hearings and some of Lloyd Blankfein’s star turns give the impression that the firm’s moral compass is so badly broken that its leadership and many of its employees genuinely thinks there is nothing questionable about this type of conduct. And if that is true, the firm is beyond redemption.

the firm is beyond redemption

Unless they issue a press release declaring that they’ve all “come to Jesus” and have been washed clean of all sin.

But years later, they will have to issue another press release about how “the spirit was willing, but the flesh was weak” as they were short-selling into the Rapture….

I don’t know why the media is harping on Goldman’s client transgressions now when they have been doing this since the earlier part of the decade.

The MSM also seems to miss that both Goldman’s prop desk and advisory only seem to make money in bull markets. This is simple delivering beta and has nothing to do with trading outperformance!

When is someone going to bother to mention how outrageously overpriced Goldman has been for the last three or four years? The premium that they got was definitely not deserved and when one takes an objective look at the numbers, they barely earn their cost of capital, even in bull markets. One should look beyond the accounting earnings and into the actual, effective economic profit. See http://boombustblog.com/reggie-middleton/1817/ and

Thank you, Reggie

The MSM is an abysmal disappointment, as deserving of Goodwin’s “beyond redemption” tag as GS. It seems all they can do is follow the money, shoot themselves in the foot in the process, and then desperately to hobble out to the front of the parade.

Thanks to heroic blogs like CreditWritedowns and Naked Capitalism, there’s growing record of damning evidence against this rotten system.

Moral compass. . . in the investment banking business? You’re kidding, right?

Actually, the investment banking side was once concerned with propriety and reputation, as antique as that sounds now.

Even on the trading side in the stone ages of my youth, you did not kill the goose that lay the golden eggs. You might nick some extra margin now and then, but not too often, and best when the client had made money too.

So people did have a sense of right and wrong, and kept their greed within certain bounds. The current ethic on Wall Street is very different. Many people seem to think predatory behavior is OK, if they rip off someone, it was because they were stupid and deserved it.

The problem of course is that if markets become sharktanks, no one will want to go into the pool.

You’re showing your age… ;-)

Let us count the ways –count the ways writers in mainstream and business investment media defend Goldman Sachs.

Begin with Jeremy J. Siegel writing that Goldman Is the Wrong Target on Yahoo Tuesday, May 18, 2010, because, he says, ‘the SEC lawsuit against Goldman charging that the firm misled sophisticated institutional clients bewilders’ him.

Who cares?

He then proceeds to explain. Talking his book.

How can it be said that Jeremy J. Siegel is talking his book? Jeremy J. Siegel’s profession is going down in disrepute and he must keep on writing.

So, we’re picking on Goldman Sachs.

Why?

Because Goldman Sachs leads their cronies in finance and FIRE industries in influence and takeover of the US government. Anything and everything they do pales beside that fact –in full view of the American people.

The very stupidity of Hank Paulson to behave the way he did during the takover on the TV in front of the world’s people while at the top of his profession, influence and position in government as a securities TRADER, good God, –a securities trader –is proof enough of the depravity of the company he represents and of his profession.

The list of Goldman Sachs minions in positions of influence and power in the US government is unacceptable. How much longer before something is done about it WITHIN THE LAW. Its hard to believe it can’t be done.

What are we waiting for? How about campaign finance reform for starters? Real finance reform. Public financing. Free TV for qualified candidates on every level of state, local and federal government. Active regulation of cmapaigns to react quickly to gaming the system with big penalties against media violating rules.

Why can’t we do that? What are we waiting for?

The problem is that TV expense for election campaigns overwhelms candidates who, it has been reported, spend 50% of their time dialing for dollars for the next election as soon as they are elected. The system demands politicians be supported by the highest bidder.

Politicians can’t work in government without continued big money backing or by their own personal ill gotten fortunes. Even when legitimately acquired, the lax tax laws for corporations and finance guys, and printing their own money stock option and private finance system has permitted these fortunes to become too big for any normal human being in a civilized society. Society cannot expect these fortunes to be used wisely for the benefit of the very people providing these fortunes.

Goldman Sachs domination of the highest positions and influence in American government most visibly at Treasury, executive branch advisory, and foreign policy, has created an ugly, mean maldistribution of job satisfaction and financial security. By comparison, in terms of harm done to the greatest number of people, the wealth disparity part of it is a mere distraction. Pitchfork symbolism really misses the mark.

For example Treasury Secretary Paulson Still Sees His Mission as Building Up China’s Economy

William R. Hawkins, March 14, 2007

Senior Fellow for National Security Studies at the U.S. Business and Industry Council. here

“On March 7, Treasury Secretary Henry Paulson gave a major speech in Shanghai, China. He has traveled there several times since assuming his post in the Bush Administration, but he made frequent trips when he was CEO of Goldman Sachs seeking to bring foreign investment to China. Unfortunately, his message and behavior have not changed much in his new role. He still acts as if his mission is to help his banking colleagues profit from building China into a great world power. There was nothing in his Shanghai speech to reflect his duty as a government official to advance the interests of the United States.“

Apologies. As I started with a diatribe on disparaging experience, particularly the experience of women and the harm it has done in this society, the effects of other prejudices paling in comparison, and then got to the topic of Goldman Sachs, I meant to place it where it properly belongs at the end of the thread.

But she looks good for a stone-age woman. (At risk of revealing my own age, I’m daydreaming of Raquel Welch.)

“Killing the Golden Goose”…Yur bloody right they did!

They were short gold and eggs and other people’s nest eggs. I don’t know yet if they have succeded. But, I believe that there is a cabal within the United States and probably extending beyond, that planned to crash the economy because they had sold everything in sight and need a crash to cement their gains and position. This is about more than greed. It appears to be some appocalyptic madness. I really feel that it first began with Mr. Bush senior and the first Gulf War, which had every possibility of being played out on The Plains of Abraham. Fortunetly the Republican Guard folded and nobody came to join Sadam’s party.

I agree.

It’s like behaving with suicidal abandon, only to discover how hard is to die on cue.

LOL… Many companies did manage it. Atleast enough so for their management to profit from the bloodbath. I have seen numerous cases of corporate management intentionally shooting their companies in the foot/head/backside and keep doing it until the stock price fell. This is not disclosure in the normal sense. It is a matter of driving out the common shareholders. We are seeing the same now in currencies. what kind of a world do these people think they will own???? Obviously their vision does not include putting up with the riff raff.

Unenlightened self-interest stripped naked.

So people did have a sense of right and wrong, and kept their greed within certain bounds. The current ethic on Wall Street is very different. Many people seem to think predatory behaviour is OK, if they rip off someone, it was because they were stupid and deserved it

Of course, WS has lost any sense of ethics it may have been left with. But how can you be ethic when the monetary tools are not? How can you be ethic in money management when central banks – starting with both China and US, but do not discount peripheral players such as ECB – make sure that “base” interest rates stay permanently below interest (aka R-E-A-L inflation).

This creates an incentive for a lot of nasty behaviours. Starting with households transforming themselves from peaceful savers into massive family-based hedge funds and up the line. And peaceful pension funds muting into aggressive trading entities.

Does anyone here remember what a dollar used to mean!

Daniel,

The predatory behavior was well established LONG before the super low interest rates of the dot-bomb era. I have a long discussion of the structural changes in the financial services industry that led to predatory behavior and looting in ECONNED.

For some quick proofs: Read Frank Partnoy’s Fiasco, which discusses his experience at Morgan Stanley in the early 1990s. Read up on the Bankers Trust derivatives scandals. And what about all the dot com era chicanery, while we are at it? Or the 2002 accounting scandals? The abuses were long standing by 2002, when the super low rates had just begun.

“After shaking hands with a thief, count your fingers”. Perhaps, we should change that to “After shaking hands with a Goldy, count your fingers twice”.

It seems that the firm has lost all honor. I feel sorry for your friend. He put his all into the firm and watched it slowly die from within due to rot. Well, rot can be removed by internal change or external change if the firm isn’t at death’s door due to looting.

jb; as Yves was suggesting. They are a symptom of the disease, not the definition.

The world needs a moral compass and a new value system.

It’s no real surprise that such behaviour is condoned or maybe even encouraged. The only surprise is if they actually get real backlash for it. Sometimes when the entity is “too big” to budge, all this is just background noise in a very noisy concert.

“Shareholders Value”

“Greed is Good”

All playing at the Wall Cheat Casino, where “tails I win, heads you loose” rules.

The short sightedness of the GoldSacks management is breathtaking. The current financial world seems to be the only branch where screwing your customer is allowed.

Oh, there’s one other profession. Been around forever….

But in that profession their up-front disclosure is quite clear that the customer is going to get screwed.

Personally I’m tired of bankers being compared to prostitutes, as it unfairly maligns people who offer a simple and honest service for fee (and even though I phrase it as a joke, I’m also quite serious).

Even if GS dropped prop trading, there would still be a conflict between underwriting debt and marketing CDS for those debts(done by research department). How do you manage that conflict??

I’ve met the friend of a friend this weekend in, who works for a shop that does biotech investing. Well, all on the table had PhDs (he was a trained biochemist), some were active scientists, others engineers. He made several claims, all to the effect that his profession made the world spin. There is no point to repeat the detail, but he came over as either in denial or delusional. Which is a bit puzzling. Several people I know that went to finance several years ago were smart/cynical enough to understand the business. But it is depressing that others that tried to be engineers or scientists for a few years are currently abandoning that career choice to create financial startups. I guess the money is lying on the street, courtesy of BB. Where is a moon shot program when you need it?

Sometimes the symptoms of states of abnormal pychology can reveal the distilled essence of the forces that animate what passes for sanity.

In one of Carl Jung’s writings, I can’t recall which right now, he relates that story of a young man who suffered from a form of mental illness that manifiested in a belief that the world itself was a series of postcards presented to him for his amusement. This is quite a striking image, if one reflects on it.

Every turn of the head, every shift of the eye, presents an artistically individuated photograph, as it were, for the sole purpose of amusement.

This is beyond narcissism or pyschosis. It’s an overwhelming triumph of the personal imagination over any form of collective reality — physical, moral, ethical, communal or otherwise.

What this patient of Carl Jung dramatically achieved through is own illness, I think contemporary finance has achieved through mathematics and financial theory. It is a triumph of complete soul-less insanity. And it is no wonder why Goldman cannot see what it is doing wrong. Every direction it looks it sees a postcard of money, presented to it for it’s own profit. That’s the world, right?

To IF and craazyman….nice posts.

It is a sign of the times that people put the accumulation of money as the key goal of their lives.

From Revelations (slightly modified)

The (Golden?)lamb with horns shall make men

bow down and worship the head of the Beast that is

dead and yet alive.

I don’t believe in the literal translation of ‘Revelations’, a contextual interpretations is much more pertinent. I think I could argue that someone who always thinks about money and how to accumulate it is practising a form of worship. And the ‘lamb with horns’ has attempted to envelop the whole world with debts(sovereign debt, inflated bubble based mortgages, hidden CDS that entrap nations) that it cannot pay.

Btw…I am not of those literalist Christian Evangelical ‘Tea-Baggers’. They beleive the central message of God is ‘Beleive in Me or else!!’. But I believe the central message is of God is to do what is and Truthful and Compassionate for everyone (including yourself). It is sad to see that our present financial system is designed for precisely the opposite (deception, obfuscation, and maximum self-interest irregardless of what happens to everyone else).

Thank you Ming. Actually, I’m a Professor of Contemporary Analysis at Magonia University. Speaking of crazy biblical texts, we have an ancient languages department that I work closely with, most recently on a project to translate certain ancient texts that offer inverse parallels to the life of Jesus. These were Gospels dug up in the excavation of an outhouse in the outskirts of Jersusalem, written by some no doubt deranged prophet of proft. They were called the Gospel According to Mammon, apparently based losely on the true Gosples in general narrative form. In one of them the anti-Jesus, who I translated as Don John, found a money changer tending to his debtors on the grounds outside of the temple, showing them mercy and forebearance and helping them as best he could. The narrative has Don John ordering him into the temple to set up his table where he can trick and cheat the worshippers out of their devotional donations through fraud. When the money changer resisted, Don John broke his nose with a punch to the face and called him a hypocrit because mercy and pity makes one weak and the poor are lost in sin anyway, so helping them only compounds sin upon sin. I can assure you that it was a difficult translation task. In another episode, Don John and his gang steal bread and fish from the multitude and profit by selling it in the marketplace two towns over, down the highway. The sick and poor are left hungrier and poorer than ever. In yet another scam, Don John has his disciples extend credit to the sick and the poor at usurious interest rates, then sell these obligations at a discount to face value over in Babylon, knowing that the ultimate debts will fail but pocketing huge profits selling them in the meantime anyway. This procedure for wealth creation has an odd similarity to the way Wall Street operates. I am working with the Smithsonian to bring these gospels to the public in the form of a televised documentary. The writer of these ancient texts may have been a comedian of sorts, because the “Jesus” figure is named Don John, sits on his pile when he’s not out fleecing people and lives in an outhouse. This is not the sort of thing the canonical biblical editors would have included in the Good Book. But somehow it has a ring of truth to it anyway. ho ho ho. It may be a synchronicity that these ancient manuscripts should be unearthed at the present time.

Interesting…I didn’t know an Anti-Bible existed.

As for the scams that the banking industry has managed to pull off, I am sure a perusal of financial history would reveal that many of the ‘new financial innovations’ (which Greenspan had defended) and their abuses, had existed in eras of the past.

As the wise teacher of Ecclesiates had said

‘There is nothing new under the sun’.

Bloomberg:

“Goldman Sachs Hands Clients Losses in ‘Top Trades’”

“Seven of the investment bank’s nine “recommended top trades for 2010” have been money losers for investors who adopted the New York-based firm’s advice, according to data compiled by Bloomberg from a Goldman Sachs research note sent yesterday.”

http://www.bloomberg.com/apps/news?pid=20601087&sid=aF5tV7uvY0FU&pos=3

Yves – given his experience at Goldman, how could Hank Paulson not have known about the interconnectiveness of banks with CDS.

From a lay persons perspective, I am quite prepared to believe H. Paulson knew the whole system was comming down and he got to the government position to save it with a bailout. His dry heaves was only because he was worried about getting caught. More over, the AIG bailout benefiting Goldman has his fingerprints all over it. It might be that H. Paulson will turn out to be the biggest criminal of them all. I wonder how many of the AIG liabilities were connected to naked CDS.

Can you tell us about Neil Kashkari(sp?)who was also from Goldman who wrote the original bailout memo well in advance of its apparent need. I worked for two large corporations and he seems to have the attributes of a water carrier (devoid of original thought) who follows orders.

What a mess. You talk about new corporate culture. Do you think it existed with Corzine – or was he simpley driven out by the wolves.

This no longer an issue of legal costs. Their client franchise is beyond redemption. Short Goldman!

Bingo.

It is ironic that, as hoi polloi points out, seven of Goldman’s top ten trades have lost money so far in 2010. Aren’t they famous for almost never losing money in their prop accounts?

Goldman Squid isn’t a bank or a trading firm so much as it is an international crime syndicate. Banking and trading are merely the means it uses to commit crimes. The entire staff, as well as it employees at the Fed and the SEC, up to and including Paulsen, needs to be brought up on charges of racketeering, conspiracy, and treason.

I recommend seizing the conzern’s assets and using them to convert their office buildings into penitentiaries.

If you don’t they will destroy the country. Fair warning.

GS has always been a trading firm, occassionally a market maker and only nominally a fiduciary adviser. It has many customers and very few clients.

Mixing customer service with client service is like making a vinegar and oil salad dressing. You have to shake well to obtain a proper emulsion. Even so the oil eventually floats to the top. For long term storage, it’s best to store them separately.

In the financial markets it is best to separate trading activities from investment banking. In a very fundamental way the two efforts do not mix. What GS has run afoul of is the delusion that it can be both a trading firm and an investment banking firm.

Abacus is a classic conflict of interest exercise for an investment banking firm and an otherwise dynamite trade intended to short a heterogenious market bubble. The social value of the trade is the fact that it exploits the mispriced and misallocated housing market.

The breakdown in moral conduct lies in the general acceptance of the concept that there is no responsibility for abetting the promotion of a product that is intended to fail. The assertion that no one knew the product would fail is rubbish. It was not a matter of whether, it was a matter of when.

A CDO is nothing more than an aglomeration of highly questionable claims against highly subordinated income streams whether artificial/virtual or not. The CDS that is purchased against the CDO is entirely dependent of the reliability of the seller of the CDS. If the CDS was properly priced, its purchase would have been uneconomic.

This is all the result of the abrogation of regulatory authority. It is after all, perfectly legal and any tort that is claimed can be litigated away. After all, 5 or 6 years from now I’ll have a lot of money and leave this fools paradise.

My grandfather showed me the pea and the 3 walnut shells con as a child. Simple magic and card tricks was one of his long time hobbies and he was very good.

That guy sure missed his calling on Wall Street.

The Goldman boys are crooks. They are not the only ones on Wall Street, by far. Still after all that has happened, every reputable institution on the planet has to know about Goldman. So really the only people who trade with them now have got to be other crooks. That Goldman is willing to screw them over as well just shows that there is no honor among thieves. But we knew that.

the Vampire Squid writhes ever onward

As the rich get richer, ‘pretty’ people get ‘prettier,’ so too do the compromised – they become more compromised.

I have played in these markets for several decades. Confidence in ol’ Goldy has been seriously breached. It’s advisory and corporate business will drop off, as it’s clients view it to be predatory and using its priviliged of access to proprietary information it’s own personal gain. Pretty hard to see any upside for ‘ol Goldy, and still a long ways for it to fall. I went short on ‘ol Goldy as soon as I saw that depraved psycopath Sparks lying before Congress. I went short, the ‘BIG SHORT’ on ‘ol Goldy! Let the freefall begin!

I agree with the earlier post that Hank Paulson was the biggest criminal of the crisis — treason, fraud, grand larson — he should be gutted alive and his body mummified in a mosoleum as a permanant reminder of the depths of human depravity. ‘Ol G

As the United States, so Goldman

I’ve been exploring pretty much everywhere for this specific info… I’m thankful anybody likely has the solution to a real uncomplicated question. You might have basically no idea how many www sites I have also been to throughout the past hour or so. I am grateful for that material