By Willem Thorbecke, Senior Research Fellow at the Asian Development Bank Institute and a Consulting Fellow at Japan’s Research Institute of Economy, Trade, and Industry, originally posted at VoxEU

Yves here. As we have pointed out in several posts, the idea that China’s announcement on its currency policy change is “abandoning its dollar peg” is a misreading, and it’s also clear that China is not making meaningful changes anytime soon. But it’s still worth considering what a move like that might actually do. To the post:

The People’s Bank of China announced on 19 June that it would abandon its dollar peg and switch to a managed floating exchange rate regime with reference to a basket of currencies. Will this move help to rebalance the global economy?

Figure 1 shows that China’s trade surplus has been concentrated in “processing trade”. Processing trade refers to a customs regime under which parts and components are imported into China duty free and used to produce final goods that are re-exported to the rest of the world. Neither the imported inputs nor the final assembled goods enter China’s domestic market.

Figure 1. China’s trade balance by customs regime

Source: CEIC Database

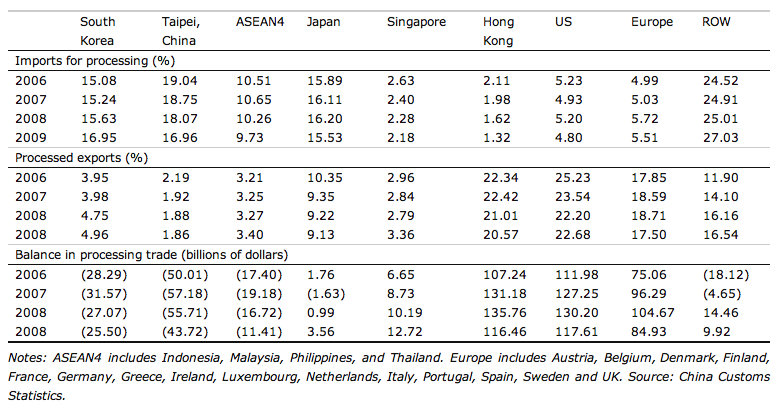

Table 1 shows some key facts about processing trade (click to enlarge):

Two-thirds of the imports for processing come from East Asia; the US and Europe account for only 5% each.

For processed exports, about 20% goes to East Asia, the US, Europe, and Hong Kong.

Imports for processing come largely from East Asia while processed exports go throughout the world, so China runs deficits of about $100 billion with East Asia and surpluses of almost $100 billion with Europe and of more than $100 billion with the US and Hong Kong.

Because of “entrepôt” trade, China’s surpluses with Hong Kong and Singapore actually represent surpluses with other countries.

Table 1. China’s processing trade, 2006-2009$

Addressing the statistical problems of trans-shipments

Kwan (2006) noted that, in the presence of entrepôt trade, import data are much more accurate than export data. When exports from China are trans-shipped through Hong Kong or Singapore, the Chinese government might not know the final destination of the goods. They thus record the goods as being exported to Hong Kong or Singapore.

When the exports arrive at their final destination, however, the importing country records the goods as having come from China. Kwan thus recommends using import data from trading partners to calculate bilateral trade balances.

Using this approach, China’s surplus with Europe increases by about 20% and China’s surplus with the US increases by 50%. This makes it clear that China’s surplus in processing trade is primarily with Western countries.

Given this pattern (large trade deficits with East Asia and even larger surpluses with the West), an appreciation throughout East Asian supply chain countries would help rebalance the processing trade by affecting the cost competitiveness of a much wider share of the value added than would happen with only a renminbi appreciation. That is, an East-Asia-wide appreciation would affect the relative euro and dollar prices not only of China’s value added but also of the value of imported inputs coming from the rest of Asia. Formal evidence indicating that an appreciation throughout Asia would affect China’s processed exports has been presented by Ahmed (2009) and in my recent research with Gordon Smith (Thorbecke and Smith 2010).

Some estimates

Ahmed (2009) employs an autoregressive distributed lag model and quarterly data over the 1996Q1 – 2009Q2 period and disaggregated renminbi exchange rate changes into those relative to East Asian countries and those relative to other countries. He reports that a 10% appreciation of the renminbi relative to non-East Asian countries would reduce China’s processed exports by 17% and that a 10% appreciation in other East Asian countries would reduce China’s processed exports by 15%. Ahmed concludes that an appreciation throughout East Asia would cause a much larger drop in processed exports than an appreciation of the renminbi alone.

In our recent paper (Thorbecke and Smith 2010), we construct a single integrated exchange rate variable to measure changes in the relative foreign currency costs of China’s entire output of processed exports. Using dynamic ordinary least squares estimation and annual panel data over the 1992-2005 period, we argue that a 10% appreciation throughout the region would reduce processed exports by 10%. Thus, a joint appreciation throughout East Asia would help to rebalance processing trade.

Conclusion

By abandoning its de facto dollar peg and adopting a regime characterised by a multiple-currency basket-based reference rate, China may facilitate a concerted appreciation in the region. China’s dollar peg had prevented Asian countries from appreciating together. With China’s currency pegged, neighbouring countries competing with China felt they also had to prevent their currencies from appreciating.

When currency markets opened on 21 June after the announcement by the People’s Bank of China, the renminbi and other East Asian currencies appreciated together. If China can gradually increase the band around its new reference rate, the huge surpluses generated within East Asian production networks would cause currencies in the region to appreciate together.

Market forces could allocate these appreciations across supply chain countries based on their value-added in processing trade. Stronger exchange rates would then reduce processed exports to the US and Europe, helping the region to redirect production away from western markets and towards domestic consumers.

“Yves here. As we have pointed out in several posts, the idea that China’s announcement on its currency policy change is “abandoning its dollar peg” is a misreading, and it’s also clear that China is not making meaningful changes anytime soon. But it’s still worth considering what a move like that might actually do.”

Come on! If we are going to do make believe remedial planning let’s just get right to it and knock off this very limited mini speculation crap…

Based on entrepôt trade hanky panky, and a whole range of other deceptions, John Lennon employed an autoregressive distributed lag model and data acquired over his lifetime into those relative to rich people and those relative to poor people. Using dynamic ordinary least squares estimation and annual panel data, again based on his lifetime of experiences, he concluded that the world could live as one …

Imagine there’s no Heaven

It’s easy if you try

No hell below us

Above us only sky

Imagine all the people

Living for today

Imagine there’s no countries

It isn’t hard to do

Nothing to kill or die for

And no religion too

Imagine all the people

Living life in peace

You may say that I’m a dreamer

But I’m not the only one

I hope someday you’ll join us

And the world will be as one

Imagine no possessions

I wonder if you can

No need for greed or hunger

A brotherhood of man

Imagine all the people

Sharing all the world

You may say that I’m a dreamer

But I’m not the only one

I hope someday you’ll join us

And the world will live as one

Deception is the strongest political force on the planet.

Yves,

I am glad that you cover this topic. I also apprecite your coverage of the Grove/Sethi pieces. It brings some balance to all the MMT and stimulus articles you cover.

As you might be able to tell, I believe that stimulus packages on their own, without these other considerations, will simply leak out of the US without helping the employment situation. In fact, I believe this is exactly what has happened during the so called great moderation and left us with the giant hole we are in right now.

tyaresun

How likely is it that China would revaluate its currency upward with the world headed back into recession?

We had a post in Feb on the idea that the RMB might be devalued. If the euro goes to parity, as a lot of US investors anticipate, I see a devaluation v. the dollar as likely.

Yves, thanks for posting this. Would be interested in that Feb post if there is still a link. Cheers.

One more thing:

“Even subtracting the cost of the wars in Iraq and Afghanistan, military spending still amounts to over 42% of total spending” from the HuffPo article.

We cannot talk about MMT, exchange rates, unemployment rates, etc without addressing US military expenditures.

Well said. It seems to me that a lot of people, including economists and politicians, are burying their heads in the sand.

That the Chinese trade surplus is really an East Asian surplus and that the RMB peg is the king-pin for other East Asian currencies has long been known, whatever the precise econometric estimates.

items:

– Size matters. Never in modern post war US history it has external economic rial this size and growing at this speed. Japan GDP during 60’s-80’s is nowhere near half of US economy, and they grow slightly slower. China is half the size of US economy and growing at 8-10%. Add this entire asia (asean, India) Brazil, all of them are trying to maintain stable price in USD, the idea that US can create inflation by printing dollar is nonsense. US economy is not big enough to saturate these high growing countries ability to absorb dollar/maintain peg.

– Krugmann is still under the fantasy that US will experience japan lost decade instead of going Argentina/Greece. Japan started the crisis with GIGANTIC budget surplus, GIANT export surplus, skyrocketing Yen value, and the highest public saving rate in developed country. They are LOADED. They can play the bail out game forever if they want to, paid for by their own citizens. (compared this to current US monetary and fiscal condition.)

Krugmann number, his trend modeling, is based on US economy when it’s still 30-40% of world GDP. That train has left the station long time ago.

– China is climbing manufacturing ladder. Whatever Taiwanese, Korean, japan (all countries that uses chinese characters) can do, china will do it all in less than 10 years.

Few years ago china was making shoes, cheap plastic toys and low end garment (taiwan in the 60’s, japan 50’s). Today they are making high consumer goods, electronics, and low end car (taiwan in the 80’s, Japan 70’s). Tomorrow they will make telcom system, aircraft, high end durables. (taiwan in the 90’s, japan 80’s) A decade from now, they will make whatever japan is making right now. (eg. current high end Japan products to asia that US has no chance competing in the world)

Changing yuan 10-20% may affect consumer behavior for $5-50 garment, but it won’t affect $5000 car in average $20,000 market. It certainly won’t affect air to air missile, container ship or A320 price.

– The minute China and entire high growth countries done reducing exposure to dollar. Then the jig is up for US. It will be Argentina within months. (Entire asia hiking interest rate, China opening free exchange gate, and making Yuan convertible) Basically, the minute, there is real alternative to move $1-2T of liquidity out of dollar, which currently only in euro, commodities and small asian opening to select few, then dollar inflation will explode.

It’s a question of WHEN, not if. Dollar run, margin call, insolvency, TBTF banks collapsing, bond spike will happen in very rapid succession.

It should be obvious that the recent currency “float” of the RMB is more of the same game played by China, to placate those trouble-making Americans when they get pissy abount their currency peg. And why shouldn’t they play this game – it’s worked everytime and soon it’s back to normal with China continuing it’s inexorable march to global economic domination, while the US feeds its insatiable appetite for debt, courtesy of its Chinese creditor.

Gee Whiz. Another slap dang piece of profound of analysis instructing China what to do!!! What happened to self-determination and freedom of choice in the so called land of the free.

— China is climbing manufacturing ladder. Whatever Taiwanese, Korean, japan (all countries that uses chinese characters) can do, china will do it all in less than 10 years.

These countries long to be under the rule of mainland China once again ? I can see no other reason for this insertion but the hidden implication.

Take the US 7th Fleet from Asia and the region’s xenophobias will explode again with even greater vengeance than before WW2. All those disputed islands and all that oil and gas, control of sipping lanes.

You should note that the Americans help perpetuating or engineered many of the world’s serious conflicts.

Yves, thanks for reposting this. Sharp reminder of what the econ-blogosphere lost when Brad Setser went away. The story of the Greater East-Asia Co-Prosperity Sphere (take 2) is all to often glossed as “China”.