By Steve Keen, Associate Professor of Economics & Finance at the University of Western Sydney, and author of the book Debunking Economics, cross posted from Steve Keen’s Debt Deflation.

The record $6 billion profit that the Commonwealth Bank is expected to announce today is a sign of an economy that has been taken over by Ponzi finance. Fundamentally, banks make money by creating debt, and the amount of debt we’ve been enticed into taking on is the sign of a sick economy rather than a healthy one. The level of private debt that is actually needed to support business and maintain home ownership at historic levels (ownership levels have fallen over recent years!) is possibly as little as one sixth the current level.

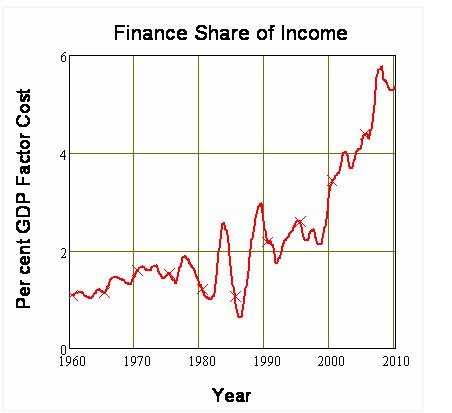

Because of that debt level, bank profits have gone through the roof as a share of GDP. Back before we had a financial crisis—when debt levels were far lower than today—so too were bank profits as a share of GDP. A sustainable level of bank profits appears to be about 1% of GDP. The blowout from this level to virtually six times as much began when bank deregulation began under Hawke and Keating, and then took off as Howard and Costello encouraged everyone to become “Mum and Dad Investors”, which meant borrowing money from the bank and gambling on share and house prices.

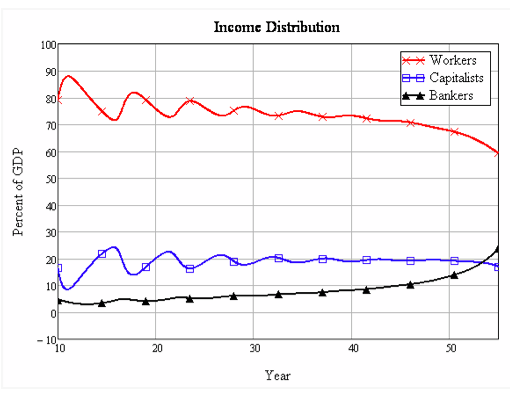

As readers of this blog know, I build models of financial instability, and in my models, one symptom of an economy that is headed for a Depression is a rise in bankers share of income at the expense of workers and capitalists. The model below has yet to be calibrated to the data, but the similarities with the actual data are still ominous.

One empirical reality illustrated by the model as well is that even if firms are the ones taking on the debt (as they are in this model—it does not include household borrowing), workers are the ones that pay for this in terms of a declining share of national income: rising debt is associated with a constant profit share of GDP but a falling workers share.

When the crisis really hits, both workers and capitalists suffer as bank income goes through the roof—leading to a Depression. The only way out of this is to abolish large slabs of the debt, and coincidentally to drive bankers share of income back down to levels that reflect is supportive role as a provider of working capital for firms—rather than a parasitic role as the financier of Ponzi schemes.

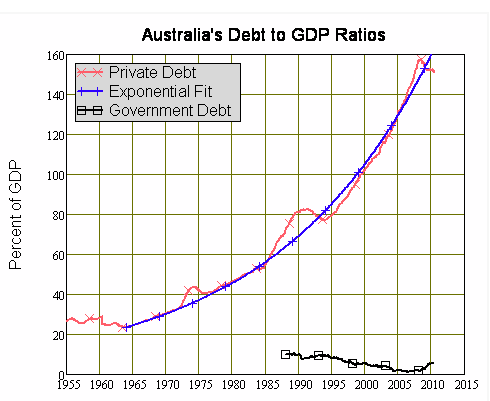

This is the real debt story of our economy right now. As the first chart above indicates, private debt is far higher than Government debt, even after the increase last year due to Rudd’s stimulus package. Government debt is currently 5.5% of GDP, whereas private debt—even though it has fallen slightly due to business deleveraging—is over 150% of GDP: 27 times the size of Government debt. The so-called debate that the major parties are having over the size of Government debt is an embarrassment.

But in the same way that concentrated power is bad only when government has it, not when corporations do, so debt is only fiscally unsustainable and morally bad when government compiles it, not when corporations do, even if the latter debt is vastly more bloated than the former.

At least that’s what every system ideologue and MSM prostitute, and even their lackeys among the populace, keep saying.

The only way out of this is to abolish large slabs of the debt, and coincidentally to drive bankers share of income back down to levels that reflect is supportive role as a provider of working capital for firms—rather than a parasitic role as the financier of Ponzi schemes.

That should happen and in the end will have to happen. We can do it the less hard way (jubilate as a people) or the really, really hard way (let it amortize over centuries of our refeudalized enslavement).

so dramatic…

cutting IBs back down to purveyors of working capital is going to be difficult. Many modern markets function because they provide liquidity. There is a cost to that function and if you think of the current commodities manipulations then it is easy to get upset.

But the question is can you provide liquidity to a wide array of markets outside of speculation. You may disagree with the brand of speculation served by the investment banks, but I think most people would agree that in market based economies, speculation is an intrinsic part of risk measurement and therefore pricing. And if you need speculation, who is going to do it? Current discussion to seperate investment banking and proprietary desks addresses this question.

I am not a enemy of speculation and believe we can capture monetary levels in the banking system through derivative legislation. Legislation didn’t capture real monetary levels because it was built on traditional accounting notions of balance sheet ratios. Off-balance sheet instruments such as derivatives bypassed ratios and pumped excessive debt into the real economy. Recapturing the derivative flow (through clearing exchanges for example as is in the current legislation) is a first step to recapturing monetary levels. The only way to bypass a minsky cycle is to enact legislation controlling total debt levels and sticking to it. The last time around, we repealed glass steagal, which derivatives had made a mockery of and went hog wild in the shadow banking system.

I don’t seem compelling evidence that complex financial products and leverage have much in the way of social value, although they do wonders for the incomes of the purveyors. As I noted in ECONNED:

But opacity, leverage, and moral hazard are not accidental byproducts of otherwise salutary innovations; they are the direct intent of the innovations. No one was at the major capital markets firms was celebrated for creating markets to connect borrowers and savers transparently and with low risk. After all, efficient markets produce minimal profits. They were instead rewarded for making sure no one, the regulators, the press, the community at large, could see and understand what they were doing.

The proof that speculation aids the larger economy is , shall we say, somewhat lacking.

“The proof that speculation aids the larger economy is , shall we say, somewhat lacking.”

However, much evidence exists to show that speculation, done to the degree that is has been since around 1980, has been very harmful. Here in the U. S. we have seen several waves of horrific speculative fever, decades long sometimes, and all have harmed the smaller investor, homeowners, small businesses, to the point of critical damage being done to the attitudes people have about money, banking and finance in general.

The savings and loan crises of the 1980’s destroyed home ownership and over $800 billions in savings would have been lost if the government had not rode to the rescue. The current ongoing housing bubble, based on leveraged accounts manipulated by Wall Street financiers, has caused severe losses-probably trillion$, in the individual housing market. Yet Wall Street tycoons are rewarded with ten or twenty million dollar bonuses.

This partly arises from what’s called ‘disintermediation’ – the trend for banks to lose their middleman role in finance as borrowers issued bonds or shares rather than taking out bank loans. Logically, this should have reduced the size of the banking sector: we would have fewer and smaller banks. But it took hold in the 1980s, when governments were deregulating and so permitted the banks to expand into areas previously closed to them.

The latest is the ownership of warehouses, which enables GS, Barclays Capital etc to take complete control of the commodity markets, including physical commodities. That has nothing to do with banking as normally understood, but at present their banking licences allow them to do it.

Strict limits should be put on the types of activity permitted to an organisation possessing a banking licence, and everything else should be left to others. If that reduces the banks’ profits and size (and their power), so be it. Everyone except the bankers would be better off for it.

As per Attempter’s comments, The debt trap that is so often invoked as being central to “western” nation’s present financial condition is ultimately a sort of lesser issue that should be more properly subordinated to the fact that, regardless of which sector holds excessive debt, our entire financial/economic functioning is untenable and arguably immoral.

I don’t agree with your analysis and indeed fail to see how you can state with in such broad generalizing terms

“regardless of which sector holds excessive debt, our entire financial/economic functioning is untenable and arguably immoral.”

Municipalities would, under your rule as emperor of the realm, never be able to build water and sewer systems, as they could never raise, all at once, the needed sums for laying pipes and constructing central processing plants for sewage. School systems would need to collect savings of millions of dollars before patching the roofs and kids during heavy rain storms, could hold their umbrellas over their desks meanwhile. We could watch victims of floods and famines perish while savings accounts were established so emergency medical care and food could be sent to the afflicted areas. Oh, but look, the victims are all dead while the savings accounts were established.

If you are unable to see the difference-as to how it is structured and its effects- between public created debt (government) and private debt- any further discussion with you is fruitless.

Does his “government debt” include the debts of the state governments, or just Commonwealth (i.e. federal) debt? Either way it’s impressive – or ought to be if you’re British or American – how low that government debt was driven by the Liberal (i.e. conservative) government. Inevitably Labor have increased it. As for the private debt: no worries, mate. This is the Lucky Country; something will turn up.

Australia really is different. It has a huge external debt, (100% of GDP?), and minimal government debt, (which is mostly run to provide bonds for financial system operations). Having been developed by capital from the mother country, it’s perpetually paying it off through primary export surpluses, mostly of raw commodities.

Come to think of it, by repaying government debt in the good times and thus storing up the capacity to increase it in the bad times, Mr Howard and his merry men may have been the only truly Keynesian government in the advanced countries. Note to US & UK: that’s the way to do it.

In Oz, maybe, but the conservatives in canada, Britain and the USA have been the ones who have run up the public debt.

In canuckistan, our pre-existing social stabilizers like unemployment insurance, etc., pre-date the Conservatives, and in fact, those conservatives have sought to reduce support for the unemployed, etc..

In North america, conservatives ALWYS cut taxes, rather than pay down debts, in the “good times”.

But “good times” are fewer and farther between now….because of the conservatives running up debts during good times, and slashing gov spending during the bad.

Bad policy, chasing out the good.

What does the author mean by “capitalists”?

Bankers are THE capitalists par excellence, aren’t they?

Re: jz.

The author is using the economist definition of a capitalist: the owner of capital.

Capital is not defined as money, but means of production (machines, factories etc).

So bankers are not the ultimate capitalists. Marx may have his own definition.

Productive capital is not mere specie or scrip.0

The value of productive capital lies in its products, not in its mere existence. Time counts for more than people allow in these things, methinks.

Very interesting:

Workers, Capitalist, AND Bankers.

Never thought of things this way before.

The larger picture is called “financialization” of the economy. Check out:

http://en.wikipedia.org/wiki/Financialization

Who owns the banks and the mines, factories and so on? The workers’ superannuation funds? If so, does that make them both the capitalists and the bankers?

Another pack of lies from the whiners who can’t see the future. If not for us and our credit, there wouldn’t have been any growth or profits at all. Figure that one. We have 6%? So what. 6% of 100 still leaves 94 for everybody else. Without us, that would have been about 44 or 34 or even 24. If everybody split 24 that’s a lot less than splitting 94. So we made them at least 50 for our 6%, if not 76. For free. I can count, can you? That’s why we got bailed out. We want to make them another 50 or more, just like the first time. I need a statue of myself someplace, where I can be admired as a hero. Or maybe the wing of an art museum can bear my name. Or maybe the whole museum. Someplace I’m safe from scurrilous attacks on my integrity by leftwing radicals.

-Mr. Jolifceous “Jolly” B. Bucks, MBA, CFA, CPA, LLD, LLC, Ltd., PhD,

President Emeritus

Canker, Banker and Wanker

The article, and the rant by attempter, are completely incoherent. The article is correct about the fact that rising bank profits are not a sign of health. But the distinction between capitalists, workers and bankers is impossible rationally to apply to the groups he seems to be talking about. It looks like by ‘capitalists’ he seems to mean non-finance sector firms. By ‘workers’ he seems to mean individuals who apply for jobs at firms.

It is not clear who he thinks does the hiring or managing of these firms. Are these individuals ‘capitalists’? Or are they ‘workers’? What about people who apply for jobs at finance sector firms? Are they ‘workers’? What about people who apply for jobs in government sector organizations. Are they ‘workers’?

In traditional Marxist accounts, there were basically two classes of people, the capitalists, who were the owners of assets, capital, plant, real estate etc. These capitalists really did exist in the 19c at the time of writing, they really did take money and invest it, they really did own businesses and hired people, who were workers in the sense that they were waged employees, and did not own any of the firm. The profits after expenses went to the capitalists.

This always was a partial account of the economy, and mixing it with a large dose of incoherent Hegelian mysticism did not make it more complete. But it did at the time describe a real phenomenon, and it did make a distinction with some reality in the external world.

Now however, the average middle manager in any US company when lectured about the ‘workers’ will look around his office in puzzlement, and wonder who they are. When he is told that his firm is a capitalist hiring these workers, he will wonder if he as he hires is thought to be one of the capitalists. He understands the concept of the shareholders, he refers to that all the time. He thinks of it as being the shareholders funds he is investing. But who are the shareholders? Are they perhaps the capitalists? They are a funny mixed bag if so, pension funds, mutual funds, individuals, and they include most of the workers he is hiring at some point through employee purchase schemes.

This is not to argue that all is well with either society the economy or the finance sector. Or government for that matter. It is however an argument that we have to look at the taxonomy of these things before naming them. There is no sense using, probably for religious reasons, a classification scheme that does not correspond to the genera and species in front of us.

I would reciprocate your epithet “incoherent” except that it would probably be too much of a compliment given your absolute ignorance.

For example, neither the piece nor my comment has anything in particular to do with Marxism, nor does your description of “Marxism” bear any relation to intellectual history. (“Basically two classes”, chortle…I do like how you picked up the phrase “Hegelian mysticism” somewhere along the way, though.)

As for my comment, it’s neither incoherent nor a rant at all. The first part is a perfectly naturalistic depiction of the hypocritical incoherence of “conservatives” (including corporate liberals), the second part is a prescription based on a rational assessment of the evidence. (The evidence itself is of course compiled on a daily basis at this blog and many others.)

hey thanks for this wonderful article about plants .

bye bye.

Thank you for that useful post. Looking for much. ciao.