By Marshall Auerback, a portfolio strategist and Roosevelt Institute fellow

A few years ago, Chris Dialynas and I wrote a piece which introduced the concept of “renegade economics”. It was derived from a Frank D. Graham’s 1943 essay titled,

“Fundamentals of International Monetary Policy.” Graham, a Princeton University economist, wrote: “In international affairs we must therefore strive to reconcile the liberty of the individual, the sovereignty of states, and the welfare of the international community.” He understood that poorly crafted economic policies and rules in a global economy would lead to great imbalances that threaten stability and freedom. His analysis and insights applied to the two world wars of the last century as well as to the Great Depression.

But Graham’s insights, we noted in the article, were still relevant, notably in regard to China. Graham maintained that a poorly regulated fixed-exchange rate regime is inherently unstable. He argued that countries would cheat by setting their currency at rates that promote national agendas, ignoring the instability imposed upon the global economy. They become “renegade nations” in effect practicing “renegade economics.”

The nation which best reflects this description today is China. In response to Beijing’s mind boggling increase in real credit in the first half of 2009,\Chinese fixed investment in industrial tradables rose dramatically . In the first phase of such an investment boom China’s imports had to rise, as the country needed capital goods and inputs for planned new industrial capacity. It takes many quarters to go from credit disbursements to the completion of new capacity and the initiation of new production. By the second quarter of this year some – but only some – of this new capacity began to come on stream. Further production responses to this new round of Chinese overinvestment lie ahead. When such capacity comes on stream there is a lesser need for imported capital goods and for the import and stock piling of inputs for planned future production. Instead, there is an onslaught of new production which targets export markets and which substitutes for prior imports.

The build-up of new production is undoubtedly a key factor behind China’s prominent rise to the world’s number 2 economic power. But because of the potential protectionist threat and the underlying fragility at the heart of China’s capex boom (along with the corruption of its political class), the change in status might prove to be ephemeral, much as Japan’s vaunted rise to number 2 ultimately gave way to a post-bubble morass which exists to this day in “The Land of the Setting Sun”.

Why the caution on China? For one thing, the recent surge in Chinese exports and even the reduction in Chinese imports reflect the first stage of the production onslaught from the industrial overinvestment triggered by the 2009 credit boom. There has been more of this in 2010, masked by a brief, but cosmetic change in China’s trade balance with the US last March. More recently, China has reported some disappointing economic numbers. They have been more negative than they look. China reports its statistics on a year over year basis, not on a sequential month to month or quarter to quarter basis. Year over year growth rates for many Chinese economic statistics have slowed somewhat, but remain very high. These are the growth rates that everyone focuses on. From this year over year data one can interpolate with some difficulty sequential month to month and quarter to quarter growth rates for these same economic variables. Based on calculations done by Lombard Street Research it appears that in July Chinese domestic demand may have gone negative in real terms. It was only a huge improvement in net trade that kept production growth significantly positive on a sequential basis.

Frank Veneroso, in particular, noted that the Asian PMIs have all started to turn down. The consensus has been that Asia would remain the strong part of the world economy. PMIs falling to 50 in several Asian economies may suggest otherwise. Obviously, much depends upon the Chinese economy. There have been signs that credit tightening in the first half of this year has led to something of a slowdown. Because of the endless flaws in the Chinese data it is hard to monitor sequential change in the Chinese economy. Both the government and HSBC PMIs from China have shown a significant industrial deceleration.

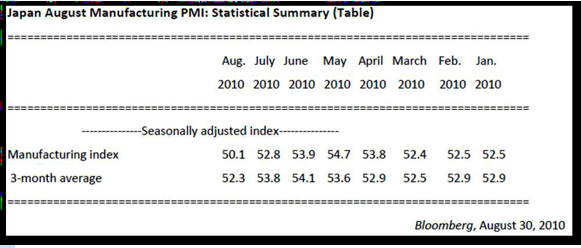

What leaps out are the declines in many Asian region PMIs all the way back down to the 50 level. Here is the most recent PMI from Japan.

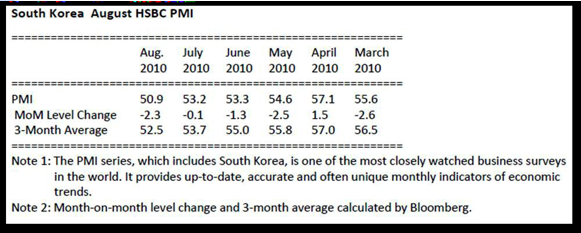

The Korean industrial data still shows significant positive growth, albeit down from the spectacular growth several quarters ago. However, its PMI is also down to the 50 level.

Korean exports also appear to validate this caution over Asia.

They are released at the beginning each month and are the first to report in Asia (indeed the world, as far as we know) and the data quality is good.

The debate over a global slowdown will continue, but Korean exports suggest that the slide has already begun. September’s release showed Korean exports fell -13%m/m SAAR in August. This is the second m/m contraction, which does not happen that often for Korea; i.e., this could be statistically significant.

Some have argued that Korean exporters would be spared a slowdown due to a sharply weaker currency, especially against the JPY. Recall Japan is Korea’s main competitor. But this drop in exports appears to be happening despite a significant currency advantage, which again points to China as the potential culprit.

The same can be said of Australia and Taiwan where their manufacturing PMIs have fallen to 51.7 from 54.4 and 49.2 from 50.5 respectively.

It is difficult to gauge the significance of this purchasing data from Asia. Nonetheless, it is noteworthy that this PMI data may be suggesting more economic weakness is Asia than the consensus has anticipated. This might be due to a ‘beggar thy neighbor’ currency policy embraced by China, much as it did in the early 1990s, as well as the relentlessly weak U.S. economic data over the last several months, or a combination of both.

In such a context of seriously slowing domestic demand, largely in response to various kinds of credit restrictions imposed earlier this year, the new increment to Chinese industrial capacity and production must find a home in foreign markets. It is this process that has probably been in large part responsible for the surge in Chinese exports over the last two months. If so, as more and more of the new capacity comes on stream, short of a violent reversal in Chinese demand management policies, Chinese exports should continue to surge. A further increase in inbound container volumes into U. S. West Coast ports in July supports this expectation.

At the same time, the notion that China has responded to this favorable shift in trade balances by “revaluing” the currency is a classic smoke and mirrors game. For Beijing, it turns out that” increased flexibility” just meant “we’ll do a quick half-percent move so it looks like we’re doing something and we’ll just make it more volatile so we can screw the speculators”. This is something they must have learned that one from the French. In terms of cumulative appreciation since the announcement, we have pretty much flat-lined around 0.6%. In other words, the RMB is not looking not too different from the Hong Kong Dollar – a currency that is still officially pegged.

It therefore appears that all China did was to make a political gesture ahead of the G-20 meeting held last June They did not revalue. They did not widen the currency band. They were not specific about reforms. They have said the ratio of their current account surplus to GDP has been declining since the beginning of 2010, “with the BOP account moving closing to equilibrium, the basis for large scale appreciation of the RMB exchange rate does not exist.” That basically suggests they think little Yuan appreciation is needed. Hence, any Chinese revaluation going forward is likely to be similarly marginal and therefore a non event for the markets.

In one sense, that doesn’t give the whole story, given that wage and price pressures have already increased in China, thereby in effect “revaluing” the RMB via internal inflation.. The recent rash of strikes in China and loud complaints from Chinese exporters over rising costs are testimony to a significant increase in the level of prices of inputs for manufacturers in China. If Chinese exporters of manufactured tradables experience a cost squeeze that cannot be good for Chinese corporate profits or the profits of its competitors in international markets for industrial goods, Chinese equities and equities elsewhere should suffer.

Of greatest importance, it is assumed by today’s market place that if the Chinese real trade weighted exchange rate revalues significantly, this would be a positive for the global economy. There is an idea out there that global imbalances in the form of excessive Chinese savings and excessive U.S. consumption has caused the disaster of the last several years. What have, in fact, caused these disasters are unprecedented global financial disequilibria resulting from myriad market bubbles, in part stemming from government policies in the U.S. and elsewhere that have fostered such bubble behavior. If China were to revalue significantly now they would increase the risks of more financial disequilibria largely because of the impact likely to be experienced in China itself, which could dwarf the situation that occurred in Japan, during its post bubble collapse.

The risk of consequent bursting bubbles lies in China itself. Today’s market participants have a belief that higher Chinese exchange rates will facilitate the transition from excessive fixed investment in China to more Chinese consumption. They seem to believe this will happen smoothly and that it will be a step towards stable global growth.

But as Veneroso has argued, throughout history, when fixed investment excesses have been reversed, there have been recessions. Fixed investment has never smoothly passed the baton to rising consumption. Whenever a fixed investment ratio has fallen from a high level there has always been an adverse multiplier into income and, therefore, into consumption. Check the historical record. There is little to support such optimism. The chances that China can smoothly transfer the growth baton from fixed investment to consumption should be less than in other historical instances. China’s current fixed investment ratio is higher than anything the world has ever seen.

In all economies and in all markets the greater the excess, the more severe the unwind. After all

the bubbles and their bursting over the last fifteen years this should be obvious to everyone.

Throughout history the greater the fixed investment excess the more severe has been the

subsequent recession when that excess was unwound. The fact that China has the greatest fixed investment excess ever suggests that, when it unwinds, there will be a nasty economic

adjustment in China.

The more China experiences a revaluation of its real trade weighted exchange rate the greater the chances of a fixed investment downturn. A large part of China’s overall fixed investment and its excesses are in tradable goods industries. It is no secret that these industries are already being squeezed by rising domestic costs and China’s peg to a rising dollar. A further double-barreled push to a higher real trade weighted exchange rate from domestic inflation plus revaluation will seriously squeeze the self financing of industrial fixed investment. This will turn this part of overall Chinese fixed investment downward.

Can China pick up the slack with increases in fixed investment in housing and in infrastructure?

That is unlikely. There has been so much over building of real estate in China that the government has taken numerous measures this year to curb real estate speculation and over building. A reversal of this policy would simply shift the locus of unstable overinvestment from the industrial sector to the real estate sector which is unwanted by the Chinese policy makers and would probably prove to be unsustainable in any case.

What about infrastructure? It is always possible that China could decide to build even more infrastructure projects than it has already started. But there are impediments to this. Most of these projects are directed by state and local governments. According to many the state and local governments have borrowed to fund these projects through unorthodox channels and are now saddled with debts they may not be able to service. We have to remember that many of these infrastructure projects do not generate revenues that make them “self-financing”. It is possible that, over the long run, the central government of China may assume responsibility for the financing of these projects and use their control over money issue to assure their finance,

But so radical a step is likely to occur only after some unwind of China’s fixed investment excesses in the infrastructure sector have already created some damage.

As for the consumer quickly picking up the economic growth baton, there is no historical precedent for this. The fact that China’s consumption is such a small share of GDP makes it even more unlikely it could happen in a meaningful way in China. The fact that high income households who account for much of Chinese consumption have a huge exposure to Chinese real estate, which is a bubble, makes it even less likely that the Chinese consumer can pick up the baton amidst a downdraft in fixed investment.

The U.S. Congress was supposed to vote on China as a currency manipulator on April 15 of this year. As the date approached China’s trade account went suddenly, almost miraculously, and very transitorily into a deficit. This, plus efforts by the Geithner Treasury to avert “frictions” over the trade issue led to a deferral of that vote and an ultimate decision that China was not a currency manipulator.

Since then China’s trade account has gone back into a huge surplus and the U.S. trade deficit has widened dramatically, to some considerable degree as a result of trade deterioration with China. Obviously, the lawmakers and politicians who wanted to brand China as a currency manipulator and backed off because of the change in the Chinese trade balance this past March are likely to now want to bring the Chinese trade and currency issues back to the table. Additionally, since April the U.S. economic data has deteriorated in a relentless fashion. We are probably not yet in a double dip recession, but at a minimum the odds favor slow enough economic growth which, if not increasing unemployment, will certainly fail to reduce it. U.S. trade deterioration has contributed to this growth slowdown. The odds are great that, if the unemployment rate rises, there will be greater political pressure to do something about the adverse impact of China’s “mercantilism” on the U.S. economy and unemployment

Obviously, if the U.S. goes into a double dip recession and unemployment soars, the China trade issue is likely to become a politically very pressing one, especially during the heat of mid-term elections.

The Chinese at home face a dual bubble in real estate. There is a price bubble. According to the NBER, the real inflation adjusted price of land in Beijing has increased eight fold since 2003 – most of it in recent years. There have been similar though lesser land price bubbles in other cities. There is a quantity bubble as well. There are estimates that many tens of millions of apartments and other dwellings in China are vacant, suggesting a supply glut and vacancy rate beyond those experienced in other notorious quantity property bubbles elsewhere in Asia. These property price and quantity bubbles have gotten much worse over the last year and a half as a result of the unprecedented real credit expansion launched by the credit authorities in early 2009.

In addition, to these two bubbles in property in China there is clearly overinvestment in many industrial sectors in China. There is also an infrastructure bubble in the sense that many local authorities have embarked on massive projects which they are unable to finance through traditional channels.

Faced with these multiple “bubbles”, the Chinese authorities have been trying to reign in price and quantity bubbles in the real estate sector, have been trying to curtail capacity in some heavy industries, and have been trying to limit unconventional and often illegal financings by local authorities. All of these point to some degree of restraint on domestic demand. Given such restraint and the now programmed surge in the capacity to produce industrial tradables the odds are that China cannot afford a reversal in its widening trade surplus, since that would leave large swaths of industrial capacity idle and threaten employment as well as the absorption of migration from rural areas to urban centers. In other words, given the fact that the credit boom of 2009 has lead to serious overheating, China will try to restrain “pockets” of excess demand and is therefore going to be loath to take measures that would stop its export juggernaut and its substitution of imports.

This combination of growing U.S. political discontent over the U.S./China trade deficit and China’s need to put its latest round of fixed investment in industrial tradables to use in the context of domestic demand constraint puts U.S. and Chinese politics as regards trade on a collision course.

Economists and policy makers in the United States regard protectionism that might arise out of such a political impasse as a grave threat and danger to the world economy. But is this really true as regards the U.S.? That is not borne out by history, according to Peter Temin’s “Lessons from the Great Depression”.

Many blame a good part of the Great Depression on the Smoot Hawley legislation passed in 1930. But

Temin notes that during the 1930s, the Smoot Hawley legislation hurt countries like the U.S. which had large export surpluses and were large net creditor countries. It did not hurt countries that were on the other side of those trade surpluses and external credits, such as the UK.

What would happen if there was a trade war between the U.S. and Asia today? U.S. consumers might find their goods slightly more expensive at Wal-Mart if U.S. companies did not manage to move the locus of their offshore production from China to other low cost countries fast enough. Would that really be so grave a loss to the U.S. economy? Asia has conducted mercantilist policies at the expense of Asian consumers for decades, and the investment world regards it as having been a successful strategy. Would it be a disaster for the U.S. if U.S. consumers had to pay a little more for their goods, but more of those goods might be produced once again back home, thereby reviving the U.S. industrial base?

If one simply looks at the numbers, in a trade war the U.S., with a low share of industry in its GDP, would be hurt far less than Asia with a very high share of industry in its GDP.

This sentiment has now been seconded by Nobel Laureate Paul Krugman who typically has the guts to challenge the orthodox consensus when it makes no sense. Krugman in effect backs the thesis set out by Peter Temin.

My colleagues believe that we should lecture the Chinese on what a bad thing they’re doing, but not actually threaten sanctions, lest we start a trade war. My belief is that this gets us nowhere. …

I say confront the issue head on – and if it leads to trade conflict, bear in mind that in a depressed world economy, surplus countries have a lot to lose from such a conflict, while deficit countries may well end up gaining.

Yeah, fly in China’s face and see what happens. But get ready for a big big surprise.

China-bashing is the same kind of scam as Democrats running against Sarah Palin. In both cases it’s the existing criminals trying to misdirect attention from their crimes to the alleged or projected crimes of others.

Just as the Dems are in fact every bit as criminal as the Reps and must be destroyed if we’re to have any hope of breaking out of the “two” party kleptocratic logjam, so “China” is a boogeyman. The fraud is, if only China would behave better, then globalization could work to the benefit of American workers. That’s meant to misdirect attention from the fact that globalization and financialization are bad as such, that they were never meant to do anything but liquidate us and turn us into serfs, and that the only road to freedom is to break free of the whole system. In which case whatever China does wouldn’t affect us at all.

(Of course even given the globalist premise the whining about China is absurd. The premise is simple: the West is supposed to be able to live grotesquely beyond its means by externalizing all the costs onto the workers and environment of the “third world”. We’re supposed to infinitely consume the products of slave labor and have China put it all on our tab. We’re also supposed to export all our jobs to China, but the fact that we have no income isn’t supposed to matter since China’s supposed to carry us indefinitely. We’re supposed to periodically whine about how “China” is somehow manipulating us. This is supposed to be a permanent state of affairs. And once in awhile someone sounds like he wants to continue with all this but at the same time do the exact opposite. Like for example China is supposed to have both a strong and a weak yuan vis the US, and the US is supposed to simultaneously run a trade surplus and a huge trade deficit.

It’s clear how rational and sustainable this all is.)

I suggest you read posts before attacking them

Trade protectionism would have America not borrowing (no trade deficit means no capital imports, meaning no borrowing from abroad). That seems to be what you want, yet you pillory Auerback.

I also suggest you read up on mercantilism. We’ve been fools for tolerating it, but economists since at least the 1930s have recognized that mercantilism is a beggar thy neighbor strategy.

And contrary to your assertion, he also presents evidence as to why the US might actually be better off if we start acting in a protectionist manner (a position even former free trade advocate Krugman advocates).

China would be the loser big time. This is really pretty clear, and I don’t see why you are so unwilling to see that.

I didn’t attack the post. I thought I was tangentially agreeing with it, along the lines of what I thought was his ironic title.

Geez……

Don’t see why you should apologize not reading what is complete nonsense. Unlike the US, China manages its economy with China in mind. Our economy is managed with the interest of a financial elite in mind. Our real economy has been hollowed out to create the profits of financialization. Unfortunately, those profits are not real; trading is a zero sum game and all depends on getting a chair when the music stops.

Of course throwing stones at China is easier than reining in currency speculation and derivative bets.

But I did read it and basically agreed with it except that it’s too tame. It’s still headed in the right direction as far as challenging the lie that Chimerica is Destiny.

My only interest in China’s own problems is how they demonstrate how this vaunted Asian middle class consumer horde is never going to rise up to replace the Western middle class consumer horde now being liquidated. But I know that it’s America who has far less to fear and more to gain from breaking the co-dependency than China. So we should go ahead and do it.

That, I took it, was the point the post feints at making. But since it’s a kind of wonkish argument which we know doesn’t work in the political brawl, my comment was taking my political rhetoric out for a spin. I guess that’s why the misunderstanding.

You’re right that the alien “US” elites make policy in their own interest and against the people, but I don’t think the Chinese elites are any different there. Their “stimulus”, for example, was just as much of a doubling down on the already busted hand of Chimerica as Obama’s was.

Yes. The cool calculating Asian mind is too sophisticated for us, short term, self interested Westerners. Only the Chinese can plot brilliant economic policies 30 years into the future. They tricked us with that Great Leap Forward mumbo jumbo, for secretly the Chinese are the vulcans of our planet. No corruption, no selfishness, just pure need to run their economy for the benefit of the greater collective whole “China.”

“Unlike the US, China manages its economy with China in mind.”

Jeez, are you even vaguely familiar with China? Try reading Minxin Pei, Michael Pettis, Victor Shih, Yu Yongding or anyone else who actually knows something about the Chinese economy and political system.

I don’t if it’s right but at least it would be consistent –

no deficit reduction during a recession nor trade war while in the same economic situation.

I would rather pay a bit more at Wal-Mart if that meant a more thriving industrial base and an economy running closer to full output than otherwise. But why should our idle workers and industrial capacity be employed in the service of making knock-off jeans, cheap toys, etc., when China is happy to produce all of this in exchange for electronic credits to their reserve account at the Fed? The trade deficit is harmful in that it reduces demand for domestic output and promotes low capacity utilization, but why can’t the Federal Government take up this slack with a much stronger fiscal posture? Although full employment is great, I would much prefer to have our idle capacity used towards the production of much needed public goods — high speed trains, new roads and bridges, etc. — rather than used to produce something China is basically willing to give us for nothing.

The trade imbalances Auerback refers to are really nothing but numbers on a spreadsheet. There is no more worry about gold outflows, forced revaluations, default, etc., like there was in the Bretton Woods era. So, from an economic perspective, it would make more sense for the Federal Government to address our chronic demand shortage via loose fiscal policy rather than through a more restrictive trade policy. That way, our economy can enjoy the real benefits of cheap Chinese imports whilst maintaining sufficiently high demand for domestic output. A strong fiscal policy can sustain itself for as long as China is willing to over-invest and under-consume. If this changes, fiscal policy can then revert to a more ‘normal’ stance.

I suspect that, in an ideal framework, Auerback would agree. The reality is, however, that there is almost no political will whatsoever for a strong and proactive fiscal policy. Fiscal policy operates in a highly charged political and ideological arena, so it is doubtful we would ever see government spending address the demand effects of the trade deficit in any direct way. So, when confronted with the political realities, perhaps it is better to confront China over its aggressively mercantilist trade policies in hopes that such action might serve to reduce or eliminate the large trade imbalances in the world economy. In my opinion, the real effects of the trade deficit are the driving force behind the break in wage and productivity growth, the shrinking of the American middle class, and the extraordinary high income inequality of today. Risking a trade war might not be the optimum solution, but politically, it might be the only solution .

DS,

I agree with you 100%. There would be nothing wrong with us running a huge trade deficit if we were prepared to counteract that with significantly greater fiscal stimulus (a Job Guarantee program would be a good start). But, as you note, politically, that’s a non-starter. And China’s policies are having a deleterious impact across Asia. Japan is getting increasingly concerned about Beijing’s actions as well. If China isn’t careful, it could find itself facing a real war, not a trade war.

Turn that around. If we push China too hard and the bottom falls out of their economy because of it – or they blame us even if it wasn’t our fault – WE could be facing a real war with THEM.

In terms of domestic politics, if their economy collapses they would have a lot more to gain from military aggression than we would, especially if they can plausibly blame their economic collapse on outsiders (us and/or other countries with whom they could pick fights such as Taiwan, Japan, Vietnam, etc.) When it came right down to it, they would probably only need the loyalty of the military (not the rest of the population) to hang onto power.

I think you are right that in a trade war we have a lot more ammo available to us than they do. But the more energetically we use those weapons the more we risk their escalating to other types of conflict, including actual war.

And I don’t think our current President has what it takes to win a war of “chicken” with the Chinese leadership. I don’t think he has the right combination of brains and steel. Not many people do, to be fair.

The Chinese will launch that “short, victorious war” that Vyacheslav Konstantinovich von Plehve advocated for Imperial Russia in order to “tem the tide of revolution”?

Well maybe. Except what would they do? USN blockading China 400 miles of its coast and whats China’s response? Hacking?

I doubt the Chinese will start a big war on purpose, but it would be politically popular at home if they got away with a grab along the lines of Tibet. Maybe Taiwan, but maybe something a bit smaller, like some of the uninhabited islands they are claiming are theirs that other countries also lay claim to.

Would Obama come up with an effective response to such a move? I have my doubts. I think he is likely to let them get away with it, at which point the saber-rattlers in China might well get cocky and go for another prize. At some point Obama would feel pushed into a more aggressive response, which if not very carefully thought through could lead to WWIII by accident (much like the way WWI started).

If things did get out of hand, we could see trouble from North Korea (actual use of nukes), Iran, Islamic terrorists, Burma, Venezuela, and who knows who else? And China itself has a lot of military capacity. Not only do they have a lot of actual and potential soldiers (their population is something like six times ours), they have been buying a lot of sophisticated toys for their military services over the years. After Tiananmen, it will be a long time before the Chinese Communist Party leadership ever forgets how crucial the military’s support is for them to stay in power, and one way they are trying to keep that support is by buying those toys.

I do not like the title. True it is explained later in the text, but a title is a title and, to my own knowledge, does correspond to reality.

I am no specialist of macro-economics and will not debate about the financial exchange arguments there. Just present some impressions about China in the last 15 years. It is by proxy: my son has been living and working in China for the last 15 years. But a good proxy nonetheless. As close as 5 years ago, you could hire an engineer for $300-400 per month. Now, it is close to $2000. Not every Chinese is an engineer, but out of 1.3 billion there are many millions who now have a good purchasing power. Last August, I went into several car showrooms in Beijing: a car salesman in the US would dream of such a situation: people queuing to buy cars that they never have a chance to testdrive: no time for such a thing. There is only time to fill in the purchasing documents. Most cars are paid cash. True, Beijing is privileged in China and I have seen in the South, far from the coast, small villages that lived like a few centuries ago. But you have to go further and further inland to see those. In the last 15 years, so many things have improved, it is mind boggling.

My feeling is twofold: there is an increasing internal market. Whether the transition will be smooth or not, I have no idea, but so far, it has been. Second the sheer number of Chinese is something a lot of Americans do not imagine. China is almost 5 times the population of the US. This alone is irresistible because this 1.3-1.5 billion Chinese are organized, and led by undemocratic (true) but even if highly corrupt at local level, much less at the top (don’t need to) people who have the future of the country at heart, not only their own power or pocket like elsewhere. This mixture of decisions from the top which are applied immediately and free enterprise is hard to understand, but so far it has worked pretty well if not without some big mistakes.

OK, this is looking at things through the other end of the glass but this sometimes helps to get the biggger picture in perspective.

Thats right, Lets all blame China for the decline in the West¡

What percentage of chinese exports are controlled by western corporations? Have we beneffit from this as citizens or consumers? or rather this Corps have doubled gross proffits on our shoulders?

How can we qualify Chinese finances with the mess we have at home?

Chinese citizens dont live on credit, they save money, and work hard for it; Are we ready for working on sundays or whenever its convenient?

There was a punk band in Barcelona in the late seventies, with sharp lyrics, rather cruel

I will Transcript one

Da Vd su permiso Don Fernando? ( May I come in Don Fernando?)

pase pase ( come in)

Lamento informarle que esta Vd despedido ( you are fired¡)

pero Don Fernando, mi mujer¡ ( but D Fernando, what will my wife say?)

esta Vd despedido ( you are fired)

mis hijos¡ ( my children¡)

esta Vd despedido ( you are fired¡)

mis cervezas¡¡ ( my beeers¡¡¡)

it resumes pretty well our attitude, which is not exemplary, we are a spoilt society

written from a bar, with a beer in my hand

Regards from sunny Barcelona

Ah, yes: the Aesopian fallacy in which the good Chinese ants saved and scrimped for the winter while the American consumerist grasshoppers sang the summer away. This issue cannot be reduced to such a simple moral calculus. The global balance of trade must balance. As a wiser man once said: if you know beyond any doubt the direction of causality here, then you probably do not understand the problem.

you missed the whole point of my post, may I say…..read it again

I certainly agree with the conclusions of this post. But it brings up some much larger, more fundamental political issues which I think help determine which side of this debate people will fall on.

First off though I feel slightly uneasy with the term “renegade nation” to describe China. Obviously I understand the practical tactical advantages this term will bring to help build a consensus in America to the policies recommended in the post. My uneasiness stems from the implication that there is some standard of international economic harmony that nations should ascribe to that China is breaking. Now of course it is true in theory that if every nation were to voluntarily take the big picture approach and subsume their national interests for the collective interest then many would probably be better off. The problem is of course determining exactly what that collective interest is since nations at different levels of development often have conflicting interests. In a peak oil zero-sum world, simply put the poor want to be rich while the rich want to stay rich. But the reality is since there is no international level of governance that could help determine the best collective interest, for the time being, all nations have to be looking out for themselves. What China is doing is seeing a world where some rich nations are (at least outwardly, there are internal issues that I will get to soon that are the real driving factors) in fact prioritizing the international over their national interests. Somewhat paradoxically, in an anarchical international situation, the only way you can have international harmony is if each country is ready to protect its own national interests. So while America is certainly powerful enough to do it, for whatever reason (and I think most of us know what it is) it is America’s dereliction of duty to demand an even economic playing field that allows China to become a “renegade”.

But why would a country like the US allow so many jobs to be shipped overseas. The simple answer is the concept of universalism, which strives to tear down all nearly all divisions between humans, for the benefit of a tiny elite. What is striking is that this universalist current is flowing powerfully on both the right and the left sides of the political debate. On the right it is called Neo-liberalism and on the left it used to be called communism, but that is such a loaded term so let’s just call it “one-worldism” or “Global Justice” movement. The opposite of universalism is particularism, which on the right is characterized as nationalism, and on the left as trade unionism. The split on the left, as on the right, most often occurs along class lines. You will find very few working class universalists in the first world, on the right or the left, since they are the obvious losers in a levelled universalist world. The bourgeoisie are economically comfortable enough (although this is decreasing as the effects of universalism start hitting even them) to place theory above survival, so they tend more towards the universalist strain. What is astounding is that while there is much sound and fury between the neo-liberals and the global justice movement, at the end of the day they are both fighting for the very same goals (but for very different reasons): a levelling of the economic differences between the rich and the poor countries. In the universalist’s ideal world, people in wealthy countries would be reduced to third world poverty levels while third world peasants would see a slight rise in their standard of living. This convergence of interests is best seen in the “no borders” movement where the ideal world of neo-liberals and social justice-types would be a complete destruction of whole idea of a first and third world. So both sides of the Universalist strain strongly agree with the process that is undeniably undermining western standards of living, the exporting of first world jobs to among other places China along with the importation of cheap third world labour to the first world.

What the globalists undeniably have going for them is theoretical purity. Why should there be any differences in the standard of living between the first and third world? Why should a small percentage of the world benefit from its legacy of colonialism, genocidal massacre, and mass destruction of the world’s resources? Why should the first world consume the world’s resources at such a wasteful rate? If all humans are equal why shouldn’t all humans have the same standard of living? These are all questions to which a particularist like myself struggles to come up with an appealing response.

While a particularist, especially on the left, can surely see within his society the wisdom of constraining power nodes, redistributing income, and building institutions that allow all to prosper, typically this kind of thinking ends at his countries borders. Sure he can understand the need for global harmony and would strongly fight obvious attempts to exploit the third world. But he would strenuously object to the notion that in order to pay for the sins of his ancestors, working class jobs should be shipped to China.

What drives both neo-liberals and global justice-types is their desire to break down all divisions between people, although outwardly at least, the justification for this destruction of communities is very different. Communities are determined by people creating circles of inclusion / exclusion, “us” subsets of the “them” totality. Many of these subsets can operate simultaneously, thus, depending on the circumstance, one person may at the same time belong to a subset defined by his community, region, labor union, religion, race (for better or worse), ethnicity, nation, gang, social class, corporation, etc. In order to understand the attitude universalists take to these circles of inclusion / exclusion we have to make an analogy to a wall. A wall can be good thing or a bad thing, it really depends on the context, and on which side of that wall you happen to be standing. A big fat brick wall running across the 580 freeway in the foothills of Oakland would pretty much be considered a bad thing by most. On a cold, snowy day, the walls of your house would be considered a good thing – as long as you are inside your house, of course.

So just like a wall, a community is simultaneously a source of protection and a source of division. Neo-liberals want to tear down all walls because of the protective nature of communities. Corporate elites get frustrated that people are (to an increasingly diminishing extent unfortunately) often are able to protect themselves from powerful wealthy elites by the use of the collective strength of a community. So neo-liberals are often hostile to religion (the Randian strain certainly, other neo-liberals are temporarily OK with religions that preach submission), the nation state, unions, community groups, etc. They dream of an atomized world of “particules élémentaires” that would have the cohesive weakness of a rope made out of sand, where individuals would be unable to collectively resist the interests of a tiny corporate neo-liberal elite.

Universalists on the Left want to tear down all walls because of the divisive nature of communities. Aspiring elites on the left get frustrated that people are (to an increasing extent unfortunately) often divided and conquered through the pitting of one community against another. So Universalists on the Left are often hostile to religion (although they are often temporarily OK with religions that they believe represent “oppressed” people), the nation state, corporations, community groups, etc. They dream of an atomized world of “particules élémentaires” that would have the cohesive weakness of a rope made out of sand, where individuals would be unable to be collectively manipulated by a corporate neo-liberal elite. But for this type of world to have any reality, the Universalists on the Left would have to execute a classic elite displacement move and shove aside the neo-liberal elite. This is made clear in the two inclusion / exclusion circles that the Universalists allow. One is the global community vs. the tiny neo-Liberal elite. The other implict division in the Universalist world is between those who have too much (most of the first world) and those who have too little (most of the third world). Obviously, once the neo-liberal elite is eliminated, it will take a global justice elite to complete the neo-liberal’s unfinished business of the egalization of the standard of living between the first and third world.

But of course in terms of real world power the neo-liberals dwarf those of the social justice movement although in the government sector, especially in Europe, there are more and more on the left who are siding with what they see as politically correct Left Universalist ideas. You see this trend in some elements within Social Democratic parties, who are becoming more concerned with promoting higher levels of immigration than in protecting jobs for their indigenous people. Whether they know it or not, whether they can admit it to themselves or not, whatever the theoretically pure justification, the exporting of first world jobs to the third world along with the importing of the third world to the first, is only furthering the seemingly contradictory neo-liberal agenda of arbitraging the levelling of global standards of living by both destructing communities while simultaneously exploiting differences between those communities that remain.

While admitting that the messy, egoistic, Particularist vision of the world is hardly satisfying, for the time being, both Universalist political currents are quietly cheering the off-shoring of American working class jobs to China and will remain hostile to any attempts for people to look after their own narrow particular interests over the universal. And why shouldn’t they combine and execute this globalist pincer movement on the working classes of the first world? Why wouldn’t a potential replacement elite, either on the left or right, not quietly cheer as their potential future host slowly weakens herself to the point of submission. Just as it is America’s fault for not fighting China’s efforts to enrich itself, it is the working people of the first world who have to wake up and BOTH resist taking the bait and demonizing the third world (who themselves are nothing but pawns in a bigger game), but instead take the fight to their real internal enemies, the Universalists of all stripes, who are sending their jobs abroad and simultaneously cheering the resulting decrease in Western standards of living. And just as it was the aristocratic Bismark who introduced the idea of a welfare state for among other reasons, to lessen the chances of a revolution, if the the particularists of the first world were eventually able to turn the tide against the universalists, they would be wise to consider a more workable version of the welfare state on the international level beyond the current haphazard foreign aid programs that are currently in use in order to undermine the conditions of human misery that the universalists are so easily able to exploit. Because in the end, it will take an ongoing combination of the universalist thesis with the particularist antithesis for the world to advance towards a more just synthesis.

Wow….now that’s a big sandwich!

Skippy…my jaw aches all ready…thanks.

Want more Chinese internal consumption? Issue every Chinese a half dozen credit cards, allow no doc liar loans for their overbuilt real estate sector, offer government credits for autos, appliances, education, etc, to pull forward demand for these assets…then set back and see what happens…my guess? Nothing. Chinese have learned that saving is a virtue and even more…savings can be what seperates the dead from the living during economic upheavel and internal strife.

The US is a country that is a couple of hundred years old and has seen no real upheaveals in government other than the civil war and even that did experience did not lead to a new government. The collective US experience has taught us, wrongly, that no real change is possible in our government…therefore US Citizens do not even consider savings as a factor in individual future well being. US Citizens have come to believe that the nanny state will always ride in on a white horse and save individual citizens and from the worst of individual and collective financial malinvestments.

China is a country many thousands of years old that has experienced many changes in governments. Chinese citizens have learned through bitter experience that they, as individuals, must be prepared to weather financial storms and government changes by relying on their own individual saved resources. Is it mere coincidence that Chinese have such a high savings rate when compared to the West? The Chinese have learned that when push comes to shove, government promises are not worth the paper they are written on.

How long will it take for US Citizens to become as wise as those of China? How long will it take for US Citizens to learn that governments don’t produce wealth, therefore their government can only tax and redistribute wealth created by those that labor in the private sector? At some point the truths of numbers will dawn on America’s Citizens…but not until they accept the fact that there is a limit to gov taxation and redistribution of wealth.

The original ‘safety net’ of social security was and is a good system…but the safety net has been expanded way beyond what the private sector work force can reasonably pay even if FDRs marginal tax rate of 95% on the top income earners is reintroduced…and, before I am bombarded with claims that more QE or direct distribution of dollars can pull indebted Americans fat from the fire let me say that all these actions will accomplish is destruction of the dollar in the not so long run.

IMO, this entire blog is another attempt to distract readers from the poor decisions of our government made long ago. Globalization was and is a bad idea for the US…but it was and is an excellent idea for multi-national corporations. Shopping for cheap labor at the expense of US workers is now the norm. It was not always so…and, pointing fingers at China for poor US political decisions is disingenious if not silly.

BTW…if you are interested in the British Empire’s solution to mercantilist Chinese policy (what happened when England tired of sending silver to China for finished goods) read about the opium wars…then you will have a grounding in real history that will allow you insight into why China is like China is…and is not going to change to accomadate the wishes of stupid US pols or Wall St theives.

What did you expect Bates.

A nation conceived by the machinations of second / third class European elites, mercantilists them selves.

Skippy…Cannibals with insatiable appetite get fat, sooner or later they lose their warrior skills and end up on someone else’s plate.

PS. at least China stayed in its sphere and we went to them, not the other way around.

The US has no moral obligation to buy anything from any other country. Trade treaties can be set aside so that we would have no legal obligation to buy anything from any other country.

China’s leadership has done well by it’s population, it is too bad that American leadership did not do as well by it’s population.

As the magnitude of our economic downturn becomes more apparent, more and more of us will be willing to speak the truth and demand action.

Global free trade is bad.

Global balanced trade is good.

This claim of deficit nations are lightly to gain in a trade war is about as disingenuous as green shoot. Even if they suffer less in a trade war, quite doubtful if you ask me, how can hurting less be constructed as gaining? Yes they might loose “only” a hand and Asia an entire limb, but guess who will squeal louder?

it is always interesting to talk about chinese corruption, manipulation of currency, excessive investment in production etc.

while the usa is worthy of some praise, let us rethink how we became so dependent upon china for our so called economic welfare.

someone cut a big deal with them to bring them into the mainstream of western capitalist development. hmmm. kissinger-nixon-rockefeller-world bank….on and on…

that was about the time we left the dollar-gold link and cut another deal with the saudis: we protect your fascist islamic regime with tons of weapons and you deposit your petrodollars in our banking system, and become a source of reliable fossil fuel from here to 9-11 and beyond.

the chinese and the saudis became covert brothers in wars in central america and afghanistan, together with the israelis under reagan-bush…

nice alliance between some pretty ugly regimes…..

meanwhile, china became the motherload of downward pressure on labor’s wages, and the walmarts of the world blossomed.

now, the icon of american manufacturing, apple, has its workers commit suicide in china to get wages increases, and it worked, the surviving wage slaves had their pay doubled overnight, and with it every major computer manufacturer in the usa, whose machines came from the same industrial complex in china, did as well…

so whose playing by the rules and who is violating them?

have not seen alot of complaining about dell, apple, hp, etc for their total reliance on cheap chinese labor for their “world class” “revolutionary” products….

wonder why…

no so let’s blame the chinese for their kicking our butts, doing what we incentivized them to do for the past 40 years….starting with nixon and being solidified under clinton….

and ratified again under obama….

how about focusing on wall street’s 14 trillion subsidy/bailout and where they put all that money???

helicopter ben could be dropping bombs of cash into depression ridden cities and small towns across america but no….give it to a handful of treasonous bankers, who are making a killing in asia, and have been…

it is the fault of china, they do not play by the rules?

please. there are no rules. we make em and break em as we see fit, and have since the end of ww2….

ask nicaragua about america’s “rules” for development. tiny little country of a few million got terrorized for a decade after daring to move left of pinochet and guatemala and el salvador’s american backed fascists….

and obama? ask the hondurans about the pentagon backed coup last year?

rules?

please….

It is amazing to see everyones gaze redirected so easly, PIGS, BRIC, Middle East, et al when ground zero for all of this…is right here on home soil…eh.

We all share the burdan but, some more than others imo.

The chances of a trade war with China are about 90%, especially after November. There is simply no way for American industries to compete in the market place with China. Getting China into the WTO brought China out of the 19th century, but too few Chinese have made the leap into the 20th century. Chinese elites are scared and are working overtime just to hang on to what they have.

Japanese businesses have adjusted reluctantly to the new realities of China’s economic hegemony, but the lack of cohesion inside China and the ham-fisted demands of regional Chinese authorities for kickbacks aren’t making the Chinese many new friends. The Japanese business people I know continue to believe they’ll get a better deal in the US, but they’ve pretty much lost hope that the US is serious about getting it’s economic house in order.

Point being, Japan would love to see America stand up to China as long as Japan has access to US markets. The main reason I wanted to see McCain win was to see a robust expansion of the US nuclear industry with Japanese companies partnering with US firms like GE.

The trade deficit Yves has written about isn’t about to shrink all by itself. The law of unintended consequences will play it’s part. But once the Tea Party starts screaming about made in America products and restoring American pride, the next step will be ‘Buy American’ without any apologies to anyone.

There is a better alternative to Smoot-Krugman –

We can conduct industrial policy via a value

added tax

Chin is too central to the world economy to start a trade war with. And as Soros said back in 2009 , if there was a collapse ‘they might very well come out on top’.

Just start with Rare Earth Metals, for one. Their investment in Asia , Africa and Latin America rivals if not surpasses the EU and the US.

The US can’t just bully the rest of the world around anymore.

This is Stocholm syndrome logic. Who is the bully here? The US has been a pig on the military front, but it has been a pasty on the economic, by letting Japan and now China pursue mercantilist strategies. I believe there was a geopolitical rationale for this sort of thing in the Cold War era, it now seems to be on autopilot because it serves the big multinationals who have a lot of political influence.

And the US still controls the seas, when China needs imported energy and can’t get enough oil via land routes.

The whole world economy is tottering. Everyone is engaged in their own particular version of extend and pretend. They are all unsustainable. China’s mercantilist policies, its bubbles, its capacity overhang, and its dependence on exports render it as unstable as the rest. I have said this before but we are the only country with the heft to exercise a leadership role in coordinating and restructuring international trade and finance, but our leaders are kleptocrats and real leadership of any kind is completely foreign to them. In the absence of such US leadership, mercantilist/protectionist policies will proliferate. Yes, this means the adoption of beggar thy neighbor policies. Why should we expect China to act any differently than say, Germany? But it is really every man for himself, sauve qui peut. Again this is all completely predictable, just as the inevitable crash up and collapse it will produce. Words have meaning. Unsustainable means unsustainable.

Somewhere between 1/4th and 1/6th of the human population is in China. Surely their government has as much moral authority as any to establish policies that are intended to assure prosperity for its nationals. I don’t see how it is possible for that to be “renegade” that assumes the West is defines “renegadism”. Colonialism, in all its forms, primitive and refined will fail.

Considerably, the post is actually the freshest on this notable subject. I concur together with your conclusions and will thirstily appear forward for your next updates.I will immediately grab your rss feed to remain abreast of any updates.

A Rogue Nation?

Compared to the U.S.?

Get real.

I pity you naive fools. For hundreds of years the capitalist democratic system has proven to be best strongest and most powerful of nation models. Many have challenged our system and all have failed. To think that China, an infant in terms of economic hostory, will somehow overtake the US is completely foolish. China has way more problems that we do but just like the cult of obama you all turn a blind eye to chinas slave labor condiitions, its environmental disasters, its enormous property bubble, its corruption in all levels of government, the repression of its people, and the fact that its essentially a command economy, and we know what happened in the ussr…..the posters on this website drink so much kool-aid, too much kool-aid if you ask me.

Surely the right solution is for the USA Treasury to find a tool to manage the total import bill better, rather than leaving the important bill to loads of private, random decisions. I’m thinking of a market-based “cap and trade” mechanism applied not just to carbon emissions, but to the whole import bill.

Such a measure would not be a tariff and would not be aimed at any country or favored industry. It basically would be establishing a second ‘effective’ exchange rate which counteracts any forex manipulation that other nations may indulge in. The message would be that once exchange rates float honestly, the second effective import exchange rate will tend to become the same as the official FX rate.

Such a measure would enable US labor to see wage rises which is what the economy and housing markets need.

I believe that China would actually welcome such a move because it is sensible and nondiscriminatory. Indeed their spokesmen regularly encourage the US to live within its means.

Auerbach’s comments on the difficulty of changing from production to consumption is interesting. Maybe it applies to the Japanese economy which is famously stuck in recession. Could it be because their minds know that they should consume more but their instinct is still to produce and save. And paradoxically, the lower the interest rate, the more savers feel they should save to achieve their goals.

This saving reflex could become a problem in the US, if quantitative easing allows the US Treasury yield curve to get too flat. For if baby boomers see the capital needed for retirement rising because of lower LT interest rates, surely they will save more rather than consume. With a flat curce, unemployment will carry on up, wages and real estate would suffer; though at least saving will naturally serve to reduce the trade deficit.

Here’s a thought. One country, never occupied by the U.S. has a large earthquake. It has an excellent response. Another country that had a democratic government toppled with U.S. encouragement and connivance and an “okay” response. A third country that was occupied for twenty years and has been constantly interfered with by the U.S. government has an abysmal response to the earthquake. Name the countries.

The title and the premise is quite arrogant. Why is China rogue for managing its economy in its own interests? More fundamentally, the author fails to take into account the view of the world from Beijing, which is something along these lines:

why should the Chinese government consider anything suggested by Western economists as credible, post 2008? The same economic and financial “experts” drove the world economy off a cliff. Why now listen now to the policy suggestions of a failed profession, especially to an economy that is not free-market or capitalist, both by government/Party design and in reality? Given that the US and European economies would have collapsed without massive state intervention, which Western experts have the credibility left to advise China on what exactly is the right economic model for its current political environment and stage of development?

I suggest people who want to understand how the Chinese policymakers view the world read Barry Naughton:

Barry Naughton-Post-Crisis Economic Dilemmas of China Leadership http://bit.ly/a55pbd

I have read Marshall’s piece and most of the responses. My thinking form someone who has been visitig China reguarly since 1993 is that the country is now at a crossroads. The leadership has created such a monster that it risks becoming uncontrollable. There is a housing bubble. Few first time buyers can afford an apartment; and first time home buyers outnumber the unemployed by a signficant factor. Cheap money has fuelled FAI resulting in surplus manufacturing capacity. And negative interest rates encourage despositors to seek other assets, whether real estate or commodities. The savers of Wenzhou are well versed in this art. They pool their deposits and go after whatever market they feel has the largest risk:reward ratio. They are returning once more to real estate but remain major longs in metals like copper. China is all about mis-alignment of capital. Now there is conflict at the top between those that see a nasty outcome and those who encouraged the very policies which created this monster. I suspect that we will see a change in policy very soon. The real estate speculators will be spanked; and policy will shift towards sustainablity. Going from pro-growth to the latter will probably be painful but the right course for policy makers to adopt. The west had better watch out for shocks because what emerges from the policy struggle in China will produce global shocks.