By John Bougearel, author of Riding the Storm Out and Director of Financial and Equity Research for Structural Logic

A decade ago, the Bureau of Labor Statistics predicted that the U.S. economy would create nearly 22 million net jobs in the 2000s.

These government forecasts for 2010 were particularly off. When the job market peaked in 2008 on the eve of the financial crisis, the manufacturing sector had already shed 5 million workers since the decade began, with more layoffs to come in the Great Recession. The forecasters said that the economy would create 22 million jobs over the next 10 years. At the decade’s economic peak, though, that number stood at only 7 million. Job growth in the 2000s was the lowest of any decade ever recorded by the federal government, stretching back to the 1940s.

Faith in Government Sanguine Projections are Badly Misplaced

Obama said with the benefit of his stimulus measures, the US economy would create three million jobs in 2010. The actual number of jobs created in 2011 was 1.12 million (before final benchmark revisions). Now, the CBO is projecting 2.5 million jobs will be created annually from 2011 to 2015. From the CBO: “As the recovery continues, the economy will add roughly 2.5 million jobs per year over the 2011–2016 period.”

That is more than 200,000 jobs being created per month every month for the next 5 yrs. Moody’s economists actually estimate 270,000 jobs will be created per month on average in 2011. Yet peak annual job growth ranged from 154,000 to 178,000 during the housing boom era circa 2004-2006.

But there can and will be no housing boom in the US over the next five years that will possibly match the housing boom of the previous decade. Just the excess supply of homes alone will take to 2013 to absorb, according to JPM. With no housing related jobs to create at least until 2013, there is simply no way the US can create 2.5 million or 200,000+ jobs per month on average in 2011-2012.

Faith in the US gov’t’s ability to create 2.5 million jobs for the next 5 yrs (one of the several silly and preposterous CBO projections) is sorely misplaced. The CBO has sugarplums dancing in their heads. Their 2011-2016 forecast for the US jobs market is disingenuous, misleading poppycock. Optimists making bets in the stock market based on a huge recovery in the jobs market spurring consumer demand had better think twice (and check The Hackett Group research below).

The CBO bases their projection of 2.5 million annual job creation on a bygone era which we kissed goodbye when the “Great Moderation,” got underway in the 1980s. The Great Moderation (along with automation) led to a decrease in business cycle volatility. This had the unintended negative consequences of leading to a decrease in job creation. V-spikes in job growth no longer accompany economic recoveries in the US. The jobs were and are being “disappeared” to automation and foreign companies

Exporting jobs overseas was sold to Americans as the path to cheaper goods and disinflationary trends in the US economy. Unfortunately, research has shown that the savings accrued to consumers from the cost of goods sold from overseas are negligible. Outsourcing jobs and companies overseas benefits corporate America, but the benefits have not passed through to Main Street. Main Street, once again is William Graham Sumner’s Forgotten Man. To cite a case in point over the past decade:

A recent paper by researchers at the Asian Development Bank Institute concluded that the iPhone, one of the United States’ top innovations of the past decade, actually contributes nearly $2 billion to our trade deficit because it is almost entirely produced and assembled in Asia. The paper also raises a conundrum for lawmakers and business leaders alike: If Apple moved its assembly line to the United States and created domestic jobs but didn’t raise the cost of the iPhone, the company would still turn a 50 percent profit on every one it sold.

Substantial changes in free trade agreements and the tax codes since the 1980s have incentivized companies to export jobs overseas. And the outsourcing trend is still alive and well. Howard Rosen, a labor economist at the Peterson Institute observed “US companies are investing in plants and equipment, just not in our borders…They are privatizing the gains of globalization.” US companies are “returning the spoils of globalization and technology” to new projects overseas. Another more recent case in point:

Recently, [mid 2009] ATI [an Indiana company} made $30 million worth of investments to buy, convert, and modernize a shuttered factory in economically ravaged Michigan so the company could provide more [wind-turbine] parts to GE as the green economy expands with federal stimulus funding. But a Chinese firm underbid ATI, and the factory faced having to lay off 302 union workers and shutter the plant. In an aggressive bid to keep the factory open, ATI offered to match the price of the Chinese producers. GE once again said they would prefer to buy from China. The ATI plant is now closed, the jobs gone.

GE’s Jeffery Immelt was sitting on Obama’s Economic Recovery Advisory Board led by Paul Volcker at the time. This course of action alone appears at face value to contradict the purpose of the Economic Recovery Advisory Board had set out to accomplish in 2009. Immelt’s GE received $16 billion in bailout funds from US taxpayers, like those 302 workers at the ATI plant whose jobs Immelt had just outsourced to China. The Economic Recovery Advisory Board should have enacted policies and legislation that would have not only prevented that from happening, but also made it illegal. At the least, the gov’t should have blocked GE from accepting a bid from China when a competitive bid in the USA was on the table.

On another level, though, just why would GE be so badly motivated to outsource those jobs to China when ATI had matched the China bid in the first place? At face value, GE’s management should have taken the lowest bidder for this job. That would have been ATI in Indiana. But Immelt is a “nut on China.” His decision to outsource to China was entirely reflexive of his on policies. Quoting Immelt from Dec 6 2002:

When I am talking to GE managers, I talk China, China, China, China, China. [Five Chinas] You need to be there. You need to change the way people talk about it and how they get there. I am a nut on China. Outsourcing from China is going to grow to 5 billion. We are building a tech center in China. Every discussion today has to center on China.

Is GE’s Jeffery Immelt’s partnering with and pandering to China’s interests all that? Or is it that there are such powerful tax incentives for outsourcing that Immelt would proclaim himself to be “a nut on China?” Would reforming free trade agreements and corporate tax structures disincentivize outsourcing and help repatriate jobs back home? I don’t know the answers, but the task to do just that fell to Jeffery Immelt after Obama appointed Immelt to head up Obama’s new Council on Jobs and Competitiveness earlier this month. One of Immelt’s first proclamations as Obama’s new “Jobs Czar” was:

A sound and competitive tax system and a partnership between business and government on education and innovation in areas where America can lead, such as clean energy, are essential to sustainable growth….As one of America’s largest exporters, GE remains committed to producing more products in the United States, which is our home and largest market.

Blah, blah, blah. What a bunch of crap and half-truths. It will be intriguing to see what Immelt proposes and disposes as he takes on his new role as Obama’s “Jobs Czar” after shipping out those “competitive and innovative” clean energy wind-turbine jobs to China in 2009. Marcy Wheeler is not far off the mark when she says Immelt’s actions “make him the poster child for everything wrong with the US economy right now.”

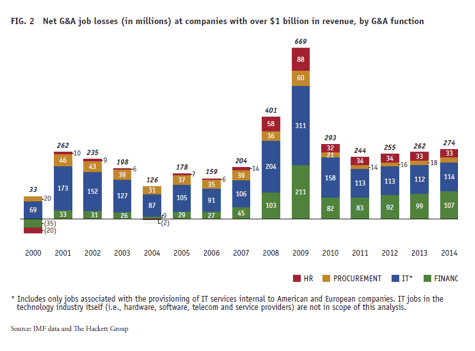

Recent trends in outsourcing are expected to persist no matter what Immelt and Obama propose and dispose. According to The Hackett Group: “On top of 2.8 million jobs lost from 2000 to 2010 in finance, IT, HR and procurement, The Hackett Group projects that another 1.0 million will disappear by 2014 in North America and Europe. By 2014 nearly half of the back office jobs that existed in 2000 will have disappeared or moved overseas. According to the Hackett report and IMF data, the job loss rate due to offshore outsourcing has accelerated since troughing in 2004. Hackett said:

“Our experience in the trenches of strategic transformation in finance, IT, HR and procurement is entirely consistent with the picture of a jobless recovery painted in this research…. There’s no end in sight for the jobless recovery in business functions, such as IT and corporate finance, in large part due to the accelerated movement of work to India and other offshore locations… Realistically, we have to discover ways to create jobs in other industries and in other ways,” said Michel Janssen, chief research officer at Hackett.

General and Adminstrative Job Losses 2000-2014 in US and Europe

The forward-looking realities of the US jobs market are not as encouraging as the CBO, BLS, and Obama administration would like us to believe. Some Democrats in Congress are showing some recognition of the structural unemployment problems in the US job market. But so far, they haven’t got beyond writing letters to the US Treasury Secretary.

In a March 2010 letter sent to Treasury Secretary Timothy Geithner, Sens. Chuck Schumer (D-NY), Sherrod Brown (D-OH), Bob Casey (D-PA) and John Tester (D-MT) said that taxpayer dollars designed to boost the struggling American economy should not be used to create jobs overseas.

“Companies located in New York, Pennsylvania, and elsewhere across the United States are fully capable of manufacturing the range of clean-energy components, and U.S. wind farms and other clean-energy projects financed with stimulus money should be buying American-built parts,” the letter reads.

The report estimates stimulus funding for wind projects have created roughly 6,000 manufacturing jobs overseas and just hundreds in America. At a press conference, the Senators pointed to a specific wind farm project in West Texas that is seeking an award of $450 million in stimulus funds for a $1.5 billion project. According to Schumer, the Texas project would create around 3,000 Chinese jobs and just 300 American jobs…. The goal of the stimulus is to strengthen the American Economy, and that means creating jobs here in the U.S. not in China,” he said.

The letter comes on the heels of a report by the Investigative Reporting Workshop and ABC News, which found that $8 out of every $10 spent on wind energy projects through the stimulus package went to a foreign company. Total recovery funds spent on wind energy projects total nearly $2 billion.

So, to our new jobs czar Jeffery Immelt: Jeff, I wish you the very best in your efforts to create 2.5 million jobs for the next 5 yrs. My advice is that you keep your day job, because when Obama fails to create those 5 million jobs by the November 2012 election, Obama and his new Council on Jobs and Competitiveness will be toast.

And Jeff, if you should find that your role as Obama’s “Job Czar” conflicts with GE’s existing practices, trends in automation, and outsourcing US jobs to China, may I further suggest you either resign from GE or that you resign from Obama’s new Council on Jobs and Competitiveness.

Obama’s new Council on Jobs and Competitiveness should be framing policy around the question: If not for the American worker, then who?

American policies must take steps to stop the bleeding of jobs overseas, Obama’s new Council on Jobs and Competitiveness should be enacting policies and proposing legislation that repatriates US jobs and disincentivizes further outsourcing of US jobs. These policies would of course be hugely unpopular with Corporate America, but that is the crossroads where we now stand.

My hat is off to you. This is the best jobs piece I have read in a long time. I linked it on my site. Muy Bueno!

Yesterday had plenty of heavy news, but I was a bit surprised that no one commented about the links “The Phantom 15 Million” article (similar subject matter).

I almost posted a comment because I had not previously seen the news about a whole decade of no meaningful jobs. It seemed not too surprising when our “growth” had shifted from real stuff to the FIRE-based ponzi scheme of multi-levels of abstraction (derivatives).

Nice to see another, longer, post on the subject.

Arrrgh!

“If Apple moved its assembly line to the United States and created domestic jobs but didn’t raise the cost of the iPhone, the company would still turn a 50 percent profit on every one it sold.”

Currently, Apple is just a marketing corporation – hype machine.

Here’s what it will take to dissuade the Immelts of the world from their China obsession – A firm statement by the DOJ that “Yes, you are free to source whatever you want from China to take advantage of lower costs, but the moment harm is done to an American consumer from melamine in baby formula, lead paint on toys, cadmium tainted jewelry, etc., we will come after your firm not just with civil charges, but with criminal charges, with the singular intent of putting your firm out of business. We will then pursue the maximum allowable criminal charges against all of the officers of your firm, and will seek prison sentences.”

Nice. But so what.

If I had a dollar for every liberal posting, why I could move to Iceland.

By now, everybody knows Barry was a Reagan posing in progressive clothing.

Where’s the candidate that’s going to primary him, or the third party candidate that can pose a threat to the 2-party duopoly?

There’s a simple way to cut the knees out from companies like GE taking the China route and dumping jobs at home. The government should open a plant to product high-speed rail, wind turbines, etc and then award exclusive contracts to them. In effect, then GE’s out of the US market.

The only thing lacking is the will to do that.

Maybe that’s why liberals talk a good game, but that’s about all.

Nice. WTF?

I’m asking when do all the ideas and writing I see everywhere from here to Firedog Lake to Frank Rich to Ian Welsh translate into action? Write to your heart’s content, but if no one does anything, then it doesn’t matter; it’s just complaining.

Do I need to run for president, then? My campaign slogan will be carry a big stick and use regularly on conservatives/Republicans/Big Business/ the uber rich folks.

It’s like Barry expecting the other side to play fair. He’ll always lose that fight (ie: 2010 elections).

You haven’t been paying much attention to the news lately, have you?

Oil lobbyist dies in freak auto fire incident…..Mitre consultant beaten to death….former Alaskan senator’s plane flies into mountain….etc., etc.

Try paying closer attention, dood.

Those who act don’t register with your kind first.

Send me some tin foil if you have any extra, ok Sarge.

This is not a political blog, and your demands that I cater to your wishes are a violation of the Ritholtz rules, which I regard as Web standard and have adopted as my comments policy.

You can’t offer remedies unless have diagnosed the problem accurately. I’m in the business of diagnosis, more specifically, encouraging critical thinking and generally debunking wrongheaded conventional wisdom on the finance and economics beat. I do offer policy recommendations in specific areas (I did in the crisis and continue to do so on the mortgage mess) but that is not the main thrust of this blog.

And I note you bitch and offer no solutions. So who here is guilty of “talk is cheap”?

You do it right Yves, there are plenty of political blogs. But no one puts the analysis in front of your face six months before it’s in the papers.

Well, last I looked, politics and economic policy have been incestuously intermingling since the Reagan administration (ie Supply Side, Keynesian, etc), so if you’re if you’re saying this is not a political blog, then that’s not quite true. You have a progressive point of view which I agree with. Afterall, the field of economics “supports” policy, partially, depending which ideology is in the White House.

My point of my comments were:

1. At what point does someone do something with all this information your blog and others are publishing? So far I haven’t seen any action or results at all. So, is there something more than just being a voice in the wilderness?

2. Economics itself won’t solve the problems. As I said, it “supports” policy. In the case where GE is dumping US jobs in favor of China (in the article if you recall), the solution I recommended is government ownership and action.

Anytime you care to debate (y’know, critical thinking and all) about this, send me a note and I’ll show up. Just remember to wear your pocket protector, ok.

Btw, you’ll have to tell me what my demands are since I don’t recall making any.

Unfortunately, this is just one more nail in the very nailed coffin of the dying American Economic Juggernaut.

Our political and economic leaders couldn’t care less about our country. They care only about short term profits (whether realized or illusory accounting profits).

In an age where we “invest” for 4 nanoseconds, who on earth has the ability to forecast out past a few months or a year?

no, the name of the game is to extract rents and build your own personal coffer ASAP, everything else be damned. Our corporate “citizens” therefore do exactly that.

Allowing and encouraging such concentration of wealth and power created echo chamber of thieves and usurpers within our government.

I wonder continually “is this how it felt in Rome?”

My reaction to Bill Black’s article from last week ‘The Anti-Regulators Are the “Job Killers”‘ was that the jobs were artificial jobs in the first place. Building cheap, unneeded houses, and the entire mortgage broker/warehouse lending industry, using imported Chinese tainted drywall, and outfitting these tract homes with imported furnishings, to what long-term productive end? And that’s ignoring the intended scam of purposely wrecking the economy in order to make billions betting that they’d succeed in doing so.

The myopia of the experts must be due to wading through too much data. Out here in the real world, the goal is clear: the elite have totally forsaken the US and fully intend to move all operations to Asia where they can profit massively. They have no civic responsibility to the powerhouse that enabled them to make their fortunes, and have already destroyed the infrastructure that enabled their success: rule of law.

They view the US labor force as greedy for merely wanting a minimally secure job, and standard of living. They aren’t called ‘The Elite’ for nothing. It’s their psychopathic attitude of entitlement and disdain for those whose labor they exploit that shows that they are no more than slavers at heart.

I’d bet that they expect to profit by creating a consumer economy in China, wherein most of the population are effectively slaves, manufacturing cheap trinkets, and a couple hundred million are allowed to earn enough to buy the junk.

While I am more than sympathetic to the analysis that we need an economy on a sure footing, one where we can plan on meaningful work that pays well enough to pay the bills and save for retirement, I would urge thinking about jobs to go beyond the commentary including the terms “artificial jobs” or “make work” or other value laden terms of contempt. The question I have to this line of thinking is: real as compared to what? Buggy whip makers, coal furnace fabricators, Edsel and Corvair assembly line positions?

Our entire social order is of a historical process, man made, and can be sustained or undone by humanity. The dignity of work, real jobs for real men is a load of shit. Literally. If you can find a paycheck with bennies, and you can ride that gravy train to age 65, you’ve got it made. Or at least you did. The lack of capital reinvestment, periodic now, and the lack of huge profits for the ruling class transfers the burden of capital accumulation out the hides the middle class in the form of wage suppression. Wage suppression takes multiple forms, including diminishing benefits, charging more for health insurance when before it was totally free. And now, the dispossession of large pools of capital allocated for retirement pension payments are regularly jettisoned as the lead weight albatross around the necks of industry. They are further characterized as undue expenses, burdens to the state, the residue of unreasonable and unsustainable economic Pearl Harbors of financial Apocalypse. So the real issue is not whether a job is artificial or a permanent real job, but the terms of any employment as deriving a percentage of the overall wealth being produced by any sector, including famously derided industries such as gambling. In Pennsylvania, 10 gambling casinos have open up in the past 18 months, providing jobs, tax revenue and short term construction activity across the state and within the city limits of Pittsburgh and Philadelphia. Of course these are roundly attacked by opposing interests as not real jobs, except for the people who work their and somehow manage to pay real mortgages and buy real food with their unreal work. In conclusion, in the future, if you are to appear as not only a friend of the working people, but appear to have actually been one yourself, at some point in time, please realize, what anyone does to earn a living is quite real to them and the IRS.

“In Pennsylvania, 10 gambling casinos have open up in the past 18 months, providing jobs, tax revenue and short term construction activity across the state and within the city limits of Pittsburgh and Philadelphia.”

Ah, yes, rent extraction from the bottom, closer to the source than the Wall Street model. What a great solution to the need for jobs.

Dignity and sustainability are important values that I feel should figure into jobs.

Casinos are dens of iniquity, serving no useful purpose, draining household funds as they indulge addictive behavior. I doubt my neighbors who voted for the casino will be happy if their daughters turn to prostitution because that’s a job. Meanwhile, these same neighbors deride the local Mexican population, the only ones with guaranteed jobs that my white neighbors disdain.

I decry government policy that fails to distinguish between meaningful work and make-work, whose only purpose is to enrich corporations without any lasting societal benefit.

Are the casino profits being put back into the community? Or just the low wages?

People like Paul always have extreme difficulty with arithmetic (I’m not even going to mention mathematics) and don’t understand the obvious, not even long after it has become obvious to everyone else.

Whenever anyone mentions “the economy” you know that person is completely clueless.

What “economy”???? When the top five banks are responsible for over 60% of the GDP, and the fantasy finance sector on the whole makes up over 70% of the GDP, there is NO FRIGGING ECONOMY.

(And the fantasy finance sector only employs 7.4% approximately, and who knows how many are actually American citizens.)

True, with America abounding in ignoramuses who can only watch TV, or sports, or guzzle their booz, or smoke their tokes, or watch their porn (although I admit to a penchant for good Erotica), is it no wonder that America exists today with NO media and No economy?

Such a shame that we’ve entered the Dark Age once again.

I have to say the comments on this being such a liberal site don’t match my view of Naked Capitalism. I could argue it was far more neutral than left or right. The analysis is paramount here and any political rhetoric doesn’t come from the writers here.

What I find most amusing is that there have been countless solutions offered during the excellent analysis provided by Yves Smith.

I have never thought Naked Capitalism was anti right either. I have never felt this blog was affilated with or concered about either party. This blog represents the search for truth that both parties could learn a lot from if they would grow up and stop acting like children.

Thanks for the very kind words. I will confess to being very anti-Palin, but that is due to her utter incompetence at anything other than self promotion and her dishonesty.

Let housing crash so u.s. workers can afford a house on $10/hour. That is the only way u.s. can be competitive with the world. But what would happen to consumer spending and 2/3 of u.s. economy? This is what the government geniuses should be trying to figure out. Good luck ITS coming!

But I thought GE and Exxon were the pillars of American industry and competitiveness. They pay billions of dollars in taxes every year. What’s that, They didn’t pay any taxes in the United States in 2009? How’s that possible? Can you explain this Mr. President?

Corporate America seems to have perfected the art of screwing American citizens and leaving them holding the bag. Ship all the jobs overseas, and hide your profits in offshore accounts at the same time. What a marvelous job of fleecing America.

Here’s an idea that might help our economy to create jobs, although it would directly oppose the global multi-national business model we are currently saddled with. It is just the seed of an idea I would like to throw out there, in hopes a cyber breeze might carry it to various business experts in cyber land, possibly finding fertile ground for beginning a serious discusion about “a new way of doing business in America”. It’s not really a new idea, more like the improvement of an existing one.

Maybe Yves and company here at Naked Capitalism could serve as a catalyst to launch a serious discussion on the matter. I believe globalism is reponsible for much of the misery, death, and oppression the world suffers from to varying degrees, and throw this out there as one idea to fight back and to move the world in a better direction.

I don’t know the exact breakdown, but am led to believe from articles and comments I have gathered from the business media, that small business is the real driver for creating jobs, at least here within our own shores. Maybe this no longer holds true, but I believe it was in the not too distant past. Of course, for the most part, by nature, small business operations are local or national in scope at most, so naturally the employment pool will tend to be on-shore.

At any rate, I think we can all agree, that in addition to the traditional mom and pop stores that make up small business, over the last several decades there has been a general trend for large corporations to outsource (both off and on shore) much of their operations to small businesses to reduce their risk, and lighten their responsibility for taking care of their work force. That is, in today’s world “what’s good for big business is good for America” no longer rings true.

With this in mind why not get serious about ESOP’s. A plan for democratizing the workforce. For those of you not familiar with the term, it is more formally known as an “employee stock ownership plan”, and the federal government provides some support by way of tax breaks and incentives for companies that adopt such a plan for their employees. In a nutshell, it is usually implemented by the plan taking out a loan, buying partial ownership of the company, and distributing the interests (stock) in accordance with some non-discriminatory guidelines, to the employees. Such interest is typically held in trust for the employee and serves as something of a retirement program (although they still may participate in IRA’s, 401 k’s, etc).

Imagine if the government beefed up support for such plans by making the tax benefits for lenders, small business owners, and employees participating in such plans so attractive that it became the preferred business model for doing business. With the right tax incentives in the way of payroll tax credits and capital investment tax credits,it could go a long way to restoring full employment, make our products more price competitive, increase government tax revenues (full-employment), and break the multi-national strangle hold on our political processes and economy. In other words, tax policy directed twowards the encouragement of growth in jobs and investment at home as opposed to subsidizing multi-national offshoring.

I have, what I believe, are some good basic ideas and am working on a draft letter to my congressman (yes I know, I probably will get the standard “thank you for sharing your views” letter in return), but realize that there would be tremendous complexity in implementing such a paradigm shift for something as fundamental as how we go about organizing ourselves in the workplace, adjust our cultural and social attitutes, formulate the policy, and so on and forth for making something like this happen. Therefore, I invite constructive feedback or comments to those with expertise in such matters greater than my own (yes, I realize there are too many too count), or those with similar or alternative ideas to breaking the global, multi-national business model. I would welcome any constructive ideas or feedback in promoting an idea such as this or alternative solutions that would move the world forward.

I work for a company that is 100% ESOP-owned. It is beginning to be a very dignificant percentage of my total retirement-account assets. I look forward to when I can begin to “diversify” it out in a few years when I turn 55 to lock in some of those assets into a liquid form.

An interesting aspect to the ESOP. The firm has a significant international component to it with numerous workers overseas. However, the overseas workers can’t own the ESOP shares, so it is 100% held inside the US. Instead the international employees simply get reasonably generous retirment account benefits (but probably not as generous as the nominal ESOP annual allocations) per their countries’ laws and customs.

The employees are all quite dedicated to the firm with relatively low turnover compared to the rest of the profession.

Reaching out and partnering with foreign organizations with goals similar to you company’s own would be a wonderful idea as long as it was predicated on a basis of serving the fair interests of both, as opposed to the present model of finding the cheapest labor to exploit.

It embarrasses me as an American to think about our nation becoming a bunch of mindless consumers and investors, willing participating in a system designed to exploit the poorest of the poor for cheap labor around the globe to satisfy our sick reliance on consumption of goods for its’ own sake and our own sense of worth (who has the most toys wins).

I am sure people that are presently involved in an ESOP could bring a lot to the table by way of experience and thought for really improving the model as an alternative to multi-national globalism.

Imagine, average people around the country and the globe reaching out to each other through the workplace, seeking common ground and opportunity for both sides. I’m sure there are literally thousands of ideas out there if only the average citizen would begin to dream of solutions. That’s a great idea, thanks.

ESOPS: “In a nutshell, it is usually implemented by the plan taking out a loan, buying partial ownership of the company, and distributing the interests (stock) in accordance with some non-discriminatory guidelines, to the employees. Such interest is typically held in trust for the employee and serves as something of a retirement program (although they still may participate in IRA’s, 401 k’s, etc).”

First, ESOPs do not create jobs.

Secondly, the interests of the company are not aligned with the interests of the employees. Decisions are made time and again by upper management that are not aligned with their employees. Case in point are all the Enron employees that socked their entire retirement plans in their ownership of Enron stock. These employees had their retirement savings “rubbed out” in a matter of months. Another case in point, Bear Stearns employees whose retirement plans were wrapped up in Bear Stearns stock were “rubbed out” virtually overnight.

GM was more of a slow motion train wreck for employees. I had to explain to my retired GM parents a decade ago that they could no longer own GM stock, their pension plan and health care benefit plans were at risk. And if those were at risk, so was the GM preferred. They had all their eggs in one basket and had to diversify.

The key is when a company is 100% ESOP owned. At that point, it is much more difficult to game a la Enron.

One of the biggest issues is that a lot of employees don’t want to take advantage of the diversification options available past 55. They believe that the company is a better bet and don’t understand how risky any individual company can be, even ones that look impregnable.

Personally, I plan to take advantage of the opportunity to diversify out the allowed 25% at the earliest opportunity. I think the ocmpany is very well run but you never know….

One never knows how stock options will play out.

One key justification in having them is to keep key employees in a competitive situation. It played a factor for me 20 or so years ago. As it happened for me, I left all my eggs in the company basket (as apposed to cashing some and diversifying) and rode the dot-com wave until a really good cash-out near the peak.

So it seemed, in this case, the options worked as designed for both the company and for me, but YMMV. I admit — I got lucky.

ESOP’s provide the illusion of alignment of interest. If anything, broad holding of minority interests by employees are so diffuse as to have no affect on the decisions of managers. WHo operate with impunity. Sam Zell, used the ESOP ownership or tribune employees as collateral to get 8 Bill in loans for the leveraged private buyout of the tribune company. He invested only 300 Million or less of his own money for an 8 bill purchase. As a condition of the ESOP, the employees were stripped of their voting rights and couldn’t control their own stock that was being used to saddle them w/ all this debt to keep their jobs and keep tribune going. Tribune will be out of busines in 24 mos and the employee’s ESOP equity will be wiped out.

ESOP is not helpful. In a similar vein, if social security is privatized, it’ll be disasterous for any possibility of fed regulation of companies designed to increase us employment. Citizens would be against the fed gov doing anything that could negatively impact the stock price of a company like GE because it has the potential to reduce their social security account invested in the stock market.

A better option might have a rule that mgrs stock options can’t vest in less than 7 years. That way they’d have a long term financial interest in their own decisions.

The government has a strong role to play in the regulation of firms and the market if it has any interest in building a society, employing its citizens and protecting the environs. There is no way to use “market forces” to do this. Regulation is inherently restrictive of short term profit and thats the largest basis of exec compensation.

One of the first actions that Obama should take with Jeff Immelt is to ask him to review the past 10 major off-shore purchases that his company has made (such as the China vs ATI episode highlighted above) and have his CFO write a 2-page memo on each one explaining why it was off-shored to Asia instead of made within the NAFTA zone.

I suspect that those memos could form the basis for US industrial policy over the next two decades.

I also suspect that one of the reasons that they were off-shored is because GE wants access to those markets and they will only be allowed access if they put jobs there. However, that would probably not be clearly spelled out in the memos.

Mish has been all over the jobs projections.

http://globaleconomicanalysis.blogspot.com/2011/01/janet-yellen-says-fed-asset-purchases.html

http://globaleconomicanalysis.blogspot.com/2010/12/jobs-forecast-2011-calculated-risk-vs.html

ESOP’s do not create jobs, offering a quality product at an attractive price does. By targeting tax incentives to small business ESOPs, the goal would be to lower their overall costs to enable them to price competitively. I could even see extending tax breaks to multi-nationals for sourcing from Esop products and services. But only local banks would be offered incentives and guarantees on loans(Goldman Sachs would not be welcome). The government’s loss in revenues from the tax breaks would be offset by an increased payroll tax base.

ESOPs, “democratizing the workplace” as I call it, would serve to align worker interests with management interests. Everyone is working for the company they own. Of course, I am not talking about some sham of an organization, that simply meets the letter of the law to qualify for tax benefits, rather an organization with a charter or agreement that specifies guidelines for executive decision making and compensation, possibly answering to an oversight board which in turn answers to the employees (employess stock is the only voting stock for board elections). For example, profits distributed in accordance with guidelines approved by the owners(including employees) that has been designed for fairness, encouragement of employee innovation and dedication, as well as time on the job. In other words, no one at the top earning millions of dollars in bonuses, designing golden parachutes for themselves and living like a God, while off-shoring and outsourcing the company jobs. These aren’t leaders, just greedy self-serving b-holes.

Of course, there is downside risk that the company will not be successful. I see the possibility of collections of these small business ESOPs, something like local “tribes”, which in turn becomes a members of a larger body in a loose affiliation. That is, organizing into some sort of decentralized organization that might offer economy of scale purchasing power, and serve to provide some sort of safety net for affiliate companies experiencing difficulties, by way of offering services and support.

I’m not trying to suggest we formulate policy that prohibits the global-multinational business model. If you believe that the road to a secure future for you and your family entails a diversified portfolio in govt. treasuries, corp bonds, and multi-national equities, go for it. I’m just suggesting as far as tax policy goes, the American people stop subsiding this model and begin to direct tax policy at encouraging jobs growth and capital investment at home. Free the American political system from the capture by multi-national corporations and banks, empower small business and the average citizen, and eliminate the need to rely so much on “protecting our global strategic interests” by way of massive military expenditures we can’t afford, and by nature require aggression, war, oppression, and other attendant evils. Let’s stay home and mind our own business for a change.

John I like your idea and I’ve been thinking similarly about what can be done to keep companies honest. There seems to be a trade off between efficiency and regional influence in any given industry and I think we have been too in ‘love’ with the idea of efficiency. I also came to the idea of decentralized, local companies working in all types of industries and achieving economies of scale through alliances that still kept a real ‘sovereignty’ for each partner.

I think this is the same idea we need to adopt in the realm of politics. Federalism is a great governing idea, but currently I think the central governments of developed nations are too powerful. More of this power needs to reside with the states/provinces and local regions within them.

I think another idea that is worth discussing is putting limits on the size of corporations in relation to the GDP. This could be done per industry or just with a flat rate. The concentration of power that we currently see is inherently damaging to a stable society.

There’s probably millions of us, all around the globe, with similar ideas. I wish thousands of people would step forward and bring all sorts ideas from every angle and discipline, to begin a new way of thinking about organizing ourselves for the new millennium. Small business owners, independent economists and business people, environmentalists, engineers, scientists, average folks looking for work, lawyers and political scientists, independent tax accountants and lawyers,etc.

With the internet, it all becomes possible on a global scale as a global people movement. Think of all the talented and brilliant people who could build such a new paradigm. Sort of an “open source” approach to re-organizing our economies. Web sites dedicated to building a new locally oriented economic models, with articles from experts, opportunities for input from layman (similar to comments from this blog), with resources, contacts and advice.

The US economy is 70% consumer spending. Policies that impoverish the middle class are inherently anti-growth and anti-jobs. Yet those are the policies the US has followed for the last 30 years.

In the 2000’s average family incomes declined. Coupled with Wall Street’s looting of middle class savings, the anemic recovery is predictable.

That 70% stuff is a bunch of bullshit someone made up. 100% of any economy is production plus credit. Cut off the credit and the economy has to survive on production. The problem in this country is being described by guys like Michael Hudson, where entire corporations are being financialized by management and corporate raiders. There is nothing going into production. The term investment has been bastardized to the point not one in 10,000 really understand what it really is. We aren’t even dealing with other people’s money any more, but credit guaranteed by our government. The management capability of the average upper management guy falls closer to the bank robbing skills of Clyde Barrow than the industrial genius of a Henry Ford. The US government should have never let credit be used in this fashion.

sorry, this was in response to the legitimate concerns of john bougearel in the above post.

The government has to create policies which support and increase our industrial and service job base. Unfortunately, trade and economic policy are written to serve the interests of capital to have no restriction on its use and transfer among nations. This can be done in an advanced economy, see the weimar system of Germany.

The declining jobs domestically is a perfect reflection of this. You have to condition favorable tax treatment on sourcing production and administration of firms in the US. You have to right size trading as an activity by implementing a tobin tax, to reduce the impact of the finance industry and place it in it proper collateral role. Any american company that produces products or services overseas should have to pay an import duty if it wants the benefit of this consumption market. Any gov lending or stimulus should be conditioned on U.S. employment, preferably buy american clauses for manufacturing should be incentivized by tax policy. Immigration must also be controlled because failing to do so weakens the bargaining power of workers, of all levels. Its not racist , its the government taking care of those who are citizens. Taking care of its citizens, not in a nanny state way, but in a way that allows preferably opportunities for its citizens is the most elemental of duties of a democratic government.

One of the points which always seems to get lost is that Bush era job creation before the December 2007 recession sucked. To the beginning of the recession, the Bush Administration created 5.609 million jobs. If you take 120,000 jobs/month needed to keep up with population growth, in those 82 months, we needed 9.84 million jobs just to stay even.

The housing bubble had almost no impact on the numbers. That’s really not that surprising when you think about it. You see you might get an uptick in construction workers, but you wouldn’t get a broader effect if all the wood for those houses was coming from Canada or all the carpets, beds, refrigerators, washers, and dryers, etc. to fill them came from China.

Sort of related to this is that US industrial capacity has been flat for 9 or 10 years now. Worse, capacity utilization for 2010 was only 74.2%. Capacity hasn’t been growing, even so there is lots of slack in the system, so how, in such an environment, will Obama’s plan to encourage “investment” actually create any new jobs?

Against this, we have this Administration’s commitment to job destroying “free trade” agreements, the abandonment and even reversal of what little Keynesian stimulus we were seeing at the federal level, ongoing attacks on entitlement programs, and major retrenchment coming at the state and local levels.

And just to re-emphasize how wrongheaded this President and this Administration is Obama appoints not just the CEO of GE but a major outsourcer of American jobs as his Jobs Czar. This is all going to end badly, and I don’t mean just in tears, but depression and revolution.

If this were stupidity, it would be on a breathtakingly epic scale, but I can’t discount the element of malice in all this. People are no doubt tired of me constantly invoking kleptocracy, but only this captures how our elites can engage in what is monumentally destructive, and ultimately self-destructive, behavior. Kleptocrats and their enablers will loot and mine the very foundations of the economy until it all falls in on them (and us). There are going to be no last minute epiphanies, no moments on the road to Damascus. Our elites are going to push this until it all falls apart. Or unlikely as that seems we stop them.

Quit Bushing this mess. Bush came in on the collapse of the biggest fraudulent stock bubble in US history. The housing mess was puny against what blew in 2000. The combined 4 of INTC, MSFT, CSCO and GE lost well over $1.2 trillion in market cap, which was never there in the first place. There wasn’t any policy going to fix that mess short of a depression. There isn’t a pump that will inflate a leaky tire for long. On any account, politicians have little effect, save for destruction. I have felt for years that the Bush Tax cuts staved off depression. Remember, we had a major pipeline company (Enron), a major telephone company (WCOM/MCI) and several other $1 billion plus market cap company go kaput. LU was one of the top 10 market cap companies on the US exchange. Went to a penny stock. Wall Street sold so much for CSCO that it broke LU. NT went to pennies as well and have 2 million square foot campus down the road empty.

You might look at these charts by Steve Keen showing the level of debt exploding against GDP in 1995. Clinton was President and he brought the magic financial man, Robert Rubin into Treasury. Rubin took $100 million out of Citi as a pay back from Sandy Weill for getting Glass-Stegal repealed. He also allowed an unlawful merger take place between Weill’s Travelers and Citi in 1998. The imaginary balanced budgets were produced by bubble financing, not by a magic wand held by Rubin/Clinton. The bursting of a bubble the size of the 2000 market is never followed by substantial job growth. The only thing that kept it from being worse was the real estate bubble led by Franklin Raines of FNMA and the money produced by government deficit financing. The US economy has been drinking scotch for a hang over for a long time, but it caught alcoholism in the 1990’s.

http://www.debtdeflation.com/blogs/2011/01/21/how-i-learnt-to-stop-worrying-and-love-the-bank/

“The housing mess was puny against what blew in 2000.”

Just based on the numbers, you’ve got it totally backwards, I think.

Not that I think Bush was a large factor in creating the situation we have now.

Aw c’mon Yves. You gonna publish my story “How Words Can Become Action” here if I get it finished?

“The actual number of jobs created in 2011 was 1.12 million”: you meant in 2010, right?

My fault, John pointed out the typo before it went live, but I did not correct it. Fixing now.

Jeff Matthews begs to differ:

http://jeffmatthewsisnotmakingthisup.blogspot.com/2011/01/fed-in-la-la-land-again.html

Why the reference to Sumner’s social Darwinist “forgotten man”? Black humor?

GREAT article! I took it and some quotes and then added more graphs, data and facts from our site in an article “Outsourcing is Not Good for America”

http://www.economicpopulist.org/content/outsourcing-not-good-america

To really find out how many jobs are being created abroad instead of the U.S., literally one must read corporate press releases and extract raw data. There is no government reporting requirement on the jobs being created overseas, outsourced.

There is only so much fiction one can remember at one time and those 10 year unemployment projections are absolutely one of the biggest spin fictions out there.

Excellent article, thank you.

TPTB look increasingly ridiculous, as they pump up the rosy scenarios. Even the POTUS, Herbert Hoover reincarnate, sounded eerily like Baghdad Bob in the SOTU address: “The stock market has come roaring back. Corporate profits are up. The economy is growing again.”

Why yes, it’s growing thanks to QEasy money, and along with the exporting of American jobs, Benny’s poverty effect is now being felt in Tunisia, Egypt, Yemen, and very soon in the beloved homeland as basic food and energy prices inflate 20%. These leaders truly are as clueless as Marie Antoinette. We are all Egyptians now.

Give Immelt a one way ticket to China, freeze his accounts and foreclose on GE. The US should get rid of the tax advantages of keeping their money off shore, pull the aid out of the non bank financials and sell the valid parts of GE to pay the debts. Immelt and his famous predecessor made GE a financial systematic risk. I could see their bankruptcy coming a mile away, but I hadn’t counted on the fascists Paulson and Geithner bailing them out. This leveraging credit on the US people, to the US people and against the US people has destroyed them. Let him move to China and fight in the next revolution.

This problem will fix itself. The trajectory of US wage income (and purchasing power, given the dollar devaluation) is it’s own cure (not that anyone is going to like the medicine).

Go back and watch Jeffery Immelt when Roubini explained what was coming (they were both on stage, sitting next to each other)….check out the shock that registered on his face.

Some poker player. Good luck “running” the folks who rose

to the top of the Chinese party system, dude…hope it was

worth it.

Incidentally, ask yourself how Jeffery could get so levered (while it was so clearly going to go bad) that his company would need $16B? (and didn’t they issue FDIC backed CDs too?)

Visionary leadership, or blind levered bat?

Notice how he tried to get more “in touch” with his

management team, after it all went bad? Full speed

ahead Jeffery…she’s unsinkable.

Let’s declare war. That way we can hang some of these bastards for treason. Or do we have to declare war?