By Daniel Pennell, a systems expert who has testified before the Virginia House of Representatives on MERS

I wonder if solar flares or something in the ether is prompting officials under attack to have unusually open conversations with people in the opposition. We’ve just had Governor Walker speak to “David Koch”, and I had a mini version of the same experience with MERS’ general counsel, except in my case, I was the recipient of the phone call. But the underlying assumptions of MERS and the Wisconsin executive were similar, in that each is confident of support from powerful allies.

Given that I am a vocal MERS critic, though testimony I have given, opinion pieces I have written and the work on legislation I have done over the last year decrying the legal standing and operational sloppiness of MERS, I was more than a little taken aback to get a call from Richard Anderson of the MERS legal team yesterday. Our conversation cast some light on the thinking and culture of MERS as it fights for its life against a barrage of legal challenges.

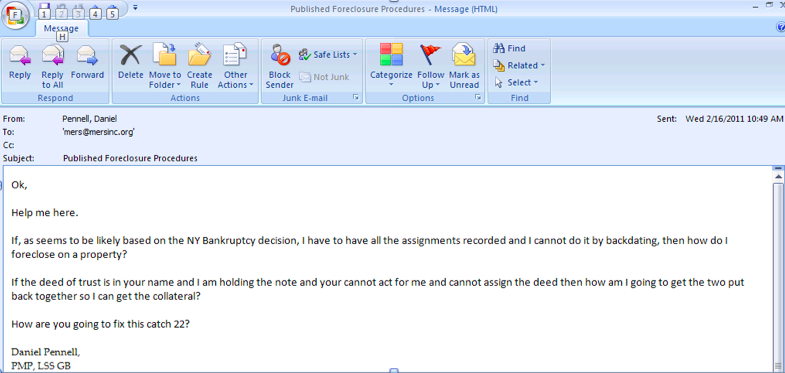

Mr. Anderson was in fact calling in response to an email I had sent to MERS last week (see below) asking how MERS intended to manage its response to the Agard case in N.Y. where judge Grossman clearly said (or in Mr. Anderson’s words “opined from the bench”) that MERS did not have the legal standing to assign mortgages.

Our conversation covered three areas of interest to those of us who have followed the foreclosure crisis and MERS saga, the effect of the Agard case, the MERS announced changes to their membership agreements and the ongoing OCC investigation.

As regards the Agard case in N.Y, Mr. Anderson first pointed out that MERS has 300 plus cases that support its legal position. He then went on to tell me that Judge Grossman did not understand or chose to ignore the laws of N.Y. and that his comments regarding MERS were nothing more than his “opining from the bench” and therefore had no legal relevance and because it was nothing more than an “opining” that there was nothing for MERS to appeal.

When I pointed out that the MERS announced changes to its membership agreements that followed so quickly on the heels of the Agard decision seemed to align almost exactly with the comments made by Judge Grossman, Mr. Anderson said that it was just a “coincidence of timing” and that the changes were just intended to avoid any potential legal issues and to improve and secure the MERS business process. It’s interesting in light of Mr. Anderson’s remarks that a Naked Capitalism reader reported yesterday that banks have been settling cases where MERS is at risk of getting an unfavorable judgment. As he wrote:

That’s not unexpected behavior–better to cave with small dollars than to lose plus have adverse law become embedded in the case law for an entire federal district. That makes it appear to non-specialists that the jurisprudence in favor of lenders/MERS is static.

I then asked Mr. Anderson about the OCC investigation. I pointed out that the reports I had read, including those in the Wall Street Journal, said that the OCC was nearly complete with its investigation of the servicers and that although MERS was originally part of that investigation, it appeared that the investigation into MERS was being parsed out and put on a separate and ongoing track.

Mr. Anderson said that he could not comment on the OCC investigation or actions but then went on to say that no administration would allow, nor would it allow a judge’s ruling, to threaten the legal standing of a MERS member to take a home. He pointed out that MERS has some relationship with 60% of the mortgages in the country worth in the trillions of dollars. In other words, in his opinion, regardless of the law or the findings of the OCC, MERS is too important because of the dollars associated with its operation to be allowed to be found to be acting illegally.

In short, this man, who from his position as legal counsel for the party under investigation has inside knowledge of the OCC investigation, is confident that the government will do all it can in its power, regardless of the evidence, to assure that MERS and its members are allowed to proceed as they wish because of the potential financial costs.

I found a few things about this phone encounter interesting.

First, one would think that a member of the MERS legal team would think to check their membership lists before responding to such sensitive questions. That however would assume that they actually know who all their members and member contacts and given what we know of the MERS system that might be giving them too much credit.

Second, I was struck by the, not quite contemptuous, disregard of the opinion of Judge Grossman. Mr. Anderson’s use of the word “opining” and his tone implied to me his general dismissal of the judge and his opinion.

Third, the willingness of Mr. Anderson to so readily express his opinion, an opinion that must be at least partially based on inside knowledge, that the OCC and the administration would do all it could to protect the standing of MERS members.

These three things tell us something of the MERS culture and what they are thinking internally. Although the words, descriptions and tone were those of Mr. Anderson communicating with what he must have assumed was a MERS member, one has to suppose that his thoughts and attitude, if so blatantly displayed must reflect the thinking and attitude of the larger organization. And that thinking was clear: that MERS is too big to fail, and hence will never have to worry about having to account for its sloppiness and misconduct.

But is this confidence well founded? As much as MERS believes it has bank regulators firmly in its camp, its reach into courtrooms all over America is quite another matter. I’d like to think that one reason Anderson was so keen to dismiss the judge’s decision in Agare is that he, and increasingly other judges, do not accept that financial services industry players are above the law. From his ruling:

The Court recognizes that an adverse ruling regarding MERS’s authority to assign mortgages or act on behalf of its member/lenders could have a significant impact on MERS and upon the lenders which do business with MERS throughout the United States….This Court does not accept the argument that because MERS may be involved with 50% of all residential mortgages in the country, that is reason enough for this Court to turn a blind eye to the fact that this process does not comply with the law.

This is outrageous! Ah, for the antiquated concept of rule of law applied equitably.

While I agree with you Yves that there is a chance this could get caught up in the courts, I expect our fascist owned congress critters to cover all this up with some hurried legislation, maybe some wrist slapping and lots of serious media coverage…or not.

Oh yeah, I forgot.

No one will go to jail but the little people for their little crimes.

> I was struck by the, not quite contemptuous, disregard of the opinion of Judge Grossman. Mr. Anderson’s use of the word “opining” and his tone implied to me his general dismissal of the judge and his opinion.

>that thinking was clear: that MERS is too big to fail, and hence will never have to worry about having to account for its sloppiness and misconduct.

How soon until judges start receiving real death threats from the banking interests which are losing $$BBillions with every passing month ?

Outrageous?

Come one now! Tell us how you really feel about this. Take example on a Masta of the genre, Barry Ritholz:

Did you mean that kind of outrage? :-)

Kudos! No attorney would call you out of the blue unless they were worried. I am not sure the “mal de MERS” problem could be retroactively fixed by legislation. I would be be more worried that MERS or a holder would file bankruptcy and seek an equitable remedy through a bankruptcy judge.

Squeeky Fromm

Girl Reporter

Hmmm, this has me wondering if any or all of these judges could be targeted in such a way for removal from their positions via legislation or perhaps more dubious means. Certainly the US Supreme Court has joined the ranks of corporate sycophants. Can there be other means to turn the rest of the court system over to corporate/bankster control? How many conservative think tanks are hard at work on this issue right now? The judicial system is certainly the last domino to fall and I really wonder if it’s just a matter of time before it too won’t make any difference.

“the US Supreme Court has joined the ranks of corporate sycophants”

Hmmm! We tend to forget how often the SCOTUS has been a political instrument in the hands of the powerful of the moment throughout the history of this country.

See this:

http://www.npr.org/2011/02/24/133960082/the-supreme-courts-failure-to-protect-civil-rights

or

http://www.npr.org/templates/story/story.php?storyId=125789097

Perhaps MERS believes that the Obama administration will protect them in the settlement agreement it is promoting:

U.S. Pushes Mortgage Deal

Obama Proposal Seeks Multibillion-Dollar Settlement of Loan-Servicing Cases

By NICK TIMIRAOS, DAN FITZPATRICK and RUTH SIMON

The Obama administration is trying to push through a settlement over mortgage-servicing breakdowns that could force America’s largest banks to pay for reductions in loan principal worth billions of dollars.

http://online.wsj.com/article/SB10001424052748703842004576162813248586844.html?mod=WSJ_hp_LEFTTopStories

Obama can push all he wants. The reality is that first mortgage principal reductions won’t happen unless and until the big 4 banks agree to write-off their $400 billion in second mortgage loans. If first liens are req’d by the Admin to take losses while the seconds remain whole, it will destroy the mortgage market (beyond it’s current state of demolition). Then again, Obama has shown no qualms about helping the big banks at the expense of the folks.

One possibility is that the Fed has or will quietly buy up many of the second mortgages (and/or related CDOs) at or above face value, protecting the banks. The losses will be shifted to the Fed, and then to the taxpayers.

“Four banks agree”?

The regulators can force writedowns. There are clear guidelines for valuation of impaired assets. The second liens in many cases are worth zero. And a writedown on a first means the second HAS to be written down. This is why the Administration has steered clear of principal mods, and why the amount suggested here is pathetic (and ~30% comes out of Fannie and Freddie, not the TARP banks).

You’ve got it backwards. The regulators have been tolerating, perhaps encouraging bogus marks because they don’t want to reveal the banks are undercapitalized. It would reveal the degree to which Timmie & Co have been selling the public a bill of goods.

Agree 100%. The entire 2nd lien should be written off. The fact is that “regulators” are not forcing the issue and Obama is in the banks’ corner on this one. Hence, my use of the word “agree” as in they won’t and Obama won’t make them.

Since the revelations that OTS was the “principal regulator” of AIG, and did so because it guaranteed a plentiful budget, it should be obvious to everyone living in this corner of the galaxy that, in the US of A, there is no such thing as a “regulator” in the sense any dictionary gives to this word.

In a knife fight between the tresury/fed and judges, I would bet on the treasury/fed. How many things are going on now that have not, are not, and will not be investigated and dealt with?

And why do people believe so much in the altruism of judges? How is it that corrupt legislators will appoint virtuous people? Note the real problem in the link below – there was evidence this was going on for years, but the legal industrial complex will only take action when the payoffs become too obvious for even them to ignore. If nobody knew what this judge was doing, it was because they didn’t want to know.

http://www.nytimes.com/2009/02/13/us/13judge.html?_r=1

Fresno.

Look at court decisions. Even before the robo signing scandal, banks were losing a fair number of foreclosure actions when challenged. It got worse for the afterwards, the presumption that the banks were truthful was shattered.

Not all judges are independent, but enough are to make life very inconvenient for the banks.

On fascism:

The first truth is that the liberty of a democracy is not safe if the people tolerate the growth of private power to a point where it becomes stronger than their democratic state itself. That, in its essence, is fascism — ownership of government by an individual, by a group, or by any other controlling private power. ”

— Franklin D. Roosevelt, “Message from the President of the United States Transmitting Recommendations Relative to the Strengthening and Enforcement of Anti-trust

It is quite clear that the bankers and MERS are relying on the United States becoming a fascist state.

Does the Tea Party really want to take the US from a democratically elected government and simply hand it to the banks and Koch brothers?

Some of the TP congressmen voted against renewing the PATRIOT act! They’re not lockstep idiots.

I’m dreaming of a world – a mythical world – where MERS VPs are declared corporate officers with personal liability. Then I wake and laugh – it was only a dream…

They have know about all this MERS mumbo jumbo for quite a while now

http://stopforeclosurefraud.com/2011/02/21/no-excuse-why-mers-shouldve-been-stopped-long-time-ago/

http://stopforeclosurefraud.com/2011/02/22/indeed-similar-robo-signed-affidavit-issue-in-2004-case-mers-v-poblete/

If MERS goes down, banks and pension funds go down in large numbers. MERS is probably correct to assume that Congress won’t let that happen.

The good news seems that a thorough whitewash requires widespread corruption of the judiciary. We can hope that some part of one governmental branch upholds the law.

MERS is too important because of the dollars associated with its operation to be allowed to be found to be acting illegally.

WHAT ?

Oh, wait, I see, it’s like a celebrity NOT going to jail. They’re too well known. Can’t put them in jail.

Yves, I’m a little confused on the analogy- Koch is an ally of Walkers. Did Anderson think you were an ally? ( and are you sure it was really him?).

Fully agree with you on the ‘bogus marks’, and further, I am convinced that they are being used under colour of the Patriot Act and under the guise of “National Security”, one of many refuges of a panoply of scoundrels.

Sorry, I see someone else wrote this.

> We can hope that some part of one governmental

> branch upholds the law.

…well, if the checks & balances have all been sufficiently captured, such that we really have only one branch of government, the next step is not unlike Requiem for a Dream.

What does one do when all hope of justice and fairness is lost?

http://www.telegraph.co.uk/news/worldnews/africaandindianocean/libya/8337670/Libya-protests-live.html

Now that I know the OCC was the primary regulator of both big banks and the derivatives market, and noticing what a teensy weensy footprint they like to leave in their areas of jurisdiction, I would have to conclude an “OCC investigation” is like like asking a few cockroaches if they have noticed any strange behavior out in the hive.

Then we do have an appellate judiciary system to protect us from the occasional errant judge.

So I can’t really say industry confidence is irrational.

So, MERS thinks it’s Roman Polanski?

On the “opining” point – – you’re missing the legal nuance: the Agard language on MERS is dicta not a decision, because the decision was made on other grounds [first paragraph quoted below], and the part on MERS is not necessary to the resolution. That said, the court does suggest it intends the opinion to be more than advisory [second paragraph below], but the basis for accepting that intent is unclear, since there is a well-established distinction between a decision and dicta.

Given the actual analysis, dicta or precedent, MERS gets hammered pretty hard. It would not be a surprise to see other courts following the analysis, though they don’t have to.

Also notable is that since there is no adverse decision, there’s no basis for an appeal by MERS to overturn the ruling. Clever!

From the decision:

“For the reasons that follow, the Debtor’s objection to the Motion is overruled and the Motion is granted. The Debtor’s objection is overruled by application of either the Rooker-

Feldman doctrine, or res judicata. Under those doctrines, this Court must accept the state court judgment of foreclosure as evidence of U.S. Bank’s status as a creditor secured by the Property. Such status is sufficient to establish the Movant’s standing to seek relief from the automatic stay. The Motion is granted on the merits because the Movant has shown, and the Debtor has not

disputed, sufficient basis to lift the stay under Section 362(d).

Although the Court is constrained in this case to give full force and effect to the state court judgment of foreclosure, there are numerous other cases before this Court which present identical issues with respect to MERS and in which there have been no prior dispositive state

court decisions. This Court has deferred rulings on dozens of other motions for relief from stay pending the resolution of the issue of whether an entity which acquires its interests in a mortgage by way of assignment from MERS, as nominee, is a valid secured creditor with standing to seek relief from the automatic stay. It is for this reason that the Court’s decision in this matter will address the issue of whether the Movant has established standing in this case notwithstanding the

Page 3 of 37

Case 8-10-77338-reg Doc 41 Filed 02/10/11 Entered 02/10/11 14:13:10

existence of the foreclosure judgment. The Court believes this analysis is necessary for the precedential effect it will have on other cases pending before this Court.

The Court recognizes that an adverse ruling regarding MERS’s authority to assign mortgages or act on behalf of its member/lenders could have a significant impact on MERS and upon the lenders which do business with MERS throughout the United States.

“To make them independent, the Constitution provides that Supreme Court Justices – indeed, all [Article III] federal judges – may serve for life “during good Behaviour.” Despite this independence, the Supreme Court is not an ivory tower by any stretch of the imagination. It is a political body and throughout its history it has made many political decisions, some of which revealed strained interpretations of the Constitution. Despite its political underpinnings, which are occasionally too obvious, it has maintained its credibility sufficient to have its rulings accepted and the political order maintained. Indeed, as illustrated below, many of the court’s decisions about the government’s power in the realm of money, banking, property rights and private contracts must be read in the context of turbulent times in order to understand why an independent court would strain to uphold the power of the central government when right reason and the plain language of the Constitution indicated otherwise. The answer usually can be found in the unstated but obvious desire of the Court to preserve the Republic. The tenor of the times is important to understanding constitutional history. The Court responds in what it considers an appropriate manner to national emergencies, whether it be confiscation of gold during an economic meltdown or internment of ethnic groups during wartime – a troubling point to remember when ruminating about the “forever war” to come.” — Gold, Money and the U.S. Constitution (http://www.gold-eagle.com/editorials_03/holloway011303.html)

Bankruptcy judges do not have lifetime tenure. See http://legalworkshop.org/2010/06/17/judicial-independence-autonomy-and-the-bankruptcy-courts

Hi, thanks for the hard work to gather all this information. My loan was transfered by mers after a refi. The orig lender did not sign off on anything. Its no wonder they are willijng to settle. The bank rep I spoke with about 2 weeks ago my options are to legal action gainst them or work with them. Kind of a bring it or stfu attitude almost. Idk how to work smething out with them if I don’t have a legal contract with them pertaining to my home.