A solid paper by Cristobal Young and Charles Varner, “Millionaire Migration and State Taxation of Top Incomes” (hat tip Matt) helps debunk the idea that high income individuals will pull up stakes if their taxes go up. The case study is an interesting one: New Jersey’s tax increases on top earners. New Jersey made the biggest increase of all US states, and also has the distinction of having a low income tax state (Connecticut) nearby, meaning that tax-sensitive residents had an option of moving not all that far to escape the increase, which presumably would allow them to maintain family ties.

The study results might be labeled “Millionaires are People Too.” Economists and lobbyists love to stress often base their arguments upon economic rationality and contend that everyone is out to maximize his personal bottom line. But moving is a hassle and costly, and most people’s social lives are grounded in their community and their workplace. Relocating is likely to result in a longer commute for those still employed, would cause disruption to any children still in school and would weaken many existing social relationships. The study also provides a survey of the literature, noting findings in Switzerland, for instance, of communities in neighboring cantons with even wider taxation differences and little evidence of tax-driven migration.

From the abstract:

This paper examines the migration response to a millionaire tax in New Jersey, which raised the tax rate on top earners by 2.6 percentage points, becoming one of the highest rates in the country. Drawing on complete NJ state tax micro-data, we estimate the migration response of millionaires using a difference-in-difference strategy. The results indicate little responsiveness, with semi-elasticities mostly below 0.1. Tax-induced migration is higher among people of retirement age, people living off investments rather than wages, and potentially those who work (and pay tax) entirely in-state. The tax is estimated to raise $1 billion per year and modestly reduce income inequality.

Now presumably there is a level of tax differentials that might lead more higher income individuals to act. But the very wealthy are already likely to have fairly well developed tax sheltering strategies already at work; the marginal benefit for them of establishing a residence in a tax favored jurisdiction (beyond the methods they already have in place) and spending enough time there for it to be credible may not be great enough for them to change behavior (yes, there are places like Monaco, which has more overtanned middle aged men in nice Italian leather shoes and shapely blonde young women than I recall seeing in combination anywhere else, but the argument is that locales like that are already established and have their residents). The general conclusion of the paper is plausible: that moderate tax increases on the rich, even if no neighboring jurisdictions follow suit, is unlikely to lead to much in the way of emigration and will thus be a net plus in terms of tax receipts.

Ha! And it’s such entrenched and propagated “conventional wisdom” among NJ conservatives (and probably everyone believes it) that the millionaires’ tax has been causing the rich to leave NJ. But every column to that effect just gives some alleged anecdotes. Now we see why.

”

millionaires’ tax has been causing the rich to leave NJ. But every column to that effect just gives some alleged

”

~~attempter~

You bet! Tell me something! Where does a polar bear dump his truck? Anywhere he likes! When you have the liquidity, you live wherever you like, wherever you have the pleasure of passing your taxes on to your clients, shareholders, suppliers, customers, creditors etc. And you can bet that whenever millionaire vacates New York, Jersey Folks open their arms to the transplant who has the knack of passing the wholesale tax burden to various retail end-users. As more state officials open their awareness to this simple math the more state revenue will be drained off into the public sector now already excessively fat from aux juice. When taxer doubles his tax he quadruples his expenditures. Only way to stop the deficit is to put a stop to the taxes. 37 Million Californians can’t be wrong. Vote for proposition 13.

Quelle surprise, indeed.

Why everyone falls for the mularkey I will never understand.

What amazes me is everyone is so blind that they can’t understand ‘transactions costs’ arguments even though they clearly apply these factors in real life, how they can’t understand ‘externalities’ even though they are horrified in real life when externalities are imposed upon them, how they can’t stand when someone steals five bucks from them in a simple transaction but are OK when someone steal thousands from them in the machine that is big, socialism-for-the-rich government.

I guess it is my own failure to be continually surprised by what is so…well…continuous. I am the fool, apparently…

The reason why economists don’t include transactions costs is because the math is difficult and answer is usually “it depends”. To get better answers you need to sample into the subpopulations and model their transactions costs.

Arguments about the “effect” of high taxes assume a high level of innumeracy. New Jersey imposes a top marginal tax rate of .089 on incomes above $500,000. But state income taxes are deductible from federal income taxes, which means the actual marginal rate imposed is .058. This means that a New Jersey resident earning $1 million would be charged slightly more than $29,000 on the last $500k for the ‘privilege’ of remaining there. This is a nuisance, nothing more. What you do is turn up the volume on Frank Sinatra or Little Anthony, hold your nose, write the check and browbeat your wife about her department store charges for a week or two.

The truth about income taxes is quite simple: they keep the poor poor and the rich rich. We have a 5000 page Internal Revenue Code; 4999 pages create the loopholes which reduce big business corporate taxes to the vanishing point and undermine taxation on wealthy individuals.

You cannot explain this to people who think the rich are responsible for investment.

I am not responsible for the links in the above comment. Where they go, Yves only knows.

I don’t see any links. Either the server is rendering the site differently for different users or they are being inserted client side by your browser, a browser plugin, malware or something.

Jake, at that income level AMT most likely has kicked in and there are no deductions for state income taxes. Or property taxes. Or anything else Also, I don’t know if the top rate is marginal in NJ, but it is not marginal in NY (8.95% vs 6.85%). A family who makes $499,999 in NY pays almsot $10,000 less in state tax than in NY than someone who hits the $500,000 number.

Yves, CT is not a “better deal” for numerous reasons, but the most obvious is that housing prices are way more expensive than Westchester or NJ, because of the lower state income tax rate.

MY TAKE

By Dwight Baker

February 9, 2011

Dbaker007@stx.rr.com

Way out there in the place where few go today called SANITY goof ball stuff like this rant to me is INSANE.

Now lets think folks where in this great Planet Earth would these rich go that is better than the USA? NO PLACE.

Most places would welcome them— but would they be any safer there? Could they get the special things here —but most places not there?

Now idle senseless goof ball threats have never impressed me.

In fact ‘for me’ I think it would be wise if our simple minded use-less under the table paid – gun for hire geo-political politicians would give the rich a free ride out of here if they did not KICK IN BIG BUCKS all the way around to keep our sinking ship afloat.

Going further down this line of non-sense— think of this —WHY IS OUR RICH ABUNDANT AMERICA THE GREATEST PLACE TO LIVE IN THE WORLD?

I submit that it has little to do with PEOPLE but is all about our rich land, access to Pacific Atlantic Gulf of Mexico our growing seasons, our over all temperate livable climate— so let us all get real—pay up rich or get out. If you going — GO—Don’t let the door hit you in the rump.

A few more points. I think there are a lot of finance professionals who left NJ and moved to PA, where the state tax rate is only 3%.

Your research article also notes that retirees are more apt to leave. I recall reading an article about NY retirees leaving in droves due to the higehr cost structure of the region, I think they were talking about Long Island. Because higehr taxes feed into all prices.

I know two families that moved by simply changing their legal residence to their vacation home. MD (D.C. suburb) to DE.

None of those transactions costs there…

NJ residents might have their vacation homes in same state on the Jersey shore?

“Tax-induced migration is higher among people of retirement age, people living off investments rather than wages, and potentially those who work (and pay tax) entirely in-state.”

So, this study tells me that, as soon as the kids are out of the house and in college, the window opens for escape. And, they will, eventually. There is a reason that upstate NY is an economic wasteland, and the brain drain that follows that exodus seals the fate of that region, just as it will NJ when the financial industry that keeps so many high earners there dissipates further out into the world.

I fail to see how the idea of tax-related migration can be dismissed on the basis of this data: the Noo Joisey increase is under 3%, well below the kind of major tax increases that get people to overcome the inertia of everyday life – kids, schools, etc. How would rich people react to a sudden increase of 10% or more? Can’t tell from this data.

Yes, and isn’t it a bit early to draw conclusions? How long does it take someone to pick up and move – a year or two? How does the job market impact this effect – i.e. are people less willing to leave now because new jobs are relatively unavailable? Same question with the housing market – with so many people underwater, can people really migrate that easily?

That’s the trouble with economics, imho, there’s simply too many factors involved to draw sharp conclusions. Yet, that’s what we want to do, particularly to fill in our own world views…

The millionaire tax has been around longer than a year or two.

Yes, traderjoe I agree 100%.

I think Yves point is (and I could be off-base) to simply refute presumptuous right-wing nonsense about taxes, public employees, and millionaires threatening to leave. The world is full of cheap places for them to relocate to. They just want to have third world prices with publicly provided constitutional legal protections.

Yeah, don’t we all.

Quelle! Quelle! Quelle!

How is it that no one mentions that those who would like to flee, indeed need to flee because they are being bled dry?

But, can’t move because they cannot sell their homes for any price.

Many of these folks own their homes outright but cannot sell.

Look at the houses on market that have not sold for 2+ years – people want out but can’t.

You all like the rationale from this “solid paper” by a couple of socialists – helps you to rationalize you world view.

Oh please. You sound like anything other than monied antebellum privilege and entitlement is scary socialism. It’s not the public sector that caused the housing collapse. The public sector is just as impacted by that as the private sector. Apparently you slept through the fraudulent bankster-created 2007/08 housing collapse.

Typical conservative – blame anyone but the perpetrators. Reality often gets in the way of rigid dogma I guess.

Hope this study is continued through Christie’s term. They might find that people leave after taxes are lowered.

The following might be of some interest to those

following moment, wealth etc…

Here’s an interactive map of where Americans are

moving within the U.S., county by county,

based on IRS returns:

http://www.forbes.com/2010/06/04/migration-moving-wealthy-interactive-counties-map.html?preload=11001

Income levels of America’s major religious

groups compared to the average U.S. income

distribution.

Over $100,000 per year:

8% Black Christians

9% of Jehovah’s Witnesses

13% of Evangelicals

16% Mormons

16% Muslim

18% National Average

18% (Other)

19% Unaffiliated

19% Catholic

21% Christian (Mainline)

22% Buddhist

23% Christian (other)

28% Orthodox

43% of Hindus

46% of Jews

website

http://awesome.good.is/transparency/web/1002/almighty-dollar/flat.html

Chart

http://awesome.good.is/transparency/web/1002/almighty-dollar/transparency.jpg

Gee, you’d never know that NJ just lost a congressional seat in redistricting based on population from this study. Other high tax states losing congressional seats, NY (-2), MA (-1), OH (-2). Texas one of the lowest tax states gained four congressional seats, Florida gained two.

http://www.newgeography.com/content/00754-local-and-state-tax-burden-maps

http://spectator.org/blog/2010/12/21/census-announces-list-of-state/print

Connecticut has the third highest tax burden in the US. NJ has the highest tax burden.

Four of the eight states (Texas, Florida, Washington and Nevada) which are gaining Congressional seats have no state income tax. This is a clear and enduring pattern.

Young and Varner would dismiss this as ‘just retirees leaving.’ But in the long run, retirees bailing out MATTERS. And so do employers bailing out for lower taxes. These phenomena produce cities such as Buffalo, Detroit, and Akron, stripped of half their residents. Young and Varner’s study is too short-term in nature to pick up these longer-term trends.

A more basic point which Young and Varner don’t address is value for tax paid. There’s no great difference in living standards between no-income tax states and high income tax states. What do those who pay high income taxes get for their money? Evidently, nothing but a bloated state bureaucracy.

In fact, New Jersey’s bloated bureaucracy was just awarded with a bond rating cut today. Nice timing for this ‘high taxes are good for you’ study!

Why could New Jersey finance itself without no income tax in 1976, but needed a crushing marginal rate of 8.97% by 2004? Why did New Jersey reach its all-time peak of 15 Congressional representatives in 1960, but first started losing them in 1980 after introducing an income tax, and has carried on losing them as rates spiraled higher?

http://www.census.gov/dmd/www/resapport/states/newjersey.pdf

Evidently, people view state income taxes as a nuisance and a burden. Given the chance, they get on freedom trains like East Germans and escape the tyranny of the oh-so-enlightened income redistributionists, whose social improvement formulas somehow always get enforced at gunpoint. Nice folks, huh!

Texas is a religious fundamentalist dominated “right to work” state that pays $2/hour for low skilled work. Florida is a banana republic that sucks up lots of our federal money and is also a gateway to Caribbean offshore banking centers. (Gee, I wonder if there’s a connection.) Nevada is an entertainment/gambling/retiree mecca way out in the desert with a devastated real estate market. Washington is a left-coast liberal socialist blah blah blah state (with the highest minimum wage) that redistributes some of its’ public revenues to the eastern rural conservative part of the state to provide adequate infrastructure for agriculture.

Relocation has little to do with state tax structure. Affordability, family, and desirable social services are what causes retirees to relocate. Jobs with adequate wages and desirability of location are what drives working people to relocate. State and local taxes are deductible on federal income tax forms. Your ideological interpretation of data is absurd. Don’t be a right-wing mooch looking for other’s communities to live off of just because you don’t what to pay your share of your states’ public obligations.

“Relocation has little to do with state tax structure. Affordability, family, and desirable social services are what causes retirees to relocate.”

You contradict yourself. Put yourself into the mind of a 60 year old who owns a home in the NY metro area. Are you familiar with what property taxes are in NJ.? The highest in the country, Pixie. And, all signs point to them going higher, soon. A not so nice little cape in an OK town surrounded by traffic clogged strip mall hell may cost 12-16,000 a year in taxes alone. Maybe more. And, that’s only property taxes. There’s sales tax, tolls on every major road, parking fees, sales taxes, new fees every time you deal with a government agency, and, high prices everywhere driven up by merchants covering their long list of fees and taxes. Now, you tell me again that those 60 year olds aren’t seriously considering moving to a low tax state in their autumn years after totaling up all of those costs and comparing them to some other state. There’s a reason you see a lot of Florida plates in NJ driving around – that’s where the seniors reside most of the year. It’s much more “affordable”. Bye bye NJ Boomers and all of their money.

Desirable social services is why retried people move to Florida, huh?

I live in New York State, where much of upstate NY looks like a third world country. Gracious and prosperous old towns and villages are run down and poverty stricken.

I am a parent and have followed with interest the lives of my daughter and her many school friends. They moved out of New York State as fast as they could. Hardly one of her high school contemporaries lives in this state. They went where there were jobs, prosperity and opportunity.

Moving to Connecticut with the intention of saving money would be a pretty good definition of insanity.

Senator Eeyore scares ’em away.

Maybe I’m just being picky about semantics, but Pennsylvania’s personal income tax is flat rate – any ‘marginal’ rate increase there hits everyone.

So people aren’t going to move away over an extra 2% in taxes when they are already rich enough to live anywhere they want.

Not surprising. I think the better question is where people and businesses decide to start new households/HQs over time. barring huge tax differences (say 10%+) between states I expect the same factors that have always dominated to remain in place: weather and historical economic development.

Maybe someone should study the affects of high taxes on the attitudes of business people who are looking to establish a business, or “move to” the best state for such. I doubt that they’re all tripping all over themselves to start up in NJ.

On the other hand, the advantages of opening a small business in a place where there is a large or larger personal discretionary income probably outweighs the paperwork burden.

Of course the premier type of this kind of business is selling $300 custom bluejeans to wealthy

women–hardly conducive to creating a healthy economy. On the other hand, opening a third fast food franchise in a educational and impoverished cultural wasteland isn’t either.

Well, I was thinking of something a bit bigger, but, ha, I guess that type of business wouldn’t even think of establishing most of it’s operations in any US state these days. China, India, maybe.

Why should tax-payers working in the public sector care about cry-baby millionaire mooches? Especially when public employee tax-payers – union or contractual – are constantly denigrated, demeaned and expected to live as second-class citizens?

The public sector adds value and desirability to communities. Those services are not free, but would be much more expensive when provided as “for-profit” rather than at shared-cost (unless you want to import more Mexicans, Indians and Chinese to provide those professional and blue-collar services, and drive down wages even more).

Working people have to relocate all the time to find jobs with livable wages. If millionaires find relocation too much of a hassle and too costly – tough biscuits. If a community is worth staying in, I suspect youthful free-enterprise will fill any void their leaving creates – making the community even more desirable.

Did you read the paper the other day? Nassau County, on Long Island, NY, just had it’s finances taken over (again). One third (one third!) of the county’s employees make over six figures. Six figures! One can only guess what their retirement benefits are. I’m guessing that a six figure employee would cost the taxpayers of that county 2.5 to 3 million dollars during their lifetimes, if they stay healthy. If they spend the last few years of their lives in and out of hospitals, add another near million. Now, what sort of “value” is worth that sum?

‘Now, what sort of “value” is worth that sum?’

That sort of question could be asked of people in quite a few lucrative professions nowadays, including–um–banking.

Well, I gag as I write this, but those bankers, most of them, make money for their bosse, most of the time. Lots and lots of money. Does Gertdude down at city hall really bring in what she’s worth? I don’t think so. I’m sure she’s nice, but, c’mon.

>> Does Gertdude down at city hall really bring in what she’s worth?

Probably not. Just like (govt-supported) banksters.

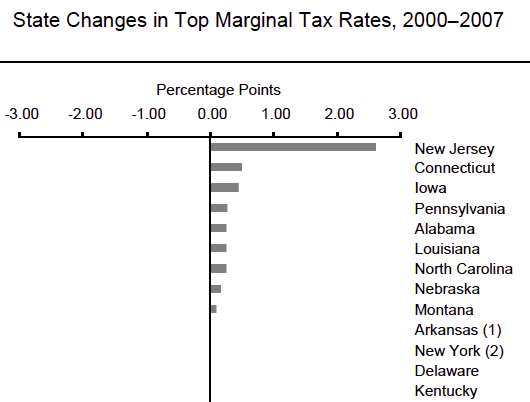

Let’s not get carried away here. Unless I’m misunderstanding something, the graph above (and in the report) is showing the CHANGE in the top bracket from 2000-2007. Yet the paper itself explains that the top bracket for NJ was introduced in 2004. The study also explains that they reviewed tax filings from 2000-2007 for NJ, but did not have the ability to track individual returns (or the people that filed them). Finally, the paper mentions that NJ saw a net outflow of millionaires from 2000-2007, but the overall stock increased (that is, NJ produced a lot of millionaires but did not import them).

So what we’re looking at is an increase in the top marginal tax rate, examined only during a massive housing/financial boom that CREATED a whole lot of new millionaires/wealthy individuals, particularly in and around New York, a major financial hub. The newly wealthy, as things are going great, are much less likely to move away from the job that made them rich, even if it means they pay higher taxes for a few years. I casually submit that they have been concerned with GETTING rich, as opposed to STAYING rich. The study’s own data indicates that those who were already wealthy had started to move away as taxes rose (from the report: Migration, nonetheless, has certainly increased since the new tax was introduced in 2004.). The study concluded before any impact of the 2008+ period could be measured, which is unfortunate as I’m not sure how relevant it to only examine a generally booming economy.

I think it’s better to have an exodus.

Unhappy millionaries can do a lot of damage to a state if they can’t get out.

It’s like increasing food prices.

Unhappy Third World peasants can do a lot of damage to those in charge if they can’t get out to the First World.

Human nature 101.

Mark above has it right. The study is flawed and covers a very short time period. Naturally, you cannot measure a business or job that was never created.

Yves is getting very political lately. What used to be a good, balanced blog/site is becoming filled with daily anti-banker/rich/capitalist propaganda.

As bad as all the bankers are, more government and taxes aren’t the answer. She seems to think government is intrinsically more noble than business. It isn’t.

As conditions worsen in our economy,

a straight reporting of the facts and figures

will appear to be ever more

radical to the comic book conservatives that never

want to think or dare to challenge their own beliefs.

There is no necessary connection between taxes and migration. Most corporations pay no taxes. The tax rate is irrelevant, when tax loop holes abound. Tax collection efficiency in the US, maybe 80% over a good period, but certainly, there is not that much of a need to flee to avoid taxes. The bs about taxes diverts all attention away from capital reinvestment questions, profit levels overall and the regular destruction of capital, like stock buybacks which is the opposite of printing money out of thin air, the conversion of cash into an abstract entity represented as an increase in shareholder equity. The hegemony over the medium of exchange that capitalism strives for by endlessly accumulating capital has ruptured the integrity of the nation state social order, replacing politics and sovereignty with money. Clearly, even considering the massive amounts of actual dollars collected by the Irs, they are recaptured by business, as every dollar spent by the government buys something that is only available from the private sector. The massive expansion of government has allowed for the massive accumulation of privately held capital. Unless of course, there really is a hollow earth with massive communist robot factories producing paper clips, furniture and baked goods, a secret the Federal Government doesn’t want you to know about.

The populated areas of Texas will be some day soon, a waste land, what good are jobs that slowly kill every one.

Skippy…Ashland chemicals in Houston is just one example.