Lender Processing Services has played a singularly destructive role in the mortgage servicing industry. The firm not only offered document fabrication services through DocX, a company it acquired and was forced to shut down after the Department of Justice started sniffing about, but is being revealed to be involved in more abuses as far as borrower records and legal process are concerned. Readers may recall that it is also the target of two national class action suits on illegal legal fee sharing which if successful will produce multi-billion-dollar damages.

This abuses matter due to the role that LPS has come to play. It is the biggest player in default services, meaning it acts as the de facto selector and supervisor of foreclosure mills via its system, LPS Desktop, which manages and oversees the work of local law firms on behalf of its bank servicer clients. It also provides the servicing platform for more than half of the servicing industry. And as our two latest examples show, the company clearly places its profits over integrity of records and due process.

The first, per Abigail Field of Daily Finance, comes out of a affidavit by former LPS employee Adrian Lofton, who worked at its subsidiary Fidelity, the mortgage servicing platform that was acquired by LPS. Lofton describes an environment where cost cutting pressures led to widespread abuse of basic security protocols. Employees of his unit had the ability to access the mortgage records of borrowers and alter them; an important control was that each employee had his own login and password and was per corporate policy allowed only to utilize only his own account. Employees were grades and rewarded on speed and on not asking their bosses for help in resolving problems. This devolved into an out of control environment:

109. Towards the end of my employment at Fidelity, my biggest concern was that most of the Associate Team members had gained unauthorized access to the logins and passwordsof their team associates and supervisors for all of the bank servicers’ computers.

110. With this unauthorized access to the Bank’s computers, the Fidelity associates could gointo the banks computer files and manipulate the data.

111. Such manipulation of the bank customer data could include changing entries, reversingtransactions, adding transactions and moving funds in and out of suspense accounts.

112. I was particularly concerned that during “crunch” times when a great volume of work came in during a short time and we were understaffed, Team Associates were cutting corners.

113. There were times when a lot of work would come in at one time and there werepressures to get the work done quickly.

114. Supervisors would tell the Team Associates to do whatever was needed to get the job done.

115. In my experience, the system encouraged Team Associates to cut corners.

116. When an employee cut corners, the employee left out one or more steps that should have been performed and had to make something up

117. The problem caused by cutting corners might not come to light until six months down the road when an attorney asks questions about the billing record.

So get this: employees muck with borrower records in their name or in someone else’s name. You’d expect some errors in a manual process, even more so if employees were under time pressure. Not only is it unlikely that a staffer who had performed a particular task would remember it weeks, let alone months, down the road, it’s impossible to get an accurate reconstruction or hold parties accountable if the casual use of logins means you don’t even know who did what. As Field warned:

Even if some of those banks have dropped LPS since then, were their records ever comprehensively fixed? And what about other LPS clients? Surely they’ve picked up more, as the tidal wave of foreclosures really grew after Lofton left LPS. Indeed, that foreclosure surge surely worsened the problems, since the time pressure on LPS employees can only have gotten worse.

If you’re tempted to feel sorry for LPS’s bank clients, given that they might not even have realized that their contractor was messing up their business records, don’t. Banks hire LPS — and fail to effectively oversee it — for one simple reason: They’re trying to get something for nothing. LPS has risen to market dominance primarily because it doesn’t charge the banks for its work. Instead, it charges the lawyers in its network who foreclose on the the banks’ mortgages.

But the pattern of not caring who did what as long as it fattened the bottom line gets even better. Thought you’d heard everything about robo-signing? One abuse has not been adequately probed. You may recall that there was a bit of excitement about the fact that some robosigners had such visibly different signatures under their name as to point to probable forgery. A deposition of one Cheryl Thomas provides an explanation:

Deposition of Cheryl Thomas, March 23, 2011

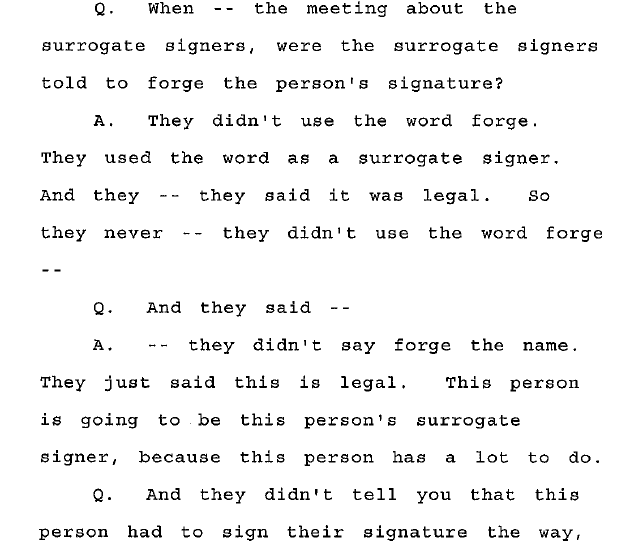

If you read the deposition, you will find repeated references to the activities of “surrogate signers”. LPS was so keen to crank out volume in the cheapest possible manner that it wouldn’t even add new robosigners. It instead hired temps and had them forge the signatures of existing robosigners:

Thomas, who was a notary, made it clear she was skeptical of this procedure but had no say in the matter:

Now the amusing bit is that this isn’t the first time we’ve had mention of this term “surrogate signer”. One person who seemed awfully well informed about it back in October was Paul Jackson. Lender Processing Services happens to be Housing Wire’s biggest advertiser. Jackson has defended LPS at least twice in editorials, and is reportedly very proud of having “rescued” the company. And we have what has the hallmarks of an anticipatory defense, revealingly using LPS’s very own term of art for this abuse. The indented paragraph is from a Gretchen Morgenson story, followed by Jackson’s commentary:

On still other important documents, a single official’s name is signed in such radically different ways that some appear to be forgeries.

That last sentence does deserve pause, because it refers to allegations that foreclosing lenders quite literally forged loan assignments. As in someone willingly signed someone else’s name on a dotted line, and managed to then have that document notarized and filed with the court. We’ll call this one the ‘surrogate signer’ controversy, since every good set of mistakes deserves its own name.

Notice the characteristic Jackson three card monte: he first admits that this practice is forgery, then attempts to depict it as a “mistake”. As Thomas’ deposition makes clear, this was no mistake but an institutionalized practice at LPS. And so what does Jackson make of this? It’s back to the usual “might makes right” argument, this time couched as “deadbeat borrower”

Just how widespread is the ‘surrogate signer’ problem? Time will tell. Like nearly every story when it comes to foreclosures, however, there is much more here than meets the eye. And should it become needed, I’ll take the time to explain this in great detail to HousingWire’s readers.

While the procedural gaffes seem to keep getting more and more serious and shocking, it’s still debatable whether or not even this newest mess is the sort of thing that actually harms borrowers—meaning that while the bank might have willfully misrepresented a signature on a loan assignment, does that act really harm the borrower who is in default to begin with? Someone, after all, is ultimately in the position to foreclose when payments on a secured loan aren’t made.

So here we have Jackson giving a conspiratorial wink and nod to readers, precisely because he’s in bed with a major, and probably the only, major perp. And the only standard is whether the borrower is actually guilty….in a court where the servicers, which engage in impermissible application of fees, force placed insurance, junk fees/fee pyramiding, and (via LPS as well as on their own) altering of borrower records (with what kind of audit trails?) are judge, jury, and executioner.

With something as important as most people’s important asset, integrity of process is of paramount importance. Casual treatment of real property undermines the very foundation of capitalism, but Jackson has repeatedly established that that is of no matter to him as long as the banks can grind along like doomsday machines, mindlessly mowing down everything in their path in their pursuit of profits. By contrast, in a very different context, someone who is equally out to punish another presumed guilty party is nevertheless insistent that conduct be scrupulous in high stakes legal matters. From former State Department spokesman PJ Crowley in the Guardian:

Earlier this month, I was asked by an MIT graduate student why the United States government was “torturing” Private First Class Bradley Manning, …The fact is the government is doing no such thing. But questions about his treatment have led to a review by the UN special rapporteur on torture, and challenged the legitimacy of his pending prosecution…

To be clear, Private Manning is rightly facing prosecution and, if convicted, should spend a long, long time in prison…. The Pentagon has said that it is playing the Manning case by the book. The book tells us what actions we can take, but not always what we should do. Actions can be legal and still not smart…..

So, when I was asked about the “elephant in the room,” I said the treatment of Private Manning, while well-intentioned, was “ridiculous” and “counterproductive” and, yes, “stupid”.

I stand by what I said. The United States should set the global standard for treatment of its citizens – and then exceed it. It is what the world expects of us. It is what we should expect of ourselves

By contrast, the actions Jackson has chosen to defend are against the law. There isn’t any grey about this. Saying it’s trivial is like saying shoplifting is trivial because you only stole a candy bar. That doesn’t change the underlying nature of the act. And the stakes here are a hell of a lot bigger than candy bars. This conduct is “ridiculous” and “counterproductive” and “stupid” and “illegal“.

Jackson ultimately stands for a two tier system of justice because, as he has declared, “It’s all about the money“. Little people are expected to adhere scrupulously to their commitments, but per Jackson, for instance, it’s no big deal if banks cheat investors by failing to honor the terms of their pooling and servicing agreements. You chip away at the very foundations of society if agreements are one sided and social and business relationships are reduced to the naked exercise of power.

And every time he defends LPS, just bear in mind that Jackson’s already told us that his loyalty has been bought and paid for.

.

Bought and paid for…it’s not Housing Wire, it’s Housing Whore!

Every time I think I’ve read it all, that it can’t possibly get any worse . . . it does. Reading this post along with the potentially grim news about the probable lack of real action by Tom Miller and his 50-State AG group makes me want to toss up my first cup of coffee. It’s all very dispiriting.

Have to agree with you. Very disheartening.

After watching Inside Job I have no faith in our banking system or it’s supporting companies and processes any more. Of course, they probably don’t care if I have faith as long as I toe the line they’ve created in the sinking sand.

On

November 23, 2010 I posted on the internet that William P Foley CEO of Fidelity National Title was the kingpin that is at the heart of all the morgage fraud. Pull up his biography and you see that he was chairman of LPS and retired only when the country started to realize his silent role for massive bank fraud behind the scenes.

I am in a two year legal battle in New York Supreme Court with racketeers at Fidelity National Title.

In September 2008 Astoria Federal S & L ‘s new attorneys stated in Astoria Federal S & L/Successor-in-Interest to Fidelity NY FSB vs. Marilyn Lane (NYSC)“It is Indemnify, Indemnify, Indemnify. We are stepping aside and the title companies are stepping in.

Thomas Malone corrupt attorney for Fidelity National Title and David K Fiveson corrupt attorney representing Coronet Title did not want to Indemnify but want to be Intervenors instead and be heard and what they told the Court is time makes forged deeds good. A FORGED DEED CONVEYS NO TITLE

I wrote a simple letter to Mr. William P Foley II Chairman of the Board of Fidelity National Title ” how come Fidelity National Title’s New York attorney Thomas Malone finds himself fighting for a forged deed?

Their reponse to me was it is proper to fight under the circumstances (the circumstance was they knowingly insured a FORGED DEED.)

With Wm Foley at the helm of Fidelity National Title and all its other named enterprises you know why it is said THE FISH ROTS FROM THE HEAD DOWN.

LPS Docx was sanctioned by a US Bankruptcy Judge, Diane Weiss Sigmund and DOCX partially admitted there were faults in their documents. They closed down their Alpharetta Georgia office but continue to mass produce replacements from their Jacksonville Fla and Dakota County MN. offices.

William P Folley has to be investigated so that the country will know how this massive fraud took place.

Dear Yves,

Thanks so much for the site. I read it daily and recommend it to friends as “true” left (i.e., legitimate compared to the progs/Dems).

I have a general question for you. You seem very focused on regulatory failure and capture. Fair enough. But, you seem to conclude, consistently, that we just need good and smart people in positions of state power as a solution. You do not conclude that state power is itself the problem in the long-run, regardless of short-term accomplishments and the real or purported noble intentions of policy.

So, my questions are:

Don’t all bureaucracies get co-opted?

Aren’t all humans fallible?

Does world history not show that concentrated power always gets corrupted, due to human failings?

Put differently, isn’t it the concentration of power and dependence on inorganic institutions that creates these problems?

Put differently yet again, I believe I have solutions (and I believe that you do, and you obviously believe that you do), but I am extremely reluctant to institutionalize them or even to allow myself the power to implement them. If I succeed, why will mine be the only institution that survived co-option/corruption? If I succeed, won’t that embolden other centralization efforts, making it easier for humans to play out their insecurities (look at how Republican/Democrat journalists express their egos via great leaders in “freeing the world using bombs” or “saving our country using social policy”).

Isn’t individual freedom and sharply constrained centralized state power the least-bad solution? It seems as if any other attitude inevitably leads to the war on drugs, all our wars in the middle east, big Agri, big Pharma, big Union, etc.

Respectfully,

Eric

Eric asks:

“Don’t all bureaucracies get co-opted?

Aren’t all humans fallible?

Does world history not show that concentrated power always gets corrupted, due to human failings?”

Of course, the answer to all these questions is yes. You’ve identified a problem. You have not proven that your alternative is free from problems (hint: you won’t, there is no utopian solution; power exists and will be concentrated one way or another unless it is constantly being pulled apart by another powerful source).

In any event, the trick is to prove that one alternative is better than the other; showing one has failings is obvious and meaningless.

Thanks, Yves. Very good points.

I guess a response (not mine, but just keeping with your and Anonymous Jones’ answers’ focus on logic) would be that there are corporations that behave well, in terms of society and in terms of their employees. I would not proceed from there to say that we just need concentrated corporate power here, just led by what we “decide” are “good” humans.

After seeing your examples, I’m still left with the idea that the well-functioning nature of those institutions are due to individuals and or culture. I was born and raised outside the US, and my wife is an immigrant. I am struck by how certain attitudes that have positive externalities, are culturally-based, not necessarily based on an institution’s raison d’etre. One I notice is how in the US, if you are wealthy but stupid, you are somehow smart, whereas in other cultures, if you are smart but poor, you are smart…there’s greater comfort having one’s own opinion, and humans aren’t reduced to their commercial value (as a cultural phenomena…I have no right to tell people how to measure their or others’ value). Prostitution and drug use, in the US, are extremely high, but un-admitted, whereas this is less the case in the countries I know. A positive about the US, though, is we are not as racist as most of Europe.

I find myself, particularly when you bring up Singapore, attracted to that idea of smart people putting on their lab coats and telling us what to do (OK, how we should be organized). I was one of those people. I am still ashamed, though, of what we’ve done to the underclass in the US via well-intentioned (or at least I can’t know they were badly-intended) policies such as the war on drugs or government-provided (as opposed to -funded) education.

Put simply, I think the Ausrian School and praxeology have some compelling arguments. I also think that technology is empowering individuals and making centralized institutions of any kind less useful and/or relevant.

Finally, what about the argument that governments are based on pretty serious coercion (guns, prison), whereas corporations ultimately need you to buy a product and face competition?

Hi Anonymous Jones…my response to Yves was meant for you, and my response to you was meant for Yves. I clicked ‘reply’ at the top prompt, not at the bottom one…getting the hang of this. Apologies.

Other countries have powerful unions that are not corrupt, see the Scandanvian countries, Germany, as examples. And they are pretty successful economies, and more successful exporters than we are.

Other countries also have pretty clean bureaucracies. As much as the US is allergic to the career elite bureaucrat model, they (as a whole) don’t have anything approaching the rampant corruption you see in the US (stupidity and elite arrogance are a different matter…)

Singapore has a famously clean and uncorrupted government. Lee Kwas Yew, when Singapre got its independence and the island clearly had nothing to go for it (small population, no natural resources) decided the only way it could compete was to have a highly educated citizenry and a squeaky clean government. To address the latter, the government pays well. Top bureaucrats (think department heads and the next 2-4 depending on the size of the unit) make what top private sector professionals make (think law firm partner, not investment banker). And they have very tough internal audit. There’s no incentive to cheat if you have status and decent pay.

Hi Yves. Aplogies…my response to you was meant for Anonymous Joe, and my response to him was meant for you. I clicked the ‘reply’ prompt at the top, not at the bottom…getting the hang of it now.

Thanks.

My point is that the reaction function that seems to be espoused here (I don’t know your particular stance) is precisely what you describe – there are problems so of course we need centralized government as the answer, without addressing why that is so given the historical record.

Otherwise, your logic is correct – I can’t just say government sucks, therefore anything else is better (I’m only arguing that the opposite is equally untrue – namely, that because concentrated corporate/incumbent power sucks, one can’t automatically invoke government).

Thank You!

This is the real heart of it… even more than all the individual losses and individual injustices.

The totality of this disaster is much greater than the sum of its parts. It represents a truly complete failure by our most important institutions… law, government and finance.

And worse yet… a failure to do anything constructive about it.

They all seem to operate as if independent of any understanding or need to respect a social contract… they now believe themselves above it.

What is most frightening to me is that they may be right… at least in this country. They’ve managed to confuse political discourse to the extent that the ‘barely-making-it’ are convinced that those even more desperate than themselves are at fault…

Apparently we’re convinced that the reason all the wealth went to the top and we got the debt over the last couple of decades is a product of the “free market”… or government being too Left or too Right.

The technical term for these false but effective arguments is horsepucky

This clusterf**k required the co-operation of shills of both parties… and sadly the people keep buying it.

Now the plan is that if only they can sweep everything under the rug… keep sending an increasing percentage of wealth to the top (so they’ll be motivated to invest in us little folks) and if they can keep all these new poor people quiet and fighting with each other instead of thinking about things too much… everything should come out just peachy.

As I know Yves knows… politics and economics don’t really belong as separate disciplines. However their separation is very convenient for oligarchies everywhere.

It allows the appointment of men like Mr. Geithner. This is not a personal attack. He may be great with those charts. But ultimately this is a political problem requiring (dare I say it) wisdom and judgment.

And in that sense, poor Mr. Geithner, Mr. Bernanke and the rest may simply doing what they now how to do… since they’ve been left with catastrophic problems a legitimate political class SHOULD have the guts to address.

And to quote a line from a commenter I admire but haven’t seen for a while…

“Deception is the strongest political force on the planet”

P.S. Dear Mr. Stumpf… I’m trying to understand how the ‘corporate’ thing works… Does Wells Fargo upper management ever rely on a sort of ‘willful’ ignorance about problems below… a sort of “plausible deniability” shield? I mean in addition to the corporate shield already there? BTW, I’m still waiting to hear from you guys about issues I’ve raised which I don’t think are silly at all! And could you stop my eviction while these things are looked into. It seems once again that things are sort of all parceled out… so the contracted “eviction attorney” has hundreds of cases and can’t really pay any attention to individual issues not part of his purview.

BTW, forgive me… its a broken-record kind of thing… maybe some sort of obsessive-compulsive disorder but I can’t help bringing it up:

Facilitating the political micro-transaction and its networking is the catalyst for the creation of a critically needed network AND PLATFORM for human association. (I’m interested in different kinds of financial innovation than you guys… utility rather than deception… sadly, I’m realizing that’s a much less rewarding exploration.)

Apparently forging a signature on a legal document, which could result in the loss of a person’s home, is far less heinous than forging a signature on a check that could result in the loss of the Bank’s money. It appears that the seriousness of the offence depends on whether the Bank – or its agents- is doing the forging or being its victim.

Some will never get it even when it is served up with silly things like the facts… There are some regulations with teeth! Please check out how negotiated settlements will occur going forward. All distressed assets require a disposition and there are some very specific dispositions the banks are not allowed to have by law, and federal regulation to keep their banking licenses, also check out a little know regulation with teeth a fair housing complaints… http://diligencegroupllc.net/wp-admin/

American Homeowner

-AH

What’s your wordpress login? Code ain’t right, link is fu$k/hosed.

The charade continues!

“109. Towards the end of my employment at Fidelity, my biggest concern was that most of the Associate Team members had gained unauthorized access to the logins and passwords of their team associates and supervisors for all of the bank servicers’ computers.

110. With this unauthorized access to the Bank’s computers, the Fidelity associates could go into the banks computer files and manipulate the data.

111. Such manipulation of the bank customer data could include changing entries, reversing transactions, adding transactions and moving funds in and out of suspense accounts.”

This will lead to an interesting test of the judges in the country. Objectively, this means the banks cannot absolutely guarantee the accuracy, indeed the existence, of any of the transactions in the borrowers’ records. The computer forensics would require going all the way back to hard copies to document the changes in the accounts. Some will, of course, be unprovable, since a missed payment has only bank documentation, in the records which are now unreliable.

While there may be an absolute-sounding legal definition of the burden of proof, Matt Taibbi among others have observed the judges in many real estate cases decide the proof in the case by the litigant rather than by the evidence. With very real uncertainty about the banks’ records, the evidence they present is going to have to be taken on faith. Trusting a bank over a homeowner should be an objective, fact-based call, but it’s going to be the judges’ political, social, and financial philosophy that will determine.

I gag at the thought of faith based rule of law

We have faith based economics and more and more faith based governance so I guess the next “logical” step is faith based rule of law……

Devolution for everyone and everything. What a future!