The kindest thing that can be said about the 50 state attorneys’ general negotiations over foreclosure abuses is that it is increasingly obvious that there will not be a deal. The leader of the effort, Iowa’s Tom Miller, has completely botched the effort. There was no way to have any negotiating leverage with intransigent banks in the absence of investigations. Miller has changed his story enough times on this and other fronts so as to have no credibility left. But whether there were no investigations (as other AGs maintain) or whether they did some (as Miller, contrary to a staffer’s remarks, now insists), they were clearly inadequate.

We’ve found the rumor, that Miller was angling to head the Consumer Financial Protection Bureau, credible. It would explain his unduly cozy relationship with Federal banking regulators, as well as his efforts to wrap up negotiations quickly, which reduced what little bargaining power he had (time pressure means a party that drags its feet can extract concessions).

But like so many zombies that inhabit the financial landscape, the mortgage settlement negotiations refuse to die. They were unlikely to succeed, given that some of the attorneys general who joined late in the game were opposed to the entire concept. That means they signed up for the sole purpose of repudiating any deal later.

Given the size and disparateness of his group, and the fact that some members were there simply to discredit it, it was incumbent upon Miller to forge a solid core with the hopes of bringing some fence-sitters along. That is another reason investigations were critical. It would be harder for Republican AGs in states hard hit by the foreclosure crisis like Florida to reject a settlement of documented abuses. It becomes more risky to repeat the bank party line that they did nothing wrong when your colleagues have evidence in hand to the contrary.

So what is the latest episode in this sorry fiasco? Shahien Nasiripour of Huffington Post reported that the AGs are putting forward another proposal next week, one watered down to reflect bank “concerns”. Note we lambasted the AGs’ first iteration as being consisting almost entirely of telling the banks they need to obey current law. Huh? It asked for only two new things: single point of contact (which we deemed overkill as presented; there are better ways to address the customer handling horrorshow called mortgage servicing) and an end to dual track.

But the most important part is what wasn’t there, meaning the most critical terms: penalties versus the breadth of release. These are the only terms that really count, the rest is noise. And with those issues NOT being on the table, but instead being the subject of leaks in the media, these negotiations can’t even be considered to be serious.

Of course, Miller’s having failed to solidify a constituency means putting forward concrete proposals on the most contentious terms will expose fault lines. The Republicans AGs refuse to consider bank-funded principal mods, the excuse being it will lead to a rapid increase in immorality and fornication strategic defaults. We don’t like them for a different reason: in isolation, they are certain to be too small to accomplish much and will simply reinforce the servicer-friendly idea that mods aren’t worth the bother (using the penalties to fund writedowns of second mortgages and an infrastructure that could vet borrowers for mods that came from reduction of investor principal would have been a much better way to go). Many of the Democrat AGs are correctly unwilling to give the banks a broad waiver.

The latest report from Shahien shows that there are large gaps in the positions of the key parties:

….it is not expected to detail any fines to be meted out in response to banks’ flawed practices, which include improper home seizures and other actions that broke federal and local laws.

Officials also remain undecided on a possible mandate to banks to reduce borrowers’ loan balances, according to the three sources, who were not authorized to speak publicly about the matter. Banks are reluctant to slash mortgage principal balances; some agencies in the Obama administration want to require it, as do most of the state attorneys general leading their mortgage probe. A vocal minority — all Republicans — are opposed.

The report confirms my worst suspicions as to who Miller is working for, and it sure isn’t the cause of justice:

Now, the top law enforcement officers in some states, most notably New York Attorney General Eric Schneiderman, want to make sure they are not constrained in taking legal action against mortgage firms for violations of state and local laws.

Some have grown frustrated with the pace of negotiations, people familiar with the matter say, and fear a broad release from legal liability will likely be sprung on them at the last minute as a condition of their settlement with the targeted banks. Attempts to begin discussions over the liability release have thus far been thwarted, however.

Mind you, these concerns are coming from the attorneys general! Miller has no business refusing their queries over such a critical negotiating issue. The only reason to withhold that information is that he already plans to offer a wide-ranging release, and he knows if he told his peers now, many would bolt. The fact that he clearly intends to use an element of surprise is proof he is working against them, not with them.

The annoying part of this update is that the powers that be are maintaining the fiction that they are aware of all mortgage related abuses, when nothing of the kind is true. We’ve discussed repeatedly that the one investigation, that of 2800 loan flies by the Foreclosure Task Force at the end of last year, omitted many key issues, such as chain of title issues, improper application of payments, use of inflated and pyramiding fees, and improper filings and impermissible fees during Ch. 13 bankruptcies.

But look at the negotiating issues. As Shahien indicated earlier, investors thought the initial proposal was weak. The AG/what is left of the Federal side (recall banking regulators signed consent orders last month, taking themselves out of the picture) are divided. They do not have a consensus on the key items, the nature and scale of the fines and the nature of the release. This level of division gives the unified bankster side the upper hand.

And we have the banks peddling propaganda:

Representatives of the five firms — JPMorgan Chase, Bank of America, Wells Fargo, Citigroup and Ally Financial — made a presentation which they claimed showed why mandating principal reductions would not prevent a significant number of new foreclosures and would be harmful to the general economy.

The banks said “it would trigger a stampede of strategic defaults,” said an official familiar with one of the two discussions, referring to instances in which borrowers who can afford to make good on their obligations choose not to. Strategic defaults are much more common in the business world than among homeowners, according to experts who study the issue.

Let me first turn over the mike to Dave Dayen:

There is no evidence whatsoever of strategic defaults currently, despite plenty of claims by the same banking representatives… So far this phenomenon is non-existent in the residential mortgage market, and I’d say that banks are misrepresenting the facts in making this argument.

Dave is right that there is NO evidence supporting the notion that strategic defaults are taking place. The few academic studies on the topic are embarrassingly bad. They either rely on surveys of intent or an unproven assertion that borrowers that default suddenly are strategic defaulters. We’ve debunked both ideas here. Major corporations long ago abandoned the use of surveys in product planning because they were utterly unreliable in assessing buyer behavior In the overwhelming majority of cases, the surveys would show much greater willingness to act than proved to be the case. From what we can tell (and others who have tried to get a grip on this question have come to similar conclusions) sudden defaulters have hit a financial wall (job loss, medical emergency, loss of hours) and given that they have no/negative equity in their home, it makes no sense to deplete retirement savings (which lenders cannot seize in the event of bankruptcy) or go to other heroic measures. Better to preserve a smidge of cash so that one can move to a rental rather than wind up living in your car or on the street.

Having said that, there probably are a few strategic defaulters, with second homes the logical candidates. But as we have stressed, the costs of defaulting are high, and the idea that people would do it casually is nonsense.

Here’s an indirect proof that the banks’ assertions that strategic defaulter are the new commies in the woodpile are bunk: the frequency of searches on “strategic default” versus “short sale,” HAMP, and “mortgage modification”:

Notice how there are so few searches on “strategic default” in the US that it does not even register. This is an informal indicator that Americans spend far more time getting information first about short sales and second about the fairly well publicized HAMP program than they do about scheming to stiff their lender.

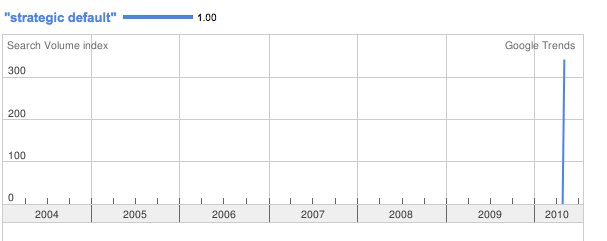

And here is a second interesting chart:

This does not look very organic, now does it? A sudden upsurge, and by interesting happenstance right around the time the robosigning scandal broke. I don’t mean to sound paranoid, but this is the sort of pattern you’d expect to see if a large messaging campaign were launched.

These kinds of posts are an ongoing evidence record refuting reformism and “working within the system”, let alone waiting for Our Leaders to do the right thing.

Now, the top law enforcement officers in some states, most notably New York Attorney General Eric Schneiderman, want to make sure they are not constrained in taking legal action against mortgage firms for violations of state and local laws.

Some have grown frustrated with the pace of negotiations, people familiar with the matter say, and fear a broad release from legal liability will likely be sprung on them at the last minute as a condition of their settlement with the targeted banks. Attempts to begin discussions over the liability release have thus far been thwarted, however.

Then shouldn’t Schneiderman organize a bloc right now which publicly commits to rejecting any “agreement” which includes such a Shock Treatment measure?

This kind of agreement would be worse than nothing, so it would be better if the whole thing shipwrecked on this, and sooner rather than later.

Friends;

The Republicrat AGs should know all about “ahem” strategic defaults. Remember Wilber Mills and his aquacaide? Or that poor fellow from New York and his ill fated “Personal Service Small Business Project?”

That Mr. Miller is planning to leave the rest of them “holding the bag” should come as no surprise. This is the essence of the “straw man” strategy. As for legitimate investigations: Remember how hard Pecorra had to struggle to get his banking investigation up and running? Of course, it helps to have an Administration, no matter how reluctantly, supporting your efforts. FDR quite rightly rejected the Paleo-Con assertion that “The business of America is Business.”

Now if only the present Administration would get out of its’ Hooverian/Rayndian rut!

I used to tell a rabid Republican I worked for once that Bill Clinton would go down in history as one of the best Republican Presidents of the Twentieth Century. Is Obama about to pull off the same trick in the new century?

Gee, no one was worried about me when the interest rate on my credit card went to 29.99%. No one worried about me when I lost my job. No one worries about my hard luck. But it important to worry about Government backed, tbtf banks and their best and brightest handmaidens.

Strategic default, I guess that means a person that knows 6 months is advance that they cannot make it, vs a person who waits to the last second.

It all seems like a long minuet towards the final decline of the economy. The TBTF banks have overtaken the minds and souls of most politicians and now control every single facet of the political and economic life of the country.

The mortgage industry has the efficiency and adequacy of a communist regime. It also has the communist strong arming tactic.

There is one problem, when they’ll impoverish the last of us, there is not going to be any business for them left.

The AGs are friends with the rentiers, who’d assume differently? Debt collectors sent by Fannie lie in court at will. Speaking of Fannie Mae, Tom Dinilon is going to be on TV this morning. Look at his job title, do you know what “security” means to US landlords? It has nothing to do with your security.

I think it might be worth pointing out that there is no such thing as a strategic default, r, rather, that all defaults are strategic. Has there ever been a case where a borrower continues to make payments until there is literally no money left, depleting every last penny in his or her bank account? Of course not. Some borrowers may have a better strategy, of course, and see the writing on the wall earlier than others, but they all have a strategy.

And the only reason that this term even exists is for its pejorative qualities, and using it is a disservice to borrowers.

I defaulted on my mortgage two years ago. And there were people who asked me if I felt bad about doing so, as though I had some moral obligation to repay the loan.

But I did not. When my lender loaned me the money, they did not ask for a personal promise to repay the loan. They gave me the option of repaying the loan or forfeiting my home.

If I borrowed money from a friend without collateral, and gave my good word as security, that would be different. But that is never the case in mortgage lending. There should be absolutely no stigma attached to exercising my option to default.

Actually Pete, that is exactly what some people are doing. They are hoping they do not have to default because they like their home and do not want to give it up or face the years of credit woes.

There really are those who do not want to default and there really are those who are tied to their mortgage, even though you weren’t. Many just wanted some help to get by the next few years so they could stay in their homes.

But you have proven a point. Most who wished to strategically default had already done so years ago.

The biggest problem is that banks and servicers are foreclosing on those in more modest homes and making money on fees and Insurance and resales.

The larger homes and Mcmansions are virtually unsellable, so the bank allows those mortgagers to default and live on the properties as they would be trashed and left sitting empty. Only the banks know how many remain in that situation, but the majority of those wishing to stiff the lenders have long done so.

“There should be absolutely no stigma attached to exercising my option to default.” Really? If not the first time, the second time? or maybe after the third then? So everybody should do it? And if everybody does it, is it then ok? (Well, I guess if Goldman says so, then it is…) Which other obligations are ok to walk out on? You may not be the villain here, but you DO sound like one.

Your country is up excrement creek with no paddle, no New Deal and no white knights … banks are holding the economy hostage and no one is willing to uphold the rule of law, not even those given that responsibility. That so many know this and no one is doing anything about it or protesting en masse means recovery is much further away than you imagine.

Hmm. And whose fault would it be that it is taking an average of 492 days to foreclose on a home? But that if there is any equity in the home, the foreclosure is done in record time?

Is there a more descriptive term for strategic mortgage servicing?

Truth.

Miller’s efforts remind me of the class-action product liability suits that come out of nowhere, settle for asswipe money and cosmetic reforms, and tell the people damaged by the product there is this or nothing.

I suppose it’s past proof that the banks are on both sides of the game. It depends on the integrity of the actors involved, and that’s no great assurance.

Yes some people do exhaust their savings and retirement trying to stay in their home and trying to meet obligations. Many of those people did so early on in the recession believing the lies told about the crisis being “contained” in sub prime or lies that banks were not at the bottom of this entire meltdown. So many people were wiped out believing the economy would turn around or that the government would not do things to make the economy get worse for several years.

This being said I agree that the banks signed a contract with you that gave them to the right to accept payment in lieu of collateral. (the house) It is a fair trade if the borrower decides to move and turn the house over to the bank.

The even bigger is misconception is that the contract between borrower and bank is written in stone. This is completely untrue and the banks only want people to believe they have no right go in and re negotiate the contract at any time. And what better time to renegotiate the contract then after the property value drops 50 or 60 percent? Any logical banker would bite the bullet and renegotiate with a borrower in this situation. It makes smart business sense fo the bank.

The biggest problem lies in the reality that the banks are being funded by goverment and they are dictating government policy. The big banks have been bailed out and now they are being given freedom to set policy as politicians cowardly run scared because they all are bought and paid for whether it is their first year or 30 th year in office.

It makes no sense for people to cry and whine about people getting a load modification. The Moral hazzard argument is total bs because everyone negotiates their own loan. Banks are free to give a deal on interest rates and they are free to charge you more than your neighbor.

The banks have used a great mind control campaign over the years to trick people into belieiving they had no power once they sign a loan. The banks are refusing to negotiate with people because they have been paid by the government and they know the government will always pay their bail.

The entire arugment about investors this and investors that, or loans can’t be modified because investors have bought into the mortgage is complete crap and more bs from the banks. If banks wanted to settle with people and give them a new loan they could do it within months and keep the borrow in the home and keep them paying payments.

We are being hosed by the banks followed Us government.

excellent comment –

Um. While the sentiment is perfectly understandable, the commenters here should get clear on the scam’s basic mechanics. Yves has covered this well with many posts on this subject —

http://www.nakedcapitalism.com/category/real-estate

The essential point: when possible, a basic principle in any business is to take the profits, sell on risk. That’s what the FIRE industry did: sold all those mortgages on — in more than 60 percent of cases ultimately parking them with the GSEs, Fannie and Freddie. In the majority of cases, the banks that originated most Americans’ mortgages are now no longer the official lenders — those owed the balance of payments on a given mortgage — but those loans’ servicers.

The banks qua servicers have very different incentives than have the actual current lenders of record, especially given the system of rich rewards for foreclosing or shortselling on erstwhile American “homeowners” that Geithner’s Treasury has been kind enough to establish.

I n short, the last thing the banks as servicers either want or are logistically prepared to do is modify the principles on home loans.

I have been away from NC for five months while dipping my toe back into the world of attorney employment. Five months drifted by, yet here we are, watching the same bad movie of prosecutors pretending to investigate and bank criminals pretending to care about their victims.

Let me tell you experts, putting aside my lawyer training, as a run-of-the-mill consumer looking at this mess, I would NEVER ever consider buying a house unless I could get it for cash. Which is becoming possible in some of the most depressed markets. I would never ever trust any bank, or any state law enforcement officer, after watching this circus/charade/farce unspool, unchanged, year after year for the past four years.

The idiot prosecutors & capitalists who think they are protecting themselves are destroying a vital American economic asset — public trust in mortgage lenders. As their greed destroys that trust, the housing market is tipping over into a double-dip recession. There is no good ending to this movie.

There is a possible good ending, though it’s still years away: homes at prices that our children and their children could afford.

AG Miller tipped his hand back in November, 2010, when he testified before the Senate Committee on Banking, Housing, and Urban Affairs, as follows:

“To be clear, the States do not believe that every foreclosure is a tragedy that must be avoided. To the contrary, we have consistently stated over the last three years that we are only interested in modifications where the cash flow from the modification exceeds the expected proceeds from a foreclosure sale. ”

He is stating that homeowners with equity should categorically be excluded from modifications because tapping into that equity is profitable for the banks and the investors in mortgage backed securities.

Anyone who was trying to help struggling homeowners would categorically INCLUDE homeowners with equity as they are intuitively the least likely to re-default (as is backed by analysis of the Home Owners Loan Corporation of the 1930’s … see Congressional report on HOLC)

Miller has always been interested in the INVESTORS, not the homeowners, so his recent actions should not come as a surprise, and his motives will become increasingly clear over time.

So the banks won’t offer write downs for homeowners who are underwater, and won’t allow mods for those with equity. Hmmmm…. who are they helping? Almost no one.

This situation is a National disgrace.

@ state A.G.’s: VOMIT. All OVER YOU.

My Dear Mz Smith;

Paranoia is generally considered an irrational fear based on perceptions divorced from reality. The evidence you present almost perfectly fits the case you posit. A case of paranoia would be more in line with the suspicion that the Republicrat Party was going to re-regulate the banking sector.

Sort of like the runway before the Peoples Choice Awards, otherwise known as the Astroturf Carpet.

Foreclosure-Probe Chief Asked Bank Lawyers for Money

(http://swampland.time.com/2011/05/09/foreclosure-probe-chief-asked-bank-lawyers-for-money/#ixzz1Lvb52kaI):

…Now, in response to queries from TIME, Miller says he initiated fundraising calls to several national firms that represent big banks after he had announced his intention to investigate the foreclosure mess. “In September and October, I tried to reach out to people that I’d worked with and I thought had respect for me and potential support for me and tried to raise money from them,” Miller says. “And a number of them were from national firms.”…

Miller says he does not believe his fundraising efforts among lawyers representing potential targets of his investigations give the impression of impropriety. Nor does he believe that negotiating with the lawyer who gave him $5,000, Meyer Koplow of New York’s Wachtell Lipton, now representing Bank of America, presents a conflict of interest. “All of this is just so much of a stretch,” Miller says.

…And maybe it wouldn’t be such a stretch if Miller had actually done what he set out and promised to do!

The rule of law in America is toast and this is your final proof…. that America has gone down the rabbit hole. (But it isn’t a dream folks)