Wow, this is what debt slavery looks like on a national level.

The Financial Times reports that a new austerity package is about to be foisted on Greece. It amounts to asset stripping and a serious curtailment of national sovereignity:

European leaders are negotiating a deal that would lead to unprecedented outside intervention in the Greek economy, including international involvement in tax collection and privatisation of state assets, in exchange for new bail-out loans for Athens….pressure is building to have a deal done within three weeks because of an IMF threat to withhold its portion of June’s €12bn bail-out payment unless Athens can show it can meet all its financing requirements for the next 12 months.

Officials think Greece will be unable to return to the financial markets to raise money on its own in March – as originally planned in the current €110bn package – meaning that the IMF is now forbidden from distributing any additional cash. Without the IMF funds, eurozone governments would either be forced to fill the gap or Athens could default.

To bring the IMF back in, the new deal must be reached by a scheduled meeting of EU finance ministers on June 20.

Even if they get their way, the rescue package is certain to fail to forestall an eventual default or restructuring because none of these rescues is a rescue. When the banks got in financial trouble, they got to borrow at discount rates. If Greece were to borrow from the ECB, say at 2% over the EBC’s policy rate, instead of the punitive rates on offer, it would look a hell of a lot more viable near term. I’m not saying that this is the best or only remedy, but the ECB is also blocking a restructuring, specifically, anything that would be deemed to be a credit event. Clearly the concern is not Greek CDS; John Dizard has pointed otu that the level of Greek CDS is miniscule, less than 2% of the outstanding debt, so what happens to the CDS writers is simply noise compared to what happens to the bonds themselves. The concern seems to be setting a precedent, that the ECB seems desperate to maintain the fiction that no eurozone sovereign will default or restructure (and these are hardly the only options; a voluntary restructuring would get the job done).

Another reason this rescue is not a rescue is that one of its major elements, that of stripping Greece of assets, is unlikely to raise the €50 billion expected. The demands here are astonishing. Greek premier George Papandreou agreed to only €5 billion of asset sales a year ago; the best state owned assets are expected to fetch at best €15 billion. Trust me, if that’s all you can get from the best properties, anything else that can be cobbled together is likely to be worth at most half that in toto. So it’s not hard to foresee that the receipts from the infrastructure sales are likely to fall short by about half.

And the notion that the invading banker hoards are going to “supervise” tax collection is sure to mean that they will make certain that they are first in getting tax receipts. As various readers have pointed out, lower middle and middle class Greeks have taxes withheld from wages; it’s the rich and the participants in the black economy that escape. It is far fetched to think that foreign involvement will improve matters; indeed, I’d expect everyone who can to operate out of the black economy as an act of rebellion.

Greece looks to be on its way to be under the boot of bankers just as formerly free small Southern farmers were turned into “debtcroppers” after the US Civil War. Deflationary policies had left many with mortgage payments that were increasingly difficult to service. Many fell into “crop lien” peonage. Farmers were cash starved and pledged their crops to merchants who then acted in an abusive parental role, being given lists of goods needed to operate the farm and maintain the farmer’s family and doling out as they saw fit. The merchants not only applied interest to the loans, but further sold the goods to farmers at 30% or higher markups over cash prices. The system was operated, by design, so that the farmer’s crop would never pay him out of his debts (the merchant as the contracted buyer could pay whatever he felt like for the crop; the farmer could not market it to third parties). This debt servitude eventually led to rebellion in the form of the populist movement.

The Greeks appear to have a keen appreciation of what is in store for them. Protests have been underway in Athens, and the locals seem to think they could eventually produce bloodshed. We received an e-mail forwarded from a source claiming to be in Athens; the inclusion of Greek-language charts suggests it is genuine. Note that it says that “parts of the national capitalist class” are taking the idea of leaving the Eurozone seriously. But reading between the lines, the writer of the e-mail appears to see that as a local looting scheme, as opposed to one to benefit foreign bankers. Ugh.

Hello from Greece,

This is the fifth day and the crowd is increasing in Syntagma square in Athens. There must have been more than 30.000 people this evening and there are still there more than 10.000 at 11.30 pm (today). As a genuine gathering of the multitude there are not prevailing slogans apart from “thefts” and “take a helicopter and leave this place” (it refers to what has happened in Argentina). Flags of Argentina can be also seen among the demonstrators. In the front a banner says in Spanish “we are desperate, we woke-up. What time is it? Its time for them to leave”. People are dancing shouting or just hanging around talking to each other. A “general assembly” is held at late hours in the square, where people can take the microphone, speak and say what they think freely. It’s not stopping and it will not stop although I think that maybe there will be less people the forthcoming days.

Maybe you are not aware on the details of the Greek time lines. There are enough money for the government until the 14 July and they desperately need the next dose of the IMF and the EU to keep the country running. EU governments are blackmailing, asking for a national consensus of at least the governing socialist party and the conservative right party, but the conservatives do not accept. They are asking for a huge privatization plan which practically spans all public enterprises including water companies and land. The latter is something quite difficult to be accepted by the public opinion.

The idea that prevails is that after selling all these crucial resources nothing will really change for the people and most possibly we will be in the same position of bankruptcy after a year or maybe two having lost by this time most of public resources. Also a huge tax collection plan is under finalization which according to leakages it will cost 3.000-4000 euros annually for a family with 4 persons . This means that a lot of marginally surviving people will fell below the elementary standard of living. Another 150.000 unemployed are expected for the forthcoming year. Final decisions will be announced most probably at 6th of June – so keep this date in mind. It might be the beginning of real bloody demonstrations.

What are the political implications of this mass mobilization and which are the probable effects? Although is difficult to say I am thinking that most probably if this dynamic goes on it might be impossible for the government to vote for the new measures. At this stage political instability with these time lines means bankruptcy.

Another interesting story is that parts of the national capitalist class are seriously thinking of bankrupting the country and take over with a new drachma. This is not discussed politically openly because a return to a national currency will be extremely painful for the masses. In fact the story of Argentina is well known. My impression of the overall situation is that for several reasons Greece follows the road to an open bankruptcy with several people waiting to benefit from that and nobody taking the political risk to support it. Since European governments are deeply divided on the Greek crisis, it is difficult to believe that they will act in a coordinated, quick and generous way to avoid the storm, although this cannot be ruled out.

Now, some figures from the public opinion

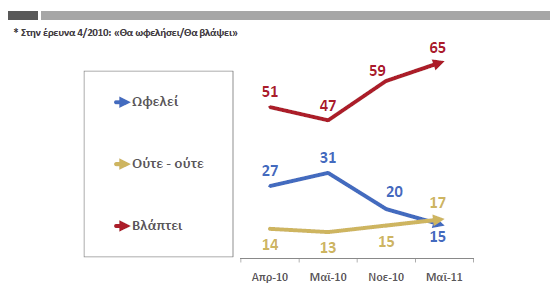

Red = the IMF-EU program is not beneficiary for the country

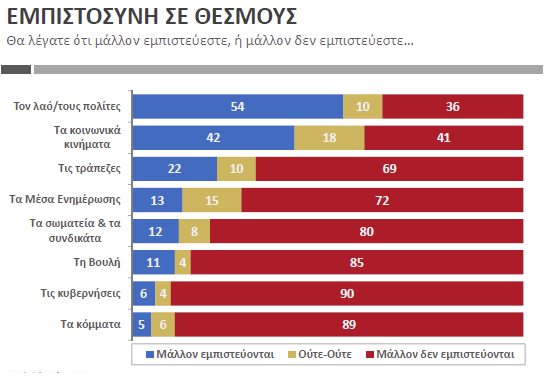

Blue = it is beneficiaryThe most important slide which shows the bankruptcy of the ruling system in Greece is the following. Please pay attention…

Red = do not trust

Blue= trust

Top bar (1st) = fellow citizens/people

2nd= social movements

3rd=banks

4th=media

5th=trade unions

6th=parliament

7th=governments

8th=political partiesDoes this explain to you what happens now at Syntagma square?

21st century Spartans need to school banksters

Why are folks focused on the banksters and not the people that tell them what sort of sociopaths to be?

The class conflict we have between accumulated wealth and the rest of us is worldwide and their multi-national organizations are light years ahead of the governments they corrupt and play off against each other.

It it weren’t for the pain this will cause to millions the next phase of humanity might be interesting to watch as a casual observer until they take my pension.

Is it a joke to ask where is the global humanitarian leadership to countervail the resources of the inherited rich?

Psychohistorian observes that “The class conflict we have between accumulated wealth and the rest of us is worldwide and their multi-national organizations are light years ahead of the governments they corrupt and play off against each other” and then asks “…where is the global humanitarian leadership”?

I wonder if it’s so much a failure of leadership as it is a failure of imagination.

After Marxism’s stunning implosion, no new ideology has emerged powerful enough to compete with the utopian allure of neoliberalism. So while neoliberalism provides corporations with a unifying ideology that transcends national interests, the world’s working people remain balkanized, loyal to their nation states.

Robert Hughes wrote of the demise of Marxism almost 20 years ago, but I’m not sure he was sufficiently clairvoyant to foresee the neoliberal nightmare Marxism’s demise would unleash upon the planet. His observations do, however, hold out a solitary hope, and that is that the neoliberal Revolution may have made the same miscalculation that the Marxist Revolution did: an overreliance on the premature death of nationalism. Here’s Hughes:

For the fact is that Marxism lost its main bet at the outset. It wagered its entire claim to historical inevitability on the idea that humankind would divide along the lines of class, not nationality. In this it was wrong. Because the bonds of nationhood were so much stronger than those of class, the Revolution could only be exported in three forms: as direct conquest by Moscow, as in eastern Europe; by the reinvention of ancient, xenophobic, authoritarian structures with a “Marxist” veneer, as in Mao’s China; and as a handy form of rhetoric which gave “internationalist” legitimacy to nationalist chieftains and caudillos, as in Ceacescu’s Romania, Castro’s Cuba or any number of ephemeral African regimes. But the basic promise of Marxism, an international of workers joined as a transnational force by common interests, turned out to be a complete chimera. Nationalism survives. Half a century after Hitler’s death, neo-Nazi gangs march, hold hate-rock concerts and burn sleeping Turkish migrants in Germany; even Mussolini’s granddaughter is in Italian politics. Whereas forty years after Stalin’s death, there isn’t a true-red Marxist believer in power, or even near power, anywhere in Europe.

Marxism has no promise for America. Since 1917, it has failed after three-quarters of a century of tests in every society where it was applied. It has produced nothing but misery, tyranny and mediocrity. The fact that it often replaced other systems which were also tyrannous, mediocre and miserable does not mitigate its failure. The historian learns never to say “never,” but all the same it is highly improbable that large numbers of people, in the imaginable future, will submit themselves to the yoke of a political ideology that assumes that mankind is capable of objectively discerning, judging and controlling everything that exists in terms of a “rational,” “scientific” program, a single model propagated by central planning. Marxism set itself against nationalism, spread by adapting to it, and in the end was laid low by it.

▬Robert Hughes, Culture of Complaint: A Passionate Look into the Ailing Heart of America

The quote from Robert Hughes does actually point it out already: Both the Soviet Union and China only had a veneer of ‘Marxism’ – it wasn’t Socialism or even Communism as Marx envisaged it at all, that they practised, but it was pure old totalitarian rule by a small elite minority.

This is totally contrary to what Marx and Engels assumed, namely that Socialism would develop from democracy.

In other words: If there ever was a real attempt at Marxism – it failed in 1917 already.

Liberalism failed, and Marxism arose to address this failure. As Reinhold Niebuhr wrote in The Irony of American History: “Marxism is so formidable a political creed precisely because it expresses the convictions of those who have discovered the errors in the liberal-bourgeois creed in bitter experience.”

But then Marxism failed, perhaps even more spectacularly than liberalism.

And then, instead of using our imaginations and experimentation to try to come up with something new that might work better, what did we do? We reverted to a twice-born liberal ideology that was already a demonstrated, proven failure.

One really should take a look at the historical succession and serial failure of what have been the three dominant ideologies of Western Civilization: Christianity, liberalism and Marxism.

All three failed to control greed and power lust.

And at this particular historical moment, I don’t suppose it should come as any great surprise that a significant number of people believe earthly salvation can be found by a return to Medieval Christianity.

If you read Marx himself you’ll see that “Marxism” hasn’t failed at all. In fact, pretty much exactly what Marx predicted would happen seems to be happening. That is, an egregious form of capitalism takes over the entire world. Only after that can the worldwide revolution take place. The revolution may not be televised (R.I.P.) but it will definitely be global. According to Marx. And then we have to survive the Dictatorship of the Proletariat before the real Utopia stuff happens. (Again, according to Marx.) “Marxism’s stunning implosion” was actually more Marxist than the rise of those ostensibly communist states.

“… pretty much exactly what Marx predicted would happen seems to be happening”.

Quite true, though he totally missed the environmental contradiction (he had vague ideas but that’s about it).

I sometimes call Marx the only classical economist worth that name. His opus magna Capital is in fact a most systematic analysis of Capitalist economy from a naturalist (materialist, scientific) viewpoint. The vintage viewpoint of Marx is that he hold no idealizations nor utopies on how the economy worked: no invisible hand, no rational choices, even not really that much importance of markets. His interest is how Capital accumulates and self-organizes.

Marx should be in all economic curricula but as the Economic “science” is actually a religion with some technical notions of complex accountancy, this heretic (and others less well known) is banished.

“And then we have to survive the Dictatorship of the Proletariat”…

The concept of Dictatorship of the Proletariat is only opposed to the extant Dictatorship of the Bourgeoisie. This has been often misunderstood by both Marxists and critics. It does not mean totalitarianism nor even authoritarianism, it just means that the political system is to be oriented to the goals of the Working Class and not the Capitalist Class, which is to be expropriated and restored to normal humanity, by violent means if need be.

A bourgeois democracy is a bourgeois dictatorship because all the system is oriented and subject to this class and its interests. The veil of “democracy” is just there (when it is) to generate consensus by means of a reality show of sorts. On the other hand a proletarian dictatorship (because it is the only way that class power, people’s power, can be guaranteed) must be a real democracy and this was clearly misunderstood by some presumed revolutionaries who allowed that way a bureaucratic class (or subclass) to take power instead of the People. But that happened in the periphery, not in the center, where the true proletarian revolution is supposed to take place first (because of the development of an fully formed working class).

So I understand that in today’s conditions true democracy, what the people is demanding at Plaza del Sol and other European democratic outposts, means dictatorship of the working class (socialism). And dictatorship of the bourgeoisie does not anymore mean even the spectacular empty “democracy” show we are used to.

The veil is falling and the bourgeoisie now will attempt to restore fascism as their last chance (probably worthless, futile – but dangerous in any case), while the working class is already attempting to expand democracy instead. And you can hunch on your own what does it mean to submit the economy and property to the People’s Power, to Democracy.

European bankers are

a) snappy dressers

b) darn smart

c) look cute on the end of a spear.

d)aren’t allowed in my DM’s campaign

Strike “European”

«The idea that prevails is that after selling all these crucial resources nothing will really change for the people and most possibly we will be in the same position of bankruptcy after a year or maybe two having lost by this time most of public resources.»

————————-

Quite insightful. Selling all the assets means that Greece – which belongs, toghether with its assets, to the people, and not to the banks – will no longer have any assets that generate revenue streams and can be used as collateral for borrowing. The Greek state then will become simply a tax collector and enforcer for the banks, with the taxes being used to pay off the loans with interest from the banks.

I’ve I were Greek I’d say no to that.

…I’f I were Greek I’d say no to that.

This could make the Greeks as stateless as gypsies.

>> The Greek state then will become simply a tax collector and enforcer for the banks

Same thing in the US. The private banks asked the government to buy the bad debts. So, now, the people can get mad at their own government instead of the banks.

Why don’t they just station the Wehrmacht in Athens and do the job thoroughly? But if this happens the people to blame are the Greeks themselves for not rising up and throwing out a government and a bureaucracy prepared to bow so cravenly to EU diktat. It’s the same in Ireland.

They tried that before.

They found that doing it too blatantly really made people mad. They could get away with it while it appeared voluntary or through proxies. However, doing it through literal invasion meant global war.

My grandpa was there (with Weermacht) – he ended up hiding under a bush with three bullets in his stomach.

If I will fight someone it certenly won’t be the greeks.

When the Ottomans did this it was called devshirmeh, or “Tribute of Children.” The ECB, IMF and the banks might not require one child to convert to Islam but it’s a pretty similar approach. The irony here is that this could end up reversing the effects of the battle of Marathon where as instead of driving Greece into Europe and starting the process of western civilization, now the financial forces of the West could drive Greece back into the embrace of the East. Granted, there is a lot of deep seated hatred and distrust to overcome in the process (which is, I think, one of the reasons the Greeks are so willing to sell their soul to stay within “Europe” – as opposed to the Turks who have not been accepted), but this process very well might do it.

And not just Greece. All of Eastern Europe is now looking more and more toward the east. And the east does not stop at Turkey — it goes all the way to China.

What could the EU or the US do if China decides to suddenly pour one trillion of its useless dollars into Eastern and Southern Europe? Would you say that that simple strategy would instantly destroy NATO’s futile attempts to militarily encircle China and Russia?

Psychoanalystus

My Dear Psychoanalystus;

The Chineese are already doing just that in Africa. There is a pterry good article about it in “The Atlantics'” archives. And do notice just what thw Chineese are investing in; arable land and raw materials. Sounds a lot like the Chineese are doing what they do best; plan for the ages.

The Chinese seem to be just as bad as the Americans and Europeans before them when it comes to international relations and trade.

If you’re looking to China as savior of Africa and the East prepare to be disappointed if not outright horrified. You need only see how they have “handled” Tibet as a harbinger of things to come.

It is exactly the same as the scramble for Africa in the late 19th century. This is the kind of conditions that were imposed on protectorates and such and for the same reasons.

What I find most outrageous is that the Right is the one demanding all that, when they were the one leading the organized robbery all these years (remember that Papandreu was elected as reaction to this massive corruption by the Conservatives, at the origin of this crisis largely). One should never trust the Right (because it represents the exploiters more directly than any other force) but it seems to me that this rule is particularly true in a poor country like Greece, because the neocolonial Right will sell the country off and laugh while they do it.

In any case, it is obvious that this is an international ripoff: a last attempt by the Capitalist Class to keep their profits while the whole system falls down in this ultra-decadent nonsense we have been brought to by our elites and naivety. An being an international ripoff of at least pan-European scale, people is reacting in an equally international way.

At this moment there are massive popular takeovers of city centers in Greece, Spain and Portugal and I’m feeling quite certain that in few days it will have extended to France (and maybe Italy, Ireland, the UK and/or Belgium).

The exact future details of this Revolution are admittedly unpredictable but what is clear is that Greece is just part of a much larger movement and that the whole EU and even beyond (Arab Spring, etc.) are experiencing a most exciting and encouraging awakening.

It may seem like 1968 but in that time the economy was buoyant and the Revolution was mostly cultural and political, against an obsolete authoritarianism (proper of the disciplinary phase of Capitalism) that was to be no more (no more De Gaulle and no more Stalinism either eventually, even if took two decades more to finish that part). Today the economy is terminally sick and marks not the end of a developing stage of Capitalism but that of the final stage, the apogee of Capitalism (social phase or Toyotism) which we have lived through (I was born in 1968 and I am now almost half century old).

This is probably not yet the final nail in the coffin of Capitalism but it is clear that people are tired of the old monster’s vices and abuses, growing boundless with senility, it seems, and are furnishing that coffin to be nailed eventually.

The People of Europe is drawing a thick red line and the Capitalist Internationl is suicidally marching against it. It cannot win: it is absolutely impossible to defeat the People at this stage, certainly not by violence and they do not look anymore in the mood of cunning, it seems to me.

I fear that there will be blood but I am also certain that that will only fuel the Revolution ahead even more strongly decidedly.

It may seem like 1968 but in that time the economy was buoyant and the Revolution was mostly cultural and political, against an obsolete authoritarianism (proper of the disciplinary phase of Capitalism) that was to be no more (no more De Gaulle and no more Stalinism either eventually, even if took two decades more to finish that part). Today the economy is terminally sick and marks not the end of a developing stage of Capitalism but that of the final stage

The economic aspect of this is that all sectors are mature oligopolies with no frontier left but that of crime and totalitarianism. Since there’s no growth frontier, the debt ponzi scheme also cannot be sustained, which only reinforces the imperative toward political tyranny (buying off the people by letting them go inot consumer debt won’t work anymore).

The physical enforcer of this is Peak Oil, which renders further exponential growth physically impossible even if it were otherwise economically possible.

Those are the reasons the neoliberal strategy was drawn up in the first place, and those are why it’s now go time for the full restoration of feudalism, in a far more vicious form than the medieval.

This is probably not yet the final nail in the coffin of Capitalism

I think it’s the final nail for globalization, though so-called capitalism may stagger along for awhile on a lesser basis.

Dear attempter;

First: The mature oligopolies are by definition criminal and systemically totalitarian. No frontier here to exploit. Given the size of the worlds population, the present ‘fertile’ ground will produce well enough, thank you.

Second: There are indeed ‘new frontiers’ out there, they just haven’t matured in the psychological and technical senses yet. The “New World” was always ‘there’ but didn’t enter and later dominate Europes consciousness until maritime technology advanced to the stage where transAtlantic voyages were feasable on a large scale. How do you think the Spanish state would have done in the Lowlands without all that Inca and Aztec treasure to bankroll their armies? All because some bright person figured out an easy way to tack before the wind. So, as an example; what do you think wil happen on Mars when we finally figure out a ‘cheap’ way to do interplanetary travel? New Frontiers indeed!

Third: The blessed doctrine of “Peak Oil” itself is open to debate. If I can ever learn to use this (expletive deleted) computer I’ll try to find and post the paper by the two grad students(?) from the Mid West who posited and somewhat proved that conventional ‘estimates’ of oil reserves are barely one third of actual reserves. It has something to do with the physical details of oil domes themselves. Using their theory they had a wildcat well drilled in a previously ‘played out’ oil field in the Great Plains states, and brought in a working well. Also, the cost of extraction is a major factor in energy production. As prices in real terms rise, the amount of available reserves grows as marginal fields enter the new mainstream. An on the ground example: In the ’70s decent sized natural gass fields were found in southern Mississippi and southeastern Louisiana. They have been capped off ever since. I once got to ask a working pertoleum engineer why the fields were unused. The answer was hydrogen sulfide. A colorless, odorless and deadly poison. The Hydrogen Sulfide would have to be extracted from the natural gas and then sequestered somewhere. Expensive and inconvenient. Until the unit cost of natural gass exceeds the cost of extraction, processing and a decent profit, that gas is going to stay underground. But, the point is, it is there, waiting.

Fourth: A pretty widely held idea about the end of the Middle Ages posits that the labour dislocations attendant to the ravages of the Black Death broke the elites stranglehold on the labouring classes by freeing those labourers from the system itself by freeing them from one particular plot of land. Mobility and free association drove the new dynamic. I theorize that this is behind the recent push to ‘regulate the internet’ in the interests of this or that smokescreen issue. The Arab Spring and now European Epiphany are demonstrating the true potential of the world wide web. If the elites can’t get control of this emerging social force, they’re history. There will always be “Meet the New Boss,” but hey, “Every Day In Every Way.”

We are living in interesting times.

There are several estimates of available oil in the world, ranging from realist to fanciful, what matters in the end is the price that it is available.

All sorts of special methods of drilling to “reawaken” dead dry wells or to process previously unusable or toxic sources of hydrocarbons into oil have been available for decades.

There are even ways to turn most anything carbon based into oil. Tires, asphalt…even people can be turned into oil via thermal polymerization which has been around since at least the 70’s.

The problem with all of these methods is that they’re all expensive, horribly so in most cases. You can have trillions of barrels worth of oil trapped in your rock formations at the bottom of the sea or whatever but if a price of $200/bbl or more is required just to break even to get it to the surface much less refine it then it may as well not even exist because most no one can afford it at that price.

We need oceans worth of cheap oil (or other energy source) to prevent social and fiscal calamity, and no new cheap mass quantity sources are to be found. Nor are any other cheap energy sources likely to become available any time soon.

This doesn’t necessarily mean its Mad Max Time, but things will likely be very very bad in the first world countries and absolutely awful in 2nd or 3rd world countries.

“We need oceans worth of cheap oil (or other energy source)”…

The Sun up there. It’s a matter of political will and nothing else. Oil, nukes and such belong to the past. Solar, wind and other renewables are what may allow us to keep part of our consume (and hence living standards).

But we do not need such wasteful living standards as in the USA or to lesser degree in Europe: we can do with a lot less. While initial increases/decreases in purchasing power make huge differences in happiness, then they produce almost no more happiness no matter how much we spend. Costa Rica is as happy or more as the USA and people there live with much less.

We can solve all the problems IF we want to. We can muster all the energy we may need from renewables… there’s no need to panic.

Solar still isn’t viable yet. All alt. energy supplies less than 10% of US energy. Even if you were to triple that amount in less than 10 years, which is probably straight up impossible BTW, we’d still have a major social crisis in our country and 2nd and 3rd world countries would still be screwed.

Why your prediction about tough times ahead is correct is not because we lack the technology to transition to renewable energies, it is because we lack, globally, the political will and the correct financial infrastructure/incentives. The tech is there, whereas politics is enmeshed in the criminality of finance and interest-bearing debt-money.

Only collapse has a chance of waking humanity up to the gravity of the situation. We need a socioeconomic system which is happy with steady state growth and not reliant on market-based profit maximization. The interview with Manfred Max-Neef linked to below makes some important and evocative points on this. Franz Hoermann, an Austrian professor of economics I refer to often, translate at my blog, and link to below, is building, with others, a set of proposals and ideas for a very different economics which would indeed enable us to ‘go renewable’ very quickly indeed. Whether or not we do so will depend on movements like Real Democracy Now. The depth of change we need to bring about will not be initiated by the status quo, which is now as decadent and criminal as it is possible to be. We must ignore it as best we are able, and collapse it from within with new democratic structures whose mature form we cannot yet discern.

And remember, the tech needed to transition us to renewables includes at least the following: an appropriate money system; a realistic, steady state growth economics; efficient housing, transport and cities; an education revolution, and most likely the end of the nation state. This is not just about sun, wind, wave etc. It is about everything.

“The tech is there, whereas politics is enmeshed in the criminality of finance and interest-bearing debt-money.”

The tech is NOT there. Solar is still too expensive, inefficient, unreliable, and land hungry to work. You have to build your solar fields close to where the power is needed otherwise the power gets mostly eaten up in the transmission lines, which is why we’re not building solar way out in the middle of the deserts we have here in the US. They’re too damn far away to work. Building them close to cities means buying up lots and lots of still very expensive land. If you can’t get the land for $50-100/acre then solar has no chance of working. There is also still no way to effectively store city sized amounts of energy still, which is what you need to do to make up the difference when your solar panels aren’t performing close to their peak.

Wind has similar problems unfortunately.

Until the long range transmission issues and capacity balancing issues are worked out along with huge huge improvements in efficiency and cost neither wind or solar will really be effective. People are working on improving these thing but its slow going and we don’t have decades to wait.

“Only collapse has a chance of waking humanity up to the gravity of the situation.”

Yes this is why I’m so pessimistic. Collapse at this point means lots and lots of people dying to say the least in the 2nd and 3rd world while standard of living will drop massively in the 1st and some will die in likely to occur social unrest too in the 1st world.

“The interview with Manfred Max-Neef linked to below makes some important and evocative points on this. Franz Hoermann, an Austrian professor of economics”

Historically Austrian economics haven’t worked any better nor are they any less resistant to corruption than neoliberal or communist economics. The solution is not to be found with any one economic ideology. The solution is to reform the government so that it is no longer working in the interest of a elite super rich few and coming at things from an economic angle can’t fix that.

“Historically Austrian economics haven’t worked any better nor are they any less resistant to corruption than neoliberal or communist economics.”

Hoermann is Austrian by birth, not by economics ;-). What he proposes is so far removed from orthodox economics as to be dismissed as lunacy by the mainstream.

The tech IS there, but, like I said later in the comment, using all solar-generated energies sensibly requires updating cities, housing, transport etc. We have the resources and know-how, only the economics (which says Solar is too ‘expensive’) and the politics, which are one, stand in our way. It is a TOTAL revolution that is called for, including but not limited to steady state growth, not just using renewables to power this system on to infinity.

“is Austrian by birth, not by economics ;-).”

Sorry for the misread then.

“The tech IS there, but, like I said later in the comment, using all solar-generated energies sensibly requires updating cities, housing, transport etc. We have the resources and know-how, only the economics (which says Solar is too ‘expensive’) and the politics, which are one, stand in our way. It is a TOTAL revolution that is called for, including but not limited to steady state growth, not just using renewables to power this system on to infinity.”

I don’t know where you’re getting the idea that solar/wind/whatever alt. energy is ready for mass deployment to replace oil/coal/nuke/nat. gas/etc. because it just isn’t and even a trivial glance at info. out there can show you that. Yes we can improve efficiency somewhat (ie. super insulated homes, high mpg cars), I already expect that to happen, but not enough to change things. Only blunt the worst of what is to come and only for the relative few who can afford the newer homes and cars.

You cannot ignore the cost of these things. If no one can afford them than they’ll never go anywhere to making any changes. Toys for rich people a la a few battery powered race cars are not a solution either. I’ll be more optimistic when you can get your home solar powered for a couple thousand without tax credits or get a battery powered Toyota Camry or Ford Flex for a couple of grand more than their gas powered counter parts and have similar driving distance capabilities.

Look up LENR (Low-Energy-Nuclear-Reactions) research. Scientist have been able to induce fusion at low temperatures. Other nations are developing this technology, but due to stigma research inside the US has stopped since 1989.

They know the effect exists, and have been trying to figure out what conditions need to be present to induce the reaction and have been able to make progress. The major issue now is that the catalyst slowly becomes less efficient because of the reaction, and the catalyst is expensive. If the government were serious about getting off oil, then they would massively invest in this technology, solar, and solar conversion technologies to syn-gas or fuel.

If you are interested, look up the work of Frank Znidarsic. He is an engineer that followed LENR experiments as well as other studies and came up with a theory that relates the quantum world to the classical world through a new constant. He uses this constant to derive many fundamental constants and he uses it to predict various known facts about the hydrogen atom.

“I don’t know where you’re getting the idea that solar/wind/whatever alt. energy is ready for mass deployment to replace oil/coal/nuke/nat.”

E.g. that tests of wind’s EROEI show it to be better than oil’s, scoring 40 to oil’s falling 10-15 in one or two Danish studies (I think it averages over 20, civilization needs about 10 apparently), and that plus-energy houses, as they are built and exist today, produce more energy than they consumer, can therefore power electric cars (they use solar and heat-exchange tech in combination, and some other tricks). Evacuated Tube Transport looks interesting too, as do mini-maglev trains for city transport, which they are rolling out in China. They use 98% less energy than cars (if memory serves). And there’s far more than I can list here, particularly to do with energy storage. Some European cities consume 80% less energy than their US counterparts, and that before we even begin to build cities intelligently for energy efficiency. The wastage of today’s system is truly criminal.

Of course implementing what I’m talking about will not happen tomorrow, and it would take oil and coal to get up and running, but that this won’t be begun is not because of the tech, it’s because of the socioeconomic system and multiple and competing vested interests, which are all about endless growth and ever-growing profits. Nor, were humanity to start tomorrow, could it ever be like the flicking of a switch, nor plain sailing. Nevertheless, I believe it is technically doable, though it would take decades.

You talk of cost as if today’s money were part of the solution. As it stands, the debt-money system we have is perhaps the deepest part of the problem. See my comments below with aw70. Franz Hoermann (and the consortium he is part of) has proposals to revolutionize the money system using existing tech. So the financial arrangements are there, in ready-to-roll form, now. We don’t ask, when we’re talking about averting global catastrophe, if we have the money to save our lives, we ask if we have the resources and the know-how. Money is a minor side issue technically speaking, and, in current form, does not tell us what we can afford as a species on this planet. Money distorts, it does not inform. That is a key error most people make when considering this problem. Put simply, money is not wealth. Resources and know-how are.

Again, I’m talking about a total revolution from top to bottom of everything we do (including money, which measures costs very poorly indeed). It won’t happen because the propaganda is too good, the dumbing-down too effective, and the cultural momentum too strong. But the tech IS there.

Imagine we have made ourselves stupid enough to kill ourselves off trying to generate enough money via debt to ‘afford’ ‘buying’ from ourselves the kit we need to avert catastrophe, just to preserve the system as it is, as the tool of finance. Probably we have become that stupid, which is a crying shame, because I believe we are nowhere near our potential as a species.

“E.g. that tests of wind’s EROEI show it to be better than oil’s, scoring 40 to oil’s falling 10-15 in one or two Danish studies (I think it averages over 20, civilization needs about 10 apparently), and that plus-energy houses, as they are built and exist today, produce more energy than they consumer, can therefore power electric cars (they use solar and heat-exchange tech in combination, and some other tricks).”

Uh that is for limited deployment in near ideal areas that get supplemented with normal coal/oil/nuke/etc because they still can’t maintain reliable power any other way. If you’re not talking mass (ie. nation wide) much less state wide in the continental US/EU/China then you’re talking about specialized corner cases. I too can make nearly anything look good if I cherry pick my data.

“Evacuated Tube Transport looks interesting too, as do mini-maglev trains for city transport, which they are rolling out in China. They use 98% less energy than cars (if memory serves).”

Yea and how many trillions do they cost up front? You know good and well the energy costs are factored in over the expected life span of the system too. If you think anyone anywhere is going to blow the necessary trillions for a regional mini maglev in the US or in EU much less tens of trillions for a nation/continent wide system…well I got a new super free infinite energy tech patent I’d like to sell to you. Evacuated tube transports are even bigger joke. They’ve been around for over hundred years and never took off for a reason you know (hint: reliability).

“And there’s far more than I can list here, particularly to do with energy storage.”

I don’t doubt you could list more silly ideas like mass maglev and vacuum transport and cherry picked data, but real viable solutions ready to go yesterday much less today or a year or 2 down the road? Don’t exist.

“Some European cities consume 80% less energy than their US counterparts, and that before we even begin to build cities intelligently for energy efficiency.”

You’re still not getting it, we could improve efficiency a couple hundred per cent and we’d still be boned because the price of energy will scale up higher than we could ever improve our tech or reduce energy consumption in any sort of reasonable time frame. If the price of energy triples or quadruples then you have improve your efficiency or introduce new tech. such that your energy consumption goes down _at least 300-400%_ just to stay even with price today, which BTW are already too high. And a price increase of that magnitude is not unreasonable over the next 10 years or so, not at all.

“Of course implementing what I’m talking about will not happen tomorrow”

The stuff you’re talking about would’ve had to been started back in the 80’s or early 90’s to have any chance of being viable now. If that sounds crazy look at how long it took to get an extensive national road and rail system up and running, and both of those are far far simpler than setting up nation wide magleve, vacuum transport, or solar/wind.

“but that this won’t be begun is not because of the tech, it’s because of the socioeconomic system and multiple and competing vested interests, which are all about endless growth and ever-growing profits.”

No, its because the stuff is just plain expensive. It doesn’t matter what economic system you choose. Making highly efficient photovoltaic cells will cost you heaps because of the high energy and material costs involved in making them. Same goes for the city sized batteries you’d need and the long distance super conducting cables required to make long distance power transmission efficient and effective. This is something you can’t just handwave away. If its not cheap its not going anywhere right now.

“As it stands, the debt-money system we have is perhaps the deepest part of the problem.”

Of course it is but even if you fixed that we’d still be screwed. Our chance to switch to alt. energy or nuke or anything non oil/coal at a minimum of cost, suffering, and sacrifice was pissed away in the 80’s and 90’s. That ship has sailed. Its gone and not coming back. Too late for easy suffering-free solutions, get them out of your head, you’re just dreaming. Now the only choices we have left to make are varying degrees of bad or worse. Bad is well… bad, but you really really don’t want to see worse either.

“Money is a minor side issue technically speaking, and, in current form, does not tell us what we can afford as a species on this planet.”

Yea you’re pretty unrealistic to put it mildly. The current economic systems we have are crap (to put it mildly) but they’re what we have to work with because the powers that be will try to maintain them at all costs. You won’t be able to change the economic systems until you change who is in power and who they listen to for advice. That is also decades away at best since these people will fight tooth and nail against any change that does not favor them. Until that time comes money as it currently exists does indeed tell us what we can afford as a species on this planet wether you, I, or anyone else likes it or not.

But even if you could somehow change the worlds’ economic systems overnight to become more efficient and effective and to eliminate corruption it still wouldn’t matter. Some things are too expensive no matter what.

“Look up LENR (Low-Energy-Nuclear-Reactions) research. Scientist have been able to induce fusion at low temperatures. Other nations are developing this technology, but due to stigma research inside the US has stopped since 1989.”

Appears to be just a rebranded version of cold fusion to avoid the stigma attached to the latter with major work stopping around 1998 in the rest of the world. I don’t think anyone anywhere is serious about doing more with this stuff other than some really cool table top experiments. So great for science and all but nothing viable mass energy wise, probably ever. Might as well go pining after Polywell it seems.

“If the government were serious about getting off oil, then they would massively invest in this technology, solar, and solar conversion technologies to syn-gas or fuel.”

They’re throwing money at it but more money doesn’t actually do much past a certain point. R&D is a slow process and most efforts fail. You fail over and over again to get a chance to succeed and then you try to build on what successes that you get. Right now there are major fundamental issues with successful mass use syn-gas, alt. fuel, and solar power. They have stuff running in labs that could possibly be a fix for these fundamental issues but no one has a clue how to mass produce them, much less do so cheaply and quickly.

“If you are interested, look up the work of Frank Znidarsic.”

A quick google turns up a bunch of stuff with him and “over unity”, infinite battery tech, anti gravity tech, etc. Maybe he is or once was legit but seems to have got himself wrapped up in quackery now.

“Uh that is for limited deployment in near ideal areas that get supplemented with normal coal/oil/nuke/etc because they still can’t maintain reliable power any other way.”

The average of many tests was an EROEI of around 20, the score of 40 may well be in ‘ideal’ conditions, but I doubt very much that the average of something like 30 to 40 tests represents ideal conditions. Also, plus-energy houses are working and lived in in Germany and in northern Europe (Sweden springs to mind), and have been for years. Nothing ideal there. Yes, there is a give and take from the grid, and the ‘plus’ part is averaged over the year, but that that equates to dependence on fossil fuels and nuke is due to existing infrastructure, which of course would have to change.

My point has never been about switching our world over to happy smiley dreamland tomorrow, rather that the tech for a very differently organized world is there, including also leaving behind consumerism and perpetual growth. Maglev is there. Energy storage solutions that are not battery based are there, including compressed air and hydro. Evacuated Tube is future tech, certainly, but is hardly integral to what I’m talking about. And we’re talking about a transition time in the decades. Were such to begin in earnest (won’t happen, I know) it would follow that the money system had also changed, and that the great weight of what humanity does, its creativity and endeavour, would be redirected. I believe we are capable of amazing things still, but doubt very much we’ll get the chance prior to collapse. That would be a miracle.

As to costs and the money system and the trillions, that, as you seem to accept, is the core issue. While the money system sucks we are not measuring costs accurately, so saying trillions or gazillions is beside the point. That this will not change any time soon is clear to me, and I have said so all along. That the fact that we have the tech to begin transitioning to a far more efficient and sane system does not mean anything will happen, agreed and stated, and I agree with your point about the people who benefit from the current status quo fighting tooth and nail to keep things as they are. That’s my point. Such is a cultural problem. It is not a technical one, unless we call culture technology, which, stretching it, I guess we could. Your point about the ship having sailed is sadly, probably, correct (there I can only hope you are wrong), but it does not mean the tech is not there, it only means the political will failed and fails still.

I’m not dreaming these things will come true. My intention is to place the blame where it’s due. It is our collective failure, and in particular the elite’s greed and the system’s tenacious clinging to a very outdated and poisonous notion of money as wealth, that has scotched our chances of a relatively painless transition. I could say much more, particularly on costs, but this debate is probably now a waste of both our time.

Dear Reader;

Accept my apologies in advance, but I think your arguement falls because of your hidden assumption in the last sentence.

Elites, being merely mortal, have developed a system geared to instant gratification. So, there is no “long term” in their plans to worry about. “Take no heed for tomorrow…”

Hard to see any way forward that doesn’t involve killing the financial class.

Well, what do you have to go up against riot police, acoustic cannons, micro-wave crowd-control trucks, not to mention combat troops, automatic weapons, tanks, helicopters, jets, cluster bombs…otherwise…sure, good idea.

Hi Mr Bolero;

Don’t forget. Many of the worlds revolutions are produced by the armed forces themselves. Check out James Fallows blog piece at the Atlantic suggestin that a military coup might be a workable solution to the present state of affairs in America. Not tongue in cheek either.

Machetes and darkness?

You just have to get smarter tactically. See how a seemingly overpowered opponent in a war games context beat a superior armed force.

http://en.wikipedia.org/wiki/Millennium_Challenge_2002

and

http://www.armytimes.com/legacy/new/0-292925-1060102.php

http://www.youtube.com/watch?v=BBQQ6i2rsXk&feature=related

rafael bolero says: “Well, what do you have to go up against riot police, acoustic cannons, micro-wave crowd-control trucks, not to mention combat troops, automatic weapons, tanks, helicopters, jets, cluster bombs…otherwise…sure, good idea.”

John Robb (former USAF pilot in special operations) has given a lot of thought to this issue in his blog devoted to open-source warfare, networked tribes, systems disruption, the emerging bazaar of violence, resilient communities, decentralized platforms and self-organizing futures:

http://globalguerrillas.typepad.com/globalguerrillas/2010/02/characteristics-of-open-source-warfare.html

as long as the corrupt politicians get their fat paychecks and they do the bidding of the banksters Greek citizens will become slaves.obviously peaceful protest gets you nowhere.

I say just go ahead and let them privatize all public land, ports, water systems, roads, and beaches. Raise a few hundred billion that way, live high on the hog like only Greeks know how, and two years later sign a military treaty with China and Russia, and immediately nationalize all those assets back into Greek ownership.

What could Germany do about that? Attack Russia?… we know how that ended last time they tried…lol

Psychoanalystus

Been playing too much risk lately? What will happen to them is what happened to Argentina, they’ll be completely cut off from capital markets and all their assets abroad will be seized by creditors. But unlike Argentina that had the good fortune to default in the middle of the richest commodities boom in the last 30 years, the Greeks dont have the soy beans to sell to the Chinese nor a Hugo Chavez type to spend some oil revenues to help out fellow comrades.

Greece has geopolitical relevance. From ports, to Aegean Sea access that connects the Mediterranean with the Black Sea.

That’s why Churchill and Stalin carved up the Balkans after WWII. The Anglo Americans took Greece, and the rest of the Balkans went to the USSR.

Exactly! Countries like Greece and Romania are a heck lot more strategically located than all the Switzerlands, Belgiums, and Austrias of the world put together. And they know that too… and so does China and Russia.

Psychoanalystus

Switzerland is a tax haven. Therefore, like other secrecy jurisdictions, it has its protectors.

Also, as you indicate, I believe a major pipeline either does, or will, travel through the Balkans, and this is supposedly what the whole Albania/Kosovo “statehood” and US recognition was about. But, the route does not go through Greece, I think, so no leverage there.

Neoliberal true-believers just don’t do reality.

Take the graph of Argentina GDP – real growth rate (%) for instance.

Neoliberal true-believers go through all sorts of extreme contortions in an attempt to explain it away. But there it is, plain as day.

Greece looks to be on its way to be under the boot of bankers just as formerly free small Southern farmers were turned into “debtcroppers” after the US Civil War. Deflationary policies

This is a distortion on so many levels its hard to know where to begin. Inserting ‘white’ to the front of ‘free small Southern farmers’ would be a start. Second, small farmers generally were abolitionist since they couldn’t compete against plantations, they were hardly ‘free’ during the slavery era. This is why Kansas – a state of small farmers – voted to be a free state. Third, Jacksonian Democrats based in the mountainous areas of the South by and large supported the Union side.

I assume she meant “free” in the technical sense. And are you saying you think the recently freed black tenant farmers weren’t under the thumb of “the Man”, as they called the furnishing merchant? On the contrary, they were at least as bad off as white farmers, and often worse.

I don’t understand your quibble. The actual mechanics of the indenture may not be identical, but the result is the same: Debt slavery.

Here’s how I see the mechanics playing out in our case. Everything’s happening on schedule in Europe:

http://attempter.wordpress.com/2010/07/05/part-4-the-full-fury-of-the-new-feudal-war-the-intended-end-state/

Purple,

What’s your source? Mine is Lawrence Goodwyn’s The Populist Movement, and absolutely nothing in my post in contrary with his much longer form description of how the debtcropper system worked.

It’s a cheap shot to say you object to what I wrote and merely cavil about using “free” rather than “white”, which is not inaccurate, merely an aesthetic preference. And the other points you raised don’t contradict what I wrote and are irrelevant to the thrust of the argument. I’m here to treat the system in short form to make a parallel, not to write a term paper on it.

Yves, Here is my source; I was raised during the 40’s and 50’s in North Carolina and very much remember black Sharecroppers (never heard the term Debtcroppers) who were definitely debt slaves under the system described;who only provided labor and were easily taken advantage of. My Uncle had sharecroppers on two farms as I remember. My parents saved old clothes to take to the “Negroes” – and they were appreciated.

A small quibble. Tenant farmers were (are?) quite different. They were small businessmen who leased land but supplied equipment and capital as well as labor and pocketed profits. A tenant ,with hard work and a little luck, could hope to buy land one day. Sharecropping was almost certainly a dead end unless the farmer could find an honest land owner.

Jim

The system I am discussing is post Civil war through early 1900s. It is not sharecropping. No one living now has any memory of it. It was broken by the Populist movement.

Separating financial oligarchy from capitalism is impossible, as Lenin noted like 100 years ago. Financial oligarchy is the end result of capitalism.

You all do not realise what is happening. This is the start of the real crisis.

I’m inclined to agree. I knew it the instant that I spotted the line about privatized water supplies.

Banks to Greeks: “We want you to join the living dead.”

Might not turn out well.

That and the reference to “Droogs.” A rereading of Burgess’ book is in order.

Aye.

To push the blog guideline boundaries…

Indeed, perhaps Nadsat (a dialect developed in the novel A Clockwork Orange) may be the dialect in which we can speak globally about the social, environmental, and political ravages of ephemeral, derivative-created magic-money based on lunatic levels of leverage.

To wit:

The prestoopnick lenders wanted to soma Greek assets they never could buy, so the malenky chellovecks lent more than twice the value of the assets, added leverage onto it all to balloon the debt, and now they come in for the kill.

The Greek malchickiwicks ought to be out in the streets with their droogs raising holy hell, because if they don’t then their the first to be put under some kind of financial Ludovico’s Technique.

I’m not one for violence; it’s a bad strategy, as well as being stupid.

The book frets about what happens when free will is taken, even from fiends.

Because the ‘free will’ of the Greeks appears to be at stake here, it put me in mind of Alex and his droogs; in a 2011 version of Clockwork Orange, I think too many of the droogs would be VPs in finance (the rest would be regulators).

=====================

The prestoopnick [criminal] lenders wanted to soma [bag] Greek assets they never could buy, so the malenky chellovecks [little men, little guys] lent more than twice the value of the assets, added leverage onto it all to balloon the debt, and now they come in for the kill.

The Greek malchickiwicks[boys] ought to be out in the streets with their droogs[friends, pals] raising holy hell, because if they don’t then their the first to be put under some kind of financial Ludovico’s Technique [ a system of mind control, which eradicates free will from its ‘patient’].

Just to reiterate: I’m not condoning violence in Greece, nor anywhere else.

I should think the distant descendents of Aristophanes would be able to invent some wickedly clever and funny ways to rubbish the banksters and expose the thievery.

A revised Aristophanes’ “Clouds”, with the banksters standing in as the the unctious philosophers that Aristophanes ridiculed with such razor wit.

(Many more laughs than ‘Clockwork Orange’ into the bargain.)

Otpor used humor very effectively as a strategy to discredit the power structure. Humor is a more important tool than most realize.

Remember Thermopylae and Salamis!!

I doubt that the EU wants a real life example on how to leave the Euro for Portugal, Spain and Ireland to see. Plus, it would be the mother of all bond haircuts.

From Greece’s perspective, the pain for staying with the Euro is looking to be about the same as leaving.

“Note that it says that “parts of the national capitalist class” are taking the idea of leaving the Eurozone seriously.”

Good! This is like the naughty boy threatening his parents that he will clean his room. Departing the eurozone would be messy, of course, but the mess will almost entirely be on the Greek side.

“Debt slavery” is fitting. I also don’t see the benefit of asset fire-sales, especially from a sellers point of view.

Since restructuring is inevitable at some point I would have a lot more confidence in the ECB knowing they had the prowess (and balls) to handle a EU member default.

This would also force our local government (I’m talking Germany) to deal with the still prevalent financial infrastructure, as I hope public support for another round of Landesbanken, etc. bailouts will be rather thin.

So I’m hoping Greece will make a stance within the European Union. I’m sure if a government can demonstrate it can “run” a country in a sustainable way (not overly relying on borrowing), it will not be hard to find people willing to invest – ever more so haircut and restructuring.

Yeah, Germany paid quite a bit in reparations AFTER WW2, and no ill result. The analogy is tenuous.

The WWII reparations were not as onerous as the WWI reparations. As I watch the stranglehold that the bankers and their derivatives are placing on the back of the people in individual nations, I wonder how long before it turns ugly. How long will the people be willing to pay for the folly of the bankers bad debts? How long before a break up of the EU zone will come as a result of war? Will the ECB force individuals into debt peonage to pay the bankers? Will this be the cause of the next crisis? Will France and Germany lead the way?

All in all I do not think this will end well.

Brilliant Comment

The Germans should be reminded what happened when their country was required to pay ‘reparations’ to other countries.

They appear to have forgotten.

Sheez Australia is almost completly owned these days (see Brazil, China, USA, etc), just some old socialist rubbish to privatize, QAS is going private in a few years, then hospitals et al.

Skippy…what ever the reasons, so many, idaviduals and countrys could not resist the cheep credit train…its in a dark tunnel now and the conductor is checking tickets…was yours properly punched.

PS. still fishing and we_are_devo…your just either in on the joke…or not.

Dear Skippy;

Jokes are like subatomic particles, they come in lots of flavours, properties, spins etc.

I’m not a “Man in Hat” but do sometimes try to puzzle out the alternate subjectivities encountered on the net. Looks to me like “Bill and Ben, the Flowerpot Men!”

Better yet, it reminds me of “Clangers.” A species of geriatric Dalek. A ittle run down, but still ready to terrorize Wimbledon Common.

Love And Kisses (LAK) to you Noddy.

lower middle and middle class Greeks have taxes withheld from wages

What, do the working class not have taxes withheld from wages? Or is “lower middle class” one of those American euphemisms for “working class” so they don’t have to say “working class”?

Ding ding! Bingo!

I think the point here is that people who get wages and salaries from mid-size to large firms with defined accounting systems have taxes deducted from their paychecks.

Small business tend to structure more in cash so some of the working class may be paid in cas and not pay taxes. Similarly, many of the business owners will figure out how to avoid paying taxes.

Greece is tax avoidance on steroids which is one of the iggest sources of their fiscal problems.

The US has a similar issue but a much smaller scale. People like myself that draw a salary that is the vast majority of income have virtually no way to avoid paying taxes. However, there are very few taxes paid by migrant farm waorkers who are largely paid in cash. Similarly, the tax code has been rewritten over the past 30 years to provide many, many ways for “capitalists” to avoid paying taxes. Hence, Warren Buffet pointing out that his tax rate is lower than his secretaries.

rd, re “draw a salary that is the vast majority of income”;

I’m no economist, (as regular readers may have twigged to by now,) but I think the real power here lies in descretionary income, not dedicated income. The higher up Mr Swifts pole you go, the more manipulative you can become. The simple accumulation of wealth guarantees it. The rest of us, down here on “The Street” are constrained mightily. Without an organizing principle (principality?) that vast power potential will remain just that, a potential.

The last step of the looting requires converting the loot into real assets (Greek assets, in this case) before the currency (EU, in this case) is trashed. The Greek should hold onto their assets and default on the debt instead; after all, the assets were never meant to back the levered bets of international (and national) bankers, so why should anyone allow it to become collateral for banker’s bad loans after the fact?

This is truly the greatest con the world has seen in a long time…

Ah, I’d missed that bit.

If you borrow more than you can pay, you really can end up in debt slavery. This is not the fault of the rest of the world, but of Greece. Greece borrowed, ran huge deficits, paid a bloated public sector more generously than it could afford. Now it is a slave to those who it borrowed from. It forgot that debts would have to be repaid.

Greece can also default. This too will have consequences, not happy ones.

All this fulmination about the evil bankers, capitalists and so on is completely silly. Fiscal irresponsibility does have consequences, whether for individuals or countries. That is what is happening.

The important point is that all this wailing distracts from the real issue facing the rest of us: a second Lehman is about to hit. That is what matters now.

You think the average person in Greece signed the loan papers that are now due? Those who borrow what they cannot pay back are stupid or cornered or dishonest, but those who loan out what is not theirs, to those who cannot pay back, knew what they were doing and were hoping to reap the national margin call down the road…

If you lend more than the system can sustain, you really can create a situation that is unstable.

All this moralizing drivel about the evil borrowers is completely silly. Regulatory irresponsibility does have consequences, but oddly these consequences are all supposed to be born by the same tax payers who had no say in the issue whether to deregulate banking. That is what’s happening.

The important point is that all this wailing about ‘being a responsible debt slave’ is that it distracts from the facts on the ground: That the rentier capitalists are now using their crimes as an excuse to loot the tax payer once again. That is what matters now.

“The real issue facing us” is whether we take action to redeem our freedom, our prosperity, and ourselves. Nothing more and nothing less.

Hopefully next crash we’ll do the right thing and make sure Wall Street perishes once and for all.

lrt, your comment above, that this is the beginning of the real crisis, is almost correct. This is in fact the continuation of the ‘real’ crisis as it broadens and deepens to sweep all up in it, gathering force as it develops.

This comment about borrowing, on the other hand, is so far off the mark as to be laughable.

The debt-money system you imply is an organic and inescapable state of nature, like capitalism, inherently demands winners and losers to ‘work.’ Some must lose that others can win. Furthermore, in a system driven by debt-money, on which interest—which does not exist in the money supply—is owed, there is always and necessarily a scarcity of money. This excites competition, and competition, by definition, requires winners and losers. It is a zero-sum game whose continuing survival depends totally on growth. Interest-bearing debt-money is a vast pyramid scheme, and as such collapses when it is not growing. It can only hide its zero-sum dynamic while linear growth is possible and happening. Linear growth cannot go on forever, ergo, neither can debt-money. Insisting on it is insisting on an unsustainable state of affairs, or, put another way, is insisting on self-destruction, for the stupidly screamed reason that ‘There Is No Other Way!’

The solution to this crisis is not austerity and ‘only borrowing as much as you can afford’ (a totally empty expression in this system), the solution lies in a new economics and a new money, neither of which require growth, both of which can be happy with steady state. A conservative relationship with the planet’s carrying capacity is called for, yes, but economics as we have it right now could not give two hoots about carrying capacity or ‘affording’; it systemically requires growth4ever. According to orthodoxy, “Hand, The Invisible” will take care of all that. Hand will take care of everything. And that religious faith oozes from your every word. Your post reeks of it.

But, as Maju suggests above, this Myth is being rejected at an accelerating pace. More and more people are refusing to buy into that shit anymore.

leroguetradeur said:

All this fulmination about the evil bankers, capitalists and so on is completely silly. Fiscal irresponsibility does have consequences, whether for individuals or countries. That is what is happening.

leroguetradeur lives in a defactualized, cookie-cutter world. Superimposed upon factual reality are ideological templates, and when factual reality collides with these ready-made formulas, it is factual reality that must be sacrificed.

————————————————————

The shift toward neoliberalism began during the dictatorship of 1976, deepened during the Menem administration, and was supported throughout by the imf. This paper aims to identify why the crisis occurred when it did, but also to understand how the underlying shifts in the political economy of Argentina over more than two decades led to two waves of deindustrialization, an explosion of foreign debt and such a marked decline in the standard of living for the majority of Argentinians.

[….]

…one would hope that the failures of a quarter century of the neoliberal model would resonate among leaders in government, not just among piqueteros. Unfortunately, the role of the Argentinian elite and the imf is still active in attempting to keep this failed model going. The possibility of change resides in the continued strengthening of the new movements of the socially excluded in Argentina, and probably serious mobilizations in the street will be required in order to bring a proper end to a failed quarter century experiment, with a neoliberalism that has enriched the few, both foreign and domestic elites, at the expense of the majority of Argentinians.

▬ Paul Cooney, Argentina’s Quarter Century Experiment with Neoliberalism: From Dcitatorship to Depression

————————————————————

The present crisis in Argentina, the worst crisis in Argentine history that reached rockbottom levels in 2001–2, can be considered a crisis of neoliberalism, particularly of the severe structural adjustments applied in the 1990s and the beginning of the new millennium under the Menem and De la Rúa administrations. It was in this period that wholesale privatizations, deregulations of all kinds including those tending to the fully-fledged ‘flexibilization’ of labor markets, and an indiscriminate ‘opening’ to the world economy took place. This was also the period in which the foreign debt continued, increasing substantially until the recent default became inevitable. This article analyzes the way economic policy systematically favored the various large economic conglomerates operating in Argentina. In agro-industry, petroleum, telecommunication, electricity, water, and banking, both large national and transnational conglomerates were favored by measures related to structural adjustment programs of successive governments. In the midst of the present crisis these large conglomerates or grupos económicos are once again showing their muscle, pressuring the government to pay the foreign debt, increase public rates, compensate the banks for their losses due to capital flight, etc. In effect, the crisis itself shows the bare anatomy of the economic structure in which these large conglomerates reign supreme while being increasingly contested by numerous popular organizations of civil society.

[….]

Thus, Argentine society was substantially transformed in comparison with what it was 20 years before. Income distribution worsened tremendously, access to food, employment, health, housing and security have been trampled upon, as a consequence of the chaos created by what could be termed a system of ‘legal’ but not necessarily ‘legitimate’ macroeconomic looting, in the wake of the so-called process of financial valorization. A system that had given priority to large economic groups and conglomerates thus led to the wholesale transfer of income and wealth to these interests. The rest of society has remained devastated, lacking food, health, education, security, adequate housing, etc. This can be also visualized as part of a vast process whereby the state adopted a series of transfer mechanisms of income and wealth in favor of these ‘privileged’ sectors. These measures did not only serve to increase growth and accumulation – on the contrary, the performance of the economy in recent years has been notorious – but the social consequences and social costs they caused has created an enormous predicament for the future of Argentine society.

▬ Miguel Teubal, Rise and Collapse of Neoliberalism in Argentina

Oops! Try this link:

▬ Paul Cooney, Argentina’s Quarter Century Experiment with Neoliberalism: From Dcitatorship to Depression

LRT: I’d draw your attention to this part of the post:

Assuming that Yves facts are accurate, this means that a pack of bamboozeling bozo banksters lent Greece more than twice what it could conceivably have paid back.

Whether this was a deliberate strategy to undo the nation state, I don’t know. Whether it was black ops, dark arts, or voodoo, I also don’t know.

The only thing that I can personally state with conviction is that I am ever damn stupid enough to lend **anyone** twice what they can possibly hope to repay me, then in a genuinely capitalist economy I have taken a risk so unbelievably stupid that I should be banned from ever touching money again.

Yet these crybaby banksters are going all control-freak on Greece?!

To repeat: the loans were **far** in excess of the stated value of assets.

Were the banksters so stupid they failed to consider that fact?

Or were the loans merely a ruse, a Phase I of Neofeudalist Overlordship that was necessary to claim control of the economic future of an entire nation’s citizens and turn them into debt-slaves?

Either the banksters were criminally stupid.

Or they were deliberately using credit in order to phase in, and then implement, Neofeudalism.

Since you’re the rogue trader, you plan to make a lot on money on these Greek defaults and 2nd Lehman events, right?

leroguetradeur, have that sinking feeling too, are you someone more in the know? – Sy Krass

Hallelujah to the rising resistance. If not now, then when? There can no longer be any doubt about the act of war – a literal cross-border invasion wouldn’t be any more stark.

The criminals are trying to use the debt as a pretext to steal all the real assets they can before the debtor’s inevitable default. (Which the criminals want to cause to happen on their own timetable, and hopefully under conditions which can continue the indenture. It’s just like a vastly larger version of the HAMP.)

There are no legitimate debts between citizens here. This is a vicious war launched by history’s most vile criminals. By now everyone who’s not one of these elites has to face facts: They intend to enslave you or kill you. Only your resistance to the bitter end can prevent this and regain your freedom and prosperity.

Is the prospect frightening? Read that post again, and consider the permanent tyranny of this gangster filth. What fate could possibly be worse than that?

There are no good options for the Greeks, and the EU proposal may well be the least bad.

You tolerate some really disgusting comments. Although I suppose when you describe a €110 billion bailout as Rape and Pillage, you get the commenters you deserve.

Funny how you seem to take hostile comments towards bankers personally. Perhaps you should consider what the industry has done to elicit such ire. We’ve just been through the greatest looting of the public purse in human history, and the beneficiaries have been an extraordinarily small group. Don’t you think that might make people a tad unhappy, particularly since the perps are singularly unrepentant and have not changed their conduct?