Yesterday, I made a basic point about the financial statements of banks and other financial firms, citing Steve Waldman, who said it better than I could:

Bank capital cannot be measured. Think about that until you really get it. “Large complex financial institutions” report leverage ratios and “tier one” capital and all kinds of aromatic stuff. But those numbers are meaningless. For any large complex financial institution levered at the House-proposed limit of 15×, a reasonable confidence interval surrounding its estimate of bank capital would be greater than 100% of the reported value. In English, we cannot distinguish “well capitalized” from insolvent banks, even in good times, and regardless of their formal statements.

The illustration of Steve’s point was that investors freaked out on Monday about an estimate that Bank of America might need to raise $40 to $50 billion in equity. The idea that the market would be surprised (as in not know that and simultaneously regard that figure as plausible) says a great deal about how little confidence investors have in their knowledge of big financial firms.

The debate over Bank of America continued, with Dealbreaker providing another illustration of lack of convergence:

In particular, given the rumors swirling that that BofA is going to be rolled up into the One Bank To Rule Them All, it might be worth checking in with JPMorgan. Their credit analysts have a note out today, and they think the news is so bad it’s good:

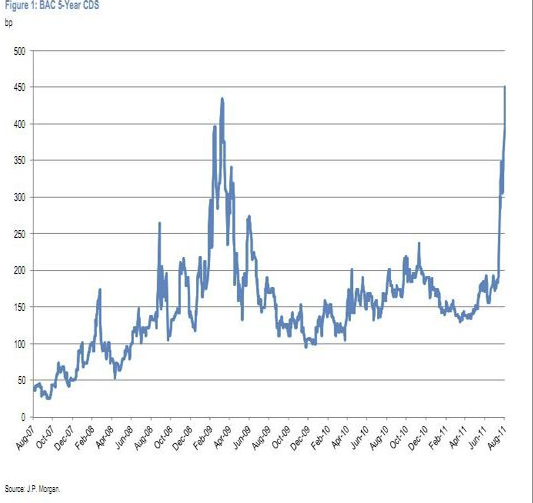

Sentiment on BAC has become increasingly negative over the past few weeks, and is reflected in a roughly 40% decline in its stock price over the past month, vs. a 15% decline in the S&P 500, and the inversion of the CDS curve. We think it’s prudent for management to address concerns in the credit market, which is very stressed, given the inversion of the company’s CDS curve. Thus, we are upgrading our rating to Neutral from Underweight. In our view, the pressure from the credit and equity markets is at a point that is increasingly hard for management to ignore. We think this may actually increase the chances of a credit-positive development, such as a capital raise.

They add that “current valuations appear to us to reflect irrationality, rather than the true, manageable, scope of issues facing the company.” Valuations such as 445bp 5-year CDS, 550bp 1-year CDS, and oh yeah this:

So to recap, JPMorgan is positive on the credit because they think markets will force BofA to dilute shareholders with a capital raise. Dick Bove is positive on the equity because he thinks that’s physically impossible. The markets – I guess they sort of seem to be in Bove’s camp, what with CDS at all-time highs and inverted and the stock down just 2% today.

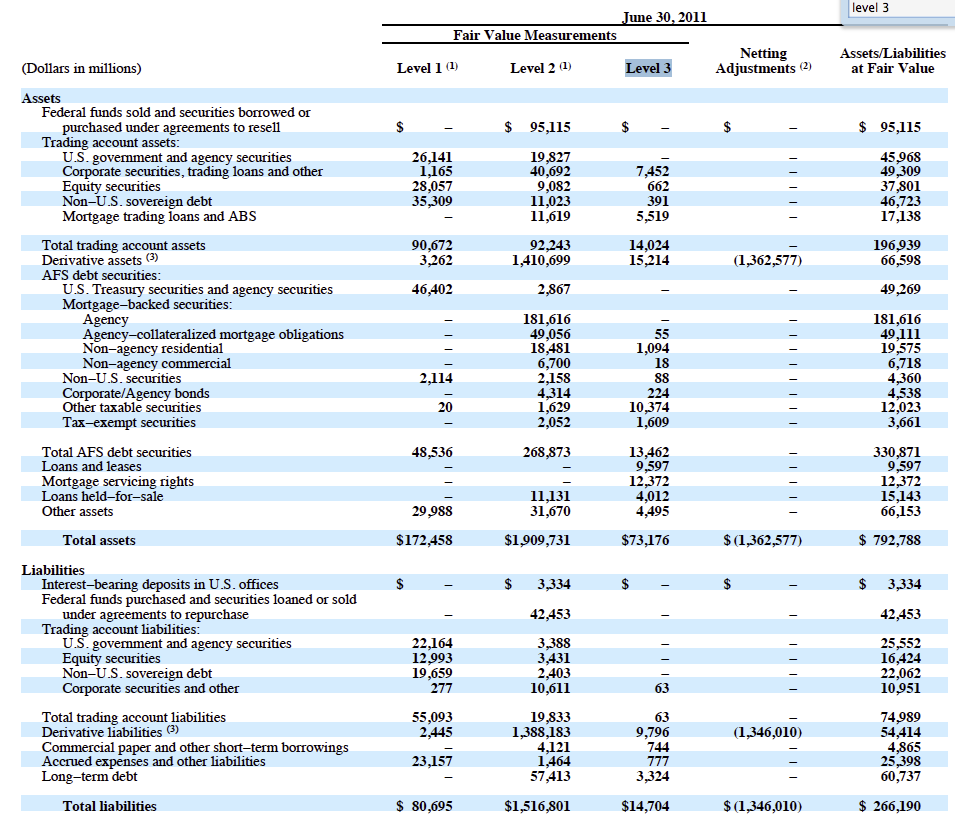

But digging further into their financials does not improve the picture. Consider their Level 2 and Level 3 assets. Remember, Level 3 are commonly referred to as “mark to make believe” and Level 2 are derived using models, but at least some of the inputs are “observable” (click to enlarge):

Ignore the derivatives section and the netting adjustment, just look at the asset section, starting with “AFS debt securities”. On a roughly $2.3 trillion balance sheet, you have roughly $58 billion of Level 3 assets. I can tell you with great confidence the $12 billion of mortgage servicing rights is worth zero and should probably be reclassified as a liability. I owe you a post on the recent “sales” of servicers, and the dirty secret is they have been dressed up in quite a misleading manner as far as the public is concerned.

And look at the Level 2 assets, roughly $500 billion in the section I highlighted. Ouch.

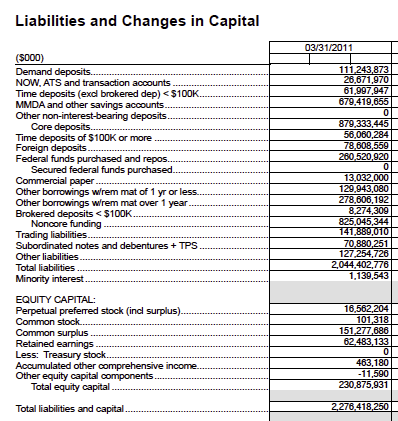

Now let’s get to how BofA is financed. One reader kept hectoring me that the Charlotte bank has a trillion dollars of deposits. Wellie, it has an over $2 trillion balance sheet, and the part that is not funded by deposits isn’t all funded by equity, so that assertion about deposits does not mean they are as solid as Gibraltar.

Let’s look at their funding, per their most recent Y9 (click to enlarge):

First, they don’t have $1 trillion in core deposits, it is under $900 billion.

Of the non-core deposits, I’m not as worried as repo as I might be, since repo these days seems to be pretty much entirely Treasuries and agencies, and increases in haircuts will probably be the result of volatility (and that has already happened to a degree). The categories that might have some flight risk are trading liabilities ($142 billion), borrowings of estimated maturity of less than a year ($130 billion) and commercial paper (a trivial $13 billion).

Now bank defenders will say that post the crisis, all the banks have much bigger liquidity buffers, usually now measured in months, not weeks. True, but consider: how long was Lehman on the ropes? It was months. When Bear went under, everyone knew Lehman was next on the list, since it was a bigger version of the same bank. Lehman failed almost exactly six months after Bear. It hung in the breeze because no one knew what to do with them. Don’t underestimate how long BofA could twist in the wind if management doesn’t succeed in restoring investor confidence. Second, WaMu was much more heavily deposit funded than BofA, and it suffered a bank run. Don’t think large banks are necessarily immune to runs.

Amusingly, BofA took issue with my post yesterday, but they didn’t contact me. Instead, they hectored Henry Blodget. Rather weird and frankly a bit cowardly, since Charlie Gaparino was quite able to find and yell at me on the phone within a couple of hours of my saying bad stuff about his positive coverage of Lehman in 2008.

Now the most interesting part is not what they disagreed with, but what they tacitly admitted to. I wasn’t doing a valuation, merely pointing out some items on their balance sheet that investors might question. One was second liens, which I suggested might need to be written down by $48 billion or so. Not a peep on that one. Nor did they push back on saying some, perhaps a lot of their $78 billion of goodwill might have air in it (that might be less sensitive, in their opinion, since they have taken to focusing on tangible common equity, which is also what US regulators have taken to emphasizing. But historically, investors care about book equity too, after all, when someone pays a merger premium, investors like to think they got value for money).

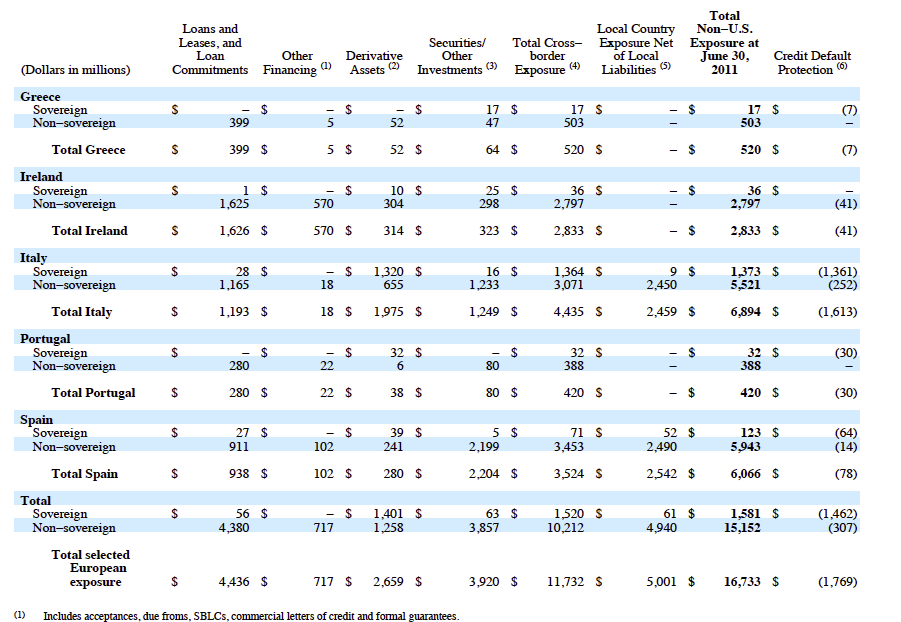

On the two items they objected to, one was on the question of their Eurorisk. My comment based on what Bank of America said in its recent Fairholme conference call. So while they do have a “gotcha” here, it is a bit churlish for them to make a mistake or have an inconsistency in their investor presentation and then charge people who rely on their statements with making an error.

I said that the conference call gave a figure of $17 billion of European sovereign exposures and claimed it was hedge (I expressed my skepticism as to how good those hedges would prove to be in a crisis). From the transcript:

The area that’s drawn the most attention are obviously the countries of Greece, Ireland, Italy, Portugal, and Spain, and going back to the first quarter of 2010 as we started thinking about sovereign debt and sovereign exposure, as Brian alluded to, we took a hard look at the types of risk that we were taking and focused very much to make sure that we were comfortable to the extent that there was a prolonged period where this went on, and if you look at our 10-Q, I think that the most telling thing that we can speak to is, within that region, we had $16.7 billion of exposure. Of that exposure, roughly $1.6 billion of it was to sovereign entities and we had credit default protection on roughly $1.5 billion of that $1.6 billion of exposure.

You can see Thompson said they have $16.7 billion and then said they have $1.6 billion. The 10-Q clarifies matters (click to enlarge):

But consider the question I raised originally: this is PIIGS only. As we know, the big risk is of exposure is to banks, and even more so the banks in the big creditor nations, France and Germany. And Belgium is also at risk. So the numbers BofA provided, as I indicted in the earlier post, are pretty incomplete. (There is also a potential secondary issue, in that these figures do not include unused lines of credit. Anyone can hit an unused LOC. These amounts can change big time, and quickly. AIG did draw down all its backup lines before it was bailed out, every last one. By contrast, Bear has huge unused backup lines from Japanese banks, my Japanese bank friends tell me they are astonished Bear did not draw down on them.)

I do have a bona fide stuff up. I read the Y9 reports to get various balance sheet items (I prefer Y9s because they provide margin info and are reported on a consistent basis across banks) . As you an see from the extract above, they are in itty bitty type with dense lines and I scanned incorrectly across the line. Aargh. The commercial real estate average balance for the first six months of 2011 per their 10-Q is $47 billion. This is very embarrassing and I am truly sorry.

But even making that correction, you can see it does not change the overall picture much. There are so many open questions about Bank of America that investors have good reason to be cautious. And the opacity of bank statements and the concerns around how quickly valuations can change means worries are not necessarily ill founded.

the elephant in the room is the derivatives. they netted them out and they total over a trillion. if the credit crunch gets worse there will be failure of counterparties. bac will not be able to collect on their good bets and they will still be expected to pay off on their bad bets. the amounts involved are huge. that is no way to run a tbtf bank.

At a minimum, you would think that the regulators would force them to breakout interest rate, credit, equity and fx derivatives separately.

Also, at a minimum, you would think regulators could come up with a standard set of zero coupon rates and a standard vol surface and force all dealers to mark their vanilla interest rate derivatives using the same inputs — no need for Level 2 mystery here.

I have absolute confidence that B of A shows a profit on their swaps with GS and GS shows a profit on their swaps with B of A and no one is the wiser!

thank you, barry.

The OCC quarterly report breaks out the interest, FOREX and equity swaps, 55 Trillion total notional, and only 58 Billion in Equities.

A question I have is what all the banks’ SIVs have at risk. What is in that 5 Trillion dollar bag? Take a page out of Enron’s book and stuff the garbage in the SIV.

http://www.occ.gov/topics/capital-markets/financial-markets/trading/derivatives/dq111.pdf

How can a bank get away with classifying “U.S government and agency securities” as Level 2?

Maybe they include IO/PO strips or seriously off the run issues? Hopefully traders will opine. But that proves the point….

Yves vs. Goliath.

The more I look at that statement, the less sense it makes or it is designed to confuse.

A substantial portion of BAC’s interest rate derivatives are cleared at LCH — so they should be classified as Level 1 (equal to being traded on an exchange). Yet, this report shows only a fraction of their derivatives as Level 1.

Agree with Yves here that these reports don’t stand even the most scant scrutiny

Kinda reminds me of the Royal Bank of Sootland’s sheets, just before they crashed and burned and were broken up…..

Sorry, that was “Royal Bank of SCOTLAND”

Question for any reader: If a person buys bonds thru Merrill Lynch, and Merrill Lynch becomes insolvent, are the bonds secure? Are they held in the name of the purchaser on the computer programs of Merril Lynch?

short answer, yes to an extent. lookup the SIPC page on your broker’s website.

if you;re still confused talk to a second-year law student who has taken a securities law class.

That depends on whether you leave the bonds in your “Merrill Lynch account” (hint: don’t, although it does have SIPC protection), or force Merrill Lynch to issue them directly to you (they will charge a fee, because they’re evil, but do it anyway).

I do have stuff in one brokerage account, but only because I trust the brokerage to be run fairly conservatively (it’s Charles Schwab). I keep other stuff in my own name just because.

Meredith Whitney on Bloomberg Radio this morning suggested that all of the large banks including BofA (especially BofA) are as transparent as they have ever been. She sees no major issues with BofA and is bewildered by the sharp decline in share price. She does say that on a speculative basis BofA would not be here first choice. Loud and Clear she said this is not 2008 or anything remotely close.

link to summary

http://www.bloomberg.com/news/2011-08-24/meredith-whitney-says-there-s-no-mad-dash-for-capital-at-bofa.html

http://newsandinsight.thomsonreuters.com/Legal/News/2011/08_-_August/Did_BofA_give_BNY_Mellon_extra_indemnity_in_$8_5_bn_MBS_deal_/

This is unrelated to BAC’s disclosure opacity, but is astonishing in terms of showing another Achilles heel in the proposed mortgage settlement.

It’s been a few years, but wasn’t Bank of New York Mellon Corp., and Goldman Sachs, involved with BofA’s giving that unsecured $1.5 billion loan to DB Shaw involving the Russian bonds, which then blew up, putting BofA in a vulnerable position for the takeover by Nations Bank?

And wasn’t that when Corzine, of Goldman Sachs, was looking into a buyout of Mellon, which caused Paulson at Goldman to go ballistic at Corzine, resulting in Corzine’s leaving GS? (Evidently, and supposition on my part, but Corzine appears not to have been part of their inner circle?)

What do you guys reckon are the odds of BofA going under? The balance sheet and their reported assets are clearly misleading, but assuming the credit crunch continues, how long do you think they can hold out? Basically, how can you objectively get a range as to what BofA is worth per share. It’s seems inexpensive right now, but that’s only if you take everything it face value. Is this a good distress buying opportunity or something to steer clear of?

Odds of BoA going under: 100%. Well, it might not go under per se, but if it survives it will be via a dilutive restructuring which will give current stockholders next to nothing.

When: God only knows. Could be ten years from now, or fifteen; could be next week.

“First, they don’t have $1 trillion in core deposits, it is under $900 million.”

Shouldn’t that read “under $900 billion”? The core deposits entry is 879,333,445, but is in thousands of dollars.

“First, they don’t have $1 trillion in core deposits, it is under $900 million.”

Typo, I think – “billion” not “million”

Sorry, as I started typing, got distracted and came back after a few minutes – I did not see above post by Michael Cain when I started typing.

Yves, I’ve been reading the latest 10-Q for BAC this week — what about on page 143 for Credit Derivatives. They have credit default swaps and other credit derivatives with a carrying value of 51 billion but a total-maximum payout value of 2 trillion dollars. How are investors supposed to make anything of those numbers?

On Level 2 including US government and agency securities: my understanding is that Level 1 is generally exchange traded securities or otherwise very actively traded securities. Most bonds in the secondary market do not fall in this category as they trade less frequently and there is not one market price but a number of quotes or inputs (spread, prepayment speed etc.). If I wanted to buy an IBM bond today it would be at an agreed spread that then I would agree to a treasury spot price to calculate the IBM bond price. I think most bonds fall in Level II for fianancial institutions as they feel they are being more conservative in disclosure. I know it most annual statements for fixed income funds I see, most assets are considered Level II. I am not sure how to reference in the new accounting codification, but as FAS 157, 28b and c includes the following reference to quotes in non-active markets and inputs used for a Level II security:

b. Quoted prices for identical or similar assets or liabilities in markets that are not active, that is,

markets in which there are few transactions for the asset or liability, the prices are not current, or price quotations vary substantially either over time or among market makers (for example, some brokered markets), or in which little information is released publicly (for example, a principal-to-principal market)

c. Inputs other than quoted prices that are observable for the asset or liability (for example, interest rates and yield curves observable at commonly quoted intervals, volatilities, prepayment speeds, loss severities, credit risks, and default rates)

Corporate bonds are the classic Level 2 asset, but I really doubt if any dealer has big corporate bond inventories. The dealers have trained investors to use CDS instead.

In the crisis, dealers would get prices on CLOs (much less liquid) for gaming purposes. MBS prices would probably be derived from Markit indexes.

YS:

I have complained about bad bank accounting for decades. The truth: these things are UNAUDITABLE. No one knows what their assets are worth.

IA

What assets are “worth” is obviously extremely subjective and ever fluctuating. If BoA had to liquidate this amount of assets, the price they could get would plummet. Especially if the market knows they are desperate or compelled to sell.

Agree, impossible to imagine solvency under the fire sale prices for TBTF. Although I learned to trust Yves expertise, it still makes me wonder which part – objective or anticipated – makes the largest impact on the final outcome. I could never tell for sure.

Yves, thank you for the food for thought as always.

What happens to Basel requirements if BofA is required to repurchase all of the bad mortgages that Countrywide wrote.

If the bank is forced to take many of those underwater mortgages back is this a double whammy? Not only does the bank have to pay to buy back the loan but won’t the bank have to boost their required capital as more risk assets are taken on their books?

Yves, you wrote: “First, they don’t have $1 trillion in core deposits, it is under $900 million”. Surely you meant $900 billion, right?

Yes, my too common typos. You can also see the actual value in the table I included.

One of your arguments is not complete. You state “As we know, the big risk is of exposure is to banks, and even more so the banks in the big creditor nations, France and Germany. And Belgium is also at risk.”

But then don’t elaborate on any scenario what so ever in regards to Germany, why not? You need to provide a case scenario there, otherwise you argument is null. Judging from you comment in the article, you are assuming a worst case scenario in Germany and France, correct? Yet that is not a likely outcome.

So I ask, what scenario do you think will happen? I tend to the think the euro fears abpout Italy and Spain are over cooked myself. Italy’s is more political. From my view of the sov. debt in their 10-q it looks like they aren’t exposed to Greece and Port, but that is clearly what you seemed to allude to in your original article. Which tends to make me believe them more than you. Just saying.

thanks,

Surf

There have been NUMEROUS posts here, a raft of articles at the Financial Times, and plenty of coverage on the blogosphere on how the European debt crisis is actually a banking crisis. Lots of charts showing how the risks map back to the banks, most of all the French and German banks. Go to FT Alphaville, for starters.

This is so well know as to not need to be discussed in detail. This is a blog post, not a graduate thesis.

Perhaps we can just trust that BofA doesn’t have much exposure to French/German banks, because if they did, they would certainly have included it in their report..

:)

German and French banks have huge exposure to PIGS countries BofA has a big exposure to German and French banks.

Today we found out that it is only going to be a $5 bill writedown on the Greek bond swap? While not great, it also shows that risk to germany and france is marginal. Additionally, a majority of Italy’s debt is owned by Italians, plus their risk is political risk. Same with Spain.

I get it I asked a tough question and nobody can back up their response with numbers. That is the problem with the analysis. Can any of you name the actual French and german banks and their exposure rates to the PIGS country? You say they are exposed, but by how much? give figures, Please dont answer with “a lot” or yadda yadda yadda, because that means you really haven’t looked into it. I have pretty extensively and its really not that bad, even with your worst case scenario.

Deutsche Bank.

Most of the other German and French banks seem to have been less inclined to play with exotic “securities”.

So, uh… I’m curious now, and since you’ve not only brought it up, twice, and looked into it… what are the figures?

I will list the largest 5 from both France and Germany tomorrow. I posed the same question in the follow up article today and want to see if anyone takes the challenge.

It is actually not that hard to find this info, it just takes leg work and a little bit of knowledge as to how foreign companies file. Its really not that hard, it just takes time. That is why I posed the question because from my perspective the question could be answered by just digging a little further for 2 hours. Thats all it really took for me to find it. The author didn’t take the time, that is the point I am going to make. I used to be a huge NC fan, but man if you are gonna provide a bear case make sure it is bullet proof. And with WB making an investment today it just make NC look bad. I explained my reasons in today’s post if you want to see why.

Not a word of Schneiderman today.

Been chewing on this all day. It’s important to remember that it doesn’t have to be like this. The presentation is intended to avoid disclosure while giving the appearance of meeting the requirements for disclosure. The interests of shareholders and speculators, global markets and regulators, borrowers and lowly users of bank services among potential readers of such reports do not, obviously, overlap. I continue to maintain that it would be pretty simple and rather informative to start with the unquestionably money good assets on the one side and the contractual liabilities that reach to the US taxpayer through the FDIC on the other. These are two reference points about which there should be little controversy as to valuation, which is what makes the exercise valuable. In old fashioned credit analysis, the ratio of cash plus collectible accounts receivable (loans) to current liabilities is known as “the acid test.”

Great starting point but how do you know for sure what is 100% money good?

There were times when everyone thought citigroup was money good without peeling back derivatives of what they thought was money good… If everyone is relying on everyone else to pay what’s money good? I’m reminded of something i read on *gasp* TBP. paraphrased…

Bernanke walks into a hotel and puts a hundred dollars on the counter, the hotelier immediately uses that to pay his cleaning staff, who uses that to pay her bill at the grocer who uses that to pay her financial planner who uses that to pay his overdue bill with a prostitute who uses that to pay her bill at the hotel. At that moment bernanke changes his mind and decides not to stay at the hotel. He takes his c note and leaves.

Who was money good in all that? A: None of them except bernanke. All roads lead to rome as it were.

Bricks and mortar are money good (well, depending on asbestos exposure, I suppose).

Nothing else is. *Nothing*. Everything else depends on how contracts were written, and we have ample evidence that contract-writing was sloppy and irresponsible.

Worse, regardless of how contracts are written, they are no longer enforced. Or they are… sometimes. A contract from a bank is now worth no more than the word of a banker.

“An illegal agreement, under the common law of contract, is one that the courts will not enforce because the purpose of the agreement is to achieve an illegal end.”

“The idea behind this federally-guided “settlement” is to concentrate and centralize all the legal exposure accrued by this generation of grotesque banker corruption in one place, put one single price tag on it that everyone can live with, and then stuff the details into a titanium canister before shooting it into deep space.” – Matt Taibbi

This write-up along with most of the trash on blogs like this are universally negative, cater to short sellers, omit basic, yet material FASB, GAAP, and regulatory understanding, and are generally comparable to 4th graders saying, ‘no you, no way, you.’

Well done acronym man. Whole lot o’ control fraud goin’ on.

Evict Shaun Donovan!

Puh-leeze Ms. Yves! What a world we live in…

CIFG Opposes Bank of America’s Mortgage-Bond Settlement With Investors

http://www.bloomberg.com/news/2011-08-24/cifg-opposes-bank-of-america-mortgage-bond-accord-with-investors.html

bond insurance company CIFG Assurance North America Inc., that is.

I agree with “simpleton” what is Yves thesis for this 12 bill getting written down to zero? His experience???? Sorry, but that’s not enough man. Where is his correct call in 2008, I haven’t seen it, which makes this guy extremely uncredible from my view. Just wondering where is the 2008 correct call Yves? You have yet to answer me in multiple posts on this question, why? Why? Why?

Surfer!

Yves, in your post, you said: “I can tell you with great confidence the $12 billion of mortgage servicing rights is worth zero and should probably be reclassified as a liability. ”

Yves, if the shoe were on the other, Bank of America, foot, and they said “we can tell you with great confidence that the mortgage servicing rights are worth $12 billion” would you believe them?

The point is, their confidence, or at least their statements, are now being parsed by any number of people. You can’t simply dismiss the statement on the basis that we are to believe in you versus them because you have ‘great confidence.”

In the aftermath of 2008, it is understandable that people might be wary of bank accounting, but so might FASB and any number of law firms currently engaged in suing Bank of America. I don’t think this is lost on Bank of America accountants themselves. So sorry, but Lets See What Sticks has a point.

As does Meredith Whitney, a person you’ve spoken of highly in the past – and who certainly doesn’t have a bullish reputation – but you haven’t responded to her opinion on Bank of America yet.

Seriously? All of this imaginary paper wealth represented by worthless promises to pay in the future, and derived from projected future cash flows under a “going concern assumption”(for the entire global economy on the precipice of a collapse no less). What’s a dollar going to be worth(how many slices of bread or quarts of gasoline will it buy) in 3 years, anybody know?

Imaginary values calculated using the same techniques, assumptions and principles, by the same people(or clones of), and audited by the same firms that brought us the financial crisis of 2008, all supposedly back stopped by the dubious full faith and credit of a bankrupt U.S. government.

Seriously? What did Lehman’s balance sheet look like a year before the collapse? Heck even a quarter or two before the collapse? I admit, I don’t know, but it seems to me I remember reading that the Lehman executives were receiving obscene bonuses, based on imaginary projected future cash flows and healthy balance sheet ratios, just prior to the company going up in smoke when the mirrors or mirage busted.

And even if they are fully hedged with so called derivative contracts(bets), if things start coming unraveled, someone else is going to be on the losing side of those trillion dollar bets, and that could be enough to start a chain of defaults in motion that would render all their assumptions used to value their own imaginary assets next to worthless.

I down loaded their latest quarterly SEC filings and it looks like 200 pages of gobble-dee-gook to me, but admittedly I am no Wall Street financial analyst. I may be wrong, but it seems to me that all of these Level 1 and level 2 market value assets could be just about worthless the day after the balance sheet is issued. In fact there’s probably a good chance of it. My advice, better get your checking and savings account money out of this bank while you can. It may be cliche but “where there’s smoke there’s probably fire”.

BAC doesn’t need capital? Warren Buffets five hundred billion dollar investment says differently.