Cross-posted from Credit Writedowns

Today is the big European summit. Expectations are low because European politics have become messy. At the beginning of September I wrote about European political dysfunction:

Clearly, [Former ECB Chief Economist Juergen] Stark sees the monetisation path the ECB is on as not at all compatible with the ECB’s mandate.

Separately, the noises coming out of the German governing coalition show exasperation with the progress in Greece. Edward Hugh writes that “a Greek euro exit is no longer the unthinkable taboo topic”. This is especially true after the beating Angela Merkel’s party took in elections in her home state of Mecklenburg-Vorpommern this past weekend.

Fiscal consolidation is not expansionary. Moreover, it increases deficits due to the increase in spending on fiscal stabilisers and the decrease in tax receipts – that is unless the cuts are extremely large. There is zero chance that Greece will make its targets. I don’t expect Portugal, Italy, Ireland or Spain to meet their targets either, especially given the incipient double dip we are witnessing.

As the Germans are likely to see their fiscal trajectory deteriorate markedly in this environment due to the anaemic domestic demand and dependence on exports, their willingness to fund bailouts will evaporate. The political calculus may turn to topping up capital at underfunded German banks. Greece, at a minimum, will default. Indeed, without the ECB’s assistance Italy would default – that’s the real Armageddon scenario because no amount of recapitalisation would prevent a deep depression. Stark’s resignation increases the chances that just this will occur.

The euro zone is coming apart at the seams. Right now the economic outlook looks bleak. If you are a euro zone investor, the policy outlook is extremely volatile. That means avoiding the periphery and piling into German and Dutch bonds and/or gold because we are about to see how limited the ECB’s bond purchases are.

This is an update of sorts.

On the first topic from above, many at the ECB still see monetisation as not at all compatible with its mandate. I don’t care what Silvio Berlusconi says about the need for a lender of last resort. Italy will dangle in the wind until they make structural reforms. Only then – or if spreads shoot to the moon – will we see whether the ECB backstops Italian debt.

Topic number two: Greece. The talk now is of 50-60% haircuts as we predicted a couple of weeks ago. Back then, there were comically weak denials. Now everyone has admitted the default and hard restructuring in Greece is upon us. German institutions are preparing for the event. Both Deutsche Bank and Münchener Rück have marked down their books for example. What about the French? That is still a question.

The third topic I discussed above, the anti-growth nature of fiscal consolidation has now been confirmed by the Troika in Greece via a leaked document we posted a few days ago. Clearly, it is this reality which has caused the troika to move to a hard restructuring. Spain has already acknowledged it won’t make its fiscal targets. I don’t expect Ireland or Portugal to do either because Europe is going into a recession due to an anti-growth fiscal policy and the ill effects of the sovereign debt crisis. Ireland looks good now. But recession will create problems.

I said in August:

I think the ECB will eventually step in here. They have already gone in the market for Ireland and Portugal. The ECB increased liquidity for banks, offering up unlimited funds for six months. These are nice measures. But they don’t go nearly far enough. They will have to act as lender of last resort for the entire euro zone and eventually they will accede to this.

The problem is what happens between now and then. You saw the interview with Elga Bartsch of Morgan Stanley. She was saying the ECB can step in at any time if need be, meaning there is no rush. And that is certainly the way the ECB has acted. However, I think this kind of panic we are witnessing right now, this kind of market meltdown, will have grave consequences for a European and American economy already at stall speed.

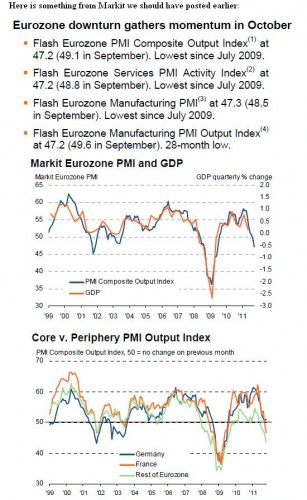

The consequences are recession all around. The ECB’s stance has led to crisis in sovereign debt and the banking sector. All indications are that Europe is already in a double-dip recession. The latest data reinforce this. Look at these charts from Global Macro Monitor from yesterday’s Eurozone Flash PMI. The composite index is below 50 at 47.2, it’s lowest in over two years. That means recession. And if you look at core Europe, you can see that France and Germany are catching up to the rest of Europe on the downside.

On the fourth topic of Germany having its fill of bailouts and moving to recapitalisation, that is definitely what is happening here. But Italy is the real problem for the Germans. Politically, there is no appetite to bail out the Italians. As I said above, “without the ECB’s assistance Italy would default – that’s the real Armageddon scenario because no amount of recapitalisation would prevent a deep depression.” The ECB is going to have to monetise Italian debt or a deep Depression is coming. There is no other choice. Silvio Berlusconi recognizes this and said as much yesterday. However, the ECB needs movement on the reform front first. The question is whether the reforms happen before the bank sector implodes and sovereign yields in Italy and Belgium spike. If they don’t, there will be contagion into the real economy and the recession in the euro zone will deepen.

Yes, I still think the euro zone is coming apart at the seams. The dust-up between Merkel, Sarkozy and Berlusconi is quite ugly, especially ahead of a critical summit. Moreover, the economic outlook looks bleak. As I have written increasingly, nationalism and populism will become ever more powerful issues as this difficult economic period continues.

Ray Dalio puts it well:

This growing populism will have important implications for monetary, fiscal and trade policies and will significantly increase risks of a markets downturn and a global depression.

I wrote two years ago that:

this kind of volatility will induce a wave of populist sentiment, leading to an unpredictable and violent geopolitical climate and the likelihood of more muscular forms of government.

We are now entering that period.

‘The ECB is going to have to monetise Italian debt or a deep Depression is coming. There is no other choice.’

Apparently the Bundestag thinks there IS another choice:

http://www.bloomberg.com/news/2011-10-25/need-for-ecb-bond-buying-ends-with-new-efsf-german-motion-says.html

How can anyone expect a smooth handover from the fully-functioning ECB to the largely-vaporware EFSF? It could easily take months.

But assume, for the sake of discussion, that it occurs as planned. Unlike ECB bond purchases, which effectively create new reserves, purchases by the non-bank EFSF do not create reserves. Rather, existing reserves are merely reallocated (a circularity which ought to give one pause).

As always, the German mentality is preoccupied with the potential for unrestrained inflationism by the ECB. However, the well-established ECB has considerably more flexibility and market credibility than the untested start-up EFSF. Tying the ECB’s hands while Europe may be sliding into recession could prove to be a serious blunder.

Meanwhile, the banksters’ ultimate political leverage only can be applied in conjunction with some serious, scary market chaos. Their threats will not resonate with the public or parliamentarians during a bear market rally.

Bild has an article showing Greeks lined up at Athens banks before 8 a.m. yesterday, converting their deposits into euro cash. That’s sure as hell what I’d be doing!

Which brings up a point: not only does the ECB face writeoffs on its outright Greek bond purchases … but also, the tens of billions of euros it has advanced to the Greek banking system against Greek bond collateral are at risk as well. A few billion here, a few billion there, and pretty soon you’re talkin’ about negative net worth. Not that it matters for a central bank, with its irredeemable liabilities. But the Germans won’t like it … not at all.

I can’t understand why so many would want the ECB to monetize Italian debt. Aren’t the German voters overwhelmingly against this? Isn’t Germany a democracy? Hasn’t NK taken a very Pro-OWS stance?

If so, how can NK readers support OWS in the USA, and simultaneously support the ECB’s violation of democracy in the EZ?

All the analysis above is accurate. Still, in my view it is premature to speculate upon the end of the Eurozone.

All the centrifugal sources of what here is called “populism” (I would call it the last traces of “real democracy”) are not strong enough so far to throw in a bigger monkey wrench into Brussels machinery.

What we experience now is political poker of money (Germany) for promises (Italy). A deal will be made as the South has better cards (and more seats at the ECB table).

Later on we may find out that money is not much more than a promise either.

Maybe 2012, but more probably 2013-15, these things will come to the fore.

‘I wrote two years ago that: this kind of volatility will induce a wave of populist sentiment, leading to an unpredictable and violent geopolitical climate and the likelihood of more muscular forms of government. We are now entering that period.’

Yep, I’d call fisticuffs in parliament a ‘more muscular form of government’ to be sure:

http://www.reuters.com/article/2011/10/26/us-italy-fight-idUSTRE79P37V20111026

Time to replace all those cherrywood parliamentary desks with indestructible stainless steel prison furniture!

Europe can’t even fix Greece. How is it going to fix anything else? A hard restructuring, now on the horizon, is not going to fix Greece either. Again I think an understanding of the kleptocratic mindset is essential. It is all about looting and how to keep the looting going. Nothing in it is about fixing. This has been going for more than a year and a half. It is not one country or one problem, but a constellation of problems at the heart of the Euro system itself, both core and periphery.

It is like a nuke ticking away in the middle of a city. The authorities know where it is and how to disarm it, but they spend all their time, filled with numerous lunch breaks, debating nuclear energy. Meanwhile they are quietly trying to protect those who put the bomb there in the first place and not so quietly blaming the ordinary citizens likely to be blown up by it. In such an environment, the very idea that the authorities will, or even want to, save the public seems bizarrely out of place.

Exactly. From the Guardian news blog at midday:

http://www.guardian.co.uk/business/blog/2011/oct/26/eurozone-debt-crisis-talks-live

Per the Oct. 21st Troika projection, a 50% haircut leaves Greek debt at 120% of GDP in 2020 — higher than it was when the crisis broke out in 2010!

Meanwhile, with Greece left structurally uncompetitive in the eurozone and its economy continuing to shrink, this is a prescription for a decade of unremitting depression.

But it won’t work because of a point which is of no concern to the banksters — democratic accountability. Long before 2020 rolls around, Greek voters will elect a government that will repudiate everything, stuff the banksters, and start with a clean slate.

Greece will look a lot like this scene recorded today, except that the hecklers will be heaving bricks and Molotov cocktails at their so-called leaders:

http://www.youtube.com/watch?v=KjCtwoai0pE&feature=player_embedded

The Reuters Headline article is the incoming Head of the ECB saying the ECB will monetize debt as needed.

Something else that needs to be discussed here is Germany shut off so many nuclear reactors so quickly after Fukushima that it has had such a dramatic affect on energy costs (especially for industry), that it going to affect exports as industrialization flees the country for lower energy/operation costs, and will affect GDP as money is “wasted” paying for energy from other countries. Given the importance of Germany in the EU this is a non-trivial concern.

Yves, I really like your blog, but the recurring pattern of gloom & doom when it comes to the “Euro endgame” and especially Germany’s role is getting a bit unnerving.

I don’t quite get why all the American blogosphere is so hell bent on using up all monetary firepower at the first sign of trouble. Have you learned nothing of the unfolding of the US-subprime and financial crisis?

After the first shock, when everyone agreed on reforms, this spirit quickly evaporated after the economy recovered. What would happen if Germany would happily use all their economic and financial might to bail out Greece, Italy and the Euro banks?

Everyone would be back to normal in no time. Only by letting the crisis unfold can Merkel force imbeciles like Berlusconi on track. Only now do we have a chance to force banks to boost their capital reserves. The EU needs this crisis to grow or die on it, if Germany were helicoptering money all over the PIIGS, we’d see a replay of the same some years down the road.

The real danger, of course is a military coup or election of a strong man in Greece.

Apart from that, what is so bad about austerity and forced reforms? Yes, it can lead to a recession, but we have had them every few years in the past. Contrary to popular scare mongering, a recession does not automatically have ripple effects all over the world, it usually affects the major trading partners but on side or the other recovers in time.

No offense, but you must be a very selective reader. It has been pointed out again and again that there are structural problems with the way the Eurozone was set up — the failing that is the stability & growth pact, the problems caused by having a single, low interest rate, the undervaluation of the DMark/Guilder going into the Euro — that make it impossible for the southern countries to compete. Furthermore, there is the fact that the ECB for instance deliberately chose to ignore the Spanish CB’s complaints (see for instance, this article by AEP from 2006) that a property bubble was inflating, and that they were powerless to do anything about it even though they did want to. As such, your notion that the south “simply has to adjust” seems to me rather callous, because I can guarantee you the Maastricht Treaty wasn’t written with the interests of the inhabitants of the “southern” Eurostates in mind; and the only thing they really did for which I would blame them (more specifically, their political elites) is for being stupid enough to be drawn into the Euro in the first place.

As for your suggestions that austerity is “harmless”, and that the “real threat” is that those Greeks vote in a “strong man”/a coup: 1. I suggest you try to live through it for a while before making such (uninformed) statements. The “recessions we’ve had every few years in the past” are in no way comparable to what’s being done to Ireland, Greece, Latvia, etc.

2. this worry of yours strikes me as an extremely patronizing, if not borderline racist (for lack of a better word) statement. You seem to be suggesting that the first thing Greeks do — when they are being forced to accept a reform package that has no democratic legitimacy whatsoever, except that it is “voted in” by their (strong-armed) legislature — is to give up (what’s left of) their democracy and pick a dictator to rule them, but that there is no reason for them to be so “angry” whatsoever.

For someone so out of breath you take a remarkably business as usual attitude.

Not sure where you come up with the canard of using monetary policy at the first signs of trouble. In the US case, the housing bubble had been predicted years in advance and that it would end badly. It blew up in August 2007 and the meltdown, also predicted, hit a year later in September 2008. I don’t think many of us were advocating a purely monetary approach to either of these crises. Indeed most of us have been quite critical of Fed policies both before and after these events.

Then you go on with the howler that “after the first shock, when everyone agreed on reforms”. Didn’t happen. We have been hypercritical of the joke Potemkin reforms epitomized by Dodd-Frank. And the economy recovered? Where? When? Again many of us have maintained there was no recovery only a temporary blip in the descent.

You then turn to Europe and show the same ignorance for what is going on there and how it has been analyzed here. After the Dubai sovereign debt crisis in 2009, it was known that Greece among others was going to have similar problems. And the Greek crisis duly hit in early 2010, more than a year and a half ago. So again what early signs are we talking about here? No one has said that letting the ECB print money would solve Greece’s and Europe’s problems. Indeed we have pointed out that Europe has several major problems that need to be solved together: the euro, the lack of a fiscal/debt union, bankrupt eurobanks, a weak ECB, unsustainable mercantilist trade patterns, and corrupt financial and political elites. An empowered ECB certainly has an important role to play in this, but it simply misstating the case to say that it is the solution.

You seem to buy into the discredited and oft debunked meme that Germany is the virtuous lender and the periphery is made up of profligate deadbeats. And then you discount the disastrous effects of austerity which has already put Europe into recession and countries like Greece into depression. To top it off you then minimize the effects of interconnectivity, effects that we already saw back in 2008.

I credit you for chutzpah coming here mischaracterizing most of what has been said and done here while at the same time showing massive gaping holes in your knowledge of the history of the last 3 years, let alone the last 35.

And just to respond to this nonsense shortly:

Are you kidding me? You know that we used to have these things called “regulators” once, right, who used to do roughly what that noun implies. It was only once the national politicians figured out that they could give their banker pals much more influence by supranationalizing banking regulation that things started to break down. Not regulating the banks was a choice they made, and then institutionalized by creating the Basel committee. This allowed the politicians to pretend that they no longer had any responsibilities when it came to regulation the banks, while they told no one what the effect would be of putting a bunch of weak hacks at best and neoliberal shills at worst into a room with an entire banking industry to whose “plight” — the fact that most banks up to the mid-1990s had been having trouble growing — those central bankers would be extremely sensitive.

Rather than be indentured debt serfs to foreign banks, the populace in these overindebted nations should insist on default, or a jubilee. It is the only way out of slavery. If individuals started defaultuing in their respective countries on their perosonal loans, which will be happening more and more anyways, countries would have to default anyways. Let the banks take the hit.

There is extreme irony in waiting with baited breath to see if the Eurocrats can agree on anything. However, we KNOW they are going to just throw money at this, they will try to save the banks by bankrupting everyone else trough profligate money printing. So we are, in effect, anxiously waiting for a catastrophic mistake.

A third grader can understand that using more debt to solve a debt crisis is beyond stupid, its suicidal. However, Japan, the USA and CHina are all engaged in the same idiocy. It may be a kleptocracy, but it s a very self-destructive one.

Right on!

What the moralist kleptocrats know but don’t want us to know that they know is this: Not all debts should be honored, most especially those of reckless lenders who made bad bets.

The political elites have a choice: grab the banksters by the huevos and drive them out of the building while getting the banks into receivership and clean up, or face extraordinarily angry constituents who won’t have any mercy for them.

DDT: ‘We know they are just going to throw money at this.’

Eventually, yes. But a Marketwatch article suggests that the new ECB chief, Mario Draghi, has very conventional instincts which may require a crisis to break:

http://www.marketwatch.com/story/dont-expect-mario-draghi-to-save-the-euro-2011-10-26?link=mw_story_kiosk

Facing skepticism because of his Italian nationality, Draghi might be forced to be more orthodox than the pope in his early days. But according to news reports, his first official statement today said he would continue with ‘unconventional measures’ of purchasing sovereign bonds, at least until the European Failed State Fund is up and running.

Trichet, ending his career under a cloud, has drastically expanded the ECB’s balance sheet with more than 500 billion euros of toxic sludge. Welcome to the treadmill, Signor Draghi!

The first rule of Ponzi Club is that you never talk about Ponzi Club.

How can the ECB be thought a lender of last resort? Is it not rather an unanchored purveyor of Ponzi finance, much like the Fed would be readily judged, too, were it not for a U.S. Treasury and a first-rate military above it?

It is disingenuous to suggest “growing populism will have important implications for monetary, fiscal and trade policies and will significantly increase risks of a market downturn and a global depression.” Maybe this is something that should have been thought of a few years back when a whole bunch of lip service was being given the “self-regulatory” nature of markets while at the same time due diligence was being relegated an entirely unprofitable business directive.

I don’t know exactly what you mean by the first paragraph, but the ECB is not at all like the Fed in that it has been effectively stripped of the ability to “print money,” with its elites largely very reluctant anyway. “Printing money” is what the European private banks do, by issuing loans. The problem is that they also have lost that ability due to, well, all the trouble that we have been witnessing.

The old Fed-ponzi narrative doesn’t quite work well with the ECB, if that’s what you are getting at.

> The ECB’s stance has led to crisis in sovereign debt and the banking sector.

No, too much spending and too much leverage have led to a crisis in sovereign debt and the banking sector.

> The ECB is going to have to monetise Italian debt or a

> deep Depression is coming. There is no other choice.

Baloney. Let the bondholders take the haircuts they deserve, nationalize the banks or start new banks where necessary, wipe the bad debt out of the system, let countries that want to leave the Euro leave, and get on with life. This Euro bailout drama is totally unproductive. It is a waste of everyone’s time.

For the US to print the private sector debt in half would require base money expansion by some fourty to fifty $trillion. Not going to happen. What is the comparable number in Europe?