For those who are fond of depicting Occupy Wall Street as a bunch of hippies with no point of view, counterevidence comes in the letter submitted by the Occupy the SEC subcommittee for a joint subcommittee hearing tomorrow, January 18, of the House Financial Services Committee on the Volcker Rule. The title of the hearing broadcasts that financial professionals are ganging up against the provision: “Examining the Impact of the Volcker Rule on Markets, Businesses, Investors and Job Creation.” The supposed “business” representatives are firm defenders of the financial services uber alles orthodoxy, and there is a noteworthy absence of economists or independent commentators on the broader economic effects. The one non-regulator opponent to the effort to curb the Volcker Rule is Walter Turbeville of Americans for Financial Reform. However, they made the fatal mistake of accepting the banksters’ framing about financial markets liquidity and merely disputed the data submitted. Update: the hearing schedule I saw did not have Simon Johnson’s name on it, and he apparently made a very effective rejoinder to the folks who want to curb the Volcker Rule.

The letter is well documented and well argued. It goes directly after the financial services industry claim that implementation of a ban on proprietary trading will cause damage by hurting vaunted and mystical “liquidity.” An illustrative extract:

Moreover, much of the so-called “liquidity” that the banks have engineered, especially in opaque OTC markets, can be most appropriately termed “artificial liquidity.” As one commentator notes, the “very belief that the proliferation of financial derivatives and securitization techniques has enhanced global liquidity has been [the] core illusion driving the sub-prime bubble in the USA.

Occupy Wall Street Volcker Rule Letter to House Financial Services Committee

However, not surprisingly, Occupy the SEC was not invited to testify tomorrow. One of the members of the Alternative Banking Group, George Bailey, a compliance expert from a Big Bank You Heard Of, prepared this post to make the Occupy the SEC letter and related issues more accessible.

By George Bailey

The Volcker rule comment process is entering its final phase. Today, the action moves to the House of Representatives when the heads of the regulatory agencies are scheduled to be grilled at two subcommittee hearings on the implementation. Eight representatives from the financial services industry and one representative from Americans for Financial Reform are also scheduled to testify.

Last week the Financial Times reported that the Japanese and Canadian regulators are complaining that Volcker rule will reduce US liquidity for their government debt. For good measure, Jamie Dimon re-joined the ‘don’t harm liquidity’ chorus last week during an interview with CNBC’s Maria Bartiroma. (at 12:08 in the clip), and again last Friday on the JPM earnings call. SIFMA , the financial industry trade group issued a study last week warning that implementation of the Volcker market making rules will severely reduce liquidity in the U.S corporate bond market. Yesterday John Walsh, the top regulator at the OCC remarked in his prepared testimony for today’s hearings that US banks will be operating at a competitive disadvantage to their foreign peers because of the Volcker restrictions on US banks.

The Volcker danger issue the financial services industry has been most loudly trumpeting recently is ‘Liquidity’. If it evaporates in key markets, the US financial markets and the US economy will suffer great harm.

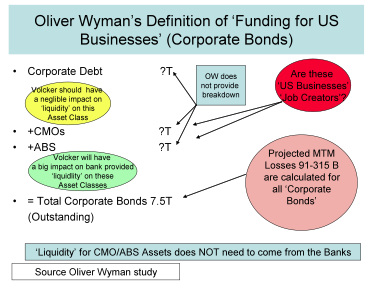

The SIFMA report, prepared by Oliver Wyman, is being widely cited as proof that the Volcker rule presents an ominous threat to the corporate bond market, or as SIFMA refers to it, the marker for ‘funding American businesses’. The message is clear, tamper with the corporate bond market and you tamper with the ability of job creating corporates to fund their operations.

In fact, the Oliver Wyman report is at odds with SIFMA’s position that financing for US businesses is facing a severe crisis if the Volcker market making restrictions aren’t weakened.

US Corporate Bond Market

Corporate debt cash markets are historically illiquid. Wide spreads are a fact of life for corporate treasurers. Dealers are holding smaller inventories of bonds than they were pre Volcker. The spread widening may be muted by a still active and growing corporate CDS market, but since CDS trading will be moving out of the banks, the reality of wider spreads for corporate borrowers is already baked in. It’s not clear whether Volcker, or CDS restrictions, will have the greater impact on liquidity in these markets. The study concedes that this segment of the bond market will not be much affected by the Volcker rule.

However, the Corporate Bond market Oliver Wyman studied encompasses not only the US corporate debt market, which is generally understood to mean ‘American businesses’, but also securitized debt markets for CMOs and ABS. ABS and CMOS are not widely viewed as ‘American businesses’ by the general public.

Estimated costs resulting from Volcker imposed illiquidity

The Oliver Wyman study attempts to estimate the costs resulting from a loss in liquidity in the corporate bond market if the banks are prohibited from making markets in those markets. The major cost will result from mark-to-market losses if corporate bonds become difficult to trade. The loss estimates need be taken with a huge grain of salt. It’s beyond the scope of this piece to analyze the methodological assumptions, the liquidity modeling assumptions, the relative contribution of the asset class components to the overall loss estimates or the reasonableness of the pricing data used in the projections, Suffice to say the Mark to Market losses will be significant even if the estimates are wide of the mark.

The study is most useful in illustrating that the losses associated with corporate bonds will be come from the non corporate debt components of the corporate bond super class.

The Oliver Wyman conclusions gloss over this distinction and present its corporate bond market disruption figures as broadly impacting all ‘American Businesses’.

Asset Manager Liquidity

The non-bank Asset Managers are taking a separate tack in attacking the Volcker rule in today’s hearing. They acknowledge that providing liquidity as a market maker requires the ability to run a corresponding prop trading book. Yet Volcker prohibits prop trading at the banks.

The Volcker restrictions on prop trading at the banks will limit banks ability to provide liquidity to the Asset Managers. The Asset Managers appear to hope to resolve the dilemma by pressuring Congress to pressure the regulators to loosen the market making exemption. Lord Abbet summarized the asset managers concerns:

Recently investors collectively responded to global political and economic risk by reducing exposure to riskier securities. If dealer banks had been prohibited from building positions and were instead forced to find a buyer for every security sold, prices would have fallen much further than they did. Banks were able to absorb the avalanche of high-yield securities in their trading accounts and were at the same time able to perform a function that long-only asset managers could not: hedge the risk. Whether through use of credit default swaps, high-yield bond index futures, or other measures, dealer banks can mitigate their exposure to this inventory while participating in the markets and, in the process, help to dampen market volatility. If banks are skeptical of how such positions may be perceived by regulators under the Volcker Rule, then banks will no longer engage in these activities, further limiting liquidity and potentially increasing volatility.

Alliance Bernstein makes the same point in their comment letter.

It’s clear that the Asset Managers are concerned about the prices of the assets that may be orphaned if banks are forced to exit the market. Their position highlights the main issue, that the banks are less concerned about funding US businesses than they are about protecting the holders of corporate bonds, including themselves, from realizing losses.

What Liquidity are the Asset Managers Worried About?

There is no evidence that the current level of trading activity in financial markets is desirable or optimal, either on a national or global level; indeed, numerous proposals to implement transaction taxes are based on the view that the amount of trading activity system-wide should be reduced. The US Congress has determined that its regulators should not take measures to preserve the current level of trading activity. If trading is not economical when no longer supported by artificially cheap funding, that likely means that it does not serve a legitimate real-economy purpose. Volcker is designed to curb speculative position-taking at US government-backed banks. Restricting market making at the US banks removes a source of artificially cheap funding to the market. It is the US regulators’ responsibility to ensure that trading activity migrates out of government-backstopped banks.

The Oliver Wyman study clearly shows the asset classes facing the greatest liquidity risk from the proposed rules are those that are currently mispriced, which Volcker intends to drive out of the banking system.

Who will be hurt if liquidity is limited?

Jamie Dimon said in the recent JPM earnings call:

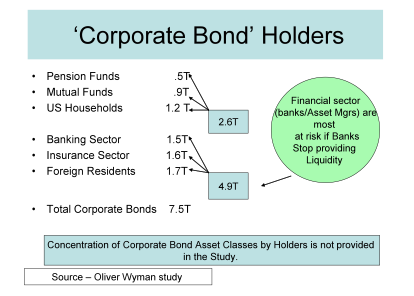

“If you lose liquidity and market makers, it will cost retirees, pensioners, and the military more money to invest their money,” said Dimon, urging Congress to be “careful not to destroy that.”

According to the Oliver Wyman study, Pension fund and mutual funds (retirees, pensioners) and US Households (a portion of which are middle class savers) hold only 3/8 of the corporate bonds included in the study. Perhaps Mr. Dimon is referring to the increased transaction costs, but from my read of the study the financial services industry is in an awful spot if the study’s MTM loss projections are remotely accurate. Suggesting that Grandma and GI Joe face the same risks as the bankers should be beyond the pale.

Conclusion

In the end the Oliver Wyman study is much ado about nothing, or at least much ado about much that is hidden from view. The study clearly shows that the financial industry continues to demand government protection. The Volcker rule threatens to take that protection away. But as the study shows, MTM losses already exist and are orphaned within the banking system for the moment. The financial services industry would prefer to leave them there.

It should be noted that this document was submitted by Occupy the SEC, not OWS, and they note in the paper itself that they do not speak on behalf of OWS (no one can unless they pass a statement through the NYC General Assembly).

So, the title of this blog post is a bit misleading.

Fixed, apologies. My headlines are automagically posted as tweets, so I wanted #OccupyWallStreet in the headline, but I should have realized that might tread on OWS protocol.

Their intentions might be good but the OWS letter really isn’t very good. The logic is a bit dubious in some places, the language sometimes less than appropriate (for this context) and there’s the occasional typo. It doesn’t inspire confidence and makes it hard to take them seriously.

I’m spent over 30 years in and around the financial services industry, including working with a number of trading businesses (derivatives traders, emerging markets desks, bank treasury departments). I thought the argument was well presented and on target. And this stands up compared to letters I’ve seen by various lobbying groups and industry associations (the American Securitization Forum, the Chamber of Commerce, or even the AFR letter on this very same topic, the Occupy the SEC letter is much more convincing).

Your comment fails to inspire confidence. The onus is on you to say what you think is wrong with the argument and see if the NC commentariat buys it. Your remark reads like it’s from a lazy financial services incumbent who is defending his meal ticket but assumes because it’s OWS, all he has to do is say “bad OWS” and everyone will fall into line.

Oh please. I found one typo, the inclusion of the word “instrument” twice in a row, and the language and points they make are excellent. I believe you just don’t like the message but can’t really point to a flaw in the logic so you attack the style and form (and even that is in a non-specific sniffy way).

Joe, can you point to particular paragraphs and underscore what you find inappropriate about the language?

Knowing where the arguments are unconvincing will help make the final product (the official Volcker comment letter) better, so if you could be a more specific in your critique, it would be appreciated.

+100

If the flaws in the logic are as easy to spot as commenter #1 seems to think, it would be just as easy to write them up for the benefit of those following along at home. So the unwillingness to add value to the post is telling.

Shorter: Put up or shut up.

Hi Occupier,

The only logical flaw I caught on first read is a missing definition for “real” liquidity as opposed to “artificial” liquidity (3rd graph from the top, page 2). The distinction is crucial to you argument and worth spelling out more explicitly. Without it, the transition to Section B feels a bit forced. Otherwise, I agree with Yves. This is the best summary of the pro-Rule argument I’ve seen.

I think the letter touches on all the major points that I would have, it makes arguments both in terms of what the regulators are used to seeing (i.e. impact on liquidity) and also touches on the broader social implications (which the regulators are not really used to seeing), and is better written than many of the letters for which attorneys were paid many hundreds of dollars per hour for drafting.

The only thing wrong with the letter is its premise: that any of the issues it discusses are even worth considering. Banks have no business gambling with public money, and public money is what the Fed provides. Banks are not making profits by prop trading. They are simply looting a public resource and covering their tracks with accounting tricks. All these traders acting collectively produce nothing but bonuses for one another and periodic black holes. Wait and see what happens with CDS on soverign debt. The whole debate is pathetic.

The big ‘question’ here is not the quality of the letter submitted (what it has to say is actually quite good). The big ‘question’ is will the regulators a) read it and b) factor it into their actions.

Based on my experience with regulators trying to write new rules for structured finance, the answer is a) the regulators will read it and b) it will have no impact on their actions – probably a result of regulatory capture and lobbying.

I am hopeful though that because the letter has been highlighted by NC, the regulators might factor it in (if they don’t, there will undoubtedly be an endless stream of posts highlighting this fact).

The letter mentions that the banks have already discontinued their prop trading activities. Where did these outfits and people go and who is now funding their activities? If it’s the same big banks, I think we may have added more opacity not less.

Richard,

If you accept the notion that ‘it will have no impact on their actions’ then the logical choice is to remain silent and guarantee it will have no impact.

Obviously Occupy the SEC doesn’t accept the notion. If the regulators choose not to listen, that’s their choice. But Occupy the SEC’s arguments will be part of the public record, and perhaps part of the public discussion (which is obviously happening here and other places).

Nice to see how multifaceted Occupy is. Here is some nit-picking proofreading offered in the spirit of making this piece a small bit more polished.

It’s beyond the scope of this piece to analyze the methodological assumptions, the liquidity modeling assumptions, the relative contribution of the asset class components to the overall loss estimates or the reasonableness of the pricing data used in the projections, Suffice to say the Mark to Market losses will be significant even if the estimates are wide of the mark.

–>

It is beyond the scope of this piece to analyze the methodological assumptions, the liquidity modeling assumptions, the relative contribution of the asset class components to the overall loss estimates or the reasonableness of the pricing data used in the projections. Suffice it to say the mark-to-market losses will be significant even if the estimates are wide of the mark.

According to the Oliver Wyman study, Pension fund and mutual funds (retirees, pensioners) and US Households (a portion of which are middle class savers) hold only 3/8 of the corporate bonds included in the study.

–>

According to the Oliver Wyman study, pension funds and mutual funds (retirees, pensioners) and US households (a portion of which are middle class savers) hold only 3/8 of the corporate bonds included in the study.

The study is most useful in illustrating that the losses associated with corporate bonds will be come from the non corporate debt components of the corporate bond super class.

–>

The study is most useful in illustrating that the losses associated with corporate bonds will come from the non-corporate debt components of the corporate bond super class.

Jessica,

Next time I’ll ask someone to proofread before, rather than after I post. Thanks

Correction:

I counted Simon Johnson in the financial services representative count in error .

The revised count is 7 financial industry reps vs 2 non-financial service reps.

Apologies to Mr Johnson

What is your opinion vis a vis the Canadian and Japanese Government positions(I know Canada is talking about a NAFTA “challenge”) I know I didn’t see much in the two non industry reps testimony(Simon Johnson and the other person from Americans for Financial Reform)on this issue

Doesn’t Canada still have in place what the Volcker Rule is trying to implement? And wasn’t that a wonderfully good thing for the country during the last crises?

It would seem a bit strange they would speak out against the rule, but I guess Harper is only too happy to do anything he can for banksters anywhere.

No Canada’s regulatory system is heavily based on a hard leverage cap of 21 to one and a mininum capital requirment of 8 percent going to 12 percent in the near future(This are pretty tough requirements I doubt someone like Jamie Dimon would want to exchange them for not having the Volcker rule). In Canada the main investment banks and commericial/retail banks have been the same for a very looong time(25 years plus) so this is why there is such a conflict.

Thanks. Like many things in Canada, it’s way easier to learn about how it’s done in the U.S. than in our own country. I had thought the investment banks were somehow separated from the commercial banks here, but maybe I’m thinking of some sort of internal separation or something else entirely, I don’t know.

I wish we had our own Yves to serve as a one-stop read on Canadian financial issues, but that would be a tall order.

In a certain legal sense the securities business is regulated by the provincial securities commissions while the traditional bank business is regulated by the Federal Government however at the parent level from a prudential perspective all of the chartered banks operations are controlled by OSFI(Federal Office of the Supriendendant of Financial Institutions). I was somewhat disappointed in watching the video afterwords as there almost no discussion of the international issues other than the prepared testimony of the rep from Royal Bank. Its as if Canada doesn’t exist.

See further as to Wyman study, testimony of Simon Johnson, Ronald Kurtz Professor of Entrepreneurship, MIT Sloan School of Management at

http://financialservices.house.gov/UploadedFiles/HHRG-112-BA-WState-SJohnson-20120118.pdf .

this letter is very, very good work. my heartfelt gratitude to all who worked so hard on this. it will have consequences. it is only a matter of time. this letter is a worthwhile, powerful action that will make that time shorter.

can anyone provide background on the “corporate reform coalition”?

link here to their home page. are they a dem party thing, or what. “some key partners” they list:

center for political accountability

common cause

people for the american way

brennan center for justice

public citizen

http://corporatereformcoalition.org/

i get all these emails (like all nc readers i’m sure) from various nonprofits that sound pretty good to me. before coming to nc i really had no clue about the level of cooptation now in place. it’s really hard to tell who’s for real, who’s a party organ, and who’s really working, with any potential real help for real people, at what they claim to be.

we need an online directory of political organizations that lists each one’s funding and gives background on officers. or is there already such a thing?

aletheia33: In my humble opinion, it’s not up to us to reform corporations, but rather to get them the heck out of our political system. As in “Out! Out! Damned spot!:

Check out http://www.MoveToAmend.org for a good way to do that. Also, if you live in one of the 100-plus American cities that will experience Occupy the Courts demonstrations on Friday, Jan. 20, in the support of the Move to Amend, PLEASE join us! Along with colleagues from all walks of life, I will be freezing my butt off in downtown Cleveland for the cause.

I expect to see arrests and detentions after the OSEC presentation. The overlords can’t be too comfortable knowing that their questioners are as intelligent as this letter shows.

Also, how many bona fide idiots will this be presented to in the House? How many of them even understand the issues here? (I.e., how many TPers will be on the committee, asking if everyone in the room is a socialist?)

Good on George Bailey and H/T to the clever nom de plume. Bet most of the audience won’t get it.

PQS,

That’s OK. I didn’t know Yves is a woman till I spent a year reading her blog.

I don’t know how many of the idiots saw it,or how many of the good guys read it, but the point I hope we made is that there are other serious voices that will be heard (at least in the public record). The argument’s merits are sound.

And just so there’s no confusion, the letter was written by the Occupy the SEC team.

I’m a member of the group but wrote the George Bailey piece separately. I intended it to be a layman’s (and a slightly more colorful) version of the issues we addressed in the letter.