By Philip Pilkington, a writer and journalist based in Dublin, Ireland. You can follow him on Twitter at @pilkingtonphil

Last Friday the BBC’s economics editor Stephanie Flanders ran one of the most terrible economics articles I’ve ever read: ‘The Truth About UK Debt.’ The problem is that it contains very little truth.

The reason it contains so little truth is because, not to put too fine a point on it, Flanders comes off as having quite literally no idea what she’s talking about. In fact, the piece comes across as less an article and more a smattering of graphs and uncontextualised facts. To say that it reads like something on the Zerohedge website would be unfair. But in terms of sheer incomprehensibility and vagueness it is certainly poised in that direction.

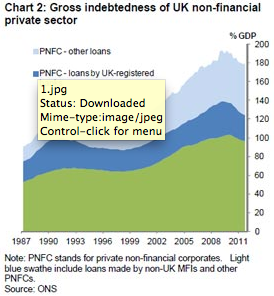

The article sets out to convince the reader that the UK does not have a problem with private sector debt. Sounds pretty fishy, right? Well, it is fishy. Very fishy. Especially given that the author starts out with the following graph:

That chart, to me, looks pretty damning – and it doesn’t even take into account the financial sector (more on that in a moment). Clearly the private sector has been leveraging itself up to the eyeballs. You can also see that after 2008 they started slowing their accumulation of debt.

None of this is particularly hard to interpret. As private sector debt increases more money is spent into the economy. As it decreases we must assume that, all else being equal, less money is entering the economy. When less money enters the economy we must assume that less people are spending and investing. This should lead to a fall in economic activity.

Of course, that’s exactly what we’re seeing in Britain right now. Unemployment is up. GDP growth is down. And everyone’s feeling a bit miserable.

The Australian economist Steve Keen wrote a piece for the London School of Economics website the other day entitled ‘Ignoring the Role of Private Debt in an Economy is Like Driving Without Accounting for your Blindspot’.

The first thing to note about the article is that Keen estimates that British private sector debt is much higher than some 210% of GDP which seems to be the figure that Flanders is working off. Keen discussed estimations in another piece entitled ‘Everyone is Starting to Realise the Size of Britain’s Debt Crisis’. There he noted that when the financial sector is taken into account the UK government estimates that the total private sector debt is around 450%. Meanwhile, independent observers like Morgan Stanley put the total figure at about 950%. Sheesh!

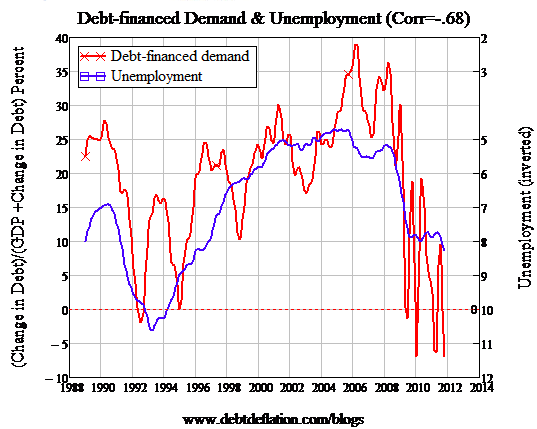

Applying the official measure Keen provides a chart of his own that juxtaposes the rate of the change in private sector debt and the rate of unemployment. Unsurprisingly there is a pretty strong correlation.

Again this makes perfect sense if you think about it. When a household or a firm, financial or non-financial, takes on debt this is then used to either spend, invest or speculate on asset prices. Assuming that not all of it is going into speculation (a good deal might be, of course) then any debt taken out by the private sector becomes an income for another person or firm.

It seems perfectly obvious that, like much of the rest of the world, Britain’s fairly decent economic growth in the 1990s and 2000s was driven primarily by an unsustainable private sector debt binge. Now that the binge is over it appears equally obvious that Britain can no longer rely on huge injections of private sector debt to ensure economic growth.

Flanders ignores all this. Instead of providing analysis and contextualisation she goes on to talk about how much debt is owed to other countries. This is an interesting topic primarily from the point-of-view of the exchange rate, but it is not a central issue.

She also talks about causation: do house price rises lead to debt booms or vice versa? What does this have to do with anything? Not much. But such is the rambling nature of Flanders’ article. Indeed, it doesn’t mean much to say that the question of causation has little to do with the central point of her article when her article, in fact, has no central point.

Finally she makes vague allusions to the government debt being ‘unsustainable’ and slowing growth. Of course, as any economist that isn’t completely dim will tell you government deficit spending actually leads to increased growth. That’s not a theory. That’s an accounting statement. When the government spends money it becomes an income for the private sector. This is then entered into the GDP accounts at the end of the year. If the private sector agent then spends within the country another entry is made in the GDP accounts at year end (this is known as the ‘multiplier effect’). This is all pretty basic stuff, but Flanders doesn’t seem to have a clue.

The worst part of all this though is that she didn’t come up with this contrarian nonsense herself. She took it on from Ben Broadbent, an economist and member of the Monetary Policy Committee.

Broadbent’s argument is more logically consistent than Flanders’ scattergun-style article, but in saying that it is more logically consistent is not to say that it makes much sense.

Broadbent recognises that there was a property bubble but claims that this didn’t have any real effects on the economy because it was primarily a transfer of wealth between those trading up in the market and those trading down. This is pretty weird stuff altogether.

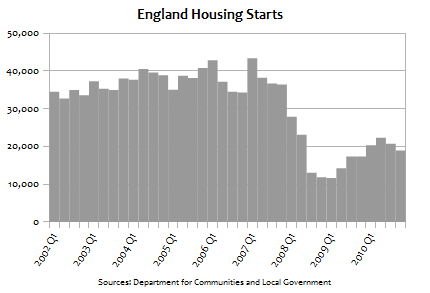

How much economic activity was undertaken during the property boom due to rising house prices? How many new houses were built or refurbished in those years that otherwise wouldn’t have been? The Cautious Bull provides us with this handy chart which should give us some idea of how much economic activity was being generated from home building alone:

And that doesn’t even take into account the various other sectors being driven by home construction OR the wealth effect generated by the uptick in property prices OR the multiplier effect such economic activity had. Any economist worth his salt should know the importance of the housing sector as a driver of the economy.

Broadbent ignores the simple fact that the housing and credit boom was clearly generating high levels of unsustainable economic activity. Instead he goes on to argue that the British credit crunch was mainly caused by the blowing up of various investments made abroad. How this dampened British economic activity so severely, he’s not exactly clear on. But the reader gets the strong impression that Broadbent isn’t really concerned with real economic activity – or reality, for that matter. He’s more interested in his strangely disconnected theories about balance sheets and their interrelations.

Broadbent’s her article is sloppy and manifestly confused. And we can’t blame Flanders for that. She has tried to grasp Broadbent’s argument and failed – but that’s mainly because Broadbent’s argument is weird, counterintuitive and most likely wrong. As a journalist Flanders should know that if she cannot summarize an argument succinctly then she has either not understood it properly and needs to try again, or it is no argument at all and the person making it is either having her on or too confused to be trusted.

“…Ignoring the Role of Private Debt in an Economy is Like Driving Without Accounting for your Blindspot’…”

I would put it more like: Ignoring the Role of Crushing Household Debt in a Consumer Based Economy is Like Driving on a Butte With a Blindfold On.

I used to listen to the BBC when I was young to learn the language. After 2005, when I saw the famous 9/11 BBC reporter Jane Stanley clip on WTC7 and the BBC handling of that tape, I have no more confident on their stories. Finito. Something must be wrong with that organization’s leadership.

Credibility is like a forest, once destroyed, is hard to restore.

I love watching the BBC for general news, science/history/travel/food documentaries but not for financial news.

BBC’s weak spot has always been biz journalism and recent budget cuts definitely don’t help. So you can’t quite extrapolate much from this.

Broadbent ignores the simple fact that the housing and credit boom was clearly generating high levels of unsustainable economic activity. Philip P

Why was it unsustainable? If the money had continued flowing would not the economic activity have continued? Then why did the money stop flowing? Because usury is unsustainable? Indeed it is unsustainable according to Karl Denninger, a fan of it himself.

Money should be spent, not lent into existence. Government can easily spend government money into existence since it requires it back for taxes. As for the private sector, why would anyone accept private money unless it was the best possible deal he could obtain? And what is the best possible deal anyone can obtain wrt money but a “share” in the profits of the money issuer?

For how long can the price of a house rise? I doubt it an accelerate to the point that it reaches light-speed. What goes up…

I doubt it an accelerate … Philip P

Usury itself REQUIRES exponential growth just to pay the usury. I have in mind growth that is possible but not required.

Inflation and government debt take care of that. That’s why we don’t have the manic depressive type of economy that existed in the 19th century. (Although we’re not perfect in that regard).

Inflation and government debt take care of that. Philip P

You mean inflation by government debt. But monetarily sovereign nations have no need to borrow their own money much less pay usury for it in the first place.

The current system (National Debts) was designed by and for the rentiers.

Closed economy w/ government sector. You and me are the only actors. So, you, me and government. You owe me $50 with 10% interest a year. If nothing else intervened one of us would have to take out more debt just to generate the interest, right?

But if we have a government that releases ever more and more debt and then pays us to do stuff (or whatever) we can meet interest payments. Throw a 5% rate of inflation into the mix and it becomes even more sustainable because the value of the debt plus interest payments are falling by 5% a year.

Ya dig?

I dig. Do you dig that deficit spending does not require government borrowing much less paying usury to the banks and the rich?

In the world I live in it does.

;)

Conservative are you?

Also, if I understand MMT properly, the debt of a monetarily sovereign nation is ITSELF a form of money and is even more inflationary than pure money printing would be since interest must be created for the debt but not for new fiat.

So why are you defending borrowing by a monetarily sovereign nation?

Not defending. Just recognising reality. When the revolution comes I’ll be the first at the barricades.

As for which is more inflationary. Yes, issuing debt generates interest income and that would be more inflationary than pure fiat. BUT if we issued pure fiat and didn’t pay interest, the interest rate would fall to zero. Under normal economic conditions that would be more inflationary as people would spend money rather than save.

Under normal economic conditions that would be more inflationary as people would spend money rather than save. Philip P

Most people would be content with a risk-free, 0% real return on their savings. Investments are another matter.

Throw a 5% rate of [price?] inflation into the mix and it becomes even more sustainable because the value of the debt plus interest payments are falling by 5% a year. Philip P

That depends on the source of the price inflation. If MV = PY then P = MV/Y. Thus falling aggregate output,Y, alone could cause price inflation and that in aggregate would not make debt repayment easier.

When the revolution comes I’ll be the first at the barricades. Philip Pilkington

There is a non-violent, just solution to this mess – a universal and equal bailout with new fiat combined with genuine reform of the money system along ethical lines.

The British economy has never recovered from the Lawson Boom bust cycle which was its final chance.

These guys & Gals think in terms of the Quantity of these assets rather then their Quality.

In the Irish economy blog now you have a Cork economist who puts numbers on our capital “assets” – most of these are a credit artifact.

1 Sizewell B PWR power plant is worth perhaps 10 times (or indeed infinite) the present value of housing stock as they are a net drain of resourses – in other words they have a negative value without other inputs(energy)

How can the banking system deal with negative values ?

Yes. Huge problem. These economists are beginning to discover balance sheets and they have literally no idea what to do with them.

When I make my fortune they’ll all be receiving Godley and Lavoie’s book in the post. Until then they will continue to publish weird stuff that people will gawk at in a few years time.

Sorry. That was a bit cryptic. These economists are confusing stocks with flows:

http://en.wikipedia.org/wiki/Stock_and_flow

Flows generate economic activity. Stocks are residuals that just sit there. They focus on stocks and then wonder why it doesn’t tell them anything about the real economy/housing market/whatever.

@Phillip

They are either retarded or corrupt – I have tried to introduce the concept of Dirigisme in areas such as transport policey but I just get dead air.

They seem to be oblivious to what went on in the post war western economies.

en.wikipedia.org/wiki/Citroën_2CV

Its long been a problem. Michel Kalecki once quipped that economics is ‘the science of confusing stocks with flows’.

If anyone’s interested, check out Mitchell’s article for a primer:

http://bilbo.economicoutlook.net/blog/?p=4870

And buy Godley and Lavoie’s ‘Monetary Economics’ if you’re really ‘into’ it. You’ll win arguments with most economists by pointing out that they’ve confused stocks with flows.

If anyone’s interested, check out Mitchell’s article for a primer: Philip P

Nice article!

The Austrians are even more wedded to deflation than they are to gold. I reckon they correspond to the lazy, master slandering servant in the Parable of the Talents.

What is most significant about private sector debt is how it is distributed among various tiers of asset ownership and income. Mushrooming debt of rentier speculators leads inevitably to financial crashes, but these produce nothing more important than a reshuffling of leisure class assets. On the other hand, mushrooming debt of worker consumers produces depressions when the accompanying asset bubbles are exploded. This is what we now face and all reporting to the contrary is just lipstick on the pig. Our modern bankruptcy laws insure that consumer debt goes on forever; our securitization fiasco prevents even mortgage debt from being liquidated through foreclosure; globalization insures continued downward pressure on wages which prevents the debt from being validated. Welcome to the world of 1873-96. All the cheerleading in the world isn’t going to change anything.

Finally she makes vague allusions to the government debt being ‘unsustainable’ and slowing growth.

It sounds like she’s making the “crowding out” argument.

Which, even if it were correct, would assume that the private sector were not over-leveraged and were actively seeking loanable funds.

As I said: this is one of the worst economics articles I’ve ever seen. I could have written 50 pages poking holes in it.

F Beard

Most Greedy Austrians are wedded to inflation (including myself ……. the precious the precious)

Why else would they hold the Barbarous relic ?

As long as we keep this system of fractional (? I know I Know they are not truely fractional any longer) they will have to inflate relative to a asset with no input costs rather then Mortgages which are net energy negative.

If the Euro survives we will get $10,000 a ounce – if it fails well it will be lucky to stay above $100.

Why else would they hold the Barbarous relic ? The Dork of Cork

To front run the fascist central banks, of course.

As long as we keep this system of fractional (? I know I Know they are not truely fractional any longer) they will have to inflate relative to a asset with no input costs rather then Mortgages which are net energy negative. DoC

You assume that gold is an asset. If so it is a non-performing one. I would pick a better inflation hedge than a mostly useless scarce metal.

If the Euro survives we will get $10,000 a ounce – if it fails well it will be lucky to stay above $100. DoC

I don’t follow your logic here.

@F Beard

The Euro works around double entry bank credit money – it is in the process of outlawing the fiscal authority with its new “Fiscal pact”

When the US Congress for example votes to get into new Debt it produces a new Asset out of nothing.

While a credit bank needs lets say a asset on the other side(mortgages for example) when it creates deposit / credit money.

In my opinion Golds rise since 1999 is almost entirely a Euro phenomena.

The strange goings on in the Gold market in the late 90s points to this conclusion.

It follows that if the euro is to survive everything will inflate against Gold as most of the assets produced since Basel 1 have been Grot.

It also follows that if the $ wins this game everything will deflate against the $ as most of the assets produced since Basel 1 have been Grot.

In the end there can be only one.

Gold as money is a barbarous (and fascist if by fiat) relic in any case; we won’t be returning to it if we are wise. Instead, we should focus on the ethics of money creation.

F Beard

I am not trying to make a moral judgement – I am merely trying to survive.

I as a Dork have no influence over monetory policey or the guild navigators who control the flow of spice(oil)

http://www.youtube.com/watch?v=dcgft-iiZ_s

I am not trying to make a moral judgement – I am merely trying to survive. The Dork of Cork

“The paradox of selfishness” – is a timeless concept.

Ahhhhh, hows that housing wealth effect working for you guys in Ireland and the UK? I don’t know Ms. Flanders or Mr. Broadbent, but after reading some your “any economist not dim” statements about deficit spending, I’m convinced you are, in fact, dim.

And for your Econ 102 class, Mr. Pilkington will explain why when the marginal productivity of government debt becomes negative, deficit spending does not add a “multiplier effect” to the economy.

Hint, if a little deficit spending is good for the economy, then alot would be better. Its one of the pesky math problems that my econ teachers made me do to proof my work.

If I am wrong, please show me one case in the history of man were a country failed due to a strong currency.

You dim keynesians still can’t admit your wrong. I hear the crowd and see the pitch forks. They’ll be knocking on your “deficit spending adds to the multiplier effect” door soon and you can show them how governments should borrow a gazillion dollars and we could all be Zimbabwe rich.

Hint, if a little deficit spending is good for the economy, then alot would be better. FO-SHO

Some deficit spending is good else gold mining should be banned under a gold standard. But deficit spending does not require borrowing by a monetarily sovereign government. The government should simply spend new money into existence. Then the marginal productivity of government “debt” (some insist on calling pure money printing “debt”) is increased by the lack of need to pay usury for the new money.

“If I am wrong, please show me one case in the history of man were a country failed due to a strong currency.”

Britain with Churchill as finance minister would be the typical example. But I guess you’re using a subjective term like ‘failed’ so that you can squirm out of it and go: “THAT’S NOT WHAT I MEAN. WHAT I MEANT WAS DEFAULT/DISAPPEAR/BE INVADED BY MARTIANS!!!”

Anyway, the article is about Flanders and Broadbent. Not me. Try the factional heckling elsewhere… maybe a football game might be appropriate.

Britian failed when Churchill was finance minister?

Did your citizens fail to eat?

You should head to Mexico sometime. Ask them how life was after the Tequila crises.

And keep racking up that debt, your marginal porductivity of government debt is negative, no matter how deep you put your head in the sand, nothing will turn your economy around.

PS Your words, not mine.

“Of course, as any economist that isn’t completely dim will tell you government deficit spending actually leads to increased growth. That’s not a theory. That’s an accounting statement. When the government spends money it becomes an income for the private sector. This is then entered into the GDP accounts at the end of the year. If the private sector agent then spends within the country another entry is made in the GDP accounts at year end (this is known as the ‘multiplier effect’). This is all pretty basic stuff, but Flanders doesn’t seem to have a clue.”

Yes, you doofus. People basically starved because that idiot Churchill pegged them to the gold standard:

http://en.wikipedia.org/wiki/Great_Depression_in_the_United_Kingdom#Gold_Standard_and_the_General_Strike

Another example is Argentina’s currency board prior to their default. They tried to prop up their currency and blew their economy up doing it.

There’s a million examples of this in history. Churchill and the gold standard was the classic case because Keynes wrote a very famous essay on it at the time.

Stop shooting your mouth off when you clearly have no idea what you’re talking about…

Churchill called sticking with the gold standard the worst mistake of his life.

Anyway, I never said when the multiplier takes effect. I said IF the money is re-spent by the person/firm that receives it the GDP accounts double-count it.

Implicitly I was criticising Flanders and Broadbent for their bad grasp of accounting/stock-flow consistency. But all you saw in it was a chance to say something clever-sounding about marginal…blablabla.

Start a blog, dude.

By the way, if any is wondering what are economist friend here is referring to he’s talking about the Marginal Productivity of Debt argument. It’s a quasi-monetarist doomsday cult that claims that if it takes more debt to arrive at a given level of national income… well… its really, erm, bad and, erm, stuff and really bad stuff is going to happen, erm, some time in the future.

What this could possibly mean in a fiat/credit money system is beyond me. These dudes seem to think that there exists somewhere some ‘real money’ or something. Gold maybe? SpaceCash?

They’d do well listening to everyone’s favourite central banker, Marriner Eccles who told the Senate the truth for perhaps the first time in history:

“If there were no debt in our money system there would be no money.”

Don’t tell the monetarists though. For them this is about as offensive as a Dali-style floppy clock is to a watchmaker!

“If there were no debt in our money system there would be no money.” Marriner Eccles via Philip P.

Yet that is not necessarily true. Money that is spent in existence need not be “repaid”. Example 1: Fiat need not be taxed out of existence. Example 2: Store coupons need not be spent; they can be saved. Example 3: Common stock as money need never be redeemed for the products of the corporation that issued it.

So why the heck do we have money that MUST be repaid?!

Tyranny much? Indeed.

Even under our current system a great deal is not repaid. Think of a dude who took out a $500,000 mortgage and handed it over to some guy for an overpriced house. The house declines by 40% and the guy defaults and hands it to the bank. The bank sell it on for, say, 50% of its original value — $250,000.

Well! That means that there is an extra $250,000 in cash floating around the economy that never has to be repaid back. Sort of a ‘residue’ from the bankruptcy.

This is one of things that the doomsday-monetarists are looking at when they look at low-levels of total debt-to-GDP. They’re looking at ‘residue cash’ that was left in the system through bankruptcies.

But you’re absolutely right. Fiat could be injected into the system with the EXACT same result. The doomsday-monetarists will cry ‘inflation’, but then why not cry ‘inflation’ when a bankruptcy is undertaken. Oh, but hang on… that’s ‘good’ money according to them, because it isn’t debt-backed.

Are you beginning to see how clueless these folks are about money creation. Not even worth conversing with.

“And if that dude lives in a car, or goes for urban camping, he can use streams or other outdoor water sources to cleanse himself of the residue. ‘Man I liberated 250K. Watch that cash float above me, freed into the economy’ ” Groan.

Give the guy the house with the imaginary 250K, that’s called bankruptcy. What we have now is facism.

Oh, but hang on… that’s ‘good’ money according to them, because it isn’t debt-backed. Philip P

Fiat need not be debt-backed either; it is already backed by the taxing authority and power of government.

But yeah, let’s all default on our bank loans; that would liberate an immense amount of money. (Too bad for you savers; you should have backed Steve Keens universal bailout while you could. :) )

While I thought the criticism of the article was entirely valid, it would be truly remarkable if the BBC or any other Angloshpere corporatist media presentation of the “facts” even accidentally matched the reality of this perverse game of “Stick The Loss On Somebody Else”, so very popular in the UK.

However, for someone with as intense a dislike of anything resembling mainstream economic “equilibrium” theory as you are at pains to maintain, you sure do go for the simple, static “thought experiments” and accounting identities you find so loathsome in others’ hands, and which often claim, but to not deliver, much in the way of insight.

In the current example, you end the story with Agent A bouncing down the street with $500k with half that amount remaining as “residue” in the system. You neglect that, if it was put by A into any other inflated asset, including a new house for the seller of the original, the “residual” investments was also doubtless savaged by some significant amount. But much worse, the real basis for having any “residual” money left in the system at all is that the bank’s loss of $250k (to go with the foreclosed home) was supposed to be eaten by the owners of the banks, thus extinguishing the debt and offsetting A’s piece of “luck” so that any “residual” in the system should not exist. But of course, when Governments blithely bail banks future, bigger problems are assured.

To assert low levels of debt to GDP are the left-over “residue” of a normal process, rather than the perversion of that normal process, is completely arbitrary depending on WHEN you do the comparison – after all, that’s where we all started, i.e., at far, far lower levels of debt.

Meanwhile, the people who actually paid for the house with their underpaid labour, residing in China, India, and myriad other very-low-cost producers around the globe slowly come to a boil under the purely exploitative extraction system originally put in place by the British Empire, long since supplanted by US-based global corporatism (Goldman/JPM approved, of course) and its seemingly never-ending supply of “greater fools”.

You effectively end up trying to maintain there is no such thing as a real loss or misallocation of capital – which any further devotion to the housing industry as driver of Western economies would surely be. Have you considered informing various banks, their owners, and Governments, that all this hand-wringing re debt is really much ado about nothing, and it’s time to start building houses nobody can pay for again?

“You neglect that, if it was put by A into any other inflated asset, including a new house for the seller of the original,…”

‘IF’ is the key word there. I was simplifying. Generally you need to simplify in order to make arguments within a paragraph. Others have praised me on my ability to do so in clear English. If you think its unacceptable… I’ll stop.

Not.

I would be more worried about marginal productivity of money. The real (that is, discounting price inflation) GDP per capita growth for each unit of ‘money-things’ in the system (credit/government debt/base currency).

That’s a real argument about the shape and state of the economy and speaks volumes of how badly is all the money being created being used (mostly hoarded by a small percentage of the population or sitting in corporate balance sheets) or more important, what’s the real rate of innovation in the economy to supply increasing worldwide consumption levels.

Not at ‘doomsday levels’, but getting there lol.

@Fo- SHO

It depends what you spend your defecit on and even if its the wrong things at least you won’t have a leverage crisis with a sort of cascade effect best seen in Euro countries with massive housing bubbles & almost zero real defecits (Ireland & Spain)

At any given time all energy available must be consumed so if you don’t go into defecit the bank credit engine will waste if for you.

If the UK invested just a small part of its crazy house consumption on 50 modern PWR reactors it would not now be having the existential energy crisis it now faces with it returning to Edwardian level energy levels as the only investments worth a damn are now incredibly its 19th century railway infrastructure.

That is one heck of a economic failure and takes some effort over and beyond mere incompetence.

I blame the traitor Roy Jenkins for leaving the IMF / EEC wolfs in the door back in the 60s.

The man almost single handily destroyed the British Boffin culture.

http://www.youtube.com/watch?v=JacGZ4LxK-0

Denis Healy : “The IMF had already decided”

Who & what is this IMF ?

Was not Britain sovergin back then ?

The presence of these churches with the exception of the embryonic BIS makes this Depression very different from the last one.

We are dealing with a very sinister darkness here.

The earlier post war British Labour Goverments sale of Nene turbojets to the Soviets which became the nucleus of the MIG -15 and therefore prolonging the Korean war is another very funny little event now not talked about much in polite company.

en.wikipedia.org/wiki/Klimov_VK-1

@Dork,

Your point is well taken and is likely the real world cause of the negative marginal productivity of UK debt.

But, the UK is where it is today and NO AMOUNT of deficit spending is going to get it out of its current mess.

Its time for some of that WW2 backbone and fighting spirit. Bite the bullet now, go through your depression and come out the other side with the British Pound worth something.

Bite the bullet now, go through your depression and come out the other side with the British Pound worth something.

Fo-SHO

The last Great Depression was followed by WWII PLUS you neglect that many innocents are hurt in a Depression.

Instead, how about we bailout the entire population ala Steve Keen and start over with ethical money creation?

Mr. Beard,

Are you implying that there have been no “innocents” hurt during the last 4 years? I sir, would disagree. And these are the good times.

First, as I was trying to say above using economic speak, there is no way around the pain that is coming. Using math, it simply does not exist.

So, it is simply a matter of degrees. Do you want to tell the pensioners that they will %100 (purchasing power of %15) or do you be honest and tell them that they can get %50 of promised, but atleast it buys %50.

Mr. Cork,

I live in California. It is one of the few places in the world where economic illiteracy per capita can compare to the UK.

More debt to solve a debt problem. Sheesh, just plain silly at this point in the game.

First, as I was trying to say above using economic speak, there is no way around the pain that is coming. Using math, it simply does not exist. Fo-SHO

Wrong.

1) Forbid further credit creation – the root of the problem. This would be massively deflationary by itself as existing credit is paid off with no new credit to replace it.

2) Bailout the entire population, including non-debtors, equally with new fiat at a rate metered to just replace existing credit as it is paid off. Since the total money supply (reserves + credit) would not change then neither price deflation or price inflation should result.

Mortgage payments alone in the US would allow $304/mo to be distributed to every adult initially without change to the total money supply. The repayment of student debt, auto loans, and credit card debt would substantially increase that amount but I don’t have the figures.

“I live in California. It is one of the few places in the world where economic illiteracy per capita can compare to the UK.”

*Snickers*

http://www.huffingtonpost.com/2011/07/26/california-debt-crisis-borrowing-billions_n_910358.html

http://money.cnn.com/2009/07/02/news/economy/California_IOUs/

@fosho

I am not British – but Roy Jenkins always gave me the creeps , he is the last person you want to be in the foxhole with.

Much better to face the Hun with big nose himself – Charlie de Gaulle.

But I suppose Maggie had her good moments also.

http://www.youtube.com/watch?v=xO1Cn4rW5RA

Mr Beard,

I understand your POV, but I telling you for a fact, that it will not work. If a country goes ahead with a new fiat currency exchange, it will end up being a 3rd world country. (That is why they are 3rd countries, they messed around with their currencies.) Again, no country has ever failed, when their currency is strong, not once. But their are 100s of examples I could point to, that failed, because they messed around with their currency.

If a country goes ahead with a new fiat currency exchange, it will end up being a 3rd world country. Fo-SHO

I don’t see why IF the new fiat was combined with a ban on further credit creation and metered appropriately.

Professor Steve Keen suggests something similar at http://www.debtdeflation.com/blogs/2012/01/03/the-debtwatch-manifesto/ :

A Modern Jubilee would create fiat money in the same way as with Quantitative Easing, but would direct that money to the bank accounts of the public with the requirement that the first use of this money would be to reduce debt. Debtors whose debt exceeded their injection would have their debt reduced but not eliminated, while at the other extreme, recipients with no debt would receive a cash injection into their deposit accounts.

The broad effects of a Modern Jubilee would be:

Debtors would have their debt level reduced;

Non-debtors would receive a cash injection;

The value of bank assets would remain constant, but the distribution would alter with debt-instruments declining in value and cash assets rising;

Bank income would fall, since debt is an income-earning asset for a bank while cash reserves are not;

The income flows to asset-backed securities would fall, since a substantial proportion of the debt backing such securities would be paid off; and

Members of the public (both individuals and corporations) who owned asset-backed-securities would have increased cash holdings out of which they could spend in lieu of the income stream from ABS’s on which they were previously dependent.

Clearly there are numerous complex issues to be considered in such a policy: the scale of money creation needed to have a significant positive impact (without excessive negative effects—there will obviously be such effects, but their importance should be judged against the alternative of continued deleveraging); the mechanics of the money creation process itself (which could replicate those of Quantitative Easing, but may also require changes to the legal prohibition of Reserve Banks from buying government bonds directly from the Treasury); the basis on which the funds would be distributed to the public; managing bank liquidity problems (since though banks would not be made insolvent by such a policy, they would suffer significant drops in their income streams); and ensuring that the program did not simply start another asset bubble.

@FoSho

The fiscal stuff if all debt is internal to a country is not really debt at all – its just token money sometimes with a time component added called interest.

Where it gets messy is inter sovergin obligations – the web of debt that is the eurozone is the most extreme example of this.

Just watch the change in oil sensitive transport patterns between Ireland & the UK after 2008………

In both countries the oil price increased although more so in the UK -however the primary difference was that in the UK more tokens were available to the populace to substitute goods & services.

Its no accident that you have a continual huge rise in rail passengers withen the UK while a stagnation in Ireland……the key is the money supply – it must always be positive in a debt based system – otherwise societal structures begin to break down.

PS

I realize the UK banking system is at the heart of the euro mess but its Sterling semi-independence helped its remaining rump economy somewhat.

Mr. Cork,

How would the Sterling be doing without the FED dollar swaps & massive amounts of liquidity injections since 2008?

Mr. Pilkington & Mr. Beard,

I understand both of your opinions. I too like Mr. Keen and think the world of him.

I also was once a very good little Keynesian and believed what I was taught. But I also think that we have adapt to the world around around us. I have had a front row seat two of the largest bubbles in the history of the US and have seen first hand the pain it has causes. Solid middle class families being economically bombed into poverty will and should cause everybody to stop, analyze the situation and put an end to the shenanigans.

Perhaps this post is bit late and my words a tad harsh, but I firmly believe that if the western world doesn’t “do the right thing” i.e., pay their debts, we will end up in war with the rest of the world.

but I firmly believe that if the western world doesn’t “do the right thing” i.e., pay their debts, Fo-SHO

The debt of a monetarily sovereign nation like the US or the UK is ITSELF a form of money so foreign debt holders have ALREADY been paid.

But if they wish we can print up some non-interest-paying fiat and exchange it for the debt.

Sir,

Debt = money will %100 mathematically fail. But used responsibly, the system, could survive for a 1000 years.

It seems that for the USA, we will not be that lucky.

I wish you in the UK all the best, but my gut feeling is that both of us will be cutting the lawn for our Asian masters in 15 years.

but my gut feeling is that both of us will be cutting the lawn for our Asian masters in 15 years. Fo-SHO

Maybe but if the US and the UK can move on to ethical money creation we should be able to once again attract real capital (mostly talent) to our shores again.

You understand that when the government runs a budget surplus that the private sector has to run a deficit, right?

Someone has to go into debt. Private sector did it in the 1990s and 2000s. Now the government is doing it.

Both cannot run surpluses. Unless you can massively increase exports. But that would require devaluation — which you seem to hate. You can’t have your cake and eat it, buddy.

Mr. Pilkington,

Greenspan said the samething in the 1990’s $2 Trillion+ surplus in the Social Security system.

Fast forward 20 years, I’m sure the Baby Boomers wish they had that money back. The Boomers will get their money, it just won’t buy spit.

Keynes new the paradigm of money = debt was never sustainable. The quote, “In the long run, we’re all dead,” comes from this.

I would retort to your many of your posts (I am not anti-debt by the way) by simply pointing out Ireland. HOWS LIFE GOING OUT THERE! YOU GUYS HAPPY? HUH? NOT TIRED YET OF PAYING OTHER PEOPLES BILLS YET? NOT POOR ENOUGH YET? WAITING FOR THE STARVING CHILDREN ON THE STREET I SEE.

By the by, I just read an article where some nice real estate agent was selling one house in Ireland and throwing a second house for free. Since things are going just great in Ireland, I may buy a couple of them homes and up the rent. You think thats funny? Wait till the Germans come.

That’s not what Keynes was talking about. He meant that we should not undertake long-term analysis as if equilibrium were a given. Or, put differently, he meant that we should not base our current policies on what we fear might happen in the future.

So, he was actually saying precisely the OPPOSITE of what you attribute to him.

@Fo-SHO

That effort was to prop up the private debt contractual system – I believe that has no value and indeed has a negative value as servicing those debts destroys even more wealth going forward as they used to say in Ireland Inc.

I can hold Sterling tokens and they can hold value as tokens while private debt obligations could be declared null & void.

A currencies value is the productivity of the state /by the number of tokens issued.

Of course there is nothing there now but Fraud ……..

Adam Curtis and his recent blogpost come to mind.

THE BITCH, THE STUD AND THE PRAWN

Adam Curtis | 14:16 UK time, Thursday, 8 December 2011

but I firmly believe that if the western world doesn’t “do the right thing” i.e., pay their debts”

Your believe is mathematically impossible, so it won’t happen.

basically what you thing is that ‘deflation is the cure to all our problems’, deflation means debt destruction, no debt repayment. Deflation also means capital destruction, both financial capital (in accounting/monetary terms) and real capital (capital goods, knowledge, human resources and everything).

So by following the liquidationist path you will achieve exactly what you are avoiding. This path and strong currencies YES have destroyed entire nations, it was the precondition for currency mismanagement, when all the production base was dislocated and destroyed was when currency mismanagement finished the job. You have the causality totally backwards.

We need indeed huge deficit spending and tightening the credit machine to sanitize household balance sheets and keep inflation in check. We need loads of investments to reduce dependency on things subject to supply shocks (like oil or other commodities), etc. that’s the only way everybody is going to survive and get better quality of life.

The other path only helps elites and the uberwealthy (which will end holding all the assets at the end of the deflation).

Seconded.

The problem with including California, Ireland or any other such entity in the conversation is that they don’t fit the narrative. The requirement of fiat monetary creation would fail. Ireland uses the Euro. California uses the dollar. Neither of those governments is allowed to create its currency. Thus, neither will fit into a narrative about a government with the sole capacity to create its own money (by definition, really).

In the case of Australia, Britain, U.S., and others, the condition of creating their own money exists. U.S. debt is issued in dollars, not renminbi. If you want to look at the situation from an extreme standpoint then the following thought experiment might help:

What if the Chinese decided that they wanted all of their loans paid right now? Getting away from the obvious restriction that the loans were to be paid later (with interest), we could still pay off the loans. The Treasury Department would need to buy up some paper and ink. They might very well need to even create some new engravings (I would suggest $100,000 bills might be enough). We would then start shipping pallets of $100,000 bills to them. If they chose to spend those (particularly in the U.S.) it would cause inflation. That would cause the value of their payment to drop dramatically.

The inflation, however, would NOT necessarily be similar to the Zimbabwe inflation. The reason is that a fixed amount (the amount shipped to China in this case) was produced, so the value of the dollar would only reduce (plus or minus some hedging by investors) by the total shipped. In other words, we would have to deal with a bunch of paper cash that was originally electronic cash. The paper is non-performing and thus could really only be used to purchase.

If China then decided to purchase stuff with the money, it would likely cause our exports to increase precipitously (unless some other poor sucker decided to ship lots of goods out for less than their actual value–as China is, more or less, currently doing).

I do accept as true with all the concepts you’ve presented to your post. They’re really convincing and can certainly work. Nonetheless, the posts are too brief for novices. May you please prolong them a little from subsequent time? Thank you for the post.

Her arguments here could be applied to the tulip mania. Debt is fine and the assets are fine because someone will always borrow more money to buy them from you. Don’t worry about unsustainable debt just borrow more and more and more.

Ben Broadbent ex-Goldman Sachs mmmm….

That is very fascinating, You’re an overly skilled blogger. I have joined your feed and sit up for searching for more of your fantastic post. Also, I have shared your site in my social networks