By Richard Smith

To remind you: until better laws are made, the guardians of New Zealand’s company register are lumbered with a game of whack-a-mole: identifying and deregistering, as fast as they can, an infestation of opaque front companies, some of which have been used for some spectacular criminal activities:

Until they get the authentication of their registrants sorted, and better legal protections for the register, it’s just a game of whack-a-mole, after all, though with several hundred billion dollars worth of international relations at stake.

It’s a good time for a progress report on the mole-whacking occasioned by company formation agent Ian Taylor. He’s the man behind the registration of the companies behind the biggest moneylaundering scheme in history.

In fact it hasn’t just been mole whacking, with him. In a move of a kind that will be unfamiliar to our core readership,Taylor’s bank joined in on the good guys’ side, and closed Taylor’s bank accounts, which brought on quite a hissy fit from Taylor, who thinks he is as white as the driven snow:

Kiwibank fraud investigator, Damian Perry, wrote to Ian Taylor telling him the bank was closing their business and personal accounts and that if they wanted to dispute this “you will need to provide reasons why Kiwibank should continue its banking relationship with you”.

Kiwibank confirmed a letter was written but would not discuss it.

Oddly, the letter was forwarded to Fairfax Media by Taylor, along with his written reply to Kiwibank in which he said the bank was closing him down because “you simply do not like fact that I provide incorporation services to international clients and provide personal nominee services to the same clients.

“Interesting that your bank willingly provides accounts for people who represent petty criminals, paedophiles, murderers, rapists and other such people who pay funds to their legal representatives, which are then banked into Kiwibank.”

…ahem, that’s quite an off-beat legal theory there…

Taylor said that if Kiwibank wanted to treat him like a criminal, then he would act like one, without breaking the law: “I will have new accounts opened by people other than myself, I will use nominee directors and such.”

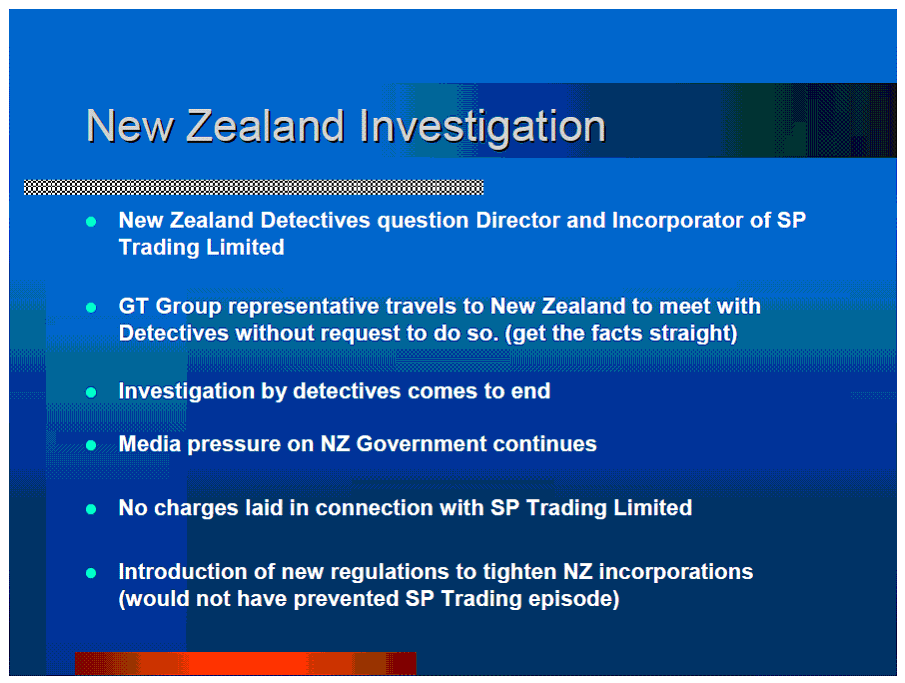

In October 2010, Taylor pitched his improved modus operandi to prospective clients (who seem very likely to be Russian speakers), here. From that presentation, we have his indignant take on the investigation of SP Trading Limited, which was used as a front company for arms smuggling:

One shares his view of the likely effectiveness of the new regulations.

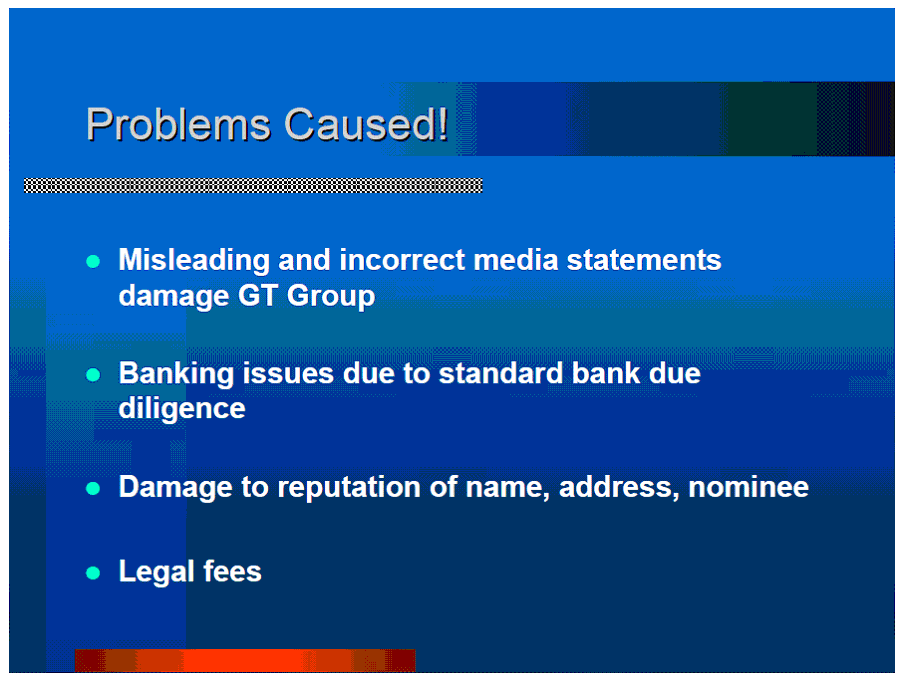

Otherwise, Taylor’s Cyclopean perspective on the story is quite alienating. Continuing his boneheaded, or calculated, display of not-getting-it, he shrugs his shoulders at the indirect consequences of his own registration activities, but does list the problems caused to him by the investigation of SP Trading:

Yes, what an expensive bore it must be, when the designedly opaque companies that you have set up are implicated in the biggest money laundering scheme ever, and in arms smuggling, too.

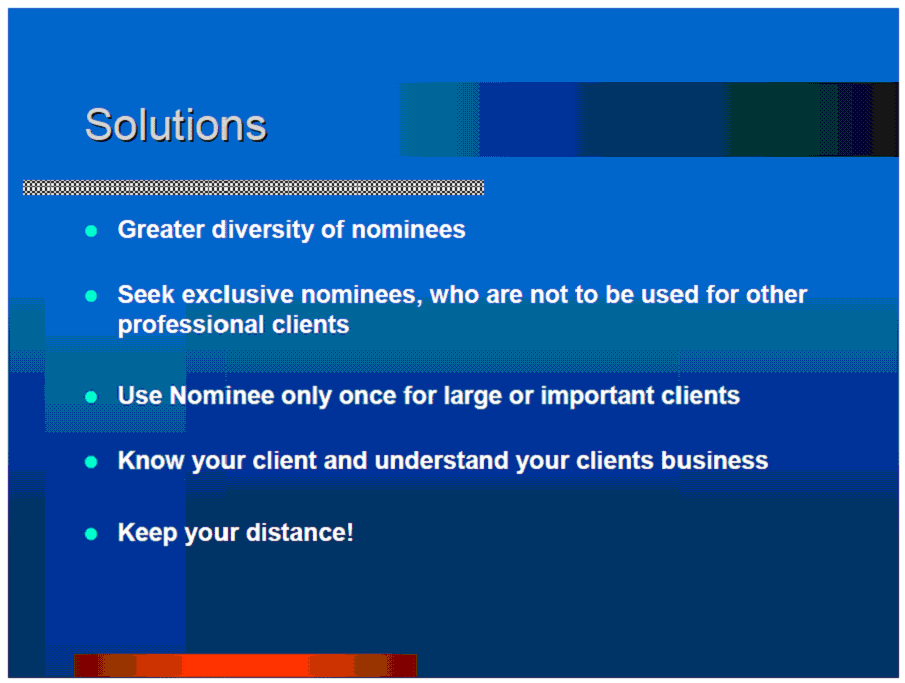

Taylor presents a solution that is completely consistent with what he put in his email to Fairfax Media: more opacity.

Taylor followed through on this plan during 2010 and into 2011. He set up a bunch more companies at a Queensland address, 54 of them. By way of the address 306 Nayland Road, Stoke, Nelson, that he frequently uses, we notice that one of his nominees is someone called Angelique Lilley. She is involved in some capacity with 51 companies, not all clobbered yet by our mole-whacker.

Many of Lilley’s 51 companies overlap with the 54 Taylor companies, of course. But the full set of companies with the Nelson registered address is bigger, numbering 144: that is, there are plenty whose directors are neither Lilley nor Taylor, though one of this duo presumably had a hand in setting them up. So it looks as if Taylor found a source of proxies.

They can come from some pretty surprising places, those proxies. In one (non-NZ) case he has (unknowingly, one assumes) registered a Delaware company with proxy contact details conned out of a Moldavian teenager:

Nineteen-year-old Boris Devdier wants to escape Telenesti, the small, dull city in the Republic of Moldova where he and his family struggle to make it on several hundred US dollars a month. The family is bankrupt, victims of both a hard-luck history and a worldwide economic crisis.

Devdier’s father left long ago. When he was 10, his mother Zinaida was stricken with cancer. She manages, despite health problems, to sell pots in the market for money to keep the family afloat. Last November, Moldova Agroindbank took her to court over a US$2,500 (29,885 Moldovan Leu) debt.

Despite all that, her teenage son has emerged as an unlikely figure in a multi-million dollar fraudulent business network under investigation in the European Union (EU).

His name appears on documents as the official representative of four offshore companies registered in the state of Delaware in the United States (US). The companies are believed to be involved in a complex web of money laundering in Romania, Bulgaria and Cyprus and in the suspicious sale of US$7.6 million in luxury jewelry which lack provenance documents.

How did that happen? Well:

In the spring of 2010, Boris Devdier had just graduated from high school when a New Zealand company registration service called GT Group run by the Taylor family used his personal data. GT Group made him on paper in Romania the representative of four companies registered in Delaware – one of the most secretive fiscal havens in the world.

…”I have never heard of those companies,” Devdier said. “I’ve never signed any set up documents.” He doesn’t know exactly where Delaware is.

…He remembers in the spring of 2010 giving a copy of his passport to someone and signing some papers he thought were his application for Romanian citizenship.

That’s how easy it is to set up your moneylaundering mechanism: once you have a trusting company registrar and a suitably uninhibited company incorporator, all you need is one desperate, clueless kid, somewhere far away, with an address and a passport. Obviously this episode also implies that Taylor’s activities are in no way confined to New Zealand and the Pacific islands. He has been contributing to a global mess.

At first blush, the post-2009 Taylor network in New Zealand doesn’t look nearly as big as the pre-2009 one, which had over a thousand companies in it. But there are other Taylor family members to try, and other proxies to spot.

For a start, look at the address change of Taylor’s GT Gloria Trading: it moves from 369 Queen Street (a favourite Taylor address; some of his companies are still active there) to 44 Khyber Pass Road. The latter address is a favourite of another industrious and undiscriminating company incorporator in New Zealand, Glenn Smith, who was the subject of an earlier post of mine, here. One of the companies incorporated by Smith has already been linked to purported wrongdoing, an alleged $680Million scam in the Ukraine; but hundreds and hundreds of his creations sport overseas director names that are firmly associated with organized crime.

Either Smith has stumbled on the same business model as Taylor, or the two of them are in harness somehow. GT Gloria Trading’s address change suggests the latter. It could be a very wild coincidence, I suppose, but it is more likely that Taylor, bang in line with his professed intention to keep his distance, outsourced a lot of his company work to our man Glenn Smith. Add the 140-odd newish Taylor companies to the many hundreds of still-active Glenn Smith ones, and it appears that the New Zealand authorities didn’t so much shut Taylor down in 2010, as put him into overdrive.

That had to stop. Just to remind you, dear readers: the arms smuggled through SP Trading were meant for Iran. Thus, via Taylor, New Zealand’s woebegone company formation regime has already made a striking contribution to international relations in the Middle East.

Without better laws, putting a spoke in Taylor’s wheel was a matter of improvisation. Kiwibank got the idea, which is something, I suppose. And the doughty mole-whacker has really been going after both the Taylor and Smith companies: they have been getting struck off at an impressive clip.

Other parties will feel free to chip in a spot of disruption too: the media perhaps? As we see from his pitch to the Russians, Taylor doesn’t like the media much. He is barking up the wrong tree: if things do warm up for Taylor, the real heat will not come from the media at all.

Let’s recap:

- Taylor has set up networks of opaque companies that can be, and actually have been, used for arms smuggling to Iran;

- Taylor works for overseas types with track records in arms smuggling and moneylaundering;

- Taylor persists in adding more, and more opaque, companies to the existing networks.

This unappealing fact set could easily attract the attention of several countries that have a very brisk way with perceived threats to their national security. They won’t care a bit that the conspicuous idiot in the middle of it all is loudly convinced that he’s doing nothing illegal. Pressing on into this very dangerous terrain, as Taylor has, looks terribly unwise. In Taylor’s shoes, or Smith’s, I’d definitely consider a different line of business, assuming my current clients were willing to let me off the hook.

In June 2011, Taylor announced that he was running off his New Zealand business, though not necessarily because he’s as worried as he should be about a visit from some secret service or other, or from his equally alarming business associates. Professedly, it’s just because of that nagging media coverage, and because of the hassle he’s been getting in New Zealand from the whack-a-mole game. In short, the proxy idea that Taylor pitched to the Russians hasn’t been working very well, because he’s still been too easy to spot and thwart. The Organized Crime and Corruption Reporting Project has the story:

OCCRP obtained a memo written by Taylor in early June to his clients announcing a halt in operations. In it, he said the services his company provides were shut down due to “irresponsible media and a government department that was embarrassed by that media and looked to blame someone.”

The offshore agent told his clients that the situation was past legal resolution.

“Even our top level lawyers are afraid to stand by us because they fear what the government may do to them, despite the fact that WE are the victims,” he wrote in the same e-mail.He said the firm would not accept new customers, but assured current clients that they would be transferred to another firm who would, for a fee, “incorporate a new structure in a reputable Asian jurisdiction” with services provided by “a bank you will already know and trust.”

Naturally, various official and unofficial sleuths will now be sniffing after this new firm and the “reputable Asian jurisdiction”…

If “a bank you will already know and trust” turns out in due course to be Wachovia again, one can only emit a hollow laugh. They were the bank involved in the supercolossal $400Bn moneylaundering that operated via companies incorporated by Taylor. Wachovia got a not-very-deterrent fine for that. If it’s some other bank, it must have been tangled up with Taylor for a long time, promising revelations that will be just as ugly as another Wachovia gaffe.

Anyway, Taylor’s activities in New Zealand do indeed taper off over the last year. By way of indication, of the companies directed by Taylor’s proxy, Angelique Lilley, just 14 are registered after June 2011, the very last on the 2nd May 2012. It looks as if he’s had as much fun as he can stand in New Zealand, for the moment.

What of Smith? Amusingly enough, and also in early June 2011, Glenn Smith registers a company called Exit Stage Right Limited. That sounds like as clear a declaration of intent as one’s ever going to get, but in fact it doesn’t really stop there. Smith appears to be slowing down, though, just like Taylor: just 64 new companies were registered at Level 4 Khyber Pass Road between June 2011 and the most recent entry on 31st May 2012. Lately there is no named agent registering these companies, just some variant of “Equity Trust International”. The only New Zealand entity with a name like that is Equity Trust International Tax Agents Limited, directed by Glenn Smith; so yes, he’s still at it, as of a couple of weeks ago, albeit at a reduced pace; or under better cover.

Hats off, then, to the mole-whacker who has been trudging through New Zealand’s company register and turfing out the rubbish inserted by Smith and Taylor. There are hundreds more companies that need a close look, but, pending some more cunning tactics on the part of the moles, the mole-whacker is having some success. Perhaps he will soon have soulmates in other jurisdictions, too. One awaits the next grisly sightings of Taylor’s legacy, registered in “Asia”, or Delaware, or London, or wherever.

Background reading:

For an overview of modern international crime, state capture, and the impotence of international law enforcement: Mafia States

For the state of the art on corporate transparency: OpenCorporates opens up new database of corporate directors and officers

UPDATE: A brisk smack upside the head from milliepickle in the comments prompts me to point out that Kiwibank, which closed Taylor’s bank accounts, is state owned. That might indeed help to explain its unbanklike responsiveness to the governmental embarrassment caused by his activities; or to explain a sense of civic duty not universally present in privately owned banks.

Please update your understanding of the New Zealand banking system. Kiwibank is the only public-owned bank, which would account for their ‘surprising’ (per your statement) behaviour. It is not, therefore like the other banks you mention. A further article, or update to this one, incorporating that information would clarify the unusually forthright behaviour. It is under threat in the current government who would love to privatise it. The other 4 big banks in NZ are all Australian. NZ has had to fight tooth and nail to get and keep our own bank. But it is obviously worth it as they behave in a publicly responsible way when crimes like those you mention occur.

“It is under threat in the current government who would love to privatise it.”

The entire globe is under threat millepickle…

http://www.mediawhores.co.nz/index.php?option=com_content&view=article&id=281:kiwibank-to-be-rubbished-by-global-banking-cartel-so-it-can-be-sold-off-cheap&catid=1:latest-news&Itemid=47

Deception is the strongest political force on the planet.

How cheeky of those Russians to sell arms to Iran. Don’t they know that’s a CIA monopoly?

Can’t have Iran get arms when they are in the crosshairs of Israel and the US. BTW, when is the last time Iran invaded another country? When is the last time Israel and the US invaded another country? Hmmm…maybe the wrong countries are getting way too many arms.

From your link:

“United States authorities plan to indict a New Zealand company involved in selling North Korean arms to Iran, sources linked to the investigation say.”

Last time I looked, no-one had elected the US to World Policeman.

To the extent that facilitating the sale of arms to Iran is illegal, it would be a problem for NZ law.

http://www.mfat.govt.nz/Treaties-and-International-Law/09-United-Nations-Security-Council-Sanctions/Doing-business-with-Iran.php

And, echoing Jagger, if Iran wants to buy air defense systems able to shoot down attacking Israeli and US jets, or anti-ship missiles capable of putting holes in US carriers, I say “Good on them”. Seems perfectly reasonable.

Remember, this is a feature, not a bug. This was put in place by the fanatical “privatizers” in the New Zealand government, and as you all know, “privatization” is code for theft. The people who wrote the current law in New Zealand like it this way — being a haven for criminal operations is equivalent in their minds to being “good for business”.

There are obviously other members of the NZ Parliament who disagree with this attitude, but they’ve been unable to get it fixed.