Warren Buffett famously said, “Only when the tide goes out do you discover who’s been swimming naked.” Buffett did not add that unlike nature-induced exposure events, market losses will feed on themselves when there is meaningful leverage involved. We are getting a sense now of how significant borrowed money was in stoking the crypto boom as experts warn that the downdraft could go from bad to bloody. Due to the lack of regulation and centralized reporting, along with the very large number of coins implicated. it’s not possible to know how much debt was behind the crypto boom. But the persistent fall of the once pride of the pack, Bitcoin, suggests quite a lot.

We’ll soon discuss crypto “treasuries,” a cleverly misleading branding of entities that bought cypto and borrowed against it and then sold interests to investors as ETFs, giving them an all-too-easy way to turbo charge their crypto exposure. But let’s first look at the level of carnage.

“Since October 2024” ought not sound that bad….unless you were among the punters who added to Bitcoin or crypto positions since then.

LIKE, IF YOU ARE NOT SELLING #BITCOIN pic.twitter.com/uRb5F4kGMO

— Vivek Sen (@Vivek4real_) December 1, 2025

But all eyes are on the crypto treasury Stragegy. The lead story in Bloomberg Asia now:

From the text:

- Retail investors who invested in Michael Saylor’s Bitcoin experiment are paying a heavy price as Strategy Inc.’s shares plunged more than 60% from recent highs.

- The most popular exchange-traded funds tracking Strategy’s stock have dropped more than 80% this year, with the trio of MSTX, MSTU, and MSTP losing about $1.5 billion in assets since early October.

- Strategy Inc. has created a $1.4 billion reserve to fund dividend and interest payments, hoping to calm fears that it may be forced to sell Bitcoin if prices fall further.

Strategy Inc. — the company once hailed for wrapping crypto exposure into a public stock — is scrambling to calm markets after its shares plunged more than 60% from recent highs, amid a sweeping digital-currency rout. On Monday, Strategy said it had created a $1.4 billion reserve to fund dividend and interest payments, hoping to calm fears that it may be forced to sell Bitcoin if prices fall further.

But for many investors, the damage is already done. The most popular exchange-traded funds tracking Strategy’s volatile stock — MSTX and MSTU, which offer double the daily return — have both dropped more than 80% this year. That puts them among the 10 worst-performing funds in the entire US ETF market, out of more than 4,700 products currently trading — just behind obscure short bets against gold miners and semiconductor stocks. A third fund, known as MSTP, launched during the crypto mania in June, is down a similar amount since its debut. Together, the trio has lost about $1.5 billion in assets since early October…

At the center of concern is a valuation metric known as mNAV — or market net asset value — which compares Strategy’s enterprise value to its Bitcoin holdings. That premium has largely vanished, bringing the ratio to around 1.15 — a level executives have flagged as a warning zone. CEO Phong Le said on a podcast that slipping below 1.0 could force the company to sell Bitcoin to meet payout obligations, albeit only as a last resort.

For half a decade, Strategy (NASDAQ:MSTR) — still “MicroStrategy” in every trader’s muscle memory — has lived by a simple, almost religious rule: buy Bitcoin (CRYPTO:BTC), never sell. Executive chairman Michael Saylor turned that hard-and-fast rule into a brand — a battle cry, even — and the company’s stock went up faster than the asset it was hoarding.

SStrategy’s orange dots — the little markers Saylor posts on X every time he adds more Bitcoin to the pile — became a kind of crypto liturgy. There have never been any red dots. Ever. Whenever the crypto’s high priest was asked by someone about what would happen during a steep collapse in price, he declared he would simply buy more Bitcoin.

And from the Wall Street Journal in The Year’s Hottest Crypto Trade Is Crumbling:

Michael Saylor pioneered the move in 2020 when he transformed a tiny software company, then called MicroStrategy into a bitcoin whale now known as Strategy. But with bitcoin and ether prices now tumbling, so are shares in Strategy and its copycats. Strategy was worth around $128 billion at its peak in July; it is now worth about $70 billion.

The selloff is hitting big-name investors including Peter Thiel, the famed venture capitalist who has backed multiple crypto-treasury companies, as well as individuals who followed evangelists into these stocks..

“The whole concept makes no sense to me. You are just paying $2 for a one-dollar bill,” said Brent Donnelly, president of Spectra Markets. “Eventually those premiums will compress.”

When they first appeared, crypto-treasury companies also gave institutional investors who previously couldn’t easily access crypto a way to invest. Crypto exchange-traded funds that became available over the past two years now offer the same solution.

Shares of Strategy slipped after the bitcoin champion launched a US dollar reserve to fund its dividends and warned that it could incur a $5.5bn loss if the price of the cryptocurrency does not rebound this year…

The company has funded its bitcoin purchases using a mix of debt and equity products, many of which have promised to pay investors dividends.

But as the price of the world’s biggest cryptocurrency has fallen from record highs above $126,000 in early October to around $85,000 in just over a month, Saylor’s method has come under pressure.

Strategy said on Monday it had created a $1.44bn “US dollar reserve” to fund its dividends. The reserve was financed by money raised from its share sales, and the Nasdaq-listed company said it aimed to maintain a dollar reserve that would fund “at least 12 months of its dividends”, growing to eventually cover “24 months or more” of payouts.

Shares in Strategy trimmed an intraday decline of as much as 12.2 per cent to close 3.3 per cent lower on Monday. The stock has fallen almost 41 per cent this year as investors have questioned the viability of its business model.

The company buys bitcoin by issuing shares, convertible debt and new preferred equity instruments. The move highlights how Strategy is bracing for its share price to fall even further. The company will in particular need cash to repay its $8.2bn worth of convertible debt holders if its share price does not rise.

And per the accelerating rout, it’s not as if this fall took place in isolation. From the Economist two weeks ago in Crypto got everything it wanted. Now it’s sinking:

In recent years the crypto industry has gone from an object of mockery in mainstream finance and the target of outright hostility from regulators to being broadly accepted, even encouraged. Banks and asset managers are launching products and the latest cast of American regulators are crypto enthusiasts. In October bitcoin’s market value peaked at $2.5trn.

Odd as it might seem, these victories now pose a problem for crypto. Prices have tumbled: bitcoin has dropped from an all-time high of around $126,000 in early October to just above $92,000. For a speculative asset—one which produces no income and relies solely on hopes for future capital gains—the absence of a fresh bullish narrative to justify further price rises is a challenge. And because wider acceptance has deepened crypto’s links with other markets, the ripple effects from the dip will be felt far beyond the industry….

In 2020 and 2021 lockdowns and fiscal largesse were paired with the increasing provision of crypto trading by mainstream brokers…

Today investors have no trouble getting their hands on bitcoin. Brokers offer access to a range of crypto assets to anyone with a phone. Some big investors have stayed away. This month crypto enthusiasts cheered the news that the Czech central bank had purchased $1m in bitcoin and other cryptocurrencies. But that was a drop in the ocean relative to the bank’s $171bn in reserves. And most central banks still rule out including digital assets in their defensive hoards. The scope for higher trading volumes, then, seems limited.

The other price of victory is that the pain from a crypto crash will be felt more widely than in the past. The investors most exposed to the recent slump are those who behaved as if the boom would never end…On October 10th some $19bn in leveraged crypto positions were wiped out after Mr Trump announced fresh 100% tariffs on China (the levies were walked back a few days later). No one knows how much leverage remains, but the further prices fall, the greater the risk of serial blow-ups.

To add to the China part of the equation, its government just announced it was tightening its crackdown on crypto. From Coinspeaker on November 29:

China is taking new steps to strengthen its crackdown on crypto payments as regulators warn that digital assets are once again creating risks in the country’s financial system. Officials say trading activity has resurfaced despite earlier restrictions, and they are now preparing stronger enforcement to curb the use of crypto and stablecoins in payments and transfers….

They [China’s central bank and other regulators] agreed that although the 2021 ban pushed crypto trading underground, the market has been active again. Now, the market has more scams, illegal fundraising schemes, and unregulated cross-border transactions.

Officials repeated that digital assets are not legal tenders and cannot circulate as currency inside the country. They warned that using them for payments or investments constitutes an illegal financial act.

For context, some stablecoins were a major concern because their anonymous nature makes it harder to identify users and trace funds.

China has indeed been intensifying its crackdown on scams, to the degree that it has increased its harassment of Thailand, admittedly with justification. But the “scams” campaign is likely even more about stopping capital flight, tax evasion, and money laundering..

Back to the idea that Strategy won’t liquidate Bitcoin is whistling past the grave. As Michael Shedlock explained:

Technical Failure

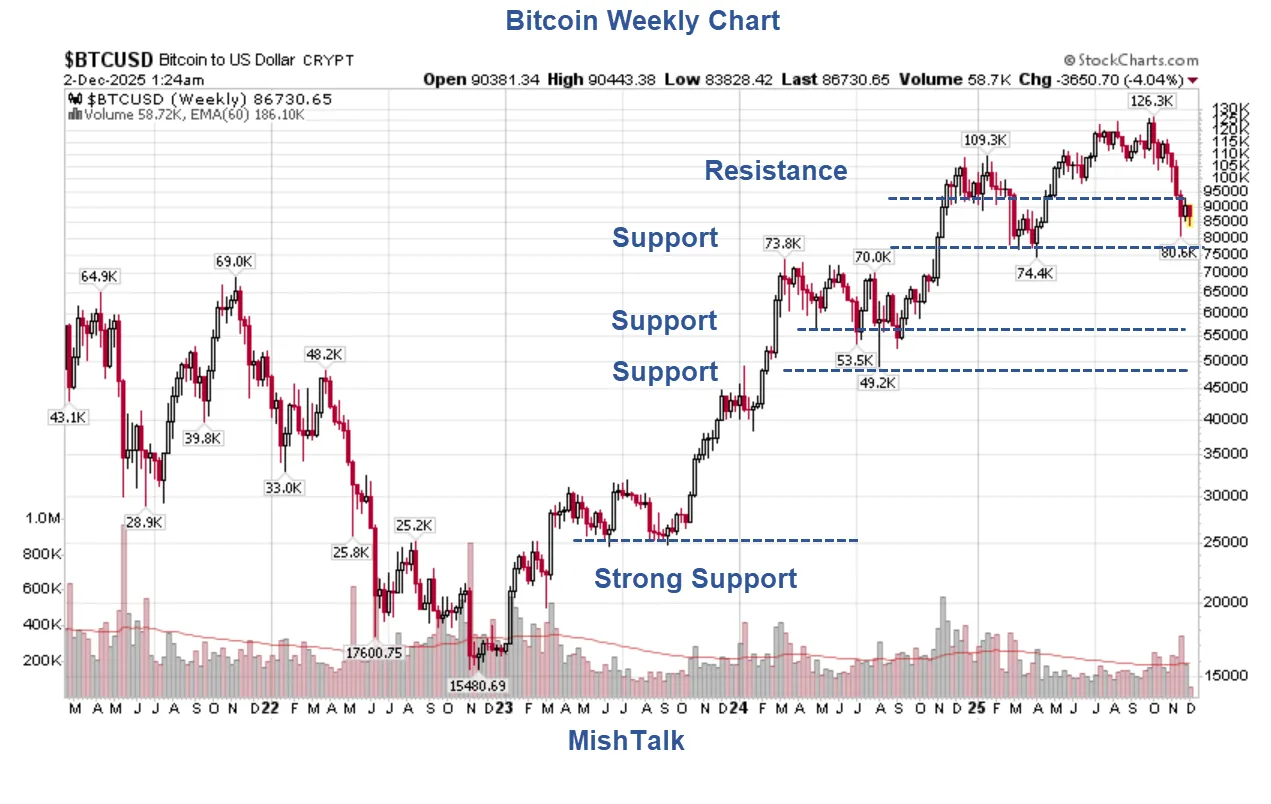

Bitcoin took a big dive from over $126,000 to $80,000.

Bitcoin then bounced to about $93,000 where it has since died.

If Bitcoin fails at this level, there is support at $75,000 then 55,000 then 49,000. If that fails then it’s 40,000 and 25,000.

Others are more pointed:

Remember what Michael Saylor said he will never sell bitcoin?

-I told you from day 1 this clown was a liability to the entire industry$MSTR is by definition a Ponzi. They had to sell stock to pay back current investors & loans

Now, they’ll dump $BTCpic.twitter.com/WoXu7NH8zR

— Crypto Bitlord (@crypto_bitlord7) December 2, 2025

Twitter has some tweets crying about victimization:

JPMORGAN ACCUSED OF PARTICIPATING IN MARKET MANIPULATION🚨

🤔🩳 JP Morgan sells shares of MSTR, increases margin req. from 50-95%, pushes for Strategy’s exclusion from the MSCI index, has a history of manipulating BTC price, calls for lower price, waits for -35% drawdown and… pic.twitter.com/t6gP3yc5uz

— X Market News🚨 (@xMarketNews) December 2, 2025

Along with IMHO “the lady doth protest too much” level cheerleading about inevitable success:

Reminder that I will be absolutely fucking unbearable when MSTR is trading at $1,000.

— The ₿itcoin Therapist (@TheBTCTherapist) December 2, 2025

Contra Shedlock, some believe there is a floor for Bitcoin:

Bitcoin has NEVER dropped below its electrical cost

Current Electrical Costs = $71,000 pic.twitter.com/E0lBK7TB15

— Coin Compass (@CoinCompassHQ) December 1, 2025

There is also much excitement on Twitter to try to counter the downer Bitcoin charts that Vanguard is just now allowing the purchase of Bitcoin ETFs. One has to think that most who hearted coin would have already done so outside Vanguard.

But there are other interpretations:

🚨 INSIGHT: Bitcoin mining difficulty is set to rise as hashprice sits near record lows. pic.twitter.com/grHta93AQI

— Cointelegraph (@Cointelegraph) November 30, 2025

Needless to say, this episode is still in play. Stay tuned.

All this leveraged trading seems dangerous, especially if it spreads to other highly leveraged markets. Weren’t there some rumblings about bad debt in the AI boom? In theory, from what I recall leveraged trading in stocks is regulated, but given the size of the bubble and the fact people were saying VC money was “about to run out” or something, for how much longer can this go on?

From what the VC guy who was quoted said, seems like maybe five quarters are left at the current frenzy rate of AI construction. I’d guess less because when the VC money starts to run low, they’ll quit investing, I can’t see them going all in on something that has never made a profit and never will. So maybe a year left before everything rolls over and dies.

The craziest thing about Bitcoin et al, which constitutes the largest bubble of all time, is the ‘Seinfeld of investments’ (it’s an investment about nothing) will offer no evidence that the bubble ever occurred in say 2525 if man is still alive, aside from the prop coins used in every photo op in stories regarding Bitcoin, that you can buy on eBay for a few bucks.

…when does the spot price of old yeller and Bitcoin cross?

Well I suppose that if Bitcoin crypto start to blow up, then all those investors could move into something safer and more secure – like Bored Ape NFTs-

https://en.wikipedia.org/wiki/Bored_Ape

I wonder if Jimmy Fallon and Paris Hilton still have theirs.

NFT’s? There’s never been a better time to buy!!!!!

This quote from the Economist caught my eye.

For a speculative asset—one which produces no income and relies solely on hopes for future capital gains—the absence of a fresh bullish narrative to justify further price rises is a challenge.

Narrative Futures, how 2025. I’ll argue that crypto’s utility in the field of money laundering and untraceable payments is worth something, and likely the reason it hasn’t been criminalized or regulated out of existence.

FTX was founded in May 2019. Over the next 17 months, FTX shoveled something north of $100 million (IIRC) at the 2020 elections, the consensus opinion being SBF looking to buy favorable crypto regulation, and I agree. What I’ve learned is that, in less than two years, a color revolution could be privately funded with money conjured out of thin air. I wonder if SBF regrets not aiming his money cannon in a different direction?

SB,F back in the news, from November 4, apologies if this was already linked). Appeals court dubious of FTX founder Bankman-Fried’s conviction challenge, CNBC.

From your quote, MSTR is “a speculative asset — one which produces no income and relies solely on hopes for future capital gains”.

Furthermore, MSTR operating procedure is to “buy[s] bitcoin by issuing shares, convertible debt and new preferred equity instruments”.

The strategy of MSTR is “a simple, almost religious rule: buy Bitcoin, never sell” — hence it could never take advantage of the favourable evolution of the bitcoin price to generate cash. And bitcoin itself does not generate any income.

Apparently, MSTR pays dividends — it is even constituting a “reserve” just for that — despite never generating any income.

So this means that dividends to MSTR shareholders can only be paid out of further sales of shares, or by taking on additional debt.

To me this looks like the exact definition of a Ponzi scheme.

How did those “sophisticated” investing/trading/speculating people fall for this? Were they hoping that MSTR would unexpectedly sell all its bitcoin holdings at the best time for a huge windfall that would cover everything?

My thoughts exactly….cash flow = more equity investors?

If it walks like a ponzi, talks like a ponzi…

sophisticated…speculating people

welcome to 2025…now it’s fungible. In a netherworld of suitcases…containing no clothes

“If the price drops, I’ll just borrow more and buy”. I’ve heard that song before, during the dot com boom. It works well until it doesn’t, but the first failure tends to be fatal.

In mathematics this is known as the “Gambler’s Ruin”. If you always keep betting more, never take money out, and just go on indefinitely, you’ll go bankrupt 100% of the time. This is true even if you make EV positive bets.

Serious liquidity issues surfacing in a variety of opaque places like private equity, private credit and of course this accident waiting to happen. Where will it all end?

As I write this, Bitcoin is up about 4.5% since yesterday’s drop:

https://www.tradingview.com/symbols/BTCUSD/?timeframe=7D

Volatility!!

Lol, it’s 150 miles to NYC, but when I cup my ear I swear I can hear Morning Joe delivering his patented line.

I did see a lot of rallying of the true believers on Twitter.

For some reason every time I hear/read about crypto I can’t help but think “Beanie Babies..”

When I hear people tall about Crypto, I think of “Pet Rocks” and tulips.

I had a Pet Rock named Reggie, paid $6 for it a half a century ago, never went up in value and the most I could lose was six bucks, which is how it worked out.