By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

I genuinely thought the Europeans were getting somewhere in the last few weeks as I detected (or maybe that should be optimistically hoped) a change of rhetoric from some of the more hardened camps and a growing realisation that the current approach to “solving” the crisis is failing. My optimism was helped by the fact that the OMT, like the LTRO before it, has driven down sovereign yields which has given the European leaders yet another opportunity to sit down away from the fire fighting and discuss outcomes beyond a short term market window.

But alas, this is Europe and I appear to have been wrong. So, as I warned last week, the next step along the road to further integration, the banking union, appears to have hit a wall:

German Chancellor Angela Merkel and French President Francois Hollande had gathered at the Baroque palace in Ludwigsburg, southwestern Germany, where Charles de Gaulle gave a watershed speech to German youth in 1962.

But despite affirmations that European unity was the only way out of the debt turmoil lashing the euro, they differed over a key plank of crisis-fighting: tighter checks on the European banking sector.

“I support a banking union, it is an important measure and we must proceed step-by-step,” Hollande told reporters, while stressing that such a framework should be in place “the earlier the better”.

Merkel, for her part, said Berlin also backed European oversight of lenders but urged a more cautious approach, saying haste could prove costly.

“For me it is important that quality is ensured. It is pointless to do something very quickly that in the end doesn’t work,” she said.

“It must be thorough, it must be of good quality and then we’ll see how long it takes. We will get our finance ministers to work with each other on it as quickly as possible.”

As I said in my previous post on the matter, the most important part of the union isn’t the supervisory component it is unified deposit insurance:

The whole point of having a supra-Eurozone backed insurer is that deposit holders in any participating country know that their savings are backed not just by their own national government, which may be struggling, but by all participating governments. In practice this should significantly reduce the outflow of deposits because, although probably not perfect, periphery banks will be seen as being considerably safer than they do today.

Without this component deposit outflows can be expected to continue, further weakening the periphery banking system while stabilising the core. There is a possibility, however, that this is about timing. The Germans would like to see periphery governments under the umbrella of the fiscal compact and providing deposit insurance, like the OMT, is a disincentive. The jawboning of Spain continues and German politicians are becoming frustrated that Rajoy hasn’t yet drunk from the poison chalice:

Germany’s governing coalition showed growing exasperation with Spain, as a senior ally of Chancellor Angela Merkel said Prime Minister Mariano Rajoy must stop prevaricating and decide whether Spain needs a full rescue.

“He must spell out what the situation is,” Michael Meister, the chief whip and finance spokesman for Merkel’s Christian Democratic Union, said in an interview in Berlin today. The fact he’s not doing so shows “Rajoy evidently has a communications problem. If he needs help he must say so.”

Obviously this is about politics. Mr Rajoy is well aware that austerity programs in other nations have seen the end of the government and I am very doubtful, given other circumstances, that Spain will be any different. I note, however, that Mariano is doing a fair job of destroying his own career.

The Spanish banking system continues to see rising bad debts and a new report due shortly is likely to show that at over €60bn is required to cover losses. Given the current economic situation of both the state and the regions on top of the continuing declines in asset values it does not seem possible that the Spanish sovereign can cover these costs. The Spanish government is attempting to implement austerity of its own in order to soften the blow of conditionality, but this won’t in anyway alter the outcome that Spain will require an external program.

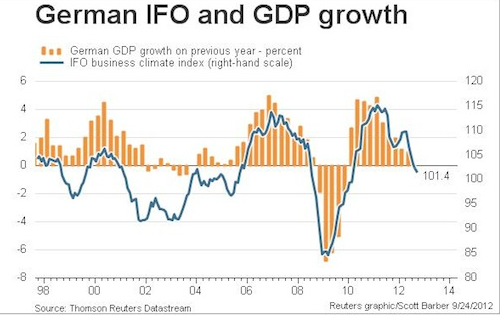

The poor economic data also continues. In a follow-up to the depressing read that is the Eurozone flash PMIs, the latest German IFO continues to follow the same trend:

Germany’s relative resilience to the euro zone crisis has been steadily fraying as its firms see falling demand for their products from key European partners and signs of a slowdown in other markets.

Earlier this month ECB chief Mario Draghi announced a new and potentially unlimited bond-buying program to lower the borrowing costs of embattled euro zone countries such as Spain but market optimism has not spread to company boardrooms.

The Munich-based Ifo institute said its business climate index, based on a monthly survey of some 7,000 firms, fell to 101.4 in September from 102.3 in August, defying expectations for a slight rise.

In other news the Troika discussions in Greece have been halted for a week after long and heated back-and-forth over further budget cuts. There has been no official word from the Troika as to the outcome but given IMF President’s, Christine Lagarde’s, latest statements I can only assume she has been briefed on the futility of the current situation:

Greece faces a financing gap that won’t be solved by budget measures being discussed because a weak economy and delayed privatizations have worsened its fiscal situation, International Monetary Fund Managing Director Christine Lagarde said.

Lagarde said efforts being discussed by the Greek government and the so-called troika to find 11.5 billion euros in savings won’t be enough to put back on track Greece’s 130 billion-euro (168 billion) bailout jointly funded by the IMF, the European Commission and European Central Bank.

A “financing gap” has emerged because of “the macroeconomic situation, the major delay in privatization and therefore shortfall in proceeds from the privatization” as well as “limited revenue collection,” Lagarde said at the Peterson Institute for International Economics in Washington. “The Greek debt will have to be addressed as part of the equation.”

As I said a month ago the discussion over the latest package is quite irrelevant. The Greek economy is in a shambles, resembling that of a failed state, and it is very obvious that Europe will have to a ) provide on-going funding, b ) provide some form of official sector adjustment, possibly a large lengthening of maturity c) let Greece default.

Overnight German lawmakers re-iterated their objections to further funding, so I have to ask what’s left?

German lawmakers would refuse to back a further writedown of Greek debt because such a move would amount to a third aid program, a senior ally of Chancellor Angela Merkel said.

“How could we possibly do that?” Michael Meister, the parliamentary finance spokesman for Merkel’s Christian Democratic Union party, said in an interview in Berlin today. “Where would it stop? We’re talking about loans from as recently as last year.” Germany’s lower house of parliament, the Bundestag, which must approve aid, “would not go with it.”

Asked about a report in this week’s Spiegel magazine that Greece’s budget gap may be almost twice as big as envisioned, Meister said that even if it were true, “it’s up to the Greeks” to address the problem. He reiterated that as long as the nominal aid for Greece is not increased, “there are a number of possibilities, including front-loading financial help from the second packet.”

So against my misguided optimism it seems the Eurozone has fallen back into its old ways. The economy continues to shrink, the current policy response is making the problem worse but meanwhile the eurocrats struggle to agree on anything that may help.

Any European “optimism” was unrealistic to begin with. We’ve been warning about this on our site pretty frequently. Glad to see it come up here.

Stiglitz: Steal

http://market-ticker.org/akcs-www?post=211952

Yves I am wondering if you could weigh in on the comments regarding S.S.regarding if they have to pay the debt owed the fund back or not in this zh article or if you have an expert who could?

http://www.zerohedge.com/contributed/2012-09-24/fed-systematically-destroying-social-security-and-retirement-plans-millions

What is the point of having a banking union and deposit insurance when the whole system has almost no collateral in it? It’s a ponzi scheme operation being played and pyramided between computers, and at the imminent eventuality when somebody tries to cash out of it, we’ll all discover just how utterly worthless all this “money” is.

This is why all this finance talk of “rescues” and “away from the fire” doesn’t amount to a hill of beans. There is no collateral. There is no collateral. There is no collateral. And all the jawboning and postponing in the world isn’t going to change that fundamental fact of reality.

The way this is *supposed* to work is that depositors get payouts (up to the deposit insurance limit), from newly-printed money, and the *banking institutions* — which caused the mess — are declared insolvent and dissolved, while their *managers* (who REALLY caused the mess) are rendered unemployable, criminally investigated, and have their personal fortunes expropriated.

Desire to give the bank managers whatever they want is what is preventing this outcome.

The real problem here is that the human race is running short of natural resources to plunder, and this naturally has knock-on effects on our arbitrary monetary system that absolutely demands infinite consumption and unlimited waste.

It is extremely annoying to me that this is a fact that those who study economics and finance are usually blind to, but I suppose they’ll become aware of the errors in their thinking soon enough. When the lights go out.

This is the big picture Gordon. Something to worry about at a scale of decades. Meanwhile, at the scale of democratic elections (the scale that matters to the political masters) there are still many tricks and subterfuges and double somersaults and juggling acts to be performed to entertain the subjects and advance political and econometric careers.

Burying one’s head in the sand like all the politicians and masters of the universe are doing does not make the “big picture” go away. I just traveled through 900 miles of the northwestern US so filled with smoke that the air is un-breathable. A half million acres of forest in central Idaho alone on fire. All the grain fields without irrigation hardly worth harvesting–a pattern continued into the midwest.

Above the arctic circle the polar ice cap is rapidly becoming a historical artifact— its demise is a near certain event that will take place as soon as next year or at most a few decades. Its impact will be a drastic reorganization of the worlds climatic patterns, with no guarantee as to what or if a new equilibrium state may resemble. The die has already been cast, and no amount of “engineering” can change its basic outcome.

The “big picture” is one of the world we live in and depend upon. Compared to our actions as a species in which there is little evidence that we are more intelligent than lemmings, a circus in which two political whores contest the title of President of a declining empire is of no significance.

JGordon,

There’s all kinds of things we can produce that don’t plunder natural resources…

Education

Medical care

Leisure activities

The list is endless…

Using solar and wind energy may help the situation too.

We need food, shelter, healthcare, education, transportation, happiness.

Everything else is secondary and we can live without it.

Don’t forget clean water. It’s probably the most critical thing right after energy we have to worry about.

I wouldn’t worry too much about clean water; the ocean is full of it. Soon graphene based desalinators will make desalination much cheaper.

We should probably spend a lot of new money on building aquaducts to get fresh water from where it is plentiful (such as the Great Lakes) to where it is needed. Also on new thorium reactors for any desalination and pumping needed.

“But alas, this is Europe and I appear to have been wrong.”

This dreadful anti-European cynicism has become just as pathological as the no less disgusting gloating of Anglosaxon economists and media at the Eurozone’s “woes”. The real “woes” are with the Anglo-American economies where debasing currencies and corrupting yield curves and inflation expectations have been rampant for years. Not to speak of the bloated, commodity-based Australian economy. Aren’t you a little bit ashamed? Isn’t it time you people took a hard look at yourselves before bashing Europeans?

nonsense, calm yourself, nobody is bashing “europeans” on this blog

btw I know a lot of ‘europeans’ who don’t want to be called an european nowadays, as being ‘european’ is seen today by many as a synonym for being german

Ah, you know a lot of Europeans who don’t want to be called “an (sic) European”?

Well thanks for this gem of an anecdotal argument. I have another one for you: I know many Europeans too, probably many more than you do, as I’m a European myself. None of them have a problem being associated with Germany. In fact, most would like their country/compatriots to be more, not less like Germany and the Germans.

Of course, you would never know that as a monolingual American reading the Europhobic rants splattered daily on anglosaxon blogs and news websites.

Make no mistake, this is a financial war, waged against Europe by the shortsighted and irresponsible elites of credit-addicted Anglosaxon economies, aided and abetted by their coopted news media pandering to the anti-continental populism that has been fed for years by, among others, News Corp’s paranoid Europhobia.

du bist ein idiot!

Another excellent argument! Thank you, Google Translate

vaafanculo

übrigens, mein lieber ‘Europäer’, mit Karl Kraus würde ich sagen, dass ich mit gewissen Leuten nur die Verdauung gemeinsam habe, und das auch höchst ungern

tja, meine Lieben, in ‘Europa’ spricht man jetzt deutsch, und zwar mindestens 1000 Jahre lang :-)

It’s not gloating, it’s not bashing, it’s not cynicism. It’s not financial war; if anything the Anglo-Saxon nations have been helping Europe by their somewhat better policy & the relatively higher demand therefrom.

It is sympathy for a continent of fellow human beings who are being insanely tortured for no reason at all. Woes inflicted by a mad European elite, mentally stuck in a medieval insane asylum.

For the sake of innumerate, illogical, incomprehensible economic theories that sort of sound good, sort of sound commonsensical. That have probably ensorcelled you. But in actuality make no sense. That no one understands – because they make no sense. That use mathematical fakery – that no real mathematician has ever been involved with or not laughed at. That have never worked anywhere. But have tragically been institutionalized in the Euro, and in the insane “reforms” (self-destruction) which central intervention is conditioned on. Which followed decades of inferior economic performance, decades of mild austerity, decisively since the idiot Mitterand’s idiotic 1983 tournant de la rigeur, and really before. And in the brainwashing of the German people, fed lies about their own economic history, fed absurdities equating “printing money” with debasing currencies. What matters is not whether you “print money”, whether you go into debt, but what you do with the money, the credit. Considering Europe, why not listen to the decency of Helmut Schmidt, criticizing recent German behavior?

Quite a bit of puzzling grammar and word choice there, Calgacus, and it’s hard to find a decent argument in your curious anti-European rant, but let me address the one seemingly coherent point you make about printing money not being the same as debasing a currency:

While I understand and appreciate MMT-type arguments, you – and many others here – should realize that there really is no empirical evidence supporting the view that monetary stimulus works at the zero lower bound. Can you name one example in economic history of a large monetary entity succesfully reversing a bout of asset price deflation by “printing” more money?

“Can you name one example in economic history of a large monetary entity succesfully reversing a bout of asset price deflation by “printing” more money?”

WWII?

Wasn’t WWII a fiscal stimulus? Doesn’t Mitchell advocate fiscal stimulus and views montery stimulus as pretty much worthless?

Robert Dudek September 25, 2012 at 12:58 pm

Yes to both. WWII was fiscal stimulus. The reference to monetary authority means the government that has both options. I wouldn’t be surprised if most people are confused about the difference, hence the claim that “the Fed is printing us into hyperinflation”.

Quite a bit of puzzling grammar and word choice there, Calgacus, and it’s hard to find a decent argument in your curious anti-European rant, but let me address the one seemingly coherent point you make about printing money not being the same as debasing a currency:

Nothing anti-European in what I wrote. The anti-Europeans are those imposing austerity, poverty & unemployment on a continent, for no reason at all, but to make a few rich people relatively richer. And unfortunately you seem to support them – correct me if I am wrong – so I would call you objectively “anti-European” if I called people such things.

While I understand and appreciate MMT-type arguments,

I don’t think so, or you wouldn’t mention zero lower bounds.

It just doesn’t matter how a deficit is (not) financed. “Zero Lower Bound” is nearly meaningless. What matters is how big a deficit is & how it is spent. The real “printing money” happens during (deficit) spending. Monetary, central bank, operations are a sideshow. (Except in Europe, where the ECB has essentially fiscal powers.)

you – and many others here – should realize that there really is no empirical evidence supporting the view that monetary stimulus works at the zero lower bound. Can you name one example in economic history of a large monetary entity successfully reversing a bout of asset price deflation by “printing” more money? How about every time? How about every country, ever, during a reasonably successful war after such a deflation? How about the New Deal, in addition to WWII adduced above? – As Marshal Auerback notes, even the “liberal” “progressive” “left” have a record of distorting, belittling how effective the New Deal was.

There may be a semantic problem here: I am using “printing money” in the older, commonsense way of money created for deficit spending. Sometimes it is used for “QE” buying bonds with newly created currency. That this purely monetary, nonfiscal policy has a substantial effect is a joke – all it does is lower rates; no big deal unless the central bank just created a depression by raising them to the roof. Much/most of the time, like right now, it is / should be deflationary, not inflationary.

Aikamoista hevonpaskaa suollat, toveri. Mitäs jos vetäisit vaikkapa vitun päähäsi ja kuolisit, perkeleen idiootti?

Asshats like you make me despise the “european identity” even more, may your fetid dreams of an EU dictatorship under banker tyranny face a swift and miserable death.

Don’t worry, Sebastian, Europe is just the first to go. Then comes China, Japan, the developing and other developed nations of the world, and then the United States.

HAHAHAHAHA!!!!!!!

Touchy subject, Salvo, because many so-called “progressive” who inveigh against Bernanke for “saving the system”, extol Draghi’s subversion of democracy in the continent of Europe for doing the same.

Many “progressives” are willing to sacrifice democracy for the “great good”, and to them, the “greater good” is a United States of Europe, in which the “resident” from the state of Germany considers a mid-level bureaucrat in Greece his “fellow citizen”.

Lost on these “progressives” is that a Spaniard in Spain actually wants to cheer for the Spanish team as it competed in the Olympics, or that the Italian wants Italy, and not a team from the US of Europe, to win the upcoming World Cup.

Lost on these progressives, too, is that many many currency unions have imploded.

I quite agree with you Mr. Amithere. The American foray into British imperialism and all its monetarist trappings are, indeed, at the root of the crisis afflicting Europe. Try not getting too worked up about cynicism directed toward Europe, as open-ended hyperinflationary bailout the U.S. Federal Reserve is committed to guarantees Europe’s woes will only more deeply penetrate U.S. shores. The same insane asylum producing Europe’s political establishment is displaying its influence this side of the Atlantic, as well. Rest assured, misery loves company and there will be plenty to go around here.

“as open-ended hyperinflationary bailout the U.S. Federal Reserve is committed to”

Can you explain this with a little more detail please?

What Bernanke’s doing in no way resembles the magnitude of Draghi’s intervention in the EZ.

Draghi is unilaterally crafting fiscal policy in Brussels and imposing it on the non-core nations.

For all the problems the US has, it is infinitely better positioned to prosper than the Eurozone and it’s “small group of far sighted statesmen” who believe that democracy is no longer necessary.

Yes, the US sucks. The hyperpower wants to drag the whole world down to Hell along with it as its prolonged death agonies drive it mad. You know, though, I’m reminded of Claudius’s retort to his niece when she pointed out, that they all did things under the reign of Caligula they regretted. “Yes,” said Claudius, “but some of us did them a little more willingly than others.”

Being under attack by the US doesn’t mean you need to sacrifice Greece…. and Spain… and Italy… and Portugal… and who knows who else before it’s all over. Indeed, not destroying the individual states of the Union (er… excuse me, countries of the Union) might allow Europe to better resist the depredations of the Beast.

Still Europe is lucky, the Beast is in very bad shape, it’s parasites are devouring it, so it can’t take good advantage of the situation… but it’s not down for the count yet!

Ah, you know, if the European crisis has taught me anything, and it has, it’s that there aren’t any Europeans and there never were. There are Germans (Boy, howdy!), French, Greeks, Italians, Latvians, Spaniards, etc, but not one European to be found. The European is sort of like a Hobbit, a mythological creature more likely to be found in Middle Earth than “On the Continent” as they say.

And it really is too bad, because the Europeans were a great people, technologically advanced, intelligent, utopia builders… but it was all a lie. It turns out that the myth of the European was just a way for the Germans to talk everyone into using the Deutschmark rather than their local currency. Well, they are clever people those Germans (I should know, too bad lousy Bismark made my family leave the country. Damn Bismark.), they even renamed the Deutschmark the “Euro” to add more weight to the whole “New European Man” myth.

But it was all a lie. It had a good run. It inspired a lot of forward looking dreams of scientific progress and a golden age, but now it’s dead.

Hopefully “the European” will be given a decent burial soon, it’s long past time to mourn his passing. This whole mess is starting to remind me of Antigone (a Greek Tragedy, how appropriate!).

“Obviously this is about politics. Mr Rajoy is well aware that austerity programs in other nations have seen the end of the government …”

This is an understatement. Mr. Rajoy’s main concern is not the survivavility of his gov’t. It is the survival of a whole system of predatory gov’t.

I’ll give one more example of the nature of the corruption infesting the Spanish gov’t. In many modern countries with decent political masters, the citizen and specially the press can know what the gov’t spends the money on. There are several kinds of ‘transparency laws’. Spain did not have any such law, the gov’t was totally secretive, and that projected a backwards image of Spanish political masters. So the parliament passed a Transparency Law that forced the gov’t to answer questions posed by citizens about the inner gov’t processes and most importantly its expenses. BUT the law came out with one small caveat. Although the gov’t is now forced by law to answer all those questions, it may answer with silence. And so it does. That kind of chicanery does not happen in northern European contries.

The structural reforms demanded by northern countries involve not just budget constraints to secure the payment of debt and interests (this payment is the biggest expense item for the whole of the Spanish gov’t from 2013) but also a reform of the State to make it honest, professional, decent.

Mr Rajoy is dragging his feet and procastinating with the rescue package to see if things somehow change and so he avoids touching the living conditions of the predatory political class, those that make the job of Spanish politician so pleasant and rewarding for so little work and less talent. His peers in Europe are getting tired of this pathetic act; he is doing the same as he did with delaying the 1st package of social welfare cuts to help his friend win Andalucian elections, which in the end he lost.

“His peers in Europe are getting tired of this pathetic act;”

http://www.ft.com/intl/cms/s/0/5798ec4e-0730-11e2-b148-00144feabdc0.html#axzz27Y8MTF8f

Delusional Economics needs to get some fresh air in his helmut.

http://www.macrobusiness.com.au/delusional-economics/

He needs to purge his Xtrevilist shaped and formed brain of all the econoswoggle he has absorbed over the years that have made him just another tool of the man that now fans the flames of the intentionally created global perpetual conflict herd thinning and at the same time keeps the bamboozleonomics jargon alive and well.

Its not “vested interests propaganda” , its the aberrant few rich pricks Noble Lies. And it is not a financial crisis, it is a global moral crisis — a virtual gang rape of the masses by the self anointed elite rich who have hijacked and destroyed the ‘rule of law’. We are talking pure, raw, mean ass, class war here!

If he truly wants to provide a “balanced counterpoint” then he is going to have to drop the fluffy and over deflective Xtrevilist provided econobabble and speak plainly and clearly.

Enough fluff!

Get Tough!

Deception is the strongest political force on the planet!

Don’t expect too much from a guy who styles himself a Delusional Economist.

Why does anyone think that the Europeans can solve this problem, when they only know how to war against each other? They exported that trait to the U.S.A., as our own economy shows. Nothing will change until all the economists & Bankers as well as congress critters are behind bars, the keys to the doors having been melted. The idiotic game of who’s on top only leads to chaos, as we have today.

In reply to Paul, september 25, 2012 at 8:22 am (Sorry, can’t seem to make a nested comment to your reply)

WWII is not a very convincing example of monetary stimulus and its effects on deflation. In fact, yields on US treasuries right now are almost half of what they were during most of the Depression years.

It is, of course, an example of fiscal stimulus, but that’s pretty much irrelevant to the European discussion: Even if there were political support for fiscal stimulus in debt-ridden eurocountries, the EU and the Eurozone do not have proper democratic mechanisms in place for such fiscal decisions.

But even if there were, does anyone really believe fiscal stimulus in countries with 100%+ debt-to-GDP would restore confidence in the bond markets? Would growth of, say, 2% – a very optimistic scenario – do much to alleviate debt burdens in these countries?

More importantly, does anyone really believe that the relentless anglosaxon financial and media campaign against the euro, the EU and the “eurocrats” has anything to do with sincere concern for the wellbeing of the people of Spain, Portugal and Italy?

But even if there were, does anyone really believe fiscal stimulus in countries with 100%+ debt-to-GDP would restore confidence in the bond markets? Sebastian Amithere

Who the heck cares about the bond markets? The EZ countries must rue the day they gave up their monetary sovereignty.

Would growth of, say, 2% – a very optimistic scenario – do much to alleviate debt burdens in these countries? Sebastian Amithere

Growth isn’t needed to cure nominal debt; new reserves given out to the population will do the trick. Steve Keen and others have suggest this.

Yes, I’ve heard these types of arguments about the imagined advantages of monetary sovereignty many times. Mainly, again, from the mouths and pens of anglosaxons, none of whom are actually European, nor truly concerned about Europeans.

What I haven’t heard, is any convincing argument why and how the periodic devaluations and (other types of) defaults endemic to southern European countries before the EMU were that much of an advantage. Or what will happen to commodity prices and inflation in these chronic deficit countries if they would do what many in anglofinance have been trying to convince them to do, i.e. break out of the Eurozone and devalue their former currencies?

Could it be that the “pain” that the people of PIIGS are “suffering” due to “Euro woes” has more to do with short memories, relative deprivation and the old game of anglosaxon goading and divide-and-rule on the Continent, rather than with any rational expectation that returning to their chronically failing former currencies would return growth and prosperity?

And in any case, what does “monetary sovereignty” mean when Germany’s currency will dominate the continent’s economies and monetary policies no matter what, just like it did before Maastricht?

And in any case, what does “monetary sovereignty” mean when Germany’s currency will dominate the continent’s economies and monetary policies no matter what, just like it did before Maastricht? Sebastian Amithere

Monetarily sovereign governments would be wise to accept NOTHING other than their own fiat for taxes. If some one attempted to pay with Euros or DMs the Greek (for example) tax collector should say “That money is no good here. Go buy some Drachma.”

“If some one attempted to pay with Euros or DMs the Greek (for example) tax collector should say “That money is no good here. Go buy some Drachma.”

Really? What if most of the government debt is denominated in another currency, as it all too often was before the EMU? Would your tax collector still prefer Drachmas to hard DMs?

Really? What if most of the government debt is denominated in another currency, as it all too often was before the EMU? Would your tax collector still prefer Drachmas to hard DMs?

Government debt (i.e. bonds) are diffrence from taxes owed.

It’s not a matter of preference. Simply pass a law that says taxes must be paid in drachmas – as, presumably, was the case before EMU.

What if most of the government debt is denominated in another currency, Sebastian Amithere

Either default on it or tell the creditors “Here’s some Drachma. Take it or leave it.”

I prefer the first option. Lending to governments is rather scummy. If pensioners will suffer then let their home governments make up the loss.

Also forcing tax payers to buy Drachmas with, say, Euros would force up the value of Drachmas and force down the value of Euros so even if the government did need Euros it might easily buy them more cheaply itself.

>What if most of the government debt is denominated in another currency

Government debts are irrelevant, they can be nullified trivially with a government order. The only reason to keep them going is to keep on fattening up the already fattened 1% scum. You thought the arab spring was big? You ain’t seen the end of EU yet. None of you eurocrats will have fun when our national sovreignties are restored in europe. After all, you are nothing but traitors to us.

Stop harping on about “those evil anglo saxons” or whatever bullshit of the day you prefer. The only evil ones here are you megalomaniacs who try to subjugate the entire continent under a bureaucratic, anti-democratic monstrosity.

What does monetary sovereignty mean?

The UK has a similar debt/deficit profile to that of Spain.

UK can issue 10-year paper at 1.82%

Spain issues 10-year paper at 5.72%, and that’s a dirty yield quasi-contingent on German support.

The UK, having decided not to cede its monetary sovereignty, has become the premier nation in the continent of Europe.

Trust the British to understand money!

But even if there were, does anyone really believe fiscal stimulus in countries with 100%+ debt-to-GDP would restore confidence in the bond markets? “Bond markets” are not a terribly meaningful concept in a normal, monetarily sovereign state, which can very easily & probably should, control the interest rate of bonds at all maturities. The real concept is desire for savings – which is expressed as a high debt/gdp.

Would growth of, say, 2% – a very optimistic scenario – do much to alleviate debt burdens in these countries? After an impossible to predict short adjustment default/debt restructuring period, I would expect an extended period of double digit growth in a such a European country formerly enslaved to the Euro. Most of Europe has been suffering from FOUR DECADES of (mild) austerity. Before the 70s, Europe had lower unemployment & grew faster than the USA. After, these switched, because the USA abandoned sane economics, practiced austerity, somewhat less.

What I haven’t heard, is any convincing argument why and how the periodic devaluations and (other types of) defaults endemic to southern European countries before the EMU were that much of an advantage. Of course it is not good to have a “devaluation” – i.e. have your floating currency decline. It is always good to have a strong currency. But the natural (short term) effect (through trade) of prosperity, from any cause, particularly fiscal expansion, is (limited) currency weakening. SO WHAT?

Again, a strong currency is always a good thing. It’s just that the usual ways to strengthen a currency are financial quick fixes like high interest rates that destroy more than the strong currency benefits. The only good way to have a strong currency is to have a productive real economy. The hard, old-fashioned way. And the minimum to do this is to use the common sense MMT/Keynesian/Institutional/Circuitiste social technology: chock-full employment through a JG and functional finance.

And in any case, what does “monetary sovereignty” mean when Germany’s currency will dominate the continent’s economies and monetary policies no matter what, just like it did before Maastricht? Monetary sovereignty means the capacity for full employment, of the kind not seen in Europe for over a generation. And the cessation of the colossal losses of real wealth from high unemployment. And the prospect, ceteris paribus, for extended double digit growth rates comparable to China’s say.

Really? What if most of the government debt is denominated in another currency, as it all too often was before the EMU? That is a major problem. Never, ever do this. States should never, ever become significantly indebted in another currency. Issuing foreign-denominated debt is UTTERLY INSANE 99.9% of the time. Utterly shortsighted. May give a small boost, mostly to local elites, for a short time. Destroys the currency & the economy pretty damn fast.

Mainly, again, from the mouths and pens of anglosaxons, none of whom are actually European, nor truly concerned about Europeans. The Anglosphere does dominate too much. But there are a few excellent European economists, who understood the catastrophe of the Euro & austerity long ago. The best one in France is Alain Parguez, who I quite particularly like. A different style, but one that doesn’t mince words, compared to the MMTers. Thought provoking. If you tell me where you are from, I will look for one from there I recommend. I was about to compile a list for my own edification.

Unfortunately, as far above the USA that Europe has been in social programs, the intellectual colonization of the Eurocracy & austerity & faux-socialist, faux-Marxist irrationalism has been even more severe than the USA, sad to say. The USA does all the smaller things wrong, and makes the lives of many of its citizens hellish because of it. But it tends to do the very biggest things right. Europe does the reverse. The destruction wrought by Euro-austerity & economic ignorance cannot be overestimated.

“More importantly, does anyone really believe that the relentless anglosaxon financial and media campaign against the euro, the EU and the “eurocrats” has anything to do with sincere concern for the wellbeing of the people of Spain, Portugal and Italy?”

Sebastian,

Your first sentence doesn’t parse for me but I have a sincere concern for the well-being of the people of Spain, Portugal and Italy, as well as that of other Europeans including Germans, because I am aware that this same thing can happen to me.

I suspect most readers of this blog are also sympathetic to the troubles of others.

I’m also aware that the policies of American elites are not in the best interests of the majority of citizens anywhere.

The cause of most of this misery is neoliberal policies which are undemocratic at their core and a fundamental misunderstanding worldwide about how monetary economies work.

Unfortunate, because macroeconomics at the root is quite simple and not beyond the average persons understanding.

Sebastian,

Missed this:

“100%+ debt-to-GDP”

Debt-to-GDP is a useless and irrelevant measure. Many countries inthe Eurozone had very low debt-to-GDP ratios and primary surpluses to boot that turned to deficits and higher debt-to-GDP after the GFC.

Thus there is no plausible argument for causation re those “problems” in the current situation.

In the U.S. public “debt” is nothing more than the accounting record of money creation. No “debt”…no money in existence other than credit.

Anyone above ground and still breathing should be able to see that it is for all practical purposes impossible for a monetary economy to run on credit alone.

Unfortunately the Eurozone is a living, breathing lab experiment on how not to do it.

“Debt-to-GDP is a useless and irrelevant measure.”

Rogoff and Reinhart have, of course, researched this issue extensively. They conclude that at around 90% debt-to-GDP, debt almost invariably becomes a drag on economic growth.

In any case, they do not seem to find the measure that useless and irrelevant. I hope you don’t mind if I’m more convinced by their economic data and arguments than your mere declaration of its uselessness and irrelevance.

Yes, for the US, government debt may be nothing more than an account of money creation. That’s because most of the world’s economies are forced to use the dollar in international trade. There is, alas, no way around US debt for them, no matter how often this all-too-benevolent hegemon rips off the world by its monetary policies. I’d call that reserve currency myopia.

“Rogoff and Reinhart have, of course, researched this issue extensively. They conclude that at around 90% debt-to-GDP, debt almost invariably becomes a drag on economic growth.”

Sebastian,

This study is deeply flawed to the point of being worse than useless. I won’t get into it here, you can Google around and find out why.

“I hope you don’t mind if I’m more convinced by their economic data and arguments than your mere declaration of its uselessness and irrelevance.”

I don’t mind at all, I want people to think for themselves. Here, however you are substituting someone else’s thinking for your own. I don’t expect you to accept my arguments, I would hope that they move you to think about them in a logical way. If your argument strategy is to quote other thinkers you are wasting your time with me. There are no experts, anywhere. Einstein wasn’t an expert, Einstein was right.

Anyway, Rogoff and Reinharts arguments are contrary to system arithmetic, arguments from data are synthesis but the arithmetic is clear. It is impossible for stimulus not to create demand, unless you give it to people that won’t spend it (you know, rich people). If you do that you should be fired immediately and never allowed in a position of responibility again.

“That’s because most of the world’s economies are forced to use the dollar in international trade.”

The reserve-currency argument doesn’t get much traction either, it would not hurt American citizens if it disappeared. This is a second-or third-order dynamic at best.

Regardless of reserve-currency arguments simple system arithmetic defines the path of spending in monetary economies. No spending, no economy.

Germany succeeds at the expense of others in the Eurozone (and the U.S) as their surplus comes from net spending by others. Mercantilism/parasitism.

When the periphery countries go broke/stop buying your stuff where will you find your customers? What if the US continues to torpedo it’s own economy and drives it into depression? You don’t think Germany will feel the pain?

You exist in a closed system where every action effects someone else, and because it is a closed circuit it eventually affects you too. I suggest you tread lightly with your own self-importance.

“This study (by Rogoff and Reinhart) is deeply flawed to the point of being worse than useless. I won’t get into it here, you can Google around and find out why.

Sure. And while Googling around I can also find out why the world is run by lizard people.

“Anyway, Rogoff and Reinharts arguments are contrary to system arithmetic, arguments from data are synthesis but the arithmetic is clear.”

System arithmetic? Radical rationalism by another name.

“It is impossible for stimulus not to create demand, unless you give it to people that won’t spend it (you know, rich people).”

So far monetary stimulus hasn’t created much demand for anything but equities and gold. Direct fiscal stimulus to households would likely be used to repay debts.

Yes, fiscal stimulus by government spending would produce demand, as it did during WW2. But to call war on that scale “stimulus” is an absurd understatement. It’s a sustained adrenaline shot to the economy, especially to employment due to the draft. I don’t see a currently conceivable fiscal stimulus doing anything remotely similar.

“The reserve-currency argument doesn’t get much traction either, it would not hurt American citizens if it disappeared. This is a second-or third-order dynamic at best.”

Really? Which other country would be able to simultaneously fight two wars, have a housing and credit boom, cut taxes, and run record trade and government deficits year after year – in short, have free lunches for over a decade?

This is not to say I consider the dollar a net benefit to ordinary Americans. I don’t. But that’s just one more reason why we need an alternative.

Regardless of reserve-currency arguments simple system arithmetic defines the path of spending in monetary economies. No spending, no economy.

Yes. No wind no weather.

Germany succeeds at the expense of others in the Eurozone (and the U.S) as their surplus comes from net spending by others. Mercantilism/parasitism.

The euro was initally forced upon the Germans as a condition for reunion. Greece et al. willingly signed the relevant treaties and eagerly entered the EMS at elevated exchange rates. Indeed, their real GDPs grew >30% in the euro’s first decade.

I don’t see much of a mercantilist design here on the part of the Germans. Yes they eventually – rather recently in fact – profited from the euro. But that’s a collateral benefit of the euro crisis. If that’s design, it’s freakishly smart and stupid at the same time.

Parasitism is, however, an accurate description of the dollarsphere, skewing terms of trade to the benefit of the US at the expense of all other nations.

That’s where the free lunches come from. It has turned the US (citizens) into the world’s porker(s). It has also fueled the rise of China to the point where it’s already too powerful to be strong-armed into another Plaza accord.

“Yes, fiscal stimulus by government spending would produce demand, as it did during WW2. But to call war on that scale “stimulus” is an absurd understatement. It’s a sustained adrenaline shot to the economy, especially to employment due to the draft. I don’t see a currently conceivable fiscal stimulus doing anything remotely similar.”

We could have dumped all of that war machinery in the ocean and had the same benefit of the spending, without destroying Europe.

Discussion with you is tedious. You continue to focus on the periphery of the issue rather than the core argument. Please demonstrate some notion of causation without hedging.

You think system dynamics are meaningless? Be satisfied then with a history of predictions that turn out wrong. Your only chance of being right will be by accident.

Your position seems to be that economics is a moral discipline rather than a system with feedback (feedback because the system is closed). Every transaction within a closed economy is and must be zero-sum. It can’t be any other way, just like you can’t wish away gravity.

My conclusion is that you have no abstract understanding of system processes under which we all are constrained whether we like it or not.

Semantic-based logic is not up to the demands of the problem because at best it can only mimic the real world processes.

Prove me wrong by presenting a chain of logic that circles back on itself without undermining the original premise.

Rogoff and Reinhart do not differentiate between monetarily sovereign governments and non-monetarily sovereign governments. The difference is enormous.

But I agree that monetary sovereigns should never borrow. All deficit spending should be financed purely with “money printing”. Existing National Debts should be paid off the same way as they come due.

“Existing National Debts should be paid off the same way as they come due.”

Paying off the National Debt requires little more than an accounting entry, no actual funds are required, since no actual funds were used.

See “$16 Trillion Proof-Platinum coin.”

Agree. But it might be unwise to pay it off all at once since we need a private bailout with new reserves too. Also, is it even legal to prepay the US National Debt?

F.Beard,

I assumed you were familiar with the Proof Platinum Coin™ solution. Seems sneaky old Bill Clinton (his administration) created a loophole in the law back in 1995 or so regarding segniorage. Here’s a link to the proposal by Joe Firestone who developed it along with commenter beowulf (Carlos Mucha).

http://www.correntewire.com/beyond_debtdeficit_politics_the_60_trillion_plan_for_ending_federal_borrowing_and_paying_off_the_nat

This was discussed by members of the administration as high as the Treasury Secretary during the debt ceiling fiasco.

I am familiar with the PPC but am concerned that paying off the National Debt all at once would create a lot of hot money chasing yield. I’d rather we bailout US private debt first.

Right, it wouldn’t be a good idea to pay off the entire debt at once because it would dump some $11 Trillion in cash in the economy at once, creating distortions, probably severe.

What would they do with the cash? Savings accounts are out, buying equities or gold or anything else would drive the prices up drastically probably.

No where to safely store cash. This is the beauty of bonds and why I’m not so quick to move to a no-bonds system. There’s an argument that bond-sales make money more valuable. One downside is that bonds promote saving and saving is an economy-killer.

Actual solutions aren’t always as simple as we think.

The strategy for the PPCS is to gradually eliminate the interest-bearing debt over ten or more years.

No the debt of a monetary sovereign is evil; it is “corporate welfare” (Bill Mitchell); welfare should be reserved for those who need it. I’m just saying we should not pay it off all at once.

Sure selling bonds makes the currency more valuable since it is a risk-free gift.

As for safely storing fiat, the monetary sovereign is the ONLY proper institution to do that and that service should be free up to normal house hold limits.

“As for safely storing fiat, the monetary sovereign is the ONLY proper institution to do that and that service should be free up to normal house hold limits”

Nothing to disagree with in your comments, just not certain about unintended consequences yet. Currently we aren’t paying much interest on the debt and based on trend yields are headed towards zero, seems to correlate with the size of the debt.

Japan is actually paying negative yields currently (when adjusted for inflation).

Not a huge burden.

Actual solutions aren’t always as simple as we think. Paul

Don’t I know it? I’m the one who tells the MMT folks we need genuine private money alternatives because price inflation CANNOT be objectively measured. I’m the one who says Steve Keen’s universal bailout should be combined with a ban on further credit creation and metered appropriately to keep the total money supply from growing too rapidly. I’m the one who advocates common stock as private money since it requires no usury, no fractional reserves, no commodity money, no deposit insurance and no legal tender lender of last resort. I think I have demonstrated that I know the actual solution is not that simple.

Also ethics has been my guiding principle and it has been an effective means of arriving at sound solutions, imo. Also, no one can properly oppose ethical solutions.

Nothing to disagree with in your comments, just not certain about unintended consequences yet. paul

I agree the National Debt can wait but a universal bailout of the population should be done with new reserves from the Fed at 0% interest or with new US Notes.

Japan is actually paying negative yields currently (when adjusted for inflation). paul

Well, risk-free money storage should not pay any real interest.

“I’m the one who says Steve Keen’s universal bailout…”

I’m with you on Steve Keen’s debt jubilee. Seems like the govt. (thru Fannie Mae) could buy up every mortgage in America (I think they own 80% already) and write down every one to 80% of their current value. Voila! people can start spending again (but please don’t use credit from here on for consumer spending).

The problem is that credit creation cheats non-debtors too. The Austrians know this (and little else it sometimes seems) but not the MMT crowd.

So the solution is to give new reserves to the entire population* equally.

*except the uber rich and MLTPB and skippy.

F.Beard

Don’t know where you got the idea that MMT doesn’t understand credit. We just don’t focus on it. The (bad) effects of credit are obvious and uncontroversial.

MMT focuses on the sectoral balances identity and the relationship of net financial assets to savings. The properties controlling these relationships are fundamental to every dynamic system in the universe.

Credit is nothing more than enabling the spending of income not yet earned.

Sure credit creates flow when the asset is spent, but it undermines flow when it is paid back. That’s why credit is associated with bubbles.

Discussion of reserves is pointless when analyzing non-government finances because reserves don’t exist on private-sector balance sheets. Reserves are an accounting abstraction.

Reserves have no real-world meaning to you or me. Reserves that exist on the Treasury’s balance sheet become net cash when spent into the economy.

Fed reserves exist only on the government side of the balance sheet separating the government from the non-government.

Reserves are used for inter-bank settlement.

Reserves are created out of thin air by the Fed. They are nothing more than an entry on a ledger with no source, like points on a scoreboard.

Banks do not lend reserves.

Writing off bad debt converts credit to a fiscal operation. Currently this is prohibited by law, the Fed can only do fiscal in very limited ways.

At any rate, the importance of reserves is moot since the Fed is unconstrained in their issuance. Reserves are like a floating credit line, similar to the drag on a fishing reel. You can’t force reserves into the economy any more than you can force a fish out into the ocean. The fish goes where it wants to with the slack.

Credit is nothing more than enabling the spending of income not yet earned. Paul

It is thus counterfeiting.

Sure credit creates flow when the asset is spent, but it undermines flow when it is paid back. That’s why credit is associated with bubbles. Paul

Worse, it steals by both inflation and deflation.

Discussion of reserves is pointless when analyzing non-government finances because reserves don’t exist on private-sector balance sheets. Reserves are an accounting abstraction. Paul

No. Reserves are the “real” money in the economy though the general public never deals with them except when they withdraw cash at which time they cease to be reserves. Credit is the bullshit money the banks drive us into debt with. But between themselves banks deal in reserves only.

Reserves have no real-world meaning to you or me. Reserves that exist on the Treasury’s balance sheet become net cash when spent into the economy. Paul

No, those reserves of the Treasury end as reserves of the commercial banks less actual physical cash. Like you said the public doesn’t deal with bank reserves.

Btw, either every US citizen should be allowed an account at the Fed or the banks should not have them either.

Reserves are the real money in the system. It is an abomination that the Fed can lend them into existence. Only the US Treasury should create US legal tender and it should only SPEND it into existence.

Like I said, the MMT folks do not understand the moral ramifications of credit creation.

Reserves have no real-world meaning to you or me. Reserves that exist on the Treasury’s balance sheet become net cash when spent into the economy. Paul

Correction to my response: The Treasury reserves end as commercial bank reserves and customer accounts at the commercial banks are credited.

You can’t force reserves into the economy any more than you can force a fish out into the ocean. Paul

Sure you can. All Federal spending creates new reserves and all Federal taxation destroys reserves. Federal deficit spending creates new reserves.

correction: Federal deficit spending creates net reserves.

@Paul

>>Banks do not lend reserves.

Guess again.

http://www.newyorkfed.org/aboutthefed/fedpoint/fed15.html

“Federal deficit spending creates new reserves.”

So? Reserves are an accounting abstraction. they have no physical or nominal existence on balance sheets in the non-government (other than the government side of a banks ledger). The money-creation process is a black box to an observer in the economy: This black box is capable of two things and two things only, a binary choice:

1. Add net cash to the economy

2. Do nothing

That said, what could any agent in the economy care about reserves? Do you care about the circuitry in your iPhone? No. The only thing that matters is that it does what you expect it to do.

Bank operations are useless to anyone other than the technocrat whose job depends on them. If the system fails to function properly, fire him and hire someone else. His only job is to fund Congress’ appropriatons.

Credit adds zero net worth to your balance sheet. How do you explain that from the point of view of reserves? How can something that sums to zero do so much damage? If you waste your time chasing your tail over reserves you won’t have the time to answer those questions. Those questions that directly impact your and your loved-ones well-being. Why must we tilt at windmills?

Focus, please.

“correction: Federal deficit spending creates net reserves.”

Great. Show me a balance sheet in the non-government that has an entry labeled as reserves not on the government side of a banks ledger. Then you will have proved to me reserves are relevant to real people.

Is your credit limit relevant? Can we see that on your balance sheet? Anyones?

Do we care how the Sun creates it’s energy from an operations perspective or do we just hope it doesn’t stop burning anytime soon?

You assume a credit creation system; I don’t. Every US citizen should have the equivalent of a reserve account at the FED and government deposit insurance and the legal tender of last resort ABOLISHED.

Then all US banks will be on the same footing as US citizens and vice versa. Then all US citizens would deal with reserves and not counterfeit money (“credit”) created by the banks. Of course “reserves” would lose its usual meaning and be replaced by “fiat accounts.”

Could the banks still attempt to issue credit? Yes but then deposits with them would be regarded as speculative investments and not deposits.

Credit adds zero net worth to your balance sheet. Paul

Baloney. It allows me to edge out savers in the race to buy assets and consumer goods leaving them dreaming of a deflationary Depression to get even.

“Baloney. It allows me to edge out savers in the race to buy assets and consumer goods leaving them dreaming of a deflationary Depression to get even.”

F.Beard,

You’ve inserted a morality component into a math/systems problem. They are completely unrelated. I don’t disagree at all with your contempt for credit. I agree in principle with most of your arguments you make.

Further, many of your claims rest on accounting realities which you appear to abandon in this case.

As an engineer, I am compelled to focus on the problem, not the result.

When a bridge collapses, one doesn’t focus on a picture of the aftermath to fix it.

You will be a better engineer if you can learn how to define the problem correctly before attempting to solve it.

EconCCX says:September 25, 2012 at 8:41 pm

“@Paul >>Banks do not lend reserves.

Guess again.

http://www.newyorkfed.org/aboutthefed/fedpoint/fed15.html”

EconCCX, looks like you missed the part where the paper is discussing reserves used in INTER-BANK TRANSACTIONS.

Reserves are not lent to the public.

Further, many of your claims rest on accounting realities which you appear to abandon in this case. Paul

Yes, because I believe people can be deceived by Assets = Liabilities + Equity when it comes to banks.

For one thing, the interest part of both sides of the balance sheet does not even exist in aggregate as you have pointed out.

For another, current purchasing power, the liability, is compared with future purchasing power, the asset.

For another, because of extensive government privileges, the liabilities of the banking system as a whole are in little danger of being redeemed so they aren’t really liabilities.

“For another, current purchasing power, the liability, is compared with future purchasing power, the asset.

For another, because of extensive government privileges, the liabilities of the banking system as a whole are in little danger of being redeemed so they aren’t really liabilities.”

F.Beard,

Sorry, you’ve lost me here, don’t understand your point.

But to clarify my point, ihe liabilities I’m referring to here are liabilities held by private-sector borrowers, not bank liabilities.

If banks were being held to their actual liabilities currently many if not most would be deemed insolvent and dissolved.

There’s a reason banks aren’t really going after foreclosures. The losses they would have to book would make them even more insolvent.

The only really solvent bank left in the US right now is the Fed…the lender of last resort.

The bailout strategy’s main intent was to buy time and hope the economy recovers.

This demonstrates a fundamental misunderstanding of how the underlying system works…it can’t recover on it’s own, it’s starved for funds (not credit), and the non-government cannot create it’s own funds.

Stalemate as long as our leaders continue the discussion about cutting spending. At the current rate of deficit spending it will take a loooong time before meaningful recovery occurs. Muddling along at best. The good thing is few can afford to or are willing to borrow to finance consumption.

My own family is committed to a zero-credit existence. We have no debt and do not plan to ever borrow to buy something again. If we can’t pay cash we don’t need it.

Yep we need a universal bailout but we also need to destroy credit creation or at least remove all government privileges that allow it. Otherwise, we will continue to be driven into debt by counterfeiters.

“Otherwise, we will continue to be driven into debt by counterfeiters.”

Only if we willingly borrow their credit money. It’s in our hands. Banks can’t force credit on us.

Banks DO force credit on us!

How many renters are now PERMANENTLY priced out of a decent home unless they go get credit too?

“How many renters are now PERMANENTLY priced out of a decent home unless they go get credit too?”

The choice is theirs. No one HAS to own their own home, it’s not necessarily a good deal anyway.

You argue about the evils of credit and then counter with the argument that we must have it.

These days interest rates are so low (on mortgages) it isn’t that much of a burden. My first home was financed at 14% interest in 1980. Talk about a burden.

Living in a McMansion isn’t a necessity. Lot’s of more practical options.

Further, if people stopped building their credit rating by borrowing and spending money they don’t have, mortgage lenders would fall all over themselves to find ways to make the deal. They have to eat too.

You buy into a trap of your own making.

You argue about the evils of credit and then counter with the argument that we must have it. paul

Because credit creation creates (and allows – see George Soros’ “Theory of Reflexivity”) the need for more credit creation! It’s a positive feedback loop for both the demand and supply side.

It should be obvious that Europe needs to stop borrowing and start spending. Give the money to people instead of politicians or businessmen and the problem could be solved within the constraints of resource limitations and elite predation. WWII worked because it put money in people’s pockets. The fact that what the government got for its money was largely blown to smithereens ought to demonstrate that it hardly matters how the government spends. Of course, it also helped that the war destroyed most of the excess productive capacity in Europe, Japan and Russia, thus animating the animal spirits of American industrialists who only needed government to finance the European customers who were left virtually starving but at least remained alive.

Well said.

Odds the political establishment among the euro-zone’s core economies will get behind a deposit insurance scheme absent significant debt write down are zero. Speaking of which, Greece is the way and their debt write down broke the mold. Spain holds out because of this. Should “the market” try to force the bailout issue while still demanding further austerity, chances are the EMU is finished. That’s where we are, and surely the Fed has gotten word of it.

“Odds the political establishment among the euro-zone’s core economies will get behind a deposit insurance scheme absent significant debt write down are zero”

Then the odds of the Eurozone emerging from this intact are 0.

“absent significant debt write down”

I don’t think many countries in the core want significant debt writedown, unless you mean they want the citizens to take it in the shorts. They certainly don’t want banks to suffer.

Don’t worry, the European market is so fickle at the moment. Give it another two months and it’ll be Optimistic again.

The ups-and-downs of the so-called markets seem analogous to the ups-and-downs of hope that the stimulus bailouts in both the US and in Europe will succeed. Unless there is forgiveness of all debt, or bankruptcies of all insolvent banks or stimulus for ordinary individuals, this up-and-down will continue for a long, long, loooonnng time!

Didn’t Europe just announce that it would delay reporting on Greece’s international creditors’ opinion (of Greece’s creditworthiness) until after the US elections? No doubt to insure Obama’s re-election… so pro bank? There is always some reason to delay taking the clearly needed political action, i.e. new civil laws and regulations, to set the EZ on track to function politically. It should be clear by now to them that economics is politics. They should be less pro bank; they might want to read Kucinich’s Need Bill. They could do worse than adopt a new constitution that embodied his reason. I still believe the goal of the Europeans is political union, not fragmentation.

And then I read today’s Links: Telegraph. Bundesbank Castigates IMF. The EU was working just fine until it was fudged by Goldman Sachs and its own banks and then poof. The world stopped working. How silly for the Bundesbank to scold the IMF. Germany is suffering nostalgia. The EU was so self-sufficient with a German surplus and a mediterranean deficit. It worked great. But it didn’t work with the UK or the US. So now a credit embargo (Steve fr VA) until it plays fair? It sounds right. We’ll show the EU to refuse to pick up the slack for the UK and the US boom – whose model was rampant financialization. Did the EU banks do it too or did they just take a free ride? Would Straus Kahn have been so different from Legarde? Would he have promoted debt write downs?

What always seems to be missing in the ECB proposed solutions to overextended Greek(Spain&Portugal)debt is a healty debate as to under what, if any circumstances, these countries can compete in the 21st century with the rest of Europe and the world going forward.

Without a viable future economic plan outside of austerity, debt reorganization or forgiveness is just money thrown out the window. Germany/Merkel obviously understands this, but the ECB seems to deliberately ignore or are oblivious to these circumstances. Shades of our FED.

Compete for what? They aren’t capable of producing output for their own consumption? What does Iceland produce? They have a decent quality of life.

That is my point. Pehaps the most sustainable and best path forward for Greece is to be more like Iceland. There just seems to be an absence of a debate on the most viable economic models for the future. The ECB seems to want these countries to remain indentured servants to the EEC forever.

Yep, FUD, on purpose. The banks and their puppets (our leaders) don’t want us to know the money belongs to us. We shouldn’t have to rent it.

They further want us to believe we can’t succeed without them.

It’s time for us to call bullshit.

(Sigh …)

The reason there are deposit outflows …

First of all, these are outflows from entire countries’ banking systems, not runs out of a failing bank or two.

Second, some of these outflows are in turn out of the euro altogether: out of Europe, into gold or foreign (US) real estate. Deposit insurance is not of the scale needed to address capital flight out of Europe while the cost of the deposit ‘insurance’ (bailout) is breaking. What is the governor on the flight of capital is not the possibility of deposit guarantee but the inability of the sector to satisfy demands for capital in satisfactory forms fast enough.

Third, the deposit outflows indicate there is no effective European lender of last resort. This is because the European Central Bank is insolvent, it is so because it has offered (or appeared to be offering) unsecured loans, that is, loans made in excess of the worth of collateral. Keep in mind, ALL the banks in Europe are insolvent because of their leverage, the unsecured loans which they have on their books. The ECB is another, larger insolvent European bank: there is no real lender of last resort.

The ESM is nothing other than the central bank offering leverage/unsecured loans behind the ESM facade.

Finally, the current approaches are all failures. The bankrupting process is ‘conservation by other means’, this is underway right now! The Europeans’ wonderful, precious automobiles have bankrupted the entire continent. The New York Times this morning says the Spanish people are having trouble finding enough to eat. Much like the Greeks who have the same problem: the countries are pitched into the fire for the auto manufacturers. Massive borrowing takes place to buy non-remunerative automobiles and to pay for the accompanying (equally massive) fuel waste. The credit needed to gain the autos and the fuel is unaffordable, ditto the credit needed to retire maturing debts. The entire enterprise is done in by rising (real) fuel prices.

Europe is dependent upon external (endogenous) credit, it is subject to a credit embargo. The object is to bankrupt the Continent: its petroleum demand is thence exportable to the US. This isn’t a conspiracy theory, the US has orchestrated credit embargoes before (vs. the Soviet Union in the late 1980’s, in Southeast Asia and Latin American). Embargoes are a tool in the neo-liberal toolkit. The object is Europe’s 15 million barrels per day crude oil consumption/waste. If the US cuts EU consumption by cutting off EU credit the outcome is the same as finding another Saudi Arabia: 10mbpd.

Keep in mind there is nothing to stop the bankruptcy process, depletion is non-negotiable. The only possible cure is stringent resource conservation of the order of reducing consumption by less than ten-percent of current or (much) less. The alternative is the complete collapse of Europe states to autarky/what fuel resources the countries can produce themselves … from now until the cows come home.

“ALL the banks in Europe are insolvent because of their leverage”

Plus all banks in the U.S. (except the government stands behind them at our loss).

This is because the European Central Bank is insolvent, steve from virginia

Irrelevant. A Central Bank can ignore being insolvent. Also, a CB could issue 100% secure bonds at any interest rate to soak up reserves if it so desired.

Well, not interest rates above 100% since that would defeat the purpose of the sterilization. But high enough to work especially if leverage restrictions were put on the banks at the same time.

“Irrelevant. A Central Bank can ignore being insolvent.”

True. A central bank can never be insolvent in it’s own currency, since it can always create new currency to offset any liability in that currency.

“Insolvent central bank” may be an oxymoron.

You speak like you think credit and real capital are the same thing. They aren’t. Europe could default on ALL foreign debt and still earn something from its exports and tourism and from its foreign loans.

Also, you seem to think that an oil shortage triggered the GFC when the evidence is clear that excessive private debt is the cause. So which is it or did BOTH occur at the same time? Ever hear of Occam’s Razor?

Let me guess? You’re a gold bug too?

In all the discussion I’ve observed, ranging from liberal forums like this to tea-bag-head drivel, I’ve never seen a single comment that goes to the core of the problem. The ruling class in Europe and the USA does not consist of the 1% that owns a trophy house in Jackson Hole financed by owning a chain of rental car dealerships. The ruling class is more like .00001%, and they control international finance and national economies with no regard for anything or anybody except for what they perceive to be their individual benefit. The European shell game and the FED’s QE-3 are designed to only one end– vacuum up all the loose change left and flush it into the accounts of the ruling class to replace all the speculative Ponzi schemes that have reached their natural climax.

If these few thousand individuals and their families were stripped of all their wealth the world would not miss their contributions for a millisecond. In the few instances when a mad genius like Steve Jobs creates something of (questionable) value, there are thousands of others capable of inventing a similar toy. For the vast majority, they not only contribute nothing of value but do immense harm in their endless pursuit of profit without any consideration of moral value or development of human wisdom.

Until the sheeple of the world realize that the only goal of the herdsmen is to prepare them for fleecing and eventual slaughter, and rise up to trample them into the dust, the mad growth imperatives of capitalism will continue until the last single blade of green grass is consumed.

Crazy Horse:

It’s pretty obvious. Do we need to point it out over and over again. What part of “vanishingly small” do you not understand?

Ok, maybe a little bit strong, but you need to come in off the ledge.

Sitting here up on my ledge I see a giant cloud of smoke from a million acres of forest ablaze in the West. As I look to the north I see an arctic ocean with icebergs adrift in a blue sea where there has been a solid icecap for the entire history of human beings on the planet. Perhaps my vantage point allows a clearer vision than yours down there in the soup of existence in Manhattan, Brussels, or Washington DC?

In your world is it really universally understood that the masters of the universe are a very small and not particularly intelligent group, of no value to the human race, who’s elimination would at least provide a glimmer of hope that our species can mature enough to find its place in a sustainable world?

Yes.

Good comment!

You are not on the ledge at all and it is not obvious at all! It needs to be said over and over again! Instead of engaging in all of this fantasy remedial crap with no system for remedy we should be naming the names of the biggest Xtrevilist pig cannibals on the planet and devising a remedial SYSTEM to cure them of their sociopathic disease. More time needs to be spent on reclaiming and revising the morally bankrupt now scam ‘rule of law’.

Deception is the strongest political force on the planet.

And I’m glad you and Crazy Horse are carrying the hod.

Just don’t assume the rest of us are doddering fools.

Big anti-austerity protests in Madrid. No word on Mongolian horsewomen….

(Hat tip jcasey)

More pics, looks brutal!

http://www.dailymail.co.uk/news/article-2208557/Riot-police-clash-anti-austerity-demonstrators-Madrid-thousands-streets-protest-cuts.html?ito=feeds-newsxml

Shun cops!

Deception is the strongest political force on the planet.

The abused children of Daddy Xtrevilism’s dysfunctional global family continue their avoidance behavior fighting and bickering…

…“If only Daddy Xtrevilism would stop giving his unlimited candy to slutty little sister Bonfilia while hitting and butt humping her at the same time, and instead give some of it, along with more frequent abuse, to Bernado, then everything would be just fine. Bernado deserves it — he’s shiftless and lazy and has no unified candy deposit insurance!”

“That shows an anti-Bonfilia cynicism, the real problem is that Bonfilia eats candy like a fat pig!”

“It should be obvious that Bonfilia should stop eating so much candy and give most of it to little Adonis who ate so much candy he got sick and now Daddy Xtrevilism is giving him regular beatings.”

“But forget Bonfilia and little Adonis, this could easily be solved if they were more like Akihiko who makes his own candy.”

“Yes, anyone can make their own unlimited candy. That is no problem and the sure way to go as long as they eat only their own candy and refuse to eat others candy!”

“True. They can never be out of their own kind of candy since they can always create new candy for any that is eaten.”

“But daddy Xtrevilism wacked and butt humped brother Saddam for making his own candy.”

“Yes, and look what happened to little cousin Momar when he made and saved tons of his own candy and even shared some of it. He also took a severe ass reworking! Remember? Daddy Xtrevilism was really pissed!”

“Pretty soon we won’t have enough resources to make any candy at all.”

“It doesn’t matter what Daddy Xtrevilism uses the candy for as long as we all get candy.”

“Its piggy Bojing’s fault for valuing his candy more than anyone else’s candy!”

“One minute I am optimistic as it seems like there is candy everywhere and the next there is no candy at all and everyone is sick and being beaten by Daddy Xtrevilism!”

Deception is the strongest political force on the planet.

The problem I have with this resources argument is that the Earth is a closed system, matter and energy cannot be created or destroyed. We get a net influx of energy from the Sun and combined with losses to space we have an equilibrium that supports life.

We cannot run out of natural resources. Matter and energy are conserved.

The system will automatically make the adjustments to population if we don’t manage the resources properly (mainly agriculture, water and air).

Run out of energy? there will always be alternatives (until the Sun quits).

Run out of food? Only if we poison the soil or fill the atmosphere with sun-blockers.