Felix Salmon did an admirable takedown of a “CEOs [sic] Deficit Manifesto” in the Wall Street Journal. It’s yet another entry in the long-running, dishonest campaign funded by billionaire Pete Peterson to pretend that all right thinking people (and of course CEOs believe they have the right to think for everybody else) should be all in favor of trashing the middle class and the economy through misguided deficit cutting. Salmon could have gone further in his critique, but the letter was so lame he didn’t need to, and the issues he raised would be plenty persuasive to most Americans.

Felix correctly styled the letter as “self serving” and described the idea of deficit cutting now as “ridiculous”. Debt to GDP is falling and the economy would tank if we were to reduce the Federal deficit while the economy is deleveraging. But these corporate leaders tried overegging the pudding by depicting the current federal debt levels as a security threat. One aspect of this debate that doesn’t get the attention that it deserves is that the deficit hawks keep claiming that the US is about to hit a 90% federal debt to GDP ratio, which Carmen Reinhart and Ken Rogoff claim is correlated with lower economic growth. Aside from the fact that this study is questionable (it mixes gold standard countries with fiat currency countries, plus correlation is not causation; in many cases, a major financial crisis produced both the low growth and an increase in debt levels, meaning its spurious to treat debt as a driver of lower growth), the US is actually not at any imminent risk of breaching this level. The CBO, astonishingly, has kept publishing reports that project gross debt levels, not net debt. This 2010 analysis by Rob Johnson and Tom Ferguson shows what a large adjustment netting out the government’s financial assets makes (click to enlarge):

Their discussion:

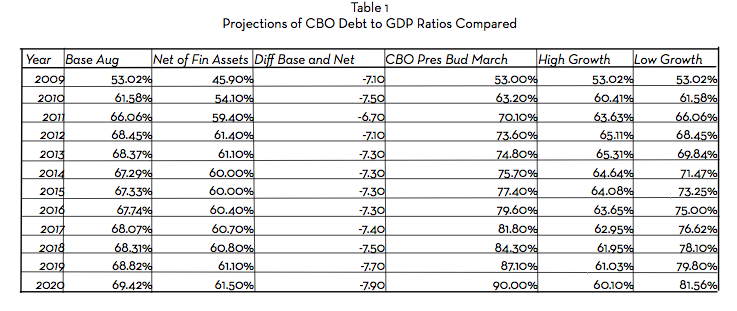

Our Table 1 displays the magnitude of the diðerence. The first two columns compare the CBO baseline budget projection, as slightly revised in August 2010, with the revised figures taking account of the U.S. government’s financial assets.69 The third column displays the diðerences between the first two, which are substantial. The fourth column shows the CBO’s March estimates of the impact of the President’s program; these figures also should be adjusted by the amount of the government’s financial assets that the CBO at last recognizes. This can be approximated by simply marking down each entry in the estimates of the President’s budget by the corresponding figure in column 3. Enacting the President’s fiscal program would not in fact push the US across the mythical 90% threshold. In 2020 the U.S. would be operating within the range of debt ratios at which other large countries function successfully right now.

The authors contacted the CBO about their analysis. The CBO has acknowledged it is correct but refuses to change its reporting. So much for the vaunted independence of the CBO.

Salmon also makes a point near and dear to our heart:

Money is cheaper now than it has been in living memory: the markets are telling corporate America that they are more than willing to fund investments at unbelievably low rates. And yet the CEOs are saying no. That’s a serious threat to the economic well-being of the United States: it’s companies are refusing to invest for the future, even when the markets are begging them to.

Instead, the CEOs come out and start criticizing the Federal government for stepping in and filling the gap. If it wasn’t for the Federal deficit, the debt-to-GDP chart would be declining even more precipitously, and the economy would be a disaster. Deleveraging is a painful process, and the Federal government is — rightly — easing that pain right now. And this is the gratitude it gets in return!

The situation is even worse than he suggests. It isn’t just that corporations aren’t investing now; they weren’t investing in the last expansion. The corporate sector in aggregate was disinvesting and we first took note of this in 2005!.

And big companies have been the biggest sinners. Notice how Obama and Romney both fawned over small businesses? They’ve been the drivers of job growth for the last decade, while the biggest companies have shed workers. In fact, since the 1980s, mediums sized and smaller companies have gained in share of assets, employment, and revenues relative to the biggest companies (and that’s before you factor in the role that acquisitions, as opposed to organic growth, have played for them). So these big companies, on the whole, are losers relative to the rest of the corporate sectors, yet they have the temerity to preach to the rest of us as if they speak from genuine accomplishment, as opposed to having been lucky or politically savvy enough to assume the leadership of companies with well established franchises. And of course, the other factor working to their advantage is that political influence can be bought for remarkably little.

If you look at the 80 CEOs that signed this list, you don’t see a single Silicon Valley or tech darling (well, there is Microsoft, but they are too long in the tooth to be darlings, and one small cap tech company, Investment Technology Group, but it’s on Motley Fool’s current list of 10 Worst Small Cap CEOs, so it proves our point). There’s a complete absence of the sort of companies that America likes to hold up as its winners.

Instead, the list is heavy with finance, including private equity firms, and mature industries. A sampling:

AT&T

Bank of America

BlackRock

Clayton & Dubilier (major LBO firm)

Deloitte Federal Government Services

Dow Chemical Company

General Atlantic, LLC (major LBO firm)

General Electric Company

Goldman, Sachs & Co.

HarbourVest Partners, LLC

Humana Inc.

JPMorgan Chase & Co.

Knight Capital Group, Inc.

Pershing Square Capital Management, L.P.

Promontory Financial Group

Silver Lake Partners (a major LBO firm)

Time Warner Cable Inc.

Verizon Communications Inc.

Now having said that, some of the members of the list are solid, well run companies, such as Deere, Caterpillar, M&T Bank, Marriott. But this is not a list of big company outperformers. Plus you have the hypocrisy of tax-dodge General Electric and the beneficiary-of-NIH-basic-research Merck happy to impose the costs of the bennies they’ve gotten on ordinary Americans. And you’ve also got some CEOs from much smaller service/not for profits players who are clearly there to curry favor, such as the head of PR firm Weber Shandwick Worldwide, leadership consultant Interaction Associates, and our favorite banking industry brown-nose, Kathryn Wylde of the New York City Partnership.

The good news is that the letter appears to have landed like a lead balloon with the audience most likely to be receptive, namely WSJ readers themselves. It got a mere 5 comments. But the bad news is that this letter is the least important aspect of this CEO effort to get Medicare and Social Security “reforms” meaning cuts, through (yes, they make noises about other “responsible” actions they’d like to see happen, but this one is the one they are most keen to get done).

Ordinary Americans have complacent as this plan to gore their ox has moved relentlessly forward. But they’ve been sold on the false idea that deficit cuts are necessary and salutary. Central bankers are perversely imposing costs on savers through ZIRP as a poor second best for greater spending. As Felix concludes:

In any case, both the global economy and the US economy are very fragile right now, and every central banker in the world is begging for help from fiscal policymakers. Which is to say, higher deficits, not lower ones. The problem is that Pete Peterson seems to be much more effective at corralling CEOs than Ben Bernanke is. More’s the pity.

Why do you call Peterson “misguided”? I suspect he and his cronies see themselves as quite well-guided, destroying that pesky democracy that keeps them from running this country as its rightful oligarchs. At this point, given all the evidence of the failure of austerity I find far more malice in the movtives of Peterson, et al.; they may be dumb, but they ain’t that stupid.

He’s so removed from ordinary people (and ego-centered, I’ve actually met Peterson) that I’d hazard he genuinely believes that what is good for him is good for America.

Fair enough. But do you think this is true for the rest of the crowd too? It’s pretty scary to think that we’re facing a mod of rich psychopaths.

Not psycopathic. Psychotic, as in unable to distinguish reality from the illusion in which they’ve enclosed themselves. What I’ve come to conclude is the inevitable result of possessing vast wealth.

Psychosis has nothing to do with malice though.

Bob Altemeyer of the Univ. of Manitoba thinks that about 5% of any population can be classified as “social dominator” individuals who do not believe in right and wrong, believe that the only sin is getting caught, and are willing to LITERALLY do anything to increase their control over others as well as their own personal wealth. So figure 5% of the super-rich are social dominator personality types…yup, pretty scary…but it does explain a lot.

By the bye, Altemeyer’s book was the best social psychology read I’ve had in a long time. The whole thing is available in pdf format here:

http://home.cc.umanitoba.ca/~altemey/

I suspect that the number of “social dominators” (AKA sociopaths) in the 1% is far higher than 5%. A lot of them get to the 1% level because of their sociopathy. So if the level in the general population is 5%, then in a self selected group where the attributes associated with sociopathy are valued, the percentage would tend to be higher.

I second that.

Only, why stipulate that 5% of the 1% are sociopathic? It seems more likely to me that of the 5% of America that are antisocial personalities, many if not most of the richest 1% are in there.

1). 1. Bank of America CEO Brian Moynihan

Amount of federal income taxes paid in 2010? Zero. $1.9 billion tax refund.

Taxpayer Bailout from the Federal Reserve and the Treasury Department? Over $1.3 trillion.

Amount of federal income taxes Bank of America would have owed if offshore tax havens were eliminated? $2.6 billion.

2). Goldman Sachs CEO Lloyd Blankfein

Amount of federal income taxes paid in 2008? Zero. $278 million tax refund.

Taxpayer Bailout from the Federal Reserve and the Treasury Department? $824 billion.

Amount of federal income taxes Goldman Sachs would have owed if offshore tax havens were eliminated? $2.7 billion

3). JP Morgan Chase CEO James Dimon

Taxpayer Bailout from the Federal Reserve and the Treasury Department? $416 billion.

Amount of federal income taxes JP Morgan Chase would have owed if offshore tax havens were eliminated? $4.9 billion.

4). General Electric CEO Jeffrey Immelt

Amount of federal income taxes paid in 2010? Zero. $3.3 billion tax refund.

Taxpayer Bailout from the Federal Reserve? $16 billion.

Jobs Shipped Overseas? At least 25,000 since 2001.

5). Verizon CEO Lowell McAdam

Amount of federal income taxes paid in 2010? Zero. $705 million tax refund.

American Jobs Cut in 2010? In 2010, Verizon announced 13,000 job cuts, the third highest corporate layoff total that year.

6). Boeing CEO James McNerney, Jr.

Amount of federal income taxes paid in 2010? None. $124 million tax refund.

American Jobs Shipped overseas? Over 57,000.

Amount of Corporate Welfare? At least $58 billion.

7). Microsoft CEO Steve Ballmer

Amount of federal income taxes Microsoft would have owed if offshore tax havens were eliminated? $19.4 billion.

8). Honeywell International CEO David Cote

Amount of federal income taxes paid from 2008-2010? Zero. $34 million tax refund.

9). Corning CEO Wendell Weeks

Amount of federal income taxes paid from 2008-2010? Zero. $4 million tax refund.

10). Time Warner CEO Glenn Britt

Amount of federal income taxes paid in 2008? Zero. $74 million tax refund.

11). Merck CEO Kenneth Frazier

Amount of federal income taxes paid in 2009? Zero. $55 million tax refund.

12). Deere & Company CEO Samuel Allen

Amount of federal income taxes paid in 2009? Zero. $1 million tax refund.

13). Marsh & McLennan Companies CEO Brian Duperreault

Amount of federal income taxes paid in 2010? Zero. $90 million refund.

14). Qualcomm CEO Paul Jacobs

Amount of federal income taxes Qualcomm would have owed if offshore tax havens were eliminated? $4.7 billion.

15). Tenneco CEO Gregg Sherill

Amount of federal income taxes Tenneco would have owed if offshore tax havens were eliminated? $269 million.

16). Express Scripts CEO George Paz

Amount of federal income taxes Express Scripts would have owed if offshore tax havens were eliminated? $20 million.

17). Caesars Entertainment CEO Gary Loveman

Amount of federal income taxes Caesars Entertainment would have owed if offshore tax havens were eliminated? $9 million.

18). R.R. Donnelly & Sons CEO Thomas Quinlan III

Amount of federal income taxes paid in 2008? Zero. $49 million tax refund.

So Mark P., that’s an awesomely efficient grid-out of the rogue’s gallery. The profitability of these mega-leech firms comes down to stiffing the government, and hence the rest of society out of meaningful contributions to the institutions which make that society run. Yet it is the Profiteers-in-Chief of these extractive organizations who feel themselves fit to tell the rest of society what _we_ should do. Their ‘advice’ goes beyond the self-serving into twisted mania, but whatever they say be sure the very oppositie is the best policy for all.

The eternal question: Stupid and/or evil…

I started very much on the “stupid” side — in the Democratic world, this is the “incompetent” meme, or the “Obama is weak” meme — but as I lose patience, I move more and more to the “evil” side.

Groupthink and the dangers therein in its most crystalline form. You have a bunch of high-ego individuals, certain of their expertise and intellectual superiority in areas far removed from their job descriptions (I see that all the time), reading the same Pete Peterson material and attending the same seminars. You will typically never see the words “jobs” or “unemployment” mentioned in any of their discussions.

And speaking of oligarchy, check out the latest installment of our security theater: Mother gets jailed for complaining about frisk of 14-year old daughter:

http://www.tennessean.com/viewart/20121023/NEWS/310240075/Clarksville-mother-found-guilty-pat-down-case?odyssey=mod|newswell|text|News|s

Watch the video–Does the mother look that treatening and disorderly to you? I found the TSA far more belligerent. As usual, the press parrots the projected motives of the TSA.

Hard to conceive of a simpler exhibit of the War on America by the corporate sector than this particular broadside. Look down that list of corporations: tax dodgers, speculators, labor off-shorers, beat down benefits and prevailing wages (don’t have to dig far into Catepiller or Marriot to spume up that rot). Their solution for the spurious ‘fiscal cliff’ magiced up by the lunatic right in Congress: “The middle class has to work longer to retire and cut their care after: they’re too expensive for us.” That’s right. We have the corporate leechocracy telling the 99% of the populace that we are too expensive, that the personal profit rate of the CEO class is ‘endangered’ by our profligate needs. The prescription is tighter belts and an earlier death, for us. Nor, of course, for them.

All of this smacks redolently of the Great Depression of 1893. When corporate and speculator America slammed the lending and investing windows closed in protes of a putatively populist Democrat winning the 1892 elections, causing a depressionary contraction. What I mean by that is that, in this country, we have seen before a robber class at the top of the pile who didn’t bat an eye at plunging the country in the toiled in their own personal interest. And blaming the rest of the citizenry for the result.

I would argue that this overt offensive by the oligarchy on the citizenry overall is of greater import than who whils the Tweedle-dee-dee election of ’12. Because no matter who wins, _THIS_ is the program they are going to be expected to pursue. We’ve just been told what the ‘right-thinking objective’ is. And why, do you suppose, that we are seeing this overt statement now? (Not that any one announcement by any one cabal is in itself decisive or more relevant than the sustained propaganda and buy-a-pol program of the oligarchy.) Because the tea leaves have been read, and the rotters at the top know they’ll have four mour of BO and a predominantly Democratic Congress, so they’re sending a shot across the bow that the oligarchy must still be served. None of that ‘pandering to the masses’ nonsense; no more bandaids on the public nickle. “Cuts must be made, balanced by more taxes on the poor.”

False balancing while the main heist continues. And still the citizenry baa-baa-baaa all the way home . . . . —Until they don’t.

Look, I had to acknowledge some were less awful. But agreed, none of them are admirable (well, M&T Bank actually is supposed to be pretty good….but that’s only one name).

I wasn’t critcizing, Yves. Some of these companies are in fact well, even prudently managed; and that is worth acknowledging. But black are the hearts of their servitors, damnable their intent . . . . *grrrrrr*

Some of those companies are well-run. But of course, knowing how to run a company does not mean a person knows what is best for the country as a whole politically.

The minute you acknowledge that any of them is anything but a cancer on the country, you play into the business school fantasy of “economic growth” as a cure for economic evil, monopoly, plutocracy, etc. You need to remind yourself that industry and business are two very different things, that large scale “business” is nearly always the strategic sabotage of industry for the purpose of extracting monopoly rents and speculative gains.

see Veblen’s Theory of Business Enterprise for the grim details.

“Industry is carried on for the sake of business and not vice versa”

http://books.google.com/books?id=RZBLAAAAIAAJ&printsec=frontcover&dq=veblen+theory+of+business+enterprise&hl=en&sa=X&ei=NqaKUKGgHIfqrQGyoYHYBQ&ved=0CDIQ6AEwAA

Good to see that someone else has read it. Veblen and Henry George remain the only American economists to ever tell the truth. The university careerists have simply ignored them.

here is an online link to Veblan’s book:

http://socserv2.mcmaster.ca/~econ/ugcm/3ll3/veblen/busent/index.html

The Institute for Policy Studies very kindly provided a rap sheet for the top ten perps – er – CEOs listed:

http://www.ips-dc.org/articles/10_filthy-rich_tax-dodging_hypocrites_pushing_disastrous_austerity_on_america

Team Evil or Team Stupid we can debate. But Team Self-Serving is pretty clear cut…

On the digressive subject of repressive rentier such as King Pete, here is a list of close comparables drawn from a database of personality character templets which is one of my (too) many projects:

3rd Duke of Bridgewater

Cornelius Vanderbult

Samuel Slater

Jay Gould

Lord Beaverbrook

David Rockefeller, Sr.

Ernest Oppenheimer

Pete Peterson

Li Ka-shing

Frank Packer

Kerry Packer

T. Boone Pickens

Sumner Redstone

Trammel Crow

Kirk Kerkorian

Stephen A. Cohen

Mark Zukerberg

With the highly dubious exception of the Duke of Bridgewater, it can’t be said that a one of these men was anything but a cancer on the land. Find a single, positive thing that any of them ever did for the societies which they’ve despoiled. You’ll have to search the back pocket of the dead in hell to find it, and it won’t be bigger than the half of a pea. These men are the epitome of klepto-rentiers. So I ask you a second question, folks: would you, in any sanity, take the advice of these men on YOUR personal financial well being? On the future of your child? On the worth of your common society? Because not one of these guys ever gave a rat’s arse for society but that they could find a way to sell it or access thereunto.

Pete Peterson’s verbiage _at any time_ is a direct counter indicator of what society would best do. If he says it, that is the thing to oppose, looking at the record. So thanks for sharing Pete: we’re reminded again of the social evil you and yours have in mind for all the rest of us.

I’m sorry to disagree with you about one name–Lord Beaverbrook. We live in the very poor province where Beaverbrook lived for many years. If it wasn’t for him there would not be:

University of New Brunswick buildings:

Aitken House[19]

Aitken University Centre

Lady Beaverbrook Gymnasium

Lady Beaverbrook Residence[20]

Beaverbrook House (UNBSJ E-Commerce Centre)

City of Fredericton, New Brunswick

Lady Beaverbrook Arena (formerly operated by the University of New Brunswick)

The Beaverbrook Art Gallery, including world-renowned art collection (New Brunswick’s provincial gallery)

The Fredericton Playhouse

Lord Beaverbrook Hotel

Lord Beaverbrook statue in Officer’s Square

City of Miramichi, New Brunswick

Lord Beaverbrook Arena (LBA)

Beaverbrook Kin Centre (formerly the Beaverbrook Theatre and Town Hall)

Beaverbrook House (his boyhood home and formerly the Old Manse Library)

Lord Beaverbrook bust in Queen Elizabeth Park

Aitken Avenue

City of Campbellton, New Brunswick

Lord Beaverbrook School

City of Saint John, New Brunswick

Lord Beaverbrook Rink

City of Ottawa, Ontario

Beaverbrook

City of Calgary, Alberta

Lord Beaverbrook High School

McGill University

The Beaverbrook Chair in Ethics, Media and Communications[21]

We are richer for having been the home of Lord Beaverbrook. He was not perfect, but he certainly helped out the province.

Now you can have (please take them) his grand nephew and grandson who have sued the Beaverbrook Gallery to get back paintings in order to pay for their home in England. We have lost a good many paintings that way and are still facing the suit of the other who wants more paintings.

I’ll agree with you, JEHR, that Beaverbrook is an outlier in that lineup. And, be it said, some of the rest have made non-neglibible gestures of philanthropy. But at what larger cost? We can say that, having pillaged many and ill-counciled most all they endowed a few. It’s good that a region neglected by most got something postive. I wonder about all those around the Empire that came up lesser or harmed by the man’s career that that benefit was feasible. Better that we simply gave you the money, though of course that was never the choice. I would reiterate my larger point: Beaverbrook’s political and socio-policy _perspectives_ were wrong, self-serving, far too costly to many, and pursued with ruthless disregard for the larger interests of society. If he had a redeeming grain, we’d still have been better off not listening to him, on net.

And Trammel Crow was a patron of the arts though mostly collecting for investment.

And David Koch has given tons of money to various (mostly East Coast IIRC) arts institutions–the Met, Lincoln Center, etc. Maybe he really loves the arts, maybe he loves what he gains from that in positive publicity and reputation.

$10s or 100s of millions spent for a few (relatively speaking) vs. billions or tens of billions made the Koch Industries way.

Which leads to the question: what if those fine institutions said “no thanks” to the money, would they fall into bankruptcy?

Bilgewater!

Yes, and I haven’t seen it noted anwhere that in the frst debate, each particpant paid respectful tribute to Simpson Bowles -sedately.

Great analysis. But I think of this argument as the flipside (“The size of our debt isn’t anywhere close to provoking an ominous crisis”) to the point that our side is going to have to shout the minute the election is over, namely: The economy remains mired in anemic growth, worse job growth, and expansionary monetary policy isn’t getting the job done. The problem is depressed demand, and expansionary fiscal policy is in fact still a tool that’s available to us. And it’s the only tool that can restore demand. Cutting spending further at this point is what will drive the economy off of a cliff, and we have ample historical evidence to demonstrate that. The so-called “fiscal cliff” is a willful, malevolent misnomer.

Do we want to be Japan in the 1990s and the 2000s? Because that’s where we are and where we’re headed, from the looks of the current debate. Have some courage, America (cynical attempt to appeal to nationalism and patriotism). We need to get people back to work in order to restore spending and demand, and the course that is being discussed is 180 degrees from the right direction.

The problem is *not* “depressed demand” but lack of production.

Moreover, the CEOs are correct about the deficit being part of the problem, despite Yves’ critque, which essentially amounts to an attack on the messengers rather than the message. The deficit amounts to a tax on the people via the Cantillon effect, and will now require direct taxation as well, sapping real production.

What we need is a reduced burden on producers (including wage-earners), reduced government intervention in the economy, and a sound-money system so we can avoid Ludwig von Mises’ economic calculation problem, which is what we are stuck with under the current central planning regime.

“Central planning regime”

How do you come up with that? Are you claiming that the Fed’s setting of interest rates is the same thing as centrally planned production ala the Soviet Union? That’s quite a remarkable statement! Who knew that the profit system had been abolished? Who knew that the small group of private property owners extracting surplus from the people that actually bring commodities into existence, i.e. the workers, had been expropriated and their ill-gotten wealth turned over to the workers? Who knew that markets in capital goods had been abolished? Who knew that production is now entirely based on human need rather than on whether or not some capitalist can make a profit? When did this revolution happen? How did I miss it?

Well, now I know there’s at least one market that’s functioning well in Amerika today: the market in hyperbolic liberarian/propertarian bullshit where the notion that the Fed’s setting of interest rates is the equivalent of central planning (i.e. the abolition of the profit system/capitalism.)

Catepiller just wants to do to America with Austerity what it has done to Palestine with armored bulldozers.

See, this is what I’ve been trying to figure out. Is the lack of investment by the parasites on that list an organic response to a dearth of profitable investment opportunities in the U.S or are we looking at a capital strike as a way to pressure Barry Bankster to give them even more?

For the last 4 years we’ve certainly seen a concerted effort by the blood suckers to “work the refs,” i.e. to spread propaganda through the media to the masses about how Barry Bankster is a “socialist” who hates the “free enterprise system.” Tea Baggers mindlessly repeat this drivel spoon-fed to them from the top and we end up in a situation where a large percentage of the population is demanding punishment from their overlords. But this carefully inculcated masochism requires more than just disinformation, right?

The disinformation, in order to be really effective, requires a material expression, doesn’t it? When you combine the whip of unemployment with the disinformation then you get desired outcome: the liquidation of working class power.

As an added bonus, the inevtitable failure of austerity to ameliorate budget woes means that you get the opportunity to buy up public assets at fire sale prices.

Something else we need to keep in mind: we’re dealing with some of the vicious criminals in world history here, no doubt. People that would knock off their own grandmothers for a buck. But it’s not merely an ethical matter. It’s also a question of what this system requires in order to resolve the deep crisis it’s in and return to a level of self-expansion comensurate with some level of stability. You could have the most ethical individuals in world running these companies, but if they’re running the same set-up with the same incentive structures the outcome is still going to be exploitation and oppression and human suffering on a vast scale.

I think the ‘jobs’ fixation and the ‘growth’ fixation are a large part of the problem. The fantasy is that ‘growth’ will provide ‘jobs’, and ‘jobs’ will obviate social evil, at least for those who have them. But too many of the jobs are sociopathic, and too much of the growth is pointless, so that at best we have a society of people exhausting themselves producing and hauling boatloads of shit for which no sane person has any sensible use, and these ‘producers’ are sustained only by brainless ‘entertainment’ and soft drugs like Coca Cola (and coffee), and people think that is terrific so long as they are the ones with the jobs, and mortgage credit allows them to speculate in the housing market, and all this is called ‘Prosperity’ and con men like Bill Clinton get reelected for providing it, and now that we’re up shit’s creek in consequence of the unserviceable debt that is the flip side of the mortgage credit, so called thoughtful people look back nostalgically to the Nineties and promote strategies to take us through the same cycle all over again.

Isn’t it time we started thinking about how to make America function for the benefit of those who live here, about meeting essential needs and jettisoning all the crap and using technology to reduce needless production and needless work and elevate the quality of people’s lives? I would like to think so. Keynes prophesied that within 100 years (from 1938) society would be doing just that. We only have 26 of those years left.

I agree that the ideological mantra of “growth, growth, growth” has become a major burden on life, both human and non-human. And what we need to get to is a zero-growth, steady-state economic system in which production is controlled by the immediate producers for purpose of fulfilling human needs rather than pursuing private profit.

I would also argue, however, that the growth mantra has served the purpose of freeing humanity from much unnecessary suffering and toil. In other words, I do think capitalism has been historically progressive.

Because of the tremendous productive forces unleashed by capitalism humanity now has the material capability of providing all of us with a decent minimum level of material comfort. But the current crisis is making it increasingly clear to lots of folks that this system has outlived its usefulness and has descended into an almost entirely parasatic drain on the sources for human advancement.

Because of the uneven development that capitalism creates, there are still places in the world where we’re going to need more growth, such as sub-Saharan Africa. But for the rich countries much of what we want can be had through redistribution and consolidation of working class political power after the revolution. The latter is the biggest key though, because without that all that redistribution will be eroded over time through the formation of a new ruling class from within the bureaucracy, as we saw with the Soviet Union and China.

“and our favorite banking industry brown-nose, Kathryn Wylde of the New York City Partnership”

Good one! Got my morning off to a laugh and I haven’t even finished my first cup of coffee.

US bankster central planners are suffering from China envy:

Many relatives of Mr. Wen became wealthy during his leadership.

By DAVID BARBOZA

NY Times

“BEIJING — The mother of China’s prime minister was a schoolteacher in northern China. His father was ordered to tend pigs in one of Mao’s political campaigns. And during childhood, “my family was extremely poor,” the prime minister, Wen Jiabao, said in a speech last year.

“But now 90, the prime minister’s mother, Yang Zhiyun, not only left poverty behind — she became outright rich, at least on paper, according to corporate and regulatory records. Just one investment in her name, in a large Chinese financial services company, had a value of $120 million five years ago, the records show. “

“The corporate sector in aggregate was disinvesting and we first took note of this in 2005!.”

In 2002, I said the only people who were making any money were the people who screwing over the rest of us. At that time, every time the job numbers were bad, the stock market went up.

Around that time, I also said the only new thing we had was the i-Pod. I suppose we also had the Blackberry, but that flew under my radar. Now we have the i-Phone and Facebook is a fake.

Corporate America has become purely extractive. The executive and managerial classes do nothing productive or creative and function almost entirely on the logic that they are superior beings who have a right to literally dine on those they deem inferior, which is almost everyone.

Oddly enough, vampires and zombies have figured large in pop culture in recent years.

Now some of the corporate vampires and zombies are seeking to transfer that same perverted business rationale to the public sphere everywhere from the federal safety net, which with Obamacare they are now actively privatizing, to local charter schools, where unionized teachers are under attack and management is paid its usual neoliberal premium.

They’re not just failing to invest, they are actively destructive, and I honestly don’t think most of them even know how to do anything else at this point.

Corporate America tried disinvesting in the early 80s. The 1987 crash notoriously brought out the talking heads to tell us the crash had created a 30% unemployment rate (others said lower) and that it would be a jobless recovery. All that cash streaked to Asia and soon caused a similar crash in Asia. Then it all came limping home for help and we-the-government created a job boom or credit boom here to jump start things which recently ended in the Great Financial Crisis. Talk about dysfunctional. I’m pretty sure the reason the CEOs want to do this all over again in Africa because Africa won’t have good laws against them for at least a decade and they are all packing up and heading there as fast as they can. It’s the last frontier. But even as they are scrambling to get there, Africa is waking up and talking about extreme social inequities and how to prevent sovereign wealth from being stolen. Finally. Except in Nigeria.

CEOs are not dumb. They know from experience that government stimulus works when there is nothing else. That industry does better when government debt is high and private debt is low. And they have the political connections to play it for all it’s worth – like getting their big corporations defined as small businesses, and other stuff. But that’s not enough for them. They want one last dance, in Africa. And they are happy to blackmail us again.

Interesting comment, JTFaraday.

I’ve been wondering about the role of the

foreman in construction. Would you see

“foreman” as one rank in the managerial class?

Looking for insight …

zf

Rentier extrodinare, Jamie Dimon mouthing off on the subject:

http://www.cnbc.com/id/49565255

Masochist telegraphing ideology over profits. Course the governement he so loathes has his back so what the fuck, it’s win win for the sociopath.

On another disgusting note, last night I had the displeasure of watching the Lawrence O’Donnell show.

What did that hack promote for a good 2 minutes (seemed far longer)? Why nothing other than that the very same wise and pragmatic CEO Manifesto bunch was promoting higher taxes on themselves–take that Mitt! You see, Obama is right to let those tax cuts expire!

On a more positive note, Jill Stein made a good 5 minute appearance on Elliot Spitzer’s program.

Friends;

A dispatch from the trenches.

A classic example of false flag polling. The question of the day on the ATT.NET/Yahoo financial site, viewed by millions I assume, is this:

A group of CEOS is urging Washington to get a deal done on the debt and avoid the fiscal cliff. What is the best way to approach the deficit?

(1) Raise taxes and cut spending.

(2) Cut taxes to boost growth.

(3) Just cut spending.

(4) Go off the cliff to force a solution.

There are so many things wrong with this , I leave it to you to have fun figuring out the myriad right wing propagandas and myths put forward in six simple sentences.

My question of the day is: Who owns and runs Yahoo?

Unbelievable! The correct answer is (e) None of the above, but that’s not an option.

Naive as it may sound, just where do these people think their income will come from when the 99% are no longer able to buy their stuff? And where will they get the fools to run their companies-the manufacturing end-import them? I guess it’s just as well that my days are numbered, so I won’t be able to enjoy the chaos that is sure to follow.

They will make all their money buying T-bills from Treasury and selling them to the Fed.

They don’t look that far ahead.

Moi aussi! The only good thing about being old today.

They plan on getting laws passed to make it legal to pay your bills with vital organs that can be transplanted.

With all that money, it only makes sense that they’ll do what they can to live as long as they can, and fresh young organs will be just the ticket!

It’s the magic of the free market.

The Chicago School Freshwater guys have assured them it’ll work out. And if it doesn’t, then, f*ck it, they get to be barons lording it over the peons.

What’s not to like?

cnn international carries an article questioning whether the rest of the world can/does still see the president as leader of the free world

a requirement of leadership is moral authority

enabling this moral/criminal rot and cancer on American society and indeed even furthering its export should answer the question why the answer is no

Every time I see the President claim the title of the Leader of the Free World I get stomach cramps and bend over in pain and laughter. What a bunch of crap!

I’m wondering who framed the term “fiscal cliff” and injected into the public’s gray matter.

It’s components are:

1) Allow Bush tax cuts to finally end. They get a little more progressive again, which is the kind that don’t affect spending in the economy much.

2) Payroll tax cut ends. SS is fixed again!

3) As a result of the failed attempt to come up with a budget during that last debt ceiling debate, automatic cuts will happen. Half of these are to defense spending. So the glass is half full. The other half fall equally on the discretionary budget, like hopefully the SEC and some others. So the glass is more than half full.

4) The extended corn ethanol tax credits finally expire, so we make one small step towards solving the energy crisis.

What’s not to like?

I agree, but why hopefully the SEC? Hopefully not the SEC, I’d say.

They have been doing a terrible job.

After the auto cuts I’d cut nearly the whole thing and start over if I had my choice. Maybe re-hire with Occupy SEC for some fresh blood.

So, what, get rid of the SEC? We can’t do without financial regulation, simple as that. Start all over, OK, but as much as anything, the problems with the SEC have been enforcement and regulatory capture by corporations.

I’d say get rid of the one we have, and replace it with a real Securities and Exchange Commission.

The only thing they seem to want to prosecute for is inside trading. The 10 year track record is they got Martha Stewart and Gupta.

Some major oversites are appproval of any and all stock related products, chinese listing of fraudulent companies on US exchanges, deciding Mortgage Backed Securities are not something the SEC deals with, and now that HFT is not frontrunning nor does it pose any danger to the markets.

I’m sure I missed many things in that list, but I actually don’t pay that close attention to them.

And here’s the US Debt Clock

Puts gross debt to GDP at 105%.

That’s without “netting out US financial assets”, whatever that means. (China’s treasuries are implicitly backed by Yellowstone Park???)

http://www.usdebtclock.org/

Looks like austerity for banksters and cronies….. Major Banks, Governmental Officials and Their Comrade Capitalists Targets of Spire Law Group, LLP’s Racketeering and Money Laundering Lawsuit Seeking Return of $43 Trillion to the United States Treasury …. read here: http://www.marketwatch.com/story/major-banks-governmental-officials-and-their-comrade-capitalists-targets-of-spire-law-group-llps-racketeering-and-money-laundering-lawsuit-seeking-return-of-43-trillion-to-the-united-states-treasury-2012-10-25

Almost reads like an Onion piece. And here I thought we’d have to wait for a military coup.

Very convincing fake, comrade.

Press releases aren’t news. In this case it’s more like paid advertising or comment spam for a dodgy law firm at best.

A decent troll needs to be written to sound more professional than those Nigerian scam email of years gone by….

http://img41.imageshack.us/img41/5857/usaracketeeringonmortga.pdf

this is a pleasure to look over…

Should their efforts to impose Austerity succeed, we’re all Greek. Greece and Spain have provided the most recent template for these careful, ruthless men.

We need an active 12-Step Program to Restore Democracy and the Rule of Law, and to Rebuild Our Country. They are closely intertwined.

The first step is to disintermediate these current and former Wall Street bankers and corporate rentiers from defining public policy.

“Should their efforts to impose Austerity succeed, we’re all Greek. Greece and Spain have provided the most recent template for these careful, ruthless men. ”

Currently, we are at that point in that TV movie “The Day After” where John Lithgow says, shocked, “Those are minuteman missiles,” as they streak by in the sky toward Soviet Russia.

At this point, we’re basically just waiting for the retaliatory missiles to get here. We have about as much chance of stopping them as the Kansan farmers did in that movie, sadly.

Brace for impact.

It’s really sad when the family can’t let the dog stay in the fallout shelter because there’s no food for it. :(

Government spending should be sold to the American people as “government investment” instead of “deficit spending”. Explain to them it’s not so much the amount that is spent but what it is spent on that matters.

When the government spends money on R & D, roads and highways, universities and education, and other infrastructure projects, the public should understand it to be a long term “investment” that will generate revenue streams in the future in the form of taxes from a healthy economy.

On the other hand, when the government investment portfolio consists of bail-outs to big international banks and support for wasteful wars, we the public should expect little in the ways of long-term returns.

Selling the general public complex economic charts, theories, and equations will basically put them to sleep and get you no where fast. But if you can put it in terms of a household, doing budgeting for savings and investment, it will more than likely strike a chord with them. Sort of like the approach the austerity folks use, equating government spending with the “need to balance the household budget”.

If they can picture or equate government investments with a healthy prosperous America for their children, with an excellent public education system, healthcare, and infrastructure that will pay for itself many times over, they would not be so frightened about government spending.

From this perspective, leaders could begin to explain the changes that need to take place in both the political and institutional spheres that need to happen in order to secure our future and reach these well defined goals.

Let’s face it when you go in the hole to the tune of trillions of dollars, while the economy lays dormant and the middle class continues to see their wealth and standard of living erode, it’s hard to convince them that so-called “deficit spending” is going to help them. Their response is likely to be, “oh yeah, been there done that”. So spell out the future you see with government investment first, then explain why and how you need to get there.

You seem to believe that the problem is one of messaging, that if the Democratic Party can just package the information in the right way then they can sell it to the American people and the world will be set right. Implicit in this kind of analysis is the idea that we’re all middle-class and that the government (or at least one of its main institutions, the Democrats) is a neutral arbiter trying to provide the greatest happiness for the greatest number. This is totally wrong.

I’m not trying to single you out here. But this kind of analysis, so integral to the ideology of left liberalism, is one of the chief culprits in the retardation of political consciousness in this country.

The first thing we all need to recognize is that Amerika is a vicious class society owned and operated by a tiny clique of extremly rich, property-owning reactionaries who care not a fig for the well-being of the people but for the expansion of their profits. Both the Democratic and Republican parties are mediating proxies for their class rule, tasked with the purpose of mitigating class antagonisms. The state itself consists, at bottom, of special bodies of armed men and institutions whose primary purpose is the pepetuation of social domination by this clique.

Without a class analysis it’s impossible to understand the true nature of this set-up and impossible to really change it. One’s attention will end up being diverted to fruitless things like trying to change the Democratic Party from within or pressuring the Democrats to do the right thing or trying to help the Democrats become their true selves.

This is all misguided. This is a class dictatorship. The Democratic Party is owned and operated by this class dictatorship. It’s a question of power, not administrative competence.

avg John may have been saying that, but I don’t think so. avg John’s comment on how you pose the frame is the main point and I agree with him. Clearly labeling what the gov’t spends on would do a lot to help. But our “leaders” do not want to do that. Still, I take avg John’s post to heart and keep the faith in the proper role of gov’t (just not our gov’t at this time :-))

+1 for DiamondJammies’ comment.

His is the most accurate expression of the U.S. citizens’ predicament I have ever read.

avg John’s comment is, of course, absolutely true and the desirable policy if we lived in a textbook ideal world. But without acknowledging the actual power situation that DiamondJammies describes so well, all of avg John’s hopes and dreams for rational and constructive government benefiting the masses will fail, as we have seen most recently during the last 4 years with the Obama Democrats, or or during the Bush years with the absence of opposition by Democrats, or during the Clinton years with Democrat sponsored deregulation, etc, etc, etc.

Calling the Peter Pinguid Society! Earth to PPS: We need you here in Austerity Land!

While I appreciate the point of this post – there cannot be too much ridicule of the CEO’s letter – I must take issue with the cheap shot at CBO. Just because they don’t change the presentation of their analysis does not mean they are no longer independent. There are often federal budget reasons, including statutory provisions, that dictate how they present their numbers. They also try very hard to stay out of both political and academic arguments by navigating the middle of the stream. But they are usually pretty good about sneaking in the info needed to do the alternative calculations.

“There are often federal budget reasons, including statutory provisions, that dictate how they present their numbers.”

Is there a mechanism whereby CBO might flag on the report with inaccurate data that appropriate changes were not made to the data “because of federal budgetary reasons and/or statutory provisions”?

Otherwise what is the point of CBO releasing reports with bad data that is hugely relied upon in economic and political decision-making (and, in the event, campaigns gearing up for D-day)?

Um, your view of the CBO is looking dated:

http://online.wsj.com/article/SB10001424052970204740904577197201992946704.html

http://jessescrossroadscafe.blogspot.com/2012/05/lauren-lyster-interviews-cbo.html

Where the CBO has constraints on how it reports is when it has been asked about the budgetary impact of legislation, and it is often directed to look at the impact in a specified time frame.

Ferguson and Johnson are both experienced analysts (Johnson was an economist on the Senate Banking Committee and later chief economist of the Joint Budget Committee) so I sincerely doubt they’d ask the CBO to correct its reporting if there was a constraint. I’ll confirm my understanding.

Just went to Jesse’s and watched the Lauren Lyster – Lan Pham discussion. Wow, was I being naive. Sounds like basically all CBO reports need to have a big red Occupy CBO Sticker on the front page with a warning: “The CBO only publishes information (er, “content”) approved by the .01% and their Lackeys in the Congress.”

The cancer really has metastasized to every nook and cranny in government.

Using Lan Pham to support the argument that CBO has lost it’s integrity does nothing to further the discussion. She is clearly a disgruntled employee who worked there just a few months and on one project only. Whatever the truth about her experience, and we have only her side here, it is hardly proof of a corrupted agency.

CBO stays firmly in the middle of the road which can be very unsatisfying in extreme times. I do not think that is the same thing as being lapdogs of the 1%. Ask Paul Ryan. I was not arguing that they do not make mistakes. I was taking exception to the leap to broadly questioning their integrity when they do not agree with you.

Since the tenor of your reply is very similar to the pre-fabbed talking points of any attorney who practices employment law on the defense side, I am going to take it with a large grain of salt. Dismissing the facts reported by Ms. Pham as “whatever they may be, now move along” is really a tell.

I’m sorry that is how you interpreted my remarks. I am not an attorney. But I do believe that it helps to know both sides of a dispute before making up one’s mind and then using it to discredit an agency that has a well-earned reputation for non-partisanship. The Wall Street Journal is no friend of CBO when it is being run by an appointee of a Democratically controlled Congress which is the case now.

If Pete Peterson and numerous CEO’s truly believe in austerity, shouldn’t the government oblige them by getting rid of 50 to 75% of the subsidies and tax advantages for corporations, hedge funds, and wealthy individuals? They can voluntarily take wage cuts so their salary is only at most, say, 25 times that of the lowest paid employee. If they TRULY believe in austerity, they can show by example.

What an excellent point. There really is no shortage of one-sentence demands that we need to start presenting to our elected shills (representatives) and/or suggesting to already active Third Party candidates.

Pay your taxes CEOs. Then we’ll talk.

Yes, government spending “investment” should be pushed. If Frankenstorm has its way, government driven investment is coming whether the CEO’s want it or not.

where should i post interesting links other than the comments?

http://www.bis.gov.uk/news/topstories/2012/Oct/employee-owner-plans-to-boost-growth

just thouhgt this link is interesting because it might be a better way to “distribute fruits of growth”, though it does sound a little too good to be true.

Financial Assets? Like student loans and mortgage backed securities? Both of which would be worthless in the perfect NC world, since the debtors would never be required to repay the loans. What else… TARP loans, holdings in GM, Fannie and Freddie?

haha. Ya, $6T in F&F MBS, $1 trillion in students loans and it’s a high growth market. Then some people like excluding the “intergovermental debt” of 4.5t in SS and Fed pensions because we “owe it to ourselves!?”.

There is the Federal park system – Chinese condo developers may like it.

They sell the airwaves to TV and radio stations and CO2 doesn’t make it any worse.

Throw in desks,chairs,PCs in Washington along with the Military, White House, Smithonian and the Washington Monument and we can probably get the books to show the US has no net debt. Plenty of assets for the taking.

ha-ha!

“Then some people like excluding the “intergovermental debt” of 4.5t in SS and Fed pensions because we “owe it to ourselves!?””

But non-federal pensions that are subject to Fed Law (ERISA), another story: lots of feed in that trough too!

I do not quite understand this point, attributed to Salmon:”Money is cheaper now than it has been in living memory: the markets are telling corporate America that they are more than willing to fund investments at unbelievably low rates.”

Money is cheaper now due to CB actions, no? The markets are being muffled, so we really do not know what they say, no? I wonder if companies may be disinvesting because markets may have become unfavorable, rather than begging for investment?

As for CEOs, their interests do seem largely misaligned with those of society and society’s misaligned with those of the environment. Cannot be good…

Headline I’d like to see . . .

“America Advocates Austerity for Rentier CEOs”.