We’ll see how his term as head of the SEC’s enforcement division has served Robert Khuzami when we learn how well he lands, but his prickly responses to well-warranted criticism of his tenure at the SEC indicate he is at least awfully thin-skinned, and might even be finding that his dubious record has lowered his value in the secondary market. Given how many empty 42 longs seem to go from splashy position to splashy position, it seems hard to believe that anyone who’d be interested in Khuzami cares about his skills (the fact that he was a general counsel for the US operations of Deutsche means he’s more than adequate) as opposed to his connections and his brand value as a former senior regulator.

Reader Mrs. G. took note of how Khuzami’s effort to defend his record in the National Law Journal backfired. Khuzami is responding to a critical article by Columbia law professor John Coffee, a very highly respected commentator on securities law, in the National Law Journal in December. His article is highly readable and persuasive. Its opener:

A disturbingly persistent pattern has emerged in U.S. Securities and Exchange Commission enforcement cases that involves three key elements: (1) The commission rarely sues individual defendants at large financial institutions, settling instead with the entity only; (2) when it does sue individual defendants, it frequently loses; and (3) the penalties collected by the commission from corporate defendants are declining and, in any event, are modest in proportion to the profits obtained.

Coffee goes on to discuss how the SEC has been unambitious in the number and nature of targets it has chosen in the wake of the crisis (he contrasts it unfavorably with the FHFA) and (quelle surprise!) has steered clear of pursuing the top brass at major firms (its failed suit against Angelo Mozilo the lone exception). And the SEC isn’t doing well even if you view it as handing out parking tickets rather than trying to punish and deter destructive behavior:

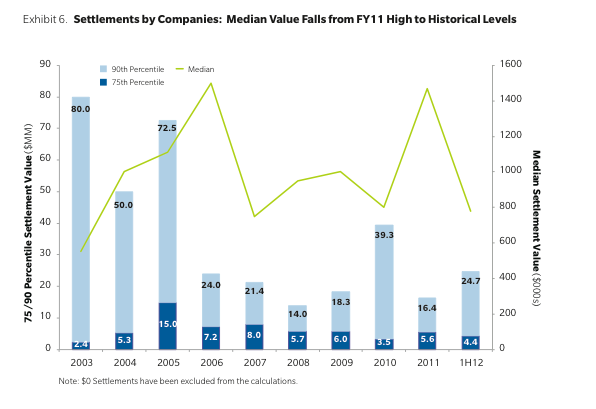

Worse yet, although the SEC has collected billions of dollars in penalties from corporate defendants and is on pace for the largest number of settlements since 2005, the median value of SEC settlements with corporate defendants declined from $1.5 million in fiscal year 2011 to $800,000 during the first half of fiscal year 2012, and both years are well below the median corporate settlements a decade ago. The median corporate settlement in 2003 to 2005 was well over $50 million.

Coffee makes a modest recommendation: have the SEC emulate other agencies with enforcement powers, like the FDIC, and engage private counsel who would be paid on a contingent fee basis to help litigate large complex financial fraud cases.

Khuzami and deputy chief of enforcement George Canellos issued a stung response in this month’s National Law Journal. Reader Mrs. G was not impressed:

A petulant adolescent wearing an adult suit peevishly takes on John Coffee point, by little point. I think it’s embarrassing. I wonder why he felt compelled to say these things in the main trade jourrnal for lawyers. Have his potential employers been sending signals that his deutsche issues and his public image as a toady for the 1% have turned him into damaged goods? Khuzani focuses on a NERA study with meaningless statistics (he obsesses over the little numbers that do nothing to contradict the truth of SEC’s massive failure as a competent enforcer in re Great Crash) instead of responding to the main charges against him that he should never have been hired at SEC because of his Deutsche past with CDOs, etc. Really super lame.

Khuzami and Canellos contend that the SEC really really had targeted important individuals (huh?) and that Coffee had mischaracterized the data on SEC settlements (from an NERA study) and the SEC really was doing better in 2011 and 2012 than in the 2003-2005 period. See the chart below and reach your own conclusions:

This section gives an idea of how strained the Khuzami/Canellos arguments are:

Furthermore, Coffee’s suggestion that SEC trial attorneys may be outmatched by defense counsel does not consider the overall pattern of courtroom success. While the SEC may be “an overworked, underfunded agency that is subject to severe resource constraints,” it is also staffed by some of the most talented, experienced and dedicated securities lawyers in the country. Many of its trial attorneys are former litigation partners at top law firms, former federal criminal prosecutors and other highly credentialed and experienced attorneys equal to the challenge of any case. While these facts suggest that Coffee is casting for solutions to a nonexistent problem, his proposed solution to replace government attorneys with private contingency-fee lawyers raises serious concerns.

He proposes that for big litigation matters the SEC engage private lawyers compensated based on a percentage of the monies they collect. However, that solution assumes that the SEC’s general goal is to sue as many deep-pocketed parties, and collect as much in penalties, as possible. But, as enforcer of the nation’s securities laws, the SEC’s goal is aggressively to uphold the law and serve the interests of justice. That means evaluating each case fairly, suing only those whom the evidence shows violated the law, assessing relative culpability of different participants, and assessing a penalty that is appropriate for the particular violation — which could be anything from a serious fraud to an unintentional violation of a more technical requirement.

Um, the SEC’s record shows that even if they do have talented staff, they have not been able to turn deploy them successfully. And Coffee was hardly suggesting to turn over the SEC’s entire enforcement operation to hired guns, but to give the ones that have both monetary potential and intrinsic enforcement value over to outside lawyers, and focus the SEC’s own staff on the remaining worthwhile enforcement targets.

Coffee roused himself to continue the debate, via a response to Corporate Crime Reporter. a key extract:

Coffee cites the Chicago Booth/Kellogg Financial Trust Index for 2012, which finds that 79% of investors have “no trust in the financial system,” the Center for Audit Quality’s Sixth Annual Main Street Investor Survey, which finds that 61% of investors “have no confidence in governmental regulators,” and the 2012 Ethics and Action Survey, which finds that 64% of the American public believes that “corporate misconduct was a significant factor” in causing the 2008 economic crisis.

“The public’s dissatisfaction with SEC enforcement is not based on statistical data, but a sense that regulators have not held accountable anyone at the top of the major financial institutions that collapsed in 2008,” Coffee says.

“This was in sharp contrast to the savings and loan crisis in the late 1980s — where many went to prison — and WorldCom and Enron — where the CEOs were convicted and imprisoned.”

“The SEC did not even try to push the envelope,” Coffee says.

It would be nice to think that this little row meant that Khuzami’s job prospects were tarnished a tad by his performance at the SEC, but I strongly suspect we’ll see otherwise. But the fact that someone of Coffee’s stature is willing to rough him up is at least a sign that people in the know are not buying what the SEC and the Obama administration generally are selling.

I have no doubt that Mr. Khuzami failure will be subtstantially more comfortable than those who lost their job, pensions, investments, and homes when the financial markets failed and the economy imploded.

Alas, under our Orwellian kleptocracy, Khuzami is almost certain to fail upwards, receiving his payoff for protecting politically-connected felonious aristocrats like Corzine, Blankfein, and Dimon . . . that is to say, Obama’s base.

When I read, “the SEC is … staffed by some of the most talented, experienced and dedicated securities lawyers in the country. Many of its trial attorneys are former litigation partners at top law firms, former federal criminal prosecutors and other highly credentialed and experienced attorneys equal to the challenge of any case,”

my only reaction is that you need to think your Hero Theory of securities law enforcement. Litigation isn’t brain surgery. It requires only financial muscle and manpower in a judicial system dedicated simultaneously to rolling over to claims by authority against the powerless, while preserving the welfare and status of the ultra rich.

The SEC is not about law enforcement against the powerful and rich. It never has been. It is about the appearance of law enforcement, and duping a gullible amorphous herd of largely imaginary “investors”, making them confident in the “integrity” of markets simultaneously being rigged by phony accounting and public relations nonsense. What law enforcement there is proceeds in a handful of highly trumpeted crusades against tinhorn confidence men operating on shoestrings.

Don’t worry about Khuzami. Just like Clinton he will reap his reward for playing ball with entrenched power. If all else fails he can write a book blaming everything on a lack of resources and public misconception regarding the identity of the real culprits, perhaps those greedy home buyers who falsified financial data and took on more mortgage than they could afford.

“[The SEC] is about the appearance of law enforcement, and duping a gullible amorphous herd of largely imaginary “investors”, making them confident in the “integrity” of markets simultaneously being rigged by phony accounting and public relations nonsense.”

Yup. And in days past, when absolutely nobody was hip to SEC’s real purpose (duping “retail” money into the markets by creating the illusion of a commitment to market fairness), Khuzami’s silly recitals of irrelevant SEC enforcement statistics would have persuaded 100% of the “retail investor public.” But today, at least, there’s a loud, and growing, peanut gallery (even though Coffee’s take on the SEC is basically that it is a real agency and just needs tweaking (e.g. the bizzarre proposal about hiring private contingency lawyers!).” When in recent or 50 year memory has the Director of the SEC ever had to defend the job he was doing in Comment sections and the National Law Journal?!

Obama’s appointment of Khuzami to head Post Crash SEC Enforcement was as good a signal to any investor with half a brain cell that “markets” must be avoided at all costs under penalty of severe financial harm and damage!

Excellent….

Khuzami will do well. The “bribe” for his “work” at the SEC is the big payoff that follows. This is part of the system of bribes that gives us the best Congress and academia that money can buy.

How about we turn over the investigation into Khuzami’s role in the fraud at his former employer.

At least Madoff owned up to his crimes … eventually

People are not buying what the Obama regime is selling? Please. Aside from a few well-informed individuals that I know (who are generally preparing for the collapse) everyone either loves/hates Obama because he’s a “Socialist” or is too busy worrying about who the winner of American Idol will be to even know what the SEC is supposed to be doing, let alone what it isn’t doing.

Reading comprehension fail:

people in the know are not buying what the SEC and the Obama administration generally are selling.

Yeah, you’re right about that. But then again as far as electoral politics goes my point is valid. There will be no benefit for the political class in cleaning out the corruption. Therefore we will continue to have corruption, and it will continue to worsen as criminal elites find new boundaries of criminality to push (that Americans will continue to not care about).

That’s not to say that I’m not an optimist. I wouldn’t want you to think that I’m encouraging people to be passive victims. It’s just that there are positive things people could be doing to improve their lives and community and NC by and large stringently avoids mentioning any of those positive mechanisms of change that might actually accomplish something in preference to futile (if entertaining) efforts at shaming miscreants.

Although I guess even that works to a degree since it fosters distrust and cynism in your readers, which I suppose is a necessary first step towards the realization that societal collapse is imminent. In that, you do very good work now that I think about it. Although people do still have to look elsewhere to find the next leg of the journey towards enlightment and preparedness. But it’s a start.

You have to be careful about confusing increasing victimization with societal collapse. We may be facing another 20 years of selective victimization, after which what will happen is anyone’s guess.

Victimization alongside increasing arbitrary systemic dysfunction, too, such as Yves detailed in her post “Devolution: Welcome to a World Where Things Don’t Work Well.”

It’ll bear some resemblances to living in the old Soviet Union, on the one hand, and yet, on the other, there’ll be new technologies kicking in and climate change increasingly on peoples’ minds.

Mr. Khuzami,

If you are reading this, please resign. Most observers agree that you have done a bad job. Do something honorable and walk off to the next well paid job in the private sector. It is clear to me and many others that the SEC has done a very poor job on your watch. Your efforts to argue otherwise are so lame they merely emphasis the point. Let someone who might be able to do the job properly take over. The very best thing you could do for the public now is admit that your work has been shoddy and they deserve better. It might prompt a bit of congressional soul searching.

Don’t you need a soul to be able to search it?

morality and ethics aside if he has a book of biz he is a perfect fit as a lateral partner in white collar defense practice in biglaw

be right at home

Yes it “takes one to know one” doesn’t it?

Uh oh, Khuzami gives an interview to … the NY Post (!) to “debunk myths about the SEC.” I can’t imagine he set up an interview with Murdoch’s tabloid of his own volition — someone high up (in the Kleptocracy)is pretty desperate about the peeps fleeing markets in droves — Khuzami is the PR Guy for the campaign to bring back the rubes to the markets! Ha ha.

http://www.nypost.com/p/news/business/my_sec_my_rules_BPlvGtUk7dDNM8bCimxpxH

Thanks Mrs. G this is priceless!

Lawyers, being a lower life form, have interesting ways of turning on their own.

It happened here in L.A. – a federal Bk judge consistenly ruled against debtors. When she came up for renewal (BK judges serve for five years terms and must be renewed by the Fed Circuit court of the district) – the lawyers in the local BK bar inidividually and as a group signed a petition (at great risks to themselves, since she was still a sitting judge ruling on them) to oppose her reappointment.

Long story short, she was NOT reappointed and the expected red carpet to a creditor BK firm and its huge payday $700K and up annually) – did not materialize. Even the bank loving firms realized she was so reviled that no opposing attorney would work with her.

End result: She now runs a 800 number type referral firm out of a store front on Pico Blvd, and is still hated and cited as the most unfair BK judge ever seate4d in Los Angeles. (I have the new candiate, but that is another sotry.)

Bottom Lime: Khuzami, Breur, and god forbid, Holder may not be in for the huge payday they had hoped for.\

Well, one can dream.

Now *that* is a nice dream. (Just in time for MLK Day, too!)

Wall Street is the Golden Goose of campaign contributions. This Administration knows that from the GWB and Clinton administrations. Consequently any prosecutions in the finance industry likely need to get Holder on board and you can see from his track record he is a purely political operator. Consequently some of the percieved anger of Khuzami etc. is likely that they have no support within the administration to do any of the things Coffee suggests.

I have been thinking a little more about the “methinks he doth protest too much” position Khuzami is taking.

Given the widespread belief on both the left and the right (see Peggy Noonan yesterday in the WSJ) and Simon Johnson today in the NY Times, that the system is rigged, and since the 3 mouseketeers (Khuzami, Brueur, and Holder, [who has seen the handwriting on the wall amd knows he is TOXIC, so he will stay as AG and continue his Quisling way in his current job, thank you very much]) any law firm would appear to be hiring people widely seen as professioinally incompetent. And yes, widely reviled and politically, ahem, delicate.

Any bank that would hire them will be widely seen as hiding something BIG (or else why take the heat of public opprobrium over their hiring when there are plenty of less high profile influence peddlers out there to suckle the bank teat) and/or buying influence especially at Justice. And why would thateven be necessary given the legal pass for banksters and financil firms Justice has institutionalized.

These three traitors have been very useful as a Fifth Column in Justice. Too radioactive (and not all that useful to the plutocracy and banksters) once they leave Justice. Jobs a bit too well done, gentlemen.

Maybe we’ll get lucky and one of them will need money, have a change of heart, and write a tell-all memoir. Now THAT would be worth reading. Yes, I know I’m being naive.

It may be just a remnant of hope which I have still to smother, but I detect in this story and a few others the emergence of tiny cracks in the criminal facade on wall street. Could it be that they have finally run out of the money and influence necessary to keep everyone sweet? Are the rats beginning to scramble to higher ground, and the devil take the hindmost?

Lawyers! Nuff said.

well…we sent Mr. Khuzami a nice big fat juicy christmas present in the form of a subpoena to produce documents in a DBforeclosure case here in florida for his work at DB and with foreclosure trade associations. we sent his buddy David Co, head of Trust activities for DB in california an invitation for a deposition in the same case. We are sure they willboth fight them…but DB may not slip away as it is probably in front of the wrong judge who is not too keen on the bank lawyers right about now…we shall see…but he will probably take a corporate job in switzerland where he can not be brought back to testify and the coporate secrecy laws in the swiss federation is why so many major corporations are setting up server operations in the little cantons…

I had a terrible fight with DB. I hope you prevail in your case and in getting Khuzami on the stand. From the bottom of my heart I hope you prevail. You must’ve gotten one of the three fair judges in the U.S. Good for you. (To the best of my knowledge there’s one in Brooklyn and one in the BK court in New Orleans who both Yves and Morgenstern in the Times have cited – Elizabeth is her first name .)

actually no one gives credit where credit is due as they are not publicity hounds…the st petersburg (pinellas county) jurists…all of them, basically mutinied against the sell out of mark rubio(more on that in a moment)…they are the reason the governor brought in these retired judges to fast trak the rocketdocket thing…they basically were the first to openly question these robo-affidavits…two fearless judges…the Honorable Amy William and Pamela Campbell have been attacked by the foreclosure mills but they stared them right back down…judge rondolino was the first to openly question the phony affidavits and judge demers-now retired-(former chief judge) basically told the bank lawyers to take a flying leap…everything needed an “evidentiary hearing”…but the chief judge, the Honorable J. Thomas McGrady in pinellas and pasco has his hands tied…rubio sold out the state constitution as the price for being made a senator…the florida constitution calls for the legislature to fund the needs of the judicial system…on the way out the door, rubio changed the funding, stripped the state funding and gave all the power to the bank foreclosure attorneys by increasing the filing fees, and basically have the banks funding over 75% of the judiciary with their control of foreclosure cases…and the banks and LPS(from jacksonville which controls 50% of all foreclosure cases) have openly challenged the courts by withholding cases in an attempt to intimidate the judiciary here in florida…but the presidential election is over…the montgomery cliff(t) is gone…and I am gonna get back on the saddle and make sure the Community Reinvestment Act is enforced….hello Lisa Glover at US Bank, NA…its showtime…

+1000.

It will be interesting to see. Even if Khuzami is damaged goods, the financial sector has a good reason to see that he gets a soft landing somewhere, not so much for him but to incentivize his replacement in turn, to remind him/her what is waiting for them out there if they play their cards right and know how to go along to get along.

Thanks Alex for the update. I’m glad you’ve got backup. Thanks Ms. G for the Post piece. It does appear that Khuzami is “talking his book” and selling pretty hard for someone who thought his soft landing was pre-ordained.

I do think Hugh, that the you are correct in that Khuzami will be provided for – maybe speaker’s fees, some arms-length consulting perhgaps for some think tank or other 501(c) 3 Koch/bankster “non-profit social-welfare organization PAC.” There will have to be a clear pay-day on the horizon for the next Quisling on the SEC as you said, to guarantee compliance with the plutocracy’s agenda.

What I find deeply satisfying is that Mr. Khuzami’s reputation appears to damaged. For people like Khuzami,and the judge I referenced here in L.A., et. al., reputational damage = diminished power and ego debasement, both of which are sublimely pleasing to the eye of an observer who has watched these douche-nozzles destroy so many other people (and me, by extension) through their complicity in the looting of the middle (soon to be lower) class of these United States.

Great post Ms. Smith.

Fellow Americans, here is .S.E.C criminal gang exposed by me

We must make a documentary on NETFLIX insider Gang loot in Billions and ROBERT KHUZAMI/MARY SCHAPIRO Scam gang at S.E.C. key role in the scam ongoing loot

Here is my WEBPAGE on NETFLIX scam for now

http://scamflixhouseofcards.com/#