By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from http://www.macrobusiness.com.au/2013/02/europe-waits-for-italy/“>MacroBusiness.

Another chapter in the Italy political story comes to a close as a government is formed, for how long who knows, but a familiar figure appears to be playing puppet master:

Italian center-left politician Enrico Letta named a coalition government on Saturday, making one of Silvio Berlusconi’s closest allies deputy prime minister and ending two months of damaging political stalemate.

Letta has said his priorities would be the economy, unemployment and restoring faith in Italy’s discredited political institutions as well as trying to turn Europe away from austerity to focus more on growth and investment.

An inconclusive general election in February left Italy, the euro zone’s third-largest economy, without effective government, threatening investor confidence and holding up efforts to end a recession set to become the longest since World War Two.

Letta, the 46-year-old deputy head of the Democratic Party (PD), said he felt “sober satisfaction” after three days of talks with rival parties produced a government that included a record number of women ministers but few political big hitters.

“I hope that this government can get to work quickly in the spirit of fervent cooperation and without any prejudice or conflict,” President Giorgio Napolitano said.

The anti-establishment 5-Star Movement has refused to join a government which party leader Beppe Grillo said “bordered on incestuous” given the relationship between Letta and his uncle Gianni Letta, Berlusconi’s long-time chief of staff.

So Berlusconi’s hands reaches back into the Italian parliament while the new leadership looks to be attempting an agenda very familiar to his own pre-Monti. Obviously, in a year where the German’s are about to have an election talk of steering Europe away from austerity is just that, talk, but as I noted last week there is a growing audience in the ‘core’ who have good reason to side with Italy.

In the meantime Moody’s has again fired a warning shoot across the Italian economy by leaving them on negative watch:

Moody’s Investors Service has today affirmed Italy’s Baa2 long-term government bond ratings, and is maintaining the negative outlook. In addition, Moody’s has also affirmed Italy’s Prime-2 short-term debt rating.

The key factors for maintaining the negative outlook are:

• Italy’s subdued economic outlook as a result of weak domestic and external demand (especially from its EU trading partners) and a slow pace of improvement in unit labour costs relative to other peripheral countries.

• The negative outlook on Italy’s banking system, which is characterised by weak profitability, a deterioration of asset quality and restricted access to market funding, and which indirectly raises the cost of funding for small and medium-sized enterprises (SMEs).

• The elevated risk that the Italian sovereign might lose investor confidence and, ultimately, access to private debt markets as a result of the political stalemate and the resulting uncertainty over future policy direction, as well as contagion risk from events in other peripheral countries.The key factors behind the affirmation of Italy’s Baa2 rating are:

• Low funding costs, which, if sustained, buy time for the government to implement reforms and for growth to resume.

• The government’s primary surplus, which increases the likelihood that Italy’s debt burden will be sustainable, despite the expectation of low medium-term growth in nominal GDP.

• Economic resiliency, which is supported by the country’s large diversified economy, the relatively low indebtedness of its private sector and the likely availability of financial support, if needed, from euro area members given Italy’s fiscal consolidation progress in recent years and Italy’s systemic importance for the euro area.

Over in Cyprus what everyone knew was going to occur is, that is an ever extending period of capital controls in order to keep the Cypriot banking system alive. Under the bailout agreement, the new Troika plan and pressure from both Russia and Turkey over financial and resource sovereignty the country is in serious trouble and it is little wonder this is occurring:

Cyprus will keep capital controls in place throughout the summer tourist season despite a marginal easing to help struggling local businesses stay afloat, a government adviser said on Friday.

The measures would be lifted only after the restructuring of Bank of Cyprus, the island’s largest lender, a process involving a 60 per cent haircut of uninsured deposits and the acquisition of some assets from Laiki Bank following its collapse last month.

The new date for rolling back is September, but I see no reason to suggest that capital controls will not be in place for well into 2014. I absolutely expect, as we’ve seen with other bailout countries, for Cypriot economic data to come in on the downside of estimates which will continue to put pressure on the government and the banking system for years to come.

Finally, is the little news out of Germany where again the BundesBank appears to be doing its hardest to ensure that periphery Europe has little choice but to give up on experiment ‘euro’, this is particularly interesting in light of the warning from Moody’s on Italy above.

The Bundesbank has lodged a deposition with the German constitutional court (In German) opposing the legality of the ECB’s OMT. Given, as far as I can see, the only thing holding up the entire Eurozone at the moment is the ‘lender of last resort’ function of the ECB I’ve seriously got to question the motives behind such action.

Yanis Varoufakis has some very good analysis on the subject which I advise you to read in full, but I’ll leave you with his conclusion:

Some readers may feel inclined to dismiss my hypothesis as too far-fetched; too conspiratorial. It is perfectly true that I have no evidence that Mr Weidmann has intentionally embraced a strategy of pushing the Eurozone toward disintegration (thus creating an inexorable dynamic that will lead to the DM’s re-introduction). However, a close reading of the Bundesbank’s constitutional court deposition leaves us with only two possible interpretations. One is that Mr Weidmann does not ‘get it’; that he cannot see that a Greek exit in 2012, or an Italian exit in 2014, would spell the end of the Eurozone; that he cannot see that Mr Draghi’s OMT announcement played a crucial role in stopping the disintegration of the common currency last year; that he has no appreciation of the catastrophe facing good, solid Spanish and Italian enterprises due to the broken down interest rate transmission mechanism. The other is my interpretation: Mr Weidman can see only too well that the above hold unequivocally but is tabling this deposition at the constitutional course knowingly and as part of a strategy that leads the euro to a death by a thousand, almost silent, cuts. You take your pick, dear reader: Do we behold a Bundesbank Grand Error or a Grand Strategy, the purpose of which is to bring about a new hard currency east of the Rhine and north of the Alps, unencumbered by the deficit countries and France? I know which interpretation I would place money on.

Personally, given the history of the Bundesbank, and other prominent and vocal German economists, such as Professor Sinn,I’m going to have to go the cynical route on this one and take Yanis’ second option.

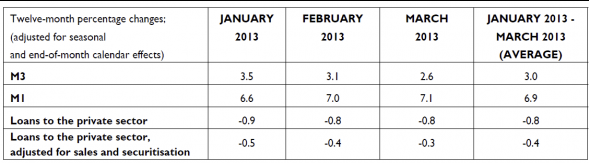

Finally today, Friday saw the release of ECB monetary aggregates and whocouldanode, they’re falling again?

There is perhaps a simpler explanation. By forcing the decision to be reviewed by the courts the BB has ensured that it has ‘cover’. A decision that OMT is legal, if it leads to problems, gives the politicians a narrative that they did things by the book. The story then becomes one of ‘we have done everything we could under the legal framework and therefore we are not to blame’.

Only a thought and happy to have it shot down if I have missed something obvious (which is my forte!)

Si

Germans are, in general, very smart people but they are also somewhat ridgid and dogmatic in their thinking: Following the rules and the proper process matters a whole lot more to a German than the result. The German aestetics find that “chaos”, “unpredictability” and “anarchy” are far worse sins than certain doom created by “following the appropriate rules and standards”.

This creates a lot of fun at project meetings often pitting our German colleages, versus the Danes, Swedish, Italians, French and American – all rule-breakers, in various degrees of offensive “rendomness” to the Germans.

I think Mr Wiedmann does “get it” but, being German, he *must* follow The Proper Procedure to whatever end.

If you’re right on the intentions of the german central bank, then an explanation is needed WHY. Which interests are served by this behaviour ?

Germany is a special case in Europe, given the extraordinary strength of its industrial (export)sector – and therefore of industrial capital and labour.

It has an important financial sector too, which is linked to the bad loans in the south (and the east).

Is it possible that the industrial sector opts for cutting the losses, sacrificing part of the financial sector and going alone, gambling on the strength of the industry on the world markets and in alliance with their satellites ?

If you go back to 2006 logic, this is what you would expect to happen. The idea being that Germany, unlike the anglo-saxon countries, would prioritise it’s manufactoring and industrial sector over the financial.

However, this isn’t 2006 obviously, and we now know the overwhelming power of finance versus every other part of the economy, globally. But the thing is, when the crisis hit, Germany’s banks were arguably the weakest of the lot, having been suckered by goldman types into buying billions of dollars worth of the very worst sub-prime dreck, and wildly exposed to peripheral area soveriegn and private sector debt. And they weren’t bailed out/recapitalised post-Lehman.

Since they’ve subsequently managed to pass most of their sh*tty sovereign debt onto the ECB, and perhaps now the worst of the sub-prime crap has passed through he system, this might be the time for the old industrial lobby power to re-assert itself, as the German banks aren’t quite so weak any longer.

Yanis:You take your pick, dear reader: Do we behold a Bundesbank Grand Error or a Grand Strategy, the purpose of which is to bring about a new hard currency east of the Rhine and north of the Alps, unencumbered by the deficit countries and France? I know which interpretation I would place money on.

Delusional:Personally, given the history of the Bundesbank, and other prominent and vocal German economists, such as Professor Sinn,I’m going to have to go the cynical route on this one and take Yanis’ second option.

Who cares? Whether error or strategy – perhaps it is the List der Vernunft (cunning of Reason)? What is obvious, as Marshall Auerback devoted an article to a couple years back, is that the departure of Germany from the Eurozone would be a Very Good Thing for all concerned, making it much easier to create a rational, workable rump Eurozone, if that is what is desired. If some Germans, whether idiots or farseeing prophets, work toward that as a practical, achievable, political end – then more power to them!

in his last piece Sinn says Germany must have higher prices by 20% and Spain, Greece etc 20 to 30% lower prices: http://www.project-syndicate.org/commentary/should-germany-exit-the-euro-by-hans-werner-sinn

No doubt the BB wants to cut the Southeners loose. But also no doubt the BB might want something but it doesn´t call the shots. The constitutional court will give the ECB the benefit of the doubt and assume that the lending to the Southern periphery doesn´t actually constitute forbidden moneterisation of debt. Therefore the ECB can continue as it does.

A much bigger problem is the murky role “Deutsche Bank” plays in all this. “Deutsche” isn´t German at all but ruled by the investment bankers from London. They have caused a great deal of the 283 Billion Dollars the German resolution authorities had to pay out to save German banks. One only needs to think of the IKB and the role derivatives played that were taken on through the good offices of Deutsche Bank.

The original sin was to let Deutsche get away with murder. Everything follows from that. With though some exceptions like Greece where I really don´t see a way out. A country that doesn´t even have a functioning tax service will have to be subsidized from here to eternity as long as she is part of the Euro.

But there is a deeper problem. Everybody quite rightly talks about growth as the only way out. But growth where to? Europe (sorry) is even in its poor Southern parts a lot richer than most of the world. Consumption per capita of the worlds raw materials especially oil is unbelievable from the perspective of most of the world. Sorry, but that is not the way out. Especially as Europe will have to earn her raw materials somehow with exports. But what to export? China has already eaten a lot of Europe´s lunch.

Any real prospect of the ECB’s OMT removal would call the Eurozone’s solvency into question. Countries would default on their government bonds and the collapse of the Eurozone would cause immense bank losses. And, for Germany, the subsequent recession in the rest of Europe would likely cause a massive appreciation of the a newly introduced ‘New Deutschmark’ the tune of say 15-20 percent against all trading partners, resulting in export year-on-year losses of up to say 20 percent .

As the average import content of exports amounts to 40 percent and exports currently account for 50 percent of gross domestic product, this would reduce overall German economic output of about 5 percent, which, with a banking catastrophe in the rest of Europe, would likely culminate in a decline in economic growth of around 15 percent in the first two years.

But OMT or no, Germany sees the same thing: political inaction, national anger, bitterness and resentment at the Eurozone periphery – all a precursors to civil strife, regional cessations or even wars. It sees the spread of this inaction and disaffection moving to the EU core, the cost of which is draining the economic lifeblood of Germany via the ECB’s OMT. Better to leave on its own “OMT unconstitutional” terms than stay and have the terms decided by inevitable fate and reaction to a crisis.

So what is the Bundesbank up to? It’s up to “going in” to bringing the catastrophe of the Eurozone to resolution one way or another and, one way or the other, come out no worse than when it went in. It’s going to find the ECB’s OMT unconstitutional and immediately raise taxes and levy the rich of Germany; and it wants the Eurozone to do the same. How?

At the time of the Cyprus bank deposit tax’ a previous reader posted a comment “we are all Cypriots now”. Maybe, but “we” Cypriots join one other nation that has history of government imposed wealth confiscation and capital levies on its poor, benighted, downtrodden, hapless population; Germany.

Since 1913, Germany’s government has imposed ‘forced loans’, capital levies or a wealth tax on its citizens, no less than seven times:

1913, the government introduced a one-off levy on higher wealth and income as a defense tax.

1919, the national emergency tax levy was introduced as a general capital levy – part of Erzberger’s financial reforms.

1922 & 23 the government also levied a forced loan, which taxed citizens with a ‘one time’ 100,000 marks.

1949, a retroactive capital levy was raised (on the asset base of citizens from 1948).

1952 ‘The Investment Aid Act’ forced loan from the commercial sector for reinvestments in the ‘primary’ industries.

1982, the coalition government introduced an ‘Investment Aid’ levy to promote housing construction – paid back at a later date with no interest.

Clearly, Germany has a history in this regard; it sees the correlation between forced loans and capital levies as obvious:

First, foremost, and most importantly, the citizenry will accept it (even in the most dismal of times).

Larger one-off capital levies are easily spread over longer periods of time to minimize the liquidity burden on taxpayers (E.g. the 1950s, capital levy was uniformly spread over a 30-year period, including interest, and collected in quarterly installments).

Third, Germany sees that forced loans and one-off capital levies serve as a “one time” fiscal instrument to secure public debt refinancing, without having to rely on external aid.

But, what’s notable, is that these retrospective levies occurred and were/are accepted not when the German people were/are at their strongest, their most fearless or resolute, but when they were/are politically, economically and socially (cohesively) at their weakest. They tend, as the Americans say, to “suck it up”.

What is at stake is a very a very large taxable base. A tax burden of, for instance, five percent could raise revenues of 15 percent of gross domestic product, or around 380 billion euros (equal to the decline in GDP should the Eurozone not come along and fall into dissolution). So, this 380 Bln Euros (or the ND-Mark equivalent) would clearly help to finance additional spending or refinance matured sovereign debt and buffer Germany for the worst of it; emerging nonetheless weaker, economically.

Historically, Germany has, prudently, forced retrospective loans or capital levies only on the wealthy members of the population and, without the OMT teat; it might expect others to do the same. And, if the Eurozone countries came along for the ride and levied their own national taxes….. Well, a rising tide raises all ships. It would be a generational event with multigenerational benefits.

There are also implementation and collection issues, – which may, in part at least, explain the close scrutiny being given to tax havens and opportunities for capital flight – but, nothing insurmountable. But, if we want to see where the next expropriation of private wealth might be, look not first to Greece, Spain or Italy but, perhaps, look to Germany itself. What easier way to lead by example on the way back to economic strength? Vorsprung durch Technik.

A wealth tax in the Euro South would the single best (economically) and least executable (politically) measure. Take Italy for example where the citizens have high private wealth but the economy is sickly. It is sickly not due to austerity, because Italy did the opposite from the start of the euro to 2011. It is because production and consumption are overtaxed. The cost of production is high and the cost of labor is high even though the wages are too low for the Italian cost of living. People in business have seen their enterprises wither and are now in dire straits whereas rentiers, and particularly those with investments in real estate, have been sitting on their asses watching their wealth grow since the introduction of the euro.

Italy needs to reduce taxes on production and on consumption like the VAT and close the gap by going after those who have accumulated wealth. And yet, the new government will probably go in exactly in opposite direction. And this is not enough. The Italian government intends to borrow at 7% to stimulate the economy in a big way, they say. It will be a complete disaster but likely good for coupon clippers.

Did anyone else have a problem with this statement from Moody’s:

Uh…is it just me, or is there not a direct f#@king correlation between wages and effective demand? How can someone with any understanding of Macroeconomics write that sentence, as anything other than a joke?

“We’ve got two problems: 1) People aren’t spending enough money; and 2) People are making too much money.”

Seriously, wtf? Does Moody’s not understand that the flip-side of “improved unit labor costs” is workers (i.e. most of us) having less money to spend on s%!t, which leads inexorably to “weak demand”?

File under: surrealist economics.

Well we don’t want Italy to lose investor confidence. We can always send them a delegation from our SEC to show them how to tap papa e mamma with advertisements and the internet. Show them how to jump start their economy. Or gosh, even jump start their derivatives market with special hedge fund products requiring very little labor at all. Very very little.

Well, Moody’s, like most other elites, think its a good thing to depress wages in order to improve exports. Since they said “”weak domestic AND external demand” (Emphasis added), I assume they were mostly talking about the latter. You know, just the elites bitching about ‘competitiveness’ again, even though its bloody stupid trying to compete with places like China and Vietnam on wages.

Regardless of their intent, I agree, its still bloody stupid. What passes for economic Orthodoxy these days in the circles of elites is more religion than anything else. Gotta keep those wages competitive with Vietnam, doncha know!

It is a nice idea Claudius. Unfortunately I believe that Germany is not up to something like that anymore. It is mindless saving, saving, and saving. No thinking of the future. Germany let China get away with taking over the solar industry by dumping and got questionable market access for her machine industries in return. Now it seems she will let Europe flounder. Very, very stupid indeed. As if people in Germany couldn´t do with a bit less to preserve the peace. And I am not talking about Greece. The shit is starting to hit the fan with France and that is really, really bad and sad. Kohl and his generation wouldn´t have ever let this happen.

Thats because Kohl, whether or not you find him moral or not, wasnt a damn fool. Rather, he was quite intelligent. As for Angie,well…

And I think we have all watched Angie long enough to know that she is no Helmut Kohl. Im not even sure shes as smart as Thatcher, honestly, which is rather pathetic to say the least. Looking at Angie is like looking at a big pile of neoliberal economic dogmatism wearing a suit. Kohl understood the difference between reality and theory, and Angie does not.