Hundreds of Thousands of Rat-Sized, House-Eating Snails Invade Florida Gawker

Flaws Seen in Protection of Animals on the Set New York Times

NOAA: Fukushima contamination possibly affecting sea lion pups — “Radiation is being looked at, just like everything else” (VIDEO) ENENews (furzy mouse)

Will the Supreme Court end human gene patents after three decades? ars technica

Biofuels are ‘irrational strategy’ BBC

Developed Nations have Already Passed Peak Oil Demand OilPrice

Global economy stuck in a rut Financial Times

North Korea dismisses talks as Kerry urges dialogue Guardian

Maduro wins Venezuela election BBC

Economic Report: China economic data disappoint, slamming stocks MarketWatch

China calls in aid as bird flu spreads MacroBusiness

The riddle of Europe’s single currency with many values Wolfgang Munchau, Financial Times

Trouble brews over EU transactions tax John Dizard, Financial Times. I don’t agree with his fulminating about the reach of a transactions tax, if it were Eurowide rather than EU wide (any central bank in a currency deemed important for international commerce, which these days means the euro and the dollar, could impose global rules by threatening to cut any non-complying bank from direct access to its payments system. That would admittedly be quite the staredown with a systemically important bank). But this tax does seem to be badly conceptualized. The point of a transaction tax is to discourage speculation, not to raise revenues. One that is designed to raise revenues is almost certain to hit transaction activity hard. And of course, a botched program in the EU would play right into the hands of bank lobbyists in the US>

A Better Way To Do The Cyprus Bank Bail-in Ledra Capital

German ‘Wise Men’ push for wealth seizure to fund EMU bail-outs Ambrose Evans-Pritchard, Telegraph

Almost One in Five U.K. Companies Favor Leaving EU Bloomberg

America’s problem is not political gridlock Larry Summers, Financial Times. Mirable dictu! There is some sensible stuff in here (this is NOT an endorsement of the piece in its entirety)

Can We Reduce Deficits by “Changing” the Defense Department? Dean Baker

Some States Dropping GED as Test Price Spikes Associated Press

PIESTEIN! EconoSpeak

Measuring the credit crunch VoxEU

Monday Morning Cup of Coffee: Low-down loans coming back Housing Wire

Growing student debt James Hamilton, Econbrowser

The Propaganda System That Has Helped Create a Permanent Overclass Is Over a Century in the Making Alternet (psychohistorian)

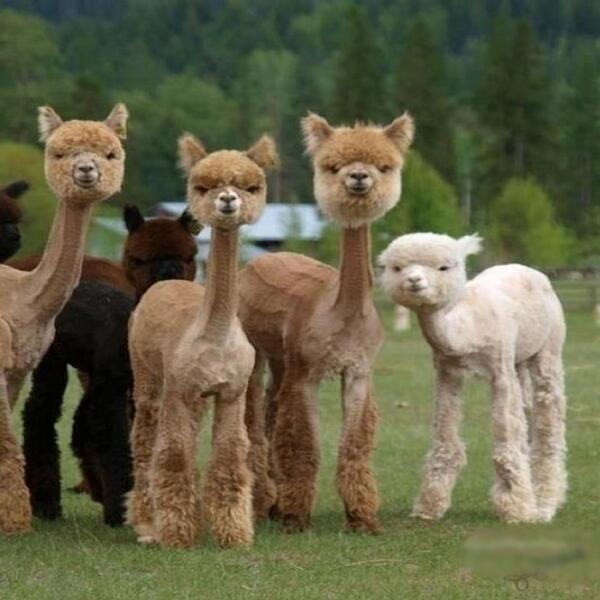

Antidote du jour:

And a bonus, although some will see this as an anti-antidote. Of course, from Richard Smith:

No articles on the gold bloodbath? I am following a supposedly wise course of action by waddling in when there’s blood on the street, even if some of it is my own. Will find out soon enough if that only applies to a Rothschild and/or specific asset classes.

I think it’s interesting that a pull-back of even 25% is viewed as “blood in the streets.”

I bought a large quantity of gold @ $600. Sold half @ $1700, and I’ll jump back in at $1000, if it ever goes that low.

The important question is how far the plutocracy can push things before the next/current bubble(s) burst. (We’re already hearing that anyone not already genatalia-deep in the “markets” is a fool.) As soon as mom and pop borrow to reinvest, the rug will be pulled out, and PMs will be shiny, once again.

As a side note, the dollar is showing strength, but to a society with crushing levels of debt, high unemployment, and stagnant wages, this is not a good thing.

The Fed system is supposed to bring balance our economy. Lately, it looks as if it has an inner-ear infection.

On page 14 of the paper linked below is a chart of gold’s price since 1974, compared to a switching strategy of holding gold only when its 12-month momentum is positive:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2244633

The momentum approach beat ‘buy and hold’ by over 4 percentage points a year.

Currently gold’s momentum is negative. You might be lucky and catch a low point, but a momentum system can be backtested objectively, while personal ‘gut feel’ decisions tend to produce erratic ‘hero or zero’ results.

Gold seems to have a ‘hot decade’ about every thirty years. Gold stocks enjoyed a massive runup in the 1930s, and again in the 1960s and 1970s. The 2000s was another great decade for gold (see a pattern here?).

The final nail in the coffin for me, is that while typing this, I just received a cold call from a precious metals boiler room in Boca Raton. It was the usual pitch … ‘Jim, I sent you some info on the platinum market, did you receive it?’

‘That’s bullshit,’ I replied. ‘You didn’t send me nothin’. I ain’t interested, so take me off your sucker list, creep.’

Is the pattern that Gold always does really well before an economic crisis?

There is no pattern. Do not confuse two data points with anything periodic or causual.

True, even if there is a correlation, correlation does not mean the same thing as causation…

I believe in making things myself.

Next on my list:

1) learn how to repousse gold into gold chalices and

2) chase silver into sliver spoons.

It’s similar to not confusing buying a house to live in with investment.

And people dismiss gold as useless. Hopefully, I can pass these silver spoons for generations, saving the planet from having to landfill more stupid plastic spoons.

Once upon a time we wne to an estate auction in Norfolk in the UK. Where by, mistake, I bid and some spoons. That cost my father 14/- (14 shillings), for which he was irriatated, but not very upset.

Ittatated until we go home and look at the collection of spoons. All hallmarked, all silver and worth much, much more that 14/-.

That’s an uplifting story.

Hopefully they will stay in your family for many generations.

The Gold bloodbath is a weighty subject.

Physical gold and ETF gold are NOT the same thing. What we’re currently seeing is naked short manipulation of the ETF’s. If you go to ebay you’ll see the real thing is still selling at last month’s prices.

Dear Wcl;

My experience has been that the prices on a lot of the internet ’emporia’ are vendor driven and often wildly inflated. The “last months prices” is an artefact of panic buying I’d suggest.

“Caveat emptor” is still very much the watchword.

Anyone know if prices on e-bay and similar sites tend to be leading indicators or lagging indicators?

http://www.forbes.com/sites/alexknapp/2013/03/22/computer-simulation-suggests-that-the-best-investment-strategy-is-a-random-one/

The primary result they determined was that over the long periods of time, all of the different strategies performed about the same. Yes, over smaller time windows, some of the strategies showed better performance than a random investment, but over the long run those differences mostly went away. What’s more, although some of the “traditional”‘ strategies showed better performance in a particular stock indiex, none performed better over the four indicies. Consequently, the authors concluded that where a strategy “won” a particular index, “the advantage of a strategy seems purely coincidental.”

But the authors did find one big advantage of a random strategy. Counterintuitively, the random investing strategy was much less volatile than the others. In other words, while on a given day, the strategy might not gain as much as another, it wouldn’t lose as much, either. The swings were much more manageable. That means, they conclude, “the random strategy is less risky than the considered standard trading strategies, while the average performance is almost identical.”

As I recall, this point was made decades ago, when it was empirically demonstrated that a portfolio of stocks chosen by throwing darts outperformed a portfolio selected by experts. Interesting that the same result is likely to pertain after massive consolidation across the economy and gigantic leaps in modeling and computing capabilities.

A cat named Orlando beat the professionals at stock picking….

http://www.guardian.co.uk/money/2013/jan/13/investments-stock-picking

Do you have its number?

I hope it doesn’t charge too much.

@Prime

I suppose a can of catfood as payment would suffice, the problem is you’ll need to tear it out of Granny’s hands.

From the paper itself:

‘The goal was simply to predict, day by day and for each strategy, the upward (’bullish’) or downward (’bearish’) movement of the index I(t+1) at a given day with respect to the closing value I(t) one day before: if the prediction is correct, the trader wins, otherwise he/she looses [sic].’

On a day-to-day basis in the stock market, about 55% of days are up, and 45% of days are down, in an almost purely random sequence. As the authors state, a random pick does as well as other method to predict the next day’s direction. But this is of interest only to day traders.

By contrast, investors are concerned with performance over periods of months and years. Because of serial autocorrelation, not only momentum methods, but also even ‘buy and hold,’ will trounce a random day-by-day allocation. But the authors did not address the actual problem of investments sustained over time.

That daily movements in stocks are nearly all noise and hardly any signal is well known. Fortunately, only day traders and academics waste their time on the trivial pursuit of predicting the direction of the next day’s move.

Oh man, what if you were out walking in the woods and saw those animals standing in your path staring at you. You’d probly surmise that you were in Magonia. This happens more often than one would think and it’s not always funny.

back up the truck and load it with gold. It’s on sale — 50% off. Wheels finally falling off the truck, bank holidays coming, riots in Europe, maybe even an asteroid!

Naked llamas on Naked Capitalism! They might be alpacas.

You’re right. They are naked. I hadn’t even thought about that, since they looked like space aliens to me and you don’t know if it’s skin or clothes.

The past 3 days have been Gettysburg for the gold bugs. It doesn’t get bloodier than turning points like this. But I tend to think the gold bugs are the Union side.

Following is what you have to worry about when you go into the woods. If I saw the animals in the photo up top on a hiking trail in some national park or forest, I wouldn’t wait around to do on the spot zoology. I’d run the other way so fast you couldn’t see me . . .

If yer butt is getting busted by GLD today, this will take your mind off your troubles.

“He also saw a strange animal he could not recognize. These animals are the size of a horse with huge antlers. He said he saw herds of them. He could not understand where they came from or why there were so many. They not an animal indigenous to the area. There is no such known animal that big in Sulawesi.”

Read the original source: http://www.unknowncountry.com/insight/abduction-wave-indonesia#ixzz2QYb2Lo5T

We are not talking about the okapi here, are we?

Nope, okapi only have short little giraffe-like nubs, not great big horns.

Too bad Summers didn’t mention how Congress moved too fast to deregulate the banks and scrap the New Deal protections for savers and investors. Oh, wait!

That piece posted by Summers was by Charles Eliot, former Treasury/Harvard guy. The blessings of gridlock? He thinks one blessing was not passing universal health care before now? Because now these costs are going to be pegged to GDP – which as we all know is negative. Weird. Bernanke did a good job rescuing the world, yes. But the lifeboat is miserable. And this had nothing to do with congressional gridlock. But nevermind. Not to worry about Congress never ever passing any relevant legislation because legislation never mattered anyway? The only thing that matters is the sea-change in national attitudes. The tsunami. (I always knew we don’t need congress, we simply need a computer referendum.) And just for the record, there are only 3 things our schools/teachers/students should be evaluated against: 1. can you read (teachers, administrators, and students should all take this test) fluently in at least one language and do you read across several subjects? 2. Can you do basic math accurately? and 3. Can you articulate your reasoning processes?

I think teachers should be evaluated based on one important yardstick: how successful they can avoid turning bad apples like Scott Walker.

Teachers who taught him have failed – that’s one way of looking at it. Or maybe he was just incorrigible.

Thought I’d wade in with a comment about the KPMG partner being indicted. Hello, SEC, this is NOT what Main Street is looking for. Some guy in California helps out a friend whose business (surprise) is tanking. Yeah, it’s ugly, but leave it to the FBI or DOJ. You, the SEC, need to go after bigger prey, C-level officers at banks, hedge funds, investment banks, hedge funds, NOT accounting firms. No one gets a warm, fuzzy feeling when you go after an accountant, or an investor, like Martha Stewart, when the REAL bad actors (and I don’t mean Alec Baldwin) go to Art Basel or Davos or retire to Long Island.

+1

someone wants to put this ad on the air:

Exxon Hates Your Children

All local TV stations in and around the Mayflower spill declined.

Correct link for “NOAA: Fukushima contamination possibly affecting sea lion pups”–

http://enenews.com/noaa-fukushima-contamination-possibly-affecting-sea-lion-pups-radiation-is-being-looked-at-just-like-everything-else-video

I’m from Alaska, the land of the Great Republican Welfare State where the motto is “Get Somoone else to pay for everything, and no free free food for the starving, because FREEEEEEDOM”.”

They just killed their golden goose, steeply reducing the oil extraction tax that Palin (in her one good act as governor) had raised. Yesterday, the legislature, at the behest of oil company whore Governior Sean Parnell, reduced the extraction tax by over $1 Billion a year, because it will result in “increased production” and JOBS! (Those of us who lived through the pipeline boom remember how long those jobs stay, and how many Alaskans actually got jobs as compared to the carpetbaggers from “outside” (local slang for “Lower 48.”)

Oddly enough, the democrats in the legislature who almost all voted against the law (with the usual exception of the native rep from the North Slope who is clearly corrupted) pointed out that if the law were in effect during the last year the budget would be $1.6 Billion underwater.

This is a state with no income tax, no sales tax, that only has property taxes, which are onerous. And as a result, no bond issue ever gets passed.

Things are going to get hinky in Alaska as everyone’s dole checks get cut. Over their dead bodies will they pay for anything themselves.

They were already gutting the Anchorage school system with layoffs before this.

FREEEEDOM is never free. I guess they’ll learn that soon enough.

http://www.adn.com/2013/04/14/2864683/legislature-agrees-to-cut-alaska.html

I understand the incredible problems of not having an income tax, but isnt not having a sales tax sort of a good thing? Sales taxes are deeply regressive and mostly hurt the lower quintiles.

Agreed, although I’m used to California where food, medicine, and services are exempt from sales tax, so while it is regressive, it doesn’t feel so bad to me.

Of course, it is also tax deductible for us people in the construction industry (as it pertained to supplies) so I suppose I was getting a free ride as far as that went. My income and property taxes helped out the state (yes I had bought a new property at the peak and taxes, even with Prop. 13 were steep. Plus we foolishly voted in escalation clauses on our bond issues, so they never stop rising – in one case, the school bond issue cost doubled in one year.)

I agree with you vis a vis the regressive nature of sales tax. I was being self-centered. I for one don’t mind sales tax as much – it seems somewhat discretionary. If I don’t want to pay it, I don’t buy the product. I have lived in states which apply sales tax to food, medicince, etc. That seems extremely onerous to me.

But or course, those are also the states where you can pay less than minimum to workers who might’ve once in their lives seen a “tip” on a table. Here in CA minimum wage applies to all. It isn’t livable, but when I was in TN and the server told me she got $2.10 an hour because of “tips” I was stunned. This was a buffet, not exactly the land of big tippers.

I feel for ya. For me, it remains to be seen if these corporate whoring, budget busting bills will continue for long. In Kansas, Gov Brownshirt (oops, Brownback) busted the future budget by removing all taxes on LLCs and S-Corps and reducing the top tax rates. The proposed patches include removing the sacrosanct mortgage interest deduction, and that’s going to go over like a lead zeppelin. My hope is Brownback is done in 2014 as the budget carnage will have started by this time although it’s hard to a Dem to breakthrough here.

“although it’s hard to a Dem to breakthrough here.”

When will you ever learn? The Dems will sell you out to the corporations just as fast as the Repubs will, maybe faster.

I guess the Dems have advantage, if you can call it that, of being more hypocritical.

The Republicans tell you they’re going to f*ck you over, and then they f*ck you over.

The Democrats tell you they’re going to help you, and then they f*ck you over.

New kid on the block: Corporate titans

Palm Beach County real estate investor Chip Bryan added 35 homes to his expanding cache in the first 60 days of the year. Backed by a private equity fund, he’s in buy, hold and rent mode. And he’s in a hurry.

Bryan’s competition is America’s financial masterminds, corporate behemoths who have set their sights on Florida as Wall Street buys up Main Street.

Another twist in the nation’s evolving housing market has hedge funds and multi-billion dollar companies becoming the landlords of the future, snapping up discounted single-family homes to rent out as they’ve done in the past with commercial properties and multi-family apartments.

It’s been just a year since a spontaneous comment by billionaire Warren Buffett ignited the corporate world’s home-buying spree. But already the New York-based Blackstone Group has 20,000 homes nationwide, including 4,000 in Florida.

Canada’s Tricon Capital, working with Lake Success Rentals, claims a bounty of 1,500 homes in South Florida and North Carolina. Colony Capital, based in Santa Monica, Calif., just announced its intention to buy 1,000 South Florida homes with a $2 billion nationwide investment.

One of the more aggressive buyers in South Florida is the Connecticut-based Starwood Property Trust. Despite having “no news to share” when contacted by The Palm Beach Post for this story, the company has picked up more than 80 Palm Beach County homes at foreclosure auction since it began buying in late November.

“This business used to be a subculture of deal makers and opportunists, mostly Realtors and contractors,” said Bryan, managing partner of Boca Raton-based Rebound Residential. “Then Wall Street arrived.”

http://www.palmbeachpost.com/news/business/real-estate/new-kid-on-the-blockcorporate-titans/nXLFt/

I saw this piece yesterday. Since the piece was focused on Florida, they failed to focus on Phoenix, where the “Big Boys” flooded in and bought everything in sight, driving up the prices.

Now the cycle is further down the road, and rents have fallen as much as 20 percent for the corporate rentals. Soon to follow, of course, values.

Delightful. Big sale coming in Phoenix!! Couldn’t happen to a more deserving bunch of hooligans. Yes, I’m looking at you Uncle Orifice of Omaha.

When the volume gets this heavy, though, the more likely these vulture will be able to claim “bailouts” if the market turns south again. Also, I’d expect the big boys to get together to:

1. Hire/outsource firms to manage these places with all the gentleness of Blackwater or whatever the hell that company calls itself these days…

and

2. Buy any judge they can.

It’s called market efficiencies, rentier style.

having been in that prop-mgmt bag, i can tell you that they love fascism and will never fire one. in other words, as long as the ‘trains run on time’ (aka rent is paid) then everything else can go to hell.

minimal upkeep, and usually that comes out of the owner’s hide directly anyway. dictatorial managers that really will tell 80 y.o. non-english speaking russian immigrant little old ladies that the fact that their flowered curtains are visible through the window at night is an unsightly abomination which must be sterilised through the blitz-blackout level use of mostly dysfunctional/rusted metal venetian blinds. letting the same little old ladies freeze all of a winter weekend because you won’t call an electrician to fix the bedroom heating unit (“hey, they have heat in the living room!”) is another notch on the lacking-humanity belt.

they really will tell little kids not to put their train sets in the windowsill (more unsightliness!). they really will not open the ‘community’ pool because the insurance costs too darn much and the thing is leaking/sliding down the hillside and no one wants to pay to repair it. they really will change policies like mail delivery or whether facilities are open/closed on a whim without even informing tenants, and they will throw out whatever black/mexican/immigrant families they personally dislike even though half the honkies in the properties are participating in the same kind of behavior that {nominally} got the black/mexican/immigrant families thrown out without recourse (a simple “no reason stated” eviction protects them against all suits, as long as there is not a documented history of maintenance/service/problems with those tenants in the file beyond a 90 day period). annual inspections to check on how good of a housekeeper you are, attempts to charge back exiting tenants for pre-existing damage, and also telling you how to raise your children are just baker’s dozen extras they’ll throw in for near-free.

and so on, as so forth (all of these situations were witnessed, not hyperbolic). actually, you’re lucky if you just get the kind of manager who only want to collect rent and never address the black mold on your bathroom fan-light unit. at least he leaves you the hell alone!

Upkeep on a bunch of dispersed single family homes will not be cheap or easy. Not such a great plan this is. Do these investors really want to be property managers? Are they even good at it? We will find out.

Appropos of everything in this f*cked up plutocracy, I offer today’s bible quote, thinking especially of banksters, congressvermin, and their related minions:

“Who Shall Give Us Flesh to Eat?” Numbers 11:18

The spin on that Bloomberg piece on business sentiment about the EU in the Uk is interesting. The vast majority didn’t favour a pull-out but the head of the lobby spun it in a disctinctly hawkish way. Very much lining up with the skeptical tone of the current administration.

Three cheers for Maduro!!!

Although im very sceptical of him. Time will tell if he is half the man Chavez thought he was. But I dont see how he could POSSIBLY be worse than the American shill Capriles.

He can’t possibly be worse than Obama.

Munchau: “The euro is not worth the same across the region – Spain and Germany have different currencies.”

No, officialdom would say. Correctly.

However, banking practices, interest rates, taxes, vary. Then there is the cultural aspect: high or low savings, home ownership, job contracts aka security, retirement plans, paying for health care, early or late marriage (which affects debt) and on and on.

The figures he quotes are meaningless. The only way to analyze this, should one wish to, is from the bottom up – do Cypriots have more: (low level examples) rooms, cell phones, fresh vegetables than Germans? Not that material possessions or having cell phones relates to happiness or a stable / productive, etc. society. It all depends. India needs more cell phones. Other places have too many rooms per person. Etc.

Fluffy, silly nonsense. In the FT. The aim is to promote strife and quarrels in the EU? Or just to fill a high paid column with trivia and distractions?

In any case the nos. he quotes for Cypriots are out of date – all that Mo-ney has gone Poof!

On the Lighter Side…

Thanks, that link was delightful. And Dr. Nutt!!! How delightful.

I’m going to take my thorazine now. Goodnight all.

@Down2

Prozac has ‘nuttin’ on psilocybin. Make my mushrooms *magic*

hehe, great find! @JimS

Homemade Bomb Disfigures Oregon Men….

They must be white dudes, as no mention of possible terror motives or any motives for that matter.

http://www.katu.com/news/local/Homemade-bomb-injures-Oregon-men-203031101.html?m=y&smobile=y

Explosions at Boston Marathon

Two explosions, 2 more devices reportedly defused. Real fatalities and casualties.

I posted link before the Boston bombing/s.

My point is the blase attitude of the news report on the Oregon men.

hey Yves,

Just to pass along an update, i was trying to apply for Obama’s national mortgage settlement funds. Well when I talked to the bank in february, they said the funds should last until june, as they were going out at about 1 million a week. Today i was proceeding with my purchase and the funds weren’t mentioned. I asked and was told the funds were all used up back in March. She said they were going out at the 1 million a week pace until about Mid-March then shot up to 5 million a week for two weeks and then the funds were gone. and the unfortunate thing is a person cannot claim those funds until closing. And if you are using any other financing programs those delays can stop you from getting funds sooner, even tho you are in process.

sounds fishy to me.

RE: German ‘Wise Men’ push for wealth seizure to fund EMU bail-outs

Uhh, yeah. That didn’t take long.

I’ve always thought that the massive government intervention to salvage our financial system would be a long-term blow to the prospects of the laissez-faire capitalists. Any government which wishes to preserve itself will always move to seize assets. In any country with such a huge gap in it’s distribution of wealth the rich make a very worthwhile target.

As far as America is concerned, I believe it was Winston Churchill who said that the Americans will always do the right thing after they’ve exhausted all the alternatives. The attempted looting of Social Security falls under one of those failed alternatives.

All I’m saying is that if the president of the United States wanted to bomb some offshore tax havens he would have my complete support. You know, because they’re terrorists.

Won’t that just drive offshore tax havens to offplanet tax havens, like Mars or Europa?

By the way, I am thinking about forming a Martian nation. I am

1. looking for some founding fathers and mothers (thanks to technology, you don’t actually have to reside there – think of it as telecommuting.

2. it will offer tax haven bank accounts

3. will have branch offices/embassies here on Earth and will be looking for representatives/ambassadors as well. We are job-creators.

4. it will be neutral like Switzerland

5. It will offer Martian citizenship for a price. This is not a Ponzi scheme and the citizenship is not ‘creation ex nihilo.’

6. We will be a monetary sovereign. Looking for your ever abundant Martian currency soon.

7. Oh, we will need a Martian flag and a Martian planetary anthem.

In this scenario, Martian currency would have no value, since the Martian government has nobody to tax (unlike earthly nations sovereign in their own currency).

Nice try though, in all other respects. If only we could get a matter transmission receiver up their, the rich would, as it were, “phone it in.”

It’s like making people drive on the left side in England. You proclaim it (and the fiat currency, as well) and so it shall be.

So, there is no need for taxpayers.

But if one insists on having some, we Martian founding fathers/mothers can decide to tax visiting meteorites/asteroids…call it a tourist visa fee for those passing by to gawk at us living there (again, physical presence on Mars for humans is not mandatory – thus we anticipate a large revenue from Earthlings purchasing our Martian passports for a nominal sum) and an immigrant fee for those residing permanently.

@MLTB C’mon, don’t pretend with me. You know very well how fiat currency works, and how MMT says it works. This is treading a fine line between snark and outright trollery.

not too long ago there was a Martian Love Call beamed down

https://www.youtube.com/watch?v=4uEATUFFaZ0

I have something to fight for and live for; that makes me a better killer. I’ve got what amounts to a religion now. It’s learning how to breathe all over again. And how to lie in the sun getting a tan, letting the sun work into you. And how to hear music and how to read a book. What does your civilization offer? bradbury/martian chronicles

After he hands his bosses the Koch bros Keystone XL, those offshore islands will be literally under water soon enough!

The rich begin to turn on each other.

Not entirely true. The Germans are proving themselves to be more committed to the idea of European unity then their detractors. The wealth tax that’s being floated is just one of the means they may utilize to preserve the European Union.

It seems the Germans are increasingly viewing countries like Greece as failed states. The inability to tax the rich being just another dysfunctional example of their political failure. But since all those rich people are fleeing with their money to the northern European countries…..

Who knows, I could totally be off the mark there.

Obama…TVA privatization.

Right now, it’s very dangerous to initiate more public infrastructure projects to create jobs.

Why?

It’s the old the 99.99%-pay-for-it-so-the-0.01%-can-own-it canard.

Like privatizing TVA.

Did cocaine use by bankers cause the global financial crisis?

Coked-up bankers caused the credit crunch, according to the former drug tsar David Nutt. One former City worker can well believe it

Article signed by @cityboylondon, so no one (other than David Nutt) is standing up to put their name to the bits about ‘sniffy noses’ in The City. But the article certainly has a ring of truth to it.

http://www.guardian.co.uk/business/shortcuts/2013/apr/15/cocaine-bankers-global-financial-crisis

—————-

And at the Independent, David Nutt speaks:

http://www.independent.co.uk/news/uk/home-news/financial-meltdown-was-caused-by-too-many-bankers-taking-cocaine-says-former-government-drugs-tsar-prof-david-nutt-8572948.html

Not clear about Nutt’s credibility, however:

Nevertheless, these two articles make at least as much sense as most other financial info that I’ve read about The Meltdown.

There is a bit of history about cocaine and the latter part of the 19th century and the early 20th.

The rise and fall and rise of cocaine in the united states –Freud’s Role – David T. Courtwright

Had cocaine’s uses been restricted to local anaesthesia and the enhancement of opera-singing, it would be remembered as an unqualified triumph of nineteenth-century scientific medicine, rather like William Morton’s demonstration of ether anaesthesia. The problem was the excessive enthusiasm of cocaine’s medical proponents. As had happened earlier with brandy, tobacco, morphine and other novel psychoactive drugs, some physicians and manufacturers recommended cocaine too indiscriminately and with too few precautions for its toxic and habit-forming properties, which were either unknown or simply dismissed. In 1886 William Hammond, the former US Army Surgeon General, assured an audience of New York physicians that there was no such thing as cocaine addiction. Based on self-experimentation, he concluded that regular use of the drug was comparatively easy to break off, like quitting coffee or tea, and not at all like enslavement to the opiates. In fact, Hammond related, he had given cocaine for some months to a woman addicted to the opium habit, increasing the dose up to five grains (324 mg) injected once a day. ‘It overcame the opium habit’, he claimed, ‘and the patient failed to acquire the so-called cocaine habit.’

When Hammond finished his remarks a Brooklyn physician and addiction specialist named Jansen Mattison rose to offer rebuttal. Hammond was wrong, he said – dangerously wrong. Seven cases of cocaine addiction had already come under his care, five physicians and two druggists. They had acquired the habit gradually, by making small injections several times a day. Cocaine could damage nerves and tissues, producing hallucinations, delusions and emaciation. Cocaine was undoubtedly toxic, and death by overdose was a real possibility. Mattison pointedly advised his listeners not to repeat Hammond’s self-experiments?

Mattison knew what he was talking about. Over the next seven years medical journals published or cited hundreds of case histories of ‘cocainism’. As Mattison had anticipated, many of the cocaine addicts were medical practitioners who had injected themselves. Another common type was the opiate addict treated with cocaine. Some of these addicts switched to cocaine, others continued to use both drugs. In at least one famous case, that of American surgical pioneer William Halsted, a switch was made from cocaine to morphine as the lesser of two evils.6

http://www.happinessonline.org/MoralDrift/mechanistic/p5.htm

Skippy… Now add money into the environment and presto[!!!] – drug lords rule the world…

Re: Larry Summers. I guess I was hoping for something more along the lines of “I beg the American people for their forgiveness…”

According to Summers, fortunate consequences of gridlock include the thwarting of a guaranteed annual income and single payer healthcare. (Unnamed)”Experts” agree! These would have been bad things.

And eye-popping stuff about Promontory (a recent NC topic), over at Felix Salmon’s, including:

http://blogs.reuters.com/felix-salmon/2013/04/12/the-problem-with-promontory/

Paul Jay’s The Real News Network

interviews

Joseph Minarik (former chief economist of the Office of Management and Budget for eight years during the Clinton Administration) and economist Richard Wolff take on President Obama’s proposed changes to Social Security

http://www.youtube.com/watch?v=c_sUHK4qo_I

And with twin explosions the lull is over. Fasten your safety belts–the Spring campaigning season is upon us. It’s quite early, but I think I’m going to crack the seal on that bottle of bourbon and do a little communing with my maker.

Boston, you’re in my prayers.

You can call me cynical if you like, but I wouldn’t be surprised if this was yet another staged event or provocation, as part of the “strategy of tension.” Almost every domestic terrorist act thus far in the war on terrorism has turned out to be staged. The last real terrorist in the USA was Ted Kaczynski, the Unabomber.

Maybe they will blame it on right-wing gun nuts, maybe on Al-Qaeda – Al-Qaeda in New England, or maybe on the North Koreans, who ran their own sparsely-attended marathon in the past few days and who would be jealous of the Boston marathon.

It hits the target audience, urbanites, on “Patriots Day” and in time for the nightly news. It is also Options Week on Wall Street, and with the Dow at record levels a lot of calls are – or were – in the money, which Wall St brokers don’t like. Did you notice the bombs went off right at 3pm, which is the customary sell-time / market reversal point for the stock market? Whuddya know – bomb strikes, market swoons. You would think that if real terrorists were at work, they would have set off the bombs right when the winners were coming in, or when the most spectators were present.

OK, I will apologize and recant loudly and publicly if this really does turn out to be domestic terrorism. But first I want to see some proof. Real proof, not just media fabrications.

Yeah, we would all be really shocked and surprised if it turns out this new terrorist was running around for months with Feds all over him like a cheap suit, and then, oops, somehow by some enormous fluke he slips away and blows shit up, because that never ever happened before, at least not before Nawaf al-Hazmi and Khalid al-Mihdhar, or at any rate not before Tim Mcveigh or Lee Harvey Oswald, or maybe the other Lee Harvey Oswald who shot the cop and took a CIA flight home with Robert Vinson.

http://www.technologyreview.com/view/513781/moores-law-and-the-origin-of-life/ Provocative theory that present day Earth life is descended from lifeforms existing before Earth existed!

“Sharov and Gordon say that the evidence by this measure is clear. “Linear regression of genetic complexity (on a log scale) extrapolated back to just one base pair suggests the time of the origin of life = 9.7 ± 2.5 billion years ago,” they say.

And since the Earth is only 4.5 billion years old, that raises a whole series of other questions. Not least of these is how and where did life begin.”

Linear?

linear regression … on a log scale

a) what is the justification FOR owning parts of the genetic code that were not ‘created by’ the patent-seeker? i can see a theoretical argument for owning parts that were altered with some kind of fancy invented technique, but….?

b) why are plants of various kinds still illegal? is it not irrational to illegalize possession of a naturally-occurring organism? i can almost see a justification of products derived therefrom, ALMOST (we obtain too many useful drugs from even the highly illegal plants for that argument to make much sense beyond “because you used it for the purposes of harm and not to heal”) but the plant itself and using it as a tea/poultice/smokeable, non or barely processed?

is this part of that INTP/J divide thing? why can’t people (and their laws) just make sense!?

Taxpayers failing to get their fair share of wireless gold rush:

http://www.latimes.com/business/la-fi-lazarus-20130416,0,2146389.column

If you missed this gem, I’m taking the liberty of sharing it here, where I know many would appreciate it:

“This Is What Happens When A Journalist Forces A Banker To Actually Answer”

courtesy of the Irish

http://www.youtube.com/watch?v=ATg1ze0ac88

Those antidotes look like alpacas, not llamas.

http://25.media.tumblr.com/tumblr_mdk6n0h5yU1rl07qno1_500.jpg