Yves here. This article is intriguing but it shows a correlation, and they need to be treated with considerable caution in trying to draw conclusions about causation.

By Stuart A Gabriel, Arden Realty Chair, Professor of Finance and Director, Richard S. Ziman Center for Real Estate at UCLA, Matthew E. Kahn, Professor at the UCLA Institute of the Environment, the UCLA Department of Economics and the UCLA Department of Public Policy, and Ryan K Vaughn, PhD Candidate, UCLA Ziman. Cross posted from VoxEU

An implosion in housing markets figured prominently in the 2007 meltdown in capital markets and the downturn in the global economy. Neither analysts on Wall Street nor regulators in Washington anticipated the depth of the crisis, its geographic and asset-class contagion, or its adverse effects on household balance sheets. What was emblematic was the pervasive failure of subprime mortgages. The loans that were provided substantially eased credit qualification and homeownership opportunity to low credit-quality borrowers. By 2008, in the wake of downward spiral in house prices, a full 45% of subprime borrowers were underwater. Two years later, a similar share of outstanding subprime mortgages were in default.

Early on, and prior to the deterioration in subprime loan performance, lenders appeared to understand the controversial nature of their product and the related importance of Congressional support. To that end, lenders may have sought to direct campaign contributions to elected Representatives to generate support for subprime loan products and to assist in easing regulatory oversight. As documented by Mian, Sufi, and Trebbi (2012), lenders became politically sophisticated in making campaign contributions to elected Representatives in the years leading up to the crisis in the 2000s.

A second potentially complementary strategy for capturing political support was for lenders to offer more credit and at better terms to borrowers in Districts represented by targeted Congressional Representatives. As further suggested by Mian, Sufi, and Trebbi (forthcoming), such strategic interactions and related side-payments could be important in a world in which explicit ‘quid pro quo’ was not politically feasible. To the extent that interests aligned, both direct campaign contributions as well as District-level direction and pricing of mortgage credit could serve the political economic interests of both the lender and the elected official. District-level expansion of mortgage and housing opportunity could be viewed as a political return to Representatives in exchange for expanded subprime-lending opportunities.

New Research

This study uses the universe of first-time homebuyer residential home loans issued by a major subprime lender to study the role of Congressional political influence in the access to and pricing of subprime mortgage credit. It provides a political economy explanation for the geography of subprime lending. By merging several data sets, we seek to implement the following thought experiment. Consider two identical marginal borrowers called ‘A’ and ‘B’ who live in the same local labour market at the same point in time. Assume that the two borrowers live in comparable but different residential communities. If A’s Congressional Representative is liberal, is a member of the Finance Committee, is a leader of the House of Representatives, or if this Representative receives direct campaign contributions from the subprime lending institution, do these Congressional attributes influence the probability that the institution makes a loan to A versus B? Further, are these same attributes associated with higher or lower loan amounts or loan pricing to A versus B?

The loan-level data in our study come from the servicing database of the now defunct New Century Financial Corporation (New Century) and the Home Mortgage Disclosure Act (HMDA). Like other studies, we control for the borrower, loan, or locational attributes that influence the allocation and risk-based pricing of mortgage credit. Unlike other studies, those controls are not the focus of this study. Instead, while controlling for a rich set of household attributes, our goal is to assess how attributes of the local Congressional Representative influenced access to and pricing of subprime mortgage credit. The ‘politics’ hypothesis posits that these attributes mattered because New Century had specific political goals in mind and used implicit subsidies to achieve those objectives.

The eased qualification requirements associated with subprime lending also may have been important to policymakers seeking to attain federally mandated lending goals related to minority homeownership. We test whether minority borrowers had a greater probability of receiving subprime loans as a function of their Congressional Representative’s attributes. Also, conditional on receipt of a subprime loan, we test whether minority borrowers received more favourable loan terms (as evidenced in loan size or loan pricing) as a function of their Representative’s attributes.

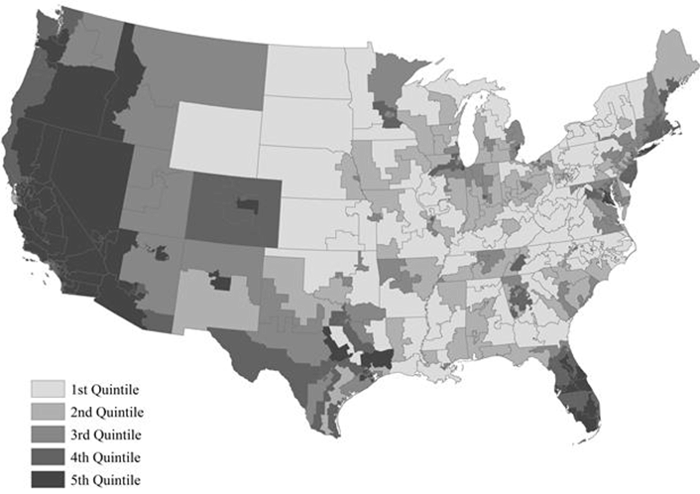

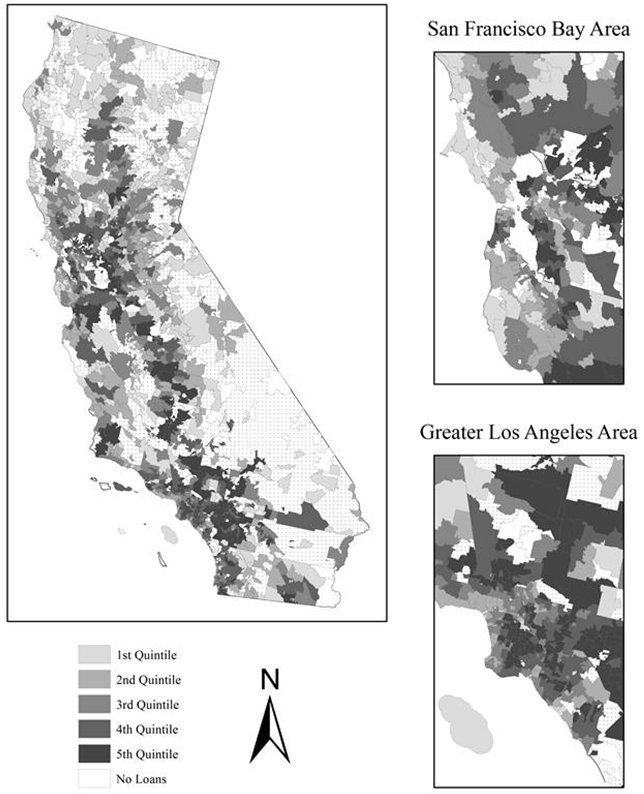

Assessment of New Century Financial Corporation loan-level data from 2003 to 2006 reveals a new political geography of subprime lending. Figures 1 and 2 display the spatial distribution of New Century’s loans during the 2003 to 2006 period both across the US (at the Congressional District level) and within California (at the zip-code level).

Figure 1. National distribution of New Century loans

Figure 2. California distribution of New Century loans

Our findings highlight that New Century was especially active in offering differential treatment to borrowers represented by the Democratic and Republican leadership of Congress. In the case of borrowers residing in the districts of the Speaker of the House and the Majority and Minority Leaders and whips, subprime lenders were less likely to reject loans; further, New Century offered lower mortgage-interest rates and larger loan amounts, all things equal, to residents of those areas. This fact is especially true for African American borrowers in these districts. Also, borrowers received rate discounts in districts where New Century donated to the local Congressional Representative’s election campaign.

Conclusions

Together with results of Mian et al. (2010), our findings suggest a consistent pattern of Congressional Representative political geography in subprime lending. New Century may have viewed direction of campaign contributions to particular Representatives as well as enhancement of subprime-credit access in those or other Congressional Districts as consistent with profit maximisation, to the extent it helped to buy Congressional support for widespread proliferation of this controversial lending instrument among less qualified borrowers.

At the same time, local direction of mortgage capital may have served to elevate Representative political capital among constituents, given provision of mortgage finance to constituent households previously excluded from homeownership attainment. As boom turned to bust, Congressional proponents of the mortgage-credit boom likely rushed to support legislation aimed at foreclosure relief for those same constituents. Political factors, including direction of campaign contributions and Representative-specific allocation of mortgage finance, provide important new insights as regards the political geography of subprime lending.

Findings suggest that Congressional leaders as well as recipients of New Century campaign contributions may have benefited from gains to trade in the direction, pricing, and sizing of subprime mortgage loans.

So, instead of just bribing Congressmen (and women) to get legislation they wanted, the banks loaned money to people they knew had no hope of repaying it, but they targeted these ‘loans’ to Districts represented by key Congressmen who could claim credit with voters for this largesse and energize voters to vote early and often, ensuring these Congressmen retained power?

Well, the only thing unusual about this is that the voters at least got something, at least for a little while. Generally, they just get windy rhetoric.

Of course, the fact that these ‘loans’ could be bundled and resold at a huge profit to dupes running pension funds satisfied to rely on transparently phony bond ratings had nothing to do with the outcome, nor did the bundling of these bundles into CDOs providing the foundation for credit default swaps peddled to other dupes running mountains of other people’s money and chasing yield like yard dogs responding to passing cars.

Don’t worry though. Barney Frank and Chris Dodd fixed the whole problem and all we need is a little renegotiation of the terms on those subprime loans and some higher taxes on the rich. And of course, zeroing out the income of anybody over sixty-five who managed to save something for retirement over a working lifetime is quite helpful too.

“…New Century was especially active in offering differential treatment to borrowers represented by the Democratic and Republican leadership of Congress. In the case of borrowers residing in the districts of the Speaker of the House and the Majority and Minority Leaders and whips, subprime lenders were less likely to reject loans”

TRACK YOUR LEGISLATOR’S TOP FUNDERS

http://maplight.org/content/track-your-legislators-top-funders

“It could probably be shown by facts and figures that there is no distinctly native American criminal class except Congress.” Twain

so did how much did john paulson pay for this study ?

lest not forget that Demarco(senior- not to be confused with junior who works, conveniently, for the Risk Management Association out in philly) has now had converstions with a paulson led group of hedgeez and has now formed a new entity to “fold” freddie/fannie into a neat package for paulson and company…

and how exactly did these folks get “access” to the New Century info…I recall my conversations with the attorneys for the US Trustees office during the New Century bk that THEY, the actual trustee was not being given access to New Century info…so how exactly did this group “magically” gain access…

and all this noise attempts to forget what drove the rush to mirror fogger loans… BASEL 2…all these german landesbanks were looking to fund german mittlestand sales to growing former second world and third world countries. The local entities in these former soviet block and 3rd world contries needed capital to grow their lending base to finance purchase of german products. Since clinton had killed off the deficit and chaney could not grow the fed deficit fast enough with dropping bunker busters into the sides of empty mountains in bactria, these entities needed “other forms” of tier 1 capital…a bunch of drunks got together at jeremy’s ale house and decided the solution was to have s/p/moodeez/fitch high five some twist and turn packages to justify a AAA rating which would allow BASEL 2 compliant loan growth to happen to allow the mittelstand entities to make lady murkel look like a brilliant fearless leader. That is why all those blow ups in germany were covered over early in the crash. These baby entities were counterparties and guarantors to insure the mittelstand engine had financing in place for their sales. Notice how the german entities have never even suggested they were going to sue anyone for these “outrageous” derivatives ??

always ask…cui bono…

oh…and when mayflower types and foreigners get subprime loans in new york city to buy homes priced at 50 times the median income of the area(which are still quite east to get…see real deal magazine) they are called JUMBO loans…aka/subprime for white people…

Thanks for that disclosure.

Additionally, I have a couple of questions for the authors(actually, i have more than a couple, but a couple will do.

Exactly how many loans are we talking about in this study?

They talk about first time homebuyers, therefore we are excluding the vast majority of loans originated by New Century. Second and investment properties themselves were the vast majority of loans in the bubble areas where New Century lived. And that is taking as fact that what New Century said was the type of buyer was the actual buyer. You do not need much knowledge of this subject to know that New Century(And CW, and Golden West, etc.) stone cold lied about the principal, second home, investment buyers in the market.

What exactly do they mean by subprime?

Are they using the Wallsion/Pinto bs definition? I would think so. Basically a cherry picked selection of a low amount of loans defined by a cheryy picked definition.

I am amazed they did not blame Barney Frank.

So if “political geography” can look at congressional influence in the subprime market why don’t they look at something besides mortgages? They could highlight all sorts of graft. I think it is a promising tool. Let’s look at big pharma. High tech. Oil. Commodities. And we could also look at the reverse effects of congressional bribery: cuts to social security and medicare; education, etc. I agree with the comments above however. This research looks like a cheap shot. Could even be finger pointing by the banksters. Why, for instance, doesn’t this research go back to 2003 – the hottest year on record (for subprime)? And why on earth should they treat the senate so gingerly. Look at Chris Dodd and Angelo Mozillo. That was live coverage of the yuk factor, wasn’t it? Also it makes sense historically that the Iraq war was preemptive, maybe an experiment in saving an economy before it crashes? Our economy was out of gas by 2000. And in spite of using every trick in the bag (except full employment) nobody could save it.

“Subprime” could refer to the entire mortgage market outside “blue chip” areas like NYC and SF. Long-term jobs with perks were replaced with iffy jobs, low pay and health insurance games that generated problems on credit reports. Wall Street captured the market using kids with lap tops in hotels told to approve every loan submitted. Underwriters in South Dakota did the same. It was a fake monopoly game using a pass-thru system that defrauded the investors who bought blind. These crazy articles are bogus ways to blame a corrupt Congress plus spread fog on what happened. A once legal system of real estate based on laws within each state was captured and destroyed by a few arrogant, ignorant and greedy fat cats who retain power to do what they like for vast profits. The “new normal” are cheap rentals owned in bulk by hedge funds with tenants who will not have their job for more than a few years in a declining economy based on predatory “pay check” lending for cars and basics for the poor. Owning a home for “pride of ownership” is a quaint part of history. Last count was $7.3 Billion in lost equity from homes with half the foreclosures still sitting on the books. Historic vulture capitalism.

“Last count was $7.3 Billion in lost equity

Read more at”

Correction – 7.3 Trillion = with a T

No, that is affirmatively not true.

Loans to borrowers in co-ops are not eligible for Fannie and Freddie. Nor are “jumbos” which are loans over the Fannie and Freddie size limits.

New York City was a BIG subprime market. You’d hear brokers in bars discuss the 90% LTV loans they were doing (usually but not always in condos. You also have no financing restrictions on rental conversions to co-ops).

Sorry to hear about NYC financing problems. SF seems to hold its own pretty well, but the valley where I live in Sacramento remains a disaster with close to 50% underwater values still in effect. When I sold in SF a long time ago my feeling was that private money was happy to fund expensive homes because the area was so solid. We didn’t have many co-ops at that time. Apartment conversions to condos were hot. My clients tended to have solid jobs with savings and great credit.

MANUFACTURNING JOBS

President Obama stated one of second term priorities would be “making America a magnet for new jobs and manufacturing.” A huge job. In the 2000s, we lost 5.7 million manufacturing jobs with 58,000 plants closed.

The Permanent Normal Trade Relations bill in 2000 started the off shoring.

We have regained 500,000 manufacturing jobs since early 2010.

We read of jobs returning but just in trickles.

The people want a national strategy outlines on how to make things in America which built a healthy middle class.

Good luck Mr. President. Bless you.

Impeach!

sure….. and when hes “revitalized” the manufacturing industry and fixed unemployment (they don’t really think its broken but shhhhh) he will “pivot” to brokering a just and lasting peace between Palestinians and Isreal. – Or he will do none of these things but claim to have done all of them AND, he didn’t do them because its someone else’s fault. Buy the book to find out who.

Bring back jobs and factories outsourced that relate to national security. Foolish to have essential parts manufactured overseas.