By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Cross posted from http://www.macrobusiness.com.au/2013/09/will-the-fed-ever-taper/“>MacroBusiness

You know something is going wrong when the heads of the largest fund manager in the world and the largest bond management firm simultanously scream ”bubble”. From Bill Gross last night:

All risk asset prices artificially high. When won’t they be? When they don’t produce growth in real economy. Is 2% GDP enough?

And Larry Fink, CEO of Blackrock, from Bloomberg:

“It’s imperative that the Fed begins to taper…We’ve seen real bubble-like markets again. We’ve had a huge increase in the equity market. We’ve seen corporate-debt spreads narrow dramatically…We have issues of an overzealous market again.”

Yep. Here, there and everywhere. Here’s a neat enough take on what’s driving it all, from PFP Wealth Management:

In the 1960s and 1970s, mid-western American states fell victim to scores of wildfires. Constant interventions by the US Forest Service appeared to have little positive impact – if anything, the problems seemed to worsen. Over time, foresters came to appreciate that fires were a normal and healthy element of the forest ecosystem. By continually suppressing small fires, they were unwittingly creating the conditions for larger and less containable wildfires in the future. Naturally occurring fires are necessary to remove old forest cover, underbrush and debris. If they are suppressed, the inevitable conflagration to come has a far greater store of latent fuel at its disposal.

The analogy, of course, is with the financial markets under central banking maestros like Alan Greenspan, Ben Bernanke and now “our own” Mark Carney. During the regime of ‘the Greenspan put’, numerous small fires in the market – including the failure of Long Term Capital Management, the dotcom bust, and a property market correction – were doused with plane loads (helicopter loads ?) of easy money. Even then, equity market investors have endured two bear markets over the past decade or so that have seen market valuations halve. Perhaps the mainstream policy response to any hint of likely economic hardship should not simply be to slash interest rates, in the same way that the best response to recalcitrant children should not simply be to smother them with sweets.

There is a glaring hole at the centre of modern economies. It is called central banking. We accept (or should do) that the modern economic world is highly complex, with practically infinite interactions between countries, governments, exchange rates, interest rates, stock markets, corporations, households, entrepreneurs, and consumers. In most areas we also accept that free markets are perfectly capable of driving Adam Smith’s “invisible hand” to ensure that enlightened self-interest benefits the many as opposed to the few. But that one institution – the central bank – is even capable of mastering such complexity and fine-tuning the workings of a highly complex economy through the brute mechanism of dictating the price of money is barely discussed. Of course central banks have now gone far beyond their original mandate of tweaking interest rates; in the words of Jim Grant,

“At the heart of the Fed’s regime is the subordination of freely discovered prices to policy goals.”

And is it going to stop? The US data overnight was lousy with consumer confidence missing consensus by a wide margin and wiping out 2013 gains:

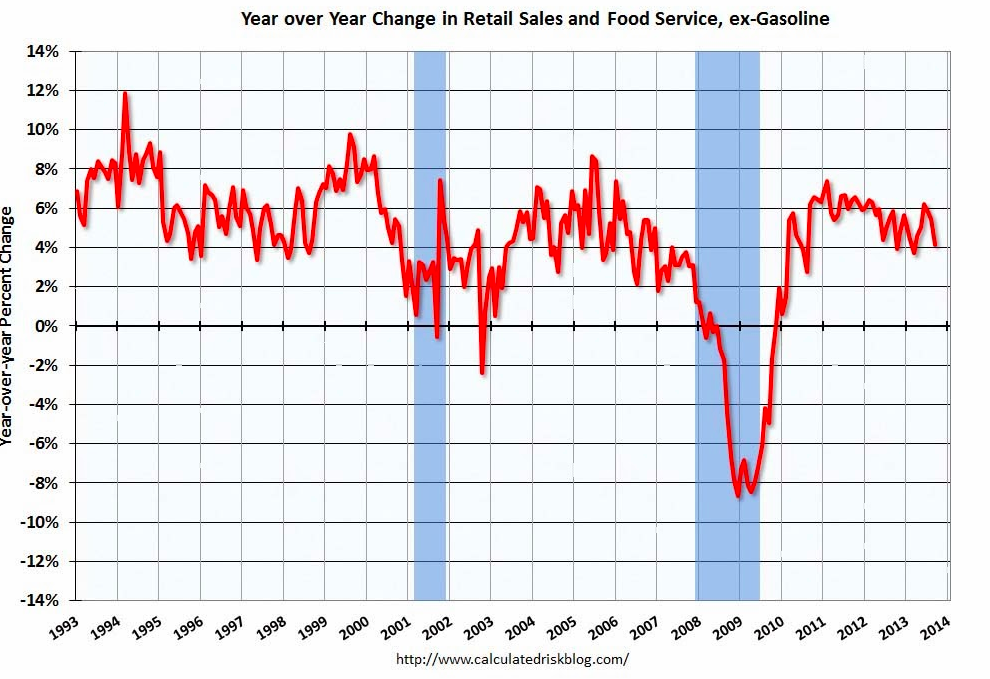

Retail sales were also out and were lousy:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $425.9 billion, a decrease of 0.1 percent from the previous month, but 3.2 percent above September 2012. … The July to August 2013 percent change was unrevised from +0.2 percent.

Nothing unexpected given the shutdown but excuse enough to push stocks to new record highs on the magically vanishing taper. As I wrote earlier this week, we’re into a new era in which asset inflation transpires without the accompanying economic benefits. It’s a trap for central banks, including Australia’s.

Will they pull out of the trap? The following exchange between ersatz Nobel economist Eugene Fama and CNBC’s Rick Santelli offers a hilarious a guide:

The delay to tapering has triggered a blow off phase in post-GFC global markets. Enjoy it but don’t believe it, stay nimble, and make sure you’re in cash in time.

“At the heart of the Fed’s regime is the subordination of freely discovered prices to policy goals.”

You know there are so many things wrong with that statement it is hard to know where to begin. I mean it is true that the Fed, as an engine of kleptocracy, has been blowing bubbles in asset markets, but it is distinctly untrue that the Fed backing off is all that is needed for classic price discovery to occur. Changing the settings on one part of the kleptocratic enterprise still leaves the rest of the kleptocratic edifice in place. Kleptocrats have zero interest in price discovery. It is all about price manipulation.

If the Fed pops the bubbles its blown, unlikely, the hot money won’t try to discover price. It will just move on somewhere to where bubbles still are being blown. However, the resulting crash here will simply transform the recession 99% of us never left into real, undeniable, depression. I’m no fan of QE. The Fed created it to bail out and enrich the 1%. But we in the 99% are going to get burned when it goes or the bubbles burst because the kleptocrats and their servant elites don’t give a sh*t about us and have prepared no plans to save our *sses when it all goes to h*ll.

And all because Main Street loves fairy tales like drowning government in the bathtub won’t leave behind a stealth government that acts predominantly in the interests of the Fat Cats!

“Price Discovery” was how we got here in the first place then. So everyone playing with finance gets to take a cut of the gains. And pretend they are actually discovering the value of things. Funny. Isn’t Fama an austerian? He confused me when he said the Fed didn’t have control over short rates because the Fed has stated variously that they do not intend to raise short rates for a long time. So they can twist out long rates, etc. But if short rates go up everybody is slaughtered, not just poor people. And he was so amused by Rick Santelli’s chaos of questions, and so bland in his answer that QE was a neutral event, I had to smile. I don’t understand any of it – but Bernanke has told us that he wants to let the MBS just run off the books and that all the QE out there is just liquidity in case the TBTFs decide to lend anything. So when will short term rates go up? If the Fed has no control over short rates, how can the Fed promise to keep ZIRP in place? And why should interest rates ever go up again if price discovery is a scam? Which it is. It would be nice to get up in the morning and read the blogs without getting sick at the thought of the possibility of the return of the “free” market. Nevermind. I’m really getting burned out.

I have sympathy for you. I found that interview to be a burlesquing of financial reporting. Santelli was his usual hysterical, ranting self, and Fama was incoherent.

If I remember my finance right, the short rate is the one rate the Fed can and does control, since it SETS the Feds fund rate, at which any bank can borrow at the Fed’s window. LT rates are *supposed* to be the geometric average of (the market expectation of) future short rates. If T-bills diverged meaningfully from the Fed Funds rate, supposedly riskless “arbitrage profits” could be made by borrowing from the Fed, and investing in T-Bills (hello, Jamie Dimon). Of course, as we have learned in this cycle, if the Fed is the end buyer of LT Treasuries, it can set LT rates as well. At least, for a good while…

The one question Fama didn’t answer, and which Santelli was too frothingly stupid to ask, is this: if QE is a push, as Fama maintains, why the f%*@ is the Fed doing it?

But we all know the answer (of which Fama seems willfully ignorant): to inflate asset prices.

I love it when these market experts, whose entire careers are built by riding bubbles, complain about Fed excesses. They know that Fed withdrawal will produce nothing but a market crash. They know there isn’t going to be any Fed withdrawal, since the Fed knows that bubble extension is the only kind of recovery which remains possible. There will be a crash but it won’t happen because the Fed backs off. What will trigger it nobody knows. Probably some external shock which frightens lenders enough to seize up overnight lending.

We’ve said it before here, and I’ll say it again: You cannot continue to run a consumption-based economy when your consumers don’t have any money. Or, at least, not enough money to support all the historic investment to provide consumption-enabling infrastructure.

The free market fundamentalists are ever-keen on creative destruction. Strangely, less so on facing up to the implications of it. And even less than that on having government support for the “little people” who might be affected by it.

Some rough anecdotal stats (sorry, not quite “my mother in law says” again, but not much better; it does illustrate to me though all the potential malinvestment. Just my opinion, but sometimes I think that everyone sits passively waiting for someone to provide them with a definitive “big picture”. Fine, if you’re willing to wait. But you can learn an awful lot simply by opening your eyes and looking at what is going on in your own community):

Number of Mercedes-Benz dealerships in a 20 mile radius from where live: 5

Number of real estate agents in my town*: 19

Number of 30,000+ square foot supermarkets in my town*: 6

Number of bank branches in my town*: 9

House Price Index SE England Oct 2008: 280.71

House Price Index SE England Sep 2013: 304.11

(http://www.landregistry.gov.uk/public/house-prices-and-sales/search-the-index)

How can falling real incomes continue to support all that lot ? They can’t. The whole economy is in the middle of a Minsky moment. The law of financial gravity has been suspended for a time. But it can’t go in forever.

Trouble is, markets can remain detached from reality for a long long time. Just because the end is inevitable, doesn’t make it imminent. Etc.

* pop. 52,000, overall moderately above average but hardly Bel Air http://www.checkmyfile.com/postcode-check/sp110nd.htm

great article and some pertinent comments below. As S.Druckenmiller has said recently, QE is the most massive transfer of wealth from the poor and middle classes to the über rich ever seen in history.

Im forever blowing bubbles,

Pretty bubbles in the air.

They fly so high,

Nearly touch the sky.

Then just like my dreams

They fade and die.

Fortunes always hiding.

I’ve looked everywhere.

Im forever blowing bubbles,

Pretty bubbles in the air.

(Hat tip West Ham United fans)

Yeah and then the fans go out and vote for Neo-Con governments Tory or Labour!

I remember an article in the British Press by a fellow named Henderson (who was discussing a study about the common person and finances). This article (derived from MRI brain research, I believe at Duke or UNC) suggested that most people have two strong reactions to complex financial discussions: fear and boredom.

While I have personally witnessed each of these in the classroom and as a former adviser (er sales person), I think there is another “emotion” – indifference. Like most, I start out wanting to participate in an open and considerate view of the “facts”, but when over the course of 10-15 minutes of reading/thinking I cannot see one person (maybe other than the writer David – whom I do not know very well) whom I would give one grain of trust to.

1) Bill Gross

2) Larry Fink

3) Eugene Fama

4) Rick Santelli

5) GreenSpanke

And the end is nigh routine brings me to the same MRI findings (which now leaves me as indifferent). I mean if I have to read this article, be influenced by it enough to make a change at 7am this morning to save the family, then we were f***ked a long time ago and the rest is scenary.

Shorter version of this article: everything would be for the best in the best of all possible worlds if it were not for the Fed.

For me, it was the same old Friedmanite “lobotomize the Fed, give us 3.7% annual growth in the money supply, and heaven on Earth shall commence.” The fact that anyone at this late date could invoke the “hidden hand” as a reified entity divorced from issues of power, class, the State, and the interests of the few versus the interests of the many is breathtaking. The author isn’t thinking, he’s sleep-typing through a reverie of ideology and wishful thinking.

Agreed. What a “invisible hand” potion.

I thought the data-charts, invoked experts, and Fama-lama-ding-dong video were enough of a sedative to fall a herd, but the author injects just a pinch of bubble rhetoric with a clove GreenSpanke central bank turd-bane and let the lobotomy begin…

I read it slightly differently; I think the author is arguing along the lines of, if we’re going to have capitalism, fine, let’s have capitalism. If we’re going to have a more state-directed economy, fine, let’s have the state firmly grasp “the levers of production” and operate them to achieve whatever outcomes they state they are trying to obtain. We can then vote in or out of office as our political persuasions take us.

But can we be released from this dreadful pretence that the state isn’t responsible and can’t intervene in “markets” while at the same time moving, almost literally, Heaven and Earth to prop up asset prices.

One thing or the other, please.

Friends;

From the trenches, the feeling is one of fear and helplessness. (Personal predilections aside, the zeitgeist ‘on the street’ is increasingly, anger.) I can well imagine the near future being somewhat like traditional social reactions to disasters past. Think the Great Depression, Americas Prohibition, The Black Death. A breakdown of social regulative norms accompanied these events. Tales about the license and venality following the Plagues appearance in Europe in the Late Middle Ages are literary masterpieces. (The execrable “Fifty Shades of Grey” can be seen as an outlier of the modern plague years, an inferior “Decameron.”)

The highly visible degradation of “official” public institutions will lead to more public disdain and ‘turning away’ from said institutions. This delegitimization is the real threat to the social fabric. The central authorities can use as much force to compel conformity as they want. Their ultimate goal, free and sincere conformation, will be but a pipe dream. A new heart for our society will develop. The local movements mentioned here and elsewhere are my hope. The pieces will not so much have to be picked up as to be nurtured and protected. The much vaunted “creative destruction” will turn out to be vastly more than some mere financial fracas.

As for the gentlemans admonition at the end of the piece: “..stay nimble, and make sure you’re in cash in time.” What kind of cash? Metals, commodities, farm land, guns and ammo? Sorry, but images of the “Bank Holiday” as it has been played out around the world over the years pop into my mind. Being a member of a well knit community could well be the new “Gold Standard.”

The cultural slippage you mention has been happening for a couple decades already, probably best expressed in what passes for rock music: the generally optimistic classic rock of the hippie era gave way to angry punk and depressed goth, then to narcissistic “emo” on one end and even angrier, brutality-laden death metal on the other in the 90s and 00s. A similar pattern exists in pop-dance music over that time, only it goes to crass sexuality rather than death imagery.

As you hint, we see that in post-Black Death imagery, too, although I think the economic issues are less responsible than is the long-term psychologically-corrosive effect of living in constant danger of nuclear catastrophe. I think some in the finance sector sublimate that to a “take all you can get b/c we’re f***ed” attitude,although they hide it with bravado.

http://www.youtube.com/watch?v=2Gtf5-PjqRg

Bonus!

http://www.youtube.com/watch?v=sZ1IWVdIqJo

The questions that haunt most of us here, I would imagine, are: how far? how fast? How far down is this economy going to slide, and how fast. If the answer is, “not too far, not too fast” then by all means position yourself in cash. The middle course would be gold and silver, as I think they will have buyers if the economy doesn’t slide too far. If the answer is “far and fast”, then it’s land, guns, and tools.

Big winners will be pharmacists who are smart enough to loot their supplies before the stores close and gunsmiths, because many gun owners don’t know how to service their weapons and may have guns and ammo but lack enough gun oil and spare parts for the long haul. These men (and they’d mostly be men) will have valuable skills and equipment during the collapse.

“Gold, Women and Sheep.”

Dear sto;

“Gold, Women and Sheep” ?????

Heavens? Have you started to ‘channel’ Ancient Male Dominated Pastoralist Societies? (As in all three of the above were considered chattels, to the men.)

I’ve missed something. I’m sure of it.

Exactly so Ambrit. It was a very funny, dead-pan skit on Colbert 2-3 years ago of a financial advisor advising his clients to invest in gold, women and sheep.

why would a man need women AND sheep?

exactly what I was shamefully thinking in this corner.

even I can see that a sheep would be more immediately useful in a variety of ways, and I AM a woman.

I feel so very, very ashamed. (And curiously inadequate too.)

There was a Bberg blast the other day screaming “FED SAID TO WARN BANKS ON LAX UNDERWRITING STANDARDS”.

Now that is effing rich. That’s like the neighborhood dope pusher chiding his junkies about their use.

The biggest bubble of all is the one the Fed lives in.

Wonder why the Neo-Cons forgot to drown the Fed in the bath tub? I really wonder why! I really wonder why!

It begins with the same letter as Bull and Bear, the letter “B”. But it’s neither Bull nor Bear, Fish nor Fowl… although it’s very fishy and emits an odor most foul. It’s inflation alright, but not so much in the usual suspects. Rather, this round of inflation – fueled with incredibly cheap (as in zero cost to Wall Street) and virtually unlimited money (our nation’s currency) – is in assets.

But as Hugh pointed out in the opening comment above, be careful what you wish for. In less polite company there is a term with which many Americans have already become quite familiar on an ‘up close and personal’ basis: “Asset Stripping”, and as many have found over the past five years of house foreclosures and repos, it’s usually delivered with a smirk.

While we all wait breathlessly for the Grand Poobahs’ latest QE-ZIRP policy pronouncement on this “Fed Day”, the second to the last of 2013, here’s an Oldie But Goody comin’ atcha from The Valley: “Here Comes Another Bubble”: http://www.theguardian.com/technology/blog/2007/dec/19/herecomesanotherbubblesong

Assuming the latest bubbles (eventually?) repeat the pattern of their predecessors:

The Good Part (Yes, Virginia, there is a good part): Uncle Milty’s ashes will finally be put to rest.

The Better Part: A deeply flawed money creation and wealth transmission mechanism from central bank issuance to distribution through the nineteen Primary Dealers, two thirds of whom are not U.S. entities, will likely be questioned and replaced.

The Best Part: Heck, I dunno… Will there be one? Maybe it’s that Keynesian solutions will again be accorded some policy consideration, MMT will be considered, and Americans will re-engage with one another, their communities and the rest of the world.

The wildfire analogy is rubbish. Wildfire suppression had barely taken hold by the 60’s and 70’s in terms of impacts on forest composition. And the largest wildfire in recorded U.S. history took place in 1910, long before fire suppression had become policy.

https://en.wikipedia.org/wiki/Great_Fire_of_1910

Using wildfires in the 60’s and 70’s in the mid-west(?) erroneously to make a point is sloppy.

On the Fama interview, I think I’ll just let Forrest handle the comment here. Besides that, the question of whether or not we need blind FIRE men fighting big or small forest fires with gasoline has been covered elsewhere.

“That’s All I Have To Say About That- Forrest Gump Quote”

http://www.youtube.com/watch?v=Otm4RusESNU

And move along with a musical interlude.

“Pink Floyd – Careful With That Axe Eugene”

http://www.youtube.com/watch?v=tMpGdG27K9o

The person with the best handle on central bank policy from a monetarist’s perspective is Doug Noland, who publishes his “Credit Bubble Bulletin” every Friday night.

I think what most people are failing to recognize in the midst of our contemporary experience is the role central banks are playing to forward an intention to dissolve the institution of the sovereign nation state. This intention originates from an oligarchy whose origins were Venice and whose base was transferred to Amsterdam, and then London with the ascension to the English throne of William of Orange. The ultimate objective of this Venetian-modeled oligarchy is destruction of the constitutional republic of the United States, itself. Central banks thus are seen operating as battering rams formed with the many volumes of sophistry rationalizing their monetarist nonsense, detached from human existence, the likes of which also spews from subverted institutions central banks both directly lord over, as well as influence. This alone explains the present day propensity of central banks to foster bubbles. As we have graphically seen via the euro-zone periphery, sovereigns are being destroyed as a result.

Again, I will argue this is the very intention of this exercise in wildcat finance central banks have been blessing under benevolent cover that, not only belies physical reality, but rather easily is seen preparing for something far worse. Just how it escapes perception we are at a moment not unlike that preceding the collapse of the Florentine banking empire in the 14th century, which event and consequent economic collapse accelerated the Black Death plague across Europe, really defies the imagination. People’s desire to trust the good intentions of those driving today’s central bank actions, maintaining an incredulous disposition toward any suggestion there’s something vile and sinister prospectively lurking from them, really exposes little more than the very substance making for any good tragedy. Such is Western civilization’s deep-seeded dilemma that is millenia in the making.