Yves here. This is a tidy and useful addition to the literature on how high levels of international capital flows generate financial instability.

By Eduardo Olaberría, Economist, OECD Economics Department. Originally posted at VoxEU

Policymakers have long been concerned that large capital inflows are associated with asset-price booms. This column presents recent research showing that the composition of capital inflows also matters. The association between capital inflows and asset-price booms is about twice as strong for debt-related than for equity-related investment. Policymakers should therefore pay attention to the composition of capital inflows, since debt-related inflows may still undermine financial stability even if they do not result in an overall current-account deficit.

For decades, policymakers’ perception has been that large capital inflows can fuel booms in asset prices. If this were true, bonanzas in capital inflows would imply an important risk to financial stability, since booms in asset prices are leading indicators of financial crises. However, as noted by Reinhart and Reinhart (2008: 50), despite being widespread among policymakers, until recently this perception was based mainly on anecdotal evidence.

Recently, a number of empirical studies (e.g. Aizenman and Jinjarak 2009 and Ferrero 2011, 2012) have studied the association between large capital inflows and asset prices – in particular housing prices. Focusing on the current account as a proxy for capital inflows, they found that the association is, indeed, positive and significant. These findings are clearly a step forward. However, focusing only on the current account can be misleading. In recent research (Olaberría 2012 and Jara and Olaberría 2013), we present strong evidence emphasising that to understand the association between large capital inflows and booms in asset prices, we need to go beyond the current account and look at the disaggregated flows. We argue that these facts are consistent with theory, and highlight why they matter for economic policy.

Asset Price Booms and the Composition of Capital Inflows

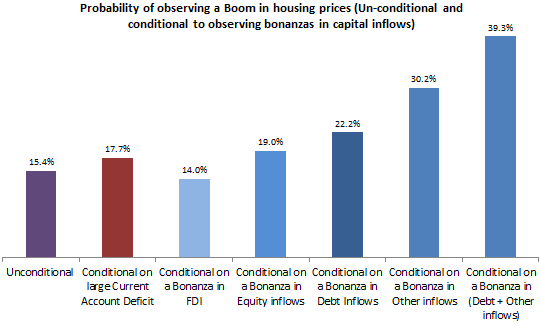

Using a panel of quarterly data for 35 countries covering the period 1990–2010, in Jara and Olaberría (2013) we estimate the unconditional probability of observing a boom in housing prices, and the probability of observing a boom in housing prices conditional on having:

1. large current-account deficits;

2. a bonanza in net FDI inflows;

3. a bonanza in net portfolio equity inflows;

4. a bonanza in net portfolio debt inflows;

5. a bonanza in net banks and other inflows;

6. a bonanza in 4 and 5.

Bonanzas are defined as episodes of extreme net capital inflows – when domestic or foreign investors substantially increase capital inflows into a country relative to their historic levels (see Forbes and Warnock 2012). Asset-price booms are defined as periods of unusually large price expansions (a method used in Mendoza and Terrones 2008 to identify credit booms).

The main results, reported in Figure 1, show that having a large current-account deficit does indeed increase the probability of observing a boom in housing prices, but that the increase is not very significant (17.7% vs. 15.4%). In contrast, the figure shows that the probability of observing a boom in housing prices more than doubles (increases to almost 40%) during periods of bonanzas in debt-related inflows. (Olaberría 2012 found similar results for booms in stock prices.)

More generally, our research provides a systematic empirical analysis of the association between capital inflows and booms in asset prices (for both housing and stock prices). Controlling for other macroeconomic factors, and using different estimation methodologies and instrumental variables, our research shows that the association varies across capital inflow categories – being about two times higher for debt-related investment than for equity-related investment. In addition, we find that the association is weaker in countries with more flexible exchange-rate regimes and better quality of institutions. Finally, we find some evidence that capital controls may reduce the association between large capital inflows and booms in housing prices, but the evidence is weak and not robust to different methodologies.

Figure 1. Conditional and unconditional probability of observing booms in housing prices

Source: Authors’ own calculations based on data from IMF and Bank for International Settlements.

These findings are consistent with theory. Theoretical models linking booms in asset prices with large capital inflows start with the idea that, because of financial market imperfections – such as adverse selection and moral hazard – an economy’s borrowing capability is limited by the value of its assets. When large capital inflows enter an economy, the demand for assets that are in rather fixed supply increases, and asset prices rise, increasing the economy’s credit limit. Increases in the credit limit promote new rounds of capital inflows, potentially evolving into an asset price boom through a circular process in which higher asset prices make the financial conditions of the economy appear sounder than they actually are, promoting more borrowing and pushing asset prices even higher.

According to Aoki et al. (2009), this theory applies mainly to debt-related flows – which are more likely to suffer from problems of adverse selection and moral hazard, and can exacerbate cycles in asset prices by encouraging excessive risky lending during booms – and not necessarily to equity-related inflows. In fact, according to Krugman (2000), equity-related inflows – i.e. FDI – could help flatten cycles in asset prices.

In sum, the composition of capital inflows matters. While large current account deficits driven by FDI inflows are less likely to be linked with booms, large inflows of debt-related investment are likely to put pressure on asset prices – even when the current account is in surplus. (Although countries with current-account surpluses are better equipped to respond to the risk than countries with large current-account deficits.)

Implications for Policymakers

In general, to monitor the threat of capital inflows, policymakers look at the current-account balance. If it is in surplus (as is the case in Germany today) or the deficit is low, they assume that capital inflows do not pose a risk to financial stability If, on the other hand, the deficit is large, they worry about the potential risk and, only then, they may look at the composition of capital inflows.

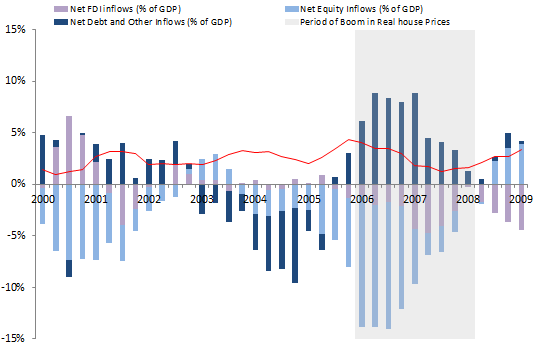

Our research shows that this view is misleading. To better measure the risk of capital inflows, monitoring their composition matters even when the current account is in surplus. To emphasise the relevance of this, consider the example of Denmark during the years 2006–2008 (see Figure 2). Denmark had a positive current account that was driven by large outflows of equity investment (net FDI and portfolio equity). However, the current-account balance was hiding a bonanza in debt-related capital inflows (net inflows of Portfolio debt and bank loans). Not surprisingly, during the same period Denmark had a boom in housing prices. Were these two things related? Our results suggest that they probably were; however, to answer this question more research is needed.

Similarly, Germany today has a large current-account surplus, but policymakers shouldn’t assume that because of this fact capital inflows are not a concern. The positive balance is explained mainly by FDI and portfolio-equity investment abroad, but Germany is also receiving large inflows of debt-related investment, and some observers suggest that house prices have been rising fast – in particular in some urban areas. Once again, our research cannot say if these facts are related, but it suggests that policymakers should monitor them closely.

Figure 2. Current account and net capital inflows by type in Denmark, 2000–2009

Source: Authors’ own calculations based on data from IMF.

See original article for references

“These findings are consistent with theory. Theoretical models linking booms in asset prices with large capital inflows start with the idea … an economy’s borrowing capability is limited by the value of its assets. … the demand for assets that are in rather fixed supply increases, and asset prices rise, increasing the economy’s credit limit….”

An economy’s borrowing capability is NOT limited by the value of its assets. The ability of people in the economy is only limited by the ability of that economy’s banking system (and also partially limited by it’s government’s printing press) to lend money. Banks create loans from thin air, they are not reserved constraint, they are profit and somebody’s-brother-in-law constraint – they lend money / make loans if they think they will make a profit on the loan or if someone tells them to loan money to their cousin Vinnie. So the first statement is incorrect and their “theory” is wrong.

Then, the economist’s totem, supply and demand; “the demand for assets…increases and asset prices rise”. They refuse to consider that prices go up because some people, with lots more money than others, bid up the price, not because of an increase in demand per say. But main stream economists only believe in a causation between supply and demand, however they define those terms. To them, TINA about “supply and demand”.

The rest of the paragraph continues, consistent but wrong as ever, the idea that money (and they confuse or don’t understand the difference between cash and credit) causes price changes. The authors never consider systemic fraud, which can and does lead to price changes, and which can and do cause volatility in all markets, especially the financial ones.

So I would say a nice, main stream, economics paper continuing the pseudo-science of economics, especially the so-called “theory” of economics and the economists’ mathematically based rationalisations for saying what the politically powerful want to hear. But not one that explains why assets (land and property primarily) prices go up when a country experiences in-flows of capital

Is it really that complicated? Toward the end of the dot com boom, a number of startup companies located in Scotts Valley, CA, created a few humdred jobs in the high five figures.

Suddenly there was a boom in rental prices for apartments in really crappy buildings. Hovels that used to rent for 400 to 600 dollars were now being offered for 1500.00.

I’m not positive, but I’m reasonably certian that most existing tenants were covered by rent control, so a set of affluent new tenants were a gold mine for property owners.

Obviously Scotts Valley was not a country, but if the landlords could have figured out a way to secede, rents would have gone up even faster – due to nothing more than new money chasing essential services.

One of the points I want to make is that the typical economist picture is too simple, they always leave out 2 or 3 essential components. To pick your example of Silicon Valley, I argue it is not just the landlords who like the influx of money – so they can charge a higher rent, but also the renters. Yes, renters. But not the pre-existing, before the influx, renters, but the newly rich ones. They don’t care what the rent is, they can afford it, it is a small pittance of their net worth. So you have left out the renters.

And this influx of money, it is not considered properly either. To the old renters, who do not get this influx, the new rents drive them into poverty – or out of town. To the new renters, those with the influx, the costs are not significant to them, life is good. So the money influx has an unequal influence and can not be ignored if you want a “good” theory / explanation of economics.

In general you are correct, but you miss part of the point as regards the renters. No one cared what the rents were as long as they had come advance control, i.e. the ability to bargain and get a higher salary to cover anticipated higher rents.

If you made a deal before finding about the rents the higher costs amounted to a loss of 15 to 25 % of discretionary income.

If the hamburger flippers actually get their $15 per hour, they are likely to be very surprised by the effect that $15 has on the overall economy. They will discover that their paycheck is measured with a rubber ruler

The reasoning is basically: people are trying for higher wages to improve their bargaining position for things they need, food, shelter, clothing. If they get to this better position, they’ll find that the American economy doesn’t produce these things in the amounts required.

The Austerian argument re Meidcare, Social Security etc. can be summarized as “America is the wealthiest nation on earth, as long as we don’t need medical treatment or food to eat. If we have to pay for those, we’re broke.”

“Similarly, Germany today has a large current-account surplus, but policymakers shouldn’t assume that because of this fact capital inflows are not a concern. The positive balance is explained mainly by FDI and portfolio-equity investment abroad, but Germany is also receiving large inflows of debt-related investment.”

From a energy balance perspective Germany is receiving peripheral countries oil rations and exporting value added goods which consume this oil in most efficient (fastest) manner possible.

Energy is therefore not available in the Euro periphery to produce primary and basic secondary goods for the local market.

Goods must be shipped from China etc etc.

The real losses from such long distance trade is massive.

http://www.youtube.com/watch?v=sw28HmmvNNs

The world needs to rediscover true English thought on this subject matter.

Economic democracy

Chapter 3

“In attacking capitalism collective Socialism has largely failed to recognise THAT THE REAL ENEMY IS THE WILL TO POWER ,the positive complement to servility , of which Prussianism , with its theories of the supreme state and the unimportance of the individual is its finest flower”

“One of the more obvious effects of the concentration of credit capital in a few hands which simply means the centralization of directive power is its contribution to the illusion of fiercely competitive markets”

There is something missing from the typical German mind …a critical thinking aspect subsumed by state propaganda for a much longer period of generations then other nations.

This means they can become the ultimate teachers pet.

But behind it all is the will of power.

Need I remind your readers that the symbol above the European council is none other then the evil eye.

http://www.youtube.com/watch?v=qTaXkU2N49I

Just looked up the German word for bullshit on Google translate. Apparently it’s the same.

Economic democracy

https://ia600200.us.archive.org/7/items/econdemocracy00dougiala/econdemocracy00dougiala.pdf

Thank you for this piece. I have been thinking a bit about the geopolitical implications of U.S. Fed and BoJ QE-ZIRP policies on global capital flows (including who is being displaced), currency valuations, and asset prices, with WTO and GATT in the backdrop.

There is a great deal to digest here, including who the sacrificial lambs are and why. Ties into today’s link to civil unrest in Cordoba, Argentina and elsewhere; the bubble in Australian housing; China’s bridges to nowhere and ghost cities; disturbing issues in the Euro zone; etc.

We s/b seeking diplomatic solutions IMO, if we’re not already doing so. The world is a fragile place on so many levels.

The authors imply what should be explicit, that it isnt capital inflows per se, but leverage that drives asset bubbles. Their point on debt-related inflows having 2x effect that equity-related inflows illustrates the point.

I imagine the effect is that debt inflows influence the domestic market to generate more leverage more than equity, but I dont know the mechanism for that, unless it is simply that debt inflows = less capital controls, in which case we might be seeing an effect and not a cause.

So the financialization of the world, producing capital inflows based on debt, or speculation, is bubbles on steroids. Minsky? And without bubbles, according to Larry Summers and now Krugman, the economy goes backwards or is aimless. So how to fine tune? Can anyone say financial regulation? Capital controls? Let’s assume that capital is not a store of wealth, like Bitcoin. So it always seeks its own collateral, some traditional asset. The whole idea of capital could be as problematic as that of Bitcoin. So we should definitely put up a firewall between capital and currency. How? Maybe call capital a virtual commodity – like China just declared.

Maybe respecting the actual definition of capital is the answer.

Capital is savings, earned through PRODUCTIVE activity, in excess of what is necessary for consumption, not computer generated digits handed over to speculators for free.

While I appreciate the study, I think by limiting their asset class to housing prices, they’ve limited the generalizability of their conclusions. I’m not surprised that equity inflows have little effect on house prices, since most people aren’t allowed to borrow against their stock market gains to buy a house.

But house prices aren’t the only asset class to worry about (Although it might be the largest). The stock market itself has detrimental bubbles, as do the commodity markets (which can then hugely impact the cost of daily essentials like food and fuel). Even govt debt bubbles (more seen in emerging markets where rapid changes in the international appetite for sovereign debt can make long-term planning difficult). I think if one analyzed these harmful asset bubbles as well, then equity inflows may be found to have larger effects than this study shows.

@susan

There is a point in the film I Claudius where Claudius asks his civil service to design a new winter port for grain importation.

But the civil servants have their money in corn……

In private they declare..

“I have money in corn , you have money in corn”

They inflate the construction price of the project so as to insure the new port is not built.

But this is not any old product…..its a vital primary energy good of ancient times.

I guess these guys continue to make a killing in Corn and they spend their now concentrated wealth on luxury items as Rome is where the money is minted.

But the city begins to decay for some funny reason.

To maintain their relative wealth the insiders must blow up bubbles of ever increasing size and externalize the losses as the wealth is simply not there for everybody.

Larry Summmers (or the people behind his vast bulk) engages in what I like to call a Me Claudius Moment.

Watching Larry talk is talk and indeed walk his walk is true monster piece theater.

http://www.youtube.com/watch?v=RSOu5C55kUA

Supposing this thinking is correct, it would be interesting to see how all 35 countries fare in comparison. There are some in for a rough ride that don’t see it coming – Canada, for one.

Katniss – “Maybe respecting the actual definition of capital is the answer. Capital is savings, earned through PRODUCTIVE activity, in excess of what is necessary for consumption, not computer generated digits handed over to speculators for free.”

So well said! Capital that people have worked hard for is being destroyed by the amount of leverage and speculation out there, and Krugman and Summers love it.

Economists? Hardly. They are nothing more than common every day thieves and criminals who want something for nothing.

Disagree. Capital isn’t savings, capital is spending. The accum of capital is savings that will be spent.

There is plenty of “productive” activity in the 3rd world. Which is where capital is going and why they have higher demographically adjusted growth rates compared to the 1st world which had 100+ years of intense investment and are far more built up. This increases consumption and makes actual investment, less needed.

The real problem is public disinvestment, which has been going on since the 70’s. The government isn’t spending enough interally on investment and it shows up a bit.

Vedicculture – “There is plenty of “productive” activity in the 3rd world. Which is where capital is going…”

Which is where margin and leverage are going. Productive? Bridges to nowhere, empty cities.

More like lst world trying to build up the 3rd world in their image. What an image! Cement castles in the sky!

I will also add, as countries or economic “blocs” become more wealthier, GDP becomes less useful.

There is very little reason for capital to spend in “1st world” countries at this time. They are already built up. It isn’t their job to publicly invest. Unless you get a innovation wave that brings that need to invest, they won’t invest.

The Y2K boom was a necessary. The entire economic/computer paradym wasn’t going to handle the switch to “2000” well and they invested in 1st world countries to fix it. The economy boomed in the mid-late 90’s and no surprise growth began to decline after that process was complete.

I think economic schools are at a all time failing point. They simple don’t get it. Not a one. Doesn’t matter which flavor of school you like, they just live in intellectual fantasy.