Yves here. In some ways, I hate to be having such a run of Paul Krugman posts, but his stand on the TransPacific Partnership and his continued defense of dubious economic ideas that were long ago disproven, like loanable funds, in combination with his prominence, means the attention is well warranted.

Here Steve Keen elaborates on how Krugman is beginning to give ground on the loanable funds model. And for those not familiar with it, here’s a recap which explains the concept and why it’s relevant in policy discussions:

In really simple terms, there is a “loanable funds” market in which borrowers and savers meet to determine the price of lending. Keynes argued that investors could have a change in liquidity preferences, which is econ-speak for they get freaked out and run for safe havens, which in his day was to pull it out of the banking system entirely. [John] Hicks endeavored to show that the loanable funds and liquidity preferences theories were complementary, since he contended that Keynes ignored the bond market (loanable funds) while his predecessors ignored money markets.

But that’s a deliberate misreading. Keynes saw the driver as the change in the mood of capitalists; the shift in liquidity preferences was an effect. (In addition, Keynes held that changes with respect to existing portfolio positions, meaning stocks of held assets, would tend to swamp flow effects captured by loanable funds models.)

Making money cheaper is not going to make anyone want to take risk if they think the fundamental outlook is poor. Except for finance-intensive firms (which for the most part is limited to financial services industry incumbents), the cost of money is usually not the driver in business decisions, Market potential, the absolute level of commitment required, competitor dynamics and so on are what drive the decision; funding cost might be a brake. So the idea that making financing cheaper in and of itself is going to spur business activity is dubious, and it has been borne out in this crisis, where banks complain that the reason they are not lending is lack of demand from qualified borrowers. Surveys of small businesses, for instance, show that most have been pessimistic for quite some time.

If you want to put it in more technical terms, what is happening is a large and sustained fall in what Keynes called the marginal efficiency of capital. Companies are not reinvesting at a rate sufficient rate to sustain growth, let alone reduce unemployment. Rob Parenteau and I discussed the drivers of this phenomenon in a New York Times op-ed on the corporate savings glut last year: that managers and investors have short term incentives, and financial reform has done nothing to reverse them. Add to that that in a balance sheet recession, the private sector (both households and businesses) want to reduce debt, which is tantamount to saving. Lowering interest rates is not going to change that behavior. And if you try to generate inflation in this scenario, when individuals and companies are feeling stresses, all you do is reduce their real spending (and savings power) and further reduce demand (and hence economic activity).

By Steve Keen, Associate Professor of Economics & Finance at the University of Western Sydney and author of Debunking Economics and the blog Debtwatch. Originally published at Business Spectator

What a difference a year (and three-quarters) makes. Back in March of 2012, Paul Krugman rejected the argument I make that new debt creates additional demand:

“Keen then goes on to assert that lending is, by definition (at least as I understand it), an addition to aggregate demand. I guess I don’t get that at all. If I decide to cut back on my spending and stash the funds in a bank, which lends them out to someone else, this doesn’t have to represent a net increase in demand. Yes, in some (many) cases lending is associated with higher demand, because resources are being transferred to people with a higher propensity to spend; but Keen seems to be saying something else, and I’m not sure what. I think it has something to do with the notion that creating money = creating demand, but again that isn’t right in any model I understand.” (Minsky and Methodology (Wonkish), March 27, 2012)

Then earlier this month, this argument turned up in his musings about the secular stagnation hypothesis:

“Start with the point I’ve raised several times, and others have raised as well: underneath the apparent stability of the Great Moderation lurked a rapid rise in debt that is now being unwound … Debt was rising by around 2 per cent of GDP annually; that’s not going to happen in future, which a naïve calculation suggests means a reduction in demand, other things equal, of around 2 percent of GDP.” (Secular Stagnation Arithmetic, December 7, 2013)

Don’t get me wrong: I’m glad that Krugman may finally be starting to support the case that I (and some other endogenous money theorists like Michael Hudson and Dirk Bezemer) have been making for many years: that rising debt directly adds to aggregate demand. If he is, then welcome aboard. Though there’s doubt as to whether John Maynard Keynes ever uttered the words attributed to him that “when the facts change, I change my mind – what do you do sir?”, I’m happy to accept this shift in that spirit.

But I don’t want to see this change in analysis sneak under the radar either: it deserves acknowledgement as a major shift in the thinking of a major figure in contemporary economics.

It also calls for a theory in which this is possible: a theory in which an increase in debt causes a commensurate increase in demand. As Krugman put it himself back in March of 2012, the argument that rising debt directly adds to demand “has something to do with the notion that creating money = creating demand, but again that isn’t right in any model I understand.” And that’s true, because the model Krugman understood back then was the model of ‘loanable funds’, in which increasing debt can’t add much to aggregate demand, because debt simply transfers spending power from a lender to a borrower.

In a Loanable Funds universe, only if the lender is a miser and the borrower a spendthrift will demand rise all that much – and generally, mainstream economists downplay this possibility. As Ben Bernanke put it when he downplayed Irving Fisher’s Debt-Deflation Theory of Great Depressions, “Absent implausibly large differences in marginal spending propensities among the groups … pure redistributions should have no significant macro-economic effects…” (Essays on the Great Depression, 2000) And as Krugman himself put it just a year ago, “the overall level of debt makes no difference to aggregate net worth – one person’s liability is another person’s asset. It follows that the level of debt matters only if the distribution of net worth matters.” (End This Depression Now!, 2012)

Yet here we have Krugman suggesting that change in the aggregate level of debt matters in its own right, and proposing a one-for-one correspondence between the change in aggregate private debt and aggregate demand: “Debt was rising by around 2 per cent of GDP annually; that’s not going to happen in future, which a naïve calculation suggests means a reduction in demand, other things equal, of around 2 per cent of GDP.”

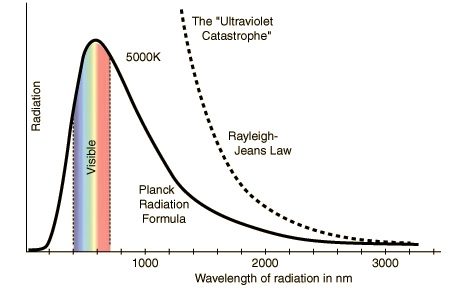

Have you heard the old joke that an economist is someone who, seeing that something works in practice, then says “Ah! But does it work in theory?”. I’m not going to pull that swifty here: as I noted last week, I see the role of debt adding to aggregate demand as an empirical reality that economists have to explain – not something that can’t exist unless economists have a model that explains it. But just as physics could only progress at the end of the 19th century after it had developed a model that explained the peculiar properties of ‘black-body’ radiation (see Figure 1), economics will only progress in the 21st if it can explain how and why an increase in debt adds to aggregate demand.

Figure 1: Classical physics agreed with experimental data only at very high or very low frequencies – it could not fit the actual data of black-body radiation. Planck’s quantum formula did fit the data, and overturned classical physics.

That requires abandoning the Loanable Funds model of lending, which treats banks as “mere intermediaries” and therefore ignores them in macroeconomics. To continue the physics analogy, I see Loanable Funds as a kindred spirit to the Classical Physics assumption that energy was infinitely divisible: if one goes (continuous energy for physics; Loanable Funds for economics), then so does the other (Maxwellian/Newtonian theory for Physics back then; the still dominant non-monetary approach to macroeconomics for economics today).

If the Loanable Funds theory of lending is correct, then rising debt can only tangentially cause an increase in demand (if the borrower spends more than the lender would have done); if on the other hand a change in debt adds roughly one for one to demand, then the Loanable Funds model can’t be right. In other words, Loanable Funds and the argument that macroeconomics can ignore private debt are ‘joined at the hip’: if one goes, then so must the other.

Krugman’s recent “naïve calculation” throws out the latter. Will he now also ditch the former? That would be a really big shift, because until now he has been the staunchest defender of Loanable Funds, and derisory of the alternative Endogenous Money model, in which banks play an essential role in macroeconomics. In a series of posts – “Minsky and Methodology”, “Banking Mysticism”, “Banking Mysticism, Continued”, “Commercial Banks as Creators of ‘Money’” to name a few – he has heaped ridicule both on the proposition that banks matter in macroeconomics, and on the people who make that case.

But if he does abandon Loanable Funds, then ‘all is forgiven’, because I’m convinced that the Neoclassical belief in Loanable Funds is the biggest barrier there is to the development of a realistic, monetary macroeconomics. If Krugman gives way on this belief, then maybe there’s hope that central banks and treasuries around the world will eventually do so too. They might finally start to develop economic policies that reduce the problems caused by the crisis, rather than making them worse.

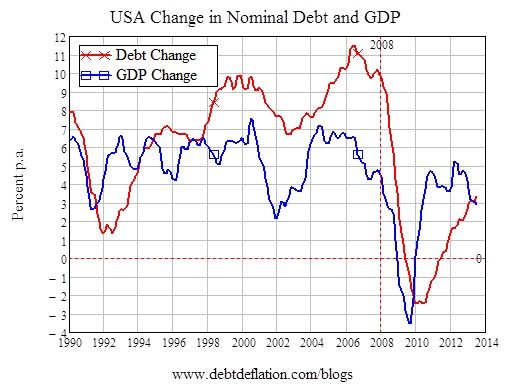

I’ll have more to say on this topic in coming weeks – including a ‘Post-Keynesian’ model of mine that shows how bank lending adds to aggregate demand, and comments on Nick Rowe’s “Neoclassical” explanation of the same phenomenon. But for now I’ll end with an important correction of Krugman’s “naïve calculation”, since he only considered household debt to banks. He should have included corporate debt as well, and the sum of household and non-financial corporate debt to banks grew 3.6 per cent faster than nominal GDP for the decade before 2008 (see Figure 2).

Figure 2: The gap between growth in nominal private debt and nominal GDP since 1990.

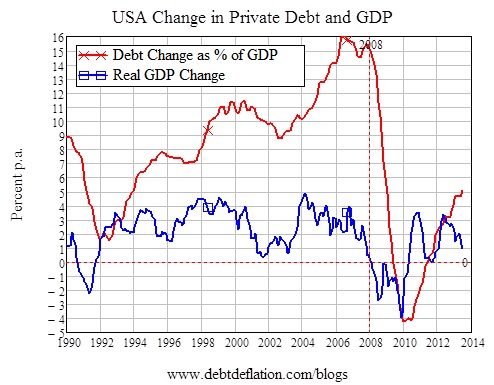

Put that growth in private debt as a percentage of GDP as Krugman did (which is also my preferred measure), and there’s not merely a 2 per cent of GDP gap to fill, but something closer to 12 per cent (see Figure 3).

Figure 3: Change in private debt as percentage of GDP and real GDP growth since 1990.

That’s a hell of a big gap to fill. But please, let’s not fill it with yet more bubbles.

Krugman also seems to be cutting through some of the mystery surrounding central bank/treasury operations which helps make money creation and distribution clearer which helps with policy decisions. http://neweconomicperspectives.org/2013/12/krugman-helicopters-consolidation

The government (Fed/Treasury) creates money and distributes it into the economy. This creates fiscal deficits but puts the money into the hands of private households and corporations. This is the real ‘public purse’. I like to think of this as ‘taxpayer money’ because it is owned by the people (the government).

If the government decides to guarantee MBS then that is a use of this public money to support an asset price. Why can’t this be done in the traditional manner of good underwriting?

And this seems to be leading to a slippery slope if the Fed is going to support more assets of even more dubious quality. At first blush supporting money market funds seems like a good idea. But what if these money market funds are supporting a liquidity pyramid of ‘cotton candy’.

((In his book ‘Extreme Money: Masters of the Universe and the Cult of Risk’ (2011) Satyajit Das talks about the ‘Liquidity Factory’.

On an inverse pyramid at the bottom little pinnacle are the central banks, 2%, then there are bank loans, 19%, then securitized debt, 38% and then derivatives 41%.

This is all considered liquidity ie the lubricant that allows the global economy to run. And 79% of it is derivatives and securitized debt which are largely unregulated and full of fraud. And the $16 trillion of US Treasuries used as collateral to back it all up is a small little fraction.

This is financialization run amok and what he calls ‘cotton candy’ which is spun sugar composed mostly of air.}}

———

I thought Nancy Fraser had some interesting ideas on incorporating the problems with financialization, the environment and the social contract.

http://www.nakedcapitalism.com/2013/12/can-societies-commodities-way.html

A healthier economy doesn’t have to be based on trivial production and consumption but we have such tremendous income inequality that there is certainly room for demand distribution.

I liked her line: ‘securitization has unleashed a tsunami of insecurity’

And she sees ‘green finance’ as a way to generate quick speculative super profits which draw money away from long term, large scale, necessary ecologic investment.

It’s interesting that 90% of Americans were against TARP and as she stated 70% supported Occupy in the first few weeks. I think people can figure out better ways to use these fiscal deficits.

Great points!

Thanks from Mexico!

This is an interesting paper..

http://www.astrid.eu/Regolazion/Studi–ric/Archivio-25/Copeland_et-al_prox_FRBNY-Econ-Policy-Rev.pdf

Adam Copeland, Darrell Duffie, Antoine Martin, and Susan McLaughlin

Key Mechanics of The U.S. Tri-Party Repo Market

“”The market value of the securities purchased typically exceeds the value of the cash. The difference is called the “haircut.” For example, if a cash loan of $95 is backed by collateral that has a market value of $100, then the haircut is 5 percent. For the closing leg of the repo, which occurs at the term of the repo, the collateral provider repurchases the securities for $95 plus an amount corresponding to the interest rate on the transaction.””

When we put money into a money market fund that money is not guaranteed. They have to invest that money to even come up with a 1% interest payment to pay us. In fact there is no guarantee that their investments will go well and maintain par value of the fund. So these funds can actually lose money ie ‘break the buck’ which is what happened to Reserve Primary Fund in 2008. This surprised a lot of people who started a run on these funds which started to dry up the tri-party credit market. President Bush had to go on TV and say that the government would in fact guarantee these funds. That guarantee has since been removed.

From the above quote we get an idea of how this works via repo. The money market funds lend money to a broker in exchange for an security. (like something MF Global thought was a good investment). So if the security goes bad and the broker doesn’t have the money to rebuy it (repo it) the money market fund is stuck with the loss. Someone with deep pockets such as JP Morgan it the tri part of the party. If they decide they don’t like what they see they can refuse to provide the liquidity to facilitate these transactions and pull the money from the whole deal. Too bad for the broker and the money market fund. JP Morgan has the money and the lawyers (think Lehman bankruptcy) can see if they can get any of it back).

It’s important to remember that this is a paper from the Fed so it also contains some humor…

“”Second, these repos (bilateral) involve the potential for fraud. These complexities are alleviated in the tri-party repo market””

Another important part of this paper is that it mentions that the cash investor margin level for Treasuries and other government guaranteed securities is 2% which corresponds to Das’s tip of the pyramid mentioned above. This means that they are leveraged like crazy into these risky ‘cotton candy’ products and very susceptible to being sucked in by deleveraging events.

This is why Michael Hudson’s advice below similar to that of David Graeber’s is that we need to proactively take this pyramid of debt down before it crashes in on us.

Thanks, financial matters,

Very cogent post. Ordering Satyajit Das’ book now ( I recall a radio interview in October 2008 with Das who made incredibly savvy observations about how we got into Financial Crisis mess; his clarity of thought was impressive to this layman). And I concur completely with Hudson’s idea about debt forgiveness; his writings about the historical precedent for it are compelling.

=====================

From Mexico,

You wrote below:

Every day that goes by my own thinking comes closer to that of Hudson than that of the MMTers.

I don’t see the difference. In fact, after the Rimini Italy conference in Feb (?) March (?) 2012 at which both Kelton and Hudson presented (with Black, Auerback, and Parguez), Hudson’s comments about Kelton’s presentation (“brilliant”) indicated he didn’t see any either. I think they are complementary.

The usual response to that is “of course it adds to the growth, but it’s really just moving it from the future to the present!”.

Which is a bit inconsistent, as there’s a well known formula for the gov’t debt sustanability, which tells you that the debt is “sustainable” (meaning that it can be realistically repaid in a finite time w/o bankruptcy) if the interest on the stock of the debt is less than real growth+inflation. It recognizes that the debt can be rolled over as it matures and doesn’t have to be repaid at any gievn time (but could, in theory, be repaid sometime in the future as long as the CPI+RG<interest i.e. as long as something could be set aside to service the notional in the – however far – future).

The classical argument why this doesn't apply to private debt is that private individuals, unlike a state, have very short (finite) lifespans compared to states, thus making it impossible to roll the debt forever as needed. I believe this is a falacy of composition. Yes, a single private individual has a finite life, but the aggregate debt in the whole of private factor _CAN_ and _DOES_ get rolled over as needed.

The other side of the equation is slightly different (as in gov't we assume that taxes are a constant part of GDP, thus we're concerned with the nominal GDP vs. nominal debt). In private sector we can say that the stock of the aggregate debt is serviceable for as long as the private sector income + inflation < interest.

That said, this all still runs into the problems with morality (which few econ theories consider) – even if we can show that a rational behaviour like that would work, if we have irrational moral belief about debt that influence our behaviour against our best needs, we're stuffed. And I'd point out that the morality here doesn't work only on the borrower's side, but can be on the lender's side or even neither-borrower-nor-lender (prohibiotion/restriction of lending)

Whats striking is the extreme and polite willingness to give Krugman credit at all

“If he is, then welcome aboard.”

I would not even throw him a life vest – let him swim unaided in a neo classical sea.

PS – all of this was known before Minsky and the lads.

”

“The explanation of this is that in highly

developed countries such as ours practically

all purchasing -power commences life as a

credit created by the banks. These credits are created at the instance of manufacturers

and dealers; are distributed by them in

the shape of wages, salaries, and profits,

and spent Trade is thus almost entirely

carried on with borrowed money or credit,

although the fact may be hidden at various

points. The goods we buy are produced on borrowed money; the money we buy

them with goes to extinguish the debt;

but it itself is derived from credits that

have been borrowed from the banks, and

consequently its value must reappear in

selling prices somewhere, and be recovered

again from the consumer if the banks are to

be repaid their advances

It is clear therefore one credit is only cancelled with the creation of another and larger credit

In considering the above arguments,

let not the reader allow himself to

become confused by the fact that B has at some previous time been represented

by payments of wages,

salaries, and dividends

While this is of course true, it is irrelevant—it is the rate of flow which

is vital. The whole economic system is in ceaseless motion—purchasing-power is constantly flowing back from individuals

into the credit system from whence it came,

and if the outflow is less than the inflow, someone has to lose purchasing-power”

CH Douglas – credit power and democracy chapter II

https://ia600408.us.archive.org/21/items/cu31924013919968/cu31924013919968.pdf

It is interesting how many engineers gets involved with economic theory, and quickly end up with something that make a lot more empirical sense than the wankery that most economists produce.

I’m not so sure. As John Maynard Keynes once noted:

“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.”

What Keynes said is certainly true in this case with D.H. Douglas, because all Douglas is regurgitating is Keynesian theory, which was in turn predicated on Marxist theory. Here’s how Stephanie Kelton and John Henry explain it:

***quote***

An Alternative Framework: Keynes’ Monetary Production Economy

In a monetary (or capitalist) economy, the proper formulation expressing the exchange relationship is M-C-M’. In this framework, money, not goods of different use values, is the object of exchange. Production is undertaken on the belief that the quantity of money received at the end of the production-exchange process (M’) will be greater than the amount of money advanced at the outset (M). Capitalists borrow to purchase inputs, which are used to produce output, whic h is sold to generate more money. If M’>M, debts can be cleared and the process repeated. As Keynes explains:

The distinction between a co-operative economy and an entrepreneur economy bears some relation to a pregnant observation made by Karl Marx. . . . He pointed out that the nature of production in the actual world is not, as economists seem often to suppose, a case of C-M-C’. . . . That may be the standpoint of the private consumer. But it is not the attitude of business, which is a case of M-C-M’, i.e. of parting with money for commodity. . . in order to obtain more money (Keynes, 1979 [1933], p. 81; emphasis in original).

Thus, in a monetary economy, the economic process is not directed toward the production of products (use values) as in neoclassical theory. Rather, it is the production of profit that is of concern. This requires the exchange of commodities so that the potential income contained in the product can be realized in money form. The economic process starts with debt (money) advanced to labor and the owners of purchased inputs, prior to the creation of output. Use values are then created, but these are useless in themselves to capitalists (or entrepreneurs, in Keynes’ terms). Use values must first be converted into money so that debts can be cleared; these can then be used to satisfy the physical requirements of consumption and further production (capital goods). In a very perceptive analysis of The General Theory, Dudley Dillard observed: “Real goods appear to the individual producer as an artificial form of wealth until they are converted into money which appears as real wealth to the individual producer.” (Dillard, 1954, pp. 28-29).

http://www.cfeps.org/pubs/wp-pdf/WP26-HenryBell.pdf

***end of quote***

As Hannah Arendt notes:

“More recently, his [Marx’s] influence has been frequently denied. That is not, however, because Marx’s thought and the methods he introduced have been abandoned, but rather because they have become so axiomatic that their origin is no longer remembered.

–HANNAH ARENDT, “Karl Marx and the tradition of Western political thought”

“because all Douglas is regurgitating is Keynesian theory”

I don’t think that is accurate, not least because Douglas’ seminal works (Economic Democracy and Credit-Power and Democracy in 1920, followed in 1924 by Social Credit) predate Keyne’; major economic works. I doubt that Douglas read any Keynes before 1920.

There are some similarities between the two approaches but they are by no means equivalent.

Yes , indeed.

@Micheal

There are other mechanisms….

Such as giving equity money back to the people on a equal basis.

It is much more difficult at this time of course as for example the Uk (even in time of Empire was essentially a closed coal / production system with a free trade in agricultural goods) but it needs to be done regardless.

We need a system where domestic goods become cheap again relative to cash flow – then we can subsequently trade on a rational basis.

If we look at the decline of the fishing industry in Ireland – it was much more then about European fishing quotas …..the centralized credit system created more credit for junk leaving less physical surplus for beer.

Irish Guys will not risk their life and limb unless they can enjoy themselves afterwards.

To maintain the industry the poorest people in the world have been drafted into the Irish fishing industry with a Egyptian guy losing his life in west Cork last year.

Money needs to be ripped from the cold dead hands of the banks …be it commercial or central.

The production of simple military fiat will suffice once credit activities are banned..

I think the reason the loanable funds fiction won’t die is because it reflects the everday experience of most people. After all, isn’t loanable funds the way household finance works? State and municipal government in the US works? National finance in the Eurozone works? National finance for those countries that use a currency peg or currency board works?

The reason that the loanable funds fiction is so obdurate is the same reason that the geocentric conception of the cosmos was so obdurate. People could experience with their eyes the sun rising in the east and setting in the west.

It wasn’t until the invention of the telescope and the estabishment of the Archimedean point — that imaginary point somewhere out in outer space from which man could look down on the solar system from afar to see how it really worked — that the critiqe of the geocentric model became palpable. And then it took hundreds of years to finally deubnk the geocentric model.

Can we expect from, lets say, university professors, that they are able to make such a “difficult” and “abstract” distinction like between a household and a sovereign country? With all that math training they have? We should, shouldn’t we?

Or as a popular saying goes: “Maybe they don’t have the wrong models, maybe they are just stupid?”

It is a highly adaptive and deliberately cultivated form of stupidity.

“The human eye is a wonderful device. With a little effort, it can fail to see even the most glaring injustice.” — Quellcrist Falconer

The only time loanable funds makes sense are when they involve the lending of physical objects.

I swear that economic theory is mired with a gold/physical kind of thinking, while most of the economic transactions that happen today are accounting operations.

Economist: A buys from B by making a barter exchange by proxy via the use of tokens (gold, paper, shells, etc).

Real life: A buys from B by telling accountant C to note a transfer from A’s account to B’s account.

One the same process you have lending.

Economist: C loans to A by handing out a stack of tokens.

Real life: C loans to A by noting a transfer to A’s account.

I enjoy your perspective of loanable funds models being analogous to a geocentric model of our universe. In that frame, modern monetary theorists and heterodox economists should be quite glad the Roman Pope is no longer the arbiter of truth (ask Galileo). Along this trail, I also must admit that it is clearly good for the dissemination of heterodox thinking about economics that the current Pope is Francis, not Benedict (read Chapter 4 of his Evangeli Gaudium). While the TV has replaced the podium as societies “font of truth” it is not a bad thing that this pope seeks the truth.

I think it is important, however, to look at how this media, our new priests, has treated heterodox economists. Except for RT News, interviews I have seen of Mr. Keen tend to treat him as odd and his theory as weird. This is the functional equivalent of a priest suggesting a heretic is “not with God”, implying he must be with the other – a danger to society. If Keen is successful in shining a light into Krugman’s eyes, it just might change the playing field. I honestly haven’t a clue how one goes about increasing the intellectual curiosity of MSM, especially a MSM beholden to corporate masters who are benefitting from public ignorance.

I mildly disagree with those who believe we are suffering through a financial crisis. In fact, we are suffering through a crisis of civilization in which power, tightly held by a few, is being used to maintain the ignorance of the masses. The financial crisis is but one of its symptoms. But I digress. Thank God for Yves Smith and friends.

“After all, isn’t loanable funds the way household finance works? ”

Uh, no. No it isn’t. Most household finance is that, financed by credit – borrowing on (hopefully there) future earned cash-money. Most households and individuals operate on credit-money. Don’t believe me? Just cut up your credit cards and operate with just the money in your bank A/C or in your pocket. Checks and debit cards are allowed. See how far you go. No airflights, no rental cars, no house purchases, no large pieces of furniture, etc, etc.

Taking this post in isolation this debate seems to be a distinction without difference.

Keynes says it all when he attributes ‘a change in mood of the market’ as the primary driver of a change in demand. If the there is flat demand for products from consumers, or investment to produce those products from companies who is going to increase levels of debt – however much money is created in the system? This is the story de nos jours.

All Krugman appears to be saying is that debt does not automatically create demand and that there is no model which suggests so. His later post speaks of debt rising at 2% [or 3.6% if you wish] during the years when demand was rising fast despite the inability of wage levels to fuel that demand – an indication of the mood of the market.

Show me your model where creating money invariably increases demand with no corresponding change in mood of the market or I will believe that this essentially a ‘fake’ debate.

In all curiosity. JB.

You should read the quotations again. Krugman is clearly stating that increasing aggregate demand via debt is not possible, as one person’s spending is another’s saving. He’s still partially stuck in a 19th Century banking model.

Have you heard the old joke that an economist is someone who, seeing that something works in practice, then says “Ah! But does it work in theory?”. I’m not going to pull that swifty here..

Pity, because although a joke I think it brilliantly captures so much of what is wrong with the social sciences. Then they wonder why reality so often stubornly refuses to conform to the predictions of their models. Often this ends with the conclusion that the model functions fine so there must be something wrong with reality.

The loanable funds fallacy is a case in point: empirical evidence indicates transfering money from savers to borrowers increases aggregate demand. A scientist would say “given the empirical evidence, what theory is adequate to explain the phenomenon?” An economist on the other hand says “Since saving and borrowing are an identity the net effect has to be zero. Given that the theory is sound, the empirical evidence is irrelevant”.

Then he writes a paper applying the mathematical concept of identity to saving and borrowing, and is then satisfied that the matter has been settled. The fact that mathematics cannot independently validate a conclusion that was assumed from the premise never enters into it. The important thing is that we kept the theory pure and didn’t sully ourselves by deigning to understand how real economies work.

Lexington said:

“I think it brilliantly captures so much of what is wrong with the social sciences. Then they wonder why reality so often stubornly refuses to conform to the predictions of their models. Often this ends with the conclusion that the model functions fine so there must be something wrong with reality.”

Keynes made the same observation about classical economists:

“The classical theorists resemble Euclidean geometers in a non-Euclidean world who, discovering that in experience straight lines apparently parallel often meet, rebuke the lines for not keeping straight—as the only remedy for the unfortunate collisions which are occurring. Yet, in truth, there is no remedy except to thro over the axiom of parallels and to work out a non-Euclidean geometry.

–JOHN MAYNARD KEYES, The General Theory

Well, it just so happens that I’ve finally gotten around to reading Michael Hudson’s “The Bubble and Beyond,” and if anything jumps out at the reader in the early going it is that 70% of bank loans are going for real estate lending and Hudson places great stress on how “unproductive” that usually is; it is not going into creating new production facilities which would have a greater impact on the economy and physical output. Hudson then reminds us that the real estate industry has lobbied successfully to transfer taxes off their backs and onto others less able to defend themselves, which, when combined with capital gains, means that an enormous amount of what goes for vigorous economic activity in “equations” isn’t all that productive. Movement and motion for essentially a modern version of “rent extraction” and tax farming. Anyone who reads Hudson’s shorter postings knows that he has even more precise and colorful ways of describing this. But the broad battleground he frames up will unleash long arguments over what is, and isn’t productive investing, and how differences get translated in mathematical models.

Put Hudson’s views together with those of historian James Livingston in his recent book “Against Thrift” – that the tax breaks the “producers” are always arguing for so that they can make productive investments are incentives that are really not needed at all: since 1919 or thereabouts, net capital investment has not grown but productivity has, through the tax mechanisms of depreciation and the physical replacement of equipment, which, as we know from computers, have grown in power and productivity every few years. So mere physical replacement by the current state of the art improves productivity. Of course, as Krugman is vastly dismissive of even his close professional peers much of the time, Livingston, who is not an economist but a historian interested in economic history (he has, though, a wonkish Appendix in this book entitled “Capital in the American Economy: Kuznets Revisited”) is not going to be on his radar screen.

And as I’ve been thinking about Hudson’s work, and Keen’s posting above, lets not forget some of the broader ideas that got us to an intense focus on just what “financialization” of the economy means. And those would be the phases of capitalism, from the industrial to post-industrial economy to the service and FIRE economy…but the old traditional “production facilities” didn’t just disappear: they migrated abroad, aided and abetted by you know who…this vastly complicates the equation and the accounting flows…But the broader point is the acceptance of these evolutionary stages as natural may have encouraged some very perilous macro directions that, as Hudson maintains, are not equally productive investments, no matter how they have been “equated” in the equations…

I well recall Krugman’s attack on Bill Greider’s book, “One World Ready or Not,” – how could a mere journalist, with his interviews and travels – but no models – understand what was really going on. Of course Greider made the historical economic point: no great economic power in history has survived the transfer of its focus from production to financialization (Kevin Phillips repeated this warning and observation) and maintained its power…

Now the pros can go at it and pick this over.

Steve Keen once called Michael Hudson a classical economist with a Marxist influence.

Every day that goes by my own thinking comes closer to that of Hudson than that of the MMTers and MCTers (e.g., Steve Keen) who operate more in the tradition of Keynes (Steve Keen, “MMT-MCT Fields Institute Seminar” http://www.youtube.com/watch?v=pOxZixjorho ). It seems to me that at this point in history, a more radical approach (e.g., Marx, Veblen) is needed. It may very well be that a more radical tradition will never prevail, but I see it as being necessary to pull the Overton window back in the other direction, kind of like the good-cop bad-cop dynamic of, for instance, Martin Luther King and Malcolm X.

More populist thinkers like Kevin Phillips and John Kenneth Galbraith begin the clock on financial capitalism not with the industrial revolution and the advent of British industrial capitalism, but with the advent of mercantile capitalism in the 16th century.

As Benjamin Kunkel points out, one of the most recent contributions in this field is from Giovanni Arrighi:

***begin quote***

In his final book, Adam Smith in Beijing (2007), the late Giovanni Arrighi expanded on Harvey’s concepts of the spatial fix and the switching crisis to survey half a millennium of capitalist development and to peer into a new, probably Chinese century. In Arrighi’s scheme of capitalist history, there had been four ‘systemic cycles of accumulation’, each lasting roughly a century and each organised on a larger scale than the one before, with a new polity at the centre: a Genoese-Iberian cycle; a Dutch cycle; a British cycle; and an American one. A systemic cycle’s first phase, of material expansion, came to an end when the central power had accumulated more capital than established trade and production could absorb. This was followed by a second, financial phase of expansion in which capital overaccumulated at the centre of the system promoted a new nucleus of growth. Ultimately the rising centre came to finance the expenditures, often on war, that the old and now declining centre could no longer cover out of its mere income.

It fits Arrighi’s scheme that the US, having (along with the Chinese diaspora) once led international capital onto the Asian mainland, had now become dependent on Chinese credit. For him, this announced the greatest switching crisis of all time, as China prepared to assume the hegemonic role being reluctantly relinquished by the US, and to inaugurate a new cycle of accumulation.

http://www.lrb.co.uk/v33/n03/benjamin-kunkel/how-much-is-too-much

***end of quote***

Kunkel also explains David Harvey’s theory regarding why financialization almost always results in real estate bubbles:

***begin quote***

The real originality of The Limits to Capital, however, is to add a new geographical dimension to crisis formation. Harvey goes about this via a theory of rent. One effect of the approach is to suggest why property speculation – with its value ultimately tied up in potential rental income – should be such a familiar capitalist perversion (in the psychoanalytic sense of overinvestment in one kind of object). Another is to convert an apparent embarrassment for Marxian theory into a show of strength. The would-be embarrassment lies in the evident difficulty of reconciling a labour theory of value with the price of unimproved land, given that land is obviously not a product of human labour. Harvey’s bold and ingenious solution is to propose that, under capitalism, ground rent – or the proportion of property value attributable to mere location, rather than to anything built or cultivated on the land – becomes a ‘pure financial asset’. Ground rent, in other words, is a form of fictitious capital, or value created in anticipation of future commodity production: ‘Like all such forms of fictitious capital, what is traded is a claim on future revenues, which means a claim on future profits from the use of the land or, more directly, a claim on future labour.’

I just got off an e-meeting with Steve and Dirk. We ended by discussing the political CONCLUSION of Steve’s model, which I think should be the lead-in to any discussion because it really shows how difference Steve’s Minsky model is from the loanable funds model.

The difference is endogenous money creation is endogenous DEBT creation — leading to a debt overload as a result of the magic of compound interest coupled with an increasingly reckless bank lending. The financial system becomes increasingly debt-leveraged and hence unstable.

The ONLY way to resolve this — unless the economy is to sink into depression — is a debt writedown.

In the loanable funds doctrine, the solution is to make yet MORE loans, as if lending is spent on real GDP — whereas in practice banks simply recycle their debt service into lending yet MORE against the economy’s assets, NOT to create new capital investment and employment.

We all agreed on the need to juxtapose this endogenous debt/money creation model to Larry Summers’ urging of negative interest rates to load the economy even further into debt. So the politics of Steve’s model end up being diametrically opposed to those of the LF model.

I think the Minskyan/Keen/MMT pictures also have something to say about preventing crises in the first place. You can’t get prudent and restrained lending by managing the monetary base, contrary to what many mainstream economists have thought. And you probably can’t even do it by managing the policy interest rate – other than by the crude, brute force/recession-inducing barbarism of Volcker jacking the Fed Funds rate up to 20%, which is sort of like pulling the parking brake on the highway.

To preserve financial stability you need more hands-on microprudential regulation of credit instruments themselves, restrictions on the ability to offload risk, and effective punishment of those who violate the regulations.

Also, I think it is important not to focus to closely on “money” and its creation as the be-all and end-all of financial stability. Tradable credit instruments of many different kinds exist in our economy, and there is no sharp distinction between the ones that are money and the ones that are not. Financial instability comes from the natural proclivity of human beings to make promises that they might not be able to keep when the wants of the present overwhelm the prospects for the future, to accept promises that might not be kept when the profits promised are very high, and to tolerate higher and higher levels of risk as confidence grows and as “everyone else is doing it”. The phenomenona of credit and debt are pervasive features of modern life and must be well-regulated given the limits on human intelligence, rationality, honesty and emotional stability. These phenomena can’t be regulated via some special “money” channel alone.

I agree completely, with the exception of one quibble, and that is where you say:

“I think the Minskyan/Keen/MMT pictures also have something to say about preventing crises in the first place.”

My quibble is that this line of thought pre-dates Minsky. Keynes, for instance, called Fisher the “great-grandparent” of his own theories on how monetary forces influenced the real economy ( http://www.economist.com/node/13104022 ).

Here’s Fisher:

“I venture the opinion, subject to correction on submission of future evidence, that, in the great booms and depressions, each of the above-named factors has played a subordinate role as compared with two dominant factors, namely over-indebtedness to start with and deflation following soon after; also that where any of the other factors do become conspicuous, they are often merely effects or symptoms of these two. In short, the big bad actors are debt disturbances and pricelevel disturbances.”

–IRVING FISHER, “The Debt-deflation Theory of Great Depressions,” 1933

Yanis Varoufakis made the claim that “Keynes’ gem of a ‘discovery’ about capitalism” was that the economy “could fall into one of these terrible equilibria at the drop of a hat, unpredictably, without rhyme or reason, just because a significant portion of capitalists feared that it may do so.” ( http://www.nakedcapitalism.com/2013/12/yanis-varoufakis-confessions-erratic-marxist-midst-repugnant-eurozone-crisis.html ) Varoufakis’s claim is terribly ill-informed.

We all agreed on the need to juxtapose this endogenous debt/money creation model to Larry Summers’ urging of negative interest rates to load the economy even further into debt. So the politics of Steve’s model end up being diametrically opposed to those of the LF model.

Yeah, the mainstream approach since 2009 has been focused on re-inflating credit. That’s because they are generally unwilling to contemplate the kinds of redistribute and government-centric policies that would probably be needed to drive a savings-led expansion. And its been extremely hard to get through to them on the idea that any monetary-driven expansion that doesn’t expand credit has to go through the fiscal policy branches of government, not the central bank.

Exactly!

Except what’s that Upton Sinclair quote?

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.’

The ONLY way to resolve this — unless the economy is to sink into depression — is a debt writedown. Michael Hudson

How can you know Steve Keen and say that? His a “A Modern Debt Jubilee” recommends the distribution of new fiat to the entire population:

A Modern Jubilee would create fiat money in the same way as with Quantitative Easing, but would direct that money to the bank accounts of the public with the requirement that the first use of this money would be to reduce debt. Debtors whose debt exceeded their injection would have their debt reduced but not eliminated, while at the other extreme, recipients with no debt would receive a cash injection into their deposit accounts.

The broad effects of a Modern Jubilee would be:

1. Debtors would have their debt level reduced;

2. Non-debtors would receive a cash injection;

3. The value of bank assets would remain constant, but the distribution would alter with

4. debt-instruments declining in value and cash assets rising;

5. Bank income would fall, since debt is an income-earning asset for a bank while cash reserves are not;

6. The income flows to asset-backed securities would fall, since a substantial proportion of the debt backing such securities would be paid off; and

7. Members of the public (both individuals and corporations) who owned asset-backed-securities would have increased cash holdings out of which they could spend in lieu of the income stream from ABS’s on which they were previously dependent.

Clearly there are numerous complex issues to be considered in such a policy: the scale of money creation needed to have a significant positive impact (without excessive negative effects—there will obviously be such effects, but their importance should be judged against the alternative of continued deleveraging); the mechanics of the money creation process itself (which could replicate those of Quantitative Easing, but may also require changes to the legal prohibition of Reserve Banks from buying government bonds directly from the Treasury); the basis on which the funds would be distributed to the public; managing bank liquidity problems (since though banks would not be made insolvent by such a policy, they would suffer significant drops in their income streams); and ensuring that the program did not simply start another asset bubble. from http://www.debtdeflation.com/blogs/manifesto/

Moreover, the distribution of new fiat could be neutral wrt to changes in the money supply IF it were combined with a temporary ban on new credit creation and metered to just replace existing credit debt as it is repaid. The distribution (and new credit ban) could and should continue at least until all deposits are 100% backed by reserves.

Look. Let’s not make a solution politically unfeasible (not to mention unjust) by ignoring non-debtors.

Ya indeed, the way I put this in a comment on a different post not too long ago, was that the problem was the overall ratio of Money:Debt, and the fact that Debt inherently grows faster than Money (when you create new Money, you create new Debt on a 1:1 basis due to bank loans – and of course, Debt carries interest), which becomes increasingly unsustainable as debt (and interest payments) grow far beyond Money.

So, when you just look at the ratio Money:Debt there are two ways to resolve this:

1: Increase Money without increasing Debt (this can only be done through government spending – which can include a debt-jubilee handing out money to everybody, as you note, and/or a Job Guarantee)

2: Decrease Debt (writedowns without a jubilee)

Kindly look at China where banks are lending/investing on the order or 3.5 TRILLION rmb a month.

@F beard

Hudson wants to maintain the centralization of money ……..this is very sad but predictable.

Consumption will remained centralized it seems.

Thank you for this post. It is easy to understand Steve Keen and it clarified my confusion about Krugman not acknowledging public debt as a driver of the economy. Krugman really thinks that if debt reduction also reduces GDP/interest that it doesn’t work in reverse? Even I can get a handle on that. Thanks for the recap too. I imprinted on the blurb about how (in an ordinary bubble) only “transformational technology” has the potential to revive a new economy. That loanable funds are not productive funds raises the question about the direction of fiscal policy. We are at the end of an era. What we need is a phase change from growth capitalism, which is dead, to some sort of specialty capitalism so we invest in things that are crucial to humanity. And conservative policy in that sense. But liberal in an equity sense. And as such the investments cannot be financialized. Necessity isn’t just the mother of invention – it is also the mother of economics.

But liberal in an equity sense. Sto

You mean like using common stock (shares in Equity) as private money? And abolishing the pet counterfeiting cartel of the rich, the government-backed banking system?

my reply got posted at the bottom

Here in the US, we are mourning the centennial of the creation of the federal reserve and the 100 year trial of debt based money…These are the fruits of that vine.

We are in need of a “public monetary system”,

another couple of cents on the krugman/summers negative intrest rate ballons that have been floated…in recognition of a broken system,

@ economicstability.org /youtube “krugman and summers get an “F””

http://www.youtube.com/watch?v=IvDkvN0xMrs&feature=c4-overview&list=UU7FgKsc9xDhu7I9hmEVmdtQ

I don’t want to make anybody mad, and remember I’m a Certified Mental Healthcare Professional so I say this with therapeutic concern — but economics is a mental disorder. So arguing about whether it should be one way or the other way is just a symptom of the disease.

Does Professer Krugman get royalites every time his name is mentioned? If he does, he may end up with all the loanable funds on the planet, and then we’d find out if he’ll lend any or even if we need him at all. That would be an empirical study. hahah

You shouldn’t pay any attention to them, craazyman. It just encourages them.

so true. they’re the crazy ones and guys like us, we’re completely sane because we understand that reality is a composition of both Quantity and Form. :)

Anyway, they’re like the monkeys screeching in a cage. Throwing them a banana is a guilty pleasure. But sometimes your arm just moves by itself.

I wonder what it’s called when economists argue forever over a 100 year old theory and one group takes the position that the theory is correct because it’s part correct and the other group takes the position that the theory is incorrect because it’s part incorrect. And the argument just continues.

Is it some sort of compulsive disorder?

Then sometimes I think it might be employment. That’s when I get depressed.

I don’t know… It seems to me that if it hurts people who have worked to save money and put that money in the bank, then it cannot help the economy.

Whatever else all the free money that the Fed gives to banks has done, it has sure hurt regular savers

Saving is not the Biblical ideal; investment is. See Mathew 25:14-30.

That said, savers should not lose purchasing power (other than risk-free storage and transaction costs (past normal household limits on account size and number of transactions) and a hoarding penalty for excessive saving beyond legitimate liquidity needs if the saver is wealthy) but they should certainly not gain purchasing power by doing nothing risk-free.

Our money system is truly a moral nightmare but what can one expect from a heavily privileged usury for stolen purchasing power cartel that very many famous men and the world’s major religions have condemned?

Maybe. But I’m not sure that much private enterprise will be a good thing.

My reply to Beard.

Without the counterfeiting cartel, corporations would be broadly owned and thus broadly representative of the population.

Look. We risk boring God with our endless oscillation between fascism and socialism. How can people possibly believe that ethics and money creation are not compatible? The battle over who gets to create money is centuries if not thousands of years old. The answer is obvious from Mathew 22:16-22: Coexisting government and private money supplies.

Counterfeiting cartel = Austrian gold bug hangover.

“corporations would be broadly owned and thus broadly representative of the population.” – beard

Skip… That smells like the all huge theocracy based Orgs, 5000 years of fail imo. BTW if the answer[s is some human centric mythology from antiquity, absolutely no in my book.

skippy… I’ll take socialism over this fundamentalism mess or the ones preceding it – any day – over theocracy.

The Austrians can eat my shorts but only an idiot would fail to see that unethical purchasing power creation = counterfeiting. Are you that idiot?

I’ve never been a gold-bug except for a short-time when I considered it as a starting point in my study of money and banking. I’ve long since rejected gold as money as stupid, environmentally destructive, idolatry, and fascist if government is involved.

Yes, my ideas on money come from the Bible and they easily top the best you Progressives have come up with and the Austrians too. You should wonder at that. And Steve Keen’s “A Modern Debt Jubilee”? Independently arrived at by me from ethical considerations.

The irony is that I have hope of being Raptured out of this mess so why should I care? If everyone was like you, skippy, I might not.

Here’s the thing you should worry about:

But they have done this to fulfill the word that is written in their Law, ‘They hated Me without a cause.’ John 15:25

Well you have the same rhetorical mouth as they do, label others and then point at it i.e. progressives et al. Especially when I’ve made it a point that I don’t do ism and ologys, years ago, since everything is a case by case observation and subject to new data.

“my ideas on money come from the Bible” – ergo from thousands of years ago mythology and not present observations. Why don’t you include all the – data – rather than pick a ideological biased starting point [massive blind spot].

The sin of hating without a cause and first temple was destroyed[?]… There’s that prevailing pathology again… everyone hates me – us… for my – our beliefs… by which everyone – thing else is observed…. ***without self introspection first*** Man what a head job.

John 15:25 Cross References

Luke 24:44

Then he said to them, “These are my words that I spoke to you while I was still with you, that everything written about me in the Law of Moses and the Prophets and the Psalms must be fulfilled.”

Psalms Origins

The composition of the psalms spans at least five centuries, from Psalm 29, which is adapted from early Canaanite worship, to others which are clearly from the post-Exilic period.

Canaanite religion is the name for the group of Ancient Semitic religions practiced by the Canaanites living in the ancient Levant from at least the early Bronze Age through the first centuries of the Common Era. Canaanite religion was polytheistic, and in some cases monolatristic.

Ancient Semitic religion encompasses the polytheistic religions of the Semitic speaking peoples of the ancient Near East and Northeast Africa. Its origins are intertwined with Mesopotamian mythology. As Semitic itself is a rough, categorical term (when referring to cultures, not languages), the definitive bounds of the term “ancient Semitic religion” are only approximate.

These traditions, and their pantheons, fall into regional categories: Canaanite religions of the Levant, Assyro-Babylonian religion influenced by Sumerian tradition, and Pre-Islamic Arabian polytheism. There is also a possible transition of Semitic polytheism into Abrahamic monotheism, by way of the god El, a word for “god” in Hebrew and cognate to Islam’s Allah.

Skippy… So as you can see, “I do have a problem” – with you – pointing that mental bias at me or anything else. In your jargon – you can own it – but don’t try and make ***me a slave to it*** or you will incur my wrath, for a reason and not some hate out of nowhere shtick.

I do wonder at you. The Austrians hate me (or at least should) yet according to you I’m a crypto-Austrian with sinister motives. To my knowledge, I’m not. In fact, I’m to the Left of you since:

1) I advocate land reform.

2) I advocate a universal bailout with new fiat.

3) I advocate the redistribution of the common stock of all large corporations.

BUT since I also advocate that private money creation be decentralized and ethical, I’m the enemy?

I could diagnose you as paranoid or at least insecure. But why not, your own worldview is depressingly bleak.

Please stop running around in circles.

Two simple questions to clarify your position.

1. are you an Anarcho libertarian capitalist

2. do you believe in praxeology or any other synthetic a priori by which you view human nature.

3. do you still hold any of the core tenants of Austrian or neoclassical theory valid and why.

4. if humanity does not abide by your mythology, we should all die, and let your creator arbitrate the P/L of that event.

skippy… simple straight forward questions beardo… BTW no using scripture… in your own own please.

I take your lack of engagement as a yes then, as you don’t want to avail your true position, debating honesty.

skippy… is deception a core feature in your mythology.

Actually no. I believe the truth will set one free (John 8:31-32). (Btw, God may use evil spirits to do His dirty work with regard to deception. See: 1 Kings 22:20-23)

And ALL liars will be thrown into the Lake of Fire, a fate I fervently hope to avoid.

All of this seems a bit theological to me. The real question is does any of this produce a society that we want to live in. You see “demand” is a flawed concept because it is not an end in itself. What we want is a better, fairer, more decent society. Demand only has some meaning in so far as it helps get us there.

The same is true if we reformulate “demand” as use of resources. It is not the increased call on those resources that gets us where we want to go but how they are used and distributed. Distribution is key and is ignored by both Keen and Krugman. The extreme wealth inequality we see today is the result of resources not going where they need to go and not being used to create the society we want.

You see fundamental errors are being committed here. Both Keen and Krugman assume an economy that is fundamentally sound. But extreme wealth inequality belies this assumption. And the underlying reason for it, looting, blows it completely out of the water. If Apple borrows to pay bonuses to its C level execs, debt increases but demand does not. If the rich and the corporations they control leverage their stakes in equity bubbles, debt is increased but demand is not.

Beyond this, the problem is not just whether Krugman still holds to his belief in the loanable funds model but whether he, and Keen, understand the problem of interest. A loan is not a balanced transaction. While a borrower takes out a loan for X amount, they must repay X + Y, Y being the interest. That Y does not cancel out because it keeps going to the same people, the rich. That is interest is a net transfer of wealth upwards. Even in a non-kleptocratic environment, this would be the case, and would need to be dealt with through some combination of taxation of the rich, injections of money by government to borrowers, and manipulation of interest rates to keep them as low as possible.

Now the rich effectively already have access to all these means. So debt means something entirely different to them than it does to us, and it operates differently for them.

Well Hugh… The ideologues have “human nature” all sorted out – ex nihilo – hundreds (more like thousands) of years ago, its the gift that keeps on giving… eh.

skippy… personally I becoming to loath PIE and Cake… full of sugar…

@Skippy

F Beard was NEVER a gold bug as far as I am aware of.

The argument is one of centralization of money (which socialism is in on in a big way) and distribution of real equity money to the bottom of the Pyramid rather then taking management decisions on consumption as the giving of credit via banks is a top down affair…..therefore the bank decides on what to and who will consume rather then a Industrialist making for a real demand signal.

Most economists look at the big picture without seeing what the credit money does on a micro scale.

If we take a look at the decline of fishing in Ireland it is not only because of destructive European fishing legislation which is another top down and more direct form of scarcity management. (they throw away much of the fish overboard)

No Irish lads have left the industry – not because they have got soft but because they cannot afford to buy beer with their wages.

Capital is destroyed (via the credit process) before they can directly consume.

Beer therefore becomes expensive relative to cash flow.

And Irish lads will not risk life and limb for no beer.

In many cases irish crew have been replaced by all types of nationalities but generally from the poorest countries such as Egypt or Philippines now.

In many cases what remains of the irish fishing industry has now become much like the international shipping industry – as there is no law other then from faceless executives and no fiat king the society reaches for the bottom.

The Euro especially is a form of giant entropy engine in this regard and indeed in all matters.

We are witnessing a total destruction of societies so as to extract a short term yield.

The more competitive you are the shorter your half life.

http://www.youtube.com/watch?v=10_UiB12uP4

Bankers are doing this with very clear cold and dead eyes.

They know exactly what they are doing.

Creating extreme scarcity in local areas to drive pointless (for most) trade.

What people don’t get from the GDP figures is the Irish local and national economy no longer exists – we are their perfect model but yet our masters want more.

As people don’t understand the system they accept when a scientist tells them – to throw dead fish back into the sea as the top men know what they are doing…….

The system always rots from the head down.

“F Beard was NEVER a gold bug as far as I am aware of.” – Cork

Incorrect – Beard is an ex Ludwig von Mises Austrian neoliberal that claims they read – interpreted the bible wrong WRT to some fundamental core tenants i.e. money. Otherwise he would still be in the fold. Typical theological fracturing imo. Ownership of some inanimate object is the underlining premises of all this rot, providing the individual cognitive bias ergo “I” before “WE” (Royal WE meaning all life and that which enables it).

As far as the rest of your comment goes, especially entropy, I concur, as myself has commented the same in the past. The scientist trope although is my only disagreement, science is not the source of agency, the agency is an ideology born of mythology and fleshed out with a reductionist numerology i.e. GDP, consumer, P/L, ignored externalities, et al. The banking system is just one component of a much larger corporate – propertarian relationship. To highlight this one piece, out of a whole, is disingenuous. If you remove [banks] the relationship between other agents still mirrors this action through contracts and basic incentive, does nothing to address the fundamental issues save lessening the friction between contracts.

Skippy… Beard and a few others are smelling more and more like anarcho libertarian capitalists… Which are quite fond of blaming the tool and not the human [agency] – its an old ploy… its the left hands fault… the commies… the socialists… the poor… the entitlement mobs… everything save the agency its self… extremely pathological imo.

Just a few of the ways I differ from the Austrians:

1) They follow Mises, an agnostic Jew, I follow, along with the rest of the prophets, Moses, a believing Hebrew.

2) They love deflation – to purge the “malinvestments”; I see deflation as just as bad as inflation if not far worse.

3) They refuse to consider restitution for the population while I embrace Steve Keen’s a Modern Debt Jubilee (but more radically than Steve).

4) They love commodity monies which are silly since if used as a commodity they cease to be money and vice versa.

5) They laugh at the idea of common stock as private money but cannot refute it.

As for Progressives, they insist that money must be debt while I’ve proved that it need not be. It seems they are adverse to sharing too.

It’s too bad I’ve poisoned the pill of monetary reform with the Old Testament but I refuse to plagiarize God and besides it’s amusing to see you Progressives choke on it while you flaunt your advocacy of the right to commit sodomy in public*.

Oh, and I used to be a Progressive before I was an Austrian but apparently I can still learn, as the Bible predicts for those who read it.

* On the evidence of two witnesses or three witnesses, he who is to die shall be put to death; he shall not be put to death on the evidence of one witness. Deuteronomy 17:6

“A single witness shall not rise up against a man on account of any iniquity or any sin which he has committed; on the evidence of two or three witnesses a matter shall be confirmed.” Deuteronomy 19:15

Anarcho libertarian capitalist was not addressed for some reason or not.

“besides it’s amusing to see you Progressives choke on it while you flaunt your advocacy of the right to commit sodomy in public*.” – FYI again – don’t label me in order to paint me with your filth.

Myself is only human – a human animal that wants to learn and not have his head filled with opinions from antiquity, which are dressed up as irrefutable fact[s… cough… what the Austrians and neo-classical’s try to do with ex nihilo – synthetic a priori.

Skippy… do you praxeology still?

don’t label me in order to paint me with your filth. skippy

So you’re against that alleged right? Or do you not have the guts to admit that?

But I will label you: You seem to be a hard leftist who’d make life a living hell for everyone who disagreed.

In my case, I’m willing to live and let live or in your case live and let die since you refuse life.

Ok… so I take it that by omission that your an Anarcho Libertarian Capitalist (gang rule sort [DOR]) and you “believe” in Praxeology still.

In Econned jargon I would better viewed as a Carrying Capacity Heterodox Post Keynesian w/heavy MMT slant – would be a better Nom than hard leftist, but, you can’t help taking the rhetorical victims stance in leu of a factual argument.

“So you’re against that alleged right? Or do you not have the guts to admit that? – beard

skip here – what bloody rights are you foaming on about, there was no inference of of rights in my comment, save your constant need to libel and slander for lack of argument. The same shtick you use against other religions and those so called foreigners aka aliens, live and let live my backside.

Skippy… when you are ready we can debate the core tenets like prax and human nature, the rest is just a fog of deception.

@Skippy

looking at your writings you seem to be smoking stronger stuff then what I am smoking.

@F. Beard

looking at it now – I have to admit you have been right about most things.

Its great that you have kept plugging along all these years.

You are a true trooper.

PS wage deflation is not just as bad as inflation – in fact its the same thingy.

Good luck

But the world of real people is running out of time.

“The music business is a cruel and shallow money trench, a long plastic hallway where thieves and pimps run free, and good men die like dogs. There’s also a negative side.”

Hunter S Thompson.

Well if we were on a FB economics page you just hit the ideological like button Dork, quite droll imo.

Why don’t you attempt to provided some granularity in your opinion rather than resort to back slapping and halo hanging.

skippy… btw what is your economics theory brand?

@Dork: backhanded compliments to both sides puts you in a no-man’s land.

Anyone that follows NC closely can sense the progressive – libertarian tensions. While both groups share similar concerns over government-corporate collusion (tyranny crimps one’s freedoms), some libertarians on NC are not forthright. They slyly present a libertarian viewpoint using various devices but, when challenged, they don’t want to talk about libertarianism or how such view might contribute to the problems we face today.

Skippy is right to call out this behavior:

Beard and a few others are smelling more and more like anarcho libertarian capitalists… Which are quite fond of blaming the tool and not the human [agency] – its an old ploy… its the left hands fault… the commies… the socialists… the poor… the entitlement mobs… everything save the agency its self… extremely pathological imo.

@Skippy

My theory is that most of us are f$£ked

This is how modern capitalism formed.

Mercator by Nick Crane

Chapter 1 :A little town called Gangelt

“In Gangelt they were locked into the fate of the peasant, who was currently enduring rural Europe transition from an ancient feudal system to a money economy ,where the freedom to work for a wage came at the cost of dispossession from the land , as owners consolidated their estates for commercial production”

The rising prices of farm produce benefited the large farmers and estate owners,but crippled the peasants who were forced to work more ,for lower wages for crops that were not theirs.

As larger farms became more viable ,the ancient privileges which gave peasants the wherewithal to live off the land was eroded.

A new term emerged ,”roboten” , meaning drudge ,toil ,fag , sweat.

The peasant became a wage slave ,a Robot.

@jackrabbit

I can see the advantages of centralization (socialism) as I have always liked France but after a recent trip there I have become more libertarian in my views.

As the country of central planning is failing.

I am not against Industry (production) as such & indeed some dirigisme but the consumption of basic goods needs to become democratic again if the west(whatever that is ??) is to regain its dynamism and spiritual center,

In practice – this means equity money needs to get into the hands of the Roboten

@Dork – I feel where your coming from, especially after the last 40ish years but, liberalism is a theory that got over cooked. To the point that anything not pure in its expectations was some form of evil incarnate. See Beard and his incessant and constant fear, all dripping with some envisioned claustrophobic pit for him and his. A vision embraced through endless repetitive readings and confirmation by fellow travelers. So moribund is this patient deepening stupor that they have all ready committed themselves to this pit, seeking only the event horizon to claim its truth. Till then, it is only a matter of personal enjoyment to pass the time. A bi polar like state of seeking happiness whilst waiting for the epic event of all events.

Although it seems some are still not aware that we are all on one planet and not Mercator 2d maps. That there are systems upon systems to numerous to count, out side the reductionist metrics employed today. Herein lies my rub with libertarianism, of any stripe – by which correlation does this theory, which proclaims “natural value”, find its validity in any other system on this orb. Why is it the libertarian in the room is always the loudest and most boisterous proclaimers of natural truth, in a exceedingly authoritarian manner, contrary to the theory’s basic premiss… eh.

Skippy…. @Dork of Cork… maybe when we stop labeling our selves or others… stop making stuff up… we can start to live as humans… on the only home we have…

PS. market imperialism is a direct result of Locke imo… that the mind is a blank slate or tabula rasa is not holding up under new data and numbers can not quantify reality even if a black hole was deployed… to power that calculation.

Lets not forget whom we are dealing with and the forces that molded him…

Religious beliefs

Some scholars have seen Locke’s political convictions as deriving from his religious beliefs.[48][49][50] Locke’s religious trajectory began in Calvinist trinitarianism, but by the time of the Reflections (1695) Locke was advocating not just Socinian views on tolerance but also Socinian Christology; with veiled denial of the pre-existence of Christ.[51] However Wainwright (1987) notes that in the posthumously published Paraphrase (1707) Locke’s interpretation of one verse, Ephesians 1:10, is markedly different from that of Socinians like Biddle, and may indicate that near the end of his life Locke returned nearer to an Arian position.[52]