By Philip Arestis, Director of Research at the Cambridge Centre for Economic & Public Policy at the University of Cambridge, UK, and Professor of Economics at the University of the Basque Country, Spain and Malcolm Sawyer, Professor of Economics, University of Leeds, UK, and Managing editor International Review of Applied Economics. Originally posted at Triple Crisis

In the immediate aftermath of the financial crisis, most European governments allowed the automatic stabilisers to kick in and implemented some mild discretionary measures, despite the strictures of the Stability and Growth Pact (SGP). But it was not long before the siren calls for “fiscal consolidation” arose, spurred on by spurious claims of “expansionary fiscal consolidation” and the now discredited claims that debt ratios threatened the economy. This has been followed by claims that it was failures to constrain budget deficits in the mid 2000s, which were to blame for the debt crisis and which placed limits on the ability of governments to respond to the Great Recession. Within the eurozone, fingers were pointed at the failures of the SGP, which had been intended to keep national budget deficits below 3% of GDP at all times, to have budgets which balanced over the business cycle, and to keep debt-to-GDP ratios below 60%. In the years 2002 to 2007, budget deficits averaged around 2% of GDP, the 3% limit was breached on numerous occasions, and, even in 2007, seven countries (of the then 12 members) had debt ratios of over 60%.

The SGP was slightly modified in 2005—though not to any great effect. The budget deficit conditions had been broken in 2004, when France and Germany broke the 3% limit without penalty and then Portugal broke the limit and was punished. But countries persisted in breaking the terms of the SGP (and the debt ratio was persistently breached). In light of these experiences, the European leaders decided at meeting in December 8-9, 2011, to adopt tighter rules on budget deficits and stricter enforcement of those rules. The “fiscal compact” rules are now embedded in the inter-government Treaty on Stability, Coordination and Governance, with the budget rules written into national constitutions or equivalent. The deficit rule becomes “balanced structural budget,” that is, a budget which is balanced (actually less than 0.5%of GDP) when the economy is operating at potential output—alternatively expressed as a zero output gap. There is a further deflationary twist with the addition of “excess deficit procedure” to force governments with debt ratios of over 60% to run surpluses. There is a requirement for the submission of national budgets to the European Commission, which will have the power to request that they be revised. The underlying rationale appears to be that governments are profligate, running deficits for the hell of it, and have to be contained. But there is a quite different reason—governments often run budget deficits because they have to secure a reasonable level of demand. This is not the case for all governments, but it is for the majority. If budget deficits came from government profligacy it would be observed that the private sector was being “crowded out” and the economy overheating. There was precious little evidence of that.

Clearly, this treaty reflects the notion that the euro crisis was due to fiscal indiscipline; consequently, more discipline is the only solution. Such a principle is clearly misleading. There is no justification for a balanced budget requirement, which poses restrictions in the use of fiscal policy in the face of economic crises. There are already signs that countries are not able to meet the targets set to move towards the limits of the “fiscal compact.”

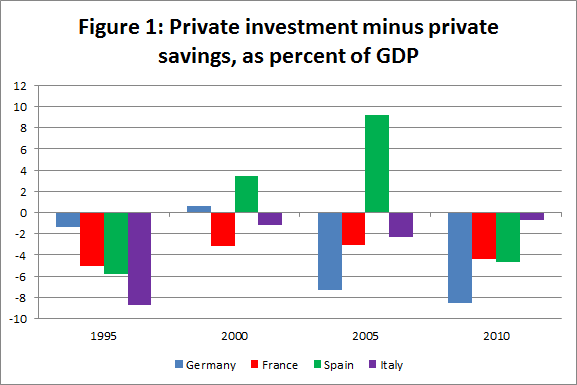

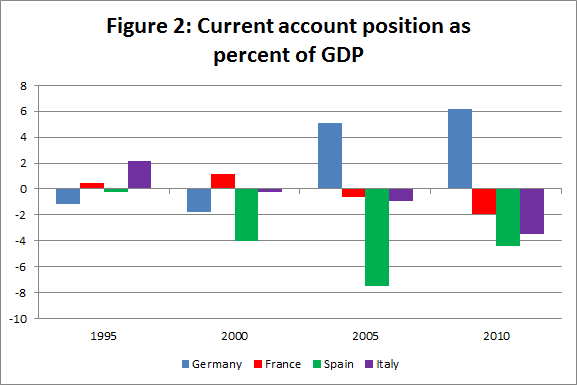

Countries differ substantially in terms of their balance between private savings and private investment (see Figure 1) and their current account position (see Figure 2). There is a basic requirement that: budget position + private investment – private savings + current account position sum to zero. If the second and third differ across countries, then necessarily the budget position must differ. It does not make much sense to impose the same budget deficit requirements on each country when there are these differences.

A balanced budget requires that private savings minus private investment plus current account deficit ( = capital account surplus) sum to zero. There is little reason to think that such a relationship is compatible with economy operating at potential output—let alone at full employment. Attempts to achieve a balanced structural budget without actions which will raise investment, lower savings, and promote net exports are doomed. The pursuit of balanced budgets will involve cutting public expenditure and raising taxes; it will not achieve the target and will involve misery along the way.

How long will it take until the Eurozone authorities and countries recognize that the conditions of the “fiscal compact” are unattainable in the sense that—whilst some countries are able to have a budget balanced at “potential output”—most cannot? Continuing to insist that fiscal austerity be pursued to balance budgets will bring misery. But now that the structural balanced budget requirement is written into national constitutions with penalties for failure to do, how will the counties signed up to the Treaty wriggle out of those commitments?

“how will the countries. .. wiggle out…” That last sentence is based on fellows of good will. Would someone please show me a major country – European or otherwise, whose leaders are such? The Euro Zone crisis was percipitated and perpetuated by leaders (political and financial) of not good faith.

I’m afraid that the real reason behind the “balanced budget” mantra is something else. And then it’s not a disaster from the point of view of the European “1%”.

I think the real aim is to use the crisis for a complete makeover of the social politics in Europe : breaking down workers rights, workfare instead of welfare, lowering pensions etc.

As the 1% often say : “never waste a good crisis”.

This is something only to be discussed directly on high levels between friends and faithfull, though.

The problem they face is politics : how do you sell this to the socialdemocrats, who are essential in this scheme ? That’s were you need to make them believe that “there is no alternative”, on basis of economic “theory”.

That’s the role of PASOK in Greece, de new Great Coalition in Germany, the coalition in the Netherlands with the socialdemocrat minister of finance on the helm in de Eurozone. If necessary you coerce them into the scheme, as happens now in France.

Amen! This is the point. Everyone with half a brain (even in Europe) knows that current policies are irrational form the POV of the public but rational for the 1%. Again, economics on its own is nonsense–it is always subject to politics. And the politics in the EU are very similar to the US–except here the game has been won–what is left of social-democrats fundamentally agree to the neoliberal project and thus there’s somewhat less of a need for austerity–we have consensus even with the public. Everyone wants to balance the budget since no one seems able to explain to the American people that governments are not households–particularly the USG which, in fact, does not have to pay back the principal of any debt since the USD is still the world currency.

Right on the mark. Very similar to Stephanie Kelton’s recent presentation at the Fields Institute at the University of Toronto.

“Fiscal Space and Financial Stability: A Differential Analysis”

http://www.fields.utoronto.ca/video-archive/2013/11/221-2524

Thanks fm. That was good. The fiscal space (tools) to ensure private sector surpluses via public sector deficits. Because high levels of private debt kill any economy. Made me wonder how economists brought us to this point where we must borrow from private banks to operate our system, therefore we must bail them out of the mess they make. And our system, compared to the EU, is light years better. But still, when are we going to stop enriching the private banks to our detriment? And Congress panics and blusters about inevitable rising interest rates if we “print” money, etc. When in fact that argument is meaningless in a sovereign currency. Will the Europeans ever admit they are misguided? Is that why Ukraine backed out, I wonder.

A bit of off topic, but since you mention Ukraine backing out of the EU…

I am just amazed that 350,000 are demonstrating in the Ukraine because they want “integration”, which is for the Ukraine would mean structural adjustment, mass layoffs, deregulation, deep social spending cuts, wage freezes or cuts, unrestricted free market access for EU corporations, corporate friendly tax cuts, marginalizing trade unionism, and harsh crackdowns on nonbelievers.

Greek voters loved “EU integration” so much that they let PASOK make German banks whole by converting losses into sovereign debt. Now working greeks are screwed, but they still cling to the EU in polling.

That is the power of Neoliberalism.

Power of neoliberalism ? In part maybe.

But in the Ukrain there are other motives then EU illusions :

– Nationalism vs. Russian imperialism

– The deal included the release of Timosjenko, threatening Janukovitsj in the coming elections.

In Greece the main reason for people to stick to the EU is fear for the unknown – as used and fomented in de 2012 elections.

In both cases you have to ask yourself : who does the explaining and who presents alternatives ? That’s the real weakness.

How long will it take … ?

Europe’s invisible hand has given the public the finger.

They are told to tighten their belts, but they are not all wearing the same pants. Those farther up the income distribution ladder are wearing pants with suspenders and are unaffected.

[How can you trust a man who wears both a belt and suspenders?]

“Europe’s big illusion consists in the belief that the crisis was generated by irresponsible budget management.” – Paul Krugman ,Der Spiegel, 23 April 2012

Arguments for austerity become perversity, futility, jeopardy:

• The perversity thesis: the proposed action or reform “will produce, via a series of unintended consequences, the exact contrary of the objective that is being pursued.”

• The futility thesis: “the attempt at change is abortive, that in one way or another any change is or was largely surface, facade, cosmetic, hence illusory, as the ‘deep’ structures of society remain wholly untouched.”

• The jeopardy thesis: “a new reform, if carried out, would mortally endanger an older, highly prized one that has only recently been put into place.”

– Albert O. Hirschmann, The Rhetoric of Reaction.

“Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.”

– William Butler Yeats, “The Second Coming”

You Can Make the Math Work if You’re a Near-Genius and There’s a Lot of Those Out There

why not just multiply tax revenues by some factor like 10 for countries with deficits. If Greece takes in 10 euros in tax revenue, just consider that 100 euros after it’s in the door. That solves the budget problem. Then spend that 100 euros on some investment project, like, I don’t know, an anti-gravity research facility and a bleach cleaning of the Parthenon.

Some people would scoff and say that’s just handing them 90 euros for every 10 they collect, but not really, because if you just handed it to them, they could do anything they wanted with it like sending it to Switzerland for safe keeping.

In this case, they have to spend it on something useful. But how do they know something is useful before they do it? Let the Germans make that decision. You know they won’t just make something up and laugh.

If any body watches that 48 minute video by Professor Kelton, please post a comment about what it says. 48 minutes is kind of long and the attention span is short but it would be nice to get the gist of it without having to watch it.

One of the main things is a rejection of some of the ideas behind a lot of the current models. Rather than using a lot of complicated equations she works mostly with 3 ‘sectoral balances’ which includes government and non-government and non-govenment is divided into foreign and domestic. The foreign is the current account (the difference between imports and exports).

Government = private sector (household plus business) + current account

Right now the US govt is responding appropriately by increasing deficits but it’s mostly directly to business (esp financial and the 1%).

We have more fiscal space by being able to run deficits larger than 3 or 4% but we need better fiscal direction to get that money into the hands of the 99% who tend to get that money moving into the real economy.

In a sense it means not printing money and giving it to the banks for speculation but spending money into the productive side of the economy.

hmmmmm. well I appreciate the synposis. but what cofuses me is this: I live on a planet orbiting star in Orion’s Belt that has only one country and everybody in our country considers themselves part of the govermint. We don’t distinguish govermint and private sector. We dont’ have a word for “govermint” on my planet, in fact. But somehow we have a thriving economy! How can we do this? since there aren’t any sectors to balance or to go into debt. maybe we’re delusional and we’re really broke! hahahah You guys on earth crack me up.

Philip Arestis wrote:

NBER records of the U.S. economic cycle (which is not too different qualitatively from Europe’s) show that expansions typically have endured about three times longer than contractions in the postwar era.

Even accepting that some government-induced demand enhancement might be needed during recessions, it still does not follow that a ‘majority’ of governments should be engaged in continuing demand supplementation.

Both the habitual tilt toward deficits (the U.S. has run only a handful of fiscal surpluses in the past half century, despite expansion years vastly outnumbering contraction years) and the ratchet effect on taxes (e.g., European VAT taxes trending inexorably upward, without stanching fiscal deficits) suggest that governments indeed are profligate.

Why wouldn’t they be, when the overriding parliamentary incentive in democratic regimes is to spend other people’s money freely in order to court re-election?

So let me get this straight, European taxes have gone up, which has caused US deficits to go up?

Doesn’t that kind of leave something out, like Nixon’s supply-side tax-cut theology, which he ushered in by procaliming that “we’re all Keynesians now.” It was conservative Republicans that originally invented tax-cut Keynesianism (deficits are fine if you’re giving money back to the folks who count), but since then Democats have certainly taken the ball and ran with it.

If you looked at all the people in Europe in one glance you couldn’t tell where the government is and where the private sector is.

if they were all at work in buildings and offices, you might be able to tell but there’d be lots of people coming and going back and forth, so you really couldn’t tell.

Now you’re supposed to be able to say the govermint spends this and owes that, and the private sector spends that and owes this, when you’ve already admitted you can’t tell by looking at the people what is what.

And then you’re supposed to be able to tell how much they’re spending, but often they don’t even use cash and paying 100 is the same motion as paying 1000000.

None of this really makes sense, but people pretend it does just to make their lives easier. They’re only fooling themselves and creating mountains of nonsense while they’re at it. Who can take this stuff seriously? They can, evidently, and no doubt they’ll still be at at a year from now and two years from now. By that point, hopefully there’ll be some solution to getting rich quick because after a while you just can’t take it anymore.

maybe that’s part of Kelton’s point, that it is one big mix which can only be approximately separated out with general accounting assumptions… and that might be the very thing that makes accountability (her word) “squishy” enough that government deficits can create private surpluses at all… and 10$ in 1905 did become 100$ and if it went back to 10$ it would be very counterproductive.

Sure – the euro boys and girls want to destroy banking nation states ….centralizing production of unwanted goods which will be force feed to the peripheral population.

But in reality the last thing Ireland and Greece needs is more debt of any kind…..both countries need to produce local currency so as to somehow bring back rational internal trade and commerce.

The village and market town needs cash and cash only.

We live in a truly absurd world with Ireland pushing for the outer limits of absurdity.

Our figurehead is over in Asia supposedly trying to sell Irish Beef to the Japs.

Meanwhile Irish Beef is & will be overpowered by cheap external imports.

imagine all the capital and oil wasted in this non end use long distance activity ?

The purpose of trade now is not to sell goods that people need but to export so as to pay off debt causing huge economic externalities lost in the deep crevices of this utterly pointless world trade system.

We don’t need economic expansion – we need a critical mass of local commerce in our villages , market towns & Provincial cities.

http://www.youtube.com/watch?v=oX1OktbFkXw

Debt to the suburbs.

“There is no justification for a balanced budget requirement . . . ”

The die was cast when each euro nations gave up the single most valuable asset any nation can have — its Monetary Sovereignty.

Monetarily NON-sovereign entities cannot run deficits indefinitely, as they are unable to create currency to pay debts (in contrast with the Monetarily Sovereign U.S. government).

See: http://mythfighter.com/2013/07/27/i-just-thought-you-should-know-lunch-really-can-be-free/

Fiscal consolidation?

The looters, the banks are consolidating the real assets of the people and nations they drove into debt, because in aggregate that debt is impossible to pay?

If this is deliberate I see that Dante had a point.

God has a consolidation of His own in store for the arrogant and the wicked.

for the arrogant and the wicked. FB (moi)

Make that “for all the arrogant and every evildoer” lest I be less than accurate wrt Scripture (Malachi 4:1-3).