CalPERS continues to make a science of not walking its talk. If you are new to our arm-wrestling match with the giant California public pension system, we have asked CalPERS to give us data about their private equity fund performance that they provided to two scholars at Oxford University, Tim Jenkinson and Ruediger Stucke. Their paper, written with an additional co-author, Miguel Sousa, was published in 2013. It stressed that they had the entire performance of all of CalPERS’ 761 private equity investments, from CalPERS’ first participation in that strategy in 1990 through the first quarter of 2012. The article also stated repeatedly that substantial portions of their data has never been made public.

CalPERS is subject to a California version of FOIA called the Public Records Act. A well-settled principle of the PRA is that once an agency has given out a record to one member of the public, it has forever waived the right to claim any exemption from disclosing the records to others.

As we’ll discuss, we’ve been trying to get this information since we filed a PRA request at the end of September. Not only has CalPERS engaged in what look like stonewalling tactics, but far more seriously, their latest, still incomplete response to our request contained serious errors which suggest there are basic record-keeping problems at CalPERS. Given that CalPERS is a fiduciary, this would be an extremely serious lapse.

Let’s catalogue how many times CalPERS has baited and switched us to date:

1. We submitted our PRA request on September 29. In mid-October, I contacted CalPERS as to why my PRA did not appear in their September log, which had just been released. A CalPERS employee wrote me to say they had no record of my request. Now that already is troubling, in that my PRA request was submitted via a portal at CalPERS’ website. If a request disappeared, either the system is not reliable or a human disappeared it. Neither possibility reflects well on CalPERS.

2. CalPERS sent a letter on December 18 saying they expected that we would receive the information we requested by December 27. We did not get any information. When we pressed CalPERS in January as to what had happened, they sent us a letter dated January 27 which stated CalPERS staff had not given the data to the academics so they had nothing to give us.

As we wrote, this response looked like artful misdirection, since the Oxford authors clearly got their data from CalPERS or an agent of CalPERS; it didn’t fall off a truck or was handed to the scholars in a dark alley by an aggrieved former employee. But limiting their answer to what CalPERS’ staff had done meant they could finesse the question of whether the CalPERS had directed its data custodian (then LP Capital) to give the records to the academics.

3. My lawyer Timothy Y. Fong wrote a nastygram and CalPERS began to pretend to be cooperative. But then they sent us a pathetically small amount of information that was AFTER the time frame in our request! This was a stick in the eye. They had cherry picked one part of our letter (a sort of “gee can you throw this in too?” with the understanding that we could submit a PRA request for that too and better to get this all done and get us out of their hair) and took the position that our request had been filled.

4. We filed suit at the end of February. CalPERS ‘fesses up they did deal with the academics directly.

5. CalPERS also said the academics got a 226 page pdf and looked as if they planned to send that to us. We tell them sternly that giving us a paper record which would be a nightmare to input and could probably not be converted reliably via an optical character reader, was not acceptable. The PRA says the records must be given in the manner in which they are kept. A pdf is a report prepared from underlying electronic records, not the record proper.

6. CalPERS said sweetly that they are cooperating and gathering the data. They then send us three e-mails with five attachments total. This is from the cover note by Christopher Phillips, a litigator at CalPERS:

I told you during that initial phone conversation last Wednesday and in subsequent communications, that CalPERS was committed to adhering to the PRA and cooperating with Ms. Webber. I have now gathered the information requested above and have verified with our PE staff that the attached files are responsive.

As we’ll show, this is another flagrant misrepresentation. But even worse, the errors in what they sent raises troubling questions about the caliber of the recordkeeping at CalPERS.

It took Team NC longer to deal with the CalPERS data than it should have because your humble blogger was really sick and our terrific volunteers for this project had some conflicting commitments. But it didn’t take long to extract what CalPERS sent to look for the most basic level of completeness, namely, did they send us what looks like the data from all the funds, meaning is the total number of investments similar to what the Oxford academics said they got?. Their transmission was a blindingly obvious fail.

From the very get-go, we have referred to and given links to the SSRN home of the article in question. We’ve cited text from it. The staff at CalPERS is as capable of reading it as we are. So it’s pretty remarkable for them to think that sending us data on only at best 60% of the funds at issue would pass muster.

The paper states, and we’ve repeatedly told CalPERS, that the paper analyzes 761 funds, which they present as the full history of CalPERS’s investment in private equity from 1990 to the end of the first quarter 2012. No matter how you cut and slice it, CalPERS’ response to us is way short of the total we should have received. We’ll walk you through the analysis, but the bottom lines is the absolute minimum number of funds on which we should have received data is 689 (the 761 total less 72 funds which CalPERS invested after 2008; the researchers got data on the later funds from public sources). We were sent information on 432 funds, or less than 2/3 of the total. And that number would assume the data had been scrubbed in the same manner the authors’ did.

In fact, the researchers got information about more funds from CalPERS and excluded many from their sample. And some of the funds on which we got information included types that were indeed of the type excluded by the researchers. In other words, that 432 total includes funds that were clearly excluded by the researchers (such as fund of funds), making the percentage of the responsive data even lower (as in our 432 funds includes X funds that were excluded by the Oxford authors; so the relevant percentage would be 432/(761+ X + Y additional funds included in the Oxford list but not provided to us that they also excluded).

But the picture is even worse than this tally suggests. Even on this cursory pass, we identified some funds which are not private equity funds no matter how you define it. This means CalPERS’ records are tainted. You can reach one of two conclusions: either CalPERS rummaged around in 2009 records and slapped together something, and grabbed some crappy records off someone’s computer. But that is not how a PRA request is supposed to be handled; we are supposed to be given the records in the form in which they are kept, meaning the definitive accounts.

So the first possibility is that CalPERS is continuing to deal with us in bad faith. That’s also consistent with them mentioning a 226 page pdf as if they had the actual document. If they did, there would be no justification for sending us files that so obviously fell short of what the researchers got. So it is entirely plausible that Calpers was told either by the researchers or by the former employee that the information was sent in the form of a 226 page pdf. They either could not locate or could not be bothered to locate the actual record, and just threw together a bunch of data in the right time period that looked roughly big enough to try to get rid of us.

But even allowing for the first possibility, the records are entire files (for instance we got three zipped files that contained a number of folders within them). We found meaningful errors within these files. This strongly suggests that the PE records at CalPERS are inaccurate. Even if these were folders prepared by managers from more definitive records (the database then maintained by LP Capital), the inclusion of non-private equity funds in compilations of supposedly private-equity related data raises the possibility that the definitive database is erroneous (as in the local files were almost certainly created from queries to the definitive database, and thus the errors are there as well).

We’ll parse out both of the problems with the data.

CalPERS Sent Information on Way Too Few Funds

Because we’ve both contacted the authors (Tim Jenkinson, a professor and the lead author, has been very helpful), CalPERS and we both know that Jenkinson et. al. got their data from CalPERS in 2009, and it included all of 2008.

It is also important to understand how private equity is defined, as in precisely what the boundaries are, since investors’s results are compared against various benchmarks (the Standard & Poors 500 index, various private equity return indices). Thus, to evaluate the performance of any particular manager, it is critical that the deals that they describe as their private equity transactions include all of germane ones (no cherry picking!) and no strays from other strategies (no contamination of the sample).

For generalist readers, here is how authors Jenkinson, Stucke, and Rudiger describe PE:

Institutionalized private equity refers to an asset class that invests in companies whose equity claims are not registered on an organized stock exchange. Early funds focused on venture or growth capital for early-stage and mid-stage companies in the 1970s, but the 1980s saw the emergence of buyout and restructuring capital for mature companies, often involving high levels of financial leverage. In the 1990s, further sub-classes beside corporate private equity gained traction, such as mezzanine funds which include both debt and equity claims, distressed debt which may result in a debt-to-equity swap, as well as investments in real estate.

I have a quibble, which is the inclusion of real estate. Real estate funds are considered to be a separate asset class (in fact, early academic work on asset classes typically looked at very broad categories, often stock, bonds, cash, and real estate). At CalPERS, real estate investments are handled by a completely separate team from private equity.

It is also clear that Jenkinson and his colleagues got more than private equity data; their paper clearly discusses that they had to exclude funds And even though the data that Jenkinson, Sousa, and Stucke included real estate transactions, they removed them from their sample, along with “general and customized fund of funds” and funds acquired in secondary transactions (as in from other investors part way through the fund’s life, versus investing in the fund from one of its initial closing dates). But we don’t know precisely how many funds they stripped from the data CalPERS gave them.

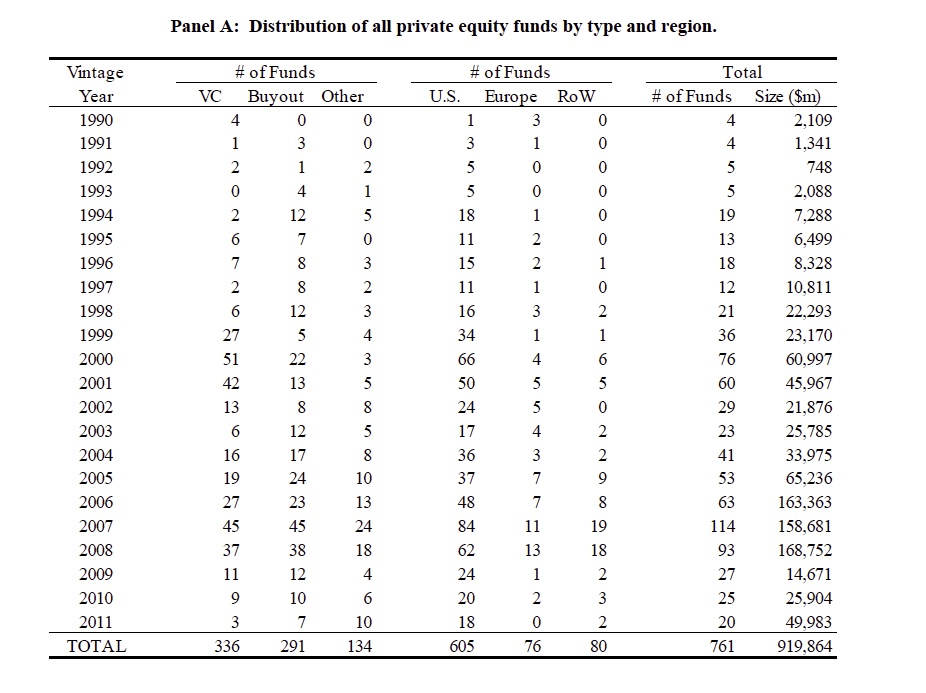

Here is why we are confident CalPERS has grossly shortchanged us. From the paper (click to enlarge):

Focus on the rightmost column, the totals. You can see the grand total, at the bottom right, is 761. They show that the total number of funds, after they scrubbed their data, was 20 in 2011, 25 in 2010 and 27 in 2009. They were given data directly by CalPERS through the end of 2008. 761 – (20 + 25 + 27) = 689, the bare minimum we should have gotten, versus the 432 we were sent.

Moreover, if you compare the Jenkinson et al. results to the widely-used Prequin database, you get similar totals. Prequin shows the number of CalPERS private equity fund investments from 1990 to present at 784. Of that total, 81 closed after 2008. So Prequin (due to slightly more permissive definitions of the relevant universe), puts the total PE investments at 703, giving a bit better picture of how much information CalPERS is holding back.

Oh, and that’s before we get to the fact that CalPERS also failed to send us the data fields we requested, a huge omission we will not belabor at this point. The Oxford researchers stated they got cash flow data, meaning the actual dates and amounts of CalPERS contributions to funds and the funds’ distributions to CalPERS (their previous public disclosures are of quarterly changes, not actual dates). They’ve never contested giving us this information in any communications; in fact, the CalPERS litigator Phillips said in writing he believed this was all disclosable. But even more important, CalPERS conceded this issue in the itty bit of data they gave us in February, by sending us 2012 and 2013 data with cash flow details.

Errors in Calpers Data

CalPERS included in files of private equity funds certain funds that clearly didn’t belong. We are hardly experts, yet we caught these errors:

Relational Investors L.P., a 1996 closing. Relational Investors is a well-known activist fund. They do not invest in private equity. They take significant minority stakes in public companies they believe are mismanaged and press for governance and other changes (often corporate restructurings). This fund has no business being in a private equity fund listing.

Carlyle Realty Qualified Partners L.P., a 2001 closing and Carlyle Realty Partners Europe. L.P, a 2002 closing. Note that these are the only real estate funds that were included in the information sent us. Since, as we indicated, real estate investing is an entirely separate group at CalPERS, those records are maintained separately from those of the private equity team. We gave CalPERS the option of excluding real estate data. CalPERS has a large portfolio of real estate investments; we’d expect to see a large number if they sent those along or none if they excluded those files. In these same years, CalPERS also invested in Carlyle private equity funds: a venture fund in 2001 and a high yield fund in 2002. This looks troublingly as if the Carlyle’s relationship with CalPERS in those days was with private equity professionals, and the real estate team was hopefully brought in to vet those deals, but they wound up being included in the PE rather than the real estate database. And Prequin agrees with our reading; neither of these funds are included in its list of CalPERS private equity investments.

CalPERS appears to be operating under the misapprehension that their interests are best served by running interference for the private equity industry, which requires investors like CalPERS to sign onerous confidentiality agreements. But CalPERS is a fiduciary, and far and away its most important duty is to its pensioners. And the longer CalPERS engages in a pitched battle over an entirely reasonable records request, the more it looks like it is CalPERS, and not just the private equity funds, that has something to hide.

The lack of transparency and automatic default to cover-up across all institutions is now a fully-fledged legitimation crisis. Even if CalPERS fesses up now, why should we believe what is says? There are massive double standards. Someone accused of a criminal offence in the UK is told any defence they come up with after time to think about what happened or after consulting a lawyer may well lack credibility when brought up in court. So why should CalPERS not lose credibility after this obfuscation and delay?

It will be interesting, after Calpers’ abject surrender to the honey badger from hell, to compare the 257 omitted funds to the 432 disclosed to date. What is the distinction between the two groups, or is it truly a series of random omissions?

Free the Calpers 257!

pure candy… confidentiality v. fiduciary… killer.

CALpers is running scared. Surely they are more intelligent than Joost of Yoost SEO fame but they really don’t want you to have the raw data.

Here is to hoping that one of these days the analysis you do about fraud in our world will result in jail time for the perps……It can’t come to soon, IMO

Good on you and death from a thousand cuts to the management of CALpers.

Onward!

I used a stronger word than I wish I had used in regards to what I wanted as suffering for the management of CALpers and for that I apologize. I get incensed thinking about fraud perpetrated by those with the responsibility for pension funds of others. Especially fraud for which they will probably never experience any of the pain that they subject the earners of those pensions to.

We are really on the road to ruin if there is never any justice for our inhumanity to others and the last couple of decades has provided countless examples of that. It is one thing to talk that inhumanity like I did and another to act it out consciously.

Well, you didn’t suggest they be fed to feral hogs. I take it that Yves is looking for a pony and CalPers wants her to have to sling manure to find it. What is it? It is my guess, only a guess, that there are some real clankers in CalPers past portfolio. We all know that there was a kickback scheme with a former manager – who is now in jail. One wonders what current management is hiding – and for whom they are hiding it. If its just bad investment decisions, that’s an embarrassment, but if its kickbacks and the like – yes indeedy, somebody is going to jail. If the former is the case, I suspect that Yves will shortly get everything she wants. If its the latter, she will get what she wants only after a court order, if she’s lucky.

If the staff of CalPERS are defrauding the board of CalPERS, the staff would be running scared. As soon as the board finds out the truth, the staff are out of jobs and quite probably in prison.

Just one possibility, but a *very* plausible one which explains the behavior.

It is more likely that the problem is just that the mgmt/staff finds the truth embarrassing. We shouldn’t jump ahead. If the public is always looking, then the problem will be no bigger that some mistakes and incompetence. Yet when mgmt gets comfortable that no one is really analyzing what they are doing, the the fraud begins. Let’s go one step at a time.

The bigger problem, from my viewpoint, is how the board is selected and their incentive to agree with mgmt irregardless of the facts.

Here’s the thing:

– whatever the data is, it can’t be too embarassing to give to the board. If anything is so embarassing that they’re not giving it to the board, then they’re defrauding the board in some way. And there’s evidence that management is *not* telling the board about Yves’s lawsuit….

I’d expect “management in deep with the board” if management were telling the board everything. But apparently they aren’t. Management seems to be either incompetent, or otherwise not doing their job, *and is concealing the true state of the portfolio from the board*, which is the fraud.

It very much sounds like Nathan Thurm is working the levers behind the scenes there at Calpers. He was a former Joe McCarthy aid (you’d think he’d be dead by now, but somehow he lives).

Here’s proof. Once you watch it there’ll be no doubt.

Counselor Fong will have his hands full, but truth will out — if you all walk righteously in the light cast by the justice of the Lord.

http://www.youtube.com/watch?v=98MNisZJyFI

You’re the best Yves… keep going!

Bravo!

Has Calpers made any major, recent changes to their records handling and storing? The record-keeping companies have made a lot of inroads at legacy organizations of late – in and out of government. The transition from old techniques isn’t always seamless.

Beyond that, there’s a lot of ways that an unsexy but crucial corporate function like records can fail all on its own.

It appears that avoiding FOIA requests is now a competitive sport in Obama’s America.

The first researchers should deliver the goods to you, Yves. Stop bloodying your head against a cliff along the Pacific Coast Highway in California. I repeat, below, my post of Feb. 28, 2014:

Tom in Denver February 28, 2014 at 10:57 pm

Well, if researchers – academic, economic, or otherwise – can’t be nice and share, how can we expect transparency from our government? Otherwise, this is just another futile exercise is trying to get accountability and responsibility when everybody is smoke-stacked and protective of their own interests. Don’t ask for something that your own kind won’t deliver. On a positive note, go Yves!

This is economics. Academics in economics don’t share their data. Remember the Reinhardt/Rogoff spreadsheet scandal? They’d refused to hand over their data for five years and they only reason someone got it was Carmen Reinhart handed it over to someone she deemed not to be a threat (a grad student). Oops.

Yves, thanks for that clarification. I had the same idea, why not ask the authors for the data. I understand the authors’ position, but I feel that it is wrong. The data they have is public data, not their or CALPers private data. They should have a legal obligation, much less a moral or social one, to share the raw data. Their conclusions and the patterns they find are their own, but the raw data is not.

Unlike the Reinhardt/Rogoff data, this data is subject to the PRA and you can get it with a subpoena. This should be easy for your lawyer to do.

Did you read the post?

“This should be easy for your lawyer to do.”

No, it’s not easy. They are fighting every step of the way.

You have a lawsuit going. Couldn’t your attorney subpoena the economists to whom CALPERS has provided the data for a deposition and require them to produce what they received from CALPERS? That information would certainly be relevant to your claim that CALPERS has failed to disclose to you what it disclosed to them.

Please reread the post. The academics are at Oxford, hence the UK, beyond the reach of US laws and subpoenas.

You can probably get it via international discovery under the Hague convention. I’m pretty sure England is a signatory, but you can check with the US State Dept’s web page.

Also, check who published the academic article. Oxford’s press is here in the USA.

“The Oxford University Press, Inc. (OUP USA) is Oxford University Press’s second major publishing centre after Oxford, and is by far the largest university press in the USA. Set up in 1896, OUP USA was the Press’ first international office. Since it began to publish its own US books in the 1920s, the Press has been honored with seven Pulitzer Prizes, several National Book Awards, and over a dozen Bancroft Prizes in American history. It publishes at a variety of levels and for a wide range of audiences in almost every academic discipline, furthering Oxford University’s objective of excellence in research, scholarship, and education. ”

Source: http://www.ox.ac.uk/international/oxford_around_the_globe/north_and_central_america_the_caribbean/united_states_of.html

They did not publish this through Oxford University Press.

Our hearing is in May. No way will we get through international procedures even if they worked. Generally, you can go to the Hague only if the laws in question are “international law” or national laws that are almost universally in force. FOIA type laws are peculiar to the US and UK. They are not operative in a lot of countries.

We have made a selective FOIA of Oxford, but I’d rather have the academics continue to cooperate with us, and FOIAing their data would put them in the opposition. Plus they might not have done the study under Oxford’s auspices, so it could be exempt.

The affirmative defense to screw up record keeping so badly that any investigator will simply throw up their hands and quit.

It’s like arguing with my teen son.

Once it gets to the point of filing a lawsuit any presumption of good faith goes out the window. CalPERS is running a stall. The people of CalPERS aren’t idiots. They have a ton of people who can query a database, pull up a file, spreadsheet, or a report, and know what is and is not a PE investment. And this whole process at this point is being vetted by their lawyers who also have expertise in these areas. So no, no good faith errors.

A stall is made up of various components which can be mixed and repeated: ignore, deny, delay, and misunderstand (i.e. respond with incomplete and/or erroneous data. At this point, the assertion will be made that full disclosure has been made, subject over.) CalPERS is running a stall. They will not disclose until they are absolutely forced to, and will likely seek to minimize the extent of the material disclosed to the bitter end (as well as possibly attaching conditions on its use). They will likely both stonewall and seek to portray Yves as unreasonable and her request onerous and excessive.

CalPers, here in our (yours and mine) beloved state of California, engage in self-serving, fraudulent, criminal behavior?

Say it ain’t so!

I meant to point out that it would be very interesting to know in detail the PE action in 2008 and 2009. It looks like about $150 billion (or some sizable chunk of it) in PE investment went poof. And now after that experience, it looks like CalPERS is on a trajectory to make the same mistake again.

Isn’t all this “management” of funds complete BS? (CALPERS is sooooo professional is a mantra I grew up in CA hearing) Isn’t the truth CALPERS is not going to get a rate of return that it claims, and instead of owning up to that, and makeing the politicians raise taxes and/or cut pensions, which would make the politicians very, VERY unhappy with CALPERS personnel, – better just to say we got money out the wazoo!

https://www.youtube.com/watch?v=8yFFyW4Ad8k

http://articles.latimes.com/2012/mar/14/business/la-fi-calpers-returns-20120314

The cut in assumed rates of return was almost certainly recommended by their pension fund consultants to reflect lower return rates in the age of ZIRP and QE. That’s actually responsible behavior and you can’t fault them for that.

Simple solution: subpoena the academics for the actual data they received from CALPERS.

As indicated earlier, they are in the UK and a US subpoena has no force. Plus there would be no basis for subpoenaing the data. The most we could do (even if we could do it) would be to depose them on how what we have been given compared to what they received.

why do some here at times continue to badger the princess when she has spoken…??

Saying that the information can not be gotten from the parties in the UK is factual.

Judge Judy is not the real world…

the UK Government has exercised its right under Article 23 of the Convention to declare that it will not assist foreign courts in relation to the obtaining of “pre-trial discovery”.

http://www.sedgwicklaw.com/Publications/detail.aspx?pub=4472

as to the whole government actually handing off information just because there is a public records act or FOIA or sunshine laws…

welcome…to the truly frustrating world of asking for “public” information…

as you will find, these laws of the publics right to find out what government is doing

is really only for the “special people” who might not have the capacity to interpret things, or is to be asked for by certain “approved” dissenters, who will then proceed to do a hatchet job on the target who is causing problems for the status quo…and from which the “public” records will produce the accelerant needed to be done with a pest…and do a job of lynching the abrasive or presumptuous unwashed who dare step forward and poke their little heads above the clouds…

reality, what a precept…

and to all a good night