Lambert here: Germane to our Ukraine discussion. And assuming, which not all assume, that ISIS is for realz.

By Houses and Holes, who edits MacroBusiness. Originally published at Macrobusiness.

Chief Economist at Saxo Bank, Steen Jakobsen, thinks they should:

“There are causes worth dying for, but none worth killing for” – Albert Camus

The world is increasingly becoming engaged in civil wars and general turmoil where Camus’ words could and should play a central but never will. This article is one of the hardest to write as war is never about right or wrong. They are per definition always wrong and extremely personal and emotional. The fact is, however, that we need to put “the risk of wars” into our macro outlook as they are increasing not only in intensity but also in the numbers of casualties.

I will not condone anyone or any party involved in the present conflicts – I learned my hard lesson advocating the removal of Saddam Hussein, only to learn that his successors are just as bad. Therefore, Camus’ words will remain my mantra.

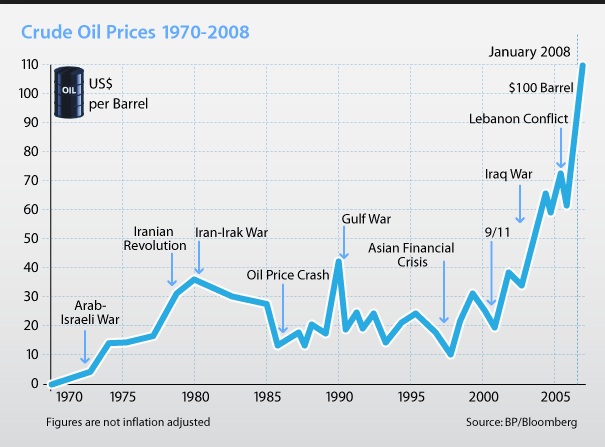

The simplest way to “measure” geopolitical risk is to look at the price of energy. Energy is everything for a macro economist as it’s a tax on the economy when high, and a discount when low. High energy consumption levels makes it a critical part of any projection but despite this, energy assumptions are often exogenous (given!).

Think about this: Everything you did this morning involved energy consumption: Waking up to your smart phone (charging overnight), putting on the coffee, pouring the cold milk from the fridge, taking a shower, driving the car to work and walking into your air-conditioned office. Likewise, the rest of your day will be one big consumption of energy. The world’s energy resources are primarily extracted from “volatile” or underdeveloped regions, creating a real risk of disruption of supply. Herein lies a clear and quantifiable risk.

The way I measure this geopolitical risk is through measuring the spread between the 5th contract of WTI crude oil and the first contract. Of course, there are other factor at work, but in the absence of a better alternative, I use this.

Source: Bloomberg, Saxo Bank

As can be seen, since July 15 the “war premium” or more neutral “disruption premium” have increased by USD 2 and the world’s consumers are now paying two dollars more per barrel of WTI crude. Overall there are many factors influencing the crude market but the price of energy remains the one component we need to know is stable and preferably falling.

The overall impact from war is negative despite the glorified analysis of how World War II stopped the recession – think of the 1970s – probably a better and more relevant analogy to today’s trouble in Gaza, Iraq, Russia/Ukraine, Libya, and Syria. Many will argue it’s different this time, back then we were too dependent on the Middle East! Sure, but prices were only between 10 and 25 US dollars a barrel back then!

Now we have lived with an oil rise in excess of USD 100 more or less since 2007! Crude is now four times higher in price than during the “inflationist” 1970s – the era in which we ended the Bretton Woods system of monetary management and where central banks started targeting inflation instead.No, the signal from the energy market about the demand of energy and the risk of getting enough of it is clear: Prepare for less growth, less certainty and more geopolitical risk. The market, however, maintains a steady hand: Israel will be contained inside a couple of weeks, Russia vs. Ukraine will find a solution. The non-acceptance of tail-risk (Black Swans) is clear for everyone to see. The market is “perfect” in its information, zero interest rates will save us and we have all been fooled into believing that the real world no longer matters.

Unemployment, social inequality, wars, innocents being killed, and TV images of people fighting to live another day are not relevant………except for the fact that for world growth to keep increasing we need to continue to see growth in Africa, the Middle East and Eastern Europe.

We need to accept that the world is now truly global – we smiled while globalisation reduced prices and made our companies more profit, now the escalation of wars reflect a world where growth is low, energy is expensive and increasingly hard to get and that we have gone full circle with macro and interventionist policies.

The escalation of turmoil in the world is yet to play a role for the market, but be warned: everything economic has a delayed reaction of nine to twelve month – whenever there is an action there will be a reaction. If the present state of alertness continues through the summer you can bet on higher energy prices having a serious impact on not only world growth but also on markets. But don’t ever forget that the real losers are the individual families losing loves ones. No, Camus got it right. There is nothing worth killing for, plenty to fight for.

Fair enough but I disagree. The Gaza and Ukrainian conflicts are very unlikely to draw greater powers into conflict and that’s what matters to global markets. It’s actually energy supply from Russia that’s preventing it so let’s not get too upset by a small premium built into prices there.

The conflict that represents the largest potential threat to markets is still the ISIS invasion of Iraq. There oil supply could be severed and the jockeying among regional middle powers possibly lead to a wider scale conflagration between Sunni and Shia sponsor states.

Oil is at $100 owing to its peak production and the challenge that that represents not because of any exogenous geopolitical problem. Minor premia built into energy markets are sensible enough but they are not signalling some wider move to war discounts, nor should they be, until greater powers come to blows.

“everything economic has a delayed reaction of nine to twelve month”

Yves, considering today’s technology and larger global participation in the markets, do you see delayed reaction time tightening? …maybe even more so in the energy markets

We’ve blown it. The largest energy resource this planet ever saw.. spent. Our grandchildren will be doing their homework by candlelight and ask us, “What did you expend those Billions of tons of oil energy on, Grandpa..?” And we will answer, ” A good time, mostly. It all got soaked up in cocktail swizzle sticks and outlandish sports cars…Boo YAH!”

But GM was saved, and now makes cars with 600+ horsepower! Just competing with all the other car manufactures and their 600+ horsepower cars.

As a species, human beings really do seem genetically predisposed towards suicidal stupidity. The examples in history of that are too numerous to list, and the US seems to be recapitulating and improving upon every single one–as well as creating some new ones that were heretofore unseen, like DARPA Deathbots(tm) and nuclear reactors. If we were not complete morons we would use the last of our recoverable fossil fuel reserves to close down and bury all the nuclear plants still operating in the world. But apparently complete morons is exactly what we are.

A big chunk of oil prices has a lot to do with speculation at trading desks. Companies like GS will never take the physical asset, bit will certainly hold long positions. So what if supply is higher than demand? Oil traders have found a gold, I mean, oil mine. International bad news that comes around provides justification for the speculators and cold comfort for everyone else. Traders also see India and China as another rationale to keep the bid price up.

Economic discussions on fossil fuels nearly always miss the bigger picture. We cannot suck it all from the ground and burn it. Our environment is under threat because of the high demand for fossil fuel use. At some in the next few decades there is no turning back. Polar ice caps will be gone, horrific climate events will be more frequent, and the toll on human life will be catastrophic. Every year we don’t significantly reduce C02 emissions from fossil fuel use, the less likely we can stabilize the damage. We need economists of all stripes and persuasions to begin to include the environment as a stakeholder in economic discussions.

There needs to be a green alternative to ISIS in Iraq and to other fossil fuel producing areas. At some we need to say: You can keep your stinking oil or coal.

Oddly enough, in 2008, Morgan Stanley and Goldman Sachs really did take physical possession of petroleum.

http://en.wikipedia.org/wiki/Oil-storage_trade

I counted 11 full oil barges moored in the lower Hudson one morning during that period while traveling by train to NYC!

‘Crude is now four times higher in price than during the “inflationist” 1970s.’

Hard to believe a bank economist would write something this simplistic. The U.S. CPI has increased by a factor of 5.5 times since the end of 1972, just before the first oil shock. Comparing nominal commodity prices over decades is patently invalid. So are arithmetic ‘hockey stick’ charts, in place of semilog scales. Here is a chart of real (inflation adjusted) crude oil prices:

http://static.seekingalpha.com/uploads/2012/4/9/saupload_Real_Crude_Prices.jpg

Today’s price is a little higher than in 1981, after Oil Shock II, but still 30% below the record $147/bbl price of July 2008.

“I will not condone anyone or any party involved in the present conflicts”

Does this include those who earn their living, profits and/or pensions producing war materiel?

The world needs to de-militarize. Who is going to start? As far as I am concerned, the BDS (Boycott, Sanction, Divest) movement has only just begun and the US public needs to take a hard look in the mirror.

So far, Mr. Market usually wins. I agree with the fact the Israeli Gaze adventure will wind down after the lawn is mowed–it’s a pretty stable situation that is unlikely to ever change–very Orwellian in my view–the oligarchs on both sides thrive on conflict, fear, threats, and all the usual nonsense particularly the Israeli right and the Saudi/Turkish backers of Hamas.

As for Ukraine, it looks like it will settle into something stable–the a-holes at State and the CIA will go too far and Mr. Market will wave his finger and show his wad of cash and the crazies will go into hibernation, get some good jobs on the Street and so on and so on and so on. More East Ukranians will die of go to Russia and some degree of ethnic cleansing will occur as the rest of Ukraine keeps boiling in its foul juices and be real problem for Europe in a way that has little to do with Russia.

The midterms are coming up and the focus will shift to the reality of a GOP House and Senate which should be more interesting than the current situation–I can hardly wait.

Re: …”The midterms are coming up and the focus will shift to the reality of a GOP House and Senate which should be more interesting than the current situation–I can hardly wait.”

What substantive policy changes do you foresee assuming that development, Banger?

I’m not Banger, but the answer is: very little.

……..

“The conflict that represents the largest potential threat to markets is still the ISIS invasion of Iraq. ” I don’t know where to begin with this statement. Most readers of NC may not be aware of a few salient facts. First, ISIS is extremely small – 3000 in its main strike force , perhaps 5000 total. This is a tiny fraction of the Iraqi army that ran at first sign of trouble. ISIS is occupying a political vacuum.

The problem is not ISIS , but the lack of legitimacy of the Iraqi state. The chief force behind Iraqi nationalism is/was the Iraqi Ba’ath party, personified by Sadaam Hussein. NC readers should need no review of what happened to the Ba’ath. Further, the idea of an Iraqi nation has been nullified by the existence – established by the US – of a in reality independent Kurdistan. If the Kurds are de facto independent, why not a independent Sunni state ? Why not a Shia state ? Why die in an ‘Iraqi’ army for a fiction ?

A Yugoslav solution – the breakup of Iraq into three or more ethnic cantons is one solution. The other solution is a Ba’ath like nationalistic state. The present situation will be anarchy until one or the other solutions take place . US policy is firmly on the side of anarchy. We can’t be seen giving up on our 2003 war aims.

ISIS poses no danger it is a construction of Turkish, U.S. and Saudi intel and does whatever the bosses want.

What you’re suggesting is called the Yinon Plan and doesn’t benefit Iraqi citizens. It benefits Saudi, Israel, Turkey, etc.

The problems with the Iraqi state come from people, not borders. If Maliki wasn’t such a sectarian rock head, this problem wouldn’t be nearly so bad.

The world was always “global” in the sense a event large enough could have global implications.

However Dinosaurs or North American Indians did not scale up their activities using their freindly bank down the volcano / up the river.

The problem we have is one of scale.

Its not really a energy problem when looked at from this perspective.

Empty French and Spanish villages still exist.

If Spain no longer works for a Bank it can revert back to 1950s /60s oil inputs without a total collapse of its society.

Spanish oil consumption 1965 – 2013 ( 2009 & 2014 BP stat figures)

1965 : 278

1970 : 552 ( consumption doubled within a half a decade!!!!!! – this period was the flaming heart of the so called Spanish Miracle)

1975 :840

1980 :1,070

1985: 927 ( 80s euro structural adjustment depression)

1990 : 1,040

1995 : 1,177

2000 : 1,452

2005 : 1,619 (peak consumption ) in the 2013 BP stat overview this has changed to 1,594 with peak in 2007 at 1,613

2010 : 1,394

2013 : 1,200 ( return to 1995/6 consumption levels but at a much higher population)

What has destroyed Spain ?????

Modernism in whatever form takes your fancy

Many of its villages now have nobody living in them.

They may however have a summer tourist office where tourists many of them Spanish drive up 1,000+ meters to listen to a young girl explain to them that people actually lived here and stuff.

No shops exist up here so no commerce can be engaged in – everything is centralized below in the interests of apparent efficiency

A utterly surreal experience for a observer on foot.

Spanish people now have no personal sovereignty.

The slightly funny but sad story of the Valle de Chistau.

One of the strangest places I have ever walked through.

The place is a dead zone – the desperate 1980s quest for women that the men engaged in was a utter failure.

The women drifted back down the slopes to gain access to artifical credit.

https://www.youtube.com/watch?v=oX4f1FLWjf4

The world is living inside a two week window from which a declaration of war is likely to be made over the Ukraine conflict.

A Friday July 18 interview exchange between Der Spiegel and German Foreign Minister Frank-Walter Steinmeier:

SPIEGEL ONLINE: The fighting in Ukraine has continued without abatement. Do you still believe that a peaceful solution is possible?

Steinmeier: In the last two weeks, I haven’t taken my eye off the Ukraine crisis for a single second.

SPIEGEL ONLINE: Has the danger of a Russian intervention passed?

Steinmeier: A further escalation is not out of the question, the situation continues to be extremely dangerous. The fighting in Donbass has continued with unmitigated severity. People are dying every day.

For Germany, the tensions with the US and the conflict in Ukraine are palpable. Der Spiegel: “Until last week, most in Western Europe perceived the civil war in Ukraine as a foreign and faraway conflict, dominated by bearded men in strange uniforms. The downing of flight MH 17 has suddenly brought the conflict much closer…[and] could go down in history as a turning point in the Ukraine conflict. If it does, it wouldn’t be the first time that a civil aviation disaster has had enormous political consequences… It represents a watershed moment for the West, and Europeans in particular, because it could force them to begin taking a more decisive approach in the Ukraine conflict.

[Back in the US, Obama is pounding his fists] “We don’t have time for propaganda. We don’t have time for games.” Over the weekend, British Prime Minister David Cameron cried “We must turn this moment of outrage into a moment of action,” whipping EU leaders to “respond robustly with new sanctions.” On Sunday, Cameron, German Chancellor Merkel, and French President Hollande all agreed on Sunday to “reconsider its approach to Russia.”

In yet another Der Spiegel post yesterday, we learn that the Obama administration is not happy over Europe’s inability to enact further sanctions against Russia. See “US Loses Patience with Europe: Washington Wants Tough Russia Sanctions.” Quoting from Der Spiegel: “The Americans are proposing an end to EU weapons deliveries to Russia. With orders on the books for two Mistral-class amphibious assault ships for Russia worth €1.2 billion ($1.6 billion), that move could hit France particularly hard… Obama’s government is expected to wait until after the EU foreign ministers meet on Tuesday [July 29], but administration officials are already preparing the next steps, with measures aimed at Russia’s financial sector. [Tuesday-Wednesday July 29-30 are red alert days for the financial markets because of this particular EU meeting]

Heather Conley, a Europe expert at the Center for Strategic and International Studies (CSIS) in Washington, believes trans-Atlantic relations could be put to the test again if the United States and Europe don’t pull together. “The Americans know that sanctions again Russia will only work if the Europeans take part,” she says. “After all, the EU has far greater trade with Russia than the Americans do.” Trans-Atlantic policy expert Janes says that expectations are accordingly high. “People here are following very closely just how prepared EU member states are for sanctions — especially Germany, which is so strong economically,” he says.

Declarations of war, by the way, and I don’t know why this is the case, but four declarations of WWI occurred between July 28 and August 3 1914 – one hundred years ago today. And the declaration of war between the US & Iraq in 1990 occurred on August 2 1990.